Franklin County Trustee Deed for Sale of Foreclosed Property Form (Mississippi)

All Franklin County specific forms and documents listed below are included in your immediate download package:

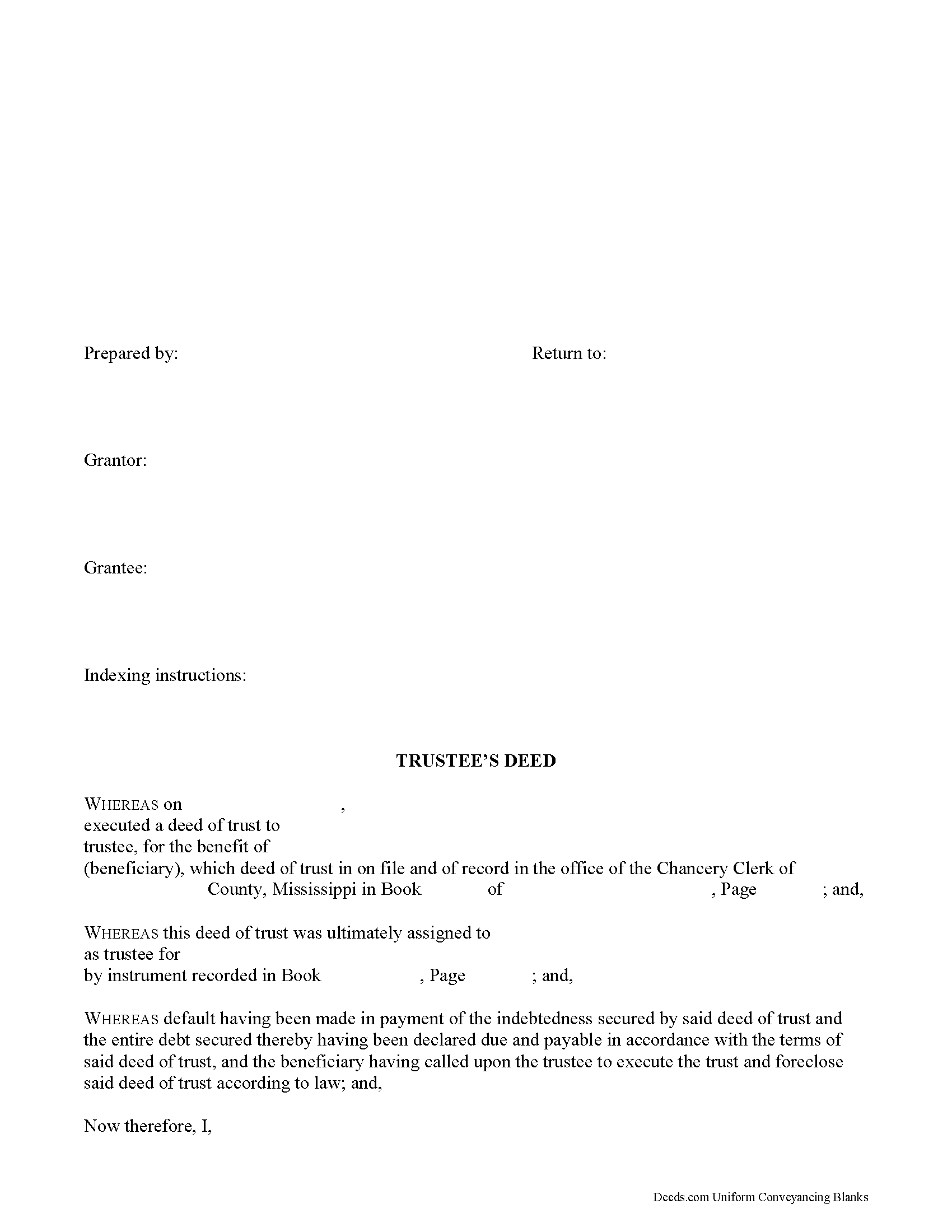

Trustee Deed Form

Fill in the blank form formatted to comply with all recording and content requirements.

