Yates County Transfer on Death Deed Form (New York)

All Yates County specific forms and documents listed below are included in your immediate download package:

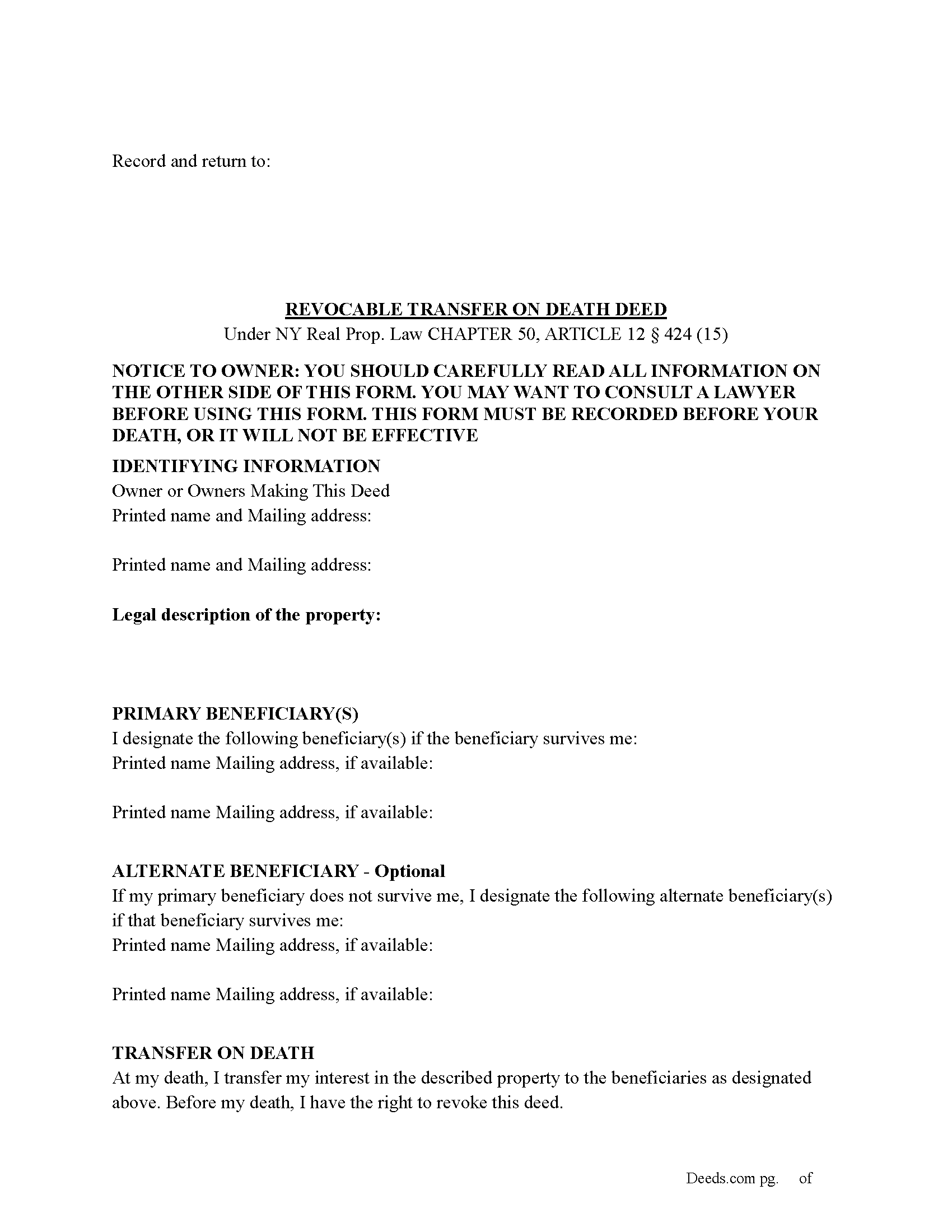

Transfer on Death Deed Form

Fill in the blank Transfer on Death Deed form formatted to comply with all New York recording and content requirements.

