Gates County Beneficiary and Administrator Deed Form (North Carolina)

All Gates County specific forms and documents listed below are included in your immediate download package:

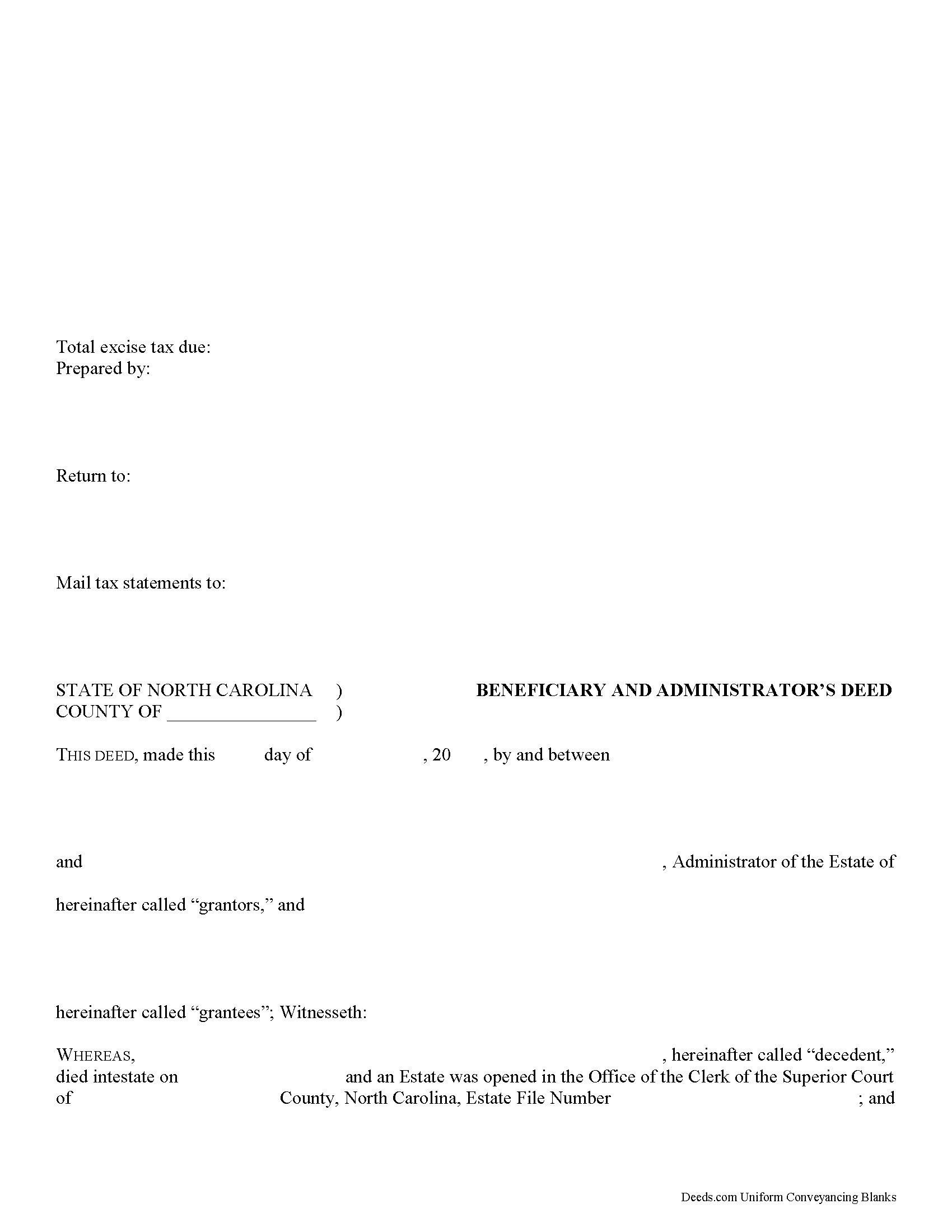

Beneficiary and Administrator Deed Form

Fill in the blank form formatted to comply with all recording and content requirements.

