Macon County Revocation of Beneficiary Deed Form (Missouri)

All Macon County specific forms and documents listed below are included in your immediate download package:

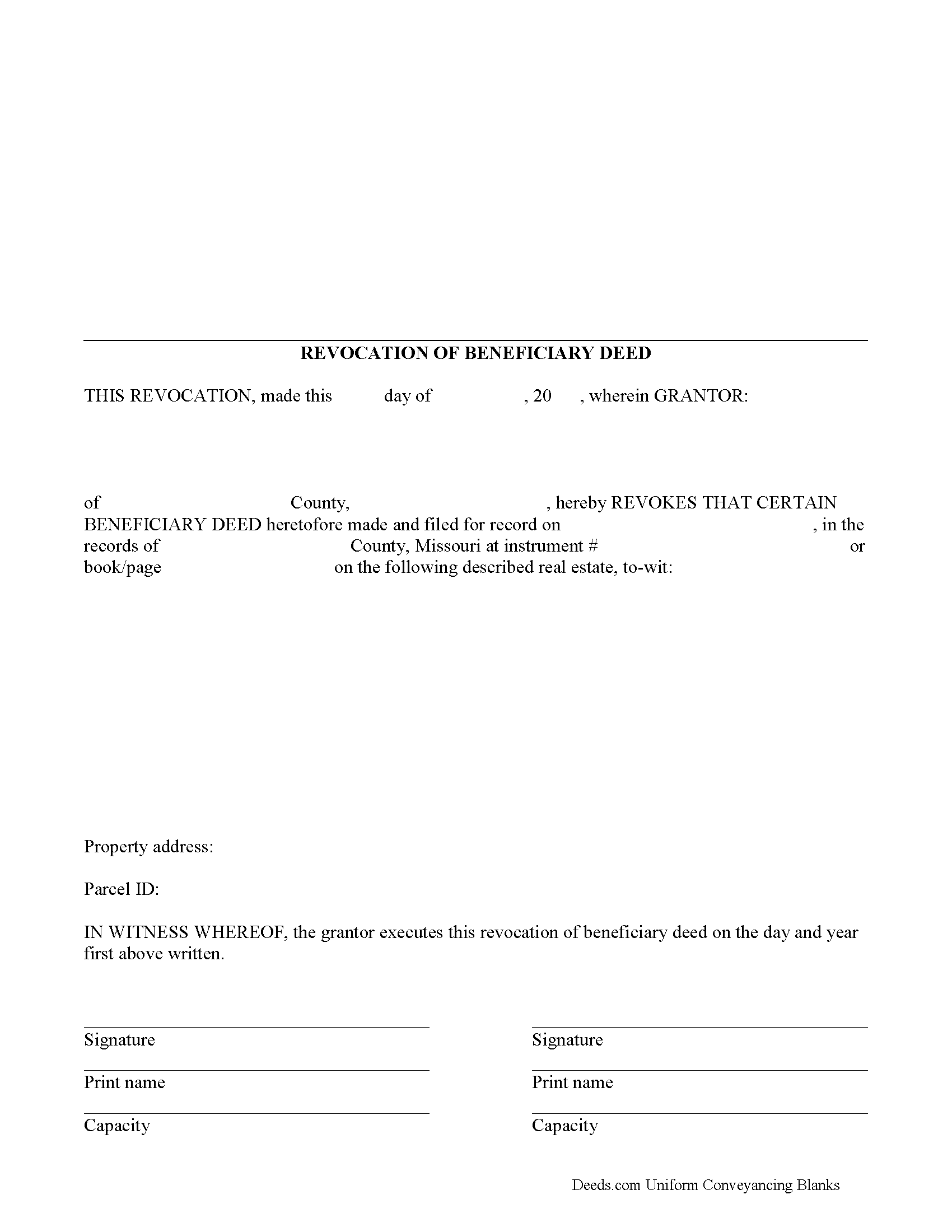

Revocation of Beneficiary Deed Form

Fill in the blank form formatted to comply with all recording and content requirements.

