Ocean County Quitclaim Deed Form (New Jersey)

All Ocean County specific forms and documents listed below are included in your immediate download package:

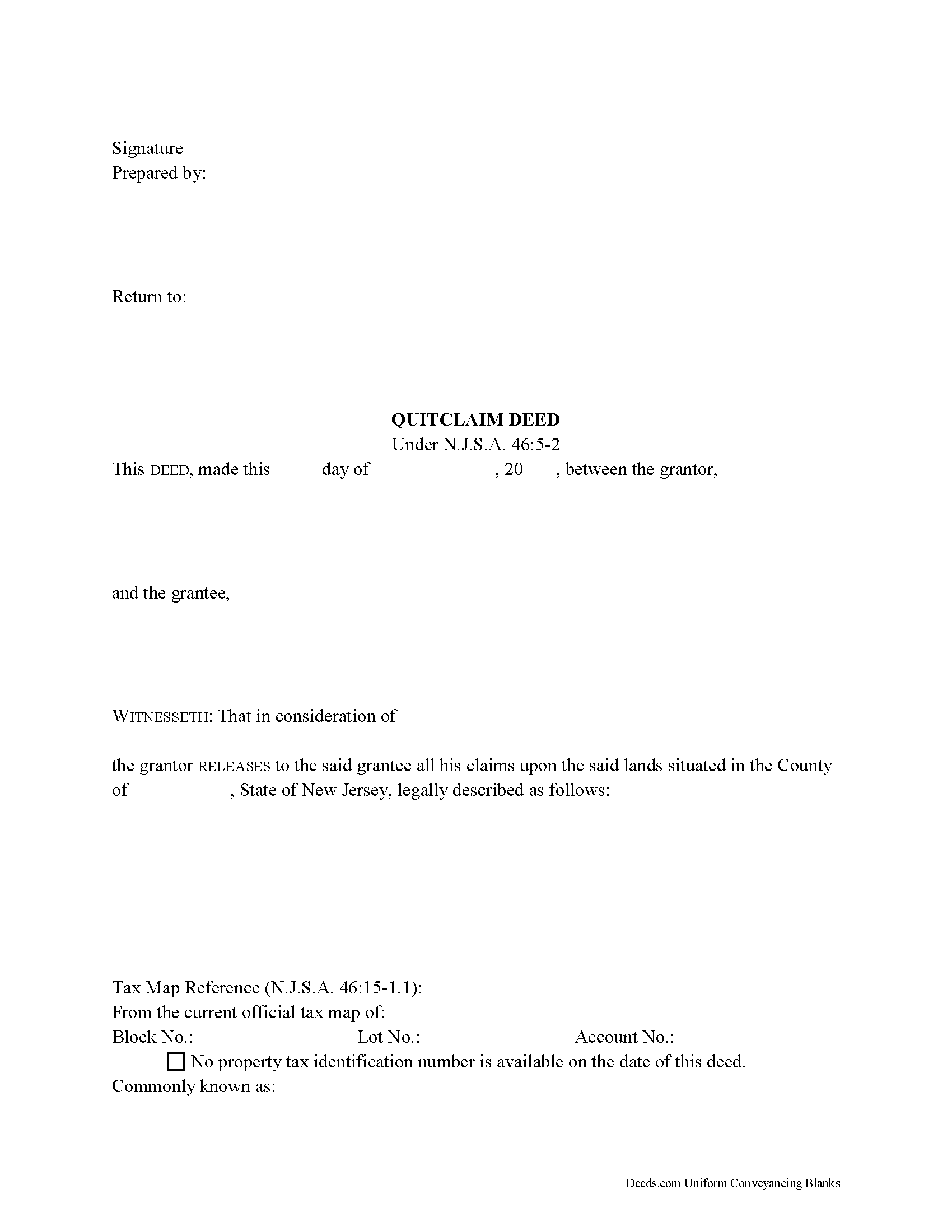

Quitclaim Deed Form

Fill in the blank Quitclaim Deed form formatted to comply with all New Jersey recording and content requirements.

