Clark County Notice of Mechanics Lien Form (Nevada)

All Clark County specific forms and documents listed below are included in your immediate download package:

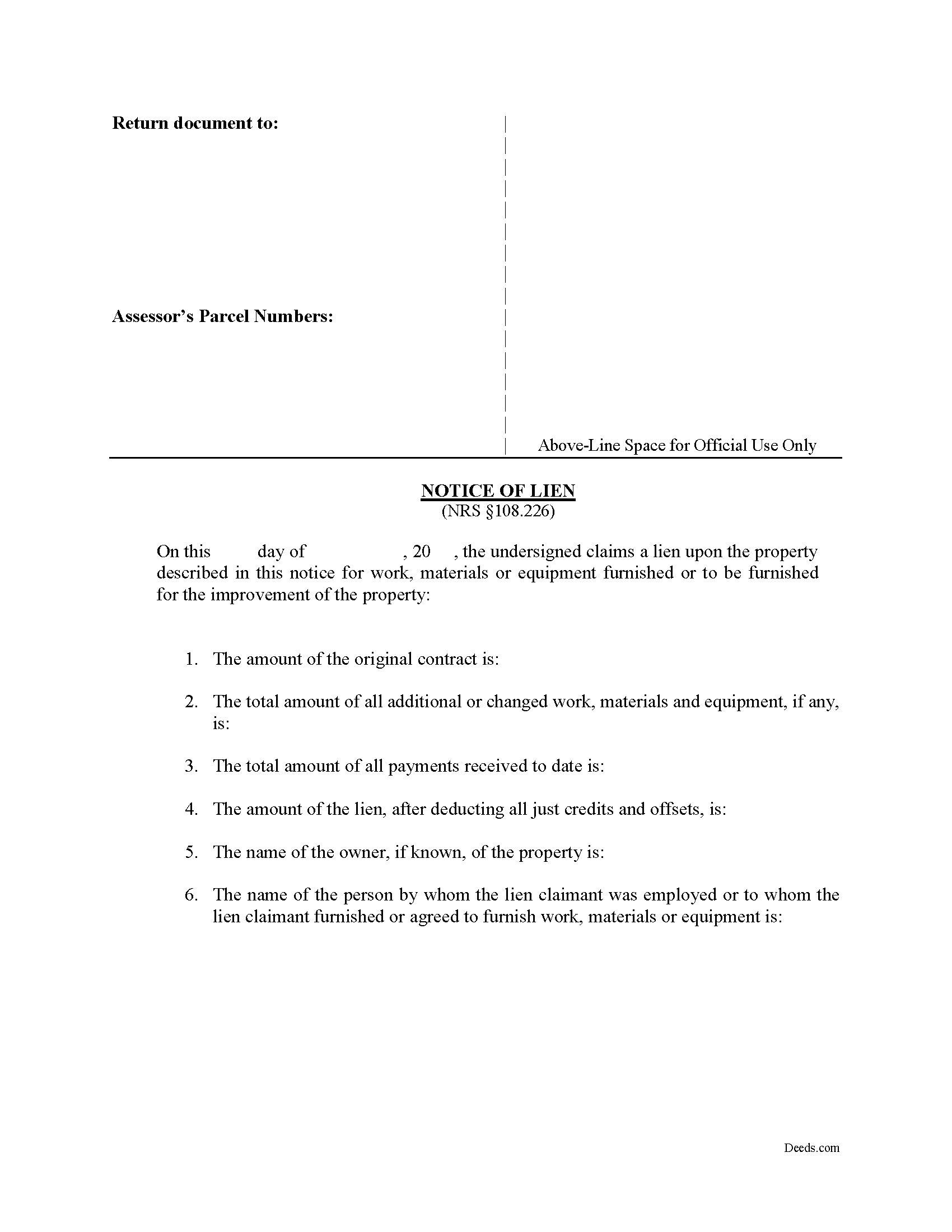

Notice of Mechanics Lien Form

Fill in the blank Notice of Mechanics Lien form formatted to comply with all Nevada recording and content requirements.

