Mora County Transfer on Death Revocation Form (New Mexico)

All Mora County specific forms and documents listed below are included in your immediate download package:

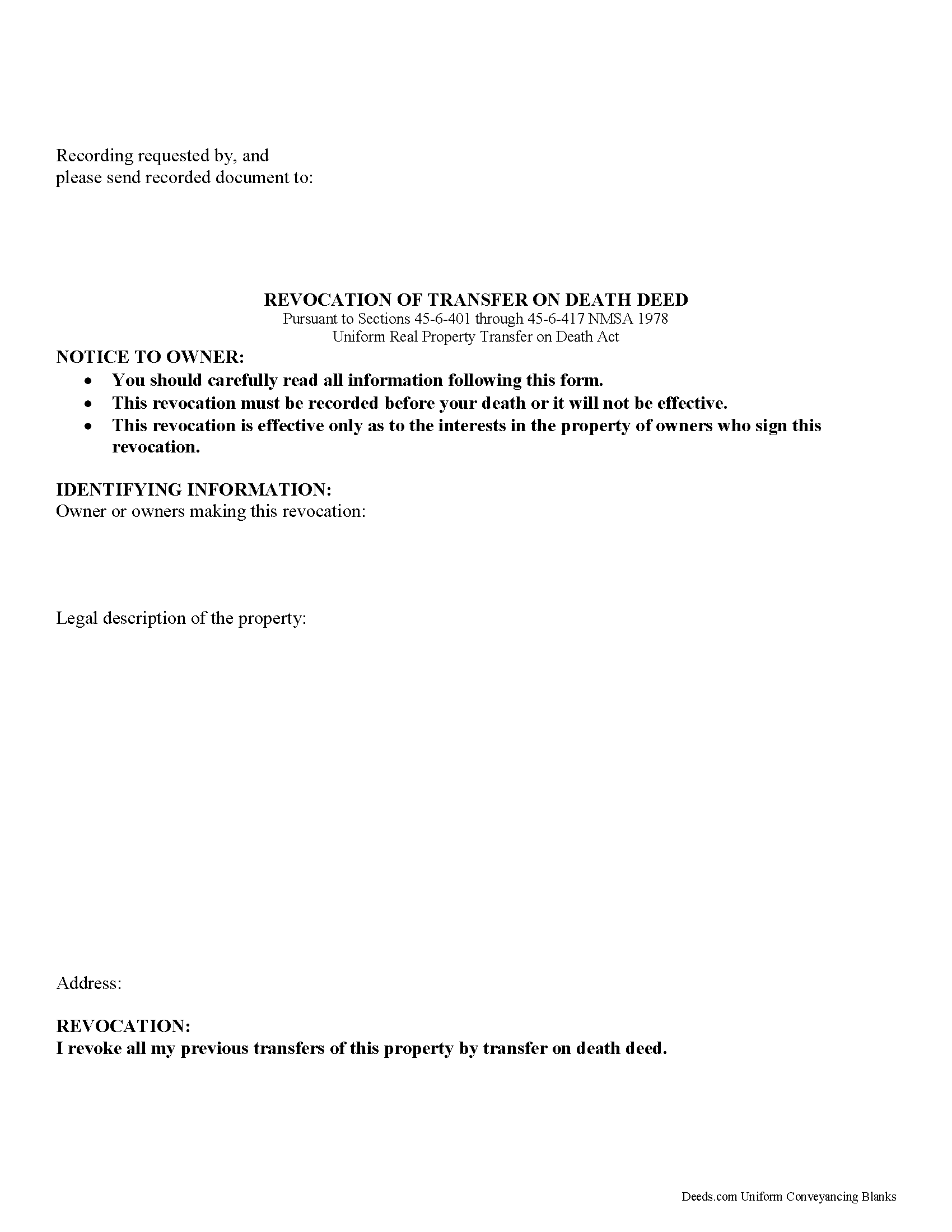

Transfer on Death Revocation Form

Fill in the blank form formatted to comply with all recording and content requirements.