Included Ocean County compliant document last validated/updated 11/18/2024

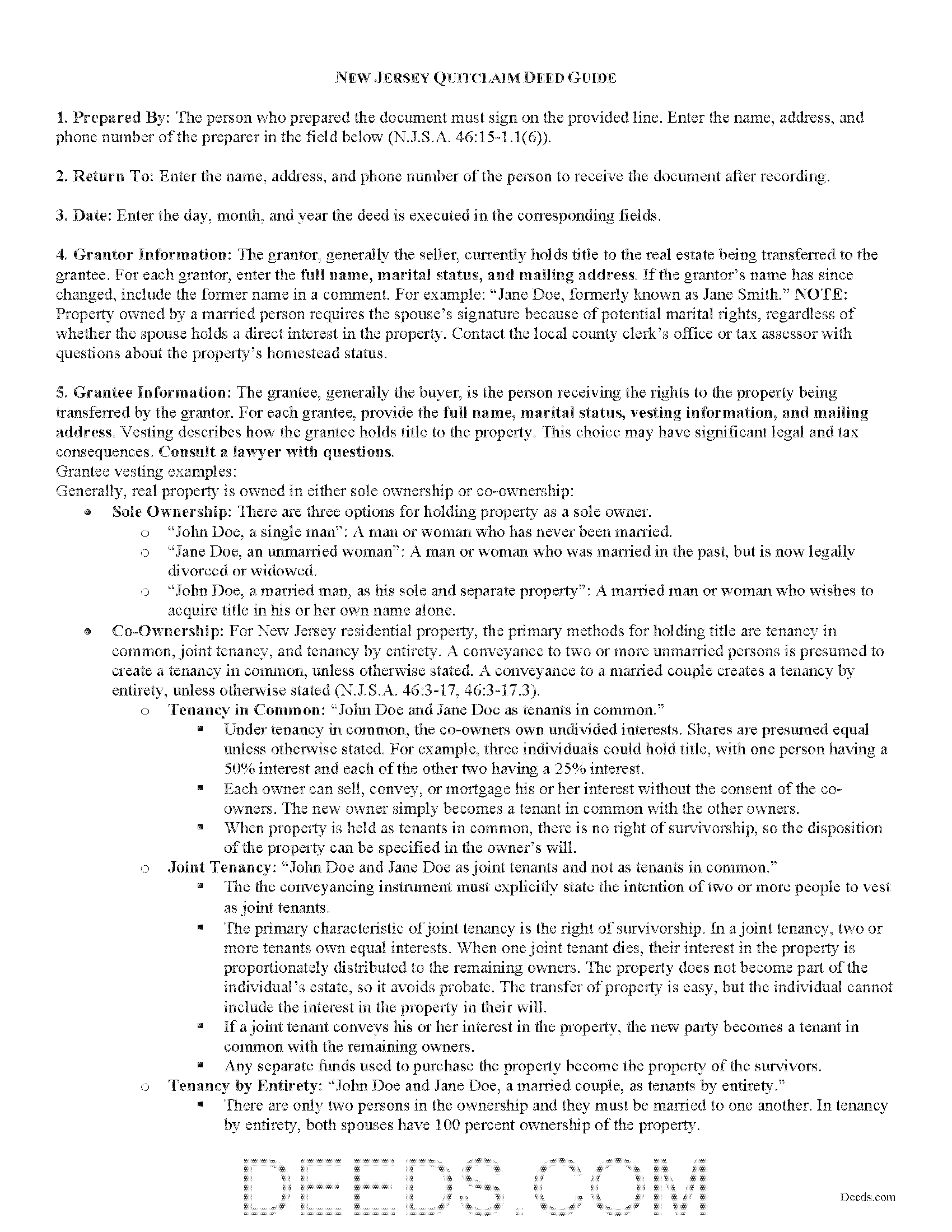

Quitclaim Deed Guide

Line by line guide explaining every blank on the Quitclaim Deed form.

