Rockland County Transfer on Death Deed Form (New York)

All Rockland County specific forms and documents listed below are included in your immediate download package:

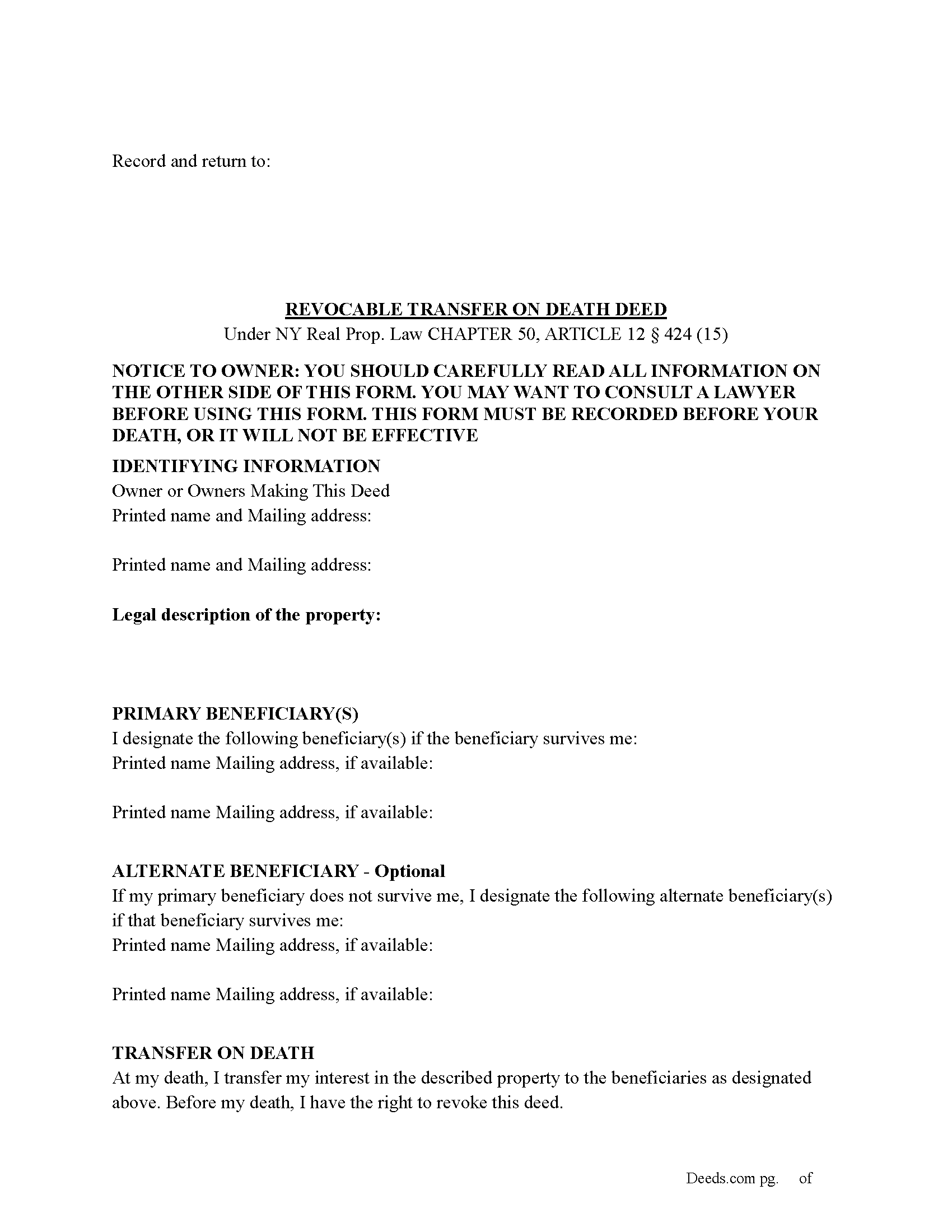

Transfer on Death Deed Form

Fill in the blank Transfer on Death Deed form formatted to comply with all New York recording and content requirements.

