Lander County Conditional Waiver upon Progress Form (Nevada)

All Lander County specific forms and documents listed below are included in your immediate download package:

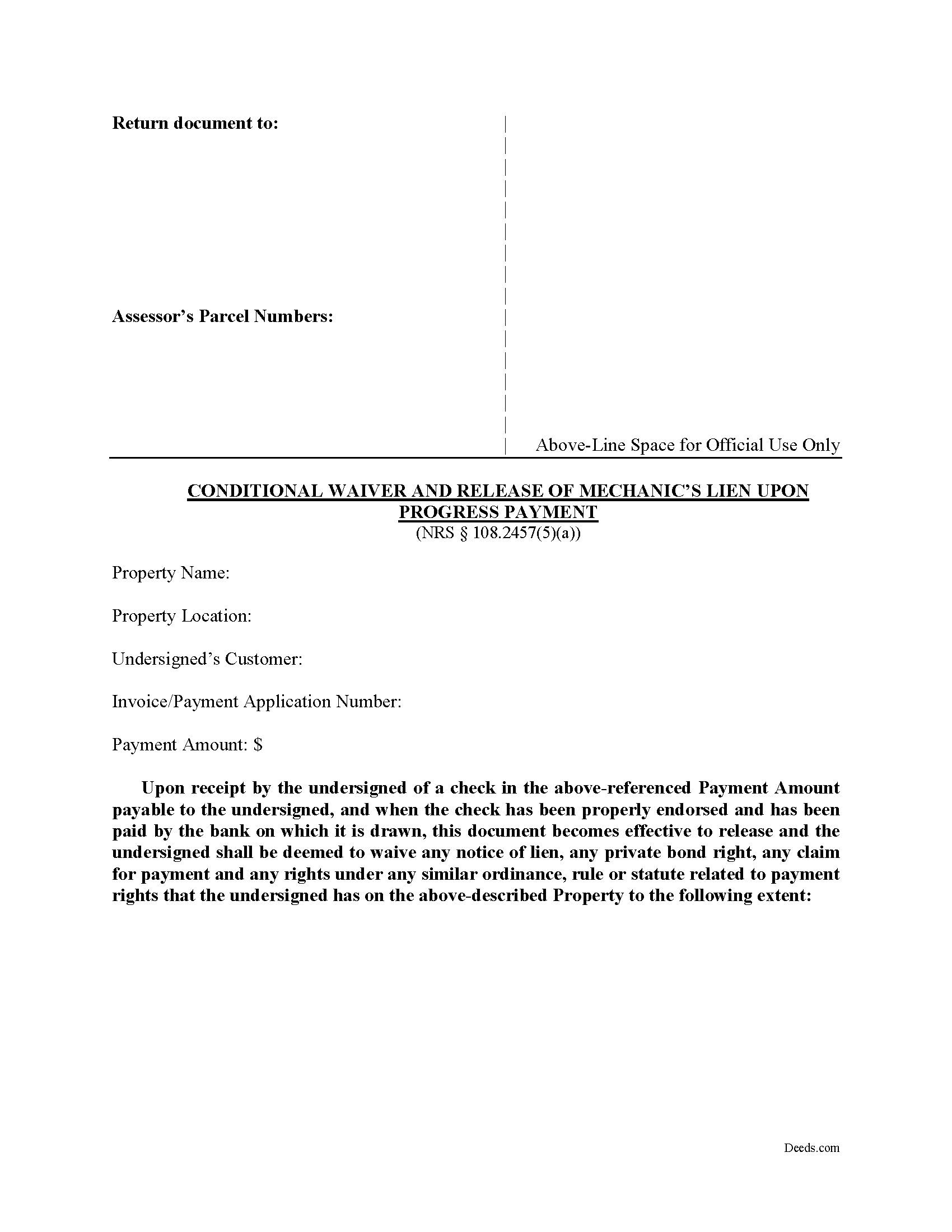

Conditional Waiver upon Progress Form

Fill in the blank Conditional Waiver upon Progress form formatted to comply with all Nevada recording and content requirements.

