Grant County Grant Deed Form (New Mexico)

All Grant County specific forms and documents listed below are included in your immediate download package:

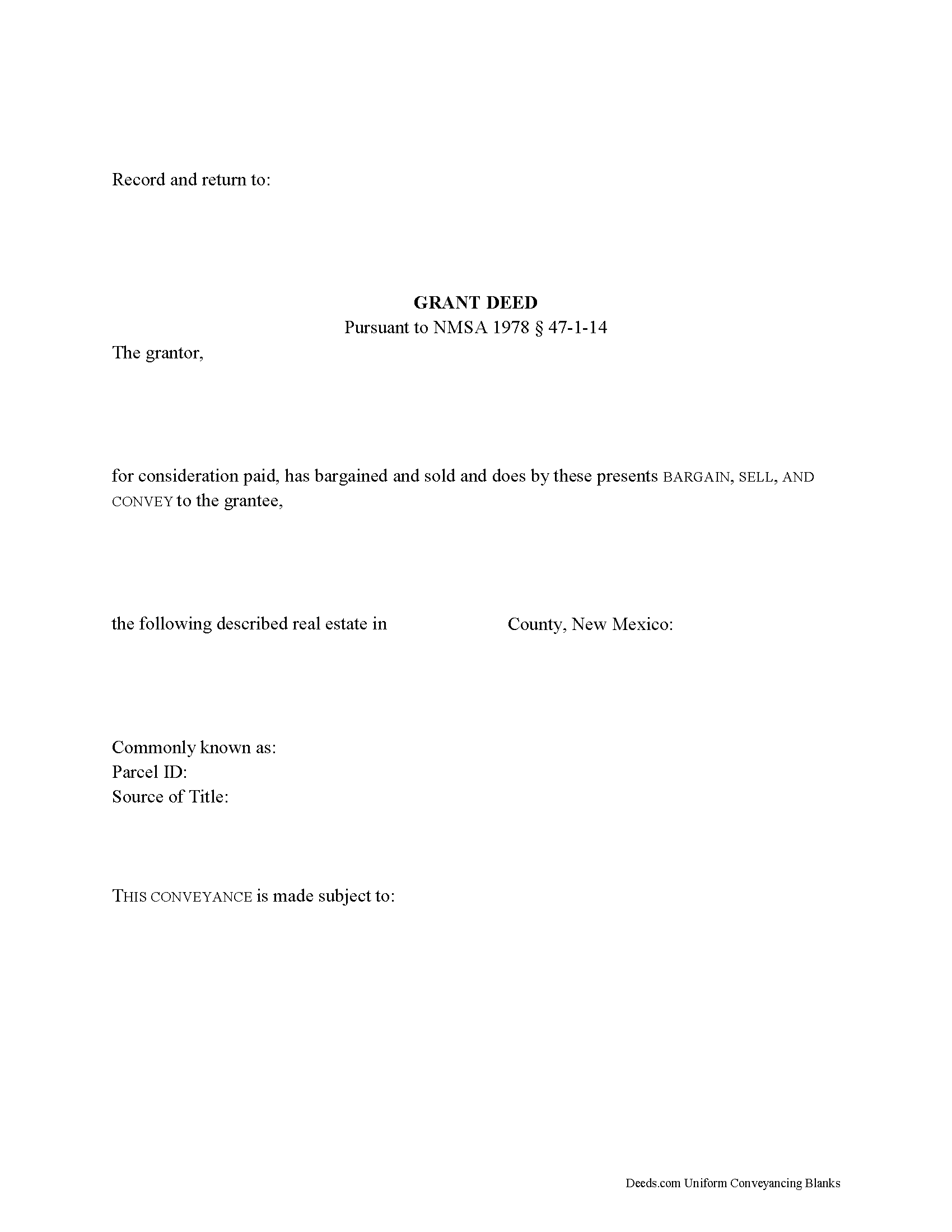

Grant Deed Form

Fill in the blank form formatted to comply with all recording and content requirements.

