George County Revocable Transfer on Death Deed Form (Mississippi)

All George County specific forms and documents listed below are included in your immediate download package:

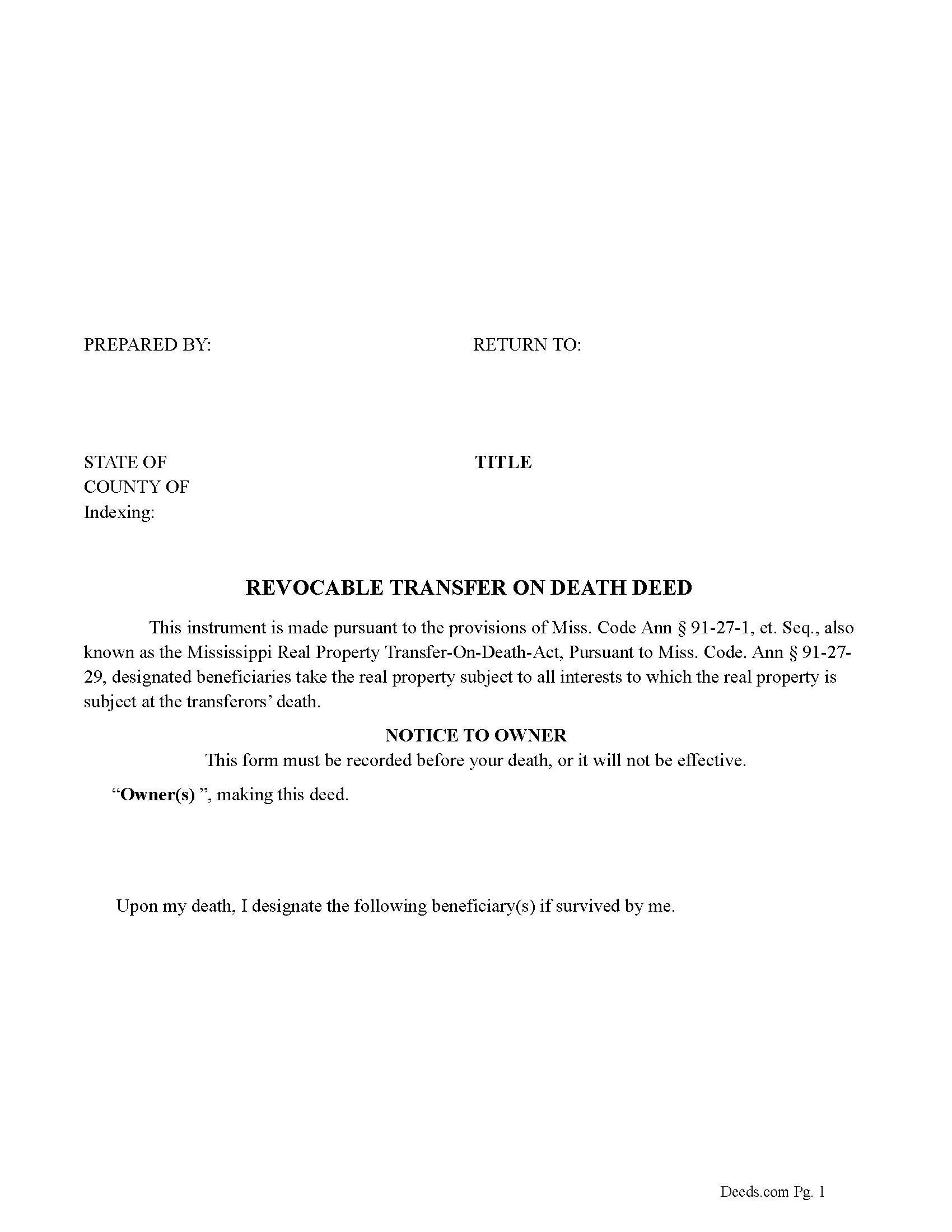

Revocable Transfer on Death Deed Form

Fill in the blank form formatted to comply with all recording and content requirements.