Included Lander County compliant document last validated/updated 12/16/2024

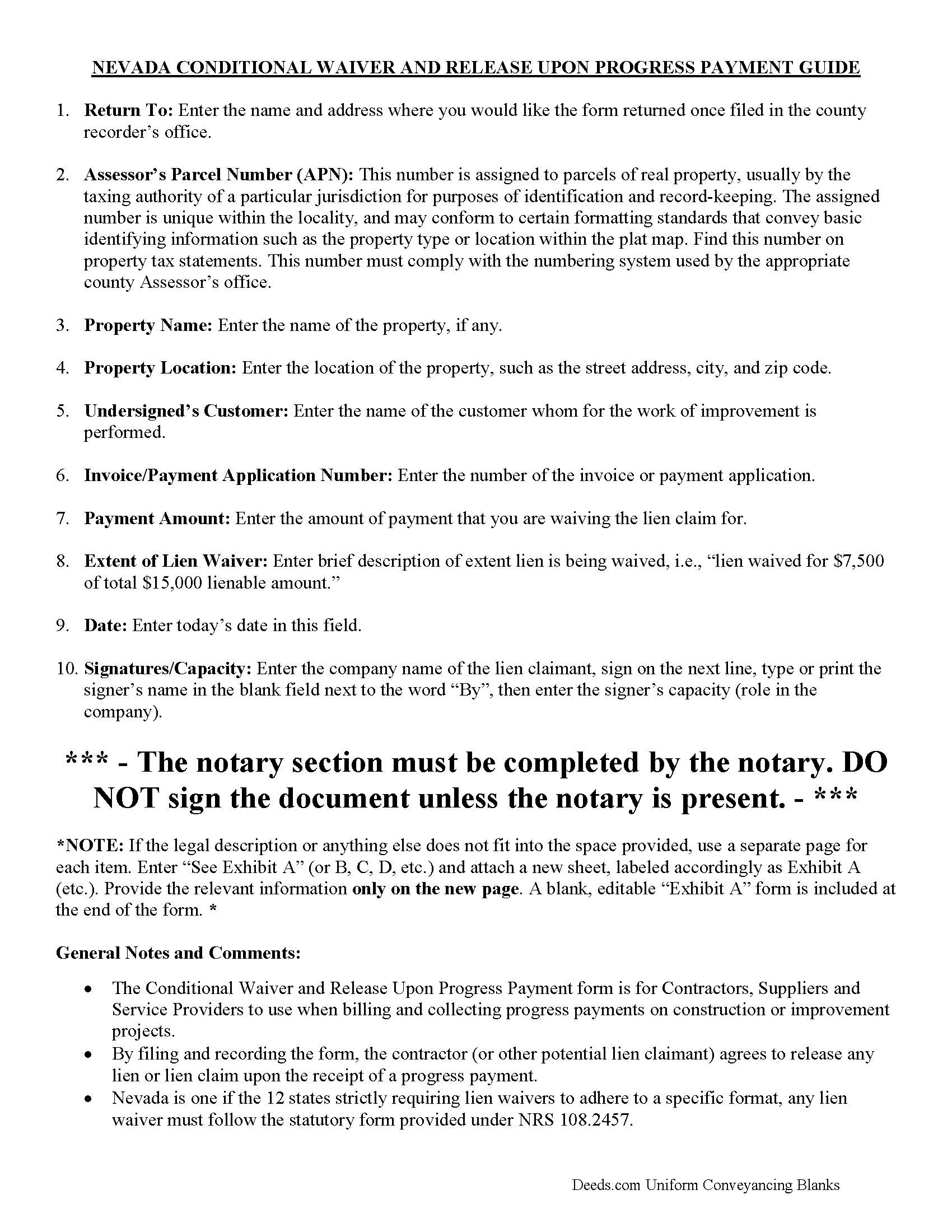

Conditional Waiver upon Progress Guide

Line by line guide explaining every blank on the form.