Included Grant County compliant document last validated/updated 8/19/2024

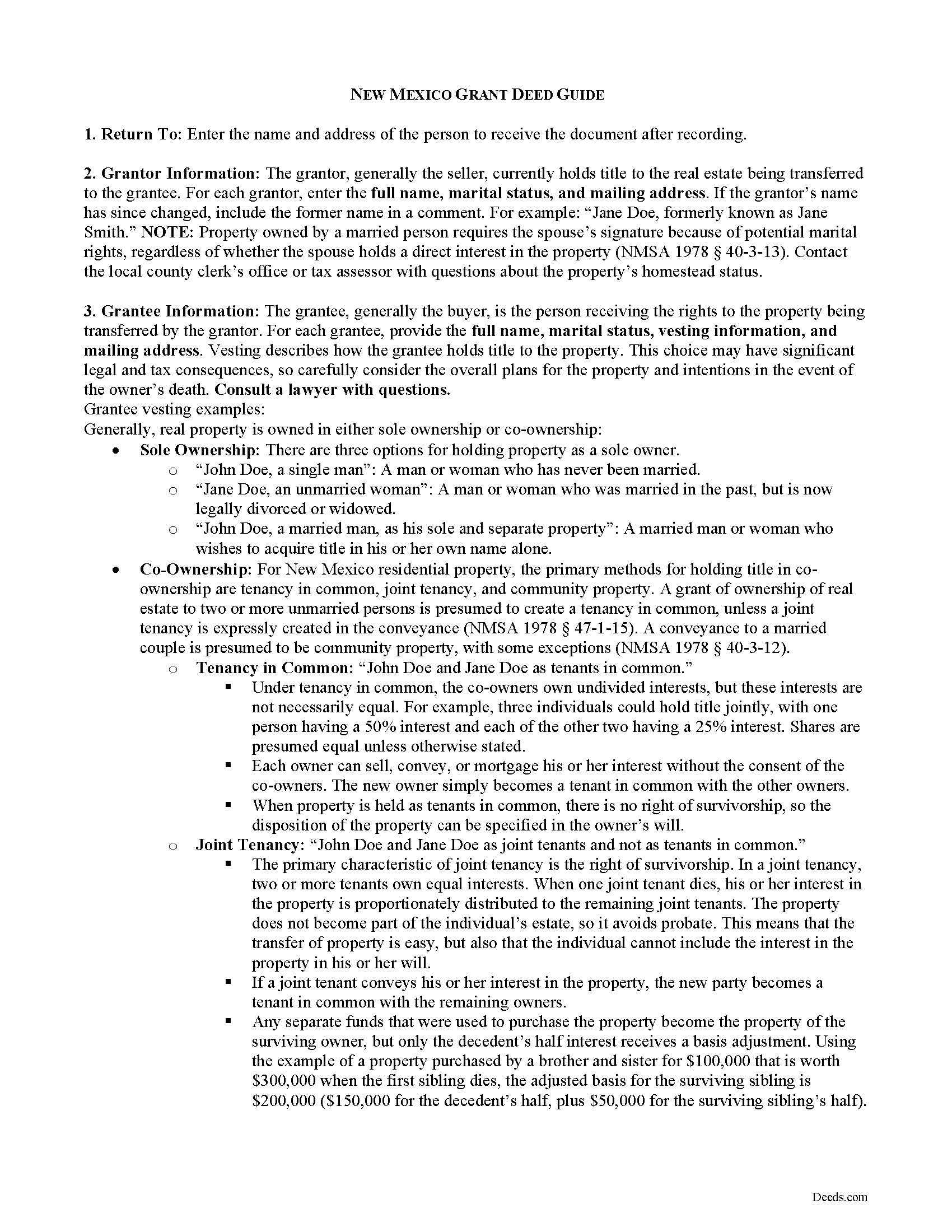

Grant Deed Guide

Line by line guide explaining every blank on the form.