Included Ocean County compliant document last validated/updated 10/31/2024

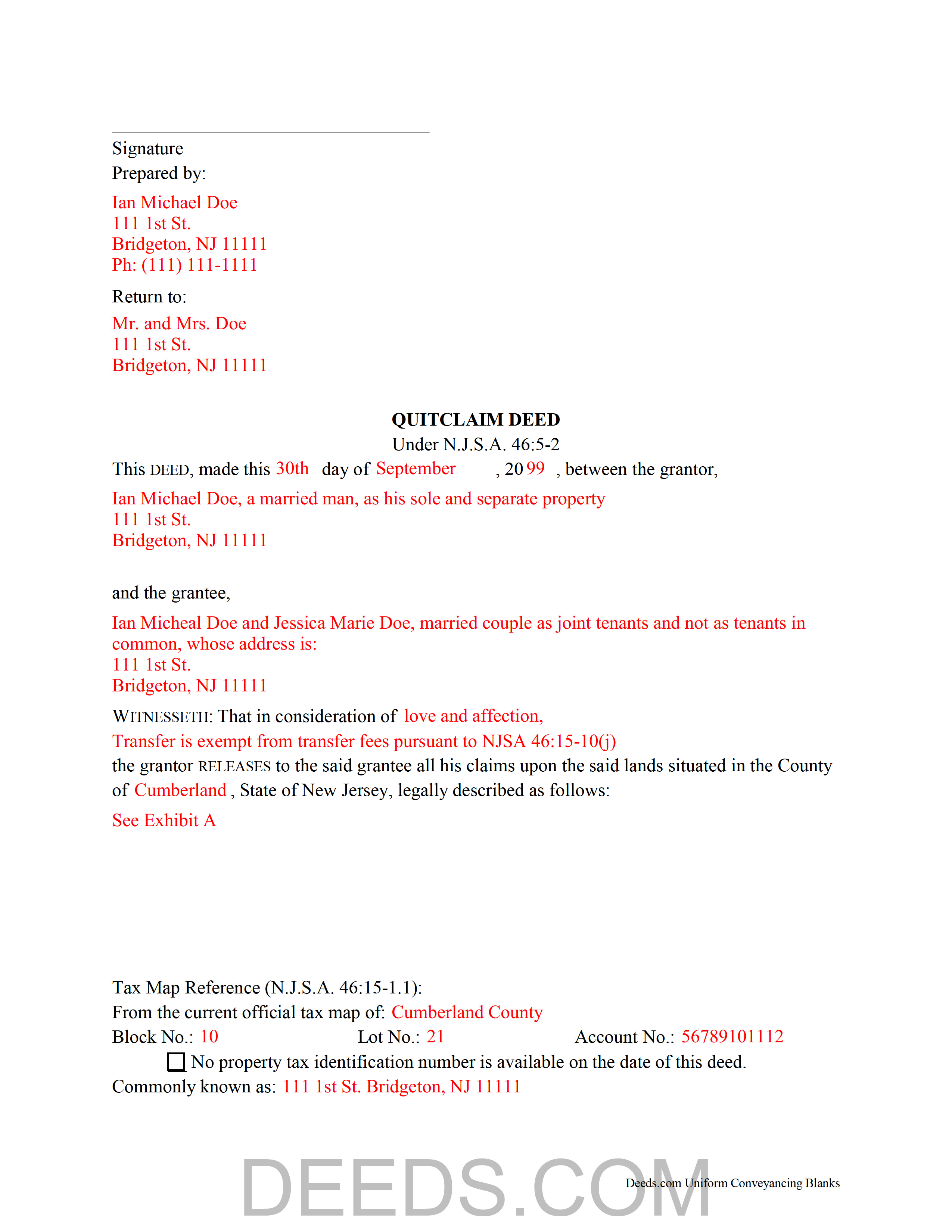

Completed Example of the Quitclaim Deed Document

Example of a properly completed New Jersey Quitclaim Deed document for reference.

