Wright County Quitclaim Deed Form (Missouri)

All Wright County specific forms and documents listed below are included in your immediate download package:

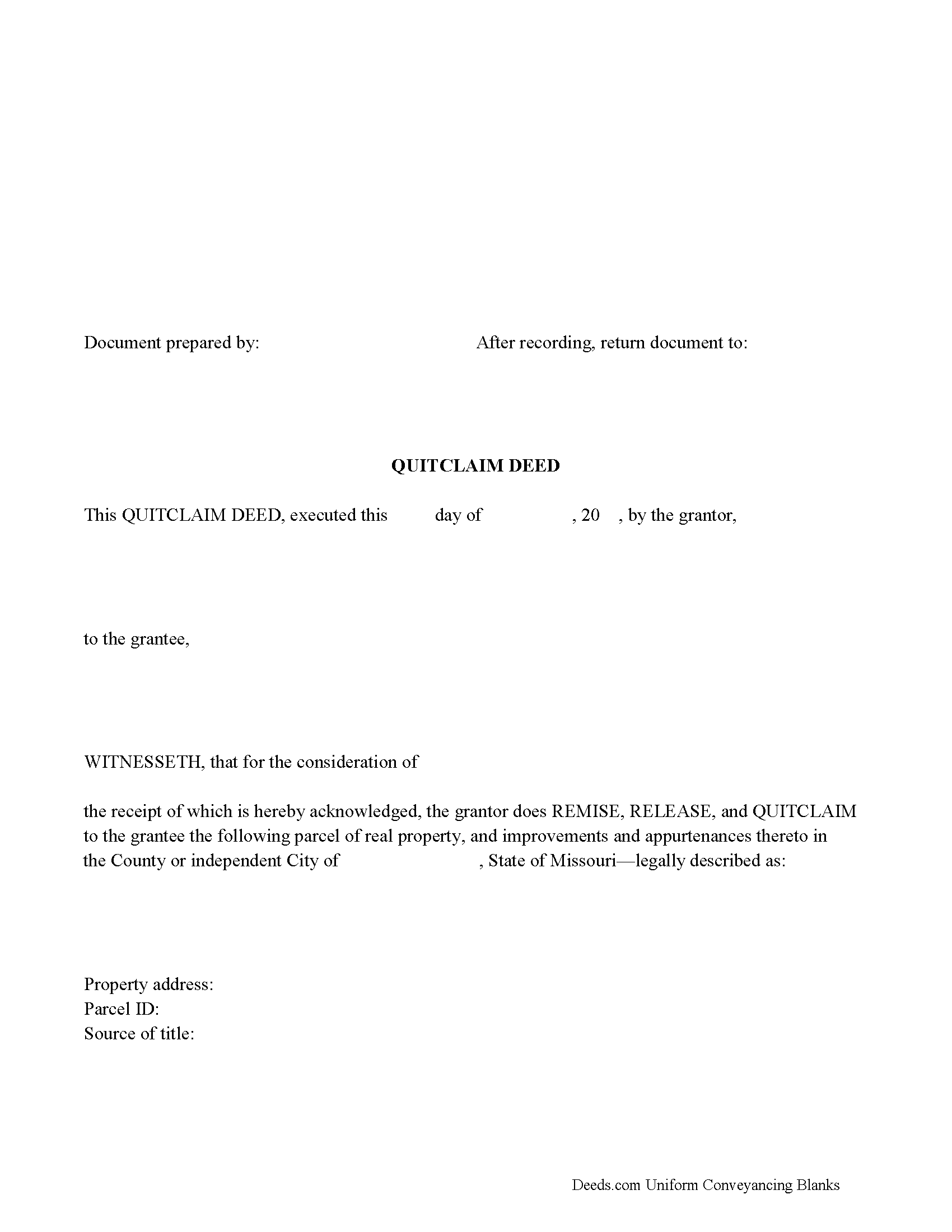

Quitclaim Deed Form

Fill in the blank Quitclaim Deed form formatted to comply with all Missouri recording and content requirements.

