Download Nevada Affidavit of Death of Spouse Holding Community Property Legal Forms

Nevada Affidavit of Death of Spouse Holding Community Property Overview

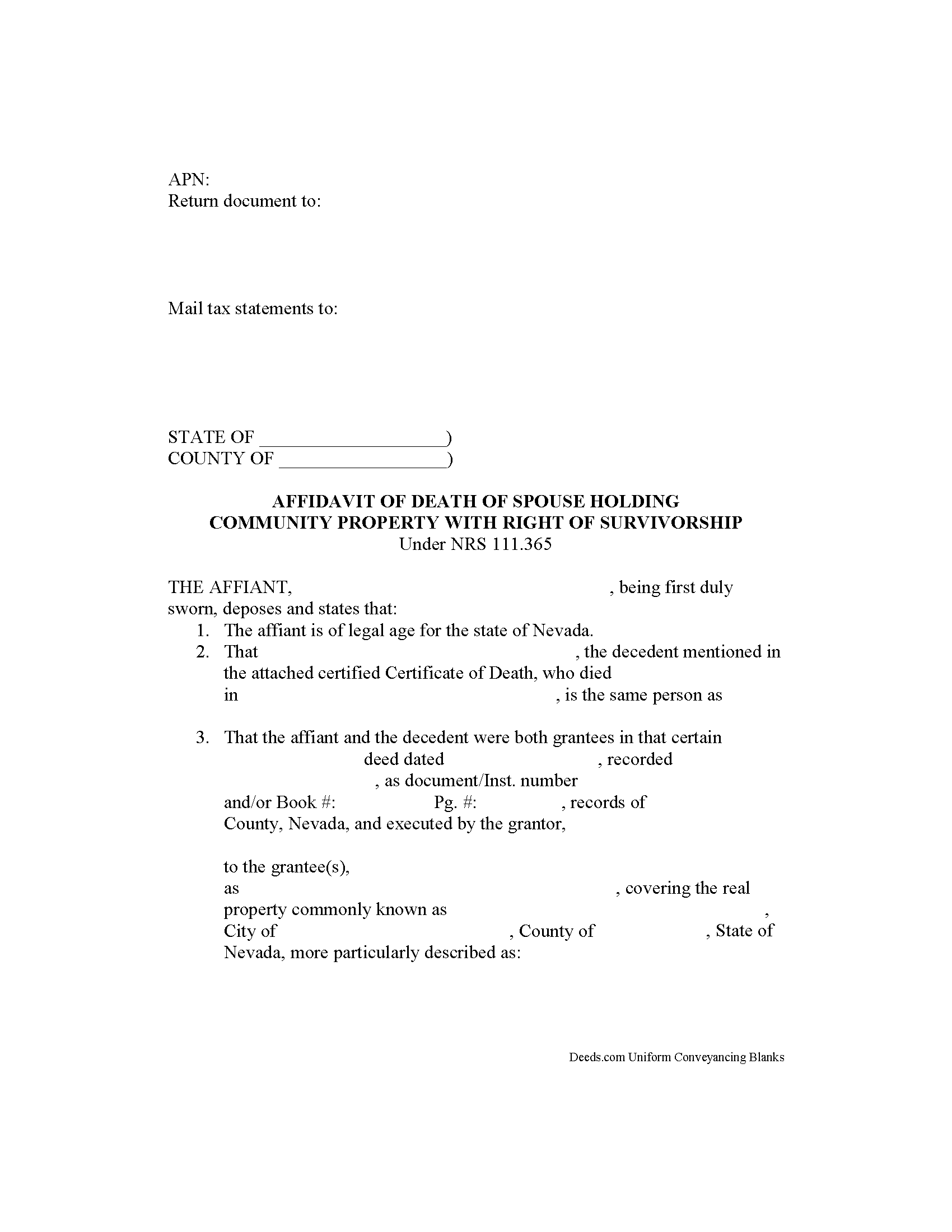

Nevada Affidavit of Death of Spouse Holding Community Property with Right of Survivorship

The requirements for an affidavit of death in Nevada are contained in NRS111.365.

For Nevada real estate owned by spouses as community property with right of survivorship, the death of one spouse means that his or her property rights are conveyed to the remaining spouse, without the need for probate distribution. This transfer technically happens "as a function of law" when one owner dies.

Even so, surviving spouses must initiate the process by recording an affidavit of death, accompanied by a certified copy of the death certificate, to terminate all title to or interest in real property of the deceased spouse. After the affidavit is recorded in the office of the recorder of the county or counties in which the real property is located, the deceased owner's rights are presumed to be terminated, and vested solely in the surviving spouse.

The days and weeks following the death of a family member are often difficult, but timely recording of the affidavit of death is important. It preserves a clear chain of title, which makes future conveyances of the property less complicated. In addition, updated records ensure that property tax bills and assessments are sent to the correct recipients.

(Nevada AOD of SHCP Package includes form, guidelines, and completed example)