Mcpherson County Transfer on Death Deed Form (Nebraska)

All Mcpherson County specific forms and documents listed below are included in your immediate download package:

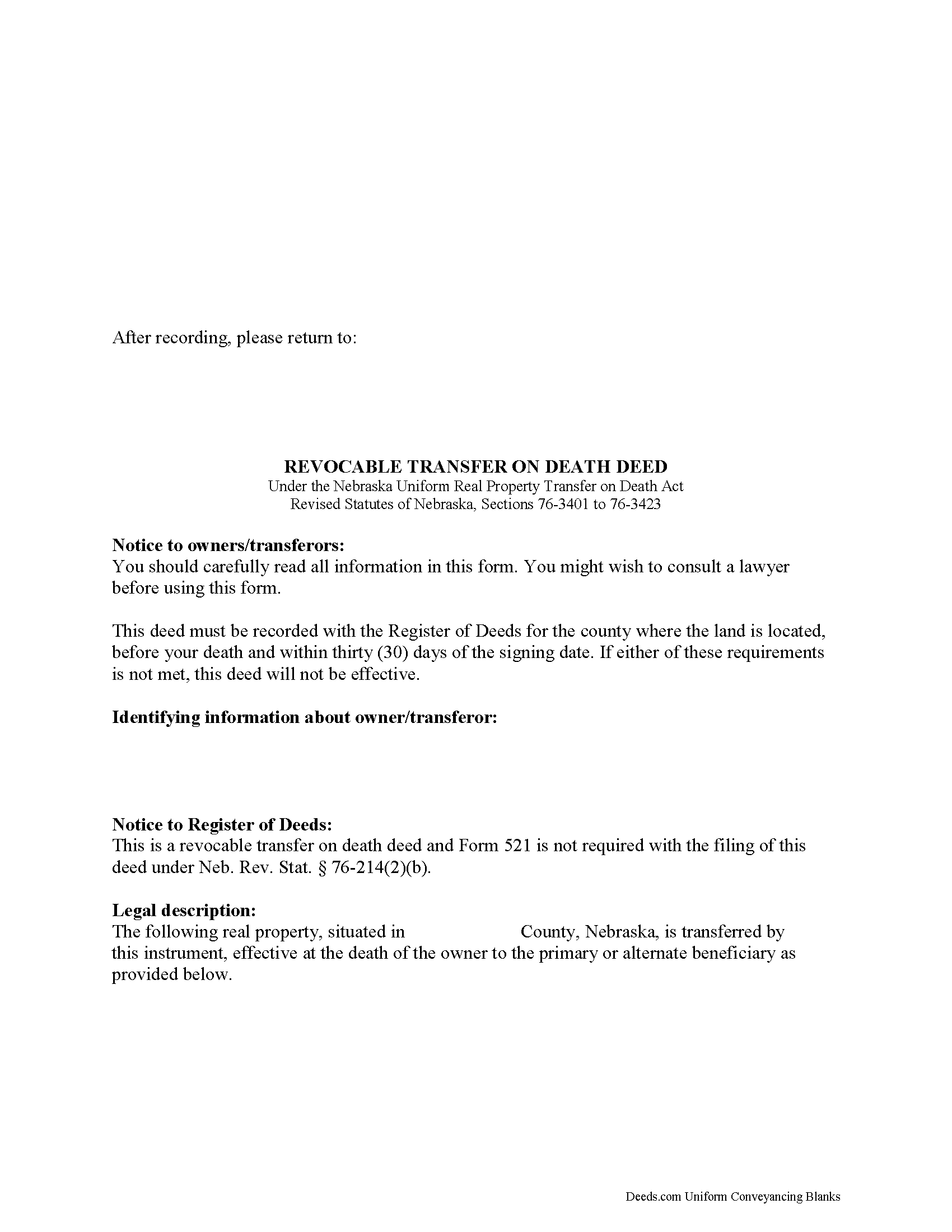

Transfer on Death Deed Form

Fill in the blank form formatted to comply with all recording and content requirements.

