Wayne County Executor Deed Form (New York)

All Wayne County specific forms and documents listed below are included in your immediate download package:

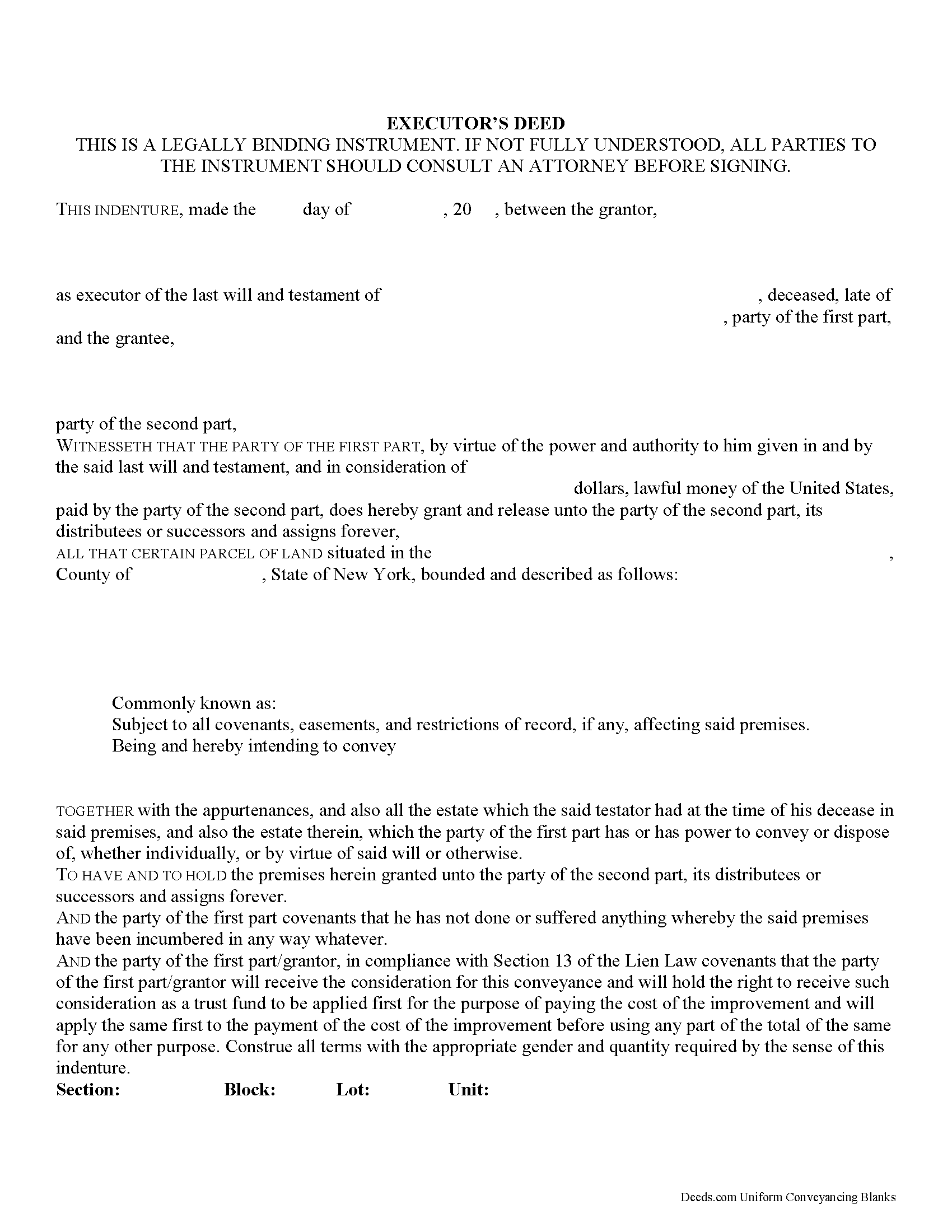

Executor Deed Form

Fill in the blank form formatted to comply with all recording and content requirements.

