Jefferson County Trustee Deed Form (Missouri)

All Jefferson County specific forms and documents listed below are included in your immediate download package:

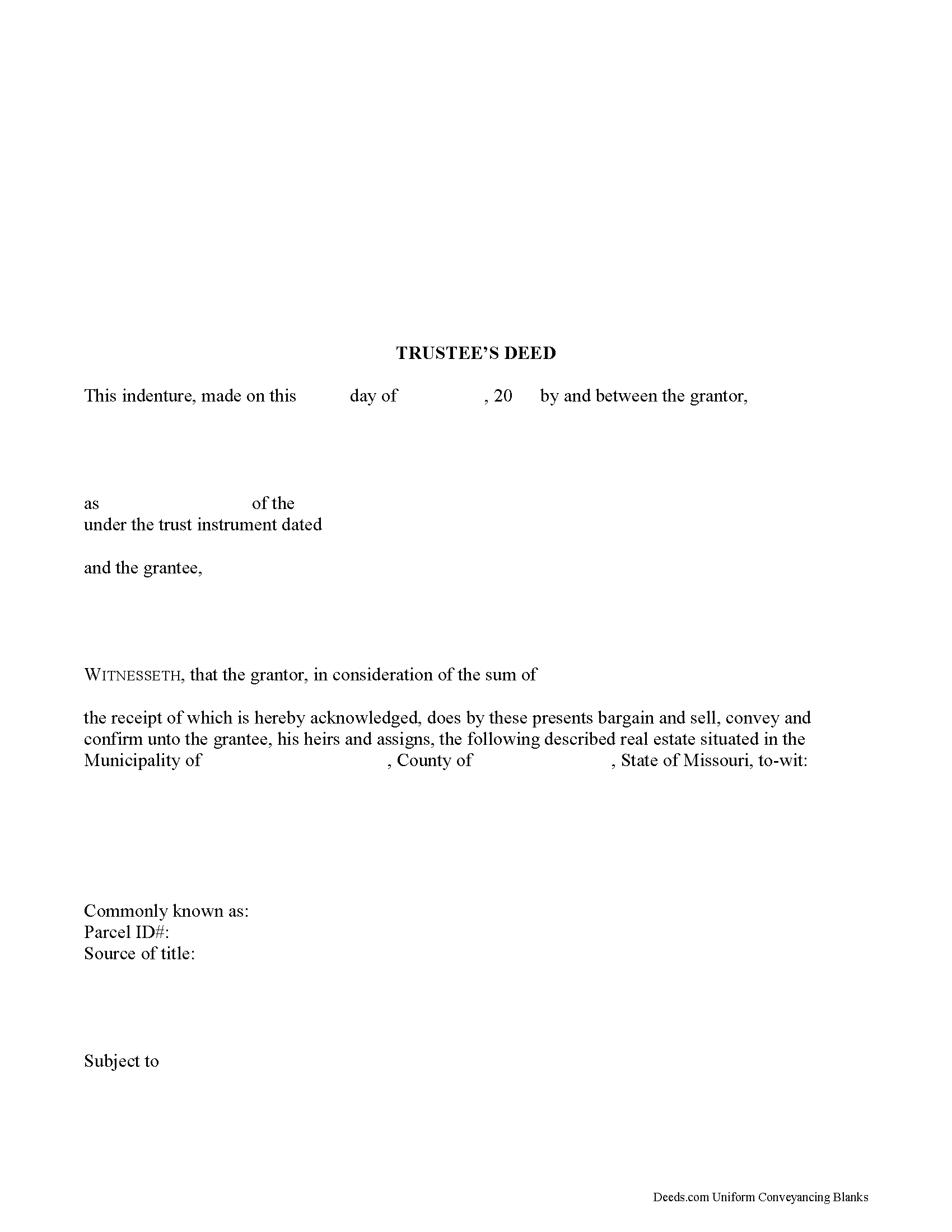

Trustee Deed Form

Fill in the blank form formatted to comply with all recording and content requirements.

