Clay County Conditional Waiver on Final Payment Form (North Carolina)

All Clay County specific forms and documents listed below are included in your immediate download package:

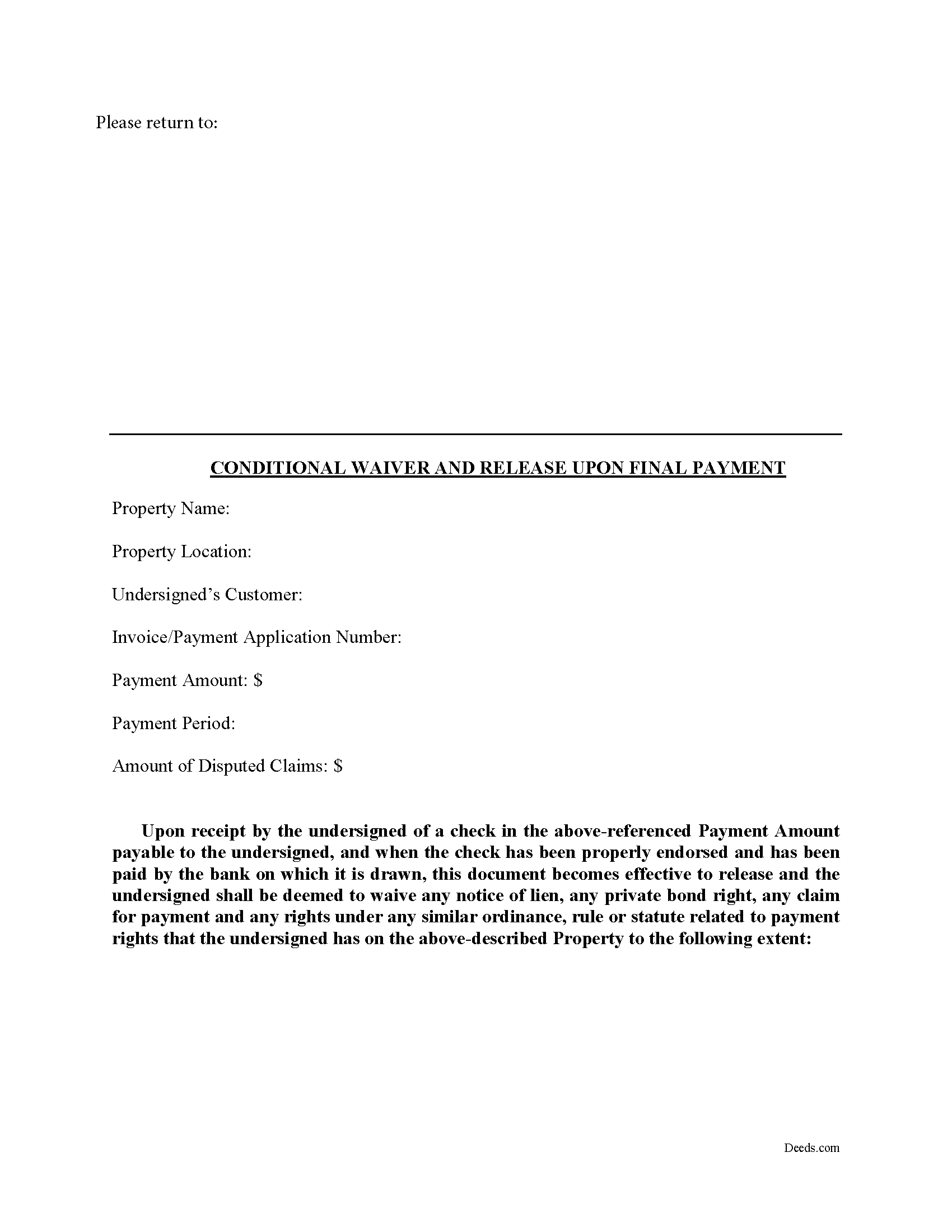

Conditional Waiver on Final Payment Form

Fill in the blank Conditional Waiver on Final Payment form formatted to comply with all North Carolina recording and content requirements.