Included Mcpherson County compliant document last validated/updated 9/26/2024

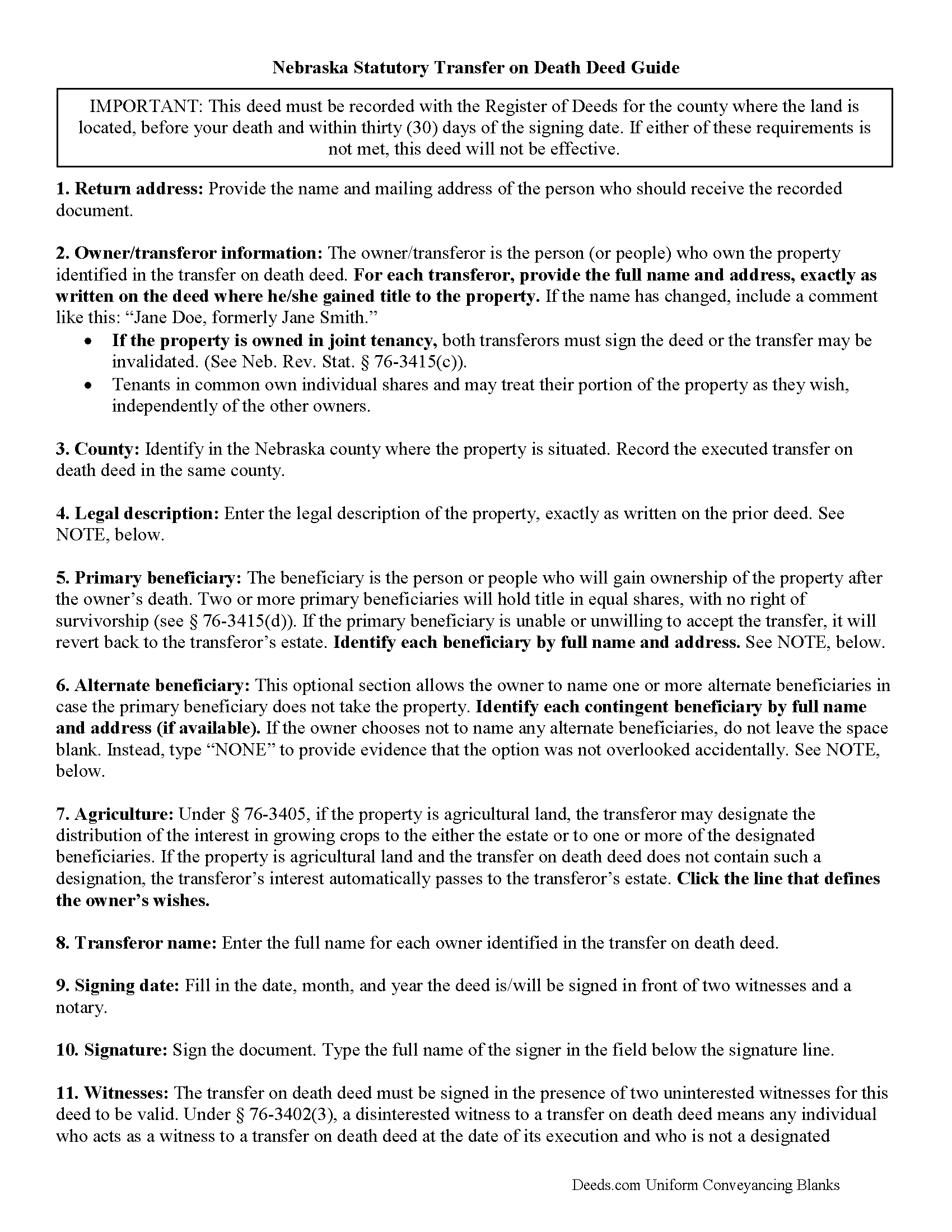

Transfer on Death Deed Guide

Line by line guide explaining every blank on the form.