Included Mora County compliant document last validated/updated 11/14/2024

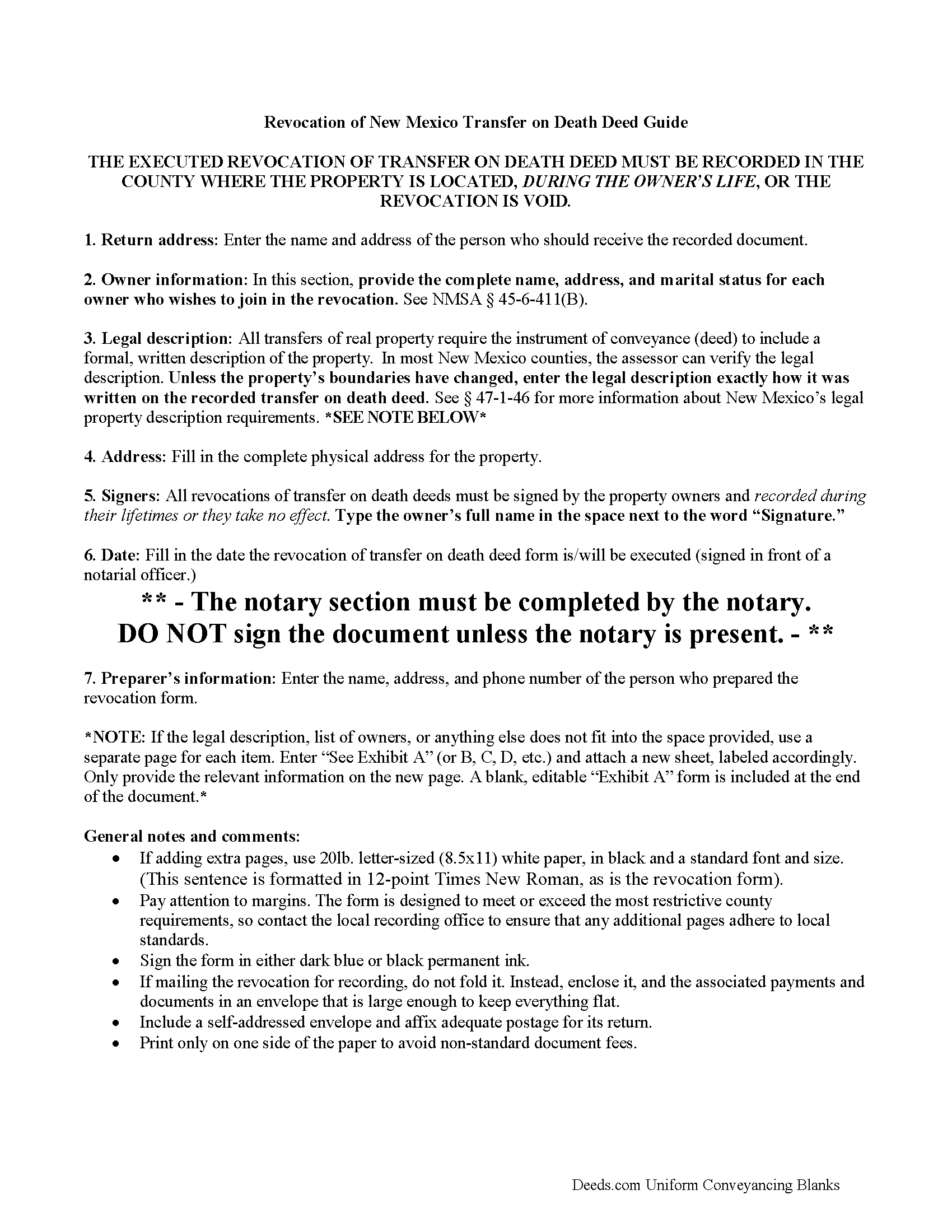

Transfer on Death Revocation Guide

Line by line guide explaining every blank on the form.