Included Lander County compliant document last validated/updated 12/9/2024

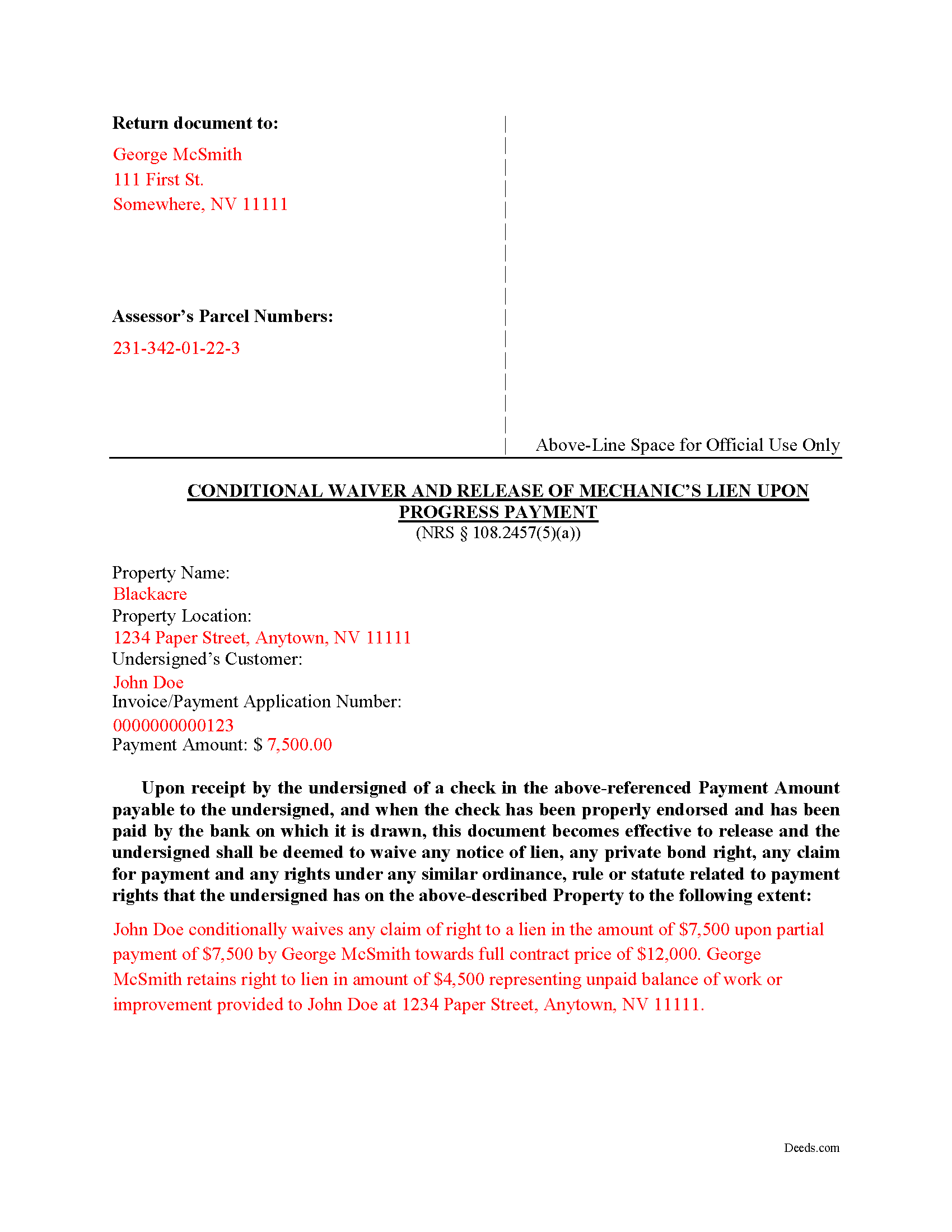

Completed Example of the Conditional Waiver upon Progress Document

Example of a properly completed form for reference.

Included Lander County compliant document last validated/updated 12/20/2024

The following Nevada and Lander County supplemental forms are included as a courtesy with your order:

When using these Conditional Waiver upon Progress forms, the subject real estate must be physically located in Lander County. The executed documents should then be recorded in the following office:

Lander County Recorder

315 South Humboldt St, Battle Mountain, Nevada 89820

Hours: 8:00 to 5:00 M-F / Recording until 4:50

Phone: (775) 635-5173

Local jurisdictions located in Lander County include:

- Austin

- Battle Mountain

How long does it take to get my forms?

Forms are available immediately after submitting payment.

How do I get my forms, are they emailed?

Immediately after you submit payment, the Lander County forms you order will be available for download directly from your account. You can then download the forms to your computer. If you do not already have an account, one will be created for you as part of the order process, and your login details will be provided to you. If you encounter any issues accessing your forms, please reach out to our support team for assistance. Forms are NOT emailed to you.

What does "validated/updated" mean?

This indicates the most recent date when at least one of the following occurred:

- Updated: The document was updated or changed to remain compliant.

- Validated: The document was examined by an attorney or staff, or it was successfully recorded in Lander County using our eRecording service.

Are these forms guaranteed to be recordable in Lander County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Lander County including margin requirements, content requirements, font and font size requirements.

Can the Conditional Waiver upon Progress forms be re-used?

Yes. You can re-use the forms for your personal use. For example, if you have more than one property in Lander County that you need to transfer you would only need to order our forms once for all of your properties in Lander County.

What are supplemental forms?

Often when a deed is recorded, additional documents are required by Nevada or Lander County. These could be tax related, informational, or even as simple as a coversheet. Supplemental forms are provided for free with your order where available.

What type of files are the forms?

