Quay County Personal Representative Deed Form (New Mexico)

All Quay County specific forms and documents listed below are included in your immediate download package:

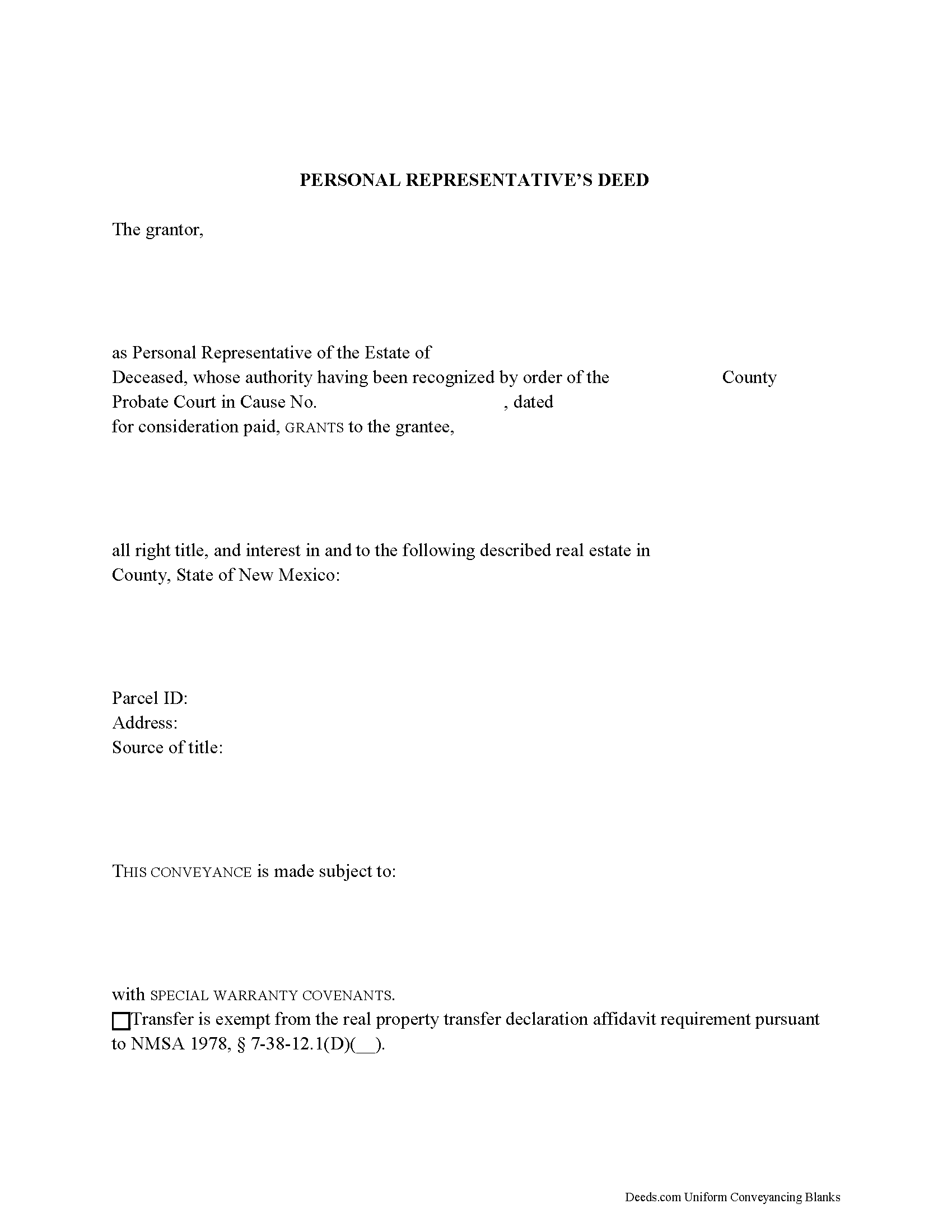

Personal Representative Deed Form

Fill in the blank form formatted to comply with all recording and content requirements.

