Hickory County Revocation of Beneficiary Deed Form (Missouri)

All Hickory County specific forms and documents listed below are included in your immediate download package:

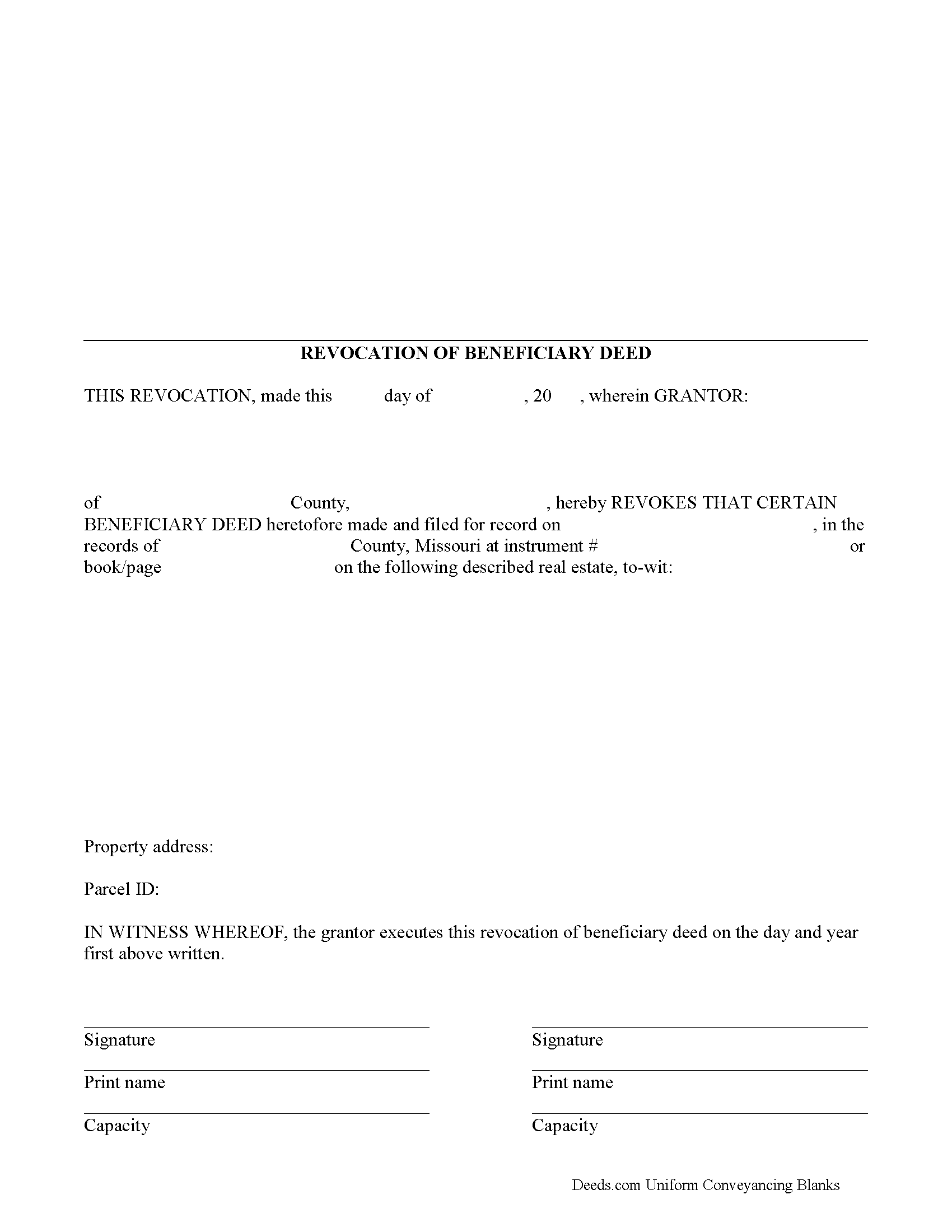

Revocation of Beneficiary Deed Form

Fill in the blank form formatted to comply with all recording and content requirements.

