Liberty County Deed of Full Reconveyance - for Trust Indenture/Deed of Trust Form (Montana)

All Liberty County specific forms and documents listed below are included in your immediate download package:

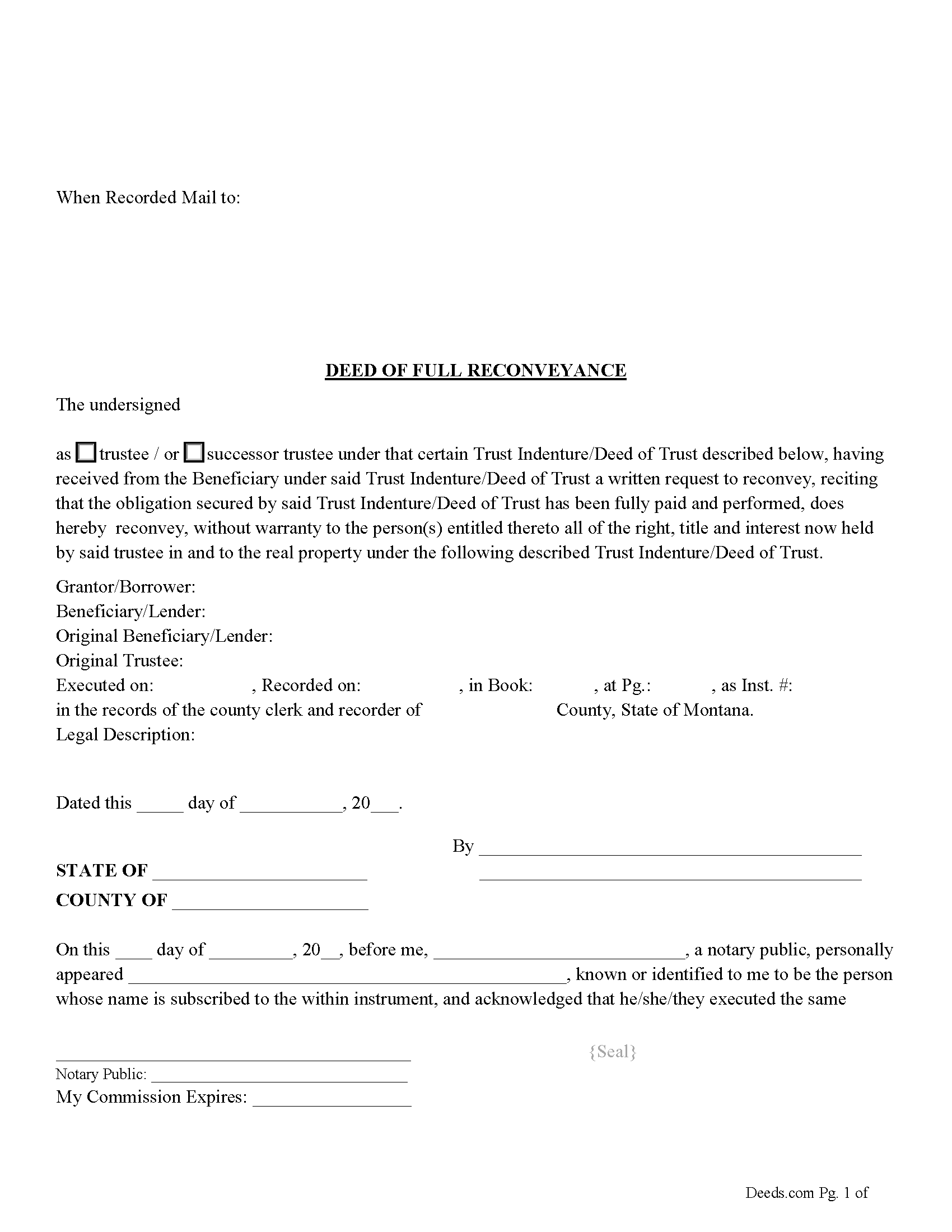

Deed of Full Reconveyance Form

Fill in the blank form formatted to comply with all recording and content requirements.

