Treasure County Disclaimer of Interest Form (Montana)

All Treasure County specific forms and documents listed below are included in your immediate download package:

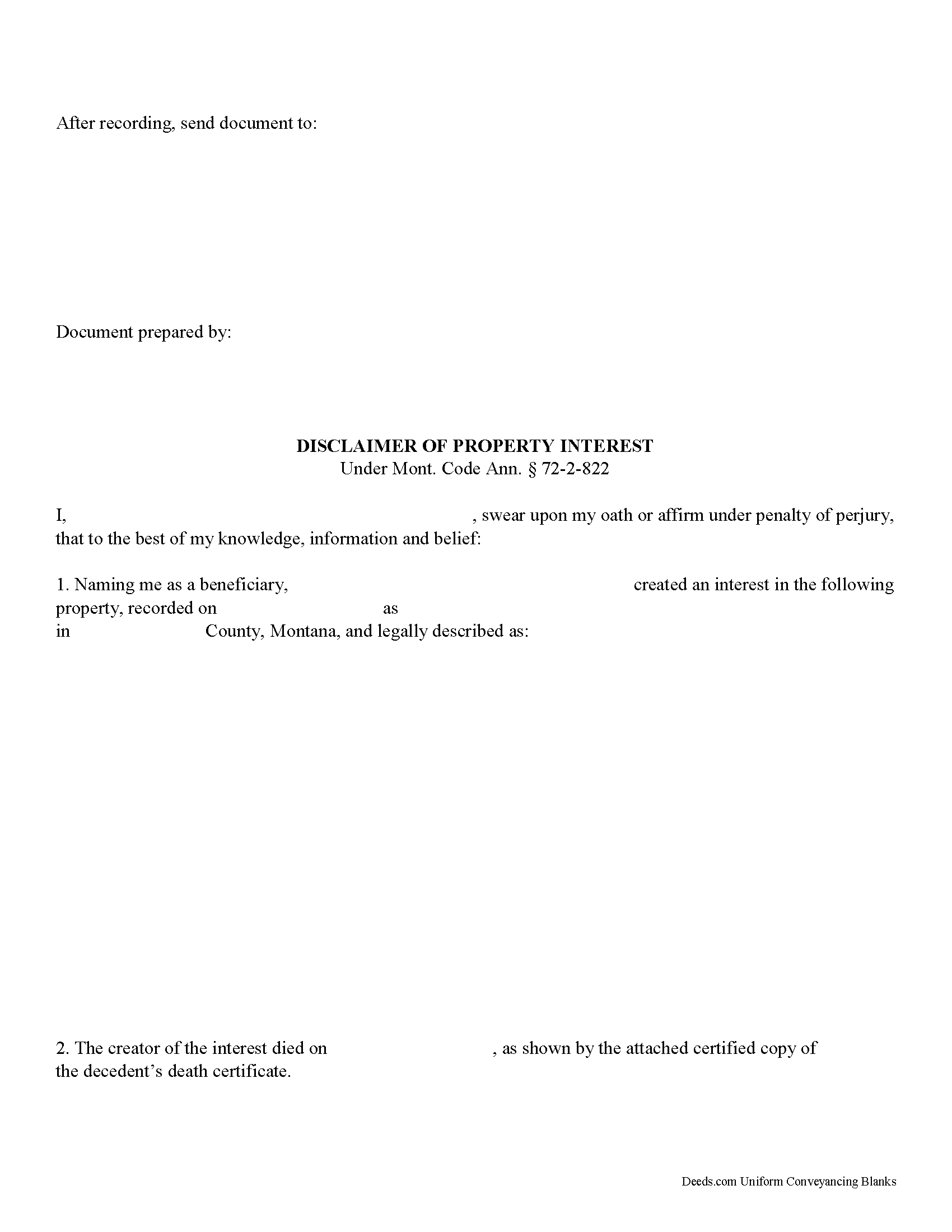

Disclaimer of Interest Form

Fill in the blank form formatted to comply with all recording and content requirements.

