Lyon County Assignment of Deed of Trust Form (Nevada)

All Lyon County specific forms and documents listed below are included in your immediate download package:

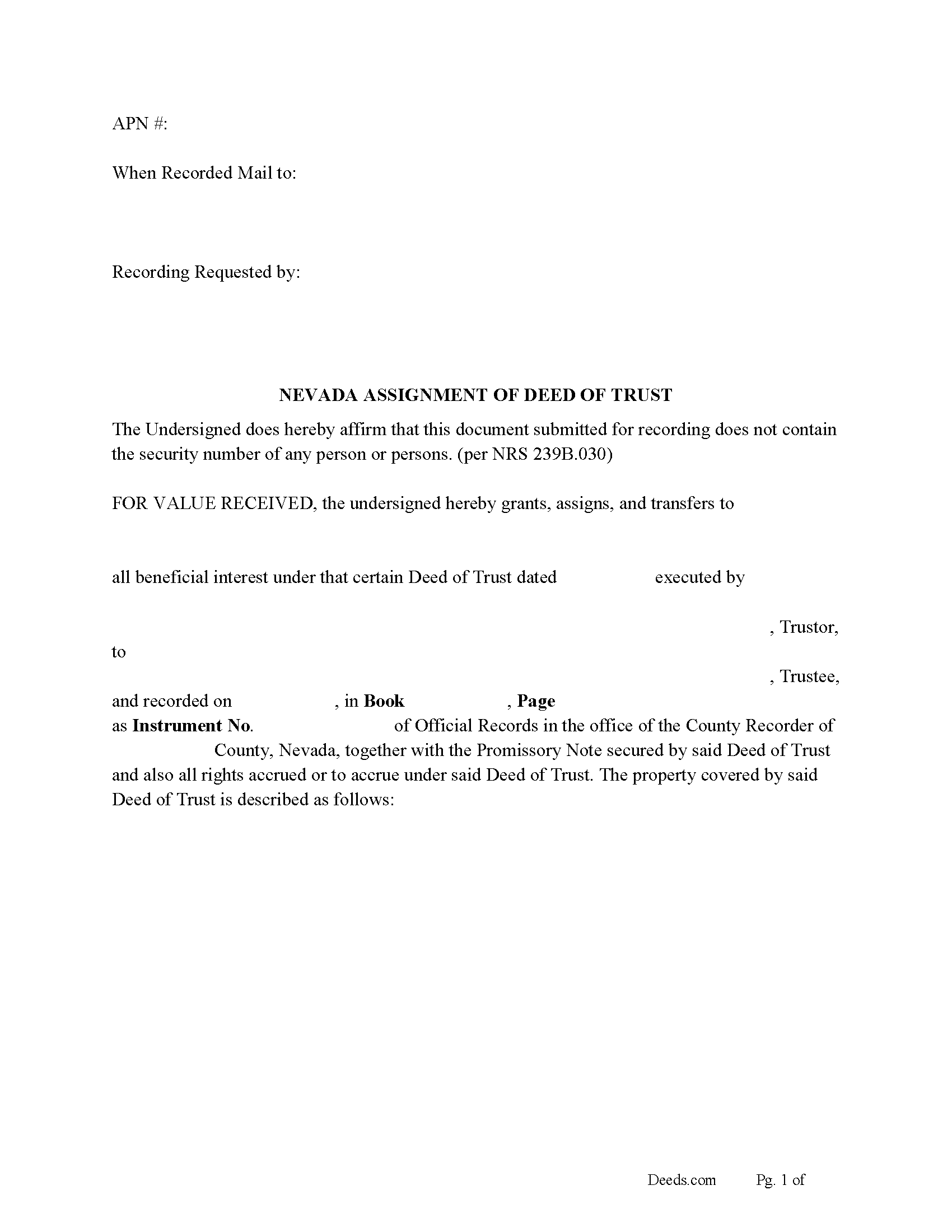

Assignment of Deed of Trust Form

Fill in the blank Assignment of Deed of Trust form formatted to comply with all Nevada recording and content requirements.