Included Franklin County compliant document last validated/updated 11/26/2024

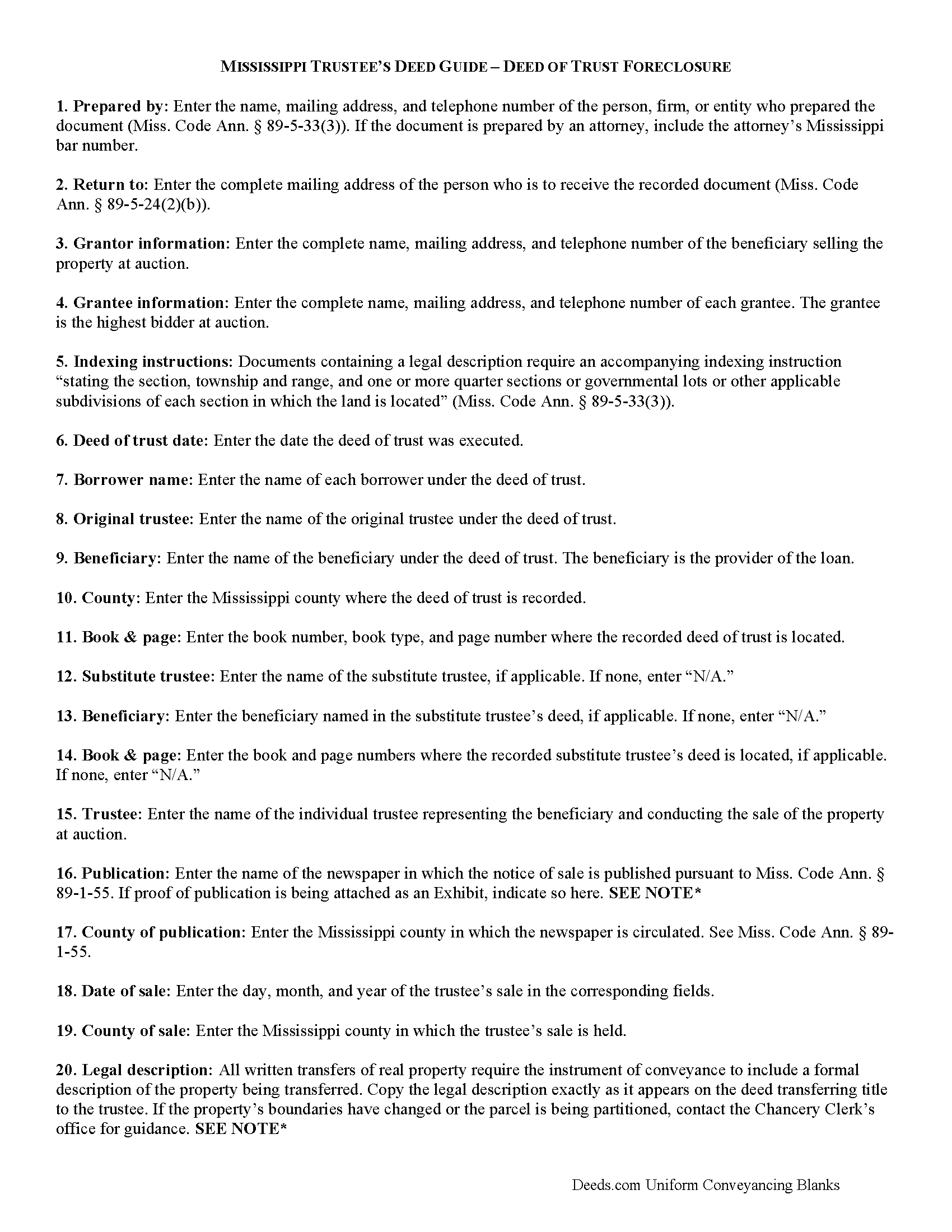

Trustee Deed Guide

Line by line guide explaining every blank on the form.