Included Yates County compliant document last validated/updated 11/28/2024

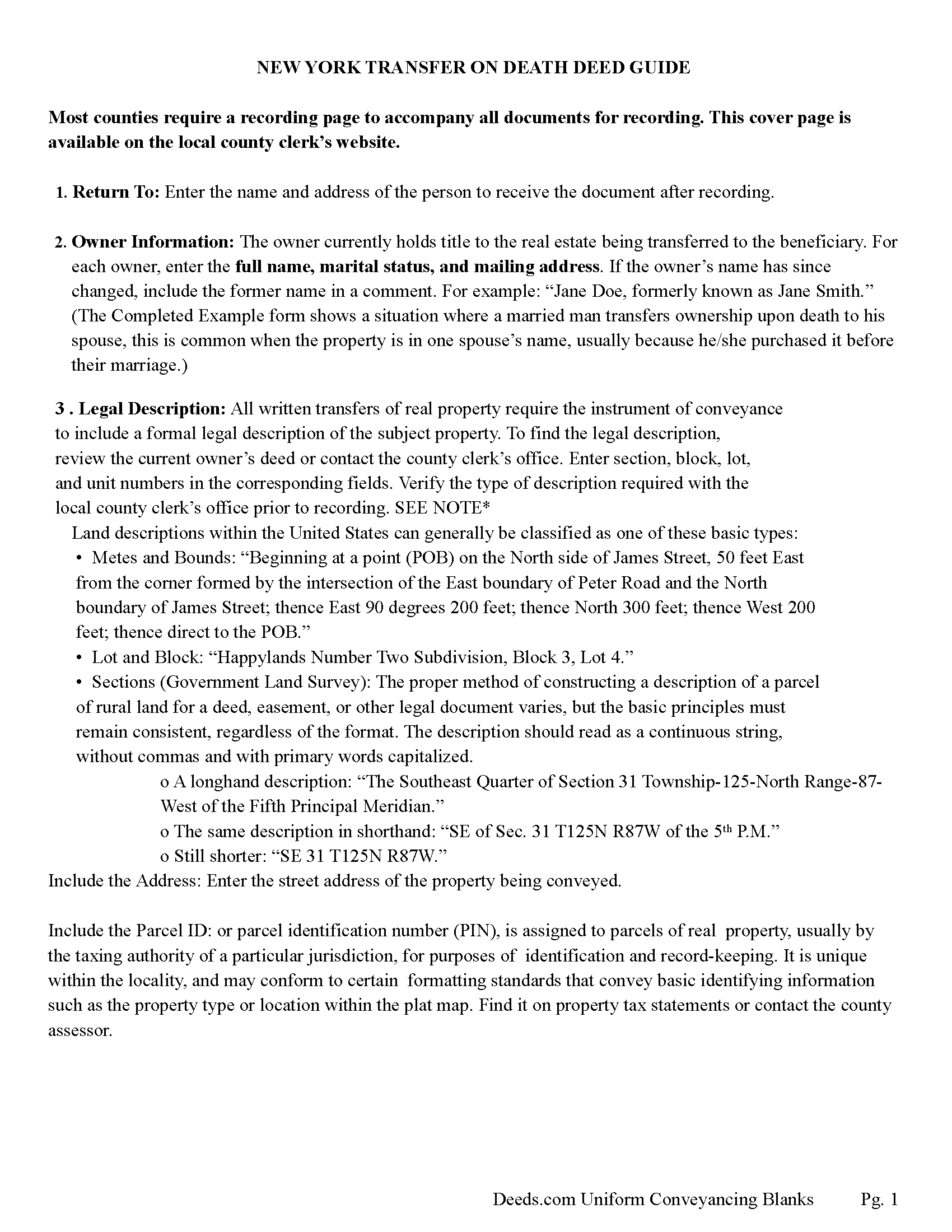

Transfer on Death Deed Guide

Line by line guide explaining every blank on the Transfer on Death Deed form.

