Billings County Certificate of Trust Form (North Dakota)

All Billings County specific forms and documents listed below are included in your immediate download package:

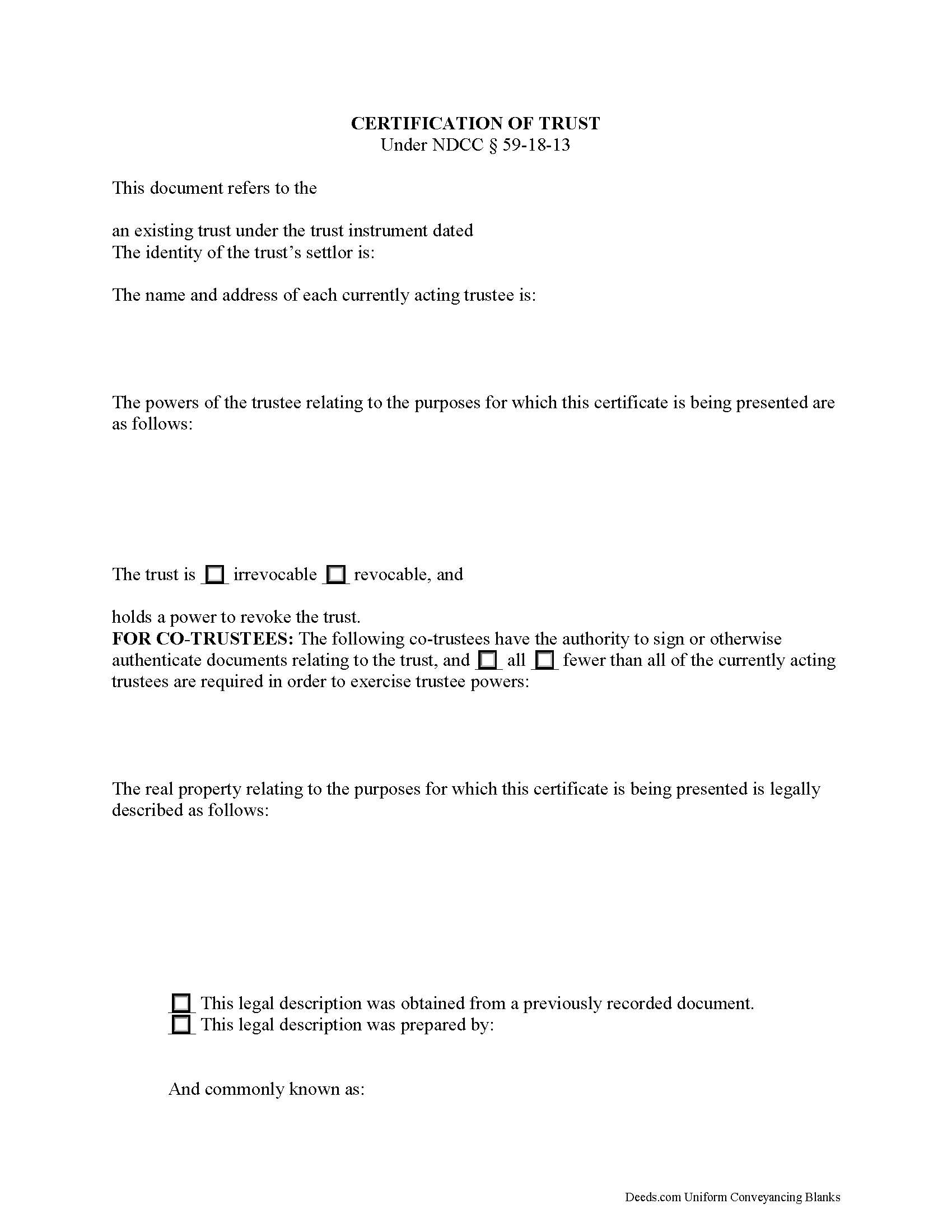

Certificate of Trust Form

Fill in the blank form formatted to comply with all recording and content requirements.

