Grant County Certificate of Trust Form (Nebraska)

All Grant County specific forms and documents listed below are included in your immediate download package:

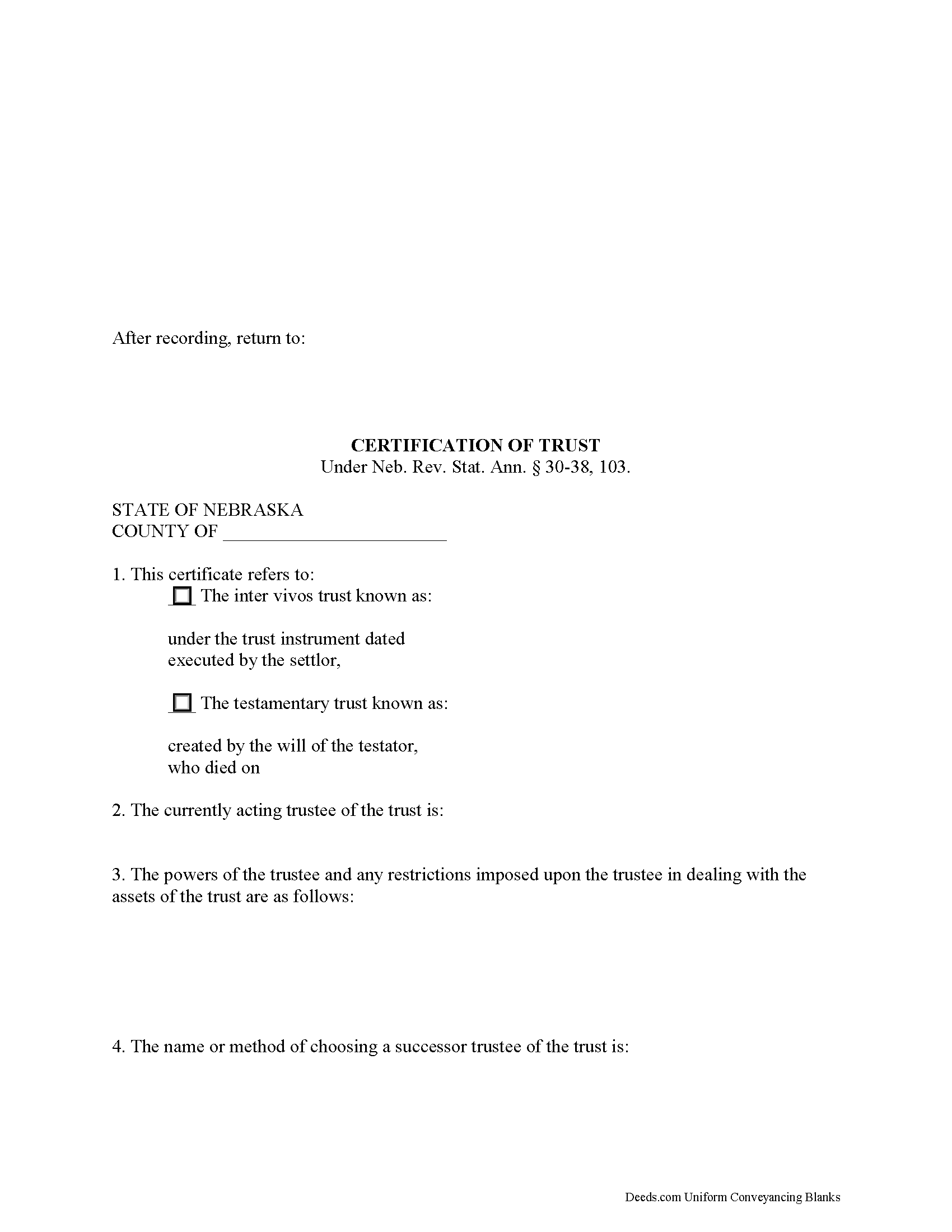

Certificate of Trust Form

Fill in the blank form formatted to comply with all recording and content requirements.