Included Yates County compliant document last validated/updated 12/16/2024

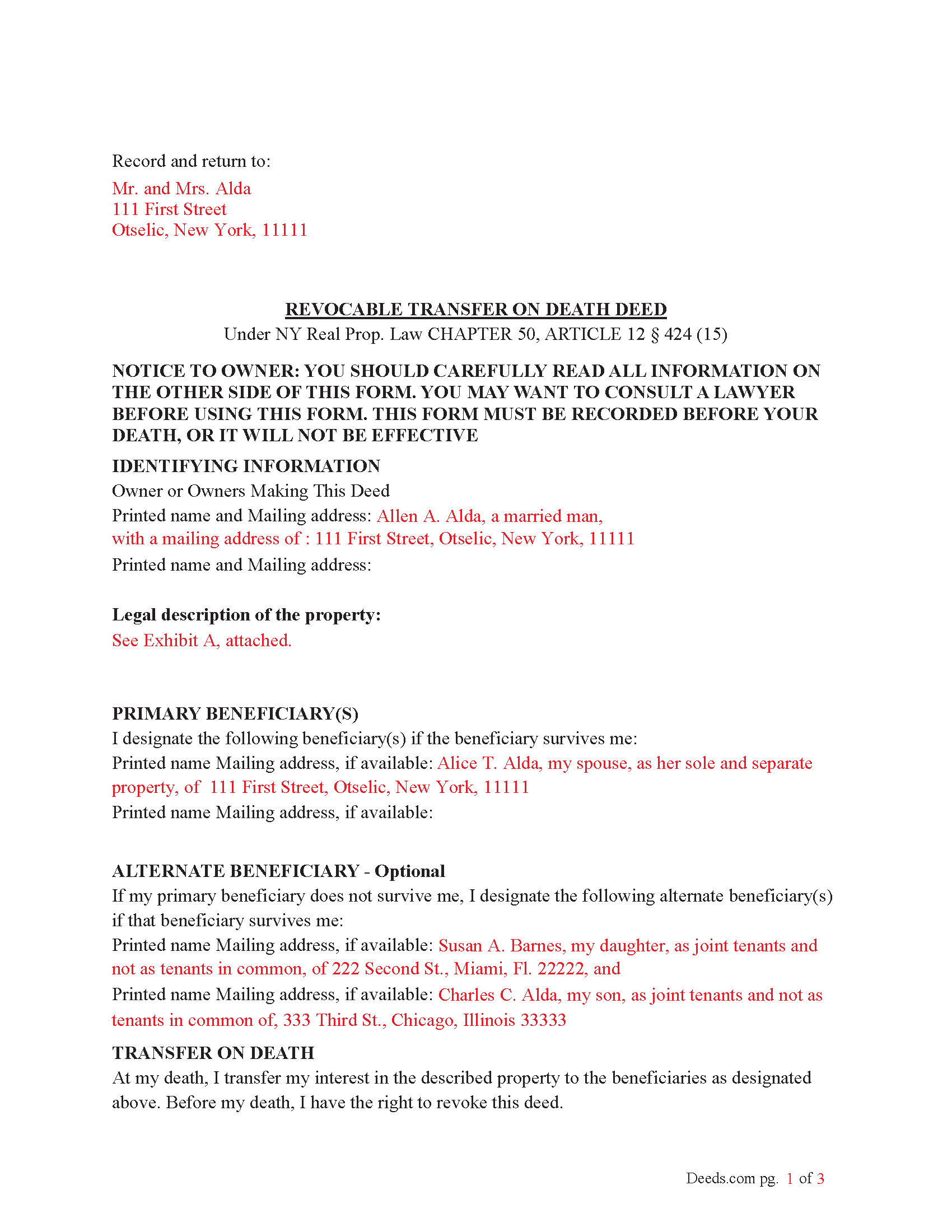

Completed Example of the Transfer on Death Deed Document

Example of a properly completed New York Transfer on Death Deed document for reference.