Included Quay County compliant document last validated/updated 10/28/2024

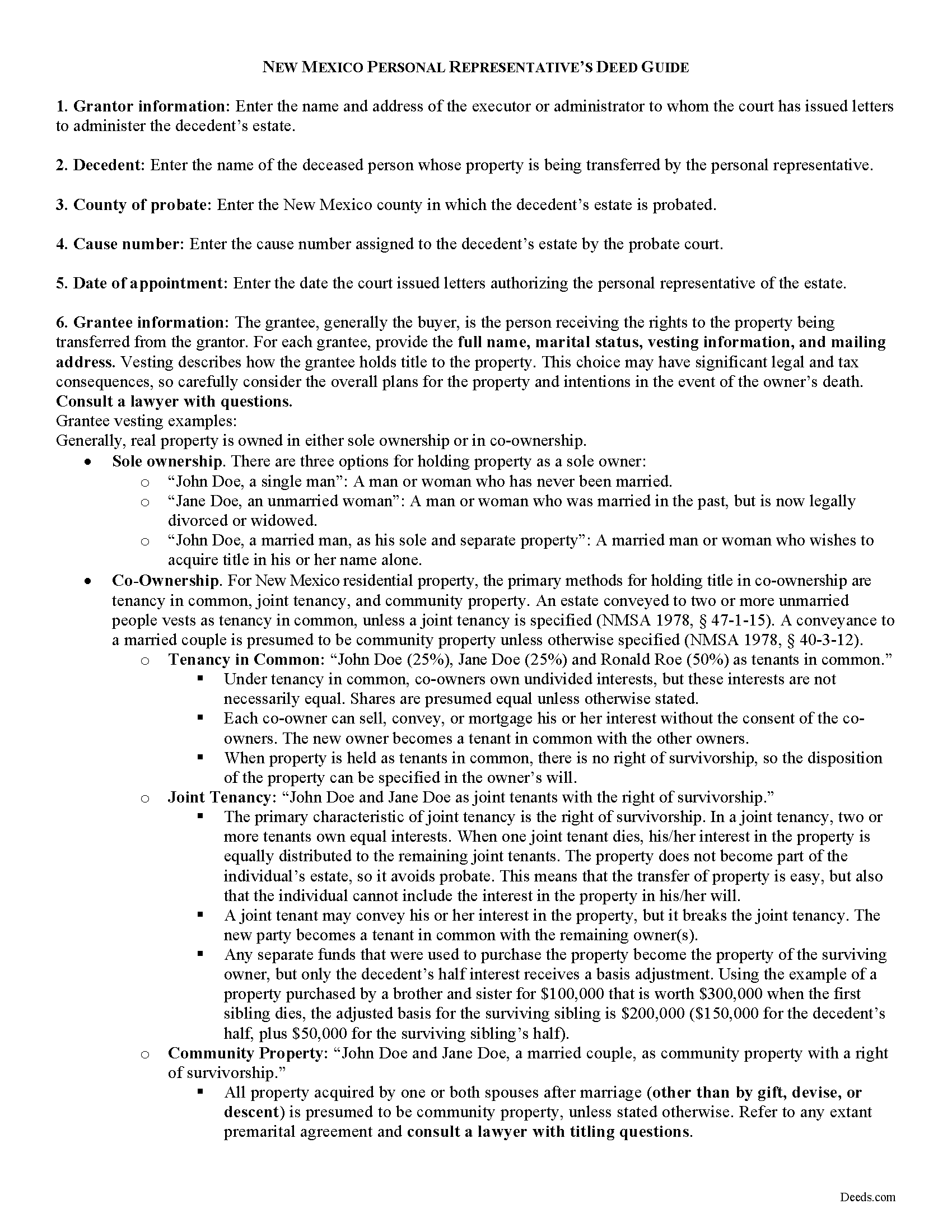

Personal Representative Deed Guide

Line by line guide explaining every blank on the form.