Included Mcpherson County compliant document last validated/updated 11/7/2024

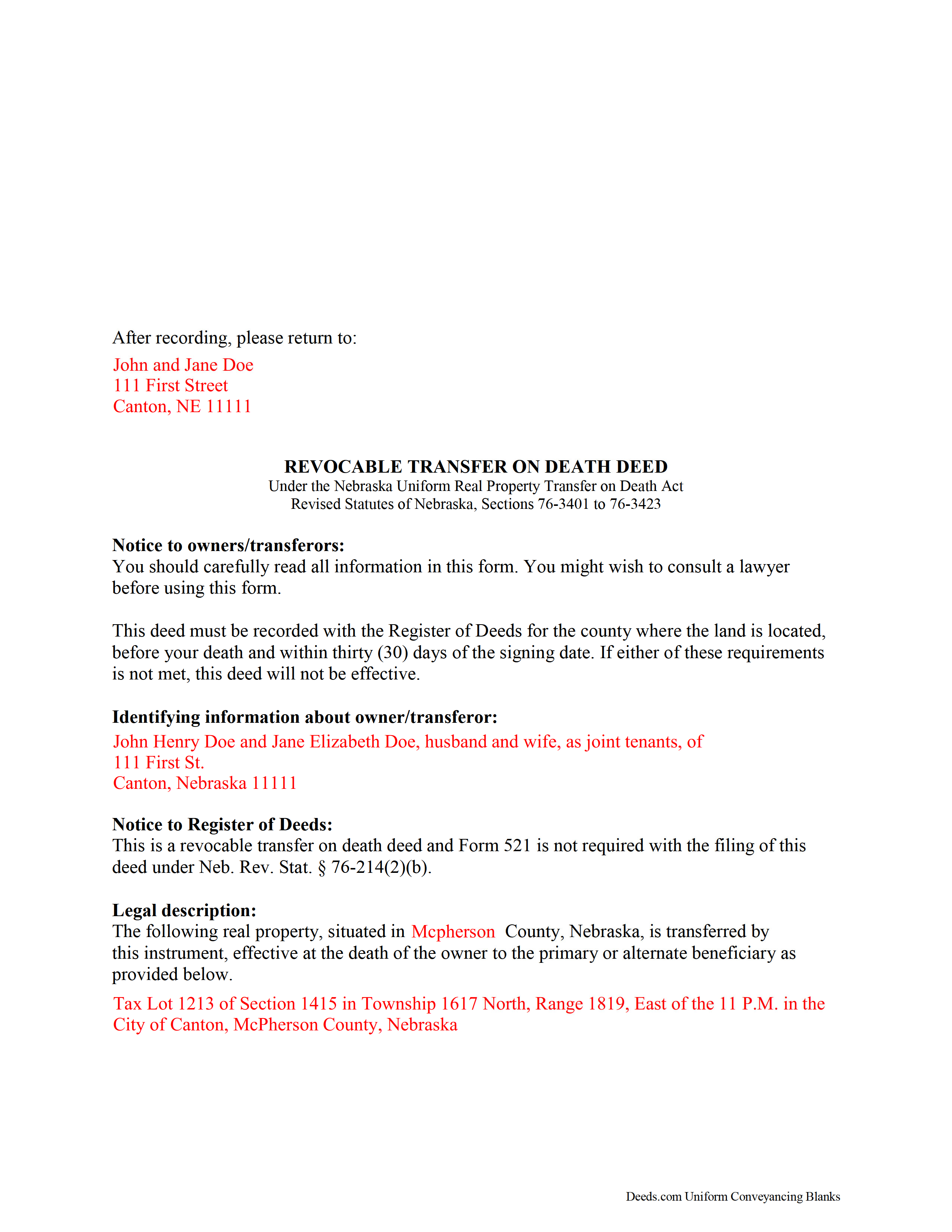

Completed Example of the Transfer on Death Deed Document

Example of a properly completed form for reference.