Included Gates County compliant document last validated/updated 11/12/2024

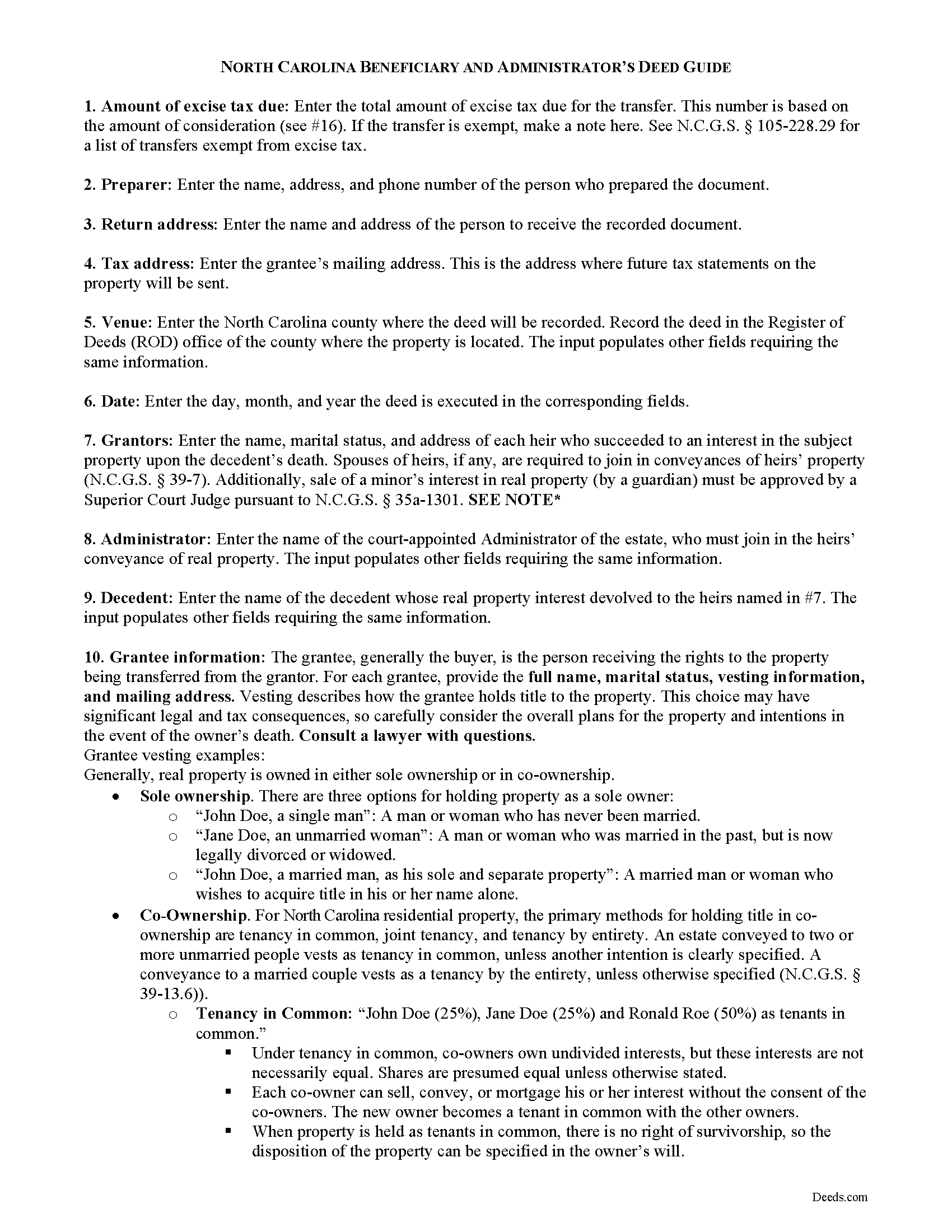

Beneficiary and Administrator Deed Guide

Line by line guide explaining every blank on the form.