Included Macon County compliant document last validated/updated 10/15/2024

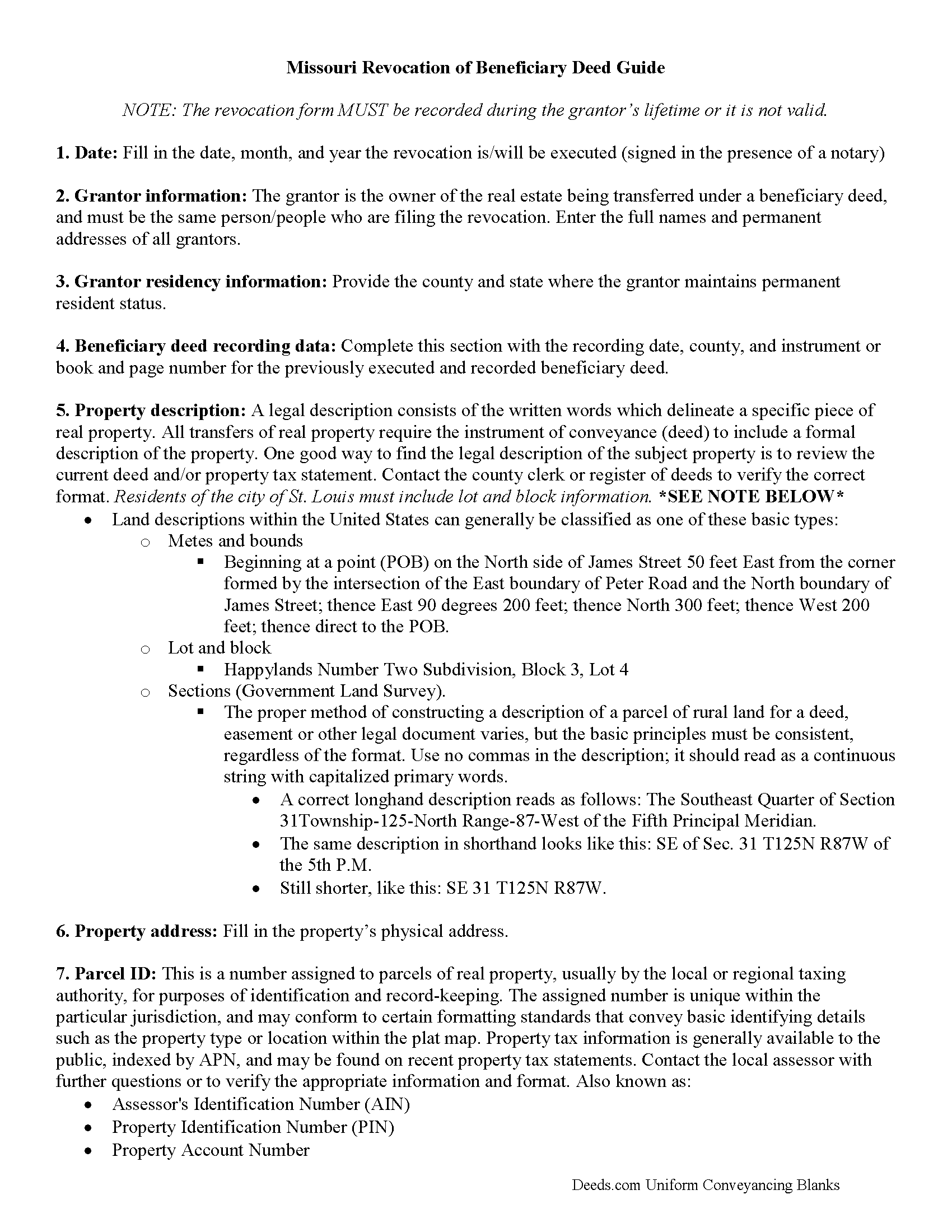

Revocation of Beneficiary Deed Guide

Line by line guide explaining every blank on the form.