Included Hickory County compliant document last validated/updated 10/15/2024

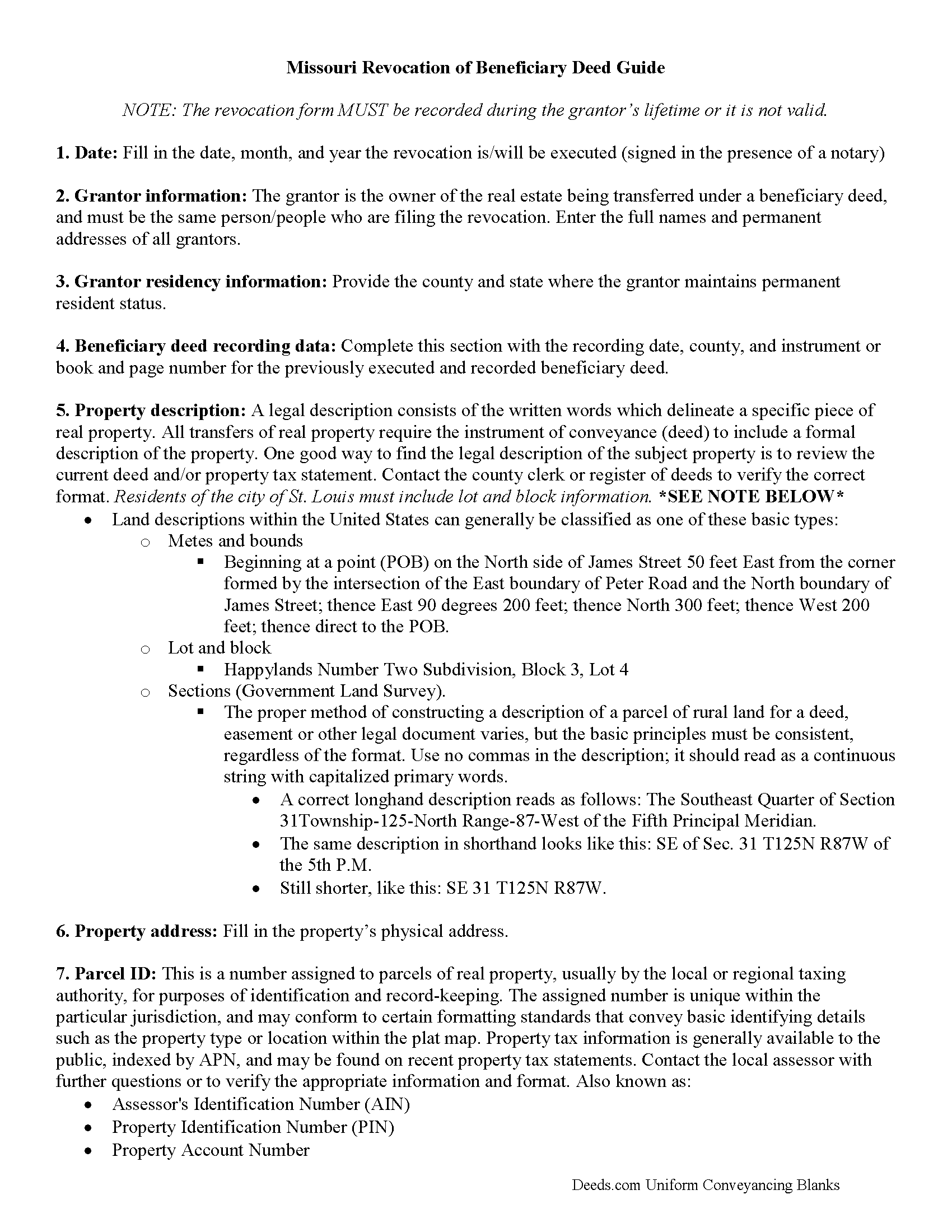

Revocation of Beneficiary Deed Guide

Line by line guide explaining every blank on the form.