Included Gates County compliant document last validated/updated 11/5/2024

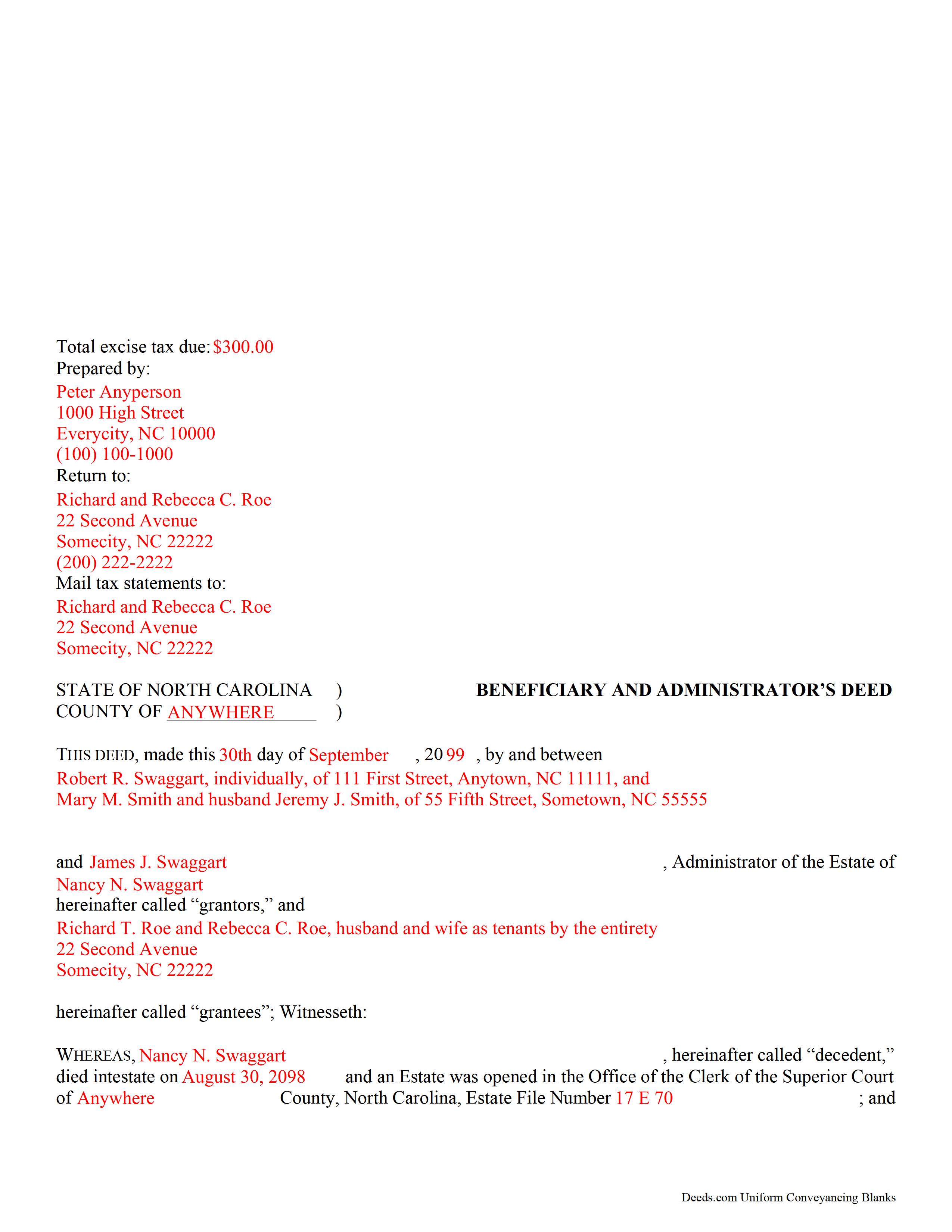

Completed Example of the Beneficiary and Administrator Deed Document

Example of a properly completed form for reference.