Included Macon County compliant document last validated/updated 12/19/2024

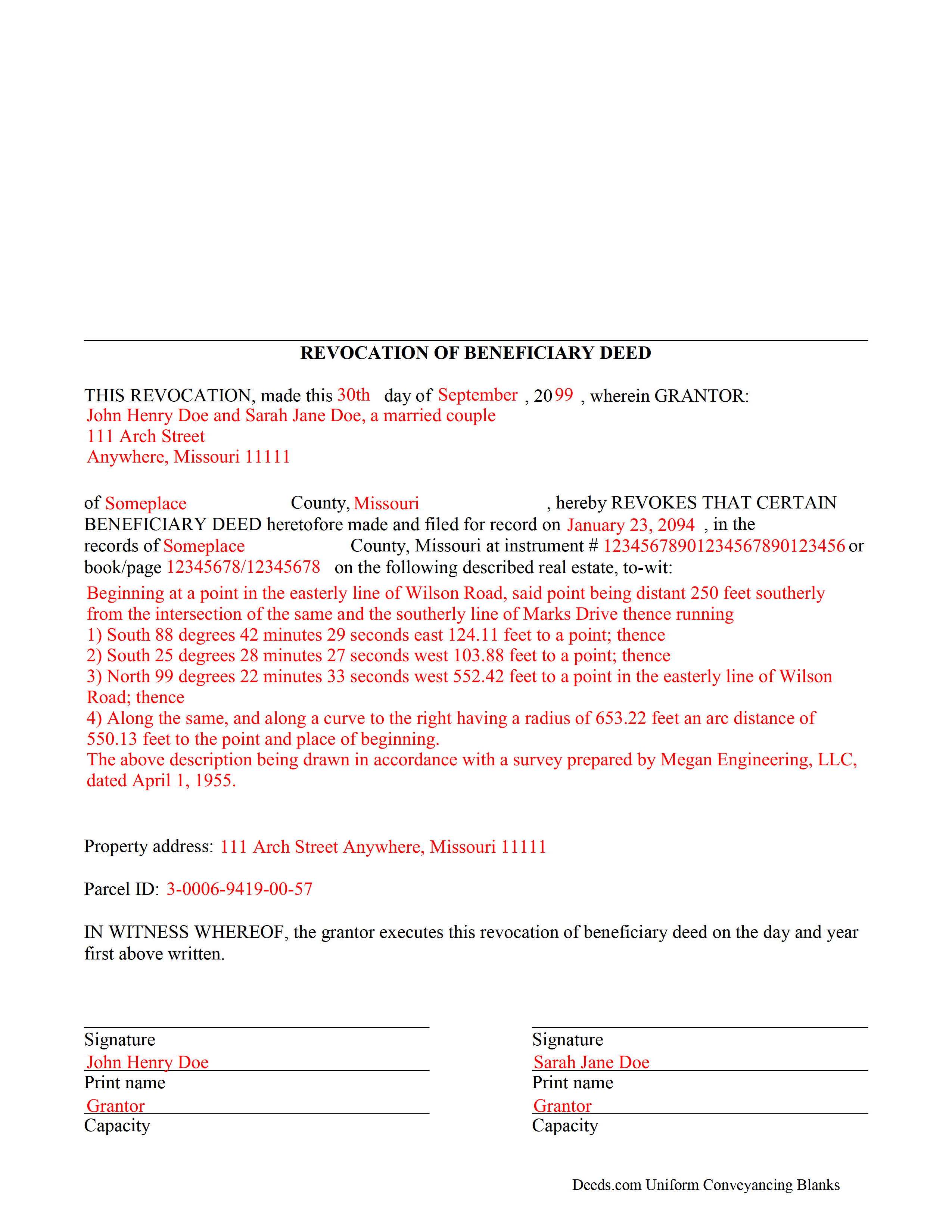

Completed Example of the Revocation of Beneficiary Deed Document

Example of a properly completed form for reference.

Included Macon County compliant document last validated/updated 11/28/2024

The following Missouri and Macon County supplemental forms are included as a courtesy with your order:

When using these Revocation of Beneficiary Deed forms, the subject real estate must be physically located in Macon County. The executed documents should then be recorded in the following office:

Macon County Recorder of Deeds

101 E Washington St, Bldg 3, Suite 300, Macon, Missouri 63552

Hours: 8:30 to 12:00 & 1:00 to 4:00 Monday through Friday

Phone: (660) 385-2732

Local jurisdictions located in Macon County include:

- Anabel

- Atlanta

- Bevier

- Callao

- Elmer

- Ethel

- Excello

- La Plata

- Macon

- New Cambria

How long does it take to get my forms?

Forms are available immediately after submitting payment.

How do I get my forms, are they emailed?

Immediately after you submit payment, the Macon County forms you order will be available for download directly from your account. You can then download the forms to your computer. If you do not already have an account, one will be created for you as part of the order process, and your login details will be provided to you. If you encounter any issues accessing your forms, please reach out to our support team for assistance. Forms are NOT emailed to you.

What does "validated/updated" mean?

This indicates the most recent date when at least one of the following occurred:

- Updated: The document was updated or changed to remain compliant.

- Validated: The document was examined by an attorney or staff, or it was successfully recorded in Macon County using our eRecording service.

Are these forms guaranteed to be recordable in Macon County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Macon County including margin requirements, content requirements, font and font size requirements.

Can the Revocation of Beneficiary Deed forms be re-used?

Yes. You can re-use the forms for your personal use. For example, if you have more than one property in Macon County that you need to transfer you would only need to order our forms once for all of your properties in Macon County.

What are supplemental forms?

Often when a deed is recorded, additional documents are required by Missouri or Macon County. These could be tax related, informational, or even as simple as a coversheet. Supplemental forms are provided for free with your order where available.

What type of files are the forms?

All of our Macon County Revocation of Beneficiary Deed forms are PDFs. You will need to have or get Adobe Reader to use our forms. Adobe Reader is free software that most computers already have installed.

Do I need any special software to use these forms?

You will need to have Adobe Reader installed on your computer to use our forms. Adobe Reader is free software that most computers already have installed.

Do I have to enter all of my property information online?

No. The blank forms are downloaded to your computer and you fill them out there, at your convenience.

Can I save the completed form, email it to someone?

Yes, you can save your deed form at any point with your information in it. The forms can also be emailed, blank or complete, as attachments.

