Keith County Affidavit for Transfer of Real Property without Probate Form (Nebraska)

All Keith County specific forms and documents listed below are included in your immediate download package:

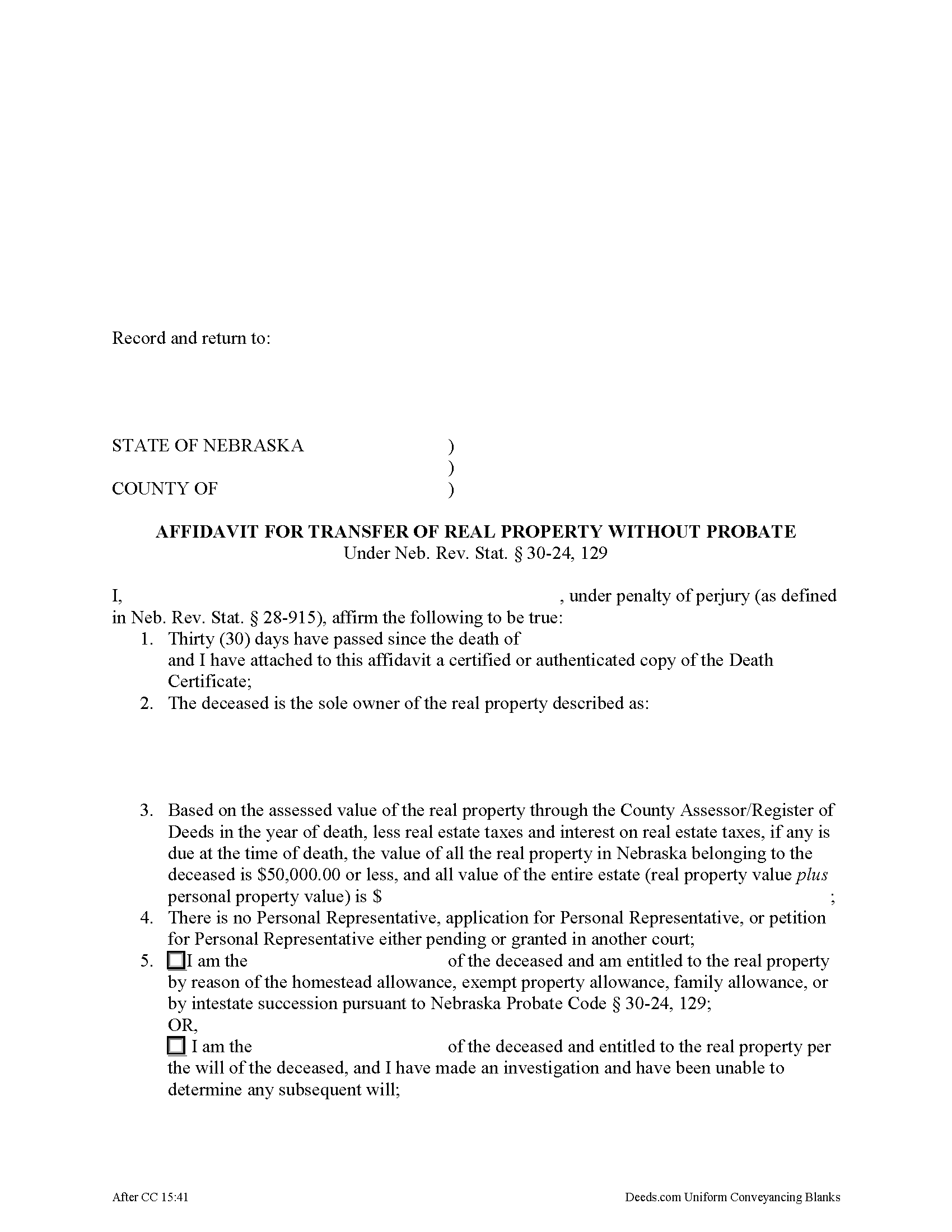

Affidavit for Transfer of Real Property without Probate Form

Fill in the blank form formatted to comply with all recording and content requirements.