Included Quay County compliant document last validated/updated 9/4/2024

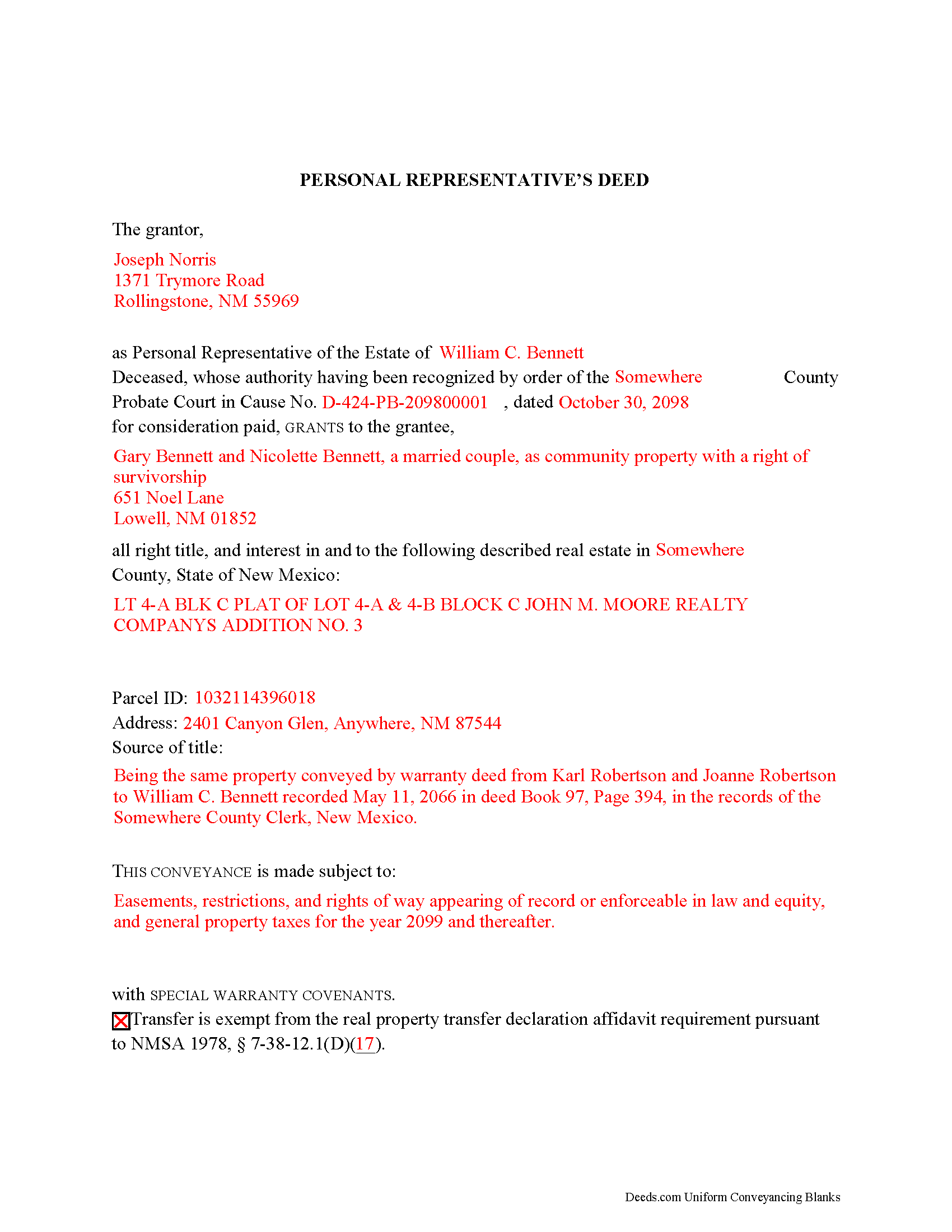

Completed Example of the Personal Representative Deed Document

Example of a properly completed form for reference.