Included Hickory County compliant document last validated/updated 12/19/2024

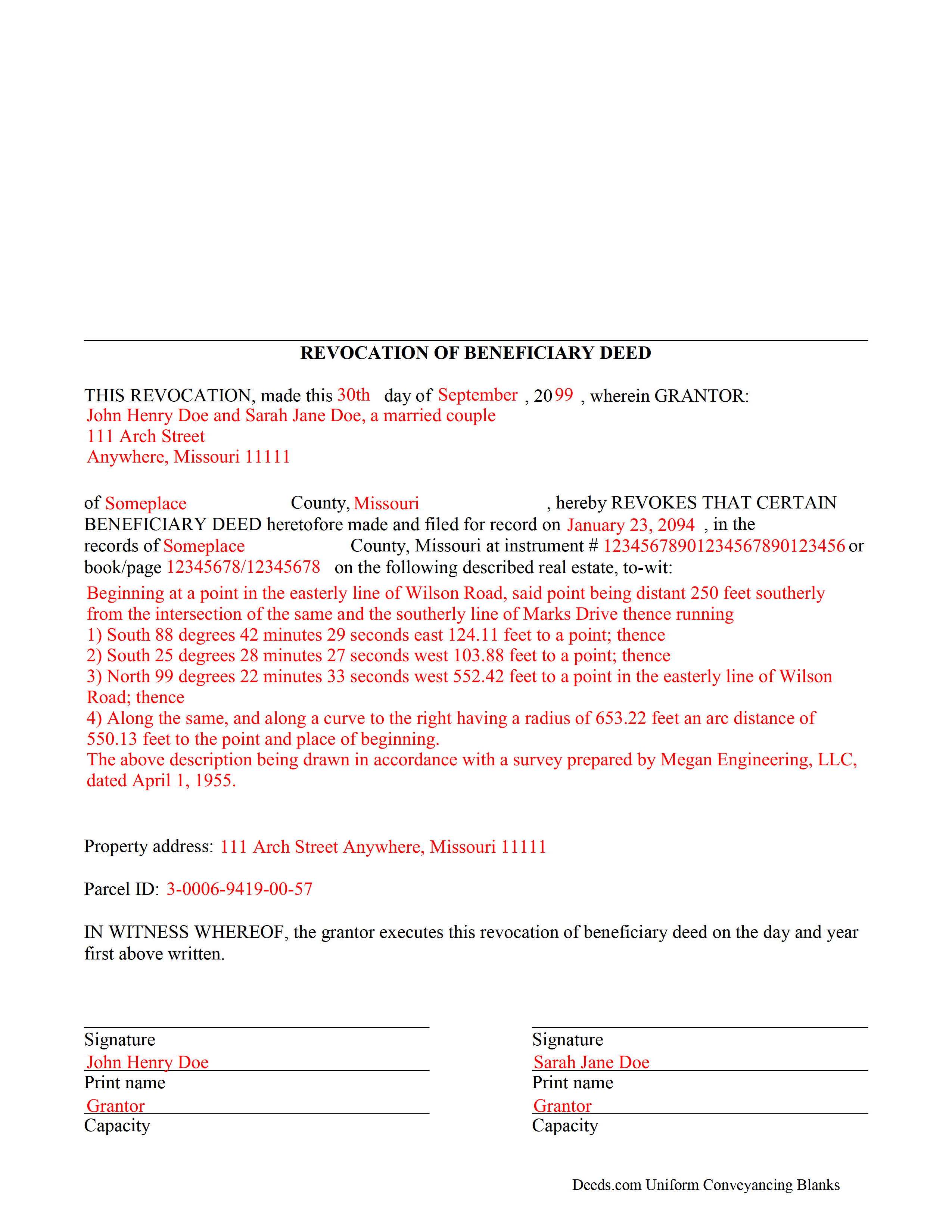

Completed Example of the Revocation of Beneficiary Deed Document

Example of a properly completed form for reference.

Included Hickory County compliant document last validated/updated 11/28/2024

The following Missouri and Hickory County supplemental forms are included as a courtesy with your order:

When using these Revocation of Beneficiary Deed forms, the subject real estate must be physically located in Hickory County. The executed documents should then be recorded in the following office:

Hickory County Recorder of Deeds

Courthouse Square, Suite 203 / PO Box 101, Hermitage, Missouri 65668

Hours: 8:00 to 4:30 M-F

Phone: (417) 745-6421

Local jurisdictions located in Hickory County include:

- Cross Timbers

- Hermitage

- Pittsburg

- Preston

- Quincy

- Weaubleau

- Wheatland

How long does it take to get my forms?

Forms are available immediately after submitting payment.

How do I get my forms, are they emailed?

Immediately after you submit payment, the Hickory County forms you order will be available for download directly from your account. You can then download the forms to your computer. If you do not already have an account, one will be created for you as part of the order process, and your login details will be provided to you. If you encounter any issues accessing your forms, please reach out to our support team for assistance. Forms are NOT emailed to you.

What does "validated/updated" mean?

This indicates the most recent date when at least one of the following occurred:

- Updated: The document was updated or changed to remain compliant.

- Validated: The document was examined by an attorney or staff, or it was successfully recorded in Hickory County using our eRecording service.

Are these forms guaranteed to be recordable in Hickory County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Hickory County including margin requirements, content requirements, font and font size requirements.

Can the Revocation of Beneficiary Deed forms be re-used?

Yes. You can re-use the forms for your personal use. For example, if you have more than one property in Hickory County that you need to transfer you would only need to order our forms once for all of your properties in Hickory County.

What are supplemental forms?

Often when a deed is recorded, additional documents are required by Missouri or Hickory County. These could be tax related, informational, or even as simple as a coversheet. Supplemental forms are provided for free with your order where available.

What type of files are the forms?

All of our Hickory County Revocation of Beneficiary Deed forms are PDFs. You will need to have or get Adobe Reader to use our forms. Adobe Reader is free software that most computers already have installed.

Do I need any special software to use these forms?

You will need to have Adobe Reader installed on your computer to use our forms. Adobe Reader is free software that most computers already have installed.

Do I have to enter all of my property information online?