Included Lyon County compliant document last validated/updated 8/5/2024

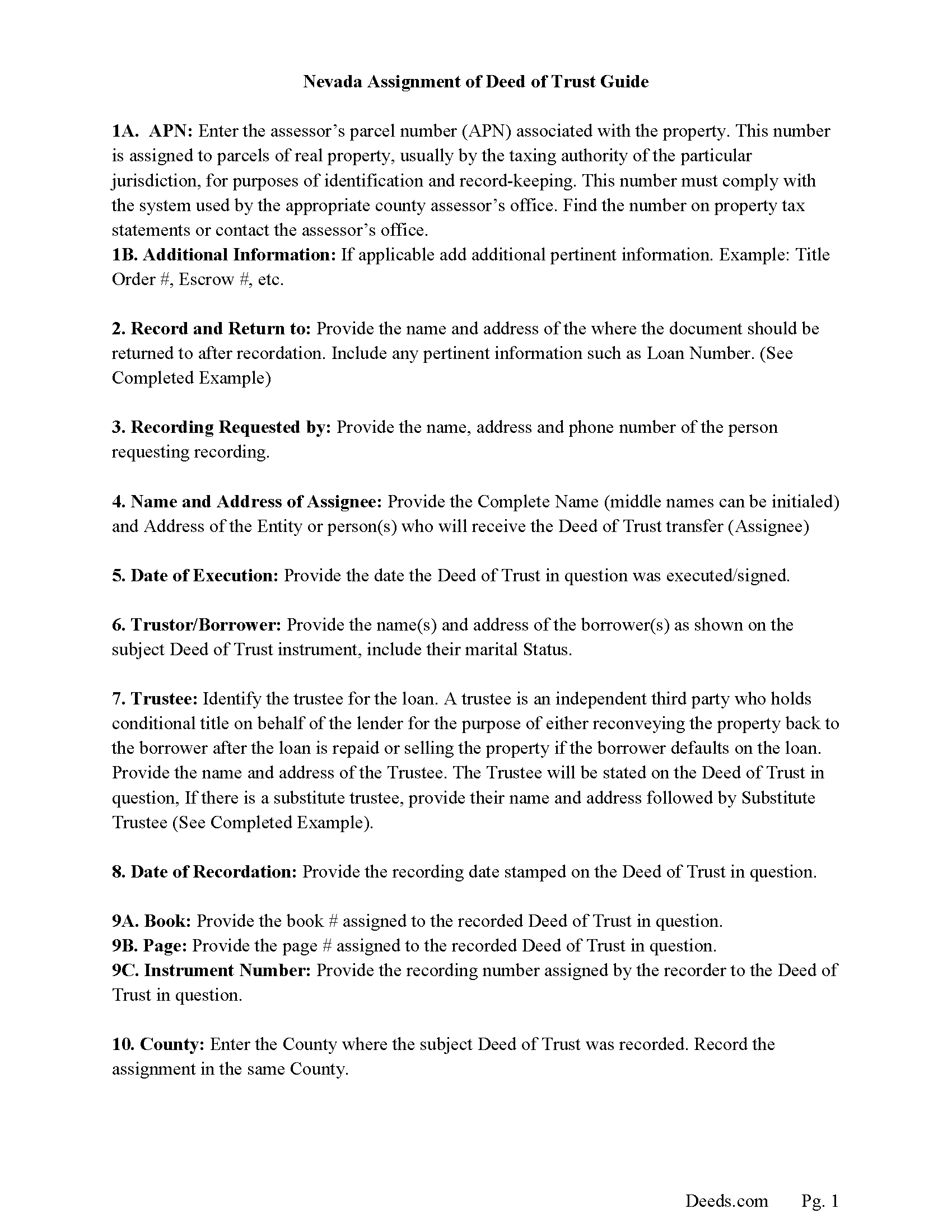

Guidelines for Assignment of Deed of Trust

Line by line guide explaining every blank on the form.