Included Keith County compliant document last validated/updated 12/10/2024

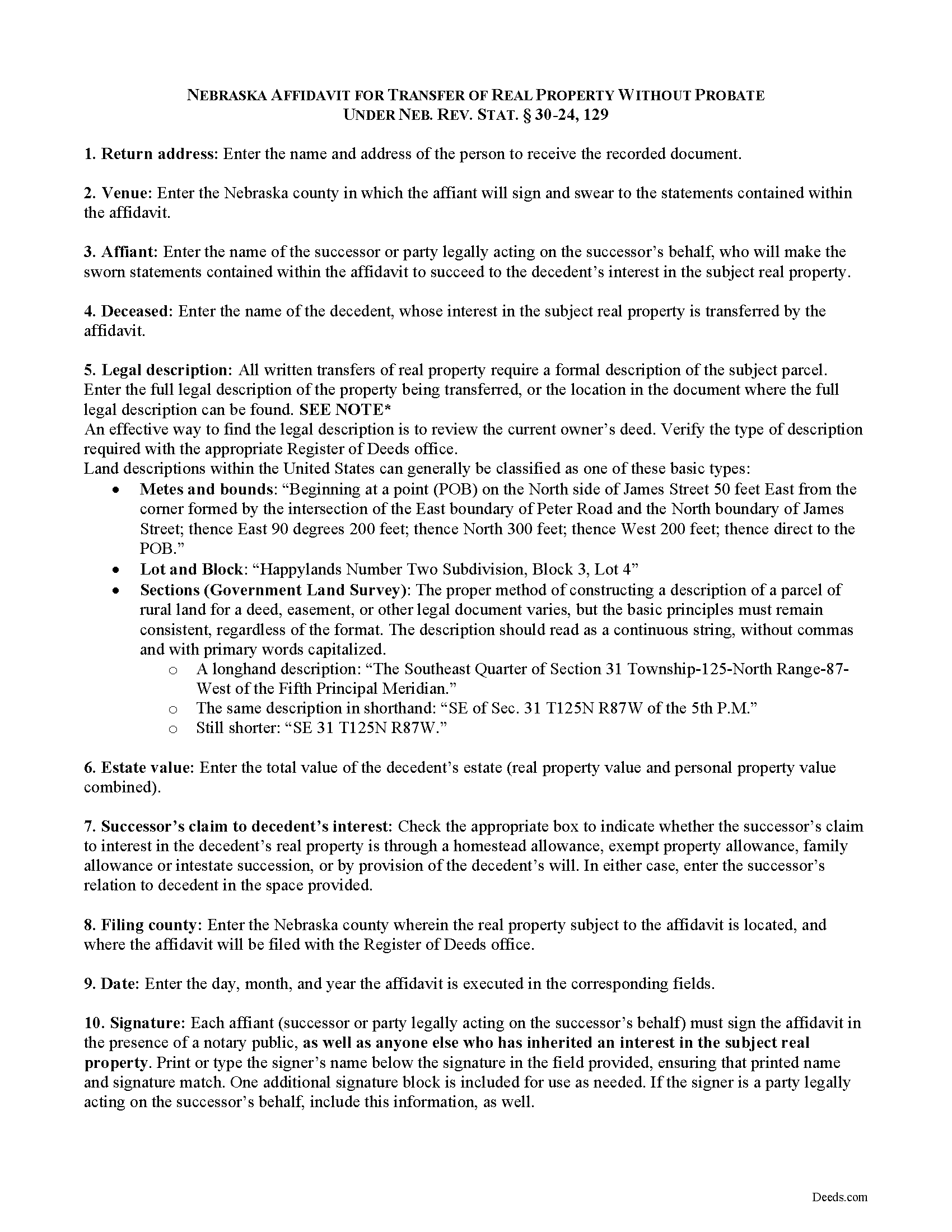

Affidavit for Transfer of Real Property without Probate Guide

Line by line guide explaining every blank on the form.