Included Gates County compliant document last validated/updated 7/18/2024

The following North Carolina and Gates County supplemental forms are included as a courtesy with your order:

When using these Beneficiary and Administrator Deed forms, the subject real estate must be physically located in Gates County. The executed documents should then be recorded in the following office:

Gates County Register of Deeds

202 Court St / PO Box 471, Gatesville, North Carolina 27938

Hours: 9:00am - 5:00 pm Monday through Friday

Phone: (252) 357-0850

Local jurisdictions located in Gates County include:

- Corapeake

- Eure

- Gates

- Gatesville

- Hobbsville

- Roduco

- Sunbury

How long does it take to get my forms?

Forms are available immediately after submitting payment.

How do I get my forms, are they emailed?

Immediately after you submit payment, the Gates County forms you order will be available for download directly from your account. You can then download the forms to your computer. If you do not already have an account, one will be created for you as part of the order process, and your login details will be provided to you. If you encounter any issues accessing your forms, please reach out to our support team for assistance. Forms are NOT emailed to you.

What does "validated/updated" mean?

This indicates the most recent date when at least one of the following occurred:

- Updated: The document was updated or changed to remain compliant.

- Validated: The document was examined by an attorney or staff, or it was successfully recorded in Gates County using our eRecording service.

Are these forms guaranteed to be recordable in Gates County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Gates County including margin requirements, content requirements, font and font size requirements.

Can the Beneficiary and Administrator Deed forms be re-used?

Yes. You can re-use the forms for your personal use. For example, if you have more than one property in Gates County that you need to transfer you would only need to order our forms once for all of your properties in Gates County.

What are supplemental forms?

Often when a deed is recorded, additional documents are required by North Carolina or Gates County. These could be tax related, informational, or even as simple as a coversheet. Supplemental forms are provided for free with your order where available.

What type of files are the forms?

All of our Gates County Beneficiary and Administrator Deed forms are PDFs. You will need to have or get Adobe Reader to use our forms. Adobe Reader is free software that most computers already have installed.

Do I need any special software to use these forms?

You will need to have Adobe Reader installed on your computer to use our forms. Adobe Reader is free software that most computers already have installed.

Do I have to enter all of my property information online?

No. The blank forms are downloaded to your computer and you fill them out there, at your convenience.

Can I save the completed form, email it to someone?

Yes, you can save your deed form at any point with your information in it. The forms can also be emailed, blank or complete, as attachments.

Are there any recurring fees involved?

No. Nothing to cancel, no memberships, no recurring fees.

Probate is the legal process of settling a decedent's (deceased person's) estate. An administrator is the personal representative appointed by the clerk of superior court to administer a decedent's estate.

When the estate's assets are not sufficient to pay debts, the administrator may need to petition the superior court where the estate is open to obtain an order to sell the decedent's real property. In North Carolina, title to real property vests in the decedent's heirs upon death, and a special proceeding is required to bring the property into the estate. An administrator may not sell realty without the court's permission.

The beneficiary and administrator's deed is an instrument executed by a decedent's heirs and joined by the administrator of the estate to convey an interest in real property from an intestate estate (so called when the decedent dies without a will, or does not name an executor of the estate) to a purchaser.

When the estate is still open in probate, the administrator joins in the deed consenting to the sale of the real property described within as required by N.C.G.S. 28A-17-12. By signing the deed, the administrator waives the possibility of opening a special proceeding to bring the property back into the estate later.

Heirs must execute the deed for a valid transfer. The deed lists all heirs and their marital status; spouses of heirs must join in signing the deed to release homestead rights under North Carolina law. Because title is legally vested in them, the executing heirs may make warranties of title, but the administrator typically does not. Any warranty language included in the deed is binding on the heirs.