Included Mora County compliant document last validated/updated 10/8/2024

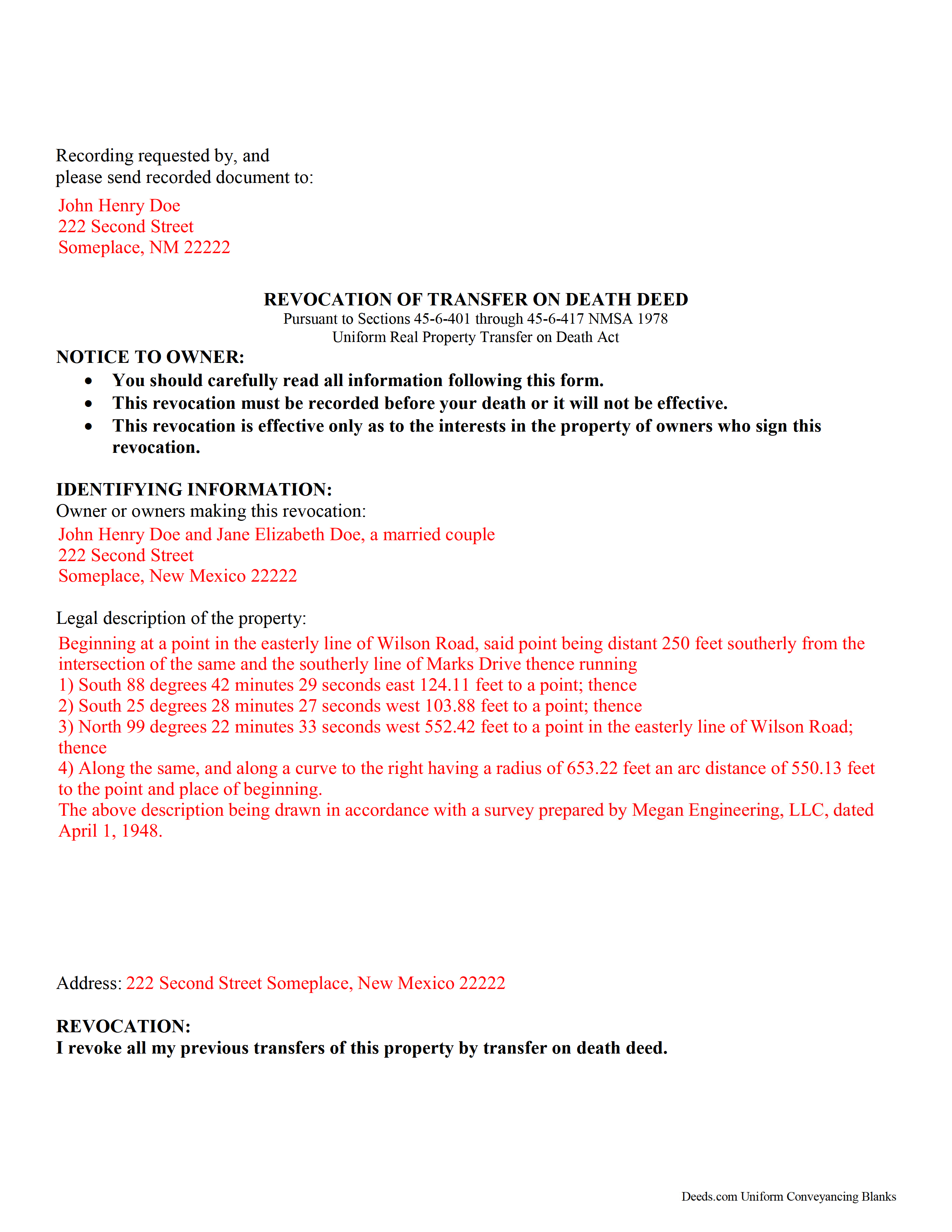

Completed Example of the Transfer on Death Revocation Document

Example of a properly completed form for reference.

Included Mora County compliant document last validated/updated 11/25/2024

The following New Mexico and Mora County supplemental forms are included as a courtesy with your order:

When using these Transfer on Death Revocation forms, the subject real estate must be physically located in Mora County. The executed documents should then be recorded in the following office:

Mora County Clerk

1 Courthouse Dr / PO Box 360, Mora, New Mexico 87732

Hours: 8:00am to 4:30pm M-F / Recording until 4:00pm

Phone: (575) 387-2448

Local jurisdictions located in Mora County include:

- Buena Vista

- Chacon

- Cleveland

- Guadalupita

- Holman

- Mora

- Ocate

- Ojo Feliz

- Rainsville

- Valmora

- Wagon Mound

- Watrous

How long does it take to get my forms?