Included Treasure County compliant document last validated/updated 10/17/2024

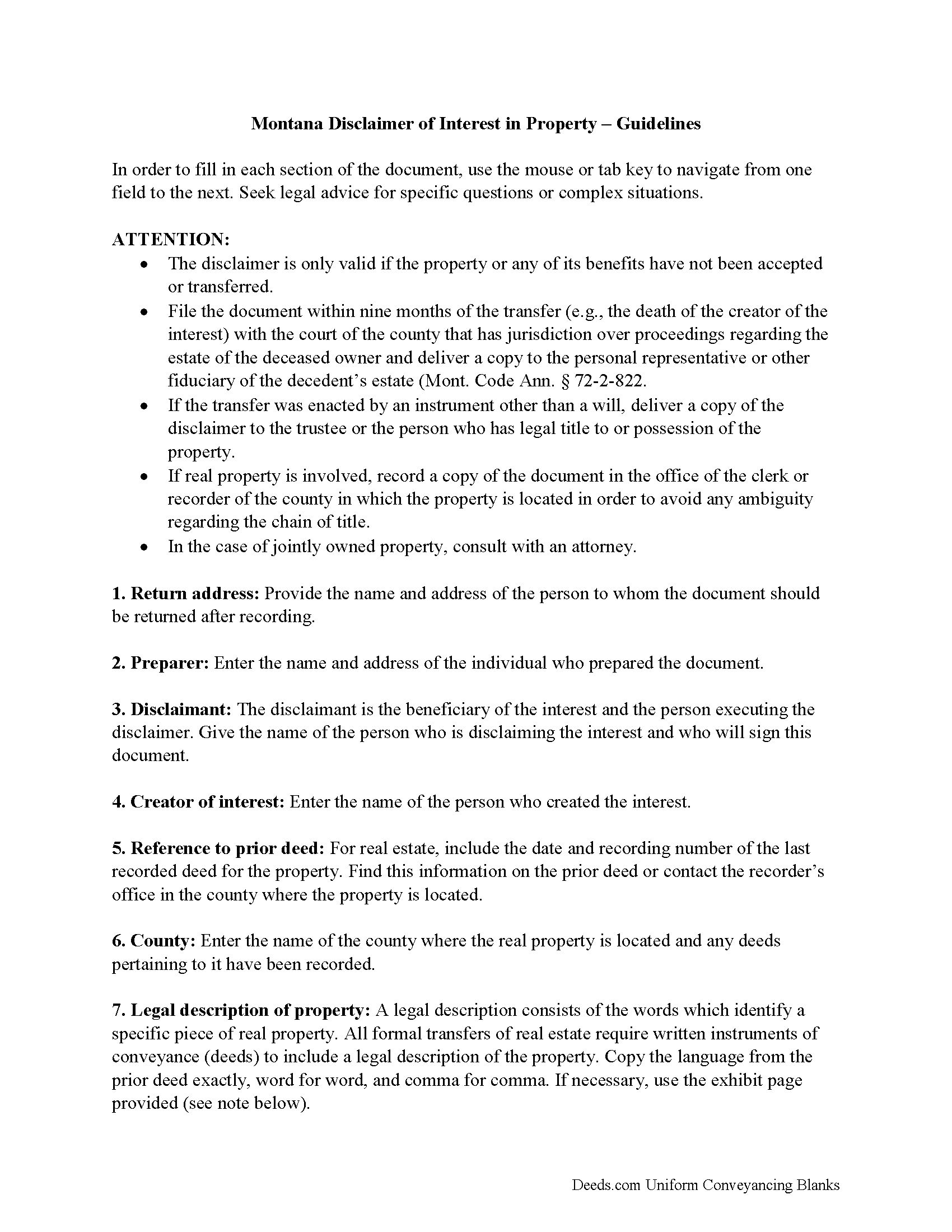

Disclaimer of Interest Guide

Line by line guide explaining every blank on the form.