Included Lyon County compliant document last validated/updated 11/20/2024

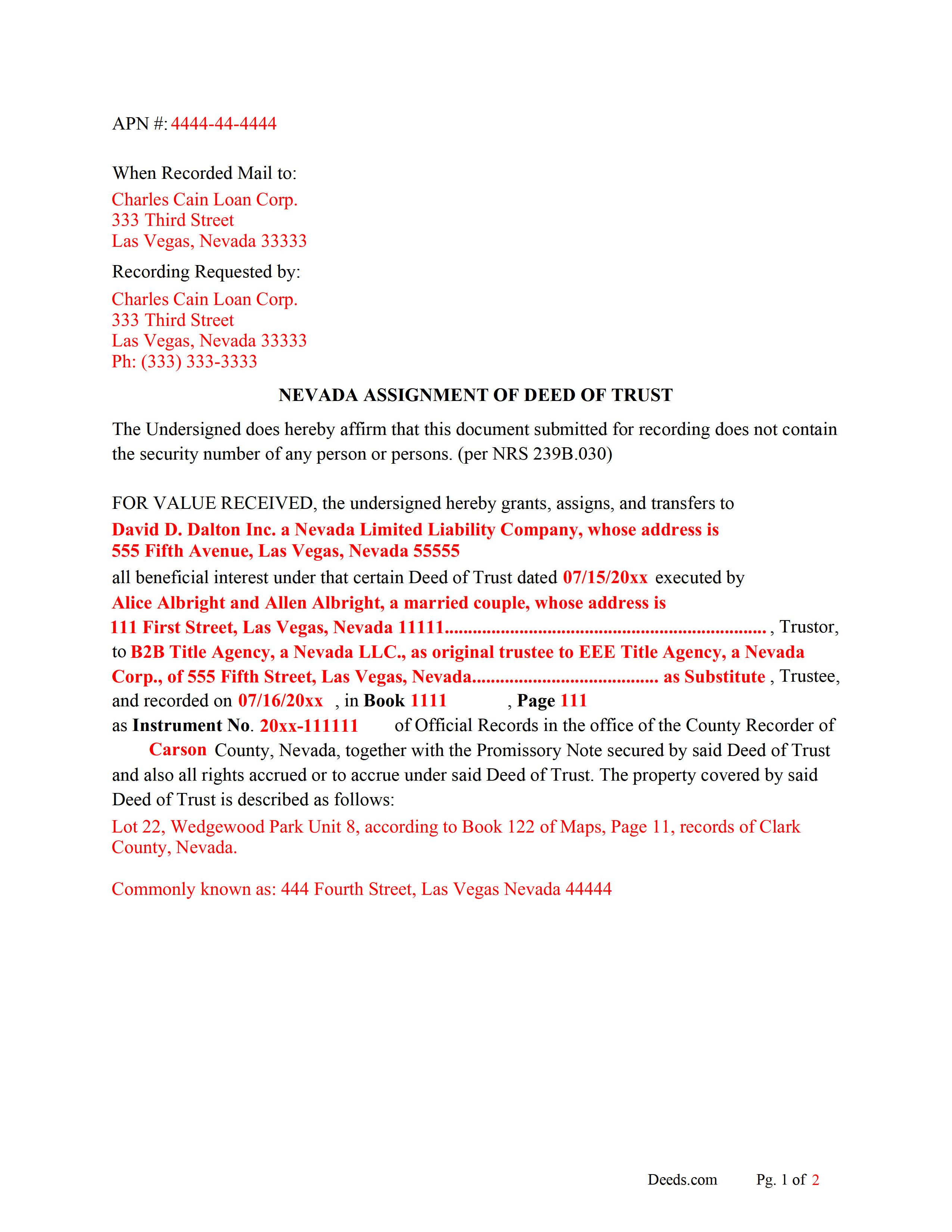

Completed Example of the Assignment of Deed of Trust Document

Example of a properly completed form for reference.