Included Jefferson County compliant document last validated/updated 8/1/2024

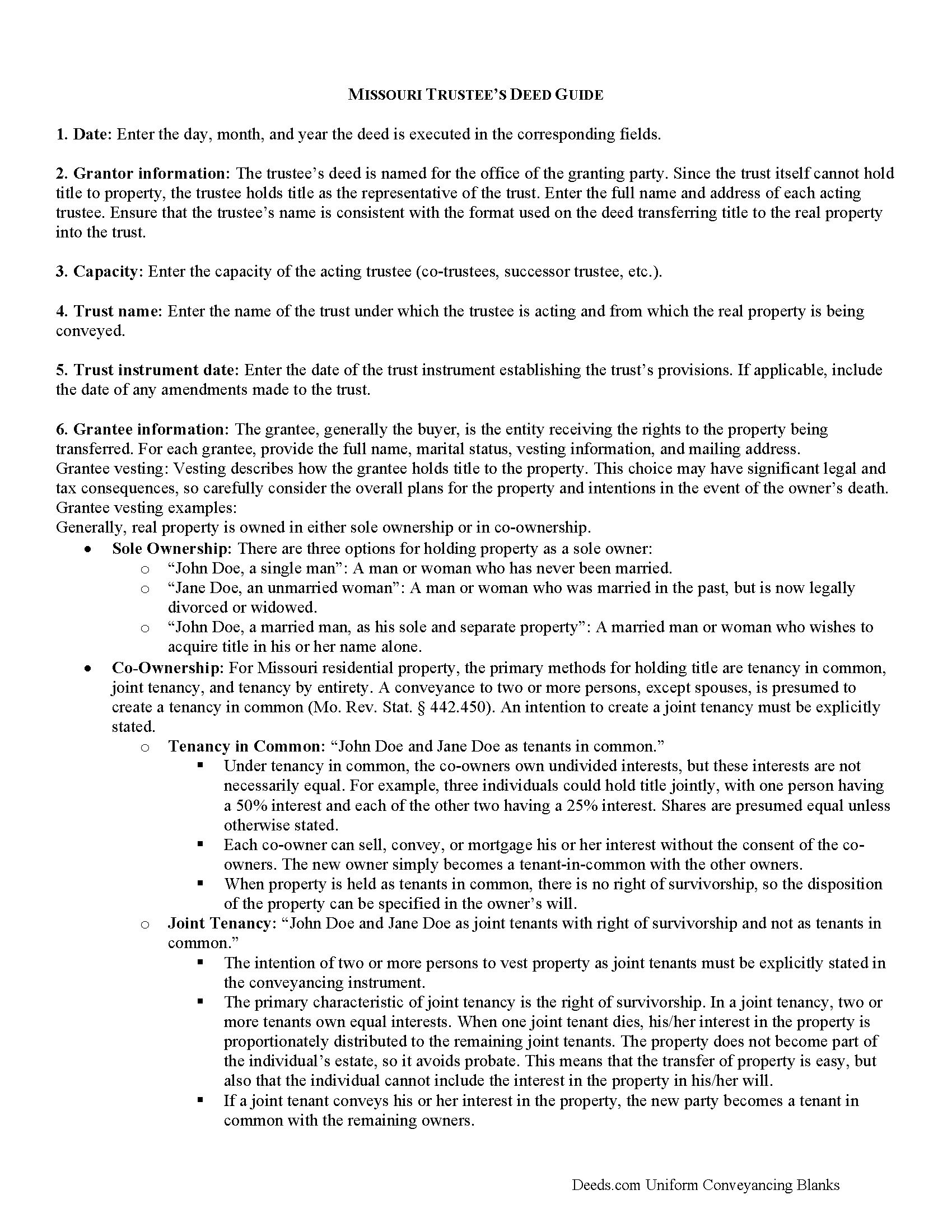

Trustee Deed Guide

Line by line guide explaining every blank on the form.

