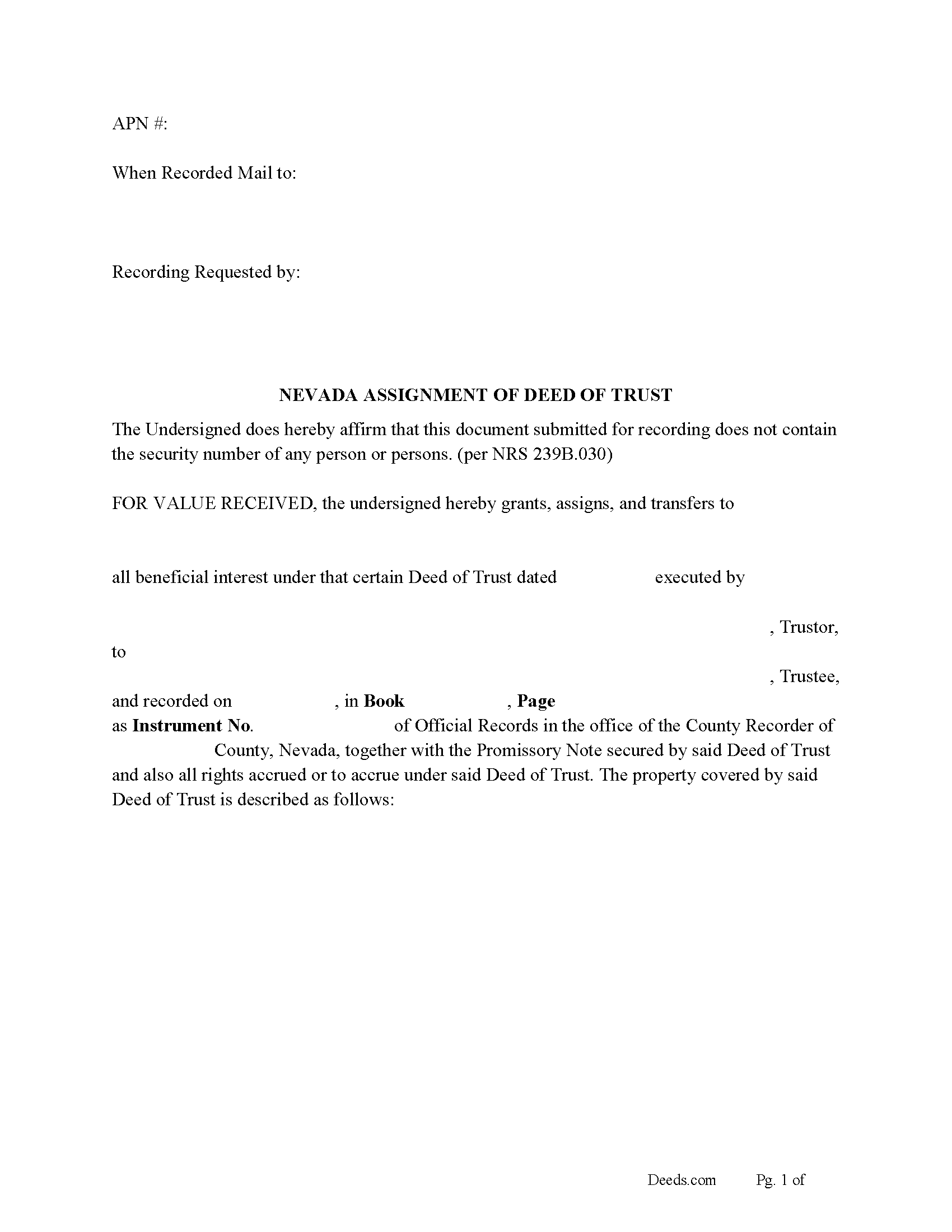

Download Nevada Assignment of Deed of Trust Legal Forms

Nevada Assignment of Deed of Trust Overview

In this form the beneficiary/lender transfers interest in a Deed of Trust and Promissory Note to another party. (Any assignment of the beneficial interest under a deed of trust must be recorded in the office of the recorder of the county in which the property is located, and from the time any of the same are so filed for record shall operate as constructive notice of the contents thereof to all persons) (If the beneficial interest under a deed of trust has been assigned, the trustee under the deed of trust may not exercise the power of sale pursuant to NRS 107.080 unless and until the assignment is recorded pursuant to this subsection.) (NRS106.210). The borrower of a Deed of Trust may request to the servicer for a [certified copy of the note, the deed of trust and all assignments of the note and deed of trust if:]

[(a)The real property subject to the deed of trust is a single-family dwelling;

(b) The grantor is the owner of record of the real property;

(c) The grantor currently occupies the real property as his or her principal residence; and

(d) The servicer or beneficiary of the deed of trust is a banking or financial institution (as defined in NRS 106.295) or any other business entity that is licensed, registered or otherwise authorized to do business in this State.] [NRS107.071]

Not more than 10 days after receipt of a written request pursuant to subsection 1, the servicer of the deed of trust shall provide to the grantor the identity, address and any other contact information of the current owner or assignee of the note and deed of trust. NRS107.071(2)

If the servicer of the deed of trust does not provide a certified copy of each document requested pursuant to subsection 1 within 30 days after receipt of the request, or if the documents provided by the servicer indicate that the beneficiary of the deed of trust does not have a recorded interest in or lien on the real property which is subject to the deed of trust: (107.071 (3)

(a)The grantor of the deed of trust may report the servicer and the beneficiary of the deed of trust to the Division of Mortgage Lending or the Division of Financial Institutions of the Department of Business and Industry, whichever is appropriate; and

(b)The appropriate division may take whatever actions it deems necessary and proper, including, without limitation, enforcing any applicable laws or regulations or adopting any additional regulations.

NRS107.440 "Mortgage servicer" defined."Mortgage servicer" means a person who directly services a residential mortgage loan, or who is responsible for interacting with a borrower, managing a loan account on a daily basis, including, without limitation, collecting and crediting periodic loan payments, managing any escrow account or enforcing the note and security instrument, either as the current owner of the promissory note or as the authorized agent of the current owner of the promissory note. The term includes a person providing such services by contract as a subservicing agent to a master servicer by contract. The term does not include a trustee under a deed of trust, or the trustee's authorized agent, acting under a power of sale pursuant to a deed of trust.

Current Borrowers must be notified of the assignment. Notification consists of contact information of the new creditor, recording dates, recording instrument numbers, changes in loan, etc. Included are "Notice of Assignment of Deed of Trust" forms.

The Truth and lending act requires that borrowers be notified when their Deed of Trust has been sold, transferred, or assigned to a new creditor. Generally, within 30 days to avoid up to $2,000.00 in statutory damages, plus reasonable attorney's fees. Systematic violations can reach up $500,000.00.

(Nevada AODOT Package includes form, guidelines, and completed example) For use in Nevada only.