Included Wayne County compliant document last validated/updated 9/2/2024

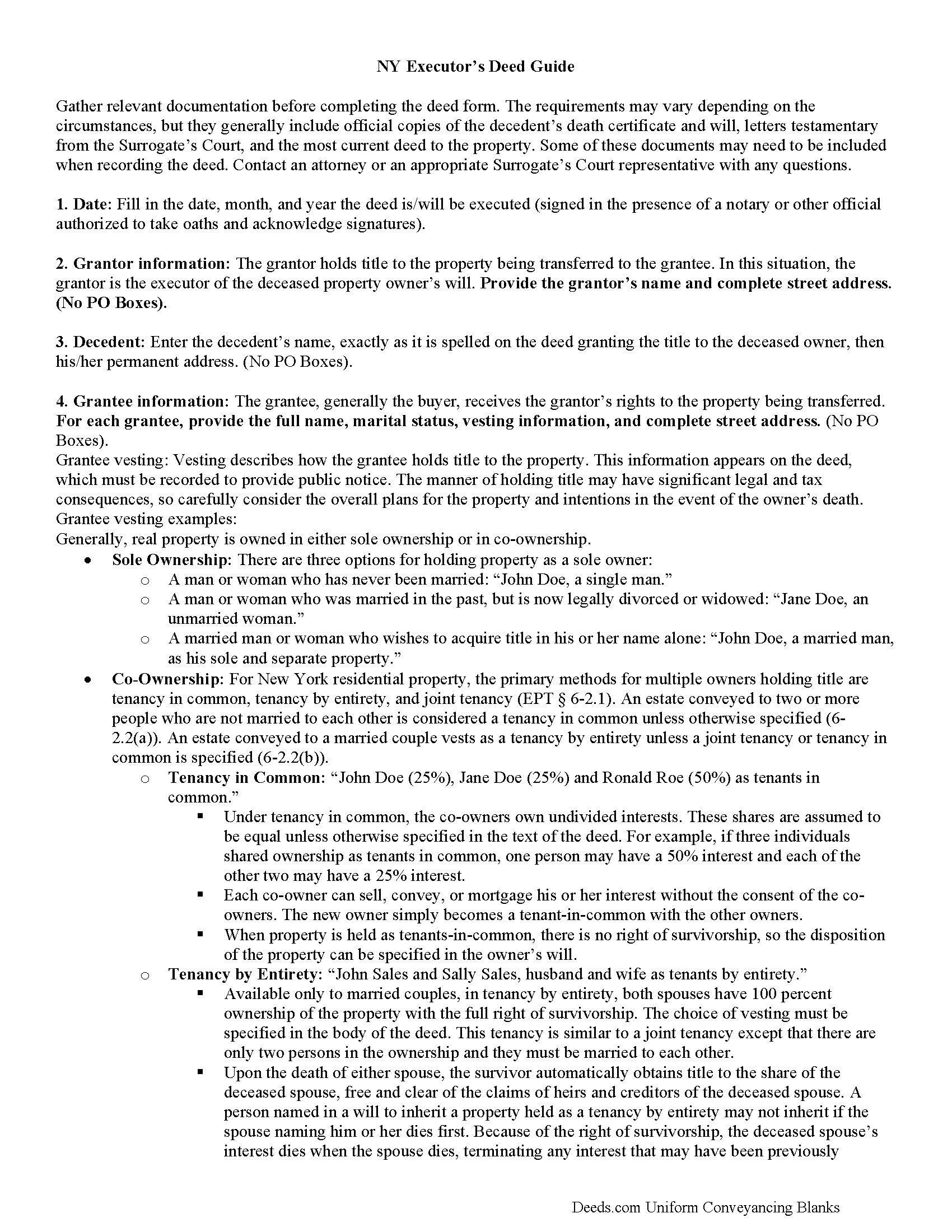

Executor Deed Guide

Line by line guide explaining every blank on the form.