Included Mcpherson County compliant document last validated/updated 9/26/2024

The following Nebraska and Mcpherson County supplemental forms are included as a courtesy with your order:

When using these Transfer on Death Deed forms, the subject real estate must be physically located in Mcpherson County. The executed documents should then be recorded in the following office:

McPherson County Register of Deeds/Clerk

PO Box 122, Tryon, Nebraska 69167

Hours: Call for hours

Phone: (308) 942-6035

Local jurisdictions located in Mcpherson County include:

- Tryon

How long does it take to get my forms?

Forms are available immediately after submitting payment.

How do I get my forms, are they emailed?

Immediately after you submit payment, the Mcpherson County forms you order will be available for download directly from your account. You can then download the forms to your computer. If you do not already have an account, one will be created for you as part of the order process, and your login details will be provided to you. If you encounter any issues accessing your forms, please reach out to our support team for assistance. Forms are NOT emailed to you.

What does "validated/updated" mean?

This indicates the most recent date when at least one of the following occurred:

- Updated: The document was updated or changed to remain compliant.

- Validated: The document was examined by an attorney or staff, or it was successfully recorded in Mcpherson County using our eRecording service.

Are these forms guaranteed to be recordable in Mcpherson County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Mcpherson County including margin requirements, content requirements, font and font size requirements.

Can the Transfer on Death Deed forms be re-used?

Yes. You can re-use the forms for your personal use. For example, if you have more than one property in Mcpherson County that you need to transfer you would only need to order our forms once for all of your properties in Mcpherson County.

What are supplemental forms?

Often when a deed is recorded, additional documents are required by Nebraska or Mcpherson County. These could be tax related, informational, or even as simple as a coversheet. Supplemental forms are provided for free with your order where available.

What type of files are the forms?

All of our Mcpherson County Transfer on Death Deed forms are PDFs. You will need to have or get Adobe Reader to use our forms. Adobe Reader is free software that most computers already have installed.

Do I need any special software to use these forms?

You will need to have Adobe Reader installed on your computer to use our forms. Adobe Reader is free software that most computers already have installed.

Do I have to enter all of my property information online?

No. The blank forms are downloaded to your computer and you fill them out there, at your convenience.

Can I save the completed form, email it to someone?

Yes, you can save your deed form at any point with your information in it. The forms can also be emailed, blank or complete, as attachments.

Are there any recurring fees involved?

No. Nothing to cancel, no memberships, no recurring fees.

The Nebraska Uniform Real Property Transfer on Death Act is found at Sections 76-3401 to 76-3423 of the Nebraska Revised Statutes. This useful law provides an option for land owners to convey their real estate after their death, but without the need to include it in a will.

A transfer on death deed (TODD), when lawfully executed, allows property owners to retain absolute title to and control over their land during their lives ( 76-3414). The deeds are also revocable (76-3413). In part, these features are possible because unlike traditional deeds (warranty deeds, quitclaim deeds, etc.), TODDs do not require consideration from or notice to the beneficiary ( 76-3411).

In addition to meeting the content requirements of traditional deeds, people who use or revoke TODDs must meet the same competency standards as for creating a will (76-3408). The statute also demands the signatures of two disinterested witnesses (76-3409). Further, the document must contain specific warnings and must be recorded before the owner's death and within thirty days of signing ( 76-3410).

The rules for revoking a recorded TODD are set out at 76-3413. They include executing and recording a document that specifically revokes the TODD ( 76-3413(1)(B)); a new TODD that revokes the previous deed and changes the beneficiary or details about the transfer (76-3413(1)(A)); or transferring the real estate with a traditional deed (76-3413 (1)(C)).

When the owner dies, the beneficiary may accept the transfer by recording the appropriate documentation (76-3412, 76-3415) or disclaim the interest as provided by section 30-2352 (76-3416).

Overall, transfer on death deeds are flexible tools to consider as part of a comprehensive estate plan, but each circumstance is unique. Please contact an attorney for complex situations or with specific questions.