Included Franklin County compliant document last validated/updated 10/22/2024

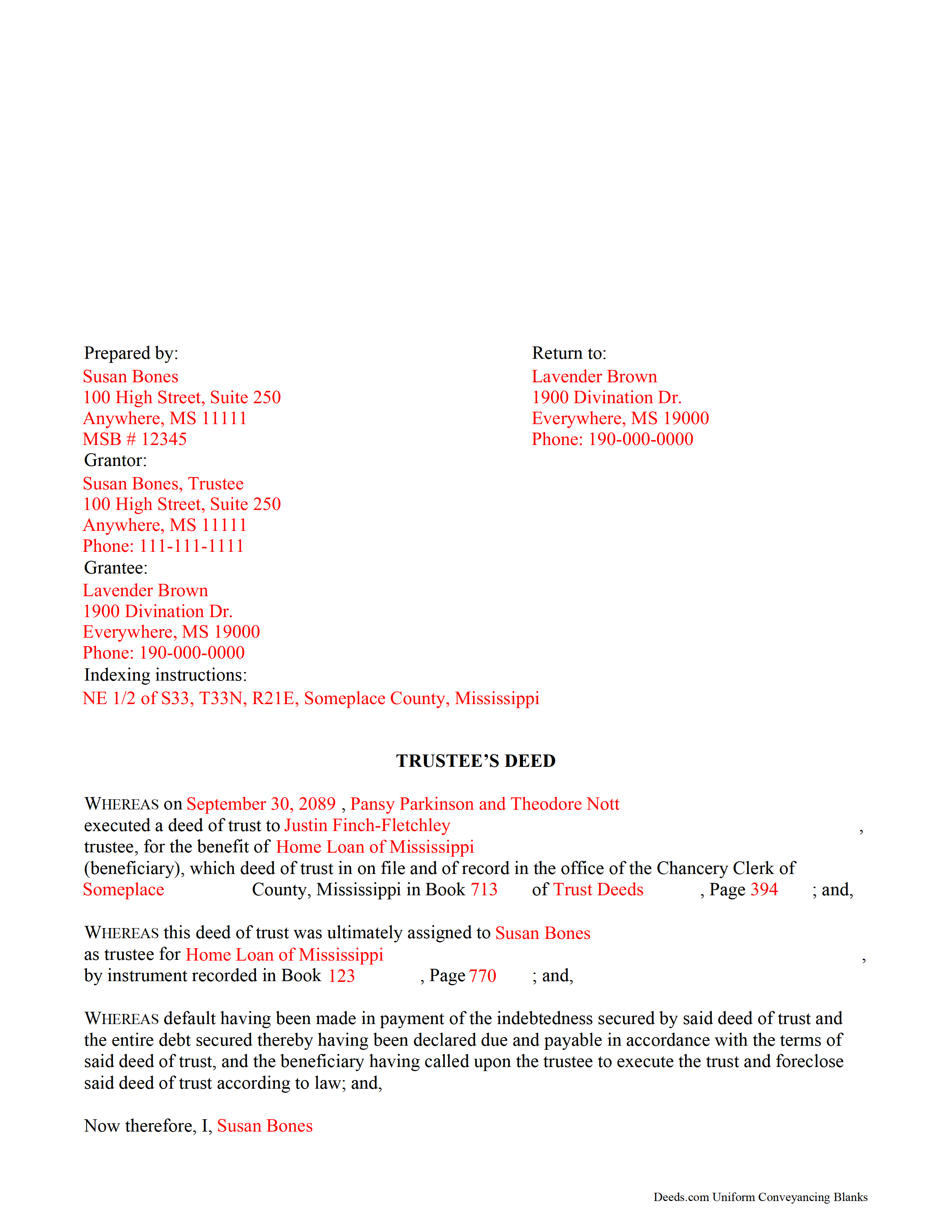

Completed Example of the Trustee Deed Document

Example of a properly completed form for reference.

Included Franklin County compliant document last validated/updated 9/13/2024

The following Mississippi and Franklin County supplemental forms are included as a courtesy with your order:

When using these Trustee Deed for Sale of Foreclosed Property forms, the subject real estate must be physically located in Franklin County. The executed documents should then be recorded in the following office:

Franklin County Chancery Clerk

36 Main St / PO Box 297, Meadville, Mississippi 39653

Hours: 8:00am to 5:00pm M-F

Phone: (601) 384-2330

Local jurisdictions located in Franklin County include:

- Bude

- Mc Call Creek

- Meadville

- Roxie

How long does it take to get my forms?