Included Clark County compliant document last validated/updated 10/28/2024

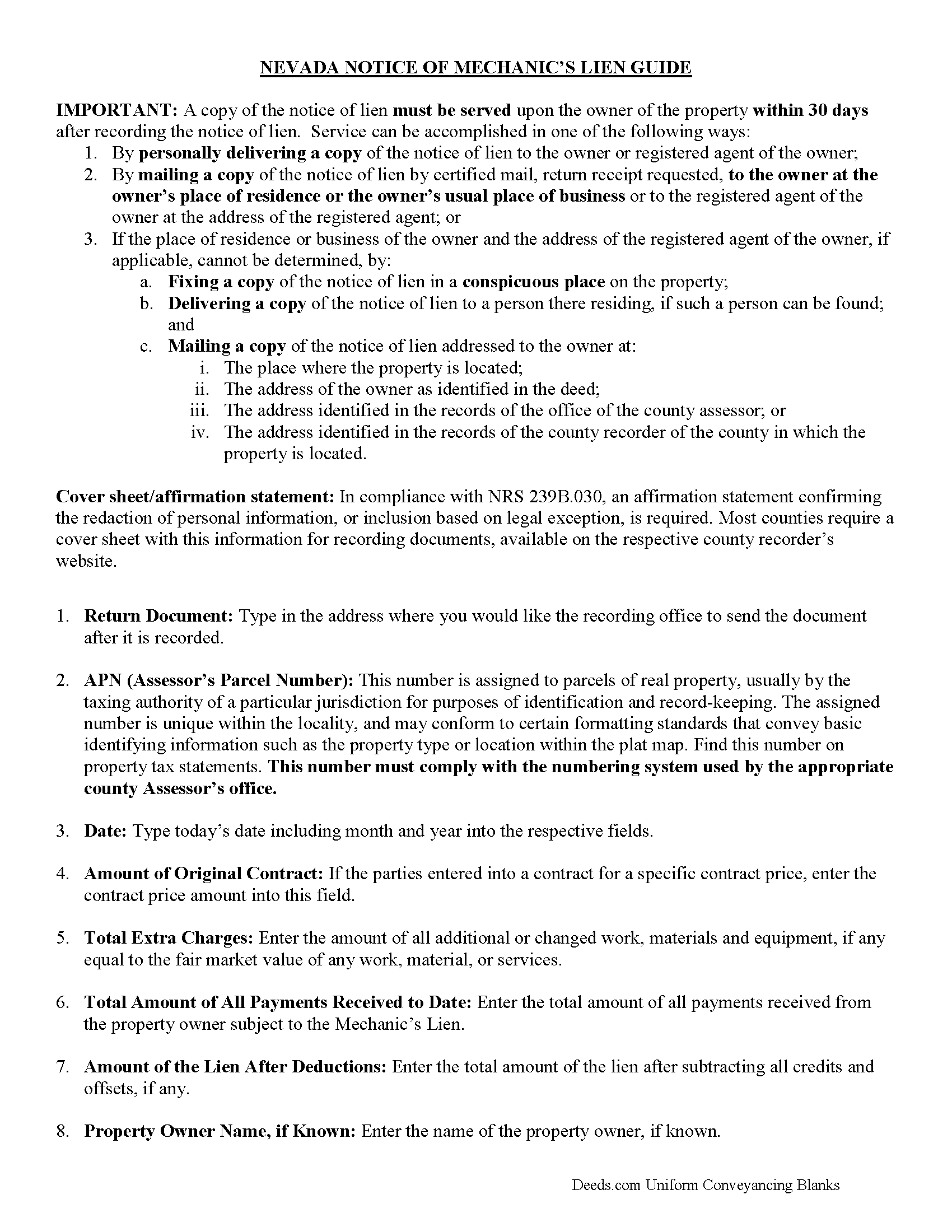

Notice of Mechanics Lien Guide

Line by line guide explaining every blank on the form

Included Clark County compliant document last validated/updated 10/3/2024

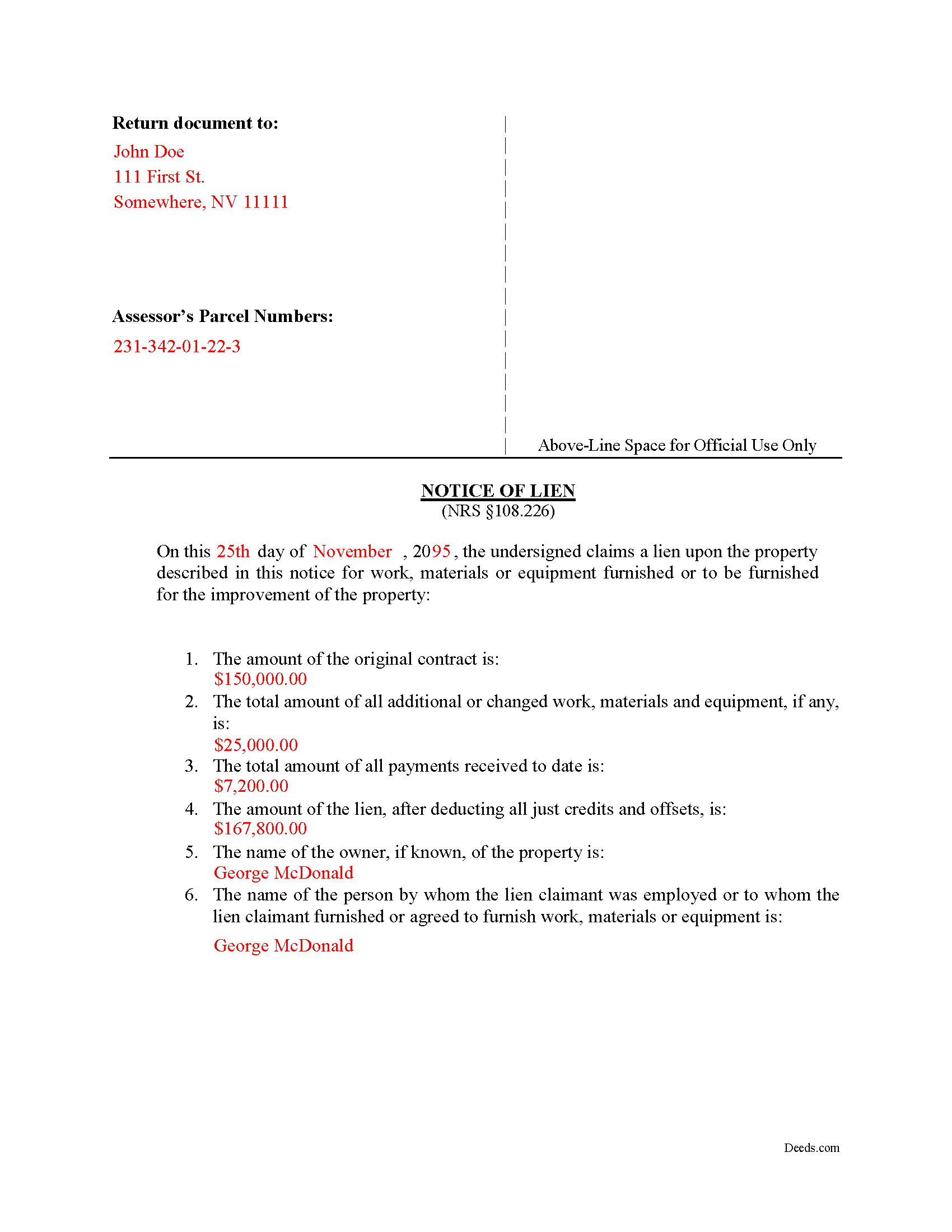

Completed Example of the Notice of Mechanics Lien Document

Example of a properly completed form for reference.

Included Clark County compliant document last validated/updated 11/4/2024

The following Nevada and Clark County supplemental forms are included as a courtesy with your order:

When using these Notice of Mechanics Lien forms, the subject real estate must be physically located in Clark County. The executed documents should then be recorded in one of the following offices:

Clark County Recorder's Office

Government Center - 500 S Grand Central Pkwy, 2nd Floor / PO Box 551510, Las Vegas, Nevada 89106-1510

Hours: Monday through Friday 8:00 AM to 5:00 PM

Phone: (702) 455-4336

Northwest Branch Office

3211 N Tenaya Way, Suite 118, Las Vegas, Nevada 89129

Hours: Monday through Thursday 8am - 5pm. Closed 12:00 - 12:30pm

Phone: (702) 455-4336

Henderson Branch

240 S. Water Street, Henderson, Nevada 89015

Hours: Monday through Thursday 8am - 5pm. Closed 12:00 - 12:30pm

Phone: (702) 455-4336

Local jurisdictions located in Clark County include:

- Blue Diamond

- Boulder City

- Bunkerville

- Cal Nev Ari

- Coyote Springs

- Henderson

- Indian Springs

- Jean

- Las Vegas

- Laughlin

- Mesquite

- Moapa

- Moapa Valley

- Nellis Afb

- North Las Vegas

- Searchlight

- Sloan

- The Lakes

How long does it take to get my forms?