Included Billings County compliant document last validated/updated 10/23/2024

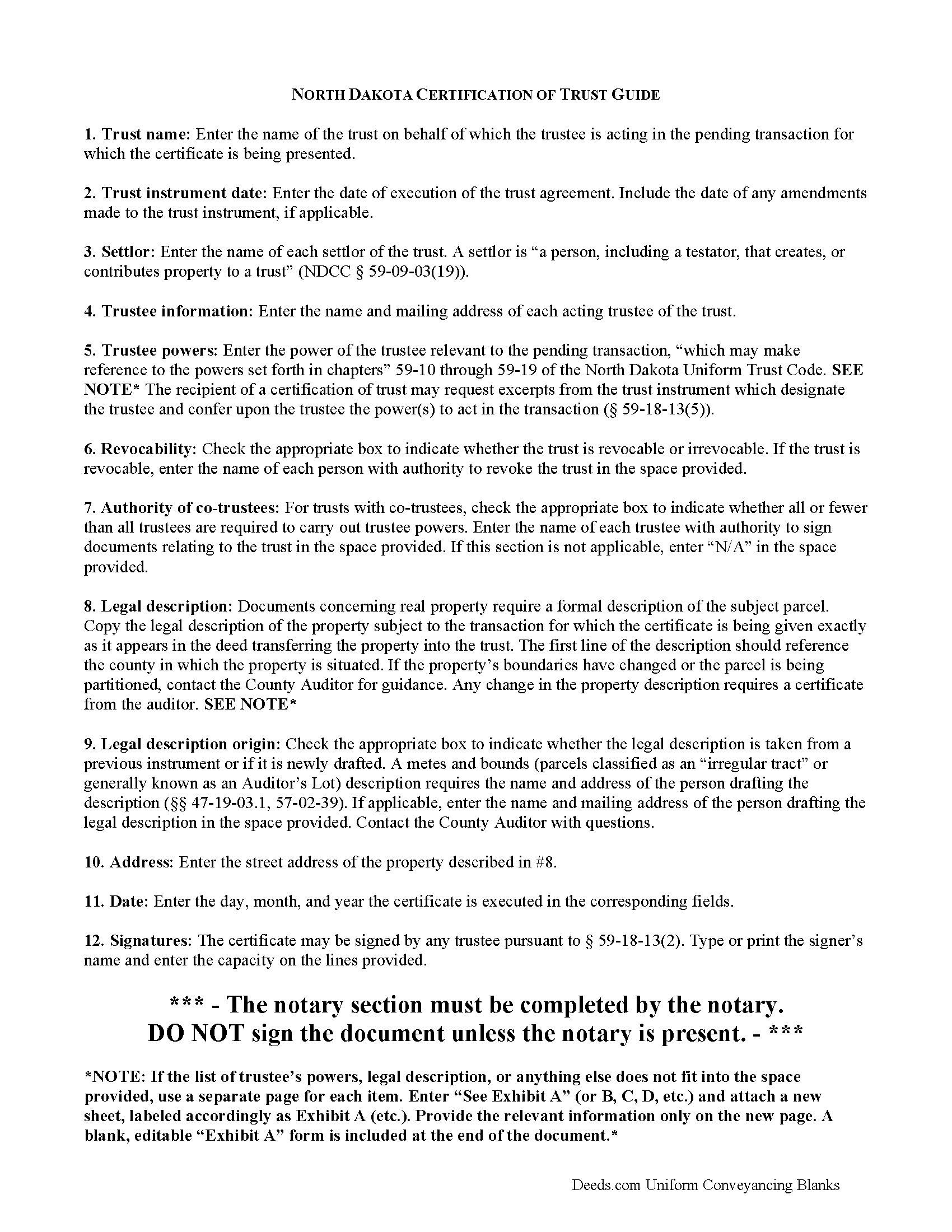

Certificate of Trust Guide

Line by line guide explaining every blank on the form.