Forms are available immediately after submitting payment.

How do I get my forms, are they emailed?

Immediately after you submit payment, the Franklin County forms you order will be available for download directly from your account. You can then download the forms to your computer. If you do not already have an account, one will be created for you as part of the order process, and your login details will be provided to you. If you encounter any issues accessing your forms, please reach out to our support team for assistance. Forms are NOT emailed to you.

What does "validated/updated" mean?

This indicates the most recent date when at least one of the following occurred:

- Updated: The document was updated or changed to remain compliant.

- Validated: The document was examined by an attorney or staff, or it was successfully recorded in Franklin County using our eRecording service.

Are these forms guaranteed to be recordable in Franklin County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Franklin County including margin requirements, content requirements, font and font size requirements.

Can the Trustee Deed for Sale of Foreclosed Property forms be re-used?

Yes. You can re-use the forms for your personal use. For example, if you have more than one property in Franklin County that you need to transfer you would only need to order our forms once for all of your properties in Franklin County.

What are supplemental forms?

Often when a deed is recorded, additional documents are required by Mississippi or Franklin County. These could be tax related, informational, or even as simple as a coversheet. Supplemental forms are provided for free with your order where available.

What type of files are the forms?

All of our Franklin County Trustee Deed for Sale of Foreclosed Property forms are PDFs. You will need to have or get Adobe Reader to use our forms. Adobe Reader is free software that most computers already have installed.

Do I need any special software to use these forms?

You will need to have Adobe Reader installed on your computer to use our forms. Adobe Reader is free software that most computers already have installed.

Do I have to enter all of my property information online?

No. The blank forms are downloaded to your computer and you fill them out there, at your convenience.

Can I save the completed form, email it to someone?

Yes, you can save your deed form at any point with your information in it. The forms can also be emailed, blank or complete, as attachments.

Are there any recurring fees involved?

No. Nothing to cancel, no memberships, no recurring fees.

The trustee's deed is used to convey real property after foreclosure and sale under a deed of trust. It takes its name from the executing party rather than from the type of warranty the deed contains. After conducting a trustee's sale at public auction, the trustee uses the deed to vest title to the property in the name of the highest bidder.

A deed of trust (alternately called a trust deed or a deed in trust) is a variation of a mortgage whereby a trustee holds legal title to property as security for the repayment of a loan. The borrower, called the trustor or grantor, executes the deed of trust to the trustee for the benefit of the lender, called the beneficiary. The trustee is generally an agent of the beneficiary.

Upon fulfillment of the terms of the deed of trust, the trustee revests the legal title in the name of the borrower (Miss. Code Ann. 89-1-49(1)). If the borrower breaches the conditions of the deed of trust, the beneficiary can instruct the trustee to initiate foreclosure proceedings. In Mississippi, "any deed of trust...may confer on the trustee...the power of sale"; this power must be conferred upon the trustee in the deed of trust in order for him/her to act upon it (Miss. Code Ann. 89-1-63(2)).

Before the trustee can conduct a trustee's sale at public auction, preliminary requirements must be fulfilled under Mississippi law, including the publication of notice of sale in a local newspaper and posting of notice of sale at the county courthouse in the county where the subject property is located (Miss. Code Ann. 89-1-55). The deed then recites that the requirements for the posting of notice of sale under Miss. Code Ann. 89-1-55 have been met with proof of publication sometimes attached as an exhibit to the document.

Upon conclusion of the public auction, the trustee executes a trustee's deed to the highest and best bidder. The trustee conveys only such title as is vested in him/her as trustee under the deed of trust. The form's granting language contains implied covenants of seisin, against encumbrances (except for those named in the deed), and quiet enjoyment (Miss. Code Ann. 89-1-41).

Besides meeting the requirements of form and content for documents affecting real property in Mississippi, the trustee's deed requires the names of all parties to the deed of trust under which the property is being sold, as well as a reference to its place of recording (Miss. Code Ann. 89-1-53). If the trustee conducting the sale and executing the trustee's deed is a substitute trustee, the trustee's deed also requires a reference to the deed of substitution (same statute).