Included Wright County compliant document last validated/updated 11/19/2024

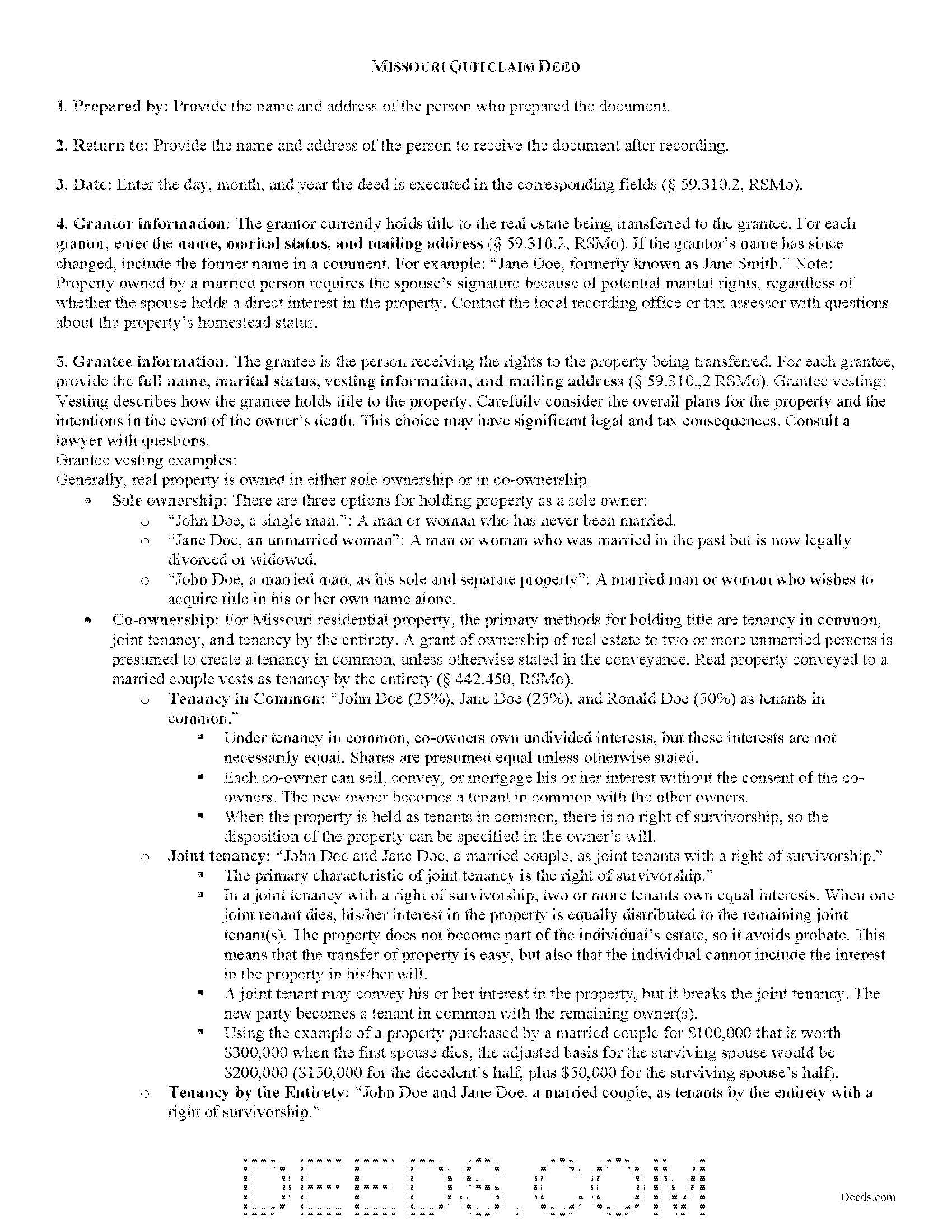

Quitclaim Deed Guide

Line by line guide explaining every blank on the Quitclaim Deed form.