Included Rockland County compliant document last validated/updated 10/1/2024

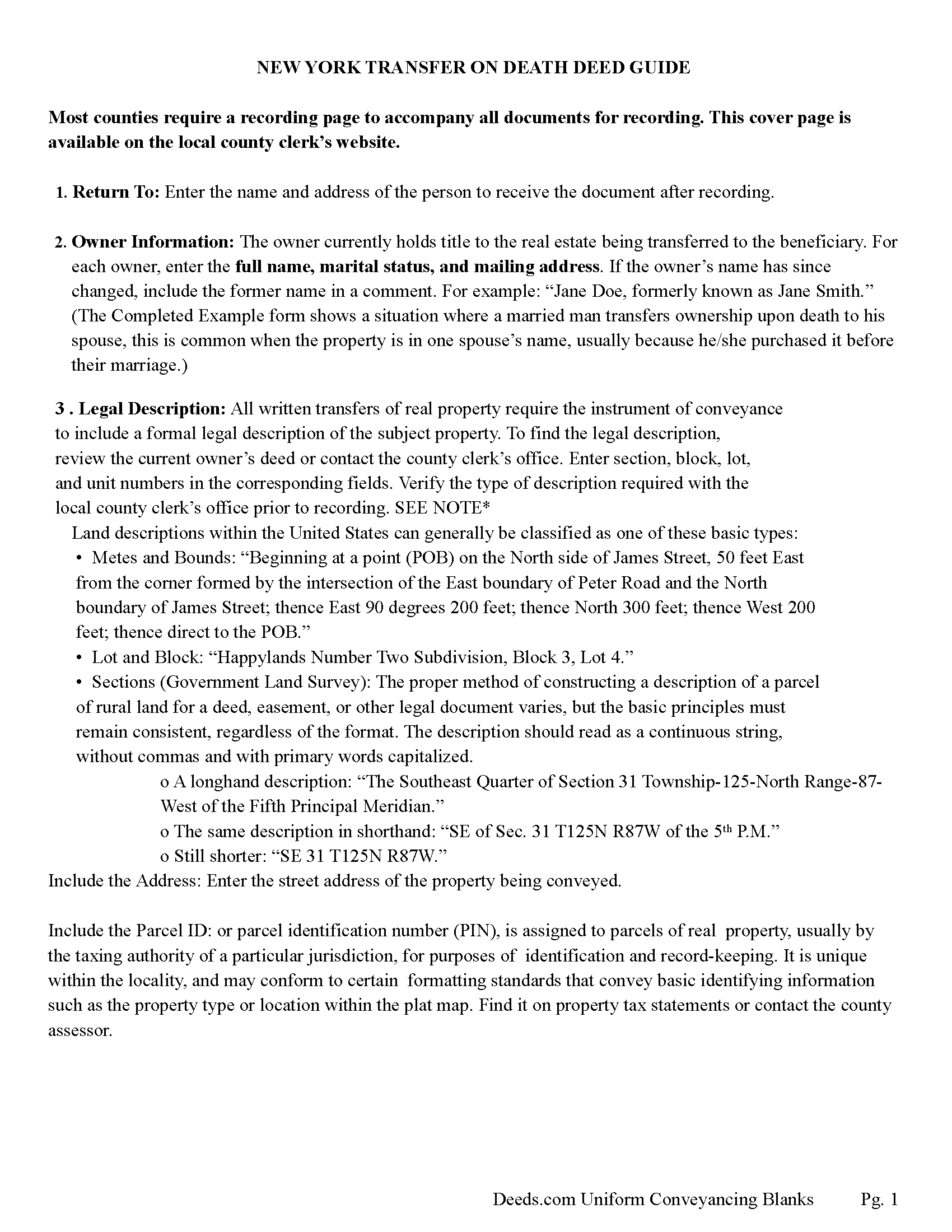

Transfer on Death Deed Guide

Line by line guide explaining every blank on the Transfer on Death Deed form.