Included Jefferson County compliant document last validated/updated 11/7/2024

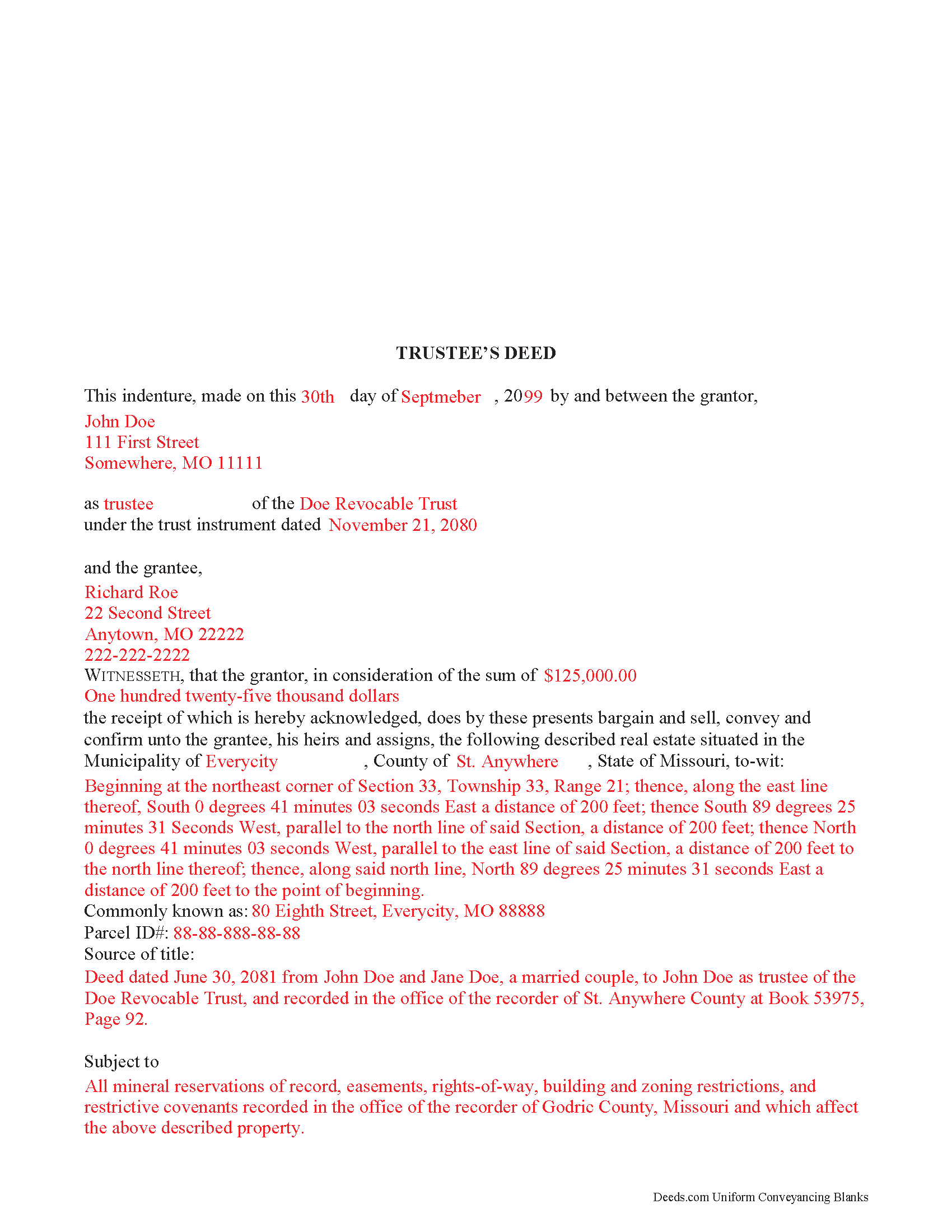

Completed Example of the Trustee Deed Document

Example of a properly completed form for reference.