Included Yates County compliant document last validated/updated 12/4/2024

The following New York and Yates County supplemental forms are included as a courtesy with your order:

When using these Transfer on Death Deed forms, the subject real estate must be physically located in Yates County. The executed documents should then be recorded in the following office:

Yates County Clerk

417 Liberty St, Suite 1107, Penn Yan, New York 14527

Hours: 9am - 5pm / July-August: 8:30am - 4:30pm (real estate closings until 4pm)

Phone: (315) 536-5120

Local jurisdictions located in Yates County include:

- Bellona

- Branchport

- Dresden

- Dundee

- Himrod

- Keuka Park

- Lakemont

- Middlesex

- Penn Yan

- Rushville

How long does it take to get my forms?

Forms are available immediately after submitting payment.

How do I get my forms, are they emailed?

Immediately after you submit payment, the Yates County forms you order will be available for download directly from your account. You can then download the forms to your computer. If you do not already have an account, one will be created for you as part of the order process, and your login details will be provided to you. If you encounter any issues accessing your forms, please reach out to our support team for assistance. Forms are NOT emailed to you.

What does "validated/updated" mean?

This indicates the most recent date when at least one of the following occurred:

- Updated: The document was updated or changed to remain compliant.

- Validated: The document was examined by an attorney or staff, or it was successfully recorded in Yates County using our eRecording service.

Are these forms guaranteed to be recordable in Yates County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Yates County including margin requirements, content requirements, font and font size requirements.

Can the Transfer on Death Deed forms be re-used?

Yes. You can re-use the forms for your personal use. For example, if you have more than one property in Yates County that you need to transfer you would only need to order our forms once for all of your properties in Yates County.

What are supplemental forms?

Often when a deed is recorded, additional documents are required by New York or Yates County. These could be tax related, informational, or even as simple as a coversheet. Supplemental forms are provided for free with your order where available.

What type of files are the forms?

All of our Yates County Transfer on Death Deed forms are PDFs. You will need to have or get Adobe Reader to use our forms. Adobe Reader is free software that most computers already have installed.

Do I need any special software to use these forms?

You will need to have Adobe Reader installed on your computer to use our forms. Adobe Reader is free software that most computers already have installed.

Do I have to enter all of my property information online?

No. The blank forms are downloaded to your computer and you fill them out there, at your convenience.

Can I save the completed form, email it to someone?

Yes, you can save your deed form at any point with your information in it. The forms can also be emailed, blank or complete, as attachments.

Are there any recurring fees involved?

No. Nothing to cancel, no memberships, no recurring fees.

To use the Transfer on Death (TOD) Deed under New York’s Real Property Law (RPP) CHAPTER 50, ARTICLE 12 § 424 (effective July 19, 2024), follow these steps:

1. Complete the TOD Deed

Designate a beneficiary: Clearly name the individual or entity (such as a charity or trust) who will inherit your property upon your death.

Include contingent beneficiaries if desired (NOT required). These are backup beneficiaries who would inherit the property if your primary beneficiary cannot (e.g., if they predecease you). Ensure the deed is filled out correctly, including the legal description of the property.

2. Execute the TOD Deed: The TOD deed must be signed by the property owner (the transferor) in the presence of two witnesses and a Notary Public. The witnesses should not be the beneficiaries themselves, as this could raise legal issues.

3. Record the TOD Deed: The completed deed must be recorded with the County Clerk's office where the property is located during your lifetime. Recording the deed is crucial because, without it, the transfer will not be valid upon your death.

4. Retain Ownership During Lifetime: After recording the TOD deed, you retain full control of the property during your lifetime. You can still sell, mortgage, or revoke the TOD deed at any time.

If you change your mind, you can revoke the TOD deed by filing a revocation form or executing a new TOD deed, which automatically invalidates the previous one.

5. Upon Your Death: Upon your death, the property automatically transfers to the designated beneficiary without going through probate.