Included Wright County compliant document last validated/updated 5/2/2024

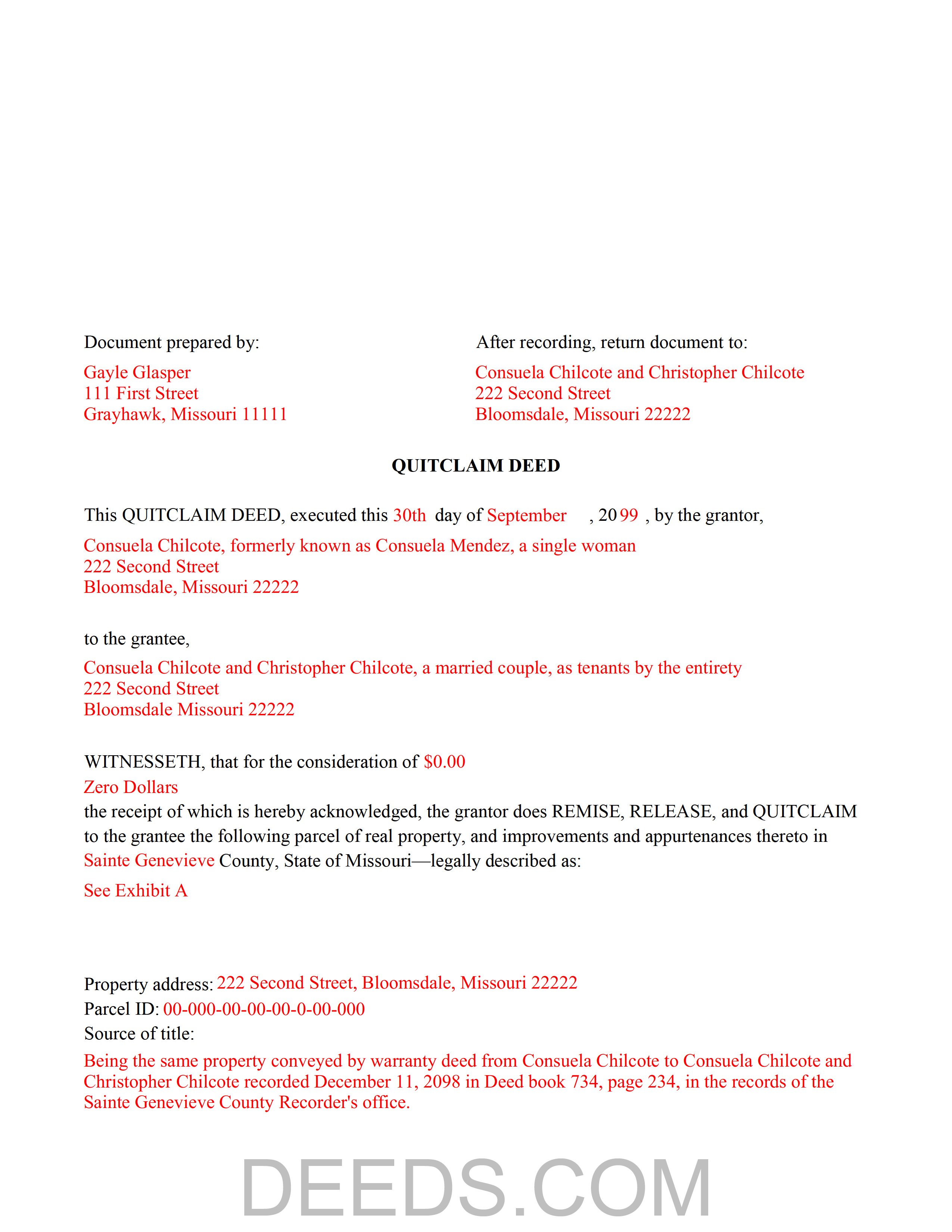

Completed Example of the Quitclaim Deed Document

Example of a properly completed Missouri Quitclaim Deed document for reference.

Included Wright County compliant document last validated/updated 12/11/2024

The following Missouri and Wright County supplemental forms are included as a courtesy with your order:

When using these Quitclaim Deed forms, the subject real estate must be physically located in Wright County. The executed documents should then be recorded in the following office:

Wright County Recorder of Deeds

125 Courthouse Sq, Hartville, Missouri 65667

Hours: 8:30 to 4:30 M-F

Phone: (417) 741-7322

Local jurisdictions located in Wright County include:

- Graff

- Grovespring

- Hartville

- Macomb

- Mansfield

- Mountain Grove

- Norwood

How long does it take to get my forms?

Forms are available immediately after submitting payment.

How do I get my forms, are they emailed?

