Download New Jersey Certificate of Trust Legal Forms

New Jersey Certificate of Trust Overview

Trusts in New Jersey are governed by the New Jersey Uniform Trust Code (NJSA 3B:31). A trust is an estate planning vehicle whereby one person (the settlor) transfers assets to another person (the trustee), who holds them for the benefit of another (the beneficiary). The settlor establishes the terms of the trust in an unrecorded document called a trust instrument.

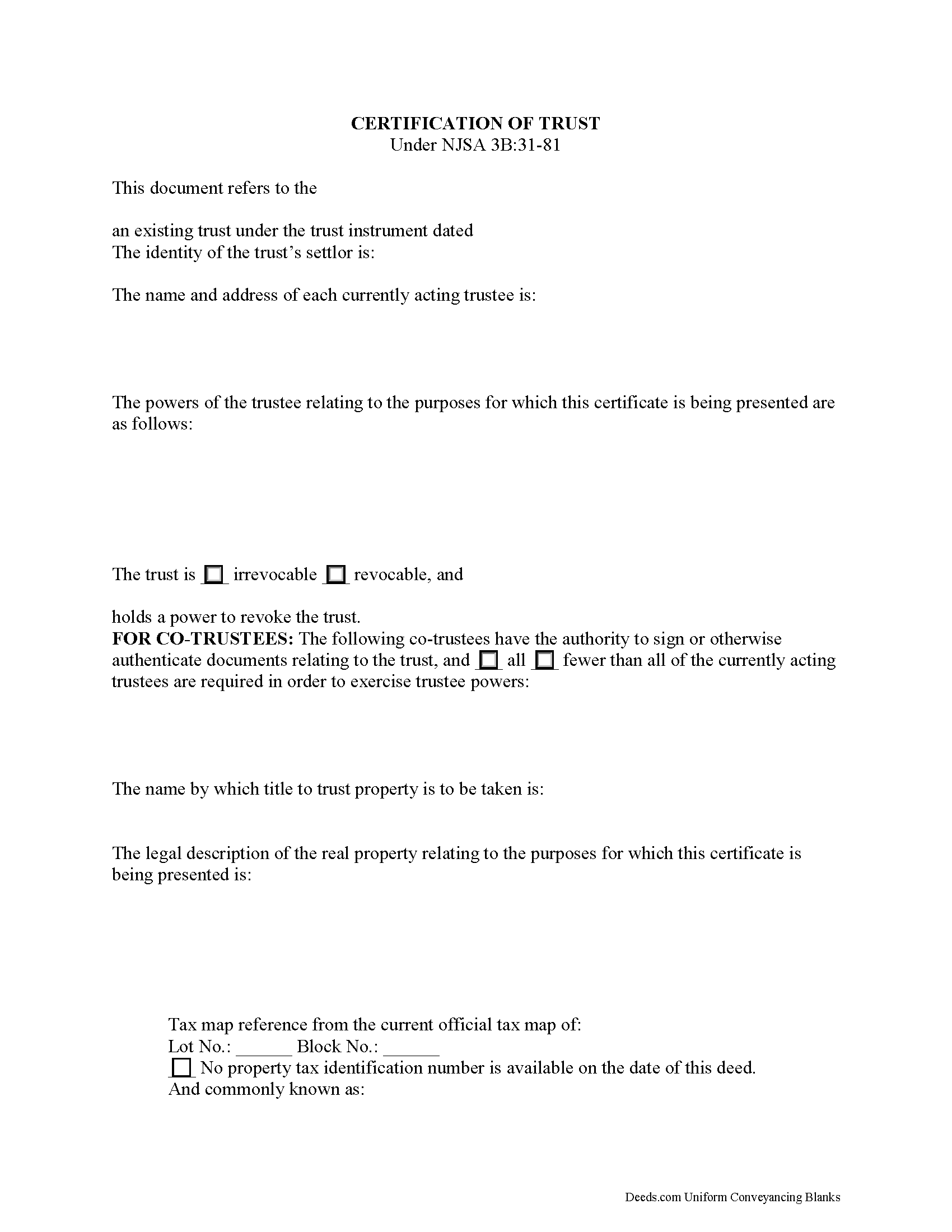

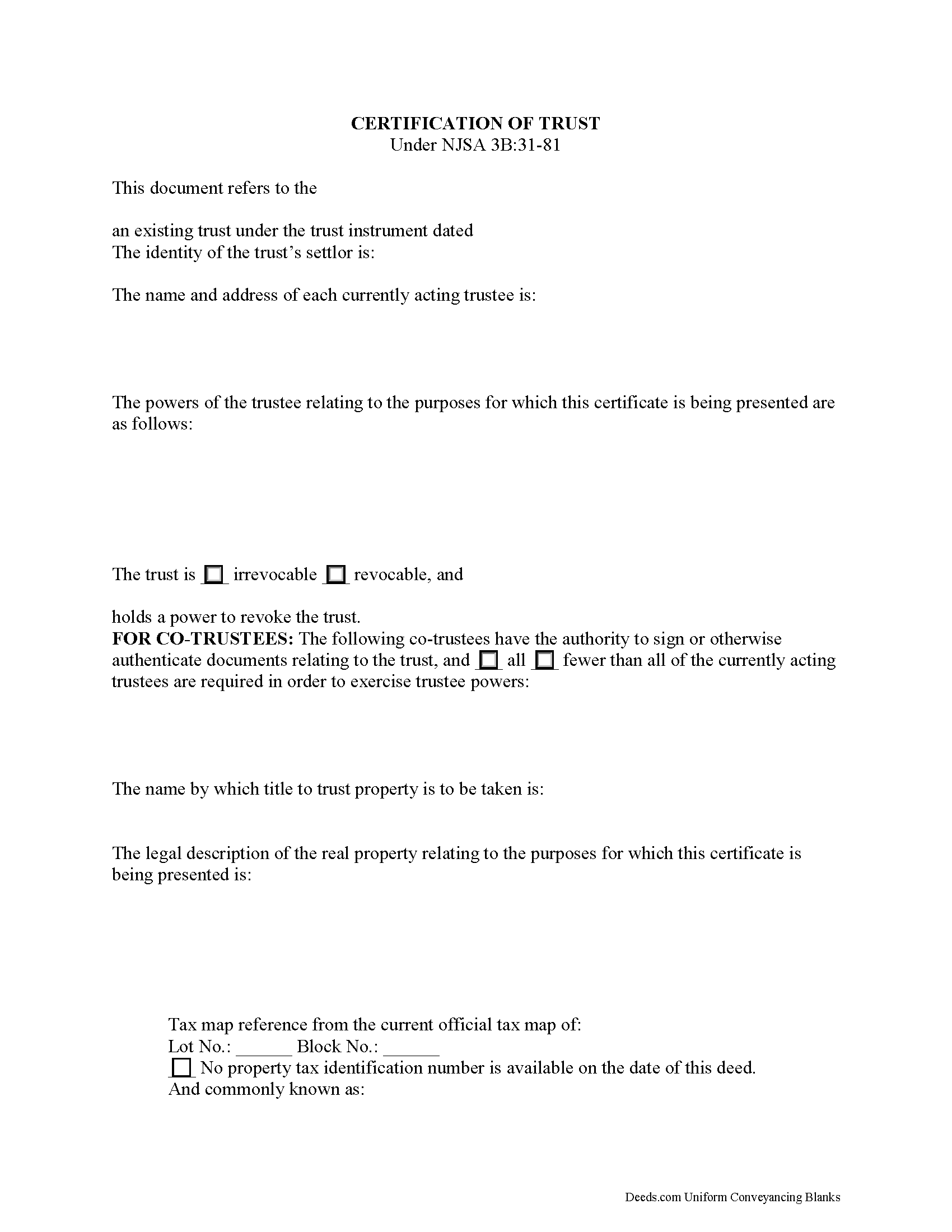

When a trustee enters into a transaction involving real property held in the trust, additional documentation confirming the trustee's authority to act on behalf of the trust may be requested. To maintain the trust's privacy, the trustee may provide a certificate of trust under 3B:3-81 to parties outside of the trust arrangement instead of furnishing the entire trust instrument.

The certificate, signed by all acting trustees of the trust in the presence of a notary public, provides the recipient with only the information about the trust necessary for the transaction at hand. Recipients of a certificate may rely on the information provided within as factual (requesting the entire trust instrument opens the recipient to certain liabilities under 3B:31-81(g)). The document certifies that the trust is in existence and that the trustee has authority to act in the transaction for which the certificate is being presented.

The form gives the trust's name and date of execution and the settlor's identity. Other requirements include the name and address of each acting trustee, a description of the relevant powers conferred upon the trustee by the trust instrument, and, in the case of co-trustees, identification of the trustees having authority to sign trust documents, and how many of the total trustees are required to exercise trustee powers. Recipients of a certificate of trust can request the excerpts from the trust instrument that designate the trustee and confer the specific powers that enable the trustee to enter into the transaction at hand (3B:31-81(e)).

As the document is used in transactions involving real property, it should also include the legal description, complete with municipality and county and tax map reference, of the subject real estate.

In addition, the certificate identifies the trust as either irrevocable or revocable, and who, if any, has a power to revoke the trust, as well as the name by which the trust will hold title to acquired assets. Finally, it includes a statement that the trust has not been modified in any way that invalidates the certified statements contained within the document.

Consult a lawyer with any questions regarding certifications of trust.

(New Jersey COT Package includes form, guidelines, and completed example)