Forms are available immediately after submitting payment.

How do I get my forms, are they emailed?

Immediately after you submit payment, the Clark County forms you order will be available for download directly from your account. You can then download the forms to your computer. If you do not already have an account, one will be created for you as part of the order process, and your login details will be provided to you. If you encounter any issues accessing your forms, please reach out to our support team for assistance. Forms are NOT emailed to you.

What does "validated/updated" mean?

This indicates the most recent date when at least one of the following occurred:

- Updated: The document was updated or changed to remain compliant.

- Validated: The document was examined by an attorney or staff, or it was successfully recorded in Clark County using our eRecording service.

Are these forms guaranteed to be recordable in Clark County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Clark County including margin requirements, content requirements, font and font size requirements.

Can the Notice of Mechanics Lien forms be re-used?

Yes. You can re-use the forms for your personal use. For example, if you have more than one property in Clark County that you need to transfer you would only need to order our forms once for all of your properties in Clark County.

What are supplemental forms?

Often when a deed is recorded, additional documents are required by Nevada or Clark County. These could be tax related, informational, or even as simple as a coversheet. Supplemental forms are provided for free with your order where available.

What type of files are the forms?

All of our Clark County Notice of Mechanics Lien forms are PDFs. You will need to have or get Adobe Reader to use our forms. Adobe Reader is free software that most computers already have installed.

Do I need any special software to use these forms?

You will need to have Adobe Reader installed on your computer to use our forms. Adobe Reader is free software that most computers already have installed.

Do I have to enter all of my property information online?

No. The blank forms are downloaded to your computer and you fill them out there, at your convenience.

Can I save the completed form, email it to someone?

Yes, you can save your deed form at any point with your information in it. The forms can also be emailed, blank or complete, as attachments.

Are there any recurring fees involved?

No. Nothing to cancel, no memberships, no recurring fees.

A mechanic's lien is a security interest in the title to property for the benefit of those who have supplied labor or materials that improve the property. In terms of real property, a mechanic's lien is also known as a construction lien. It is also called a materialman's lien or supplier's lien when referring to those supplying materials, a laborer's lien when referring to those supplying labor, and a design professional's lien when referring to architects or designers who contribute to a work of improvement.

Under Nevada law, in order to ensure payment for services and to protect the rights of a contractor, subcontractor, or material supplier, a mechanic's lien can be filed against a homeowner's property. The lien creates a legal method for these contractors, subcontractors and suppliers to foreclose on the improved property, in turn forcing a sale of the property in order to obtain payment for their work or materials.

In Nevada, mechanic's liens are governed under Chapter 108 of Nevada Revised Statutes. Any person who provides labor, materials, or equipment valued at $500 or more which is used in the construction, alteration, or repair of property is entitled to a mechanic's lien. However, if a license is required to perform the work in question, the contractor or professional can only file a lien if he or she is licensed to perform the work.

A mechanic's lien is available when labor, services, or equipment, and/or materials have been provided; labor was performed; materials were intended for and used on the property; permanent work or improvement was performed; and the work was performed with the consent of the owner or his or her agent.

Property subject to a mechanic's lien includes any property in which any improvements including work, materials, and equipment have been furnished and any construction disbursement account (NRS 108.222(1)). The definition of property includes the land and all buildings, improvements and fixtures, and any convenient space around the land. Improvements are defined as any development, enhancement, or addition to the real property. A single lien can be recorded against several buildings when there are multiple parcels or buildings. However, lien claimants should be cautious because a failure to allocate a lienable amount (unpaid debt) among several buildings can result in the subordination of the lien to a lien subsequently recorded (NRS 108.231(5)).