Immediately after you submit payment, the Wright County forms you order will be available for download directly from your account. You can then download the forms to your computer. If you do not already have an account, one will be created for you as part of the order process, and your login details will be provided to you. If you encounter any issues accessing your forms, please reach out to our support team for assistance. Forms are NOT emailed to you.

What does "validated/updated" mean?

This indicates the most recent date when at least one of the following occurred:

- Updated: The document was updated or changed to remain compliant.

- Validated: The document was examined by an attorney or staff, or it was successfully recorded in Wright County using our eRecording service.

Are these forms guaranteed to be recordable in Wright County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Wright County including margin requirements, content requirements, font and font size requirements.

Can the Quitclaim Deed forms be re-used?

Yes. You can re-use the forms for your personal use. For example, if you have more than one property in Wright County that you need to transfer you would only need to order our forms once for all of your properties in Wright County.

What are supplemental forms?

Often when a deed is recorded, additional documents are required by Missouri or Wright County. These could be tax related, informational, or even as simple as a coversheet. Supplemental forms are provided for free with your order where available.

What type of files are the forms?

All of our Wright County Quitclaim Deed forms are PDFs. You will need to have or get Adobe Reader to use our forms. Adobe Reader is free software that most computers already have installed.

Do I need any special software to use these forms?

You will need to have Adobe Reader installed on your computer to use our forms. Adobe Reader is free software that most computers already have installed.

Do I have to enter all of my property information online?

No. The blank forms are downloaded to your computer and you fill them out there, at your convenience.

Can I save the completed form, email it to someone?

Yes, you can save your deed form at any point with your information in it. The forms can also be emailed, blank or complete, as attachments.

Are there any recurring fees involved?

No. Nothing to cancel, no memberships, no recurring fees.

Real property transfers are governed by Chapter 442 of the Missouri Revised Statutes. Quitclaim deeds, however, are not specifically defined in the statutes.

(Missouri QD Package includes form, guidelines, and completed example)

Quitclaim deeds are used to transfer the rights, title, and interest in real estate from the grantor (seller) to the grantee (buyer) without any warranty of title. When using a quitclaim deed, there may be potential unknown claims or restrictions on the title, and the buyer accepts the risk, effectively taking the title as-is.

These deeds are frequently used in instances such as a divorce, with one spouse signing all of his or her rights in a piece of real property over to the other spouse; when there is uncertainty about the history of the property's title; or when a current owner or buyer wishes another party with interest in the property to disclaim that interest.

A lawful quitclaim deed includes the names and addresses of each grantor and grantee, and a complete legal description of the property (59.310, RSMo). Include the preparer's name, address, and signature as well. Besides these requirements, the form must meet all state and local standards for recorded documents.

All recorded documents or documents affecting a change in property ownership must contain information on how the property will be vested. For Missouri residential property, the primary methods for holding title are tenancy in common, joint tenancy, and tenancy by the entirety. A grant of ownership of real estate to two or more unmarried persons is presumed to create a tenancy in common, unless otherwise stated in the conveyance. Real property conveyed to a married couple vests as tenancy by the entirety (442.450, RSMo).

Include all relevant documents, affidavits, forms, and fees along with the deed for recording. Jackson County, St. Louis County, the City of St. Louis, and St. Charles County each have their own Real Property Certificate of Value. File this form with the deed at the time of recording.

In Missouri, the grantor must sign the deed in the presence of a notary public before presenting it to the county recorder. In the City of St. Louis, both the grantor and grantee must sign the deed.

Recording the deed preserves a clear chain of ownership history and provides public notice. An unrecorded quitclaim deed in writing will be valid between the parties to it and those that have actual notice of it (442.400). Submit all deeds to the local county clerk's office of the county in which the property conveyed is located.

This article is provided for informational purposes only and is not a substitute for legal advice. Contact a lawyer with questions about quitclaim deeds or any other issues related to the transfer of real property in Missouri.

(Missouri QD Package includes form, guidelines, and completed example)

Our Promise

The documents you receive here will meet, or exceed, the Wright County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Wright County Quitclaim Deed form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4448 Reviews )

Dorothy N.

December 22nd, 2024

The mortgage and note were thorough and very satisfactory for my purposes. The accompanying forms were excellent. I am very pleased with my purchase.

We welcome your positive feedback and are thrilled to have met your expectations. Thank you for choosing our services.