Included Lyon County compliant document last validated/updated 10/11/2024

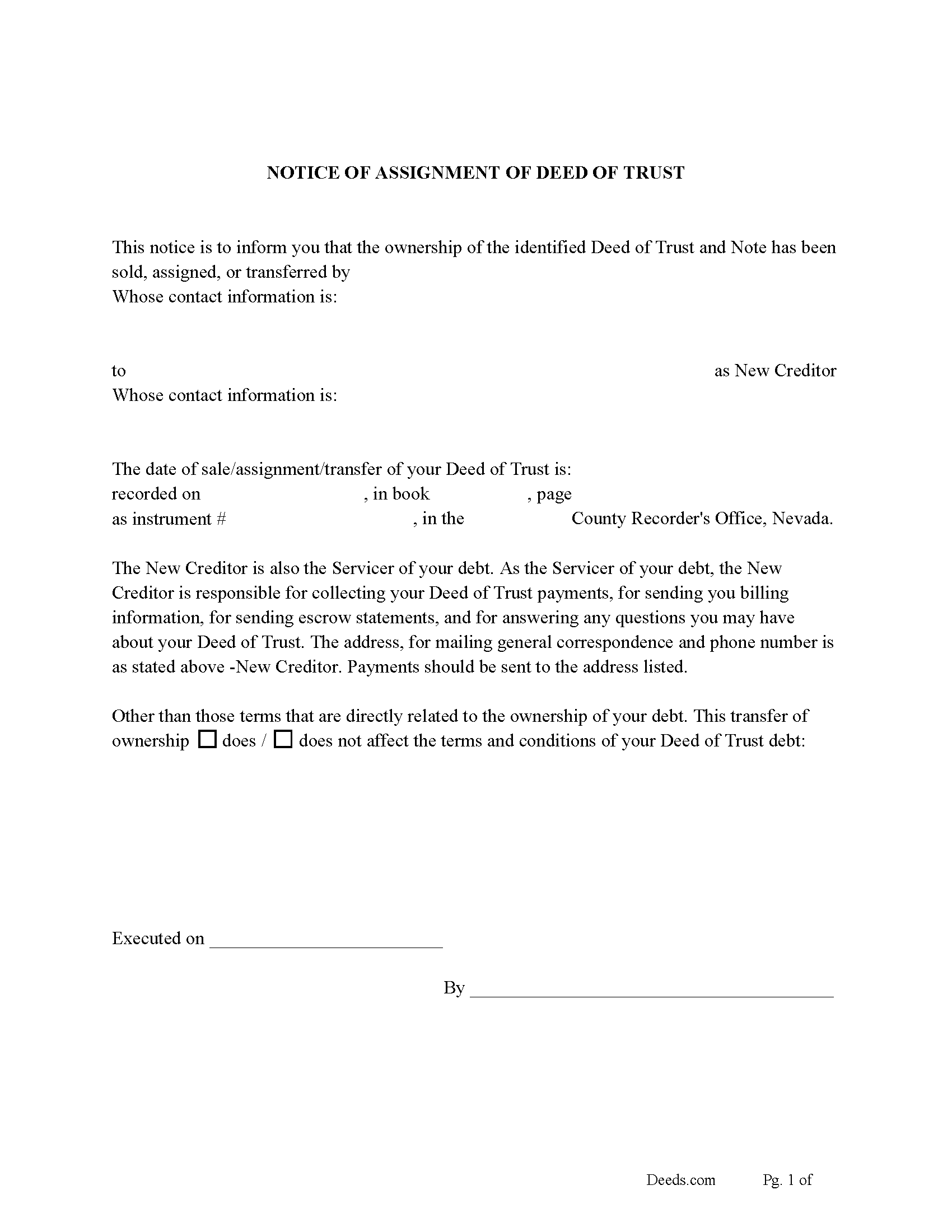

Notice of Assignment of Deed of Trust Form

Fill in the blank form formatted to comply with content requirements.