Included Grant County compliant document last validated/updated 10/11/2024

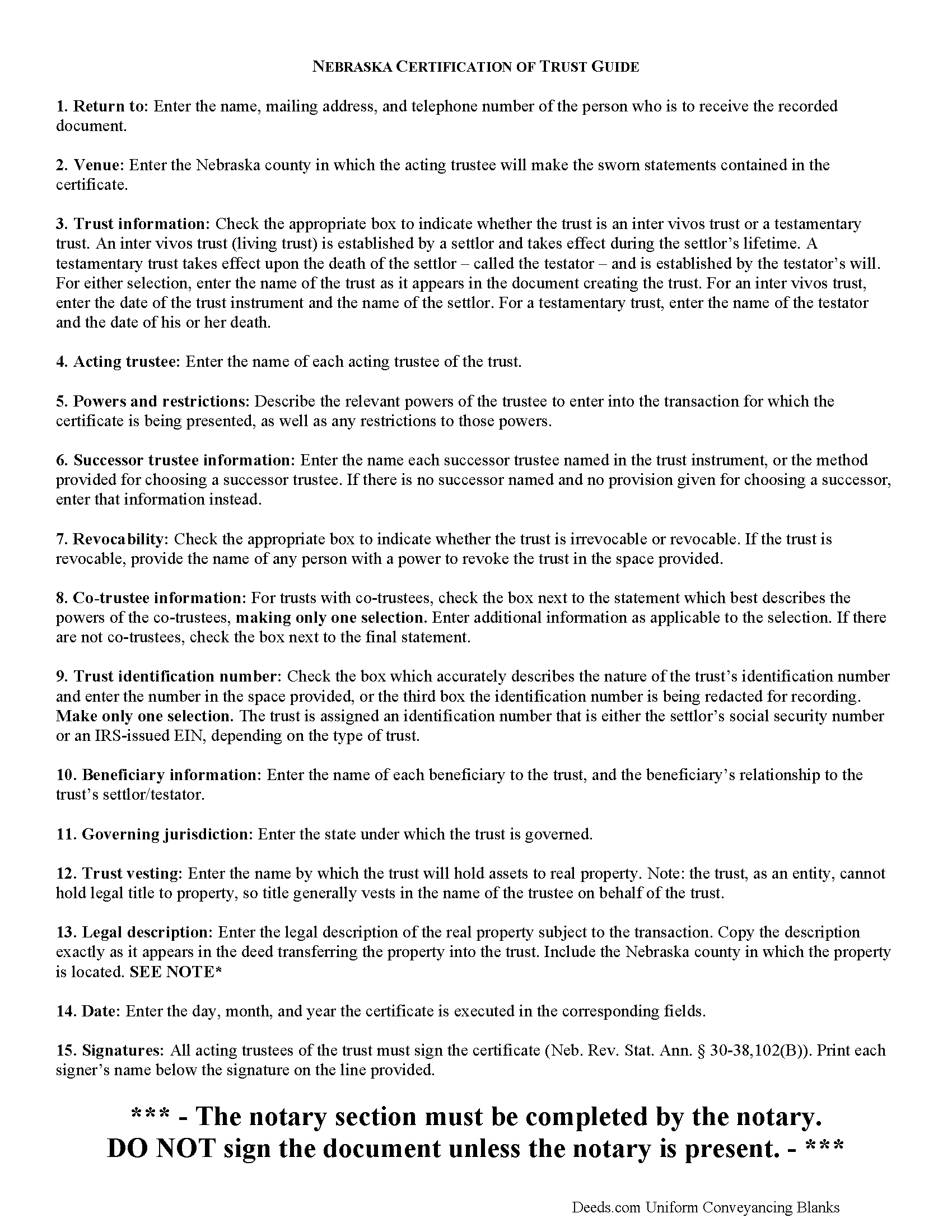

Certificate of Trust Guide

Line by line guide explaining every blank on the form.