Included Keith County compliant document last validated/updated 7/30/2024

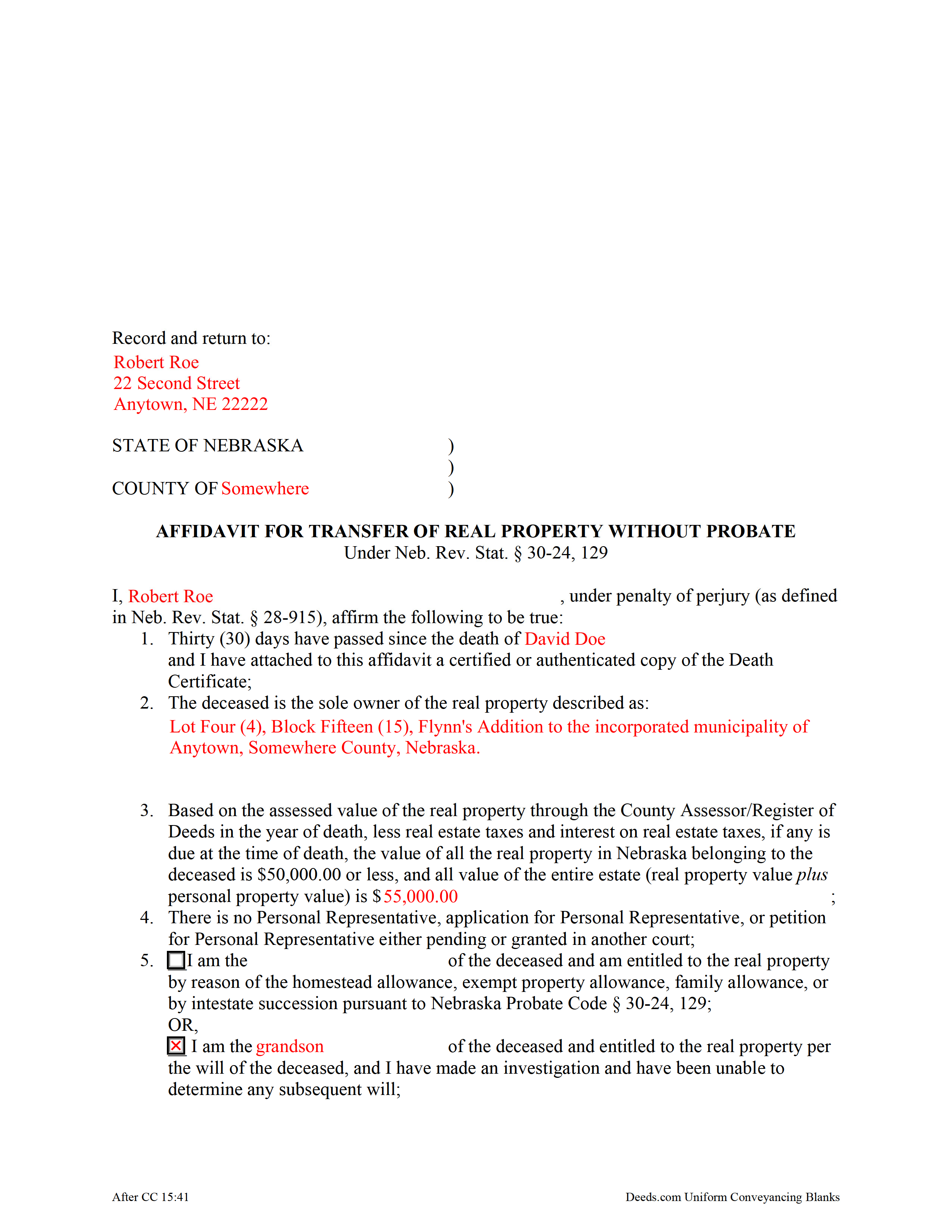

Completed Example of the Affidavit of Transfer of Real Property w/o Probate Document

Example of a properly completed form for reference.

