Benton County Affidavit as to Death of Grantor Form (Missouri)

All Benton County specific forms and documents listed below are included in your immediate download package:

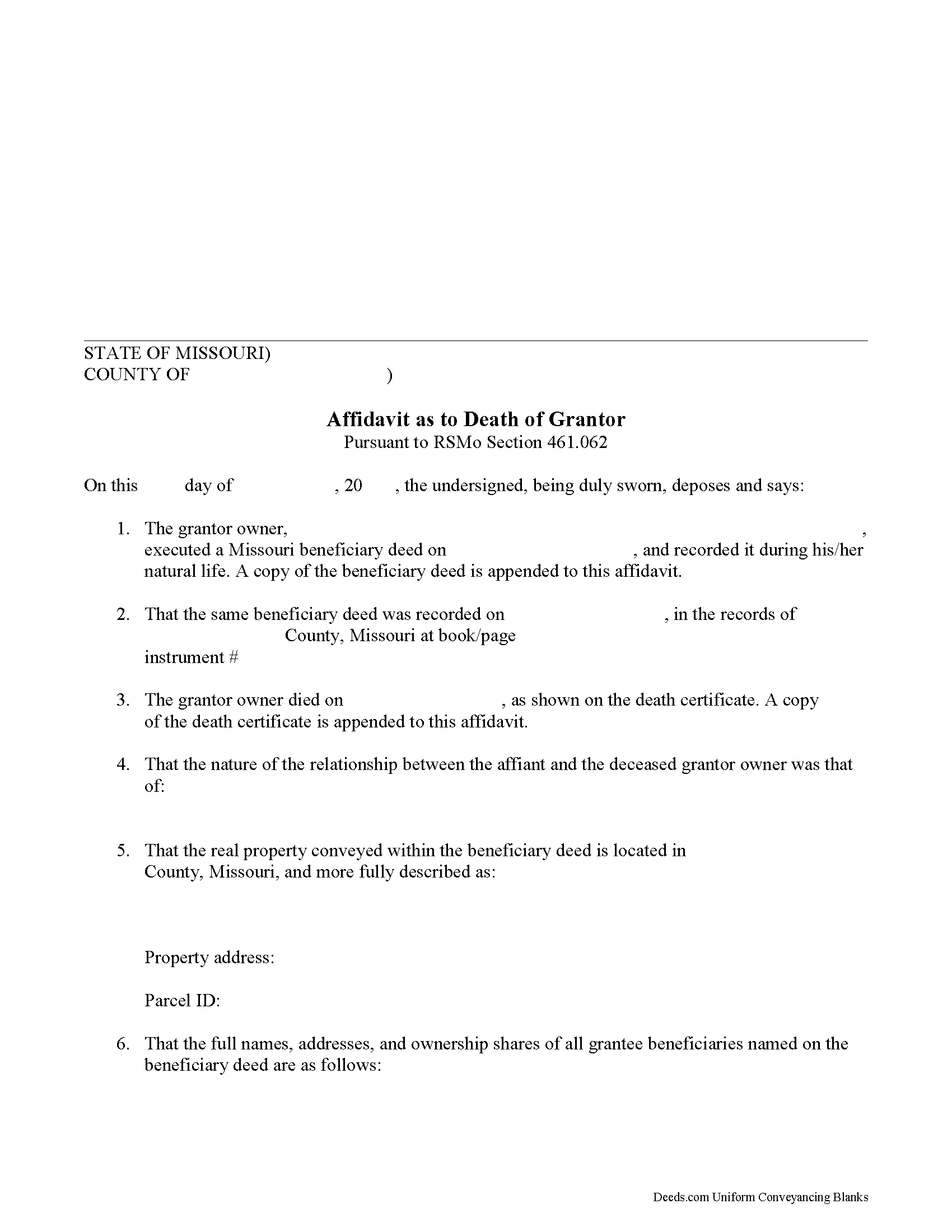

Affidavit as to Death of Grantor Form

Fill in the blank form formatted to comply with all recording and content requirements.