Included Grant County compliant document last validated/updated 11/13/2024

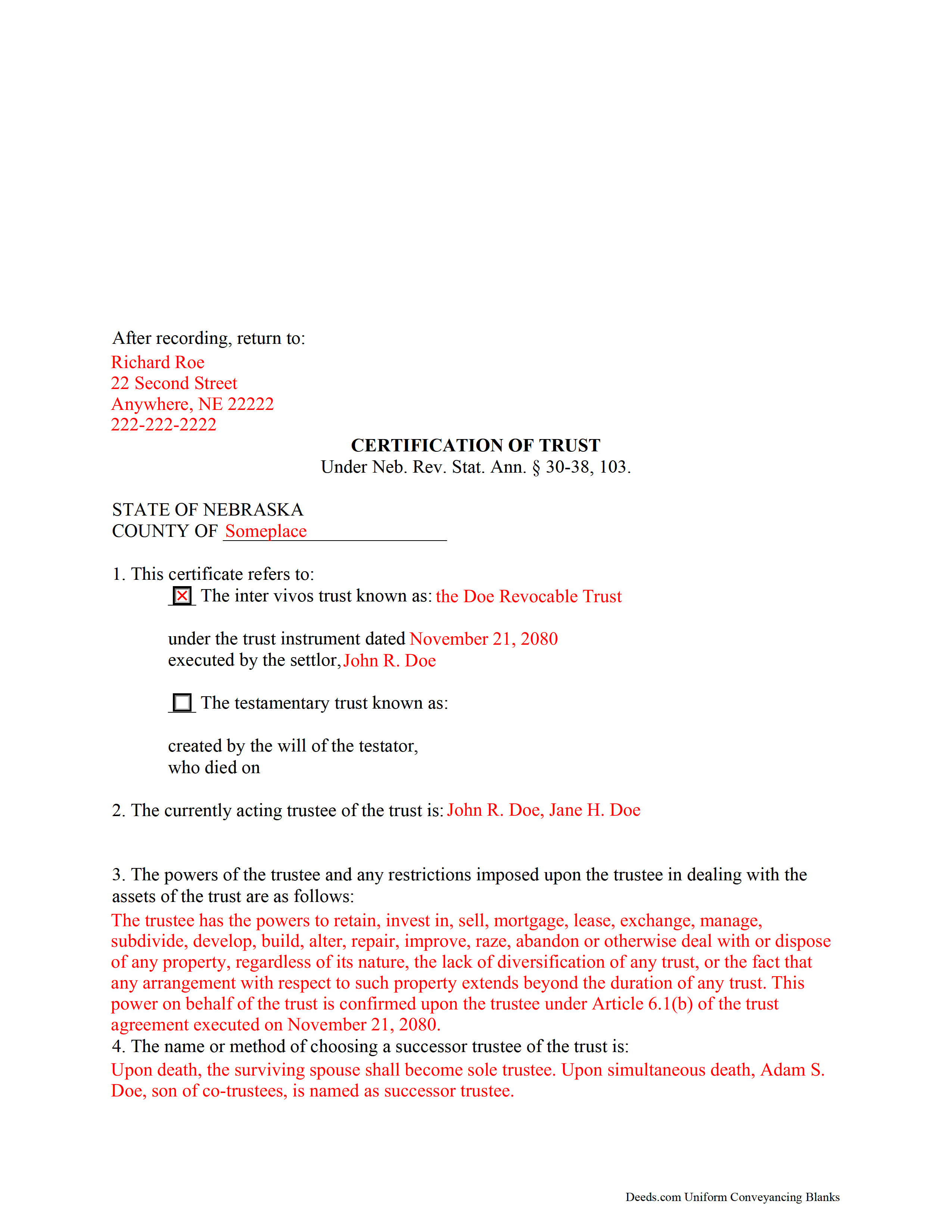

Completed Example of the Certificate of Trust Document

Example of a properly completed form for reference.

Included Grant County compliant document last validated/updated 8/21/2024

The following Nebraska and Grant County supplemental forms are included as a courtesy with your order:

When using these Certificate of Trust forms, the subject real estate must be physically located in Grant County. The executed documents should then be recorded in the following office:

Grant County Register of Deeds/Clerk

105 E Harrison St / PO Box 139, Hyannis, Nebraska 69350

Hours: Call for hours

Phone: (308) 458-2488

Local jurisdictions located in Grant County include:

- Ashby

- Hyannis

- Whitman

How long does it take to get my forms?