Included Billings County compliant document last validated/updated 9/26/2024

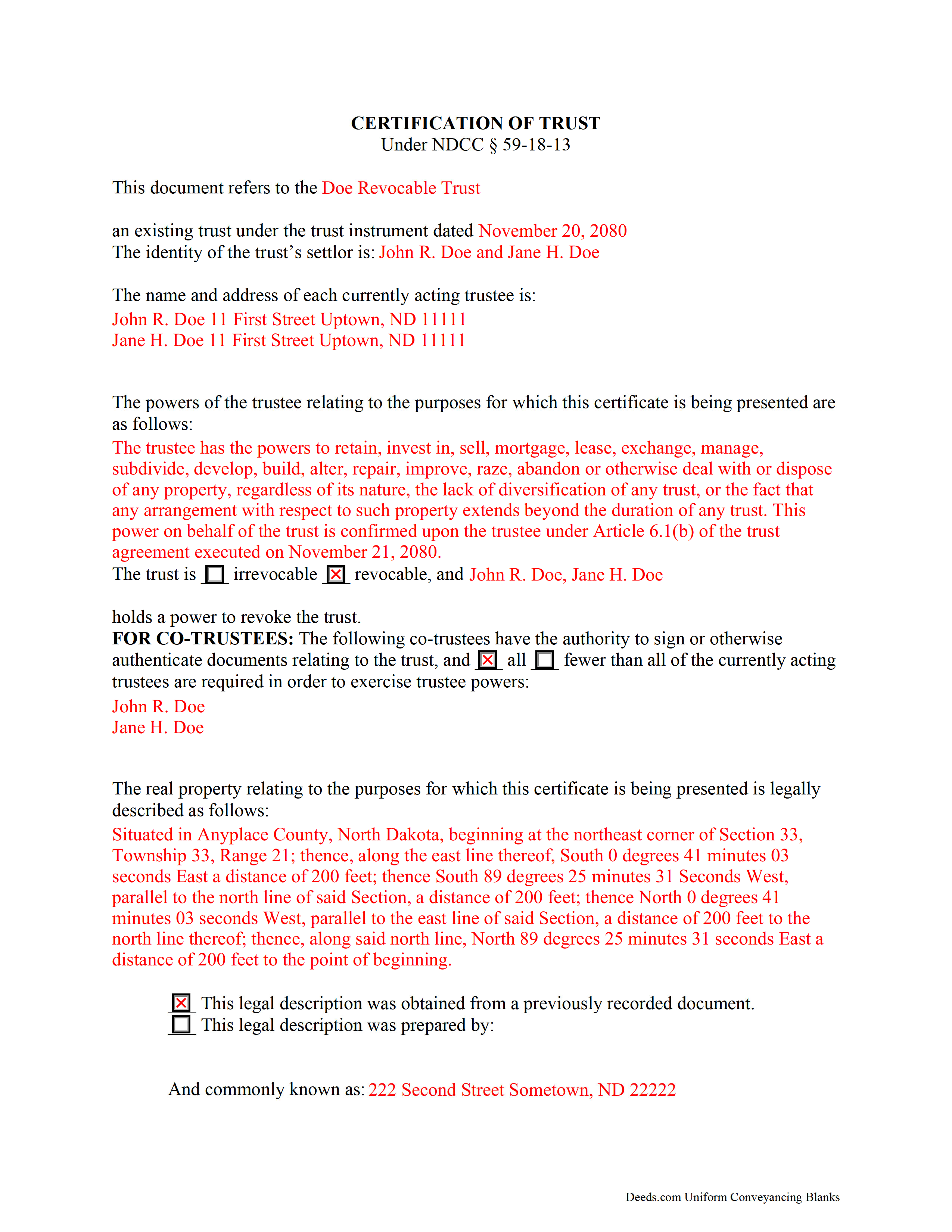

Completed Example of the Certificate of Trust Document

Example of a properly completed form for reference.

Included Billings County compliant document last validated/updated 9/24/2024

The following North Dakota and Billings County supplemental forms are included as a courtesy with your order:

When using these Certificate of Trust forms, the subject real estate must be physically located in Billings County. The executed documents should then be recorded in the following office:

Billings County Recorder/Clerk of Court

Courthouse - 495 4th St / PO Box 138, Medora, North Dakota 58645

Hours: 8:00 to 4:00 Mo-Fr; Summer: 7:00 to 4:00 Mo-Th, 8:00 to 12:00 Fr

Phone: (701) 623-4491

Local jurisdictions located in Billings County include:

- Fairfield

- Medora

How long does it take to get my forms?