Forms are available immediately after submitting payment.

How do I get my forms, are they emailed?

Immediately after you submit payment, the Mora County forms you order will be available for download directly from your account. You can then download the forms to your computer. If you do not already have an account, one will be created for you as part of the order process, and your login details will be provided to you. If you encounter any issues accessing your forms, please reach out to our support team for assistance. Forms are NOT emailed to you.

What does "validated/updated" mean?

This indicates the most recent date when at least one of the following occurred:

- Updated: The document was updated or changed to remain compliant.

- Validated: The document was examined by an attorney or staff, or it was successfully recorded in Mora County using our eRecording service.

Are these forms guaranteed to be recordable in Mora County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Mora County including margin requirements, content requirements, font and font size requirements.

Can the Transfer on Death Revocation forms be re-used?

Yes. You can re-use the forms for your personal use. For example, if you have more than one property in Mora County that you need to transfer you would only need to order our forms once for all of your properties in Mora County.

What are supplemental forms?

Often when a deed is recorded, additional documents are required by New Mexico or Mora County. These could be tax related, informational, or even as simple as a coversheet. Supplemental forms are provided for free with your order where available.

What type of files are the forms?

All of our Mora County Transfer on Death Revocation forms are PDFs. You will need to have or get Adobe Reader to use our forms. Adobe Reader is free software that most computers already have installed.

Do I need any special software to use these forms?

You will need to have Adobe Reader installed on your computer to use our forms. Adobe Reader is free software that most computers already have installed.

Do I have to enter all of my property information online?

No. The blank forms are downloaded to your computer and you fill them out there, at your convenience.

Can I save the completed form, email it to someone?

Yes, you can save your deed form at any point with your information in it. The forms can also be emailed, blank or complete, as attachments.

Are there any recurring fees involved?

No. Nothing to cancel, no memberships, no recurring fees.

On January 1, 2014, New Mexico joined with eleven other states to enact the Uniform Real Property Transfer on Death Act (URPTODA), found at Sections 45-6-401 through 45-6-417 NMSA 1978 (2014). This updated law enhances and adds clarity to the previous transfer on death statute already in force in the state.

Real estate owners who record a transfer on death deed (TODD) under the URPTODA retain the ability to revoke the recorded conveyance. These deeds offer a potential future interest but no guarantee of anything; the beneficiary only gains title to the property rights present when the owner dies.

Why does revocability matter? Life is unpredictable. For example, the original beneficiary may become unable or unwilling to accept the property. Marriage or divorce could alter the nature of the relationship between the owner and the intended recipient. The owner/transferor might decide to use the land another way. Regardless of the reason, the ability to cancel or modify a recorded TODD without involving the courts or restructuring their entire estate plan lets owners resolve unexpected issues in a relatively simple way.

There are three primary methods for revoking a transfer on death deed, as defined in the New Mexico Statutes at 45-6-411.

The named transferor may execute and record:

1. a statutory revocation form;

2. a new transfer on death deed that revokes all or part of a previously recorded TODD; or

3. an inter vivos deed (such as a warranty or quitclaim deed) that expressly revokes all or part of a previously recorded TODD.

Timely recording is essential for all documents dealing with ownership of real property, but it is even more important for documents associated with transfers at death. Just as with a TODD, the revocation must be recorded during the owner's life in the office of the clerk for the county in which the deed is recorded or it has no effect.

In addition to the reasons discussed above, consider filing a revocation form prior to selling real estate previously identified in a recorded transfer on death deed. Documenting the change helps to maintain a clear chain of title (ownership history) by closing out what might otherwise look like a potential claim against the property. A clear chain of title makes future transactions involving the property less complicated.

The right to revoke or modify a recorded transfer on death deed adds flexibility to a comprehensive estate plan. Executing and recording a statutory revocation form allows owners of New Mexico real estate to control the distribution of their property at death without the need for a will or probate. Each circumstance is unique, so contact an attorney with specific questions or for complex situations.