Included Grant County compliant document last validated/updated 11/25/2024

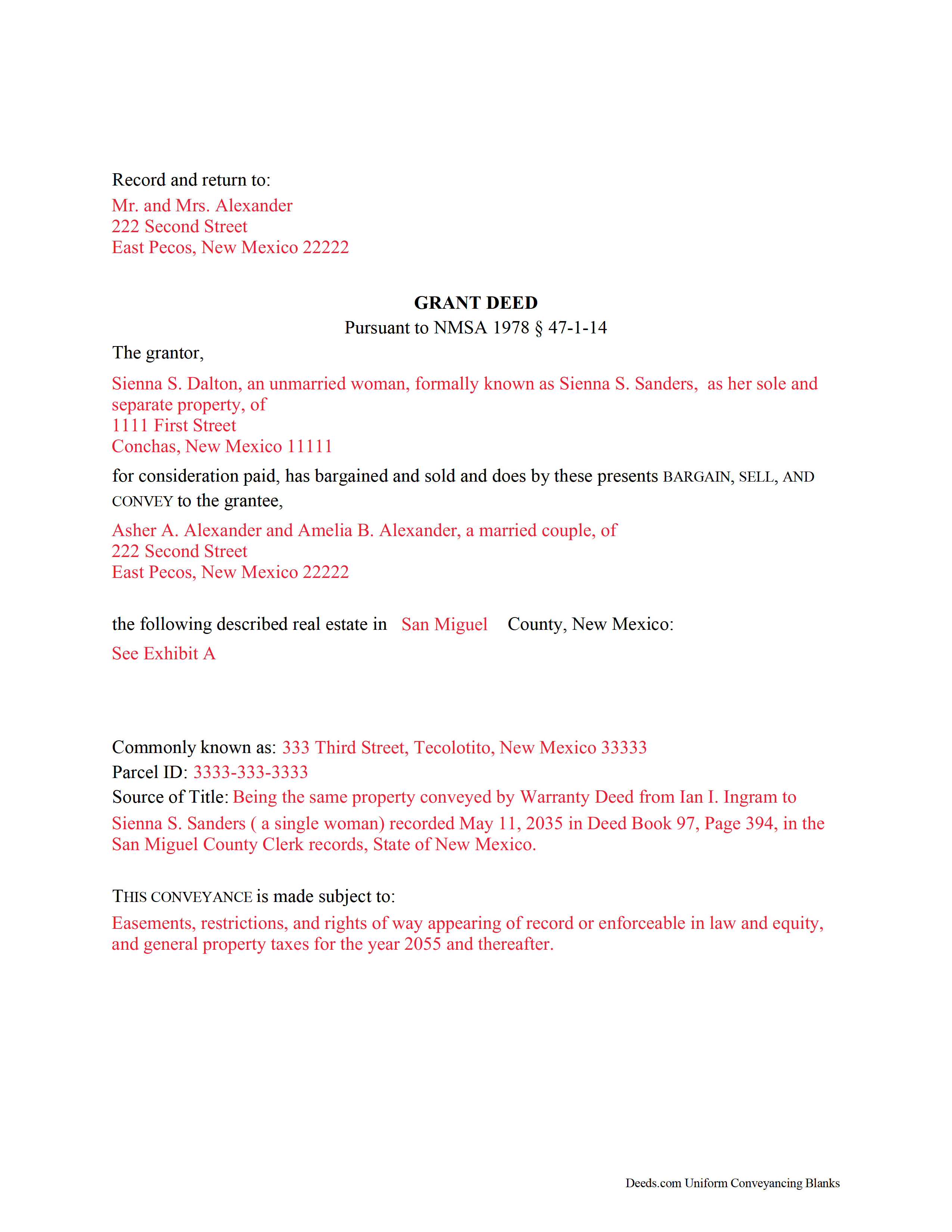

Completed Example of the Grant Deed Document

Example of a properly completed form for reference.