Included Treasure County compliant document last validated/updated 10/25/2024

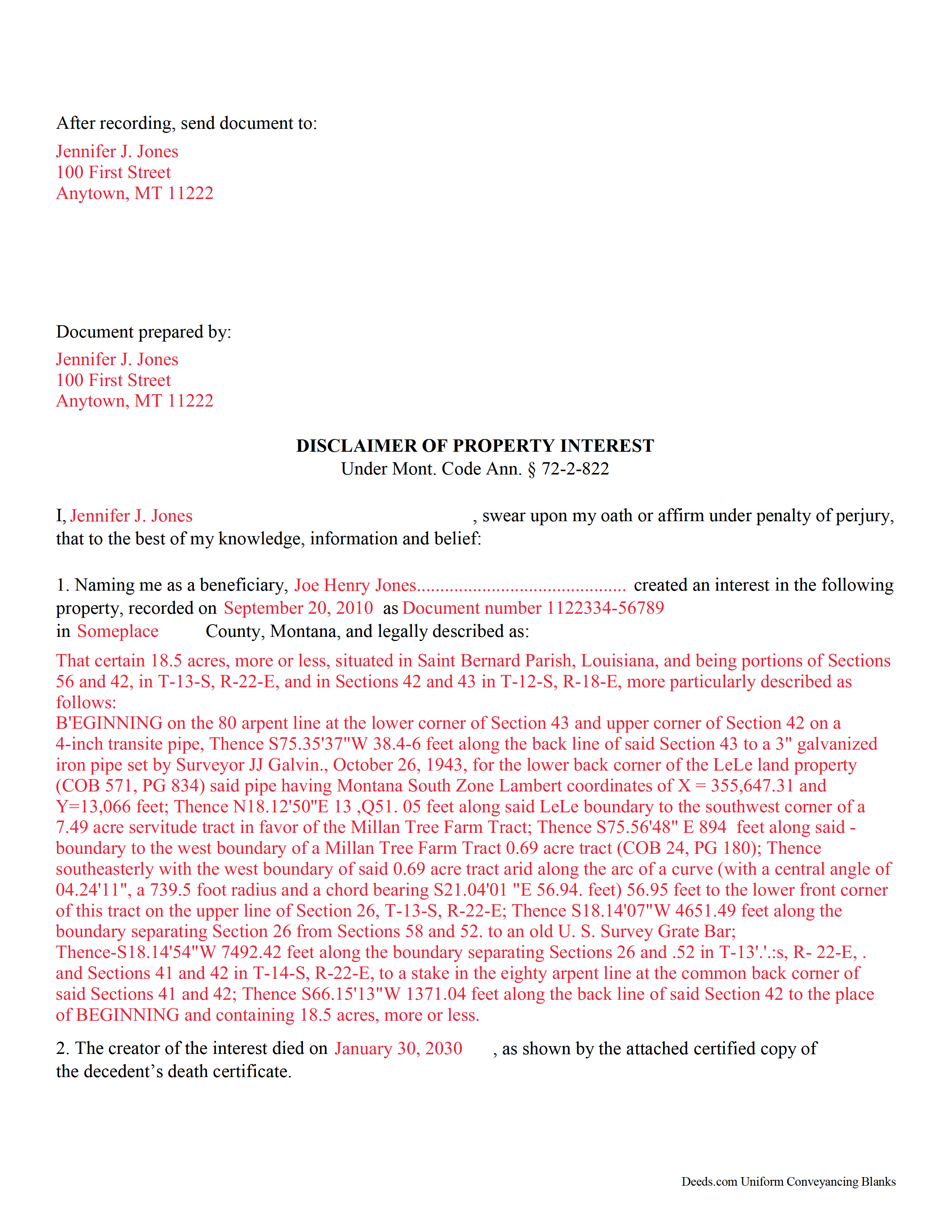

Completed Example of the Disclaimer of Interest Document

Example of a properly completed form for reference.

Included Treasure County compliant document last validated/updated 10/4/2024

The following Montana and Treasure County supplemental forms are included as a courtesy with your order:

When using these Disclaimer of Interest forms, the subject real estate must be physically located in Treasure County. The executed documents should then be recorded in the following office:

Treasure County Clerk / Recorder

307 Rapelje Ave / PO Box 392, Hysham, Montana 59038

Hours: 8:00 to 5:00 M-F

Phone: (406) 342-5547

Local jurisdictions located in Treasure County include:

- Bighorn

- Hysham

- Sanders

How long does it take to get my forms?