Included Ocean County compliant document last validated/updated 10/8/2024

The following New Jersey and Ocean County supplemental forms are included as a courtesy with your order:

When using these Quitclaim Deed forms, the subject real estate must be physically located in Ocean County. The executed documents should then be recorded in one of the following offices:

Ocean County Courthouse

118 Washington St / PO Box 2191, Toms River, New Jersey 08753 / 08754-2101

Hours: 8:30am to 4:00pm M-F

Phone: 732-929-2018

Ocean County Mall

Hooper Ave (Near JC Penney), Toms River, New Jersey 08753

Hours: Open daily during regular mall hours

Phone: 732-288-7777

Northern Ocean County

Resource Center - 225 Fourth St, Lakewood, New Jersey 08701

Hours: 8:00am to 4:30pm M-F

Phone: 732-370-8850

Southern Service Center

179 S Main St, Manahawkin, New Jersey 08050

Hours: 8:00am to 4:30pm M-F

Phone: 609-597-1500

Local jurisdictions located in Ocean County include:

- Barnegat

- Barnegat Light

- Bayville

- Beach Haven

- Beachwood

- Brick

- Forked River

- Island Heights

- Jackson

- Lakehurst

- Lakewood

- Lanoka Harbor

- Lavallette

- Little Egg Harbor Twp

- Manahawkin

- Manchester Township

- Mantoloking

- New Egypt

- Normandy Beach

- Ocean Gate

- Pine Beach

- Point Pleasant Beach

- Seaside Heights

- Seaside Park

- Toms River

- Tuckerton

- Waretown

- West Creek

How long does it take to get my forms?

Forms are available immediately after submitting payment.

How do I get my forms, are they emailed?

Immediately after you submit payment, the Ocean County forms you order will be available for download directly from your account. You can then download the forms to your computer. If you do not already have an account, one will be created for you as part of the order process, and your login details will be provided to you. If you encounter any issues accessing your forms, please reach out to our support team for assistance. Forms are NOT emailed to you.

What does "validated/updated" mean?

This indicates the most recent date when at least one of the following occurred:

- Updated: The document was updated or changed to remain compliant.

- Validated: The document was examined by an attorney or staff, or it was successfully recorded in Ocean County using our eRecording service.

Are these forms guaranteed to be recordable in Ocean County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Ocean County including margin requirements, content requirements, font and font size requirements.

Can the Quitclaim Deed forms be re-used?

Yes. You can re-use the forms for your personal use. For example, if you have more than one property in Ocean County that you need to transfer you would only need to order our forms once for all of your properties in Ocean County.

What are supplemental forms?

Often when a deed is recorded, additional documents are required by New Jersey or Ocean County. These could be tax related, informational, or even as simple as a coversheet. Supplemental forms are provided for free with your order where available.

What type of files are the forms?

All of our Ocean County Quitclaim Deed forms are PDFs. You will need to have or get Adobe Reader to use our forms. Adobe Reader is free software that most computers already have installed.

Do I need any special software to use these forms?

You will need to have Adobe Reader installed on your computer to use our forms. Adobe Reader is free software that most computers already have installed.

Do I have to enter all of my property information online?

No. The blank forms are downloaded to your computer and you fill them out there, at your convenience.

Can I save the completed form, email it to someone?

Yes, you can save your deed form at any point with your information in it. The forms can also be emailed, blank or complete, as attachments.

Are there any recurring fees involved?

No. Nothing to cancel, no memberships, no recurring fees.

In New Jersey, real property can be transferred from one party to another by executing a quitclaim deed.

Quitclaim deeds are identifiable by the word "release" in the granting clause, and they function to terminate whatever interest the grantor holds at the time of the transfer (N.J.S.A. 46:5-2). In New Jersey, conveyances in which the grantor remises, releases, or quitclaims interest in real property to the grantee without reservations "pass all the estate which the grantor could lawfully convey by deed of bargain and sale" (N.J.S.A. 46:5-3). This means that a quitclaim deed transfers the same quality of title as a bargain and sale deed. Quitclaim deeds differ from bargain and sale deeds, however, in that they do not include a promise from the grantor that he or she has not encumbered the property (N.J.S.A. 46:4-6).

A lawful quitclaim deed includes the grantor's full name, mailing address, and marital status, and the grantee's full name, mailing address, marital status, and vesting. Vesting describes how the grantee holds title to the property. Generally, real property is owned in either sole ownership or in co-ownership.

For New Jersey residential property, the primary methods for holding title are tenancy in common, joint tenancy, and tenancy by entirety. A conveyance to two or more unmarried persons is presumed to create a tenancy in common, unless otherwise stated. A conveyance to a married couple creates a tenancy by entirety, unless otherwise stated (N.J.S.A. 46:3-17, 46:3-17.3).