Included Benton County compliant document last validated/updated 11/18/2024

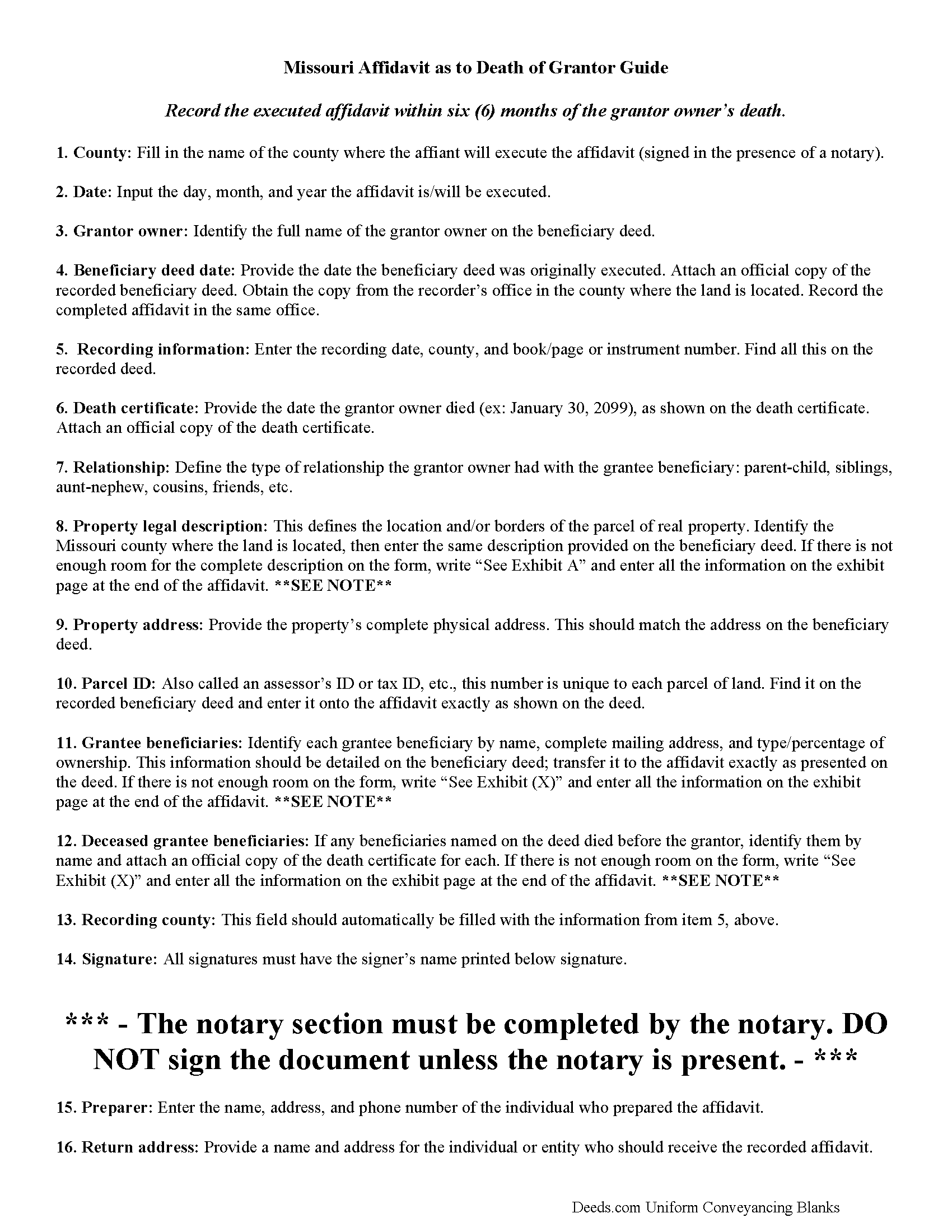

Affidavit as to Death of Grantor Guide

Line by line guide explaining every blank on the form.