Included Clay County compliant document last validated/updated 11/8/2024

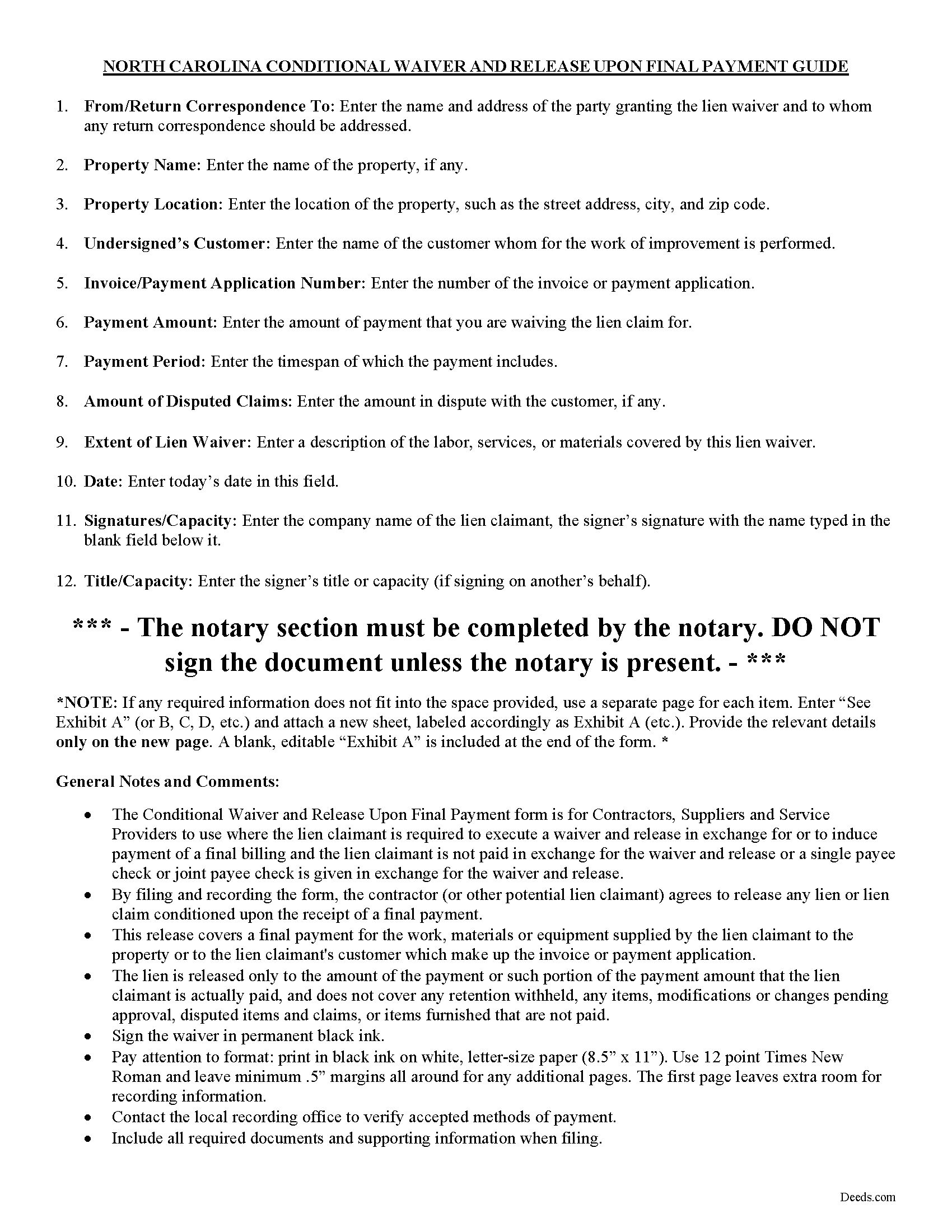

Conditional Waiver on Final Payment Guide

Line by line guide explaining every blank on the form.

