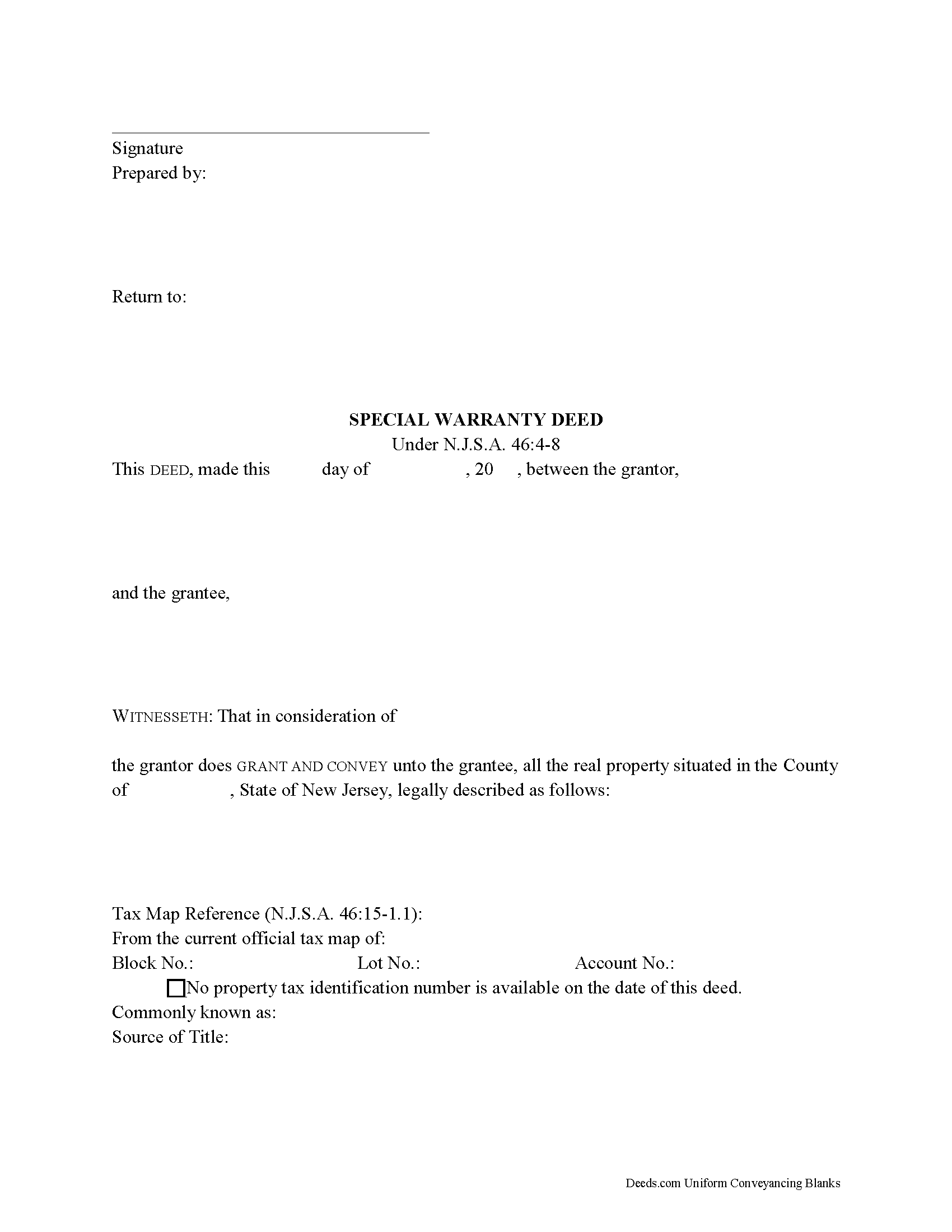

Download New Jersey Special Warranty Deed Legal Forms

New Jersey Special Warranty Deed Overview

In New Jersey, real property can be transferred from one party to another by executing a special warranty deed.

When a deed includes the statutory covenant that the grantor "will warrant specially the property hereby conveyed," it implies that the grantor and "his heirs and personal representatives, will forever warrant and defend the said property... against the claims and demands of all persons claiming by, through, or under him" (N.J.S.A. 46:4-8). So, a special warranty deed guarantees the title only against claims that arose during the time the grantor owned the property.

A lawful special warranty deed includes the grantor's full name, mailing address, and marital status, and the grantee's full name, mailing address, marital status, and vesting. Vesting describes how the grantee holds title to the property. Generally, real property is owned in either sole ownership or in co-ownership.

For New Jersey residential property, the primary methods for holding title are tenancy in common, joint tenancy, and tenancy by entirety. A conveyance to two or more unmarried persons is presumed to create a tenancy in common, unless otherwise stated. A conveyance to a married couple creates a tenancy by entirety, unless otherwise stated (N.J.S.A. 46:3-17, 46:3-17.3).

As with any conveyance of realty, a special warranty deed requires a complete legal description of the parcel. Recite the prior deed reference to maintain a clear chain of title, and detail any restrictions associated with the property. The deed should meet all state and county standards of form and content for recorded documents.

Deeds transferring new construction as the term is defined in N.J.S.A. 46:15-5(1)(g) should contain the words "NEW CONSTRUCTION" in all caps on the first page (N.J.S.A. 46:15-6(2)(c)).

If the conveyance is exempt from transfer taxes, explain why on the face of the deed. See N.J.S.A. 46:15-10 for transfer tax exemptions. A completed Affidavit of Consideration is required for deeds claiming exemption or partial exemption.

Attach an Affidavit of Consideration for Use By Seller (RTF-1) and an Affidavit of Consideration for Use By Buyer (RTF-1EE) to a deed transferring Class 4 property (residential, commercial, or industrial properties and apartments).

Record a Gross Income Tax Form (GIT/REP) with a deed when transferring real property in New Jersey. Consult the local recording office or tax assessor for guidance.

Sign the deed in the presence of a notary public or other authorized official. For a valid transfer, record the deed at the recording office in the county where the property is located. Contact the same office to confirm accepted forms of payment.

This article is provided for informational purposes only and is not a substitute for legal advice. Speak to an attorney with questions about special warranty deeds or for any other issues related to transfers of real property in New Jersey.

(New Jersey SWD Package includes form, guidelines, and completed example)