The lienholder is entitled to either the contract price in which case the lien is equal to the unpaid balance or the agreed upon price (NRS 108.221(1)(a)) or if no agreement has been made on a specific price, the fair market value of the work, materials, or services provided (NRS 108.222(1)(b)).

The order in which lienholders are entitled to collect on a lien is governed by rules of priority. A lienholder who provided labor is given first priority, followed by material suppliers and lessors of equipment, then other lien claimants who performed under contract with the prime contractor or sub-contractor, and all other lien claimants are given last priority.

A lien must be perfected in order to achieve priority over unperfected or later perfected liens. To perfect a mechanic's lien, the first step is to provide pre-lien notice in the form of a notice of right to lien. Under NRS 108.245(1), a lien claimant may provide notice at any time after the first delivery of materials or performance or work or services under his or her contract. Although no time frame is provided, a lien claimant should record this notice promptly. The purpose of recording is to provide warning to the owner of the property that the lien claimant may at a future date record a lien on the property. This required notice does not, however, create a lien (NRS 108.245(B)). Notice must be delivered in person or through certified mail to the owner (NRS 108.245(1)). Sub-contractors must also give notice to the prime contractor in person or by certified mail. Failure to provide such notification is grounds for disciplinary action against the sub-contractor by the State Contractor's Board. There is an exception to this rule for sub-contractors who provide labor only.

Additional notice is required for all residential construction projects. If the work includes construction, alteration, or repair of a multi-family or single family residence, including without limitation, apartment houses, then the lien claimant (party to the construction contract other than the owner who is seeking payment) must also serve a 15-day notice of intent to lien. The notice of intent to lien is not required to be recorded although it must be served personally or by certified mail (NRS 108.226(6)). The owner and the prime contractor must be served within 15 days of the notice of intent to lien as a statutory pre-requisite to the notice of lien filing.

To actually create a lien, you must take the second step of filing, recording, and serving a notice of lien in order to perfect. Under NRS 108.226(5), the notice of lien must be completed in substantial accordance with the form set forth by statute and specify: 1) the total amount of the original contract, 2) the total amount of all work, materials, or equipment, 3) the total amount of all payments received to date, 4) the amount of the lien after subtracting all credits and offsets, 5) the name of the property owner, 6) the name of the person by whom the lien claimant was employed or to whom the lien claimant furnished or agreed to furnish work, materials, or equipment, 7) a brief statement of the terms of payment of the lien claimants contract, and 8) a description of the property to be charged with the lien. The notice of lien must contact a verification by oath of the lien claimant.

The timing of the notice of lien is governed under NRS 108.226(1)(a) and (b) which states that the notice of lien must be recorded within 90 days after completion of the work or improvements or the last delivery of materials or the furnishing of equipment by the lien claimant, and must be served upon the owner of the property within 30 days after recording the notice of lien.

The notice of lien must be served through delivering a copy to the owner personally, or if the owner is absent from the residence or place of business, a copy can be mailed through certified mail with return receipt to the owner at his residence, usual place of business, or through his or her resident agent. If the owner cannot be located and the owner's residence or place of business cannot be ascertained, service can be achieved by fixing a copy of the notice of lien in a conspicuous place (such as affixing to the main entrance door), delivering a copy to the person residing there, or mailing a copy addressed to the owner at the property address. All owners must be served with the notice of lien, but a failure to serve all owners will not invalidate the lien (NRS 108.227(2)). Additional caution should be exercised by sub-contractors as failure to deliver notice to a general contractor is a basis for disciplinary proceedings against a sub-contractor (NRS 108.256(4)).

A mechanic's lien or construction lien is effective for six months after the recording date (NRS 108.233(1)) unless a lawsuit is commenced to enforce the lien or the time to commence a suit has been extended by written agreement, signed by both the lien claimant and the person with an interest in the subject property. The agreement to extend the time to foreclose is only effective if recorded in the county recording office prior to the expiration of six months and must be notarized. The agreement cannot exceed one year from the date of recording.

A lien claimant must wait thirty days from the date of recording the notice of lien in order to initiate a foreclosure action (NRS 108.244). An action to foreclose on a lien may not be brought any later than six months after the lien was recorded unless the time has been extended by agreement. In order to foreclose, the following documents are required: 1) a complaint filed in a court of competent jurisdiction which should include additional contract-based causes of action, and 2) a notice of pendency which must be filed with the court and recorded to provide constructive notice to the work of an alleged claim or an interest in the property.