Included Rockland County compliant document last validated/updated 10/1/2024

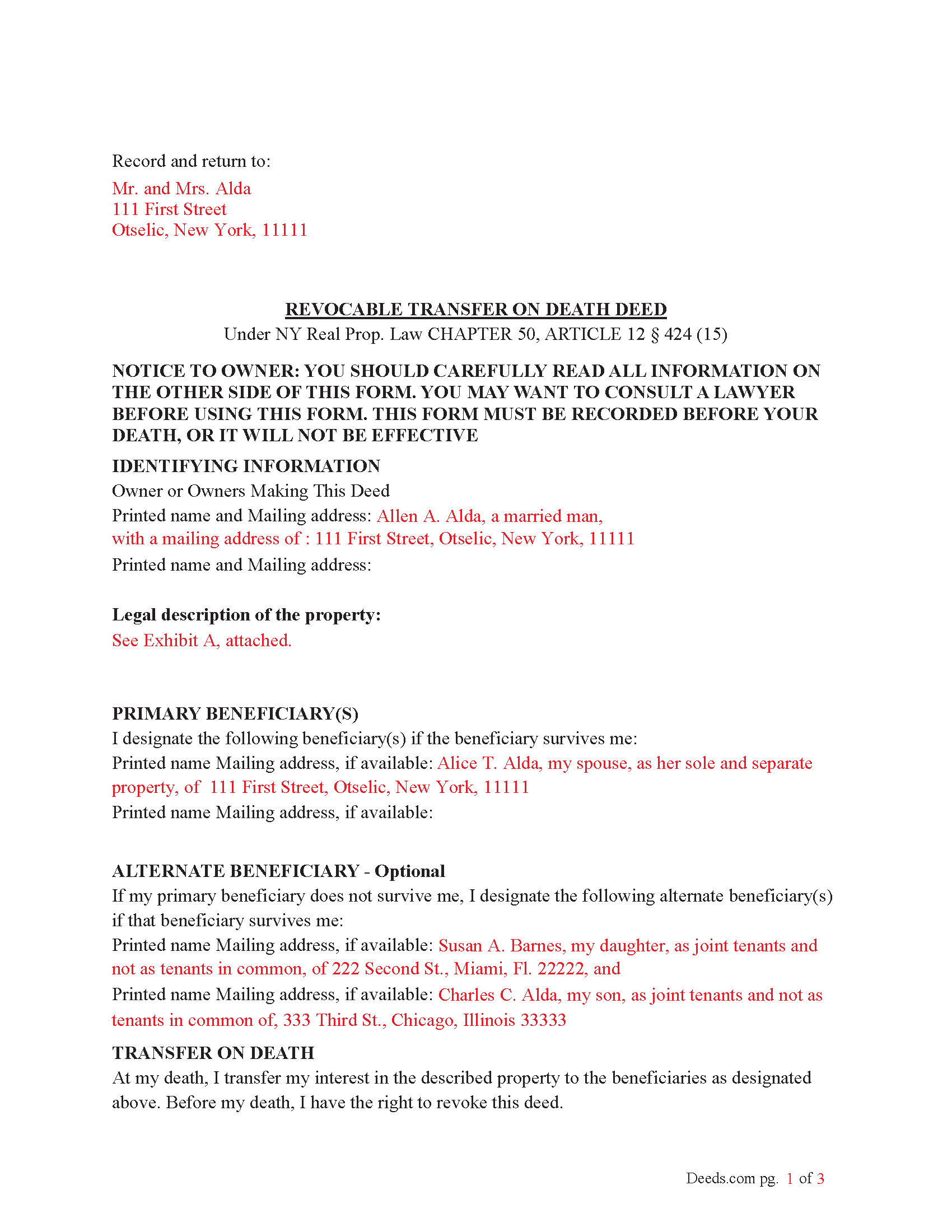

Completed Example of the Transfer on Death Deed Document

Example of a properly completed New York Transfer on Death Deed document for reference.