Included Jefferson County compliant document last validated/updated 12/4/2024

The following Missouri and Jefferson County supplemental forms are included as a courtesy with your order:

When using these Trustee Deed forms, the subject real estate must be physically located in Jefferson County. The executed documents should then be recorded in the following office:

Jefferson County Recorder of Deeds

729 Maple St, Hillsboro, Missouri 63050-0100

Hours: 8:00am to 5:00pm M-F

Phone: (636) 797-5414

Local jurisdictions located in Jefferson County include:

- Arnold

- Barnhart

- Cedar Hill

- Crystal City

- De Soto

- Dittmer

- Festus

- Fletcher

- Hematite

- Herculaneum

- High Ridge

- Hillsboro

- House Springs

- Imperial

- Kimmswick

- Liguori

- Mapaville

- Morse Mill

- Pevely

How long does it take to get my forms?

Forms are available immediately after submitting payment.

How do I get my forms, are they emailed?

Immediately after you submit payment, the Jefferson County forms you order will be available for download directly from your account. You can then download the forms to your computer. If you do not already have an account, one will be created for you as part of the order process, and your login details will be provided to you. If you encounter any issues accessing your forms, please reach out to our support team for assistance. Forms are NOT emailed to you.

What does "validated/updated" mean?

This indicates the most recent date when at least one of the following occurred:

- Updated: The document was updated or changed to remain compliant.

- Validated: The document was examined by an attorney or staff, or it was successfully recorded in Jefferson County using our eRecording service.

Are these forms guaranteed to be recordable in Jefferson County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Jefferson County including margin requirements, content requirements, font and font size requirements.

Can the Trustee Deed forms be re-used?

Yes. You can re-use the forms for your personal use. For example, if you have more than one property in Jefferson County that you need to transfer you would only need to order our forms once for all of your properties in Jefferson County.

What are supplemental forms?

Often when a deed is recorded, additional documents are required by Missouri or Jefferson County. These could be tax related, informational, or even as simple as a coversheet. Supplemental forms are provided for free with your order where available.

What type of files are the forms?

All of our Jefferson County Trustee Deed forms are PDFs. You will need to have or get Adobe Reader to use our forms. Adobe Reader is free software that most computers already have installed.

Do I need any special software to use these forms?

You will need to have Adobe Reader installed on your computer to use our forms. Adobe Reader is free software that most computers already have installed.

Do I have to enter all of my property information online?

No. The blank forms are downloaded to your computer and you fill them out there, at your convenience.

Can I save the completed form, email it to someone?

Yes, you can save your deed form at any point with your information in it. The forms can also be emailed, blank or complete, as attachments.

Are there any recurring fees involved?

No. Nothing to cancel, no memberships, no recurring fees.

A trustee uses a trustee's deed to convey property held in a living trust in Missouri.

In a trust arrangement, the settlor conveys property to the trustee, who holds title to the property for the benefit of a third party, the trust's beneficiary.

The trustee is the administrator of the trust whose power to sell trust property, in this case, is conferred by the trust instrument, the document executed by the trust's settlor establishing the trust and containing the trust provisions. The Missouri Uniform Trust Code also confirms the trustee's power to "acquire or sell property in divided or undivided interests, for cash or on credit, at public or private sale" ( 456.8-816, RSMo).

The granting language of "bargain and sell, convey and confirm" is the common language used in Missouri to transfer property to a grantee with special warranty. A special warranty contains limited covenants of clear title (subject to noted encumbrances), and protection against claims arising by or through the grantor only.

In addition to meeting the requirements for content and format required by standard deeds, such as quitclaim or warranty deeds, trustee's deeds must also reference the trust instrument designating the acting trustee. The deed must be signed by the acting trustee's in the presence of a notary public for a valid transfer. A distinct acknowledgment form for trustees is codified at 486.330(5), RSMo.

Contact an attorney with any questions about Missouri trustee's deeds, or living trusts in general.

(Missouri TD Package includes form, guidelines, and completed example)

Our Promise

The documents you receive here will meet, or exceed, the Jefferson County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Jefferson County Trustee Deed form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4448 Reviews )

Dorothy N.

December 22nd, 2024

The mortgage and note were thorough and very satisfactory for my purposes. The accompanying forms were excellent. I am very pleased with my purchase.

We welcome your positive feedback and are thrilled to have met your expectations. Thank you for choosing our services.

Edward E.

December 22nd, 2024

Easy to use.