Included Keith County compliant document last validated/updated 12/18/2024

The following Nebraska and Keith County supplemental forms are included as a courtesy with your order:

When using these Affidavit for Transfer of Real Property without Probate forms, the subject real estate must be physically located in Keith County. The executed documents should then be recorded in the following office:

Keith County Register of Deeds

511 N Spruce St, Rm 102, Ogallala , Nebraska 69153

Hours: 8:00 to 4:00 Monday through Friday

Phone: (308) 284-4726

Local jurisdictions located in Keith County include:

- Brule

- Keystone

- Lemoyne

- Ogallala

- Paxton

How long does it take to get my forms?

Forms are available immediately after submitting payment.

How do I get my forms, are they emailed?

Immediately after you submit payment, the Keith County forms you order will be available for download directly from your account. You can then download the forms to your computer. If you do not already have an account, one will be created for you as part of the order process, and your login details will be provided to you. If you encounter any issues accessing your forms, please reach out to our support team for assistance. Forms are NOT emailed to you.

What does "validated/updated" mean?

This indicates the most recent date when at least one of the following occurred:

- Updated: The document was updated or changed to remain compliant.

- Validated: The document was examined by an attorney or staff, or it was successfully recorded in Keith County using our eRecording service.

Are these forms guaranteed to be recordable in Keith County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Keith County including margin requirements, content requirements, font and font size requirements.

Can the Affidavit for Transfer of Real Property without Probate forms be re-used?

Yes. You can re-use the forms for your personal use. For example, if you have more than one property in Keith County that you need to transfer you would only need to order our forms once for all of your properties in Keith County.

What are supplemental forms?

Often when a deed is recorded, additional documents are required by Nebraska or Keith County. These could be tax related, informational, or even as simple as a coversheet. Supplemental forms are provided for free with your order where available.

What type of files are the forms?

All of our Keith County Affidavit for Transfer of Real Property without Probate forms are PDFs. You will need to have or get Adobe Reader to use our forms. Adobe Reader is free software that most computers already have installed.

Do I need any special software to use these forms?

You will need to have Adobe Reader installed on your computer to use our forms. Adobe Reader is free software that most computers already have installed.

Do I have to enter all of my property information online?

No. The blank forms are downloaded to your computer and you fill them out there, at your convenience.

Can I save the completed form, email it to someone?

Yes, you can save your deed form at any point with your information in it. The forms can also be emailed, blank or complete, as attachments.

Are there any recurring fees involved?

No. Nothing to cancel, no memberships, no recurring fees.

Record the affidavit under the Nebraska Probate 30-24,129 to transfer a decedent's real property without probate when certain criteria are met. The affidavit must be recorded in each county in which the real property described within the affidavit is located, along with a certified copy of the decedent's death certificate.

The affiant, or person executing the affidavit, is the successor in interest to the decedent's real property described in the affidavit, or an agent legally acting on the successor's behalf.

Statutory requirements stipulate that the affidavit state that total value of the decedent's real estate interests is $50,000.00 or less; thirty (30) days have passed since the decedent's death, as evidenced by a certified copy of the death certificate; there is no personal representative or pending petition for appointment of a personal representative; the successor is entitled to receive the property through a homestead, exempt property, or family allowance, or by devise or intestate succession; the successor has made an investigation and was unable to determine a subsequent will; and no other person has a right to the interest of the subject property. In addition, the successor's relationship to the decedent, the total value of the decedent's estate, and a complete legal description of the subject parcel is required. Each successor in interest to the subject property must sign the affidavit in the presence of a notary public.