Are there any recurring fees involved?

No. Nothing to cancel, no memberships, no recurring fees.

One of the many useful aspects of the Nonprobate Transfers Law of Missouri (RSMo Sections 461.003 to 461.081) is the option to revoke a previously recorded beneficiary deed. Revocation is specifically addressed in RSMo 431.033. The option to revoke is possible for several reasons: the grantor is not required to notify the beneficiary of the potential future interest; there is no consideration given in exchange for property rights; and the transfer of ownership is not completed until the grantor or grantors have all died. As a result, the named beneficiary has no actual interest in the real estate.

A grantor on a beneficiary deed may change or revoke beneficiary designations at will, and with no obligation to the individuals named as beneficiaries on the deed. To accomplish this, the original grantor (or grantors) may record a signed, notarized notice of revocation with the same office that accepted the original beneficiary deed. While effective, real estate that is not re-conveyed under a new beneficiary deed reverts back to the grantor's estate at his/her death, and is then distributed via the probate process. Alternately, the grantor may execute a new beneficiary deed, designating someone else as the beneficiary. Recording the new deed removes the prior beneficiary's name and replaces it, identifying the current beneficiary's information.

Note that any change in beneficiary designation must be executed and submitted for recordation during the grantor's lifetime.

(Missouri Revocation of BD Package includes form, guidelines, and completed example)

Our Promise

The documents you receive here will meet, or exceed, the Macon County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Macon County Revocation of Beneficiary Deed form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4448 Reviews )

Dorothy N.

December 22nd, 2024

The mortgage and note were thorough and very satisfactory for my purposes. The accompanying forms were excellent. I am very pleased with my purchase.

We welcome your positive feedback and are thrilled to have met your expectations. Thank you for choosing our services.

Edward E.

December 22nd, 2024

Easy to use.

Your feedback is valuable to us and helps us improve. Thank you for sharing your thoughts!

MARISSA G.

December 22nd, 2024

I recomemed this webside

Thank you for your feedback. We really appreciate it. Have a great day!

Jonny C.

October 21st, 2020

Easy and fast

Thank you!

Brennan H.

October 4th, 2023

I had worked for a couple of months sending things back and forth to the county and still had no success. I decided to use deeds.com and it was all done in a few hours. Such a relief! While I find this to be wrong and the county should work with property owners as well as they work with third parties, I was still grateful for this service.

Thank you for your feedback. We really appreciate it. Have a great day!

David M.

April 24th, 2019

Why is Dade County not listed for the Lady Bird Deed?

Because on November 13, 1997, voters changed the name of the county from Dade to Miami-Dade.

Julie K.

September 4th, 2023

The process for obtaining document itself was easy, and the included guide and example are great! rnI do have an issue with the format itself, though. The form has pre-defined text boxes, which cannot be altered without partially rebuilding the entire document. For the 'property description' field on the Mineral Deed form, the text box is not large enough for the rather lengthy legal description entered on my original plat.rnFortunately, I have a copy of Adobe Pro, so I have been able to re-build the doc to accommodate this short-coming.

Thank you for taking the time to provide feedback on our legal form. We're pleased to hear that you found the process for obtaining the document and the included guide beneficial.

We understand and appreciate your concern regarding the formatting and size limitations of certain fields, especially the 'property description' field. Our forms are designed to adhere to specific formatting requirements that are often mandated for legal compliance. Making direct alterations to the document can result in them becoming non-conforming, which is why we advise customers to use an exhibit page when their legal description is extensive or does not fit.

Emili C.

October 14th, 2020

Thank you! I received my forms promptly and they are easy to follow along for filling out. The examples gave me confidence that they were done correctly.

Thank you for your feedback. We really appreciate it. Have a great day!

thomas C.

July 7th, 2020

Thank you for being there for me when I couldn't get it done myself. I was a little confused with the operation at first but then became easy. I will definitely be using you again and again. Even after the pandemic is over.It's approximately 15 miles one way to downtown Orlando to do what you did for me sitting at my house

Glad we could help Thomas, have a great day!

Erlinda M.

August 14th, 2019

Very convenient & easy to use this website. Information was helpful.

Thank you for your feedback. We really appreciate it. Have a great day!

JOSE M.

November 3rd, 2021

Excellent Website.

Thank you!

Scott s.

September 2nd, 2022

Information requested was provided and time to reply was quick!

Thank you!

Debbie M.

July 3rd, 2020

The forms and instructions were easy to follow and get complete. It was very nice to be able to just find them, pay for them, and download them so that they were printed just within a matter of 30 minutes. Thank you

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Patricia E.

June 8th, 2020

Easy to understand and download!

Thank you!

Bobby Y.

June 7th, 2024

I like the content and the availability to conduct valuable business online

Thank you!