No. The blank forms are downloaded to your computer and you fill them out there, at your convenience.

Can I save the completed form, email it to someone?

Yes, you can save your deed form at any point with your information in it. The forms can also be emailed, blank or complete, as attachments.

Are there any recurring fees involved?

No. Nothing to cancel, no memberships, no recurring fees.

One of the many useful aspects of the Nonprobate Transfers Law of Missouri (RSMo Sections 461.003 to 461.081) is the option to revoke a previously recorded beneficiary deed. Revocation is specifically addressed in RSMo 431.033. The option to revoke is possible for several reasons: the grantor is not required to notify the beneficiary of the potential future interest; there is no consideration given in exchange for property rights; and the transfer of ownership is not completed until the grantor or grantors have all died. As a result, the named beneficiary has no actual interest in the real estate.

A grantor on a beneficiary deed may change or revoke beneficiary designations at will, and with no obligation to the individuals named as beneficiaries on the deed. To accomplish this, the original grantor (or grantors) may record a signed, notarized notice of revocation with the same office that accepted the original beneficiary deed. While effective, real estate that is not re-conveyed under a new beneficiary deed reverts back to the grantor's estate at his/her death, and is then distributed via the probate process. Alternately, the grantor may execute a new beneficiary deed, designating someone else as the beneficiary. Recording the new deed removes the prior beneficiary's name and replaces it, identifying the current beneficiary's information.

Note that any change in beneficiary designation must be executed and submitted for recordation during the grantor's lifetime.

(Missouri Revocation of BD Package includes form, guidelines, and completed example)

Our Promise

The documents you receive here will meet, or exceed, the Hickory County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Hickory County Revocation of Beneficiary Deed form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4448 Reviews )

Dorothy N.

December 22nd, 2024

The mortgage and note were thorough and very satisfactory for my purposes. The accompanying forms were excellent. I am very pleased with my purchase.

We welcome your positive feedback and are thrilled to have met your expectations. Thank you for choosing our services.

Edward E.

December 22nd, 2024

Easy to use.

Your feedback is valuable to us and helps us improve. Thank you for sharing your thoughts!

MARISSA G.

December 22nd, 2024

I recomemed this webside

Thank you for your feedback. We really appreciate it. Have a great day!

William H.

July 18th, 2023

It was quick and easy to download the forms I need to modify a property deed. No problems n the least.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

John S.

April 22nd, 2021

The website is very user-friendly. Easily to download forms.

Thank you!

ERHAN S.

February 3rd, 2023

amazing time and cost saving service for me. Thank you.

Thank you!

Barbara E.

March 7th, 2023

The online forms were very helpful and self-explanatory. My husband and I used several as we completed our estate planning documents.

Thank you for these forms.

Thank you for your feedback. We really appreciate it. Have a great day!

Elijah H.

December 24th, 2018

Deeds.com worked very well for me. Very Simple packet. And my County uses the same website

Thanks for the kinds words Elijah, we really appreciate it.

Robin G.

February 1st, 2024

Very user friendly. I was totally amazed. Thank you so much.

We are delighted to have been of service. Thank you for the positive review!

DOYCE F.

September 25th, 2019

Very helpful.Thank you

Thank you!

Linda D.

April 27th, 2019

It was quick & easy so thank you!

Thank you Linda.

Gordon W.

April 7th, 2022

Nice forms but it sure would have been nice to be able to at least print the guide and the example so that I don't spend all of my time bouncing back and forth between windows on a laptop.

Thank you for your feedback. We really appreciate it. Have a great day!

Caroline W.

June 30th, 2019

They didn't have what I needed, but they were very quick in responding to let me know and where I needed to go to receive the desired information.

Thank you for your feedback Caroline.

Crystal P.

April 16th, 2024

This service is amazing! We have tried several other online recording services which all disappointed. Deeds.com got all three of our documents recorded same day as invoice payment. Thank you for the quick turn around! We will be using this service often.

We are sincerely grateful for your feedback and are committed to providing the highest quality service. Thank you for your trust in us.

Stephen G.

January 15th, 2022

Well, we are 10 days from leaving the country for months and needed to notarize and record deed changes to our rental properties. We worried about USPS, UPS, DHL, etc. and hardcopies in the County's bureaucrats' hands. Soooo, we learned of Deeds.com from the County web site via one of the bulk digital recorders telling me about Deeds.com. Hit their site, read their instructions, concluded my tiny brain and decrepit abilities could handle the chore. WITHIN AN HOUR OF UPLOADING EVERYTHING INCLUDING C.C. FOR PMT IT WAS RECORDED AND I printed out copies. WORTH the $$ in speed, convenience and PEACE of mind. Pardon the loud trumpeting.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!