Recitals of a beneficiary and administrator's deed include a statement that the decedent died intestate and information regarding the opened estate, including the decedent's date of death, the county of probate, and the file number assigned to the estate by the clerk of superior court. In addition, the deed states that the administrator named within is qualified to administer the estate and joins to evidence consent to the sale, and includes the date of first notice to creditors.

A lawful deed in North Carolina states the consideration made for the transfer of title, contains an accurate legal description of the subject parcel and recites the grantor's source of title. When properly executed and recorded, the beneficiary and administrator's deed vests title to the within-described property in the named grantee(s). Any restrictions to the transfer should be noted in the body of the deed.

Both the heirs' signatures and the administrator's signature must be acknowledged in the presence of a notarial official before the deed can be recorded in the county where the subject property is located. For a valid deed, the signatures of heirs and their spouses, when applicable, must be present. An affidavit of consideration or value may be required.

Consult an attorney licensed in the State of North Carolina with questions regarding beneficiary and administrator's deeds, as each situation is unique.

(North Carolina B&AD Package includes form, guidelines, and completed example)

Our Promise

The documents you receive here will meet, or exceed, the Gates County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Gates County Beneficiary and Administrator Deed form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4436 Reviews )

Michael S.

November 27th, 2024

Recording a Warranty Deed with Mohave County AZ was easy and efficient by using Deeds.com. I will be using their service for all of my e-filing going forward. Thank you Deeds.com!!!!

We are delighted to have been of service. Thank you for the positive review!

Zennell W.

November 24th, 2024

Quick fast and easy transaction.

We are grateful for your feedback and looking forward to serving you again. Thank you!

James S.

November 21st, 2024

Forms used, created quitclaim deed that the county accepted without a second look (turns out they see deeds.com forms regularly via erecording and in person). Will be back for any real estate related forms I need and they carry. Will always be my first stop. Also, will use erecording next time, mad I didn't see it this time.

Thanks for the kind words James, glad we could help. Look forward to seeing you again.

A Rod P.

May 25th, 2019

The website was short and to the point. And I receive three responses quite quickly.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Fred B.

February 8th, 2019

Great service and all seems to be what I was looking for

Thank you Fred, have a great day!

Freda S.

April 12th, 2024

Excellent Services!

Thank you!

Janepher M.

January 27th, 2019

Easy and informative site. Helped me figure out what I was looking for.

Thank you Janepher, we appreciate your feedback!

William M.

May 22nd, 2021

On multiple tries, I could not get validation mail through my Yahoo email address. I tried Gmail, worked the first time. The rest of the process was super easy and fast.

Thank you!

Karen G.

January 22nd, 2021

Not difficult at all! Which is great for me...

Thank you for your feedback. We really appreciate it. Have a great day!

JAMES M.

July 17th, 2023

The forms are just what I needed! Easy to navigate.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Betty J W.

May 31st, 2022

Was Totally Amazed, it was so easy to follow the example and I am 75 years old. I took my paper work in and it passed with flying colors.

Thank-You So much saved me $665.00.

BJW

Thank you!

Laryn A.

March 3rd, 2020

Very happy with the beneficiary deed forms packet. It was helpful to have an example of a properly filled out form. The only suggestion would be is to show where the exemption code should be placed on the form.

Thank you for your feedback. We really appreciate it. Have a great day!

Albo A.

September 25th, 2020

Deeds.com was fast and easy to file documents

Thank you!

edward m.

February 27th, 2019

I would rate it 5 stars also. Eddie M.

Thank you!

Kolette S.

February 7th, 2020

The forms are nice; however, they do not display the "th" after the day or the second digit of the year. You can type them in, but they will not print out. I just left them blank and will handwrite.

Thank you for your feedback. We really appreciate it. Have a great day!