Included Liberty County compliant document last validated/updated 10/10/2024

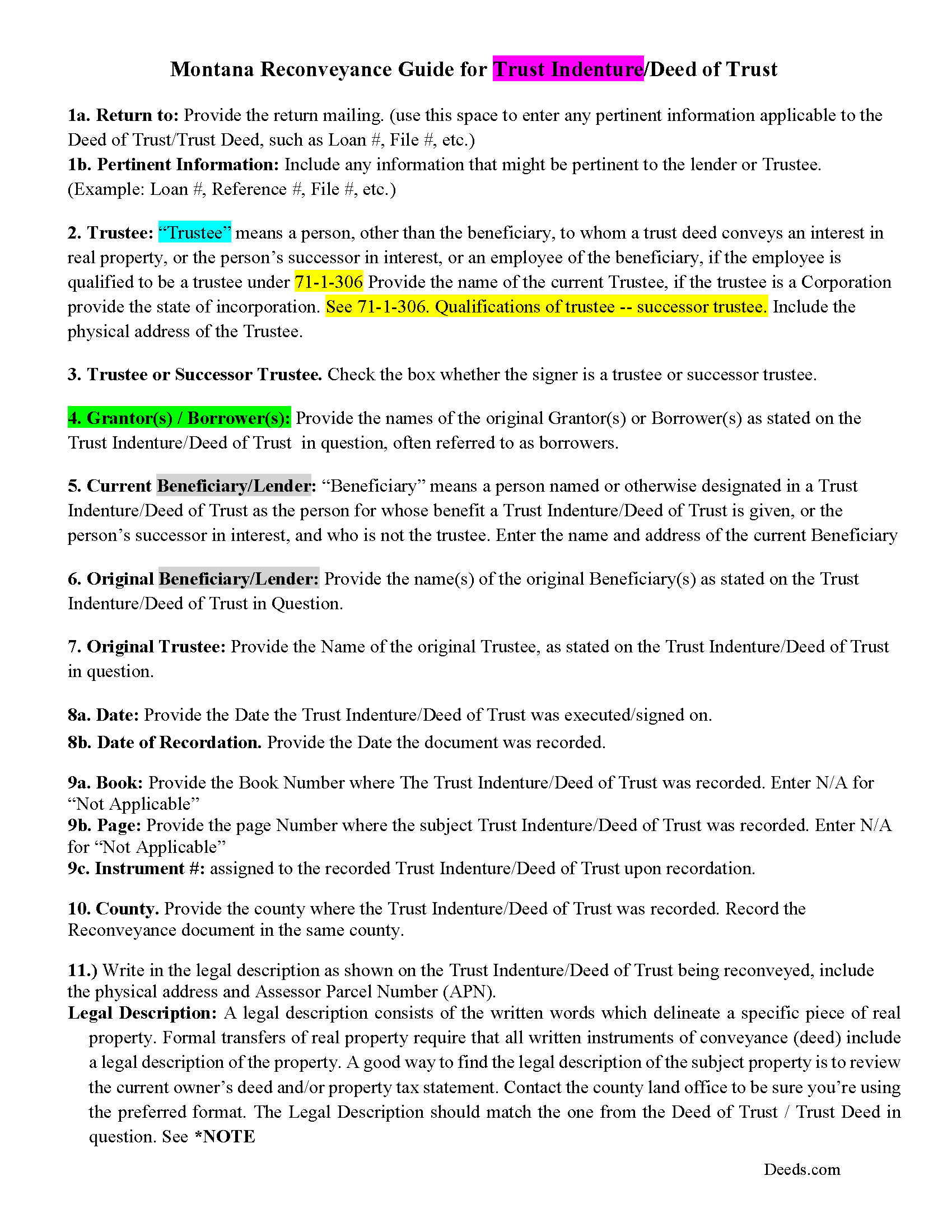

Deed of Full Reconveyance Guidelines

Line by line guide explaining every blank on the form.