Included Rockland County compliant document last validated/updated 10/1/2024

The following New York and Rockland County supplemental forms are included as a courtesy with your order:

When using these Transfer on Death Deed forms, the subject real estate must be physically located in Rockland County. The executed documents should then be recorded in the following office:

Rockland County Clerk

County Courthouse - 1 S Main St, Suite 100, New City, New York 10956-3549

Hours: 7:00am - 6:00pm M-F / Recording: 7:00am - 5:00pm

Phone: (845) 638-5070

Local jurisdictions located in Rockland County include:

- Bear Mountain

- Blauvelt

- Congers

- Garnerville

- Haverstraw

- Hillburn

- Monsey

- Nanuet

- New City

- Nyack

- Orangeburg

- Palisades

- Pearl River

- Piermont

- Pomona

- Sloatsburg

- Sparkill

- Spring Valley

- Stony Point

- Suffern

- Tallman

- Tappan

- Thiells

- Tomkins Cove

- Valley Cottage

- West Haverstraw

- West Nyack

How long does it take to get my forms?

Forms are available immediately after submitting payment.

How do I get my forms, are they emailed?

Immediately after you submit payment, the Rockland County forms you order will be available for download directly from your account. You can then download the forms to your computer. If you do not already have an account, one will be created for you as part of the order process, and your login details will be provided to you. If you encounter any issues accessing your forms, please reach out to our support team for assistance. Forms are NOT emailed to you.

What does "validated/updated" mean?

This indicates the most recent date when at least one of the following occurred:

- Updated: The document was updated or changed to remain compliant.

- Validated: The document was examined by an attorney or staff, or it was successfully recorded in Rockland County using our eRecording service.

Are these forms guaranteed to be recordable in Rockland County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Rockland County including margin requirements, content requirements, font and font size requirements.

Can the Transfer on Death Deed forms be re-used?

Yes. You can re-use the forms for your personal use. For example, if you have more than one property in Rockland County that you need to transfer you would only need to order our forms once for all of your properties in Rockland County.

What are supplemental forms?

Often when a deed is recorded, additional documents are required by New York or Rockland County. These could be tax related, informational, or even as simple as a coversheet. Supplemental forms are provided for free with your order where available.

What type of files are the forms?

All of our Rockland County Transfer on Death Deed forms are PDFs. You will need to have or get Adobe Reader to use our forms. Adobe Reader is free software that most computers already have installed.

Do I need any special software to use these forms?

You will need to have Adobe Reader installed on your computer to use our forms. Adobe Reader is free software that most computers already have installed.

Do I have to enter all of my property information online?

No. The blank forms are downloaded to your computer and you fill them out there, at your convenience.

Can I save the completed form, email it to someone?

Yes, you can save your deed form at any point with your information in it. The forms can also be emailed, blank or complete, as attachments.

Are there any recurring fees involved?

No. Nothing to cancel, no memberships, no recurring fees.

To use the Transfer on Death (TOD) Deed under New York’s Real Property Law (RPP) CHAPTER 50, ARTICLE 12 § 424 (effective July 19, 2024), follow these steps:

1. Complete the TOD Deed

Designate a beneficiary: Clearly name the individual or entity (such as a charity or trust) who will inherit your property upon your death.

Include contingent beneficiaries if desired (NOT required). These are backup beneficiaries who would inherit the property if your primary beneficiary cannot (e.g., if they predecease you). Ensure the deed is filled out correctly, including the legal description of the property.

2. Execute the TOD Deed: The TOD deed must be signed by the property owner (the transferor) in the presence of two witnesses and a Notary Public. The witnesses should not be the beneficiaries themselves, as this could raise legal issues.

3. Record the TOD Deed: The completed deed must be recorded with the County Clerk's office where the property is located during your lifetime. Recording the deed is crucial because, without it, the transfer will not be valid upon your death.

4. Retain Ownership During Lifetime: After recording the TOD deed, you retain full control of the property during your lifetime. You can still sell, mortgage, or revoke the TOD deed at any time.

If you change your mind, you can revoke the TOD deed by filing a revocation form or executing a new TOD deed, which automatically invalidates the previous one.