Included Quay County compliant document last validated/updated 11/20/2024

The following New Mexico and Quay County supplemental forms are included as a courtesy with your order:

When using these Personal Representative Deed forms, the subject real estate must be physically located in Quay County. The executed documents should then be recorded in the following office:

Quay County Clerk

300 South Third St / PO Box 1225, Tucumcari, New Mexico 88401

Hours: 8:00am - 12:00 & 1:00 - 5:00pm M-F

Phone: (575) 461-0510

Local jurisdictions located in Quay County include:

- Bard

- House

- Logan

- Mcalister

- Nara Visa

- Quay

- San Jon

- Tucumcari

How long does it take to get my forms?

Forms are available immediately after submitting payment.

How do I get my forms, are they emailed?

Immediately after you submit payment, the Quay County forms you order will be available for download directly from your account. You can then download the forms to your computer. If you do not already have an account, one will be created for you as part of the order process, and your login details will be provided to you. If you encounter any issues accessing your forms, please reach out to our support team for assistance. Forms are NOT emailed to you.

What does "validated/updated" mean?

This indicates the most recent date when at least one of the following occurred:

- Updated: The document was updated or changed to remain compliant.

- Validated: The document was examined by an attorney or staff, or it was successfully recorded in Quay County using our eRecording service.

Are these forms guaranteed to be recordable in Quay County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Quay County including margin requirements, content requirements, font and font size requirements.

Can the Personal Representative Deed forms be re-used?

Yes. You can re-use the forms for your personal use. For example, if you have more than one property in Quay County that you need to transfer you would only need to order our forms once for all of your properties in Quay County.

What are supplemental forms?

Often when a deed is recorded, additional documents are required by New Mexico or Quay County. These could be tax related, informational, or even as simple as a coversheet. Supplemental forms are provided for free with your order where available.

What type of files are the forms?

All of our Quay County Personal Representative Deed forms are PDFs. You will need to have or get Adobe Reader to use our forms. Adobe Reader is free software that most computers already have installed.

Do I need any special software to use these forms?

You will need to have Adobe Reader installed on your computer to use our forms. Adobe Reader is free software that most computers already have installed.

Do I have to enter all of my property information online?

No. The blank forms are downloaded to your computer and you fill them out there, at your convenience.

Can I save the completed form, email it to someone?

Yes, you can save your deed form at any point with your information in it. The forms can also be emailed, blank or complete, as attachments.

Are there any recurring fees involved?

No. Nothing to cancel, no memberships, no recurring fees.

Transferring a Decedent's Realty in New Mexico

Probate is the court-supervised process of settling a decedent's (deceased person's) estate and distributing his or her assets according to the provisions of a will or pursuant to laws of intestate succession.

New Mexico is one of 18 states as of the time of this writing to adopt the Uniform Probate Code, a nationally-recommended set of laws governing the probate process. The Uniform Probate Code is codified at Chapter 45 of the New Mexico Statutes.

Probate of an estate takes place in the probate court of the New Mexico county wherein the decedent resided at the time of death. Contested cases may be brought before the district court.

When a decedent leaves property titled in his or her name individually, such property is subject to probate. Any realty the decedent held as a tenant in common must also pass through probate. If the decedent's estate includes realty not situated in the county where the estate is administered, NMSA 1978, 45-1-404 provides that a notice of administration be filed in the county wherein any ancillary real property is situated.

The Uniform Probate Code also addresses non-probate transfers of property (codified in New Mexico at NMSA 1978, 45-6-101 through 45-6-417). Property held with a survivorship interest, in a trust, or with a beneficiary designation (such as a recorded transfer on death deed) transfers outside of probate. A surviving spouse in New Mexico who occupied a homestead as community property with his/her spouse may also avoid probate by filing an affidavit of transfer of title to homestead under NMSA 1978, 45-3-1205.

The first step of probate is making application for appointment as personal representative (PR), who is the fiduciary in charge of settling and distributing the estate; administration of the estate cannot begin until the court authorizes a personal representative.