Included Lyon County compliant document last validated/updated 9/20/2024

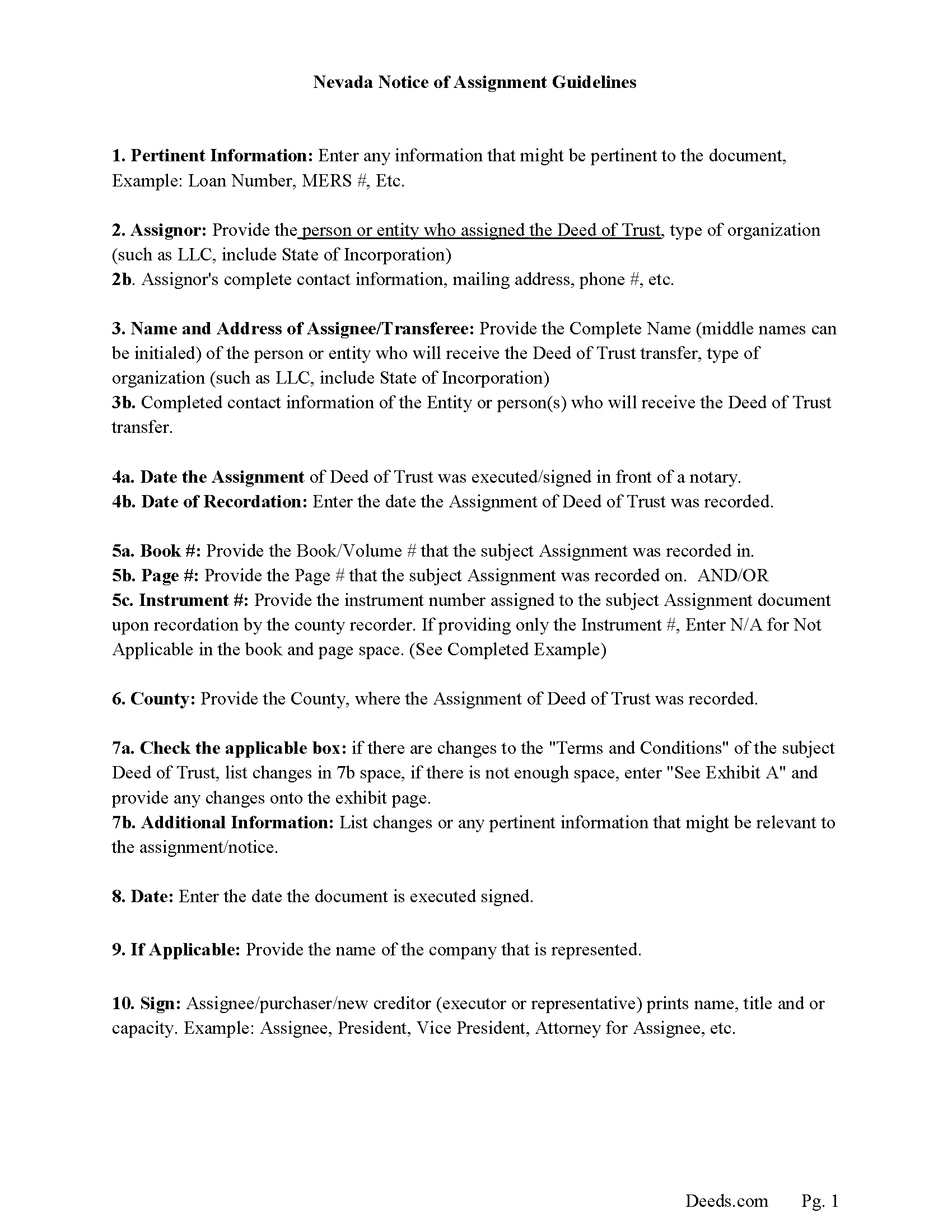

Notice of Assignment Guidelines

Line by line guide explaining every blank on the form.