All of our Lander County Conditional Waiver upon Progress forms are PDFs. You will need to have or get Adobe Reader to use our forms. Adobe Reader is free software that most computers already have installed.

Do I need any special software to use these forms?

You will need to have Adobe Reader installed on your computer to use our forms. Adobe Reader is free software that most computers already have installed.

Do I have to enter all of my property information online?

No. The blank forms are downloaded to your computer and you fill them out there, at your convenience.

Can I save the completed form, email it to someone?

Yes, you can save your deed form at any point with your information in it. The forms can also be emailed, blank or complete, as attachments.

Are there any recurring fees involved?

No. Nothing to cancel, no memberships, no recurring fees.

Nevada Conditional Waiver and Release upon Progress Payment

Provided under NRS 108.2457(5)(a), this waiver offers the most protection for lien claimants, because it states that if the claimant(s) have actually been paid to date (including no returned or stopped payment checks) the waiver serves as effective proof against any lien claim on the property. The lien is "conditioned" on receiving payment and is only waived if the claimant actually receives the payment.

By filing the form, the lien claimant represents that he or she either has already paid or will use the money he or she receives from this progress payment in order to make prompt payment in full all his or her laborers, subcontractors, materialmen and suppliers for all work, materials or equipment that are the subject of this waiver and release.

Getting a lien waiver also allows property owners to shield the title to their property from the general contractor, material supplier and every subcontractor involved with a project. By releasing the lien upon a progress payment, the property owner once again has clear title and can obtain financing or sell the property.

The property owner should require lien and labor waivers to be submitted with the contractor's invoices and no payment of any invoice should be made unless properly signed lien and labor waivers are provided. Proper lien waivers can protect the property owner from liens filed by the contractor's subcontractors, suppliers and laborers who might record a lien if they are not paid by the contractor.

Each case is unique, so contact an attorney with specific questions or for complex situations.

Our Promise

The documents you receive here will meet, or exceed, the Lander County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Lander County Conditional Waiver upon Progress form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4446 Reviews )

MARISSA G.

December 22nd, 2024

I recomemed this webside

Thank you for your feedback. We really appreciate it. Have a great day!

Dennis F.

December 20th, 2024

The release of mortgage form was OK, and accepted at the recorder's office, but there were some problems. Many of the fields to type in were too small to accept the data, and I could not find a way to change the field size or use a smaller font. Otherwise I was satisfied.

Your feedback is a crucial part of our dedication to ongoing improvement. Thank you for your insightful comments.

Frazer W.

December 19th, 2024

Deeds.com does a great job getting our legal documents filed with the D.C. Recorder of Deeds.rnrnFrazer Walton, Jr.rnLaw Office of Frazer Walton, Jr.

Your appreciative words mean the world to us. Thank you.

JOHN L.

November 17th, 2020

Not just good, very good. Very intuitive and very responsive. It just works!

Thank you for your feedback. We really appreciate it. Have a great day!

Elaine E. W.

February 13th, 2021

Your product package was thorough and I am the one who does not know how to use or begin to be interactive with a computer.

I wish I had learned long ago....ok your directions appear to be clear but when you are not familiar to the words.....it can and is difficult.....I downloaded the forms and completed them by hand/pen.....I just hope it will be acceptable to the recorder....Thank you

Thank you for your feedback. We really appreciate it. Have a great day!

Nawal F.

June 1st, 2023

Friendly user

Thank you!

Claudia S.

January 24th, 2023

Very user friendly! Processing is very fast. I would highly recommend using Deed's.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Peggy H.

December 9th, 2022

Very good!

Thank you!

tom s.

May 13th, 2021

Easier than I had expected. Was looking for the 'I have to get information that I don't understand' part which never appeared.

Thank you

Thank you!

vickie w.

February 22nd, 2020

easy & convenience .good service

Thank you for your feedback. We really appreciate it. Have a great day!

Linda Munguia N.

May 29th, 2021

Easy process. Appreciated the detailed instructions for filing.

Thank you!

Scott s.

September 2nd, 2022

Information requested was provided and time to reply was quick!

Thank you!

Neil S.

January 3rd, 2019

Very impressive. The only change I would suggest is a smaller font on the title.

Thank you for your feedback. We really appreciate it. Have a great day!

Matilde A.

October 25th, 2021

Very easy to navigate... will be back to use!

Thank you for your feedback. We really appreciate it. Have a great day!

ralph m.

March 1st, 2019

Overall the experience was pleasant and the services were delivered In a timely fashion

Thank you Ralph. Have a great day!