Depending on the testacy status of the decedent (whether the decedent died with a will), the personal representative may alternately be referred to as an executor or an administrator. An executor is someone named by the decedent to carry out the provisions of his or her will, while an administrator is a person selected by the probate court when the decedent dies without a will or the will does not name an executor of the estate.

NMSA 1978, 45-3-203 establishes the priority of persons to be appointed PR of a decedent's estate, with the executor named in the decedent's will having highest priority. If the decedent died without a will, the surviving spouse has the highest priority to serve, followed by the intestate decedent's heirs. A person petitioning the court to serve as an estate's administrator must obtain waivers from each person with a higher priority to serve, if applicable.

To officially begin administration, the court issues letters appointing the PR. When the decedent dies intestate (without a will), these are called letters of administration. When the decedent dies testate (with a will), these are called letters testamentary. The letters act as proof that the personal representative named within is the acting and qualified PR, enabling him to act on behalf of the decedent's estate and carry out the duties of administration.

The Uniform Probate Code establishes rules for providing notice to heirs and creditors of a probated estate. Once appointed, the PR must provide notice of appointment to heirs and devisees within 10 days (NMSA 1978, 45-3-705). A devisee (or beneficiary) is anyone listed in the decedent's will to receive assets from the estate. An heir is anyone entitled to an intestate decedent's property. Statutes also require the PR to provide notice to creditors to file claims on the estate within 4 months of the publication of such notice (45-3-801).

Among a PR's duties is to collect the decedent's assets and take inventory of the estate; file applicable income and estate taxes; pay the decedent's debts and the costs of estate administration; and, finally, distribute the remaining assets to the heirs or devisees. The allotted shares of heirs in an intestate estate are outlined at NMSA 1978, 45-2-101 through 45-2-104.

The PR may have to petition the district court to partition an estate when multiple heirs or devisees are entitled to undivided interests in realty. The court may make partition or direct the PR to sell property that "cannot be partitioned without prejudice...and which cannot conveniently be allotted to any one party" (NMSA 1978, 45-3-911).

In New Mexico, a PR deed is an instrument that conveys title from the decedent to a devisee, heir, or purchaser, typically with special warranty covenants. The special warranty deed is a statutory form in New Mexico, codified at NMSA 1978, 47-1-44(5). By offering a fiduciary deed with special warranty covenants, the PR covenants with the grantee that the premises conveyed are free from encumbrances made by the grantor, and that the grantor will warrant and defend the grantee's title against the lawful claims arising by, through, or under the grantor, but against no other persons (47-1-38).

To successfully distribute real property to successors in interest, whether they be devisees listed in the decedent's will or heirs entitled by laws of intestate succession, the PR must confirm the successor's title through executing and recording a personal representative's deed. Some title companies may require that a court order be entered before transferring a decedent's property.

When the grantee is an heir or devisee and the conveyance is made with no consideration, the PR deed may be alternately referred to as a deed of distribution. The deed, recorded in the clerk's office wherein the subject realty is located, serves as "conclusive evidence that the distributee has succeeded to the interest of the estate in the distributed assets, as against all interested persons" (NMSA 1978, 45-3-908). An interested person is an heir, devisee, or other beneficiary or creditor having a property right in or a claim against the decedent's estate (45-1-201(26)).

A PR deed names the authorized executor or administrator of the estate as the grantor, along with details about the probated estate, including the decedent's name, the county of probate, the cause number assigned to the estate by the probate court, and the PR's date of appointment. As with other transfers of real property, it requires the grantee's name, address, and vesting information, and contains a complete legal description of the subject parcel, along with parcel identifier, and a recitation of the source of title. Detail any restrictions or agreements associated with the premises. Whether the PR executes the deed to a distributee or to a purchaser, the instrument must comply with New Mexico's standards for form and content of instruments pertaining to interests in realty. The authorized personal representative must sign in the presence of a notarial official before recording the deed in the appropriate county clerk's office.