Key points about when it takes effect:

Timing of Transfer: The deed only takes effect upon the death of the property owner. Until then, the owner retains full control over the property and can revoke or change the TOD deed at any time.

Recording Requirement: For the TOD deed to be valid, it must be recorded with the county clerk during the property owner's lifetime. If the deed is not recorded before death, it will not be effective.

Probate Avoidance: By using a TOD deed, the property passes directly to the named beneficiary without going through probate, simplifying the transfer process and reducing legal costs.

Our Promise

The documents you receive here will meet, or exceed, the Yates County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Yates County Transfer on Death Deed form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4445 Reviews )

Dennis F.

December 20th, 2024

The release of mortgage form was OK, and accepted at the recorder's office, but there were some problems. Many of the fields to type in were too small to accept the data, and I could not find a way to change the field size or use a smaller font. Otherwise I was satisfied.

Your feedback is a crucial part of our dedication to ongoing improvement. Thank you for your insightful comments.

Frazer W.

December 19th, 2024

Deeds.com does a great job getting our legal documents filed with the D.C. Recorder of Deeds.rnrnFrazer Walton, Jr.rnLaw Office of Frazer Walton, Jr.

Your appreciative words mean the world to us. Thank you.

Ann D.

December 16th, 2024

I found what my lawyer recommended and was able to download it easily.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Maribeth M.

June 25th, 2021

Usually I have trouble registering things online, even though people tell me it's easy. This time, it WAS easy and fast, and I'm grateful I didn't have to drive somewhere and stand in line. Thank you!

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Bernadette W.

April 11th, 2022

It was very easy to use the website. I wish there was an option to pay for multiple documents at once instead of having to pay for each one individually.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Bonnie V.

May 10th, 2019

I was very pleased with Deeds.Com.

It was easy to use.

Thank you!

victoria r.

September 22nd, 2020

Easiest and most efficient process awesome online communication

Thank you!

Alan C.

December 10th, 2020

I thought the instructions could have been a little better. I didn't know how to do this if the spouses are married but living in separate residences. Also I didn't understand the "Prior Instrument Reference". That should be explained better. Very sketchy instructions.

Thank you for your feedback. We really appreciate it. Have a great day!

Gary A.

March 15th, 2019

I believe this is the way to go

without the need of a lawyer.

Fast downloads, very informative,

Now the work starts

Thank you Gary.

Don R.

January 26th, 2022

From Pennsylvania here. Documents are great and easy to fill out however you are lacking a couple of things. You only provide the option for a Grant Deed when you purchase by your county which is Mercer County for me. Why not give the ability to get a Warranty Deed that better protects the Grantee?

Also, being from Pennsylvania and in a county that mined Buituminous Coal we are required to include the Coal Severance Notice and Bituminous Mine Subsidence and Land Conservation Act Notice. You can check the box on your Deed form that they are required and attached but you do not provide the verbiage or form for this. You state that you know what each county requires and include everything required but you do not include these two required Notices. This has been a requirement for years and the wording never changes. I had to look for these Notices and hand type this information and include it on another seperate page after the Notary section on the Deed. The Grantor has to sign the Coal Severance Notice and be witnessed by a Notary so I had to add another place for the Notary and will have to pay twice for witnessed signatures when it could have been included in your document. My Deed from 2003 was done that way and then the Notary statement after that so it was only one notarized witness of signature.

Thank you for your feedback. We really appreciate it. Have a great day!

Thomas S.

April 13th, 2019

Very nice.

Thank you!

Nancy J.

September 9th, 2020

It is helpful that an example of filled out form is included.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Joseph S.

March 31st, 2022

The website was very easy to use. I rate it a five star

Thank you for your feedback. We really appreciate it. Have a great day!

Michael H.

April 8th, 2020

Very responsive and thorough. Glad to have found such a great company for our recording needs.

Thank you!

ruth l.

January 6th, 2021

I found this sight very helpful. All the information that one needs to file a quit claim deed. thank you so much.

Thank you!