Included Wayne County compliant document last validated/updated 6/27/2024

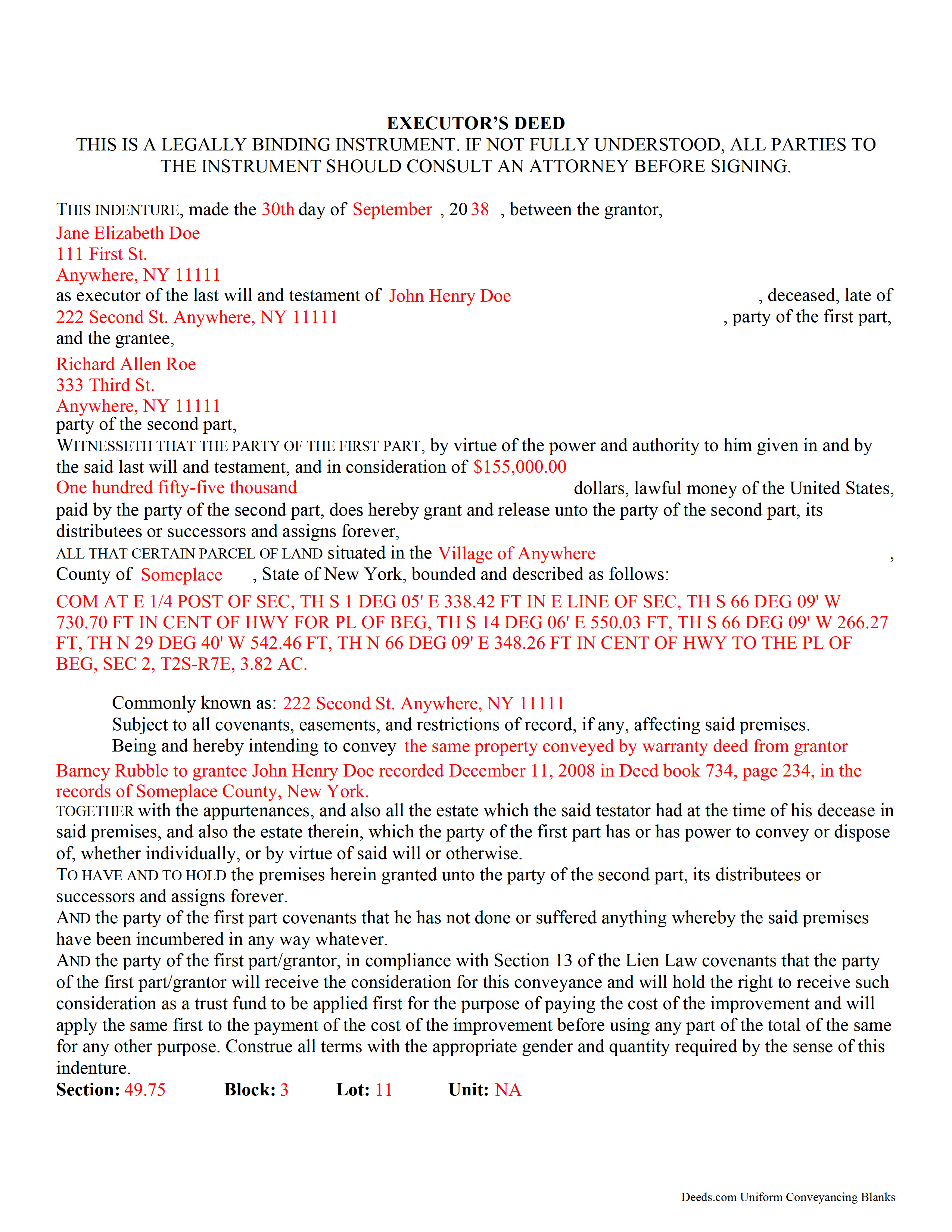

Completed Example of the Executor Deed Document

Example of a properly completed form for reference.

Included Wayne County compliant document last validated/updated 10/8/2024

The following New York and Wayne County supplemental forms are included as a courtesy with your order:

When using these Executor Deed forms, the subject real estate must be physically located in Wayne County. The executed documents should then be recorded in the following office:

Wayne County Clerk

9 Pearl St / PO Box 608, Lyons, New York 14489

Hours: 9:00 - 5:00 Monday - Friday (Recording until 4:30pm)

Phone: (315) 946-7470

Local jurisdictions located in Wayne County include:

- Alton

- Clyde

- East Williamson

- Lyons

- Macedon

- Marion

- Newark

- North Rose

- Ontario

- Ontario Center

- Palmyra

- Pultneyville

- Red Creek

- Rose

- Savannah

- Sodus

- Sodus Point

- South Butler

- Union Hill

- Walworth

- Williamson

- Wolcott

How long does it take to get my forms?

Forms are available immediately after submitting payment.

How do I get my forms, are they emailed?

Immediately after you submit payment, the Wayne County forms you order will be available for download directly from your account. You can then download the forms to your computer. If you do not already have an account, one will be created for you as part of the order process, and your login details will be provided to you. If you encounter any issues accessing your forms, please reach out to our support team for assistance. Forms are NOT emailed to you.

What does "validated/updated" mean?

This indicates the most recent date when at least one of the following occurred:

- Updated: The document was updated or changed to remain compliant.

- Validated: The document was examined by an attorney or staff, or it was successfully recorded in Wayne County using our eRecording service.

Are these forms guaranteed to be recordable in Wayne County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Wayne County including margin requirements, content requirements, font and font size requirements.

Can the Executor Deed forms be re-used?

Yes. You can re-use the forms for your personal use. For example, if you have more than one property in Wayne County that you need to transfer you would only need to order our forms once for all of your properties in Wayne County.

What are supplemental forms?

Often when a deed is recorded, additional documents are required by New York or Wayne County. These could be tax related, informational, or even as simple as a coversheet. Supplemental forms are provided for free with your order where available.

What type of files are the forms?

All of our Wayne County Executor Deed forms are PDFs. You will need to have or get Adobe Reader to use our forms. Adobe Reader is free software that most computers already have installed.

Do I need any special software to use these forms?

You will need to have Adobe Reader installed on your computer to use our forms. Adobe Reader is free software that most computers already have installed.