(New Mexico Revocation of TOD Package includes form, guidelines, and completed example)

Our Promise

The documents you receive here will meet, or exceed, the Mora County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Mora County Transfer on Death Revocation form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4445 Reviews )

Dennis F.

December 20th, 2024

The release of mortgage form was OK, and accepted at the recorder's office, but there were some problems. Many of the fields to type in were too small to accept the data, and I could not find a way to change the field size or use a smaller font. Otherwise I was satisfied.

Your feedback is a crucial part of our dedication to ongoing improvement. Thank you for your insightful comments.

Frazer W.

December 19th, 2024

Deeds.com does a great job getting our legal documents filed with the D.C. Recorder of Deeds.rnrnFrazer Walton, Jr.rnLaw Office of Frazer Walton, Jr.

Your appreciative words mean the world to us. Thank you.

Ann D.

December 16th, 2024

I found what my lawyer recommended and was able to download it easily.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Melody S.

February 11th, 2021

Although I was given quite a bit of information, I wanted my property title. I was not informed of what I would receive before I paid for this service.

Thank you!

Kimberly S.

April 21st, 2022

I wasted a lot of my time because I didn't do any research to know what I needed. Nobody fault but mine.

Thank you!

Sharon L H.

December 30th, 2018

The forms were good enough, hard to get excited about legal forms... The information was very thorough and helpful.

Thank you!

RUTH O.

November 9th, 2019

Got access to the forms immediately after ordering. Lots of helpful information, forms were easy to use. Happy I choose this site.

Thank you Ruth. Have a great day!

Wilfrid J.

June 7th, 2021

It was fast and easy but it's really official

Thank you!

Rodney S.

October 7th, 2021

Good service; thank you.

Thank you!

Carolyn D.

March 18th, 2022

The sight provided exactly what I needed and was easy to use. I was able to download the type of Deed I used and was completely satisfied with the website.

Thank you!

Lahoma G.

February 3rd, 2021

Got it very fast !! Thanks

Thank you for your feedback. We really appreciate it. Have a great day!

Thomas D.

April 30th, 2020

The documents themselves are fine and the information provided with them is helpful. I find the actual processing of the documents, however, to be difficult particularly once the document has been saved. First, I note that the box for the date only allows entry of the last 2 digits of the year. Unfortunately, my download only allows me to enter one of the 2 digits required. When I delete it repeatedly, it eventually allows both digits to be entered but puts them in extremely small text and in superscrypt. I have not found a solution to this problem and am not sure the deed can even be recorded with this problem.

Another problem is that if you try to revise the document after you have saved it the curser goes to the end of the line after each key entry. This means that there basically is no way to efficiently save the document for reworking later since you will have to delete everything you have entered in the text box unless you only need to make a single keystroke change or are willing to replace the curser after each entry. Try that with a long property description!

Please note that I am using a Mac to prepare my documents and perhaps this is part of an "incompatibility problem". However, I didn't see a disclaimer regarding Mac use and so would expect the documents to perform correctly. Overall, I give the program a "2 star" rating because I am experiencing significant difficulties in entering dates in the documents even before saving them and because saving your work for later revision appears to be basically unworkable.

Thank you for your feedback Thomas, we appreciate you being specific about the issues you encountered. Adobe and Mac have a fairly long history of issues working together.

Evelyn R.

July 16th, 2020

Filing my deed through your service was great. All directions were clear and specific; it was very easy to upload the documents and most of all feedback from your office was professional and very timely. You service was excellent. Thank you!! Thank you so very much!!

Thank you for your feedback. We really appreciate it. Have a great day!

Ken J.

May 14th, 2022

I liked the software, it's very easy to use. Once it's saved as a .pdf document on your computer, the source document is lost when you log out. I wish it could be saved and then edited on their site later instead of having to create a new document from scratch each time.

Thank you for your feedback. We really appreciate it. Have a great day!

Dapo L.

June 3rd, 2021

The team is very responsive and gets the job done. Thank you.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!