Forms are available immediately after submitting payment.

How do I get my forms, are they emailed?

Immediately after you submit payment, the Billings County forms you order will be available for download directly from your account. You can then download the forms to your computer. If you do not already have an account, one will be created for you as part of the order process, and your login details will be provided to you. If you encounter any issues accessing your forms, please reach out to our support team for assistance. Forms are NOT emailed to you.

What does "validated/updated" mean?

This indicates the most recent date when at least one of the following occurred:

- Updated: The document was updated or changed to remain compliant.

- Validated: The document was examined by an attorney or staff, or it was successfully recorded in Billings County using our eRecording service.

Are these forms guaranteed to be recordable in Billings County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Billings County including margin requirements, content requirements, font and font size requirements.

Can the Certificate of Trust forms be re-used?

Yes. You can re-use the forms for your personal use. For example, if you have more than one property in Billings County that you need to transfer you would only need to order our forms once for all of your properties in Billings County.

What are supplemental forms?

Often when a deed is recorded, additional documents are required by North Dakota or Billings County. These could be tax related, informational, or even as simple as a coversheet. Supplemental forms are provided for free with your order where available.

What type of files are the forms?

All of our Billings County Certificate of Trust forms are PDFs. You will need to have or get Adobe Reader to use our forms. Adobe Reader is free software that most computers already have installed.

Do I need any special software to use these forms?

You will need to have Adobe Reader installed on your computer to use our forms. Adobe Reader is free software that most computers already have installed.

Do I have to enter all of my property information online?

No. The blank forms are downloaded to your computer and you fill them out there, at your convenience.

Can I save the completed form, email it to someone?

Yes, you can save your deed form at any point with your information in it. The forms can also be emailed, blank or complete, as attachments.

Are there any recurring fees involved?

No. Nothing to cancel, no memberships, no recurring fees.

Codified at N. D. Cent. Code 59-18-13 as part of the North Dakota Uniform Trust Code, the certification of trust is a document containing essential information about a trust. A trustee can present a certificate when entering transactions on behalf of a trust. As the name suggests, the form certifies the trust's existence and the trustee's authority to conduct business in the trust's name, and its recipient may rely upon the facts contained within it without further inquiry ( 59-18-13(6)).

A trust is an arrangement whereby a settlor (or grantor) transfers property to another person (trustee) to be held for the benefit of third (beneficiary). The trust is governed by the terms expressed in the trust instrument, a (generally) unrecorded document that designates the trustee, contains the scope of the trust's assets, and identifies the trust's beneficiaries. Some types of trust take effect during the settlor's lifetime (inter vivos trust), and others take effect upon the death of the settlor (testator), as provided for by a will (testamentary trust).

In North Dakota, the certification states that the trust exists and provides the trust's name and effective date of the trust instrument. In addition, it identifies each person who has contributed property to the trust as a settlor and gives the name and address of the currently acting trustee. The trustee's powers relevant to the pending transaction are enumerated; reference may be made to the statutory trustee powers codified at chapters 59-09 through 59-19 of the North Dakota Uniform Trust Code. The recipient of a certification of trust can request copies of excerpts from the trust instrument designating the trustee and conferring the power to act in the business at hand ( 59-18-13(5)).

The certificate also defines the trust as either irrevocable or revocable, and names who, if any, holds a power to revoke the trust. If the trust has co-trustees, the certificate states whether or not all trustees are required in order to carry out trustee powers. It also specifies, by name, which trustees can authorize trust documents. Finally, the document contains a statement that the trust has not been revoked, modified, or amended in any way that would falsify the statements made within.

Generally, it is unnecessary to provide a certificate of trust alongside conveyances of property from trustees in North Dakota, as the "trustee of a trust that holds title to real property is presumed to have the power to sell, convey, and encumber the real property unless restrictions on that power appear in the records of the county recorder" ( 47-10-26).