Because New Mexico is a nondisclosure state, certain types of personal information, including the consideration exchanged in a transfer of property, are withheld from public record. Most transfers require a Real Property Transfer Declaration Affidavit, which details the relevant sales information. This affidavit must be filed with the assessor's office within 30 days of recording the deed. If the deed conveys title to a purchaser, include a statement of consideration paid for the transfer and an accompanying New Mexico real property transfer declaration affidavit. Note that transfers made to effect a court-ordered partition or establish a distribution from an estate are exempt from the affidavit requirement (NMSA 1978, 7-38-12.1(D)).

The information provided here is not a substitute for legal advice. Consult an attorney with questions regarding personal representative's deeds and probate procedures in New Mexico, as each situation is unique.

(New Mexico PRD Package includes form, guidelines, and completed example)

Our Promise

The documents you receive here will meet, or exceed, the Quay County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Quay County Personal Representative Deed form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4445 Reviews )

Dennis F.

December 20th, 2024

The release of mortgage form was OK, and accepted at the recorder's office, but there were some problems. Many of the fields to type in were too small to accept the data, and I could not find a way to change the field size or use a smaller font. Otherwise I was satisfied.

Your feedback is a crucial part of our dedication to ongoing improvement. Thank you for your insightful comments.

Frazer W.

December 19th, 2024

Deeds.com does a great job getting our legal documents filed with the D.C. Recorder of Deeds.rnrnFrazer Walton, Jr.rnLaw Office of Frazer Walton, Jr.

Your appreciative words mean the world to us. Thank you.

Ann D.

December 16th, 2024

I found what my lawyer recommended and was able to download it easily.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Audra P.

March 2nd, 2021

Deeds.com was so easy to use and understand. So fairly priced too in my opinion, worth every penny! Thank you deeds.com and I'm grateful my county uses and encourages using them.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

KAREN S.

July 22nd, 2020

Easy to use this app and I was able to print my forms immediately! Great service and I would use it again.

Thank you for your feedback. We really appreciate it. Have a great day!

Roy P.

October 12th, 2021

The forms were just what I needed, very helpful.

Thank you for your feedback. We really appreciate it. Have a great day!

Arthur S.

July 19th, 2019

It is great and fast you get 5 stars from me

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

RICHARD MANUEL F.

January 26th, 2023

I never could even think to solve an important issue involving even overseas individuals without even a lawyer within 24 h. This service works for real and I'll keep using it from now for any future needs, referring to and proposing it as a legitimate, trusted real Optimus service. I'm extremely satisfied and being a Public Official myself I got to say that these guys have really impressed me!

Thank you!

Cedric W.

January 2nd, 2021

This process was very easy to go through, from beginning to end. It was fast, precise and got the job done without me having to leave my computer. If opportunities arise, I will definitely use deeds.com again.

Thank you for your feedback. We really appreciate it. Have a great day!

Christopher H.

July 21st, 2021

The product is as advertised. I was unable to navigate this process because It is complicated and I am concerned about doing it wrong. The law is written in stupid language to make it difficult for all and keep the layering business going. Its a solid form but did not work for me. Thanks

Chris

Thank you for your feedback Christopher. Sorry to hear that we’re not comfortable completing the process. It is always best to seek the advice of a legal professional is you are not completely sure of what you are doing.

Daphne M.

March 19th, 2023

As always I found Deeds.com to be excellent. Every item required on the forms I chose was explained completely. The fact that documents are available from so many states is amazing. Daphne M.

Thank you for your feedback. We really appreciate it. Have a great day!

Mary H.

June 15th, 2020

I have downloaded all the forms and the guidelines. The information provided is very helpful and easy to access.

Thank you

Thank you for your feedback. We really appreciate it. Have a great day!

Curtis T.

May 12th, 2020

Deeds support was awesome and constant. Thank you.

Thank you!

Richard T.

January 21st, 2019

This was a complete set of the necessary forms, with instructions. It will be very useful. Instant download was great.

We appreciate your feedback Richard. Have a wonderful day!

James C.

November 3rd, 2020

Deed was filed with county quickly. Great service!

Thank you!