See https://supremecourt.nebraska.gov/self-help/estates/affidavit-transfer-real-property-without-probate for more information. Consult an attorney with questions regarding affidavits to collect real property outside of probate, or any other issue related to probate or decedent's property in Nebraska.

(Nebraska Affidavit Package includes form, guidelines, and completed example)

Our Promise

The documents you receive here will meet, or exceed, the Keith County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Keith County Affidavit for Transfer of Real Property without Probate form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4445 Reviews )

Dennis F.

December 20th, 2024

The release of mortgage form was OK, and accepted at the recorder's office, but there were some problems. Many of the fields to type in were too small to accept the data, and I could not find a way to change the field size or use a smaller font. Otherwise I was satisfied.

Your feedback is a crucial part of our dedication to ongoing improvement. Thank you for your insightful comments.

Frazer W.

December 19th, 2024

Deeds.com does a great job getting our legal documents filed with the D.C. Recorder of Deeds.rnrnFrazer Walton, Jr.rnLaw Office of Frazer Walton, Jr.

Your appreciative words mean the world to us. Thank you.

Ann D.

December 16th, 2024

I found what my lawyer recommended and was able to download it easily.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

james B.

May 10th, 2021

Downloaded quickly and saved to hard drive easily. I then opened in Adobe Acrobat Reader DC then was able to enter and save data in appropriate blanks. Yes, worth $22.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

bill h.

June 10th, 2021

so far getting what i needed was easy the site is well done thank you

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Omid B.

January 14th, 2021

Super efficient, extremely responsive , and above all quick turnaround. Thank you! Will definitely use your services again!

Thank you!

Susan J.

June 29th, 2020

very fast service. immediate response and kept me informed along the way. the county was not cooperating and this was communicated to me and my fee was refunded, just like that. will definitely use this company again

Thank you!

RICHARD A.

March 4th, 2023

Smooth, simple, and complete. A great forms service.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Heather F.

January 13th, 2019

Quality forms and information. Everything went smoothly.

Great to hear Heather. Have a fantastic day!

Lori F.

July 16th, 2020

These folks are so amazing! They were very kind, patient and the communication was above and beyond. Basically, THEY ROCK!

Thank you!

Stephen B.

August 21st, 2024

This was the first time to use the Deeds.com website for preparing my deed document. This was painless and easy to follow the instructions and sample package for filling in the blank boxes document. The city clerk was impressed to review my document and easily filed my deed record without questions. I would recommend anyone to prepare a legal form that is available from the Deeds.com website.

Your appreciative words mean the world to us. Thank you.

Larry M.

August 19th, 2021

Everything went well except that any information that I typed in on the computer download moves upward so that the letters or numbers are somewhat elevated above the line that should be even with the words on the form. I think it will be acceptable to the county recorder, but I don't especially like to submit things that appear uneven. I asked for help but just received a robotic reply that said to take steps that I already had done.

So unless you know a way to correct this I likely won't use your forms again.

Thank you!

Mark M.

May 24th, 2020

This Service Provider is amazing!!

Needed Notice of Commencement

recorded in Broward County, FL..

They got it done..super fast.

High;y recommend.

Thank you for your feedback. We really appreciate it. Have a great day!

Andrea R.

December 25th, 2020

I was pleasantly surprised as I didn't even know you can record a quit claim deed digitally. I am in the mortgage business so I will gladly refer all my clients to this website! Deeds.com was prompt and fast with the entire process. My document was recorded and completed in less than 24 hours! Thank you again!

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Phillip S.

February 14th, 2024

I used the Oklahoma Gift Deed transferring property intra-family, and found it easy to complete. I could not find an Oklahoma Affidavit for the new law re citizenship verification, 60 O.S. Sec 121 and found it at another site that was not a fill in online. Oh well. Site was easy to navigate.

We are motivated by your feedback to continue delivering excellence. Thank you!