As with all conveyances in Mississippi, the deed requires a legal description of the property as well as indexing instructions. It should recite the name, address, telephone number, and bar number, if applicable, of the person who prepared the document. The trustee's signature must be witnessed in the presence of a notary public before submission for recording in the Office of the Chancery Clerk in the county in which the real property is located.

Consult a lawyer with any questions regarding trustee's deeds in Mississippi, as each situation is unique.

(Mississippi DFS Package includes form, guidelines, and completed example)

Our Promise

The documents you receive here will meet, or exceed, the Franklin County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Franklin County Trustee Deed for Sale of Foreclosed Property form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4447 Reviews )

Edward E.

December 22nd, 2024

Easy to use.

Your feedback is valuable to us and helps us improve. Thank you for sharing your thoughts!

MARISSA G.

December 22nd, 2024

I recomemed this webside

Thank you for your feedback. We really appreciate it. Have a great day!

Dennis F.

December 20th, 2024

The release of mortgage form was OK, and accepted at the recorder's office, but there were some problems. Many of the fields to type in were too small to accept the data, and I could not find a way to change the field size or use a smaller font. Otherwise I was satisfied.

Your feedback is a crucial part of our dedication to ongoing improvement. Thank you for your insightful comments.

Kenneth M.

August 2nd, 2019

It was adequate to serve my current need, however turned out to be more expensive than I cared for.

Thank you for your feedback. We really appreciate it. Have a great day!

Karl H.

January 5th, 2021

Still in process, but it is well explained. I would recommend it to anyone in Texas.

Thank you for your feedback. We really appreciate it. Have a great day!

Michael L. G.

October 1st, 2022

Thank you, Deed.com provided the needed forms to change county and state information after the passing of my father, saved me a trip to law office, especially after the lawyers would not return my calls, so I would recommend you check Deed.com for information, saved my family money for lawyer fees, would use Deed.com again. Mike

Thank you for your feedback. We really appreciate it. Have a great day!

sean m.

April 28th, 2021

Wow everything I need in one place... what a concept. thanks Deeds.com for the deeds, the guides and the transfer certificate all included for a great price

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Susan S.

April 4th, 2019

Very quick, easy and readily available forms. No wait, no advertisements, no pressure to purchase MORE. I expected to only get part of the information I needed, and for there to be a hidden cost to get the complete package, but surprisingly, I got immediate access to all the forms I ordered, AND THERE WERE NO ADDITIONAL HIDDEN COSTS! How refreshing!

Thank you Susan, we really appreciate your feedback.

Scott G.

June 4th, 2024

Frankly, if our tax dollars were being used to run government "services" correctly, we wouldn't need Deeds.comrnrnSince the sun will burn out before government is run correctly, Deeds.com provides an important, efficient, time-saving service that, all things considered, offers big savings over time-and-soul-draining struggles with government agencies.

Your feedback is greatly appreciated. Thank you for taking the time to share your experience!

Shannon D.

November 4th, 2020

Extremely easy site to use. We had our document e-recorded the same day and we didn't have to make a trip downtow!

Thank you!

STEPHEN C.

January 22nd, 2020

Excellent service. Easy to use. Thank you.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Anthony J S.

July 30th, 2022

It was nice to find a form to use for leaving my house without having my kids deal with Probate Court. The price was a lot cheaper than paying for a Lawyer to set up a transfer of ownership.

Thank you for your feedback. We really appreciate it. Have a great day!

Michael M.

February 20th, 2020

Thanks worked out great as the form was perfect and no problems filing it with the county.

Thank you for your feedback. We really appreciate it. Have a great day!

Joanne K.

July 16th, 2021

I haven't used the forms yet, but was at the county recorders office and they looked at it and said it looked fine. The instructions were easy to read and the forms easy to complete and save for a next time, if there is need.

Thank you for your feedback. We really appreciate it. Have a great day!

Ronald D.

July 15th, 2022

very quick and easy to find, confirm, pay, and download documents, well worth the money for peace of mind.

Thank you!