(Nebraska TOD Package includes form, guidelines, and completed example)

Our Promise

The documents you receive here will meet, or exceed, the Mcpherson County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Mcpherson County Transfer on Death Deed form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4428 Reviews )

Joseph D.

November 14th, 2024

Easy to use and a quick turnaround rnDeed was recorded and retuned within 24 hours

We are grateful for your engagement and feedback, which help us to serve you better. Thank you for being an integral part of our community.

Angela M.

November 14th, 2024

Great communication and always on timely manner unless issue appears with the document.rnI like their customer service, very helpful and assisting when necessary.

We are sincerely grateful for your feedback and are committed to providing the highest quality service. Thank you for your trust in us.

Susan H.

November 10th, 2024

I used the quitclaim deed form, it was easy to fill out, had notarized and was accepted by the county's recorders office. Having a example form made it so much easier to fill out.

Thank you for your positive words! We’re thrilled to hear about your experience.

Debbie M.

July 3rd, 2020

The forms and instructions were easy to follow and get complete. It was very nice to be able to just find them, pay for them, and download them so that they were printed just within a matter of 30 minutes. Thank you

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Rita M.

January 12th, 2019

I have not received the deed via email. That is what I was expecting.

Let me know if I am incorrect in my thinking.

Thanks for reaching out. While we do send some email notifications, we do not email documents. All orders are available via your account. You can log into your account from the menu button at the top left of most pages on the website.

Dana Y.

October 22nd, 2019

Purchased and used the quitclaim form. I have no complaints with any aspect. The forms, instructions, and example all came together to make the process very easy.

Thank you Dana. Have a great day!

John C.

February 26th, 2024

Ease and speed of recording are remarkable. This is especially true of deeds with problems: I often get feedback within minutes and can correct problems immediately and still complete the filing in the same day. I wish more counties accepted electronic filing! It would be helpful to list counties that do/do not accept electronic filing so I would not have to upload documents to find out my effort was fruitless.

We are grateful for your feedback and looking forward to serving you again. Thank you!

Richard L.

April 22nd, 2020

very useful

Thank you!

Maria S.

January 10th, 2019

The paperwork/forms are fine, but there isn't enough explanation for me to figure out how to file the extra forms (which I do need in my case). The main form, Deed Upon Death is fine. I think the price is pretty high for these forms. I wouldn't have purchased it because there are places to get them for much cheaper (about 6 dollars), but this site had the extra forms I wanted (property in a trust and another form). Unfortunately these were included as a "courtesy" and there are no instructions for them. So three stars for being clear about what was in the package, having the right forms that I need, but instructions for putting them to use and price took a couple of stars off. Downloading was easy and once you download you can type the info into the PDF--that makes working with the forms much easier.

Thank you for the feedback Maria. Regarding the supplement documents, it is best to get assistance from the agency that requires them. These are not legal documents, they should provide full support and guidance for them.

Salvatore R.

January 18th, 2023

It was fast and easy to find.

Thank you!

james b.

May 29th, 2020

worked great

Thank you!

Scott G.

June 4th, 2024

Frankly, if our tax dollars were being used to run government "services" correctly, we wouldn't need Deeds.comrnrnSince the sun will burn out before government is run correctly, Deeds.com provides an important, efficient, time-saving service that, all things considered, offers big savings over time-and-soul-draining struggles with government agencies.

Your feedback is greatly appreciated. Thank you for taking the time to share your experience!

MARK S.

March 17th, 2020

Forms seem direct, simple, not what a "big firm" might have, appear sufficient to do the job -- safety in following at least the basics

Thank you!

Darlene P.

November 12th, 2021

Deeds.com was a money saver for me. It made a daunting task of preparing a Quit Claim Deed a very simple task. I was happy that my documentation was accepted by my state and County first round.

Thank you Deeds.com

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Terriana H.

December 12th, 2020

Order processed and fulfilled in the same day!

Thank you!