Included Benton County compliant document last validated/updated 12/17/2024

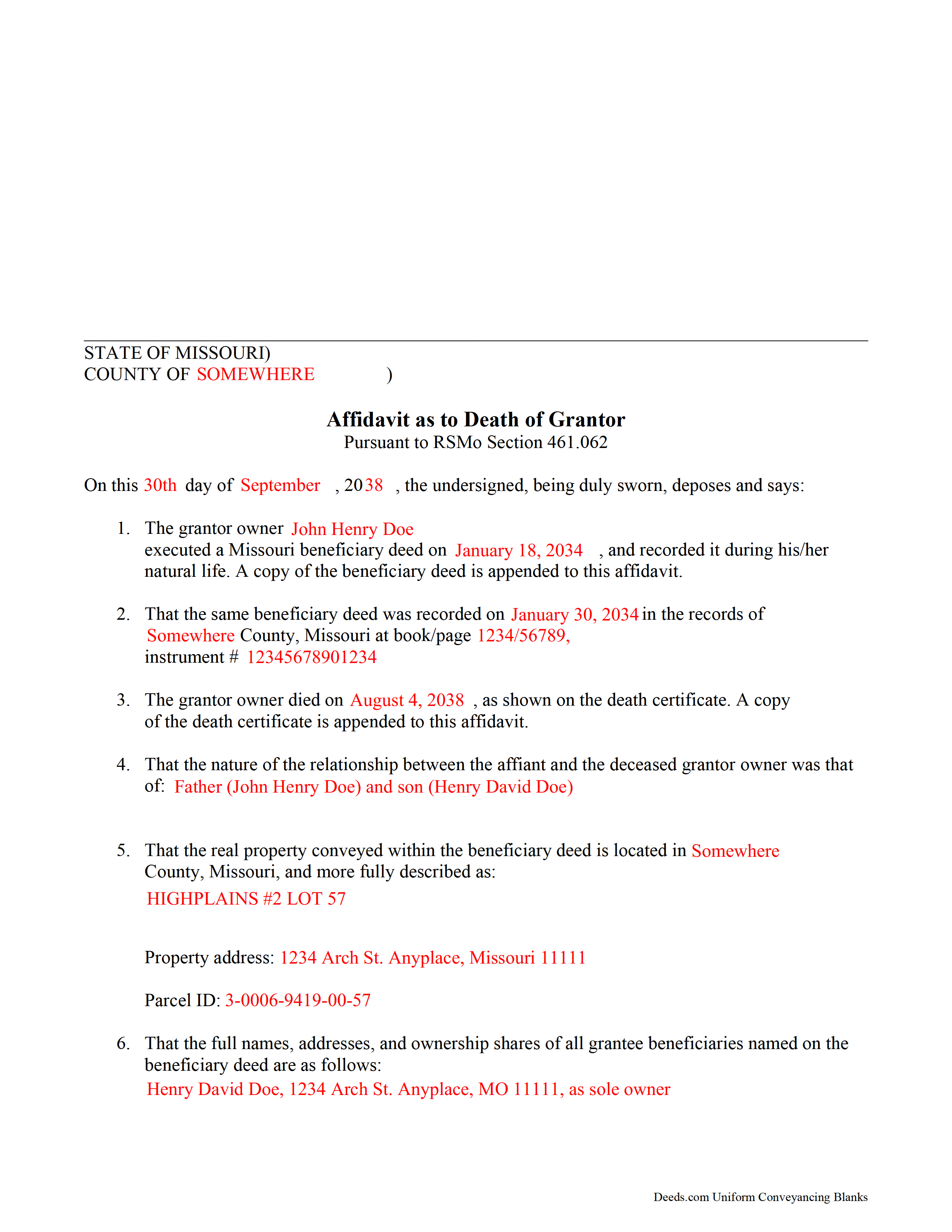

Completed Example of the Affidavit as to Death of Grantor Document

Example of a properly completed form for reference.