As with any conveyance of realty, a quitclaim deed requires a complete legal description of the parcel. Recite the prior deed reference to maintain a clear chain of title, and detail any restrictions associated with the property. The deed should meet all state and local standards of form and content for recorded documents.

Sign the deed in the presence of a notary public or other authorized official. For a valid transfer, record the deed at the recording office in the county where the property is located. Contact the same office to confirm accepted forms of payment.

Deeds transferring new construction as the term is defined in N.J.S.A. 46:15-5(1)(g) should contain the words "NEW CONSTRUCTION" in all caps on the first page (N.J.S.A. 46:15-6(2)(c)).

If the conveyance is exempt from transfer taxes, explain why on the face of the deed. See N.J.S.A. 46:15-10 for transfer tax exemptions. Include a completed Affidavit of Consideration with deeds claiming exemption or partial exemption.

Record a Gross Income Tax Form (GIT/REP) with a deed when transferring real property in New Jersey. Ask the local assessor or recording office for help in choosing the correct version of the GIT/REP.

This article is provided for informational purposes only and is not a substitute for legal advice. Contact an attorney with questions about using quitclaim deeds, or for any other issues related to transfers of real property in New Jersey.

(New Jersey QD Package includes form, guidelines, and completed example)

Our Promise

The documents you receive here will meet, or exceed, the Ocean County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Ocean County Quitclaim Deed form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4437 Reviews )

Jubal T.

November 27th, 2024

This is the most comprehensive, helpful real estate tool I have seen. I was at first worried because the 330# didn’t have live operators but I received messages in my account as quickly as a conversation had by text and was able to download a deed and record it the same day in a county 1,300 miles away. Highly recommended!

We are sincerely grateful for your feedback and are committed to providing the highest quality service. Thank you for your trust in us.

Michael S.

November 27th, 2024

Recording a Warranty Deed with Mohave County AZ was easy and efficient by using Deeds.com. I will be using their service for all of my e-filing going forward. Thank you Deeds.com!!!!

We are delighted to have been of service. Thank you for the positive review!

Zennell W.

November 24th, 2024

Quick fast and easy transaction.

We are grateful for your feedback and looking forward to serving you again. Thank you!

Kathleen H.

August 10th, 2019

EASY!!

Thank you!

Richard H.

May 2nd, 2022

Thank You! Very informative and helpful!

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Diana C.

May 7th, 2019

Great service!!! I was feeling overwhelmed but then I found deeds! I spent about 10 mins ordering, then went to bed and by morning my deed was there!! Very efficient!

Thanks so much! So worth the little bit of dollars!

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Angela W.

March 12th, 2022

Very helpful and very quick to respond. Thank you!

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Ted D.

August 17th, 2020

Very good/user friendly

Thank you!

William H.

August 31st, 2024

The form cost was reasonable - it helped me organize my thoughts and write things down to help minimize the attorney fees.

We are grateful for your engagement and feedback, which help us to serve you better. Thank you for being an integral part of our community.

Vicki G.

November 24th, 2020

Thank you for this service, saved me from driving down town. It was quick and very easy to navigate. Have a great Thanksgiving break.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

John M.

September 16th, 2022

Easy to use site with a good selection of documents

Thank you!

James A.

March 9th, 2021

Thanks for you help to get me out of a quick problem. Downloads were great. I recommend this service for the arcane situations of legal angst.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Judith S.

February 15th, 2022

Nice and Easy: two of my favorite things.

Thank you!

Michael M.

April 30th, 2019

Easy to follow directions and instructions to properly and legally fill-in the Deed that I requested. It was also very easy and convenient. If I was going to employ an Attorney or Legal Documents Preparer, they would easily charge me between $150 to $225 a Deed! For the cost of $19.97, anyone would pursue this price! Thank you, Deeds.com for a wonderful and terrific experience! I'm going to need you again to change Titles for my other Investment Properties.

Thank you for your feedback. We really appreciate it. Have a great day!

MYRON J.

October 24th, 2019

Great way to track and save forms.

Thank you!