The notice of foreclosure must be published once per week for three consecutive weeks in a newspaper published in the county where the property is located and must be delivered in person or by certified mail to all other lien claimants who have had liens recorded against the subject property at the time the complaint is filed.

A lien claimant who receives a notice of foreclosure of another lien claimant's lien must file a statement of facts constituting lien with the court within a reasonable time after publication or receipt of the notice of foreclosure. Discuss any situation involving multiple lien claimants with a licensed and competent attorney.

Under NRS 108.237, in addition to the claimed lien amount plus any costs for the preparation and recording of the notice of lien, the Court can award attorney's fees to the prevailing lien claimant. The court can also calculate and award interest either in accordance with the contract or legal rate of interest (3.5% as of January 1, 2016).

In summary, mechanic's liens in Nevada are available for contractors, subcontractors, and material suppliers as a method to ensure payment for services or materials provided as long as the lien claimant complies with Nevada lien statute. However, as each case can be unique and set forth novel legal issues, it is important to seek legal consultation from a licensed Nevada attorney familiar with issues present in mechanic's liens.

Our Promise

The documents you receive here will meet, or exceed, the Clark County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Clark County Notice of Mechanics Lien form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4435 Reviews )

Zennell W.

November 24th, 2024

Quick fast and easy transaction.

We are grateful for your feedback and looking forward to serving you again. Thank you!

James S.

November 21st, 2024

Forms used, created quitclaim deed that the county accepted without a second look (turns out they see deeds.com forms regularly via erecording and in person). Will be back for any real estate related forms I need and they carry. Will always be my first stop. Also, will use erecording next time, mad I didn't see it this time.

Thanks for the kind words James, glad we could help. Look forward to seeing you again.

Thomas G.

November 21st, 2024

Wasn’t what I expected

Sorry to hear that your expectations were missed. Your order has been canceled. We do hope that you find something more suitable to your expectations elsewhere. Do keep in mind that purchasing legal forms should not be an exploratory endeavor.

Tiqula D.

July 14th, 2021

Deeds.com is beyond convenient! It's a wonderful service for all your recording needs. The service is beyond fast and professional. Easy as 1 2 3....

Thank you for your feedback. We really appreciate it. Have a great day!

D. Jeffrey C.

June 10th, 2024

Generally I find the process works well, and the support personnel on the other end are usually fairly helpful.

Your feedback is greatly appreciated. Thank you for taking the time to share your experience!

LINDA J M.

November 18th, 2019

NO PROBLEMS. I LIKE THE DEED DOCUMENT AND INSTRUCTIONS. MADE IT EASY.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

STACIA V.

July 19th, 2019

I filled out the forms that were somewhat easy. I was surprised that it was recorded by the county recording office. I just hope that it really worked. I think it did. I will find out later this year.

Thank you!

Kerry H.

January 31st, 2019

Good experience - Just what I needed

Thank you Kerry, have an awesome day!

Christine A.

December 28th, 2018

So far do good. Don't understand the billing procedure yet and have just sent a request for information. Awaiting reply.

Thank you, Christine Alvarez

Thanks for the feedback. Looks like your E-recording invoice is available. It takes a few minutes for our staff to prepare documents for recording and generate the invoice.

Elliot B.

January 31st, 2022

Outstanding forms and the recording service made a short day of what I needed to do. Will be back for the next one, thanks!

Thank you for your feedback. We really appreciate it. Have a great day!

Pamela C.

October 5th, 2022

It was easy to download. And your guide was informative as was the completed form for an example. But I wish that I had been able to edit the forms online and then print.

My handwritten info is just not as crisp.

Thank you for your feedback. We really appreciate it. Have a great day!

Dee S.

July 18th, 2019

This was easy and much cheaper than getting a lawyer. Thanks! - From alabama

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Lisa J.

November 29th, 2019

Thank you so much for your time.

Thank you!

Diana L.

June 19th, 2020

Easy to use but need to go through the courthouse to do what I need to do.

Thank you!

Hayley C.

November 19th, 2020

Love this site, so easy to work with and customer service is amazing.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!