Included Liberty County compliant document last validated/updated 6/6/2024

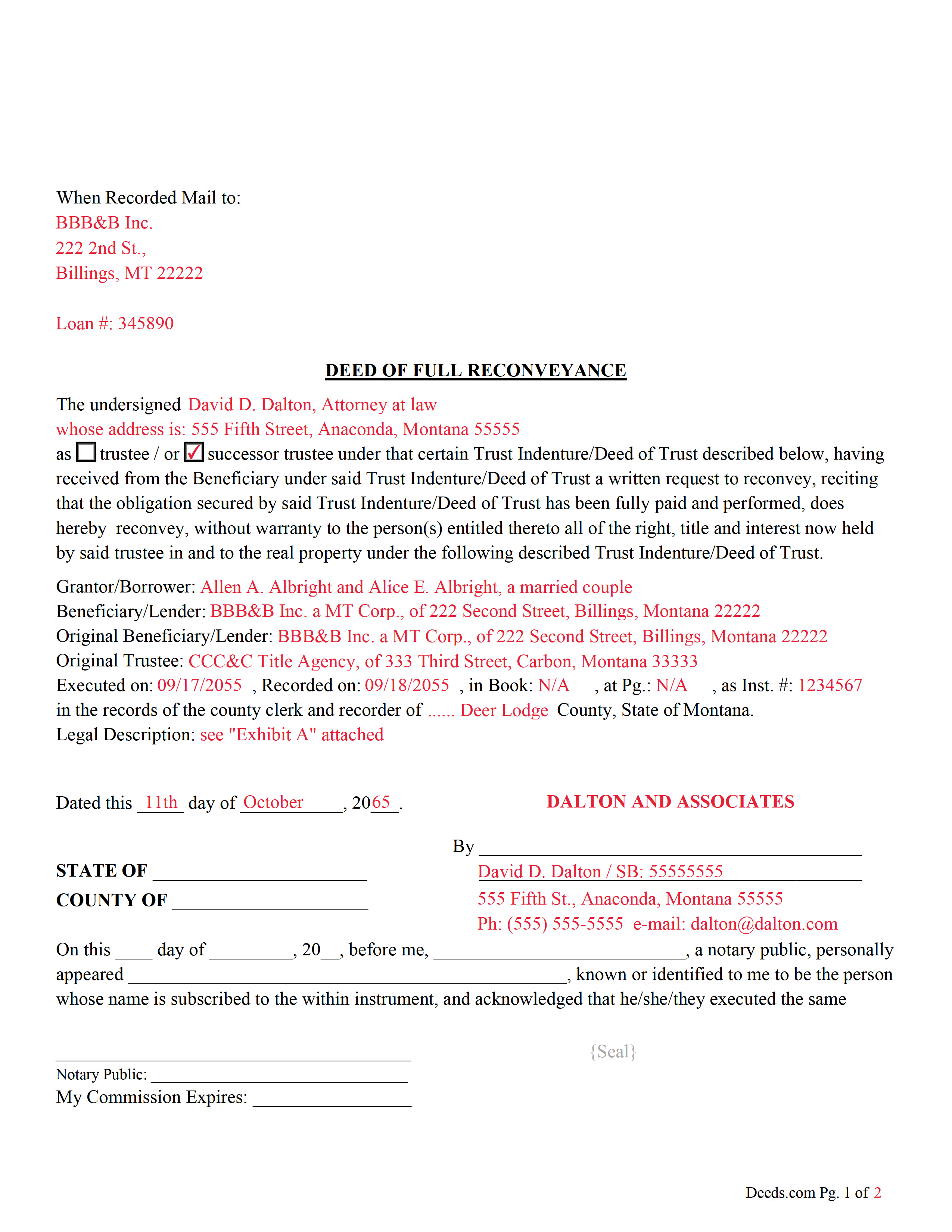

Completed Example of the Deed of Full Reconveyance Document

Example of a properly completed form for reference.

Included Liberty County compliant document last validated/updated 11/19/2024

The following Montana and Liberty County supplemental forms are included as a courtesy with your order:

When using these Deed of Full Reconveyance - for Trust Indenture/Deed of Trust forms, the subject real estate must be physically located in Liberty County. The executed documents should then be recorded in the following office:

Liberty County Clerk / Recorder

111 First St East / PO Box 459, Chester, Montana 59522

Hours: 8:00 to 5:00 M-F

Phone: (406) 759-5365

Local jurisdictions located in Liberty County include:

- Chester

- Joplin

- Lothair

- Whitlash

How long does it take to get my forms?

Forms are available immediately after submitting payment.

How do I get my forms, are they emailed?

Immediately after you submit payment, the Liberty County forms you order will be available for download directly from your account. You can then download the forms to your computer. If you do not already have an account, one will be created for you as part of the order process, and your login details will be provided to you. If you encounter any issues accessing your forms, please reach out to our support team for assistance. Forms are NOT emailed to you.

What does "validated/updated" mean?

This indicates the most recent date when at least one of the following occurred:

- Updated: The document was updated or changed to remain compliant.

- Validated: The document was examined by an attorney or staff, or it was successfully recorded in Liberty County using our eRecording service.

Are these forms guaranteed to be recordable in Liberty County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Liberty County including margin requirements, content requirements, font and font size requirements.

Can the Deed of Full Reconveyance - for Trust Indenture/Deed of Trust forms be re-used?

Yes. You can re-use the forms for your personal use. For example, if you have more than one property in Liberty County that you need to transfer you would only need to order our forms once for all of your properties in Liberty County.

What are supplemental forms?

Often when a deed is recorded, additional documents are required by Montana or Liberty County. These could be tax related, informational, or even as simple as a coversheet. Supplemental forms are provided for free with your order where available.

What type of files are the forms?

All of our Liberty County Deed of Full Reconveyance - for Trust Indenture/Deed of Trust forms are PDFs. You will need to have or get Adobe Reader to use our forms. Adobe Reader is free software that most computers already have installed.

Do I need any special software to use these forms?

You will need to have Adobe Reader installed on your computer to use our forms. Adobe Reader is free software that most computers already have installed.

Do I have to enter all of my property information online?

No. The blank forms are downloaded to your computer and you fill them out there, at your convenience.

Can I save the completed form, email it to someone?

Yes, you can save your deed form at any point with your information in it. The forms can also be emailed, blank or complete, as attachments.

Are there any recurring fees involved?