However, some situations may warrant an accompanying certificate, such as when a trustee is incorrectly identified on the deed into trust, or the trustee named on the current deed has been replaced [1]. When property deeded into a trust is erroneously titled in the name of the trust rather than the trustee of the trust, the subsequent conveyance out of the trust may be validated if the trustee's identity "is reasonably ascertainable from the conveyance or from other information of public record," such as a certification of trust ( 47-19-42.1). When used in transactions involving real property, the certificate should provide a legal description of the subject property.

The certificate must be signed by a trustee in the presence of a notary public. If recording is applicable to the situation, the certificate may be recorded through the recorder's office. Consult a lawyer with any questions.

(North Dakota COT Package includes form, guidelines, and completed example)

Our Promise

The documents you receive here will meet, or exceed, the Billings County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Billings County Certificate of Trust form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4420 Reviews )

Jimmy W.

November 1st, 2024

Very thorough with plenty of instructions. Nice to be able to fill in the forms on my computer at my own pace and edit if needed. Jim

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

RUTH A.

October 25th, 2024

I am so very thankful for the service that you provide for the public, thank you very much.

We deeply appreciate the trust you have placed in our services. Thank you for your valuable feedback and for choosing us.

Nancy R.

October 25th, 2024

Deeds.com is very precise, helpful and friendly. I found the form I needed without any effort and everything worked perfect and smooth. I recommend it 100%. rnThank you.

We are delighted to have been of service. Thank you for the positive review!

GARY S.

August 27th, 2020

sweet & easy

Thank you!

Denise B.

September 3rd, 2020

Quick and easy!

Thank you Denise. We appreciate you.

kabir r.

May 11th, 2022

Wonderful quitclaim forms, very happy

Thank you!

Laura B.

December 2nd, 2019

Downloaded and completed these quit claim forms in less than one cup of coffee, quick easy and stress free.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Maria W.

July 19th, 2022

Really, the best and easiest service given us to complete a process for recorder office! Thank you!!

Thank you!

Lori G.

May 21st, 2020

thank you for all your help and patience. I would highly recommend Deeds.com to everyone.

Sincerely,

Lori G.

Thank you!

Julie K.

September 4th, 2023

The process for obtaining document itself was easy, and the included guide and example are great! rnI do have an issue with the format itself, though. The form has pre-defined text boxes, which cannot be altered without partially rebuilding the entire document. For the 'property description' field on the Mineral Deed form, the text box is not large enough for the rather lengthy legal description entered on my original plat.rnFortunately, I have a copy of Adobe Pro, so I have been able to re-build the doc to accommodate this short-coming.

Thank you for taking the time to provide feedback on our legal form. We're pleased to hear that you found the process for obtaining the document and the included guide beneficial.

We understand and appreciate your concern regarding the formatting and size limitations of certain fields, especially the 'property description' field. Our forms are designed to adhere to specific formatting requirements that are often mandated for legal compliance. Making direct alterations to the document can result in them becoming non-conforming, which is why we advise customers to use an exhibit page when their legal description is extensive or does not fit.

John K.

June 21st, 2023

Very pleased. Responsive staff and fast recordation.

Thank you for the kind words John. Our staff appreciates you and your feedback. Have an amazing day!

Ronald P.

August 18th, 2020

Very easy to use... awaiting info

Thank you for your feedback. We really appreciate it. Have a great day!

James M.

November 23rd, 2020

Clear and easy instructions! Prompt notices of steps and status. Great job! I wish all counties in all states were this easy!

Thank you for your feedback. We really appreciate it. Have a great day!

Everette W.

March 5th, 2023

This form was very helpful ... I wish I had run across your before it would have saved me a lot of money.

Thank you!

Larry T.

July 28th, 2020

Ordered a 'Gift Deed' form

The 'Example' form was most helpful.

The actual form was very detailed, and seemed to 'cover all the bases'

We appreciate your business and value your feedback. Thank you. Have a wonderful day!