Forms are available immediately after submitting payment.

How do I get my forms, are they emailed?

Immediately after you submit payment, the Grant County forms you order will be available for download directly from your account. You can then download the forms to your computer. If you do not already have an account, one will be created for you as part of the order process, and your login details will be provided to you. If you encounter any issues accessing your forms, please reach out to our support team for assistance. Forms are NOT emailed to you.

What does "validated/updated" mean?

This indicates the most recent date when at least one of the following occurred:

- Updated: The document was updated or changed to remain compliant.

- Validated: The document was examined by an attorney or staff, or it was successfully recorded in Grant County using our eRecording service.

Are these forms guaranteed to be recordable in Grant County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Grant County including margin requirements, content requirements, font and font size requirements.

Can the Certificate of Trust forms be re-used?

Yes. You can re-use the forms for your personal use. For example, if you have more than one property in Grant County that you need to transfer you would only need to order our forms once for all of your properties in Grant County.

What are supplemental forms?

Often when a deed is recorded, additional documents are required by Nebraska or Grant County. These could be tax related, informational, or even as simple as a coversheet. Supplemental forms are provided for free with your order where available.

What type of files are the forms?

All of our Grant County Certificate of Trust forms are PDFs. You will need to have or get Adobe Reader to use our forms. Adobe Reader is free software that most computers already have installed.

Do I need any special software to use these forms?

You will need to have Adobe Reader installed on your computer to use our forms. Adobe Reader is free software that most computers already have installed.

Do I have to enter all of my property information online?

No. The blank forms are downloaded to your computer and you fill them out there, at your convenience.

Can I save the completed form, email it to someone?

Yes, you can save your deed form at any point with your information in it. The forms can also be emailed, blank or complete, as attachments.

Are there any recurring fees involved?

No. Nothing to cancel, no memberships, no recurring fees.

The Nebraska certification of trust is codified at Neb. Rev. Stat. Ann. 30-38, 103 and falls under the Nebraska Uniform Trust Code, a collection of statutes adopted from the Uniform Trust Code to govern trusts in the State of Nebraska.

In Nebraska, the certification of trust is an affidavit signed by each acting trustee of the trust, containing sworn statements made in the presence of a notary public. The certificate verifies the existence of the trust and is an abstract of relevant provisions of the trust in lieu of the entire trust instrument.

The document may be presented by a trustee or requested by any person doing business with a trustee, particularly in transactions involving real property (though failure to request a certificate of trust is not considered an "improper act" under 30-38,106). As the trust itself cannot hold title, the trustee acts as a representative of the trust. When the transaction for which the certificate of trust is presented or requested involves real property, the legal description of the parcel subject to the transaction should be included.

The certificate of trust may be used by trustees of both living trusts and testamentary trusts. For a living trust, the certificate requires the date of the trust instrument's execution and the identity of the trust's settlor. For a testamentary trust, the certificate gives the death date of the decedent and the testator's identity. In Nebraska, a certificate of trust requires the identity of the beneficiary or beneficiaries of the trust and their relationship to the settlor or testator, as well.

Essential information contained in the certificate includes the name of the currently acting trustee and a description of the trustee's relevant powers, and any restrictions on those powers in dealing with the trust's assets. In addition, the certificate identifies any successor trustee named by the trust instrument (or will, in the case of a testamentary trust), or the procedure given for choosing a successor trustee, if any exists.

If more than one person is an appointed trustee, the document requires details regarding co-trustees' authority to exercise powers. For example, a trust's provisions might specify a single trustee in charge of certain duties, and require that trustee to handle those duties solely. Or, the trust may stipulate that trustees are to act and sign documents jointly.