Included Clay County compliant document last validated/updated 8/19/2024

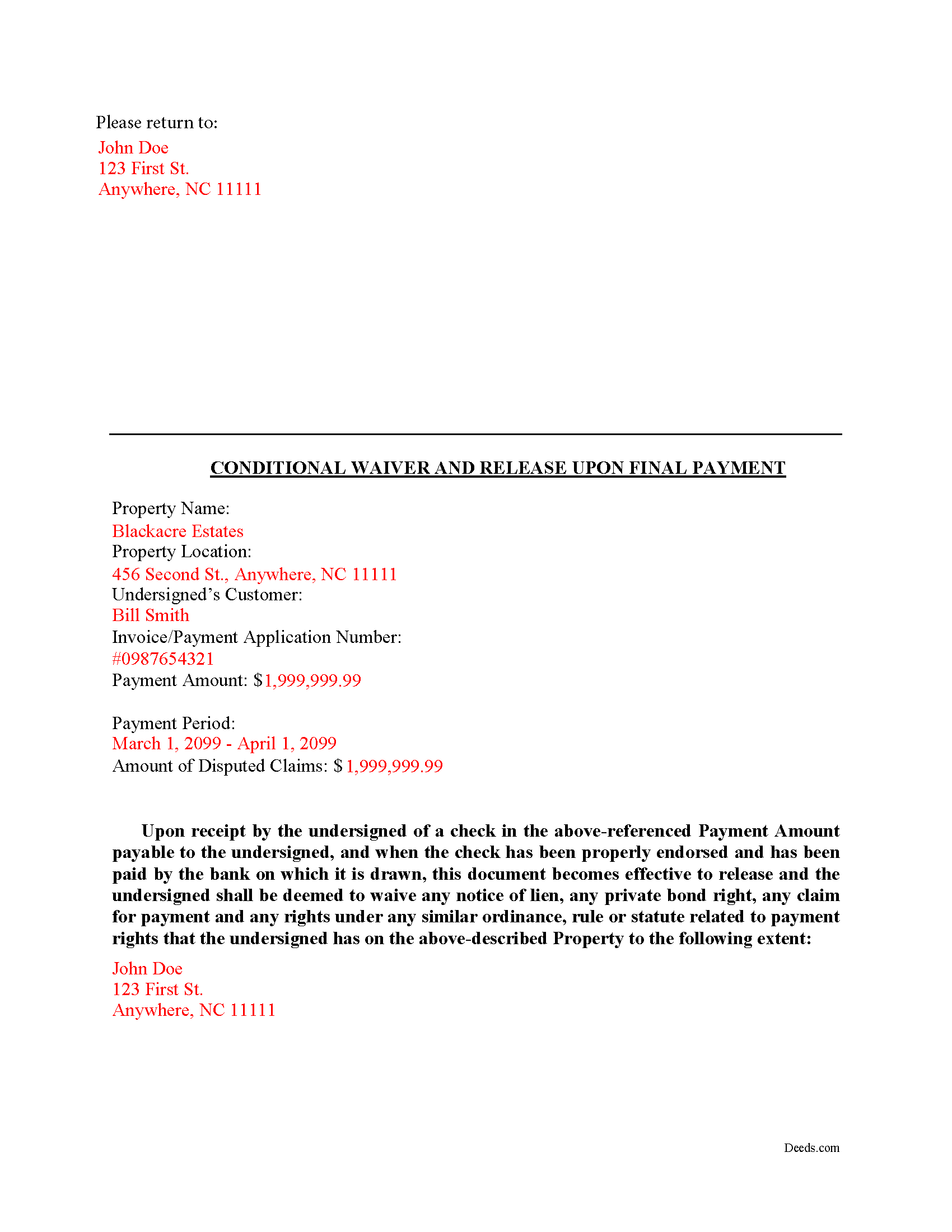

Completed Example of the Conditional Waiver on Final Payment Document

Example of a properly completed form for reference.

Included Clay County compliant document last validated/updated 10/1/2024

The following North Carolina and Clay County supplemental forms are included as a courtesy with your order:

When using these Conditional Waiver on Final Payment forms, the subject real estate must be physically located in Clay County. The executed documents should then be recorded in the following office:

Clay County Register of Deeds

261 Courthouse Drive Suite 2, Hayesville, North Carolina 28904

Hours: 8:00 to 5:00 M-F

Phone: (828) 389-0087

Local jurisdictions located in Clay County include:

- Brasstown

- Hayesville

- Warne

How long does it take to get my forms?

Forms are available immediately after submitting payment.

How do I get my forms, are they emailed?

Immediately after you submit payment, the Clay County forms you order will be available for download directly from your account. You can then download the forms to your computer. If you do not already have an account, one will be created for you as part of the order process, and your login details will be provided to you. If you encounter any issues accessing your forms, please reach out to our support team for assistance. Forms are NOT emailed to you.

What does "validated/updated" mean?

This indicates the most recent date when at least one of the following occurred:

- Updated: The document was updated or changed to remain compliant.

- Validated: The document was examined by an attorney or staff, or it was successfully recorded in Clay County using our eRecording service.

Are these forms guaranteed to be recordable in Clay County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Clay County including margin requirements, content requirements, font and font size requirements.

Can the Conditional Waiver on Final Payment forms be re-used?

Yes. You can re-use the forms for your personal use. For example, if you have more than one property in Clay County that you need to transfer you would only need to order our forms once for all of your properties in Clay County.

What are supplemental forms?

Often when a deed is recorded, additional documents are required by North Carolina or Clay County. These could be tax related, informational, or even as simple as a coversheet. Supplemental forms are provided for free with your order where available.

What type of files are the forms?

All of our Clay County Conditional Waiver on Final Payment forms are PDFs. You will need to have or get Adobe Reader to use our forms. Adobe Reader is free software that most computers already have installed.

Do I need any special software to use these forms?

You will need to have Adobe Reader installed on your computer to use our forms. Adobe Reader is free software that most computers already have installed.

Do I have to enter all of my property information online?

No. The blank forms are downloaded to your computer and you fill them out there, at your convenience.

Can I save the completed form, email it to someone?