Do I have to enter all of my property information online?

No. The blank forms are downloaded to your computer and you fill them out there, at your convenience.

Can I save the completed form, email it to someone?

Yes, you can save your deed form at any point with your information in it. The forms can also be emailed, blank or complete, as attachments.

Are there any recurring fees involved?

No. Nothing to cancel, no memberships, no recurring fees.

Transferring New York Real Property with an Executor's Deed

Executor's deeds are used to transfer title to real property whose owner died testate (with a last will and testament.)

The executor is someone named to carry out the provisions contained within in a deceased individual's will. After the will is admitted to probate in the Surrogate's Court, the surrogate (the judge managing the case) authorizes the executor to begin his/her duties. Frequently, these include using an executor's deed to sell the decedent's real estate.

Executor's deeds contain the same information as warranty or quitclaim deeds, but they also include details about the executor and the deceased owner. The executor's signature must be notarized, but some cases may require a witness to sign the deed in front of the notary, too. Note that at sections 309-a and 309-b, New York's Real Property Law (RPP) sets out specific notary statements based on whether the deed is signed inside or outside the state.

In addition to the standard state and local forms that accompany deeds submitted for recording, executors might also need to attach letters testamentary from the Surrogate's Court, certified copies of the decedent's death certificate and will, and other supporting documentation as appropriate.

Probate procedures can be complicated, and each situation is unique. Seek assistance from an attorney or from the surrogate responsible for the case with any questions about this process.

(New York Executor Deed Package includes form, guidelines, and completed example)

Our Promise

The documents you receive here will meet, or exceed, the Wayne County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Wayne County Executor Deed form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4448 Reviews )

Dorothy N.

December 22nd, 2024

The mortgage and note were thorough and very satisfactory for my purposes. The accompanying forms were excellent. I am very pleased with my purchase.

We welcome your positive feedback and are thrilled to have met your expectations. Thank you for choosing our services.

Edward E.

December 22nd, 2024

Easy to use.

Your feedback is valuable to us and helps us improve. Thank you for sharing your thoughts!

MARISSA G.

December 22nd, 2024

I recomemed this webside

Thank you for your feedback. We really appreciate it. Have a great day!

Michael P.

February 4th, 2024

WOW!! Thank you for making the availability and access to these forms an unpainful experience at a competitive price. Well done!

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Cindy J.

September 4th, 2020

I'm stuck in Florida due to family business and needed to file documents in Virginia for other family business. Deeds.com made it easy and efficient and cost effective. I'm so grateful for this service!

Thank you!

Lauren W.

October 30th, 2019

I took a chance and downloaded the Beneficiary Deed form -- would have liked to have been able to see the form before I paid, but I took a chance as everywhere else I looked online wanted me to fill out form online and then pay $30+ for each deed. I'm doing several, so I was glad to be able to just download the blank form that appears to be one I can directly type into on my computer. Yay! Would use your site again if needed. Thanks!

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Lanette H.

September 9th, 2020

I liked getting the forms but I was charged twice for some reason. I'm not sure what happened with that. Can you reimburse me? Thank you. Lanette

Thank you for your feedback Lanette. In review, it looks like your first payment was declined, second one was approved and processed. What you are seeing is one payment and a hold placed by your financial institution for the declined attempt. We are not sure why they do this but the hold usually falls off after a few day depending on their policy. If you have further questions about this you can contact your financial institution and they will explain. Have a great day.

Daniel W.

April 18th, 2020

They are amazing. So fast and friendly.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Cody M.

May 28th, 2024

They respond fast, the process is simple, and it's obviously convenient. I'm not sure what else there is to say, other than it's I would say a reasonable fee to pay them to do it.

Thank you for your positive words! We’re thrilled to hear about your experience.

Kris D.

February 7th, 2022

The Executor's Guide needs more info about what to put for grantee (estate of deceased or my name as executor?) and the price (something nominal like $10?) before there is a buyer. The guide seems to use only one example.

Thank you for your feedback. We really appreciate it. Have a great day!

JIM H.

July 21st, 2022

Excellent service

Always find the documents in minutes.

Supporting docs is a super plus!

Thank you!

angela t.

December 4th, 2019

good forms for what i needed.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Karen L.

June 14th, 2022

Form is easy to complete but has a crowded look upon printing. I would put more returns between paragraphs to make it easier to read.

Thank you for your feedback. We really appreciate it. Have a great day!

DOUGLAS H.

December 16th, 2020

Just as promised

My quitclaim deed went through the county recorders office with no problem.

Thank you for your feedback. We really appreciate it. Have a great day!

Teresa T.

October 6th, 2022

amazingly fast! Thank you!

We appreciate your business and value your feedback. Thank you. Have a wonderful day!