Additional requirements for the document include the name under which the trust will take and hold assets, the trust's identification number, and the name of the state or other jurisdiction under which the trust was formed. Trusts can further be categorized into revocable or irrevocable trusts, so the certificate should identify whether or not the trust can be revoked, and by whom it is revocable.

Finally, the document requires a notice that the trust has not been revoked or amended so as to cause the statements contained within to be incorrect, and that all the acting trustees have signed the certificate. Recipients of a certificate may rely upon the statements contained within as factual (Neb. Rev. Stat. Ann. 30-38,105). The presentation of a certificate of trust, however, does not prevent the recipient from requesting the excerpts from the trust instrument conferring the relevant powers to act in the pending transaction unto the trustee ( 30-38,104).

Aside from the above requirements, the certificate should meet all prerequisites for recording documents affecting real property in the State of Nebraska. Consult a lawyer with any questions about certifications and trusts in Nebraska, as each situation is unique.

(Nebraska COT Package includes form, guidelines, and completed example)

Our Promise

The documents you receive here will meet, or exceed, the Grant County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Grant County Certificate of Trust form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4434 Reviews )

James S.

November 21st, 2024

Forms used, created quitclaim deed that the county accepted without a second look (turns out they see deeds.com forms regularly via erecording and in person). Will be back for any real estate related forms I need and they carry. Will always be my first stop. Also, will use erecording next time, mad I didn't see it this time.

Thanks for the kind words James, glad we could help. Look forward to seeing you again.

Thomas G.

November 21st, 2024

Wasn’t what I expected

Sorry to hear that your expectations were missed. Your order has been canceled. We do hope that you find something more suitable to your expectations elsewhere. Do keep in mind that purchasing legal forms should not be an exploratory endeavor.

Jimmy P.

November 20th, 2024

They sent me everything I would need to do this. Easy purchase -Easy download. Great!! I'll be back here for all my document needs.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

DOUGLAS H.

December 16th, 2020

Just as promised

My quitclaim deed went through the county recorders office with no problem.

Thank you for your feedback. We really appreciate it. Have a great day!

Bobby T.

June 17th, 2020

Great!! Helps me out

Thank you!

LIDIA M.

February 3rd, 2021

excellent

Thank you!

LIsa B.

January 27th, 2023

Deeds.com made this process of electronic document recording so easy! The communication was quick, friendly, helpful and efficient. I am out of state and have administrative items to handle for my father who has Alzheimer's. Deeds.com is a great service. I highly recommend them, and will use them again when the time comes.

Thank you!

Sheryl L.

December 1st, 2021

EZ to use program....was able to print all forms ordered. I expect to go back to to use recording ability. Instructions are easily followed...would be nice to have confirmation included but they are available to purchase. Hope for successful recording of TOD affidavit. Pretty good value...attorney quoted well over the price I paid for package.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

LEROY S.

March 8th, 2022

Thank you for your kind help. Great help.

VR

Roy F. Sutton

Thank you for your feedback. We really appreciate it. Have a great day!

Charles F.

April 28th, 2020

Hi

Please do not take time to respond to my previous inquiry - - - I figured it out.

Deeds.com is a great tool for those of us who have occasional need for your type of services.

Thanks !

Chuck

Thank you!

Sunny S.

November 23rd, 2020

Easy to use and quick turnaround. I would use again.

Thank you!

Spencer A.

January 25th, 2019

Deeds.com made it so easy to file my paper work with the county. It saved me half a days travel and cost me about a tank of gas. This service was well worth the saved travel time and energy. I would highly recommend this service to other individuals. The other companies I spoke with only service law firms, title companies & banks etc. Thanks deed.com, I'll be back and will refer all my friends too.

Thank you so much Spencer, we really appreciate your feedback!

Stephanie P.

January 11th, 2023

It was a seamless process, inexpensive, and probably saved me thousands by having an attorney draw this same form us. Highly recommend!

Thank you!

John W.

February 10th, 2021

Wow, I wish that I would have found Deeds.com before! Great service!

Thank you!

Ron S.

April 5th, 2019

Fair price and beneficiary deed was recorded without issue. Completion instructions provided were insufficient in some cases.

Thank you!