Included Benton County compliant document last validated/updated 12/6/2024

The following Missouri and Benton County supplemental forms are included as a courtesy with your order:

When using these Affidavit as to Death of Grantor forms, the subject real estate must be physically located in Benton County. The executed documents should then be recorded in the following office:

Benton County Recorder of Deeds

316 Van Buren Rd / PO Box 1147, Warsaw, Missouri 65355

Hours: 8:30 to 4:30 M-F

Phone: (660) 438-5732

Local jurisdictions located in Benton County include:

- Cole Camp

- Edwards

- Ionia

- Lincoln

- Warsaw

How long does it take to get my forms?

Forms are available immediately after submitting payment.

How do I get my forms, are they emailed?

Immediately after you submit payment, the Benton County forms you order will be available for download directly from your account. You can then download the forms to your computer. If you do not already have an account, one will be created for you as part of the order process, and your login details will be provided to you. If you encounter any issues accessing your forms, please reach out to our support team for assistance. Forms are NOT emailed to you.

What does "validated/updated" mean?

This indicates the most recent date when at least one of the following occurred:

- Updated: The document was updated or changed to remain compliant.

- Validated: The document was examined by an attorney or staff, or it was successfully recorded in Benton County using our eRecording service.

Are these forms guaranteed to be recordable in Benton County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Benton County including margin requirements, content requirements, font and font size requirements.

Can the Affidavit as to Death of Grantor forms be re-used?

Yes. You can re-use the forms for your personal use. For example, if you have more than one property in Benton County that you need to transfer you would only need to order our forms once for all of your properties in Benton County.

What are supplemental forms?

Often when a deed is recorded, additional documents are required by Missouri or Benton County. These could be tax related, informational, or even as simple as a coversheet. Supplemental forms are provided for free with your order where available.

What type of files are the forms?

All of our Benton County Affidavit as to Death of Grantor forms are PDFs. You will need to have or get Adobe Reader to use our forms. Adobe Reader is free software that most computers already have installed.

Do I need any special software to use these forms?

You will need to have Adobe Reader installed on your computer to use our forms. Adobe Reader is free software that most computers already have installed.

Do I have to enter all of my property information online?

No. The blank forms are downloaded to your computer and you fill them out there, at your convenience.

Can I save the completed form, email it to someone?

Yes, you can save your deed form at any point with your information in it. The forms can also be emailed, blank or complete, as attachments.

Are there any recurring fees involved?

No. Nothing to cancel, no memberships, no recurring fees.

The Nonprobate Transfers Law of Missouri, Sections 461.003 to 461.081 RSMo (2012) has been in effect since 1989. While the law is specific on requirements for the beneficiary deed, it is less clear on the process for accepting the real property rights conveyed. Section 461.062, however, offers some guidance.

Under the Nonprobate Transfers Law of Missouri, <b>grantee beneficiaries</b> who survive the deceased <b>owner</b> by at least 120 hours gain ownership of property designated as "transfer on death" by function of law, upon the <b>death of the owner</b> (461.042). There are two primary reasons to formalize this transfer of ownership, even though it is supposed to happen automatically.

First, it is always a good idea to record changes to the named owner of real estate, providing notice to the public that the former beneficiary now holds title to the land and keeping the ownership history up to date. This ownership history is called the chain of title. A clear chain of title (with no gaps or interruptions) makes property easier to sell by reducing the chances of unexpected claims from others trying to assert their ownership rights.

Then, by recording an affidavit asserting the new claim on the title, the beneficiary lets the local assessor or taxing agency know that, as the record owner of the unique parcel of land, he/she is now responsible for the property taxes. Land owners must remain current on property taxes or risk penalties such as fines, liens, and possibly losing the real estate in a tax sale, so it is essential that the tax statements arrive at the correct location.

The question arises, then, of exactly how to let the relevant <b>transferring entities</b> know about the owner's death. There is no statutory form or action required to effect the change, but 461.062 provides some guidance for written requests to formalize these transfers. For the most part, it involves recording an affidavit that includes the grantor owner and grantee beneficiary's information, recording details about the beneficiary deed, and specifics regarding shared ownership of the property. To support the affidavit, the claiming beneficiary must also include a copy of the recorded beneficiary deed and a death certificate for the owner as well as any deceased beneficiaries.