Edward E.

December 22nd, 2024

Easy to use.

Your feedback is valuable to us and helps us improve. Thank you for sharing your thoughts!

MARISSA G.

December 22nd, 2024

I recomemed this webside

Thank you for your feedback. We really appreciate it. Have a great day!

Susan S.

July 28th, 2020

The actual transfer of deed form seems to be the only one not fillable in Adobe. Seems odd.

Thank you!

Ralph H.

May 8th, 2019

Your documents resolved my problem. Thanks.

Thank you Ralph, we appreciate your feedback.

Judith H.

May 22nd, 2023

This site was so easy. Got my documents in minutes. downloaded and they work perfectly and accurately.

I LOVE THIS SITE AND COMPANY!!!

Thank you for your feedback. We really appreciate it. Have a great day!

oscar r.

December 17th, 2021

VERY MUCH HELPFUL SAVED ME 600 on not having to hire attorney

Thank you!

Audrey T.

August 18th, 2020

The info was good for the money, but not all that I needed.

Thank you for your feedback. We really appreciate it. Have a great day!

Tamara H.

August 7th, 2021

Absolutely awesome, all the information and forms I needed

Thanks

Tamie Hamilton

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Eleody L.

January 7th, 2019

I mistakenly ordered the wrong package and within 3 minutes of asking for a replacement, I was given one by the company. I am extremely impressed with the prompt response and the forms! I will use this site again if I needed other deed forms!!!!

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Leo H.

May 26th, 2021

The deed was very easy to use and the material provided were helpful in completing the form. We haven't filed it yet, but I assume that all will go well.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Michael B.

November 13th, 2019

It was a breeze to utilize.

Thank you!

Jonnie G.

November 15th, 2019

I very much dreaded this whole endeavor but very pleasantly surprised. So far, so good. I feel much more confidant that the crucial form, when presented, will play well with the county.......

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Alexis B.

December 31st, 2018

Highly Pleased- Strongly Recommend Deeds.com Long review... sorry:-) Originally I was very skeptical due to the enormous amount of the scams going on now days and the number of online sources that "claim" to provide you with deed forms for free or for a few. Nothing that you need and want done is free. There is always a cost. So luckily I came across deeds.com. This was the only site that appeared to be simple, to the point, and made no crazy promises. So before selecting this site, I did a little more checking around/price checking to ensure I am getting the best price for the product I needed. I even checked Staples and Amazon to find that they do indeed sell these forms but I do not think the products they provide are specific for my state and county. They claim their forms provided are for all states but my state is specific and I prefer to have forms provided by Deeds.com that is based on Indiana statute that Deed.com clearly identifies on each form. Deeds.com price of $20 seemed a little high at first but when I saw the products provided, the $20 cost is more than reasonable and fair. You not only get the deed form specific for my state and my specific "county" but also the other various/supplemental forms that may be required. Being familiar with my state and knowing how tedious and anal my state is on everything, I was pleasantly please to see the info and extra supplemental forms provided. For example, a person new to the State who recently had property deeded to them, would not necessarily know about the Homestead tax exemption provided if property is your primary residents, over 65 exemption etc. I would highly recommend this site for anyone needing these documents because Deeds.com has you covered on any and all forms/info you could ever need! A bonus is that there is one flat fee and not monthly cost that you have to worry about canceling later unless you superficially select a monthly package. I love the fact that Deeds.com is nothing fancy. There is not a bunch of elaborate graphics etc. They only provide what you need and what they provide is very accurate. Deeds.com has a customer for life.

Thank you so much Alexis. We appreciate you, have a fantastic day.

Teri B.

January 7th, 2019

Glad to have all of the helpful extra information, even though they don't answer all questions for all situations. So, I accessed public records and asked questions at the auditor's office. Also, on my Mac computer, filling out the actual deed form is a challenge because the screen jumps to the last page everytime I try to type a few letters or hit the return key, so I'm rollling back up to the first 2 pages after most keystrokes. A bit annoying.

Overall, happy to have these form options are available! There is really no need to wait and pay for an attorney when all the information needed is available via public records. Fill in the blanks!

Thanks so much for the feedback Teri. There are known issues between Adobe and Mac, we try to work around them as much as possible. Have a wonderful day!