Yes, you can save your deed form at any point with your information in it. The forms can also be emailed, blank or complete, as attachments.

Are there any recurring fees involved?

No. Nothing to cancel, no memberships, no recurring fees.

A lien waiver is a document drafted by a potential lien claimant such as a contractor, subcontractor, materials provider, equipment lessor or other party to the construction project (the claimant) that states they have received payment and thereby waive any future lien rights to the owner's property. Simply put, waiving a lien means giving up the right to a future lien in exchange for the payment of the potential lien amount in full or part.

Lien waivers generally fall into two categories: conditional and unconditional. A conditional waiver is effective only upon the triggering of a specific event, such as the payment check clearing. An unconditional waiver is an absolute abandonment of the claimant's right to a future lien whether or not payment is ever made to the possible claimant. North Carolina does not provide for lien waivers by statute, although waivers are still permissible and will be recognized by a state court under the principles of contract law.

A conditional waiver upon final payment releases all claimant rights to file a mechanics lien if they have actually been paid to date (and that includes no return or stopped payment checks). Waivers should identify the parties, location of the job or project, relevant dates, costs, and payments, and any other details as needed.

By filing the form, the lien claimant represents that he or she either has already paid or will use the money he or she receives from this payment in order to make prompt payment in full to all his or her laborers, subcontractors, materialmen and suppliers for all work, materials or equipment that are the subject of this waiver and release.

Getting a lien waiver also allows property owners to shield the title to their property from the general contractor, material suppliers, and subcontractors involved with a project. With a lien release upon a final payment, the property owner restores clear title and can obtain financing or sell the property.

The property owner should require lien and labor waivers to be submitted with the contractor's invoices and should not authorize payment of any invoice without properly signed lien and labor waivers. Proper lien waivers can protect the property owner from liens filed by the contractor's subcontractors, suppliers and laborers who might record a lien if they are not paid by the contractor.

This article is provided for informational purposes only and should not be relied upon as a substitute for the advice of a legal professional. Please contact an attorney with questions about using lien waivers, or for any other issues related to liens in North Carolina.

Our Promise

The documents you receive here will meet, or exceed, the Clay County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Clay County Conditional Waiver on Final Payment form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4436 Reviews )

Michael S.

November 27th, 2024

Recording a Warranty Deed with Mohave County AZ was easy and efficient by using Deeds.com. I will be using their service for all of my e-filing going forward. Thank you Deeds.com!!!!

We are delighted to have been of service. Thank you for the positive review!

Zennell W.

November 24th, 2024

Quick fast and easy transaction.

We are grateful for your feedback and looking forward to serving you again. Thank you!

James S.

November 21st, 2024

Forms used, created quitclaim deed that the county accepted without a second look (turns out they see deeds.com forms regularly via erecording and in person). Will be back for any real estate related forms I need and they carry. Will always be my first stop. Also, will use erecording next time, mad I didn't see it this time.

Thanks for the kind words James, glad we could help. Look forward to seeing you again.

Melody P.

January 29th, 2021

Thanks again for such expedient and excellent service!

Thank you!

Mary R.

February 19th, 2024

Love to use DEEDS>COM

Thank you Mary.

Jacqueline T.

June 17th, 2021

Worth it for the time saved as the supplemental forms required were included the purchase. First time user, easy peasy. 5 stars from me.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Tracie R.

December 24th, 2019

Great company and very fast at getting deeds to me. :)5 star!!

Thank you!

Suzette D.

February 20th, 2020

easy to use and gave examples!

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Monica M.

September 15th, 2020

I was very impressed with the quick responses I received from my questions. Usually when forced to communicate via email, responses aren't received right away. Thank you for being on top of things.

Thank you!

Junior S.

December 22nd, 2022

Good

Thank you!

Larry S.

February 25th, 2023

I think it needs to be easier to enlarge print to fit an 8"x12" sheet of paper. Printing off samples is difficult to read as it is too small

Thank you for your feedback. We really appreciate it. Have a great day!

James U.

June 18th, 2020

Fonts for all fields are not the same. Collin County has a specified size it wants in all fields. Other than that every thing was fine.

Thank you!

BARBARA L.

February 15th, 2023

Fairly easy to use. I had to really search to get some info. I had to use the Exhibit feature because the description box was way too small and I ended up re-typing it. The package had good and useful links. The County Clerk looked at it and said, "I see you used an online form, and that's OK, but..." and proceeded to show me a couple of things that were left out. They recorded it with no problems.

Thank you!

Diane C.

April 19th, 2020

Website is very user friendly and provided a variety of forms to download for use

Thank you!

Ernest S.

July 30th, 2019

Took it to the Courthouse and the Register of Deeds said,"well Done" Thanks you so much.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!