When presenting the affidavit and supporting documents for recording, be sure that they will update the tax records as well. If not, send a copy of the death certificate and the recorded beneficiary deed to the county assessor, too.

In short, by setting aside some time in the days following the death of the owner (preferably within the first six months) to complete and record a Missouri affidavit as to the death of grantor, the beneficiary protects his/her interest in the newly-acquired real estate, while limiting the likelihood of future problems with taxes or title.

IMPORTANT TERMS as defined in 461.005

A grantee beneficiary, also called simply a beneficiary is a person or persons designated or entitled to receive property pursuant to a nonprobate transfer on surviving one or more persons.

The death of the owner in the case of joint owners, means death of the last surviving owner.

The owner is a person or persons having a right, exercisable alone or with others, regardless of the terminology used to refer to the owner in any written beneficiary designation, to designate the beneficiary of a nonprobate transfer, and includes joint owners. The provisions of this subdivision shall apply to all beneficiary deeds executed and filed at any time, including, but not limited to, those executed and filed on or before August 28, 2005.

A transferring entity is a person who owes a debt or is obligated to pay money or benefits, render contract performance, deliver or convey property, or change the record of ownership of property on the books, records and accounts of an enterprise or on a certificate or document of title that evidences property rights, and includes any governmental agency, business entity or transfer agent that issues certificates of ownership or title to property and a person acting as a custodial agent for an owner's property.

(Missouri AOD Package includes form, guidelines, and completed example)

Our Promise

The documents you receive here will meet, or exceed, the Benton County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Benton County Affidavit as to Death of Grantor form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4447 Reviews )

Edward E.

December 22nd, 2024

Easy to use.

Your feedback is valuable to us and helps us improve. Thank you for sharing your thoughts!

MARISSA G.

December 22nd, 2024

I recomemed this webside

Thank you for your feedback. We really appreciate it. Have a great day!

Dennis F.

December 20th, 2024

The release of mortgage form was OK, and accepted at the recorder's office, but there were some problems. Many of the fields to type in were too small to accept the data, and I could not find a way to change the field size or use a smaller font. Otherwise I was satisfied.

Your feedback is a crucial part of our dedication to ongoing improvement. Thank you for your insightful comments.

Francine H.

April 18th, 2023

Somewhat confusing, but I'm really not sure what I need. I have not complete4d the document.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Kimberly H.

March 27th, 2020

Very fast and easy to use!

Thank you Kimberly. Have a fantastic day.

Clay H.

July 11th, 2022

The provided docs and guide were very helpful. Well worth the price in my opinion.

Thank you for your feedback. We really appreciate it. Have a great day!

James T.

July 12th, 2021

Very easy to use. Straightforward and informative

Thank you for your feedback. We really appreciate it. Have a great day!

Shonda S.

April 5th, 2023

This is my first time using the site for business and I must say this site made it so easy for me. I was so lost, thank you so much.

Thank you!

Tammy S.

October 6th, 2022

Easy to download, great guidelines, and samples of each form needed.

Thank you!

Ruby C.

April 27th, 2019

very easy to use this site as I live out of state.

Tanks Ruby, glad we could help.

Cameron M.

June 6th, 2023

This service is amazing. Always same day recording. Quick and easy. Thank you!

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

julie S.

June 24th, 2022

I love this company!! Excellent customer service and quick!! Thank you

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Evelyn R.

July 16th, 2020

Filing my deed through your service was great. All directions were clear and specific; it was very easy to upload the documents and most of all feedback from your office was professional and very timely. You service was excellent. Thank you!! Thank you so very much!!

Thank you for your feedback. We really appreciate it. Have a great day!

April K.

October 27th, 2020

Thank you so much! Quick and easy. Received it in under 5 minutes.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Debbie M.

July 3rd, 2020

The forms and instructions were easy to follow and get complete. It was very nice to be able to just find them, pay for them, and download them so that they were printed just within a matter of 30 minutes. Thank you

We appreciate your business and value your feedback. Thank you. Have a wonderful day!