Forms are available immediately after submitting payment.

How do I get my forms, are they emailed?

Immediately after you submit payment, the Treasure County forms you order will be available for download directly from your account. You can then download the forms to your computer. If you do not already have an account, one will be created for you as part of the order process, and your login details will be provided to you. If you encounter any issues accessing your forms, please reach out to our support team for assistance. Forms are NOT emailed to you.

What does "validated/updated" mean?

This indicates the most recent date when at least one of the following occurred:

- Updated: The document was updated or changed to remain compliant.

- Validated: The document was examined by an attorney or staff, or it was successfully recorded in Treasure County using our eRecording service.

Are these forms guaranteed to be recordable in Treasure County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Treasure County including margin requirements, content requirements, font and font size requirements.

Can the Disclaimer of Interest forms be re-used?

Yes. You can re-use the forms for your personal use. For example, if you have more than one property in Treasure County that you need to transfer you would only need to order our forms once for all of your properties in Treasure County.

What are supplemental forms?

Often when a deed is recorded, additional documents are required by Montana or Treasure County. These could be tax related, informational, or even as simple as a coversheet. Supplemental forms are provided for free with your order where available.

What type of files are the forms?

All of our Treasure County Disclaimer of Interest forms are PDFs. You will need to have or get Adobe Reader to use our forms. Adobe Reader is free software that most computers already have installed.

Do I need any special software to use these forms?

You will need to have Adobe Reader installed on your computer to use our forms. Adobe Reader is free software that most computers already have installed.

Do I have to enter all of my property information online?

No. The blank forms are downloaded to your computer and you fill them out there, at your convenience.

Can I save the completed form, email it to someone?

Yes, you can save your deed form at any point with your information in it. The forms can also be emailed, blank or complete, as attachments.

Are there any recurring fees involved?

No. Nothing to cancel, no memberships, no recurring fees.

Montana Disclaimer of Property Interest

Under the Montana Code, the beneficiary of an interest in property may disclaim the gift, either in part or in full (Mont. Code Ann. 72-2-822). Note that the option to disclaim is only available to beneficiaries who have not acted in any way to indicate acceptance or ownership of the interest (72-2-822).

TITLE 72. ESTATES, TRUSTS, AND FIDUCIARY RELATIONSHIPS

CHAPTER 2. UPC -- INTESTACY, WILLS, AND DONATIVE TRANSFERS

Part 8. General Provisions Concerning Probate and Nonprobate Transfers

Disclaimer Of Interest In Property

72-2-822.Disclaimer of interest in property. (1) In this section:

(a)"Future interest" means an interest that takes effect in possession or enjoyment, if at all, later than the time of its creation.

(b)"Time of distribution" means the time when a disclaimed interest would have taken effect in possession or enjoyment.

(2)Except for a disclaimer governed by 72-2-823 or 72-2-824, the following rules apply to a disclaimer of an interest in property:

(a)The disclaimer takes effect as of the time the instrument creating the interest becomes irrevocable, or, if the interest arose under the law of intestate succession, as of the time of the intestate's death.

(b)The disclaimed interest passes according to any provision in the instrument creating the interest providing for the disposition of the interest, should it be disclaimed, or of disclaimed interests in general.

(c)If the instrument does not contain a provision described in subsection (2)(b), the following rules apply:

(i)If the disclaimant is not an individual, the disclaimed interest passes as if the disclaimant did not exist.

(ii)If the disclaimant is an individual, except as otherwise provided in subsections (2)(c)(iii) and (2)(c)(iv), the disclaimed interest passes as if the disclaimant had died immediately before the time of distribution.

(iii)If by law or under the instrument, the descendants of the disclaimant would share in the disclaimed interest by any method of representation had the disclaimant died before the time of distribution, the disclaimed interest passes only to the descendants of the disclaimant who survive the time of distribution.