5. Upon Your Death: Upon your death, the property automatically transfers to the designated beneficiary without going through probate.

Key points about when it takes effect:

Timing of Transfer: The deed only takes effect upon the death of the property owner. Until then, the owner retains full control over the property and can revoke or change the TOD deed at any time.

Recording Requirement: For the TOD deed to be valid, it must be recorded with the county clerk during the property owner's lifetime. If the deed is not recorded before death, it will not be effective.

Probate Avoidance: By using a TOD deed, the property passes directly to the named beneficiary without going through probate, simplifying the transfer process and reducing legal costs.

Our Promise

The documents you receive here will meet, or exceed, the Rockland County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Rockland County Transfer on Death Deed form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4434 Reviews )

James S.

November 21st, 2024

Forms used, created quitclaim deed that the county accepted without a second look (turns out they see deeds.com forms regularly via erecording and in person). Will be back for any real estate related forms I need and they carry. Will always be my first stop. Also, will use erecording next time, mad I didn't see it this time.

Thanks for the kind words James, glad we could help. Look forward to seeing you again.

Thomas G.

November 21st, 2024

Wasn’t what I expected

Sorry to hear that your expectations were missed. Your order has been canceled. We do hope that you find something more suitable to your expectations elsewhere. Do keep in mind that purchasing legal forms should not be an exploratory endeavor.

Jimmy P.

November 20th, 2024

They sent me everything I would need to do this. Easy purchase -Easy download. Great!! I'll be back here for all my document needs.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

barbara s.

May 2nd, 2020

you provided the service requested for a reasonable fee

Thank you!

Mica M.

March 2nd, 2021

I love deeds.com - hands down, the quickest way to record a warranty deed. The process and communication is so quick - the recording transaction too. Worth the extra $20 to me for my time! I didn't spend over an hour driving around, talking to someone via a kiosk to record the deed, didn't have to spend the energy of loading kids into the car to come with me, etc. The efficiency and timely process is worth the cost! Love having this available! The whole process via deeds.com took less than 5 minutes to upload a document and less than 3 minutes to pay the invoice shortly thereafter. The final recording was in my inbox in less than an hour. Thank you!

Thank you for your feedback. We really appreciate it. Have a great day!

Betty Z.

June 21st, 2023

Thank you so much for giving us a service so important to many. I will pass on this pertinent process to all who need it. again, thank you. bz

Thanks so much Betty. We appreciate you. Have a spectacular day!

Lana B.

August 25th, 2019

Was very helpful!

Thank you!

Pamela D K.

August 5th, 2020

very helpful. Was unable to find what I needed, but did everything they could to help.

Will try them again in the future, if need be.

Thank you for your feedback. We really appreciate it. Have a great day!

Carolyn S.

January 24th, 2021

This website was very helpful in explaining what a "gift" deed is and how to execute it. I didn't want to incur legal fees for a simple transaction and this website helped me avoid that.

Thank you for your feedback. We really appreciate it. Have a great day!

Gina M.

August 25th, 2021

Wow, great forms. They do have some protections in place to keep you from doing something stupid but if you use the forms as intended they will work perfectly for you.

Thank you for your feedback. We really appreciate it. Have a great day!

Eric G.

October 22nd, 2021

Need to offer option to download ALL forms as a single (bookmarked) PDF, rather than as separates... Quite inefficient as is.

Thank you for your feedback. We really appreciate it. Have a great day!

Richelle B.

August 10th, 2020

Thanks!

Thank you!

Charles S.

July 7th, 2021

Quick and easy. Highly recommend. Thanks!

Thank you for your feedback. We really appreciate it. Have a great day!

Kevin M.

May 13th, 2020

Maricopa County Recorders office directed to use Deeds.com for all forms, etc. Easily found the Warranty Deed form, instructions & sample form I was looking for.

Thank you!

Turto T.

February 5th, 2021

The documents were accurate and event well packaged. They contained all the information that was needed to establish revocable trusts and transfer the property into the trusts. All of this with decent price.

Thank you for your feedback. We really appreciate it. Have a great day!