Your feedback is valuable to us and helps us improve. Thank you for sharing your thoughts!

MARISSA G.

December 22nd, 2024

I recomemed this webside

Thank you for your feedback. We really appreciate it. Have a great day!

Dawna M.

June 15th, 2021

Easy to use website and immediate documents appropriate for my area. My only complaint is that the forms had an alignment problem where the fields that were filled in by me did not line up with the template text. I tried to correct it to no avail so I ended up having to retype the entire document. I purchased two templates and both had the same issue.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Nancy N.

February 12th, 2022

Very easy to use. Appreicate the sample filled out forms and the guide book. Thank you!

Thank you for your feedback. We really appreciate it. Have a great day!

Jacqueline B.

August 23rd, 2021

The service was very clear and direct. I was able to get everything I need right now.

Your website is set up well.

Thank you

Thank you for your feedback. We really appreciate it. Have a great day!

Susan K.

July 13th, 2021

They were unable to complete the task and my money was immediately refunded.

Thank you for your feedback Susan, sorry we were unable to assist.

Jose R.

January 16th, 2020

User friendly. Smooth transaction. I saved a lot of time

Thank you for taking the time to leave your feedback Jose, we really appreciate it. Have a fantastic day!

Annette H.

September 8th, 2022

Deeds.com has done a wonderful job! They are quick to get back to me either with the Deed or reason why there is no Deed. You have saved me so much time using your services that I hope to keep using them for years to come! Thank you!

Thank you!

Gary T.

February 29th, 2020

Thanks so much. Lawyers wanted $150 but with your help and my facts I knocked it out in less than 1 Hour

Thank you for your feedback. We really appreciate it. Have a great day!

LINDA J M.

November 18th, 2019

NO PROBLEMS. I LIKE THE DEED DOCUMENT AND INSTRUCTIONS. MADE IT EASY.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

James C.

November 3rd, 2020

Deed was filed with county quickly. Great service!

Thank you!

PAUL B.

August 18th, 2023

Very fast and efficient reply

Thank you!

Donna W.

October 6th, 2022

Answered all of my questions and was very easy to use. I will use Deeds.com to do all of my real estate forms from now on. Thanks.

Thank you!

A. S.

February 27th, 2019

First, I am glad that you gave a blank copy, an example copy, and a 'guide'. It made it much easier to do. Overall I was very happy with your products and organization... however, things got pretty confusing and I have a pretty 'serious' law background in Real Estate and Civil law. With that said, I spent about 10+ hours getting my work done, using the Deed of Trust and Promissory note from you and there were a few problems: First, it would be FANTASTIC if you actually aligned your guide to actually match the Deed or Promissory Note. What I mean is that if the Deed says 'section (E)' then your guide shouldn't be 'randomly' numbered as 1,2,3, for advice/instructions, but should EXACTLY match 'section (E)'. Some places you have to 'hunt' for what you are looking for, and if you did it based on my suggestion, you wouldn't need to 'hunt' and it would avoid confusion. 2nd: This one really 'hurt'... you had something called the 'Deed of Trust Master Form' yet you had basically no information on what it was or how to use it. The only information you had was a small section at the top of the 'Short Form Deed of Trust Guide'. Holy Cow, was that 'section' super confusing. I still don't know if I did it correctly, but your guide says only put a return address on it and leave the rest of the 16 or so page Deed of Trust beneath it blank... and then include your 'Deed of Trust' (I had to assume the short form deed that I had just created) as part of it. I had to assume that I had to print off the entire 17 page or so title page and blank deed. I also had to assume that the promissory note was supposed to be EXHIBIT A or B on the Short Form Deed. It would be great if someone would take a serious look at that short section in your 'Short Form Deed of Trust Guide' and realize that those of us using your products are seriously turning this into a county clerk to file and that most of us, probably already have a property that has an existing Deed... or at least can find one in the county records if necessary... and make sure that you make a distinction between the Deed for the property that already exists, versus the Deed of Trust and Promissory note that we are trying to file. Thanks.

Thank you for your feedback. We'll have staff review the document for clarity. Have a great day!