Included Lyon County compliant document last validated/updated 10/11/2024

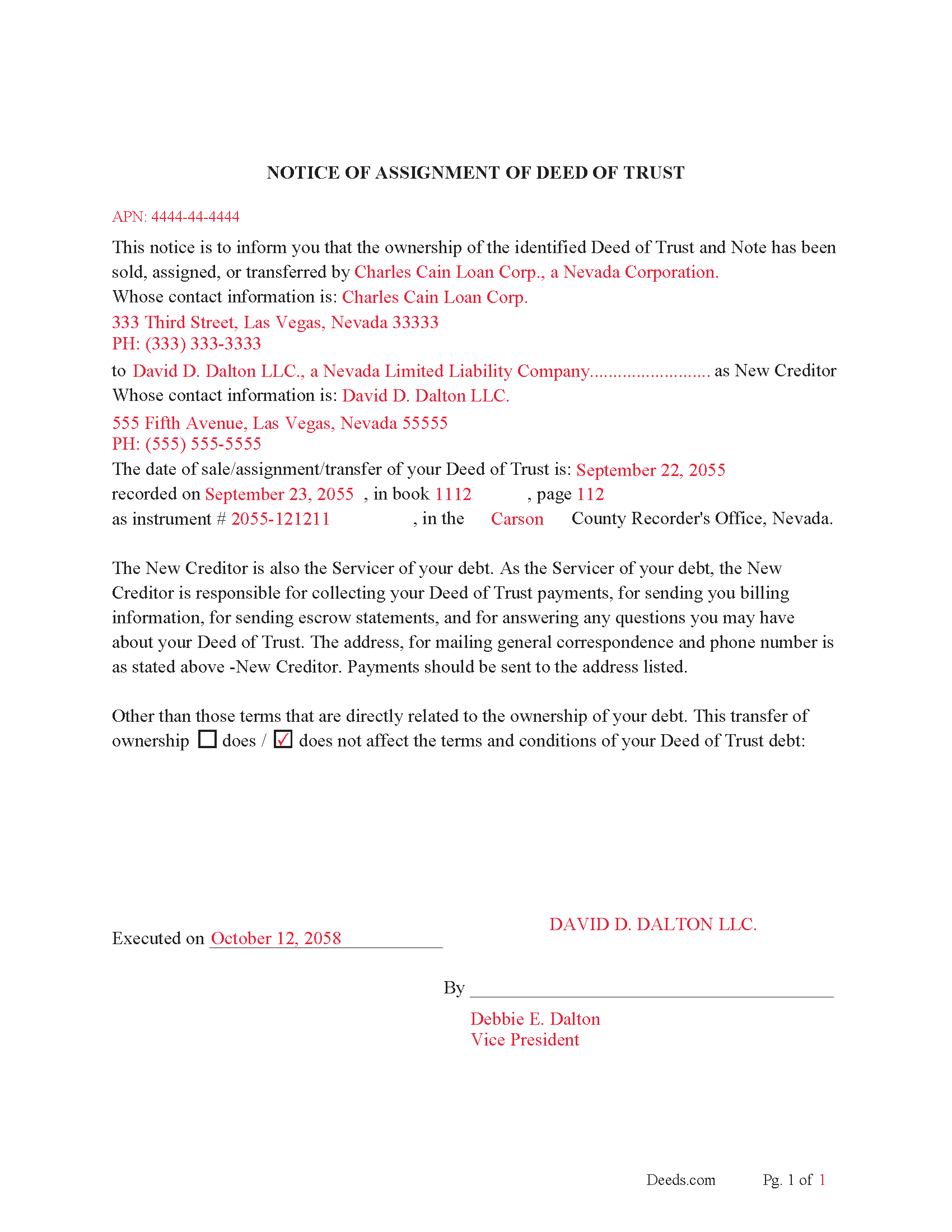

Completed Example of Notice of Assignment Document

Example of a properly completed form for reference.

Included Lyon County compliant document last validated/updated 10/7/2024

The following Nevada and Lyon County supplemental forms are included as a courtesy with your order:

When using these Assignment of Deed of Trust forms, the subject real estate must be physically located in Lyon County. The executed documents should then be recorded in the following office:

Lyon County Recorder

27 South Main St, Yerington, Nevada 89447

Hours: 8:00am-5:00pm M-F

Phone: (775) 463-6581

Local jurisdictions located in Lyon County include:

- Dayton

- Fernley

- Silver City

- Silver Springs

- Smith

- Wellington

- Yerington

How long does it take to get my forms?