(iv)If the disclaimed interest would pass to the disclaimant's estate had the disclaimant died before the time of distribution, the disclaimed interest instead passes by representation to the descendants of the disclaimant who survive the time of distribution. If no descendant of the disclaimant survives the time of distribution, the disclaimed interest passes to those persons, including the state but excluding the disclaimant, and in such shares as would succeed to the transferor's intestate estate under the intestate succession law of the transferor's domicile had the transferor died at the time of distribution. However, if the transferor's surviving spouse is living but is remarried at the time of distribution, the transferor is deemed to have died unmarried at the time of distribution.

(d)Upon the disclaimer of a preceding interest, a future interest held by a person other than the disclaimant takes effect as if the disclaimant had died or ceased to exist immediately before the time of distribution, but a future interest held by the disclaimant is not accelerated in possession or enjoyment.

A disclaimer is irrevocable and binding for the disclaiming/renouncing party and his or her creditors, so be sure to consult an attorney when in doubt about the drawbacks and benefits. If the interest arises out of jointly-owned property, seek legal advice as well.

(Montana DOI Package includes form, guidelines, and completed example)

Our Promise

The documents you receive here will meet, or exceed, the Treasure County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Treasure County Disclaimer of Interest form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4445 Reviews )

Dennis F.

December 20th, 2024

The release of mortgage form was OK, and accepted at the recorder's office, but there were some problems. Many of the fields to type in were too small to accept the data, and I could not find a way to change the field size or use a smaller font. Otherwise I was satisfied.

Your feedback is a crucial part of our dedication to ongoing improvement. Thank you for your insightful comments.

Frazer W.

December 19th, 2024

Deeds.com does a great job getting our legal documents filed with the D.C. Recorder of Deeds.rnrnFrazer Walton, Jr.rnLaw Office of Frazer Walton, Jr.

Your appreciative words mean the world to us. Thank you.

Ann D.

December 16th, 2024

I found what my lawyer recommended and was able to download it easily.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Pamela H.

April 10th, 2019

With Deeds.com I was able to acquire the form I needed for a reasonable fee. Easy navigation, plus guidelines & example of how the finished form should be filled out. I was most pleased to download blank form so I could type into it and then save the blank form. Well organized informative tool. Highly recommend

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

ELIZABETH A P.

January 11th, 2019

THE FORMS WERE GOOD, EASY TO UNDERSTAND. NICE TO BE ABLE TO DOWNLOAD THEM INSTANTLY. LIKED THAT I DID NOT HAVE TO JOIN ANYTHING WITH ONGOING FEES.

Thank you Elizabeth, have a great day!

Ruth L.

August 18th, 2021

Easy to use form. I filled it out and took it to the county office. Entire process took less than 20 min.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Equity S.

June 2nd, 2021

I love the service you provide. Very helpful and saves a ton of time.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Jason B.

August 8th, 2021

Deeds.com did a great job in explaining exactly what I'd need to file a deed transfer (quitclaim deed). I didn't have to order the forms piecemeal, but was able to order the whole package at once for a reasonable price. Once downloaded, their fill-in-the-blank PDF was easy to use with detailed instructions for each line item. I'd definitely use them again.

Thank you for your feedback. We really appreciate it. Have a great day!

Judy K.

February 23rd, 2021

Your customer service is superb. I ordered the wrong form, and you were so quick to resolve my problem. I will be using your site again.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Desiree D.

April 10th, 2024

This service is so good, quick, reasonably priced! I would use Deeds.com again!

We deeply appreciate the trust you have placed in our services. Thank you for your valuable feedback and for choosing us.

Shelly S.

November 12th, 2021

was fairly easy to work through the forms but needed better information on what goes on a few of the lines

Thank you for your feedback. We really appreciate it. Have a great day!

Donald W.

December 8th, 2019

Could not have been any easier to download the quit claim forms. The provided instructions and samples look to be helpful. Only have to set aside the time to fill out. Thanks

Thank you!

David W.

February 9th, 2021

Excellent assistance provided by your forms, guide and example.

Thank you!

James E.

December 1st, 2020

Forms were available for immediate download. Examples were helpful in completing form.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Robert S.

December 21st, 2018

Were unable to help me because of the recorders office but credited my account promptly

Thank you for your feedback. We really appreciate it. Have a great day!