Included Grant County compliant document last validated/updated 11/19/2024

The following New Mexico and Grant County supplemental forms are included as a courtesy with your order:

When using these Grant Deed forms, the subject real estate must be physically located in Grant County. The executed documents should then be recorded in the following office:

Grant County Clerk

1400 Highway 180 East / PO Box 898, Silver City, New Mexico 88061 / 88062

Hours: 8:00am-5:00pm M-F

Phone: (575) 574-0042

Local jurisdictions located in Grant County include:

- Arenas Valley

- Bayard

- Buckhorn

- Cliff

- Faywood

- Fort Bayard

- Gila

- Hachita

- Hanover

- Hurley

- Mimbres

- Mule Creek

- Pinos Altos

- Redrock

- Santa Clara

- Silver City

- Tyrone

How long does it take to get my forms?

Forms are available immediately after submitting payment.

How do I get my forms, are they emailed?

Immediately after you submit payment, the Grant County forms you order will be available for download directly from your account. You can then download the forms to your computer. If you do not already have an account, one will be created for you as part of the order process, and your login details will be provided to you. If you encounter any issues accessing your forms, please reach out to our support team for assistance. Forms are NOT emailed to you.

What does "validated/updated" mean?

This indicates the most recent date when at least one of the following occurred:

- Updated: The document was updated or changed to remain compliant.

- Validated: The document was examined by an attorney or staff, or it was successfully recorded in Grant County using our eRecording service.

Are these forms guaranteed to be recordable in Grant County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Grant County including margin requirements, content requirements, font and font size requirements.

Can the Grant Deed forms be re-used?

Yes. You can re-use the forms for your personal use. For example, if you have more than one property in Grant County that you need to transfer you would only need to order our forms once for all of your properties in Grant County.

What are supplemental forms?

Often when a deed is recorded, additional documents are required by New Mexico or Grant County. These could be tax related, informational, or even as simple as a coversheet. Supplemental forms are provided for free with your order where available.

What type of files are the forms?

All of our Grant County Grant Deed forms are PDFs. You will need to have or get Adobe Reader to use our forms. Adobe Reader is free software that most computers already have installed.

Do I need any special software to use these forms?

You will need to have Adobe Reader installed on your computer to use our forms. Adobe Reader is free software that most computers already have installed.

Do I have to enter all of my property information online?

No. The blank forms are downloaded to your computer and you fill them out there, at your convenience.

Can I save the completed form, email it to someone?

Yes, you can save your deed form at any point with your information in it. The forms can also be emailed, blank or complete, as attachments.

Are there any recurring fees involved?

No. Nothing to cancel, no memberships, no recurring fees.

In New Mexico, real property can be transferred from one party to another by executing a grant deed. A standard grant deed conveys an interest in real property to the named grantee with covenants that the title is free of any encumbrances (except for those stated in the deed) and that the grantor holds an interest in the property and is free to convey it. Grant deeds are not statutory in New Mexico, so the covenants should be explicit in the form of the instrument of transfer.

Grant deeds offer the grantee more protection than quitclaim deeds, but less than warranty deeds. A quitclaim deed includes no warranty of title, and only conveys any interest that the grantor may have in the subject property. A warranty deed provides more protection to the grantee than a grant deed because it requires the grantor to defend against all claims against the title.

A lawful grant deed includes the grantor's full name, mailing address, and marital status; the consideration given for the transfer; and the grantee's full name, mailing address, marital status, and vesting choice. Vesting describes how the grantee holds title to the property. Generally, real property is owned in either sole ownership or in co-ownership.

For New Mexico residential property, the primary methods for holding title in co-ownership are tenancy in common, joint tenancy, and community property. A grant of ownership of real estate to two or more unmarried persons is presumed to create a tenancy in common, unless a joint tenancy is expressly created in the conveyance (NMSA 1978 47-1-15). A conveyance to a married couple is presumed to be community property, with some exceptions (NMSA 1978 40-3-12).

As with any conveyance of realty, a grant deed requires a complete legal description of the parcel. Recite the prior deed reference to maintain a clear chain of title, and detail any restrictions associated with the property. Finally, it must meet all state and local standards for recorded documents. Note: because New Mexico is a nondisclosure state, certain types of personal information, including the consideration exchanged in a transfer of property, are withheld from public record.