Forms are available immediately after submitting payment.

How do I get my forms, are they emailed?

Immediately after you submit payment, the Lyon County forms you order will be available for download directly from your account. You can then download the forms to your computer. If you do not already have an account, one will be created for you as part of the order process, and your login details will be provided to you. If you encounter any issues accessing your forms, please reach out to our support team for assistance. Forms are NOT emailed to you.

What does "validated/updated" mean?

This indicates the most recent date when at least one of the following occurred:

- Updated: The document was updated or changed to remain compliant.

- Validated: The document was examined by an attorney or staff, or it was successfully recorded in Lyon County using our eRecording service.

Are these forms guaranteed to be recordable in Lyon County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Lyon County including margin requirements, content requirements, font and font size requirements.

Can the Assignment of Deed of Trust forms be re-used?

Yes. You can re-use the forms for your personal use. For example, if you have more than one property in Lyon County that you need to transfer you would only need to order our forms once for all of your properties in Lyon County.

What are supplemental forms?

Often when a deed is recorded, additional documents are required by Nevada or Lyon County. These could be tax related, informational, or even as simple as a coversheet. Supplemental forms are provided for free with your order where available.

What type of files are the forms?

All of our Lyon County Assignment of Deed of Trust forms are PDFs. You will need to have or get Adobe Reader to use our forms. Adobe Reader is free software that most computers already have installed.

Do I need any special software to use these forms?

You will need to have Adobe Reader installed on your computer to use our forms. Adobe Reader is free software that most computers already have installed.

Do I have to enter all of my property information online?

No. The blank forms are downloaded to your computer and you fill them out there, at your convenience.

Can I save the completed form, email it to someone?

Yes, you can save your deed form at any point with your information in it. The forms can also be emailed, blank or complete, as attachments.

Are there any recurring fees involved?

No. Nothing to cancel, no memberships, no recurring fees.

In this form the beneficiary/lender transfers interest in a Deed of Trust and Promissory Note to another party. (Any assignment of the beneficial interest under a deed of trust must be recorded in the office of the recorder of the county in which the property is located, and from the time any of the same are so filed for record shall operate as constructive notice of the contents thereof to all persons) (If the beneficial interest under a deed of trust has been assigned, the trustee under the deed of trust may not exercise the power of sale pursuant to NRS 107.080 unless and until the assignment is recorded pursuant to this subsection.) (NRS106.210). The borrower of a Deed of Trust may request to the servicer for a [certified copy of the note, the deed of trust and all assignments of the note and deed of trust if:]

[(a)The real property subject to the deed of trust is a single-family dwelling;

(b) The grantor is the owner of record of the real property;

(c) The grantor currently occupies the real property as his or her principal residence; and

(d) The servicer or beneficiary of the deed of trust is a banking or financial institution (as defined in NRS 106.295) or any other business entity that is licensed, registered or otherwise authorized to do business in this State.] [NRS107.071]

Not more than 10 days after receipt of a written request pursuant to subsection 1, the servicer of the deed of trust shall provide to the grantor the identity, address and any other contact information of the current owner or assignee of the note and deed of trust. NRS107.071(2)

If the servicer of the deed of trust does not provide a certified copy of each document requested pursuant to subsection 1 within 30 days after receipt of the request, or if the documents provided by the servicer indicate that the beneficiary of the deed of trust does not have a recorded interest in or lien on the real property which is subject to the deed of trust: (107.071 (3)

(a)The grantor of the deed of trust may report the servicer and the beneficiary of the deed of trust to the Division of Mortgage Lending or the Division of Financial Institutions of the Department of Business and Industry, whichever is appropriate; and

(b)The appropriate division may take whatever actions it deems necessary and proper, including, without limitation, enforcing any applicable laws or regulations or adopting any additional regulations.