No. Nothing to cancel, no memberships, no recurring fees.

This form is used by the trustee or successor trustee to reconvey a trust indenture/deed of trust when it has been satisfied/paid in full.

71-1-307 Reconveyance upon performance -- liability for failure to reconvey

(1) Upon performance of the obligation secured by the trust indenture, the trustee, upon written request of the beneficiary or servicer, shall reconvey the interest in real property described in the trust indenture to the grantor. If the obligation is performed and the beneficiary or servicer refuses to request reconveyance or the trustee refuses to reconvey the property within 90 days of the request, the beneficiary, servicer, or trustee who refuses is liable to the grantor for the sum of $500 and all actual damages resulting from the refusal to reconvey.

(2) If a beneficiary or servicer has received a notice of intent to reconvey pursuant to 71-1-308 and has not timely requested a reconveyance or has not objected to the reconveyance within the 90-day period established in 71-1-308, the beneficiary or servicer is liable to the title insurer or title insurance producer for the sum of $500 and all damages resulting from the failure.

(3) In an action by a grantor, title insurer, or title insurance producer to collect any sums due under this section, the court shall award attorney fees and costs to the prevailing party.

(Montana DOFR Package includes form, guidelines, and completed example) For use in Montana only.

Our Promise

The documents you receive here will meet, or exceed, the Liberty County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Liberty County Deed of Full Reconveyance - for Trust Indenture/Deed of Trust form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4436 Reviews )

Michael S.

November 27th, 2024

Recording a Warranty Deed with Mohave County AZ was easy and efficient by using Deeds.com. I will be using their service for all of my e-filing going forward. Thank you Deeds.com!!!!

We are delighted to have been of service. Thank you for the positive review!

Zennell W.

November 24th, 2024

Quick fast and easy transaction.

We are grateful for your feedback and looking forward to serving you again. Thank you!

James S.

November 21st, 2024

Forms used, created quitclaim deed that the county accepted without a second look (turns out they see deeds.com forms regularly via erecording and in person). Will be back for any real estate related forms I need and they carry. Will always be my first stop. Also, will use erecording next time, mad I didn't see it this time.

Thanks for the kind words James, glad we could help. Look forward to seeing you again.

Jose F.

May 19th, 2020

When I found this website, I was confused and hesitant to use this website to submit paperwork that needed to be submitted to the Clerks of Courts in Miami. I am glad I decided to go through with it. It was the easiest process I have encountered even with working with the City. Highly recommend as it is super easy to use and received that everything was approved and recorded in two working days. Thank you so much for bringing my stress level lower as many uncertainties of how to process my paperwork. Will use it again to finish my project as the City continues to not accept walk ins. Thank you so much.

So glad we were able help Jose, have a amazing day!

Lara T.

December 1st, 2021

Made recording my document so much easier and faster. First attempt failed due to illegible blue ink, got that fixed and deeds.com resubmitted and doc was recorded within a couple of hours, all from the comfort of my home.

Thank you for your feedback. We really appreciate it. Have a great day!

Kristina H.

January 23rd, 2020

Everything I needed to complete my release of lien was easy to obtain from Deed.com - and the example and instructions were helpful as well. The website is simple and efficient. Thanks!

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Josephine R.

November 18th, 2019

Completed, notarized, and recorded with no issues.

Thank you for your feedback. We really appreciate it. Have a great day!

Stephenie A.

January 11th, 2019

No review provided.

Thank you!

Nola B.

May 18th, 2021

I like the form except the title should be ENHANCED LIFE ESTATE DEED and not Quit Claim Deed

Thank you for your feedback. We really appreciate it. Have a great day!

Suzan B.

July 24th, 2019

Using Deeds.com could not have been easier. The examples and line-by-line instructions helped a lot! I am so glad I found you.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

ralph f.

January 31st, 2019

I VERY MUCH APPRECIATE THE PROMPT RESPONSE & HELPFULNESS.

I WILL DEFINITELY USE THIS SERVICE IN THE FUTURE.

THANK YOU!

Thank you Ralph, we appreciate your feedback.

Jeremy C.

May 13th, 2021

Really impressed with the speed and professionalism of the service. I would recommend putting a grey background on the form field inputs as I had trouble seeing them in the user interface, but otherwise I was really impressed and would happily return as a customer.

Thank you for your feedback. We really appreciate it. Have a great day!

MARILYN T.

January 8th, 2021

Deed.com was so easy to use to file my Quit Claim deed. They instructed me on how to send them my documents and it was a breeze. The cost was minimal and saved me tons of time.

Thank you!

Craig M.

August 24th, 2020

Fantastic! So much easier than going and recording it at the recorders office!

Glad we could help Craig, thanks for the kind words.

Malissa B.

May 1st, 2024

Fast response and quick delivery love it!

It was a pleasure serving you. Thank you for the positive feedback!