Sign the deed in the presence of a notary public or other authorized official. Record the deed at the county clerk's office in the county where the property is located for a valid transfer. Contact the same office to confirm accepted forms of payment.

All transfers require a Real Property Transfer Declaration Affidavit, which details the sales information for the transfer. There are certain exceptions, such as an instrument delivered to establish a gift or a distribution, or an instrument pursuant to a court-ordered partition. If the transfer is exempt from the affidavit requirement, detail the reason why on the face of the deed. See NMSA 1978 7-38-12.1(D) for a list of exemptions. File this affidavit with the assessor's office within 30 days of the deed's recordation.

This article is provided for informational purposes only and is not a substitute for legal advice. Contact an attorney with any questions related to grant deeds or transfers of real property in New Mexico.

(New Mexico Grant Deed Package includes form, guidelines, and completed example)

Our Promise

The documents you receive here will meet, or exceed, the Grant County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Grant County Grant Deed form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4449 Reviews )

Daniel B.

December 24th, 2024

easy to use and upload.

We are delighted to have been of service. Thank you for the positive review!

Dorothy N.

December 22nd, 2024

The mortgage and note were thorough and very satisfactory for my purposes. The accompanying forms were excellent. I am very pleased with my purchase.

We welcome your positive feedback and are thrilled to have met your expectations. Thank you for choosing our services.

Edward E.

December 22nd, 2024

Easy to use.

Your feedback is valuable to us and helps us improve. Thank you for sharing your thoughts!

Susan M.

March 15th, 2022

Loved my experience with deeds.com! Easy and simple to fill in the form, plus the extra instructions were helpful! I will use them again!

Thank you for your feedback. We really appreciate it. Have a great day!

Karen W.

October 18th, 2021

Great experience. Easy.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

RHONDA G.

February 22nd, 2024

Was driven to this site by the county website. It took a bit of work having to create an account, etc. The example was useful; however the example only showed both parties in the same county, nor did the instructions mention anything about differing counties. This caused an oversight on my part.

Your insights are invaluable to us and help us strive for better service. Thank you for taking the time to share your thoughts.

DENIS K.

July 17th, 2020

Excellent, invaluable and reasonable!

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Hayley C.

November 19th, 2020

Love this site, so easy to work with and customer service is amazing.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

William S C.

June 11th, 2021

The Lady Bird Deed appears to be fine with me as are the instructions. However, there apparently are no specific laws in Texas addressing them other than they are OK. The problem is that lenders are surely going to use them as triggers for their due on sale clauses, especially as the current small mortgage rates begin to increase. The solution to that seems to be to sign and have them notarized, but not to record them unless the holder needs to enforce the provisions. It seems to me that you should consider your solution to that problem in your instructions.

Thank you for your feedback. We really appreciate it. Have a great day!

Peter V.

November 1st, 2021

Great set of forms. Downloaded in a min and

Used immediately. Good sample as it easy to read

And fill out yours. Overall good experience

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

James A.

June 11th, 2019

As advertised.

Thank you!

Vicky M.

September 1st, 2022

I would give Deeds.com 10 stars if I could!! The staff were super friendly and easy to work with. They kept me constantly updated during the process of uploading and forwarding my deeds for recording. And, the price was extremely reasonable. I look forward to utilizing Deeds.com every time I need to record a deed no matter what U.S. State. I wholeheartedly recommend them!

Thank you for your feedback. We really appreciate it. Have a great day!

Helen A.

April 11th, 2022

Well not sure yet since I have only downloaded these forms but I read the reviews and this helped me determine if I will use your web site. I will gladly give a good review if this form serves me well!!!

Thank you for your feedback. We really appreciate it. Have a great day!

Daniel S.

February 11th, 2019

It was easy to find the forms I was looking for and the guided steps and examples of how to use the form were beneficial.

Thank you for your feedback. We really appreciate it. Have a great day!

Joanne W.

January 20th, 2020

I was very pleased to find this service, as (another website) charges about $40 for the same service, so yours was a bargain.

Thank you!