NRS107.440 "Mortgage servicer" defined."Mortgage servicer" means a person who directly services a residential mortgage loan, or who is responsible for interacting with a borrower, managing a loan account on a daily basis, including, without limitation, collecting and crediting periodic loan payments, managing any escrow account or enforcing the note and security instrument, either as the current owner of the promissory note or as the authorized agent of the current owner of the promissory note. The term includes a person providing such services by contract as a subservicing agent to a master servicer by contract. The term does not include a trustee under a deed of trust, or the trustee's authorized agent, acting under a power of sale pursuant to a deed of trust.

Current Borrowers must be notified of the assignment. Notification consists of contact information of the new creditor, recording dates, recording instrument numbers, changes in loan, etc. Included are "Notice of Assignment of Deed of Trust" forms.

The Truth and lending act requires that borrowers be notified when their Deed of Trust has been sold, transferred, or assigned to a new creditor. Generally, within 30 days to avoid up to $2,000.00 in statutory damages, plus reasonable attorney's fees. Systematic violations can reach up $500,000.00.

(Nevada AODOT Package includes form, guidelines, and completed example) For use in Nevada only.

Our Promise

The documents you receive here will meet, or exceed, the Lyon County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Lyon County Assignment of Deed of Trust form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4434 Reviews )

James S.

November 21st, 2024

Forms used, created quitclaim deed that the county accepted without a second look (turns out they see deeds.com forms regularly via erecording and in person). Will be back for any real estate related forms I need and they carry. Will always be my first stop. Also, will use erecording next time, mad I didn't see it this time.

Thanks for the kind words James, glad we could help. Look forward to seeing you again.

Thomas G.

November 21st, 2024

Wasn’t what I expected

Sorry to hear that your expectations were missed. Your order has been canceled. We do hope that you find something more suitable to your expectations elsewhere. Do keep in mind that purchasing legal forms should not be an exploratory endeavor.

Jimmy P.

November 20th, 2024

They sent me everything I would need to do this. Easy purchase -Easy download. Great!! I'll be back here for all my document needs.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Misty M.

April 14th, 2021

I appreciate the Guide and the Sample pages.

Thank you!

Eileen B.

April 5th, 2022

I was quoted $525 to do the exact same thing from Deeds.com for only $25. Seems like a no brainer to me!

Thank you for your feedback. We really appreciate it. Have a great day!

Maureen F.

January 27th, 2021

Forms were delivered quickly and were easily filled out.

State specific!

Thank you!

Barbara B.

February 17th, 2019

Great forms and instructions!

Thank you Barbara.

MARIA P.

April 16th, 2021

I finally was able to download the forms. Thank you and I know I will be able to use your service anytime I may need a legal document. Thanks again!

Thank you!

James W.

August 29th, 2019

Thank-you for your excellent services

Thank you!

Rhonda L.

May 27th, 2020

This was one of the most simple but efficient process. Walked me thru every step. Total process was less than 2 weeks.

Thank you!

James N.

December 14th, 2018

The purchasing process was very slick and my credit card was charged IMMEDIATELY. The deliver went well as the link was provided immediately.

However I asked a question via the "Contact Us" link and days later I get a survey but no reply.

I may have been directed to the wrong forms via my County and I wanted to confirm that...but still no answer.

What would that deserve as a rating???

Also, your history on our site shows no messages sent via our contact us page.

Mercedes B.

February 16th, 2020

Great site. It lets your fingers do the walking. It took me half a day to get deed info a couple of years ago.

Thanks Deeds.com

Thank you for your feedback. We really appreciate it. Have a great day!

Johnny A.

December 15th, 2018

My complete name is

Johnny Alicea Rodriguez

And the DEED is on my half brother and mine name.

Jimmy Dominguez and myself

Thanks

Rosemary W.

February 27th, 2021

considering the current epidemic your fees save me time and parking fees. with help from DC recorder of deeds I was directed to the correct link to process my deed

Thank you for your feedback. We really appreciate it. Have a great day!

Mary G.

November 24th, 2020

Very easy process, handled quickly without complications. Excellent communication about status.

Thank you!