Included George County compliant document last validated/updated 7/1/2024

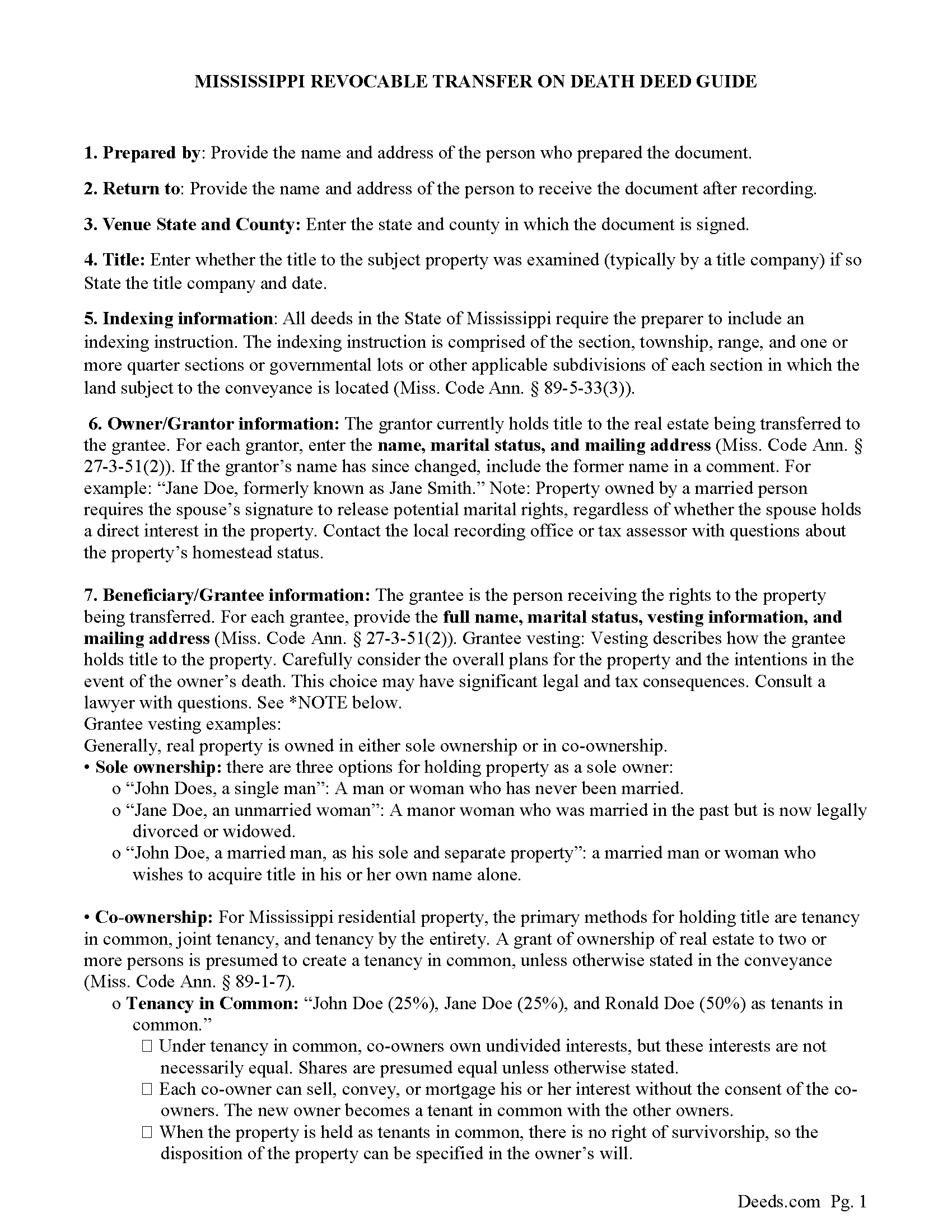

Revocable Transfer on Death Deed Guide

Line by line guide explaining every blank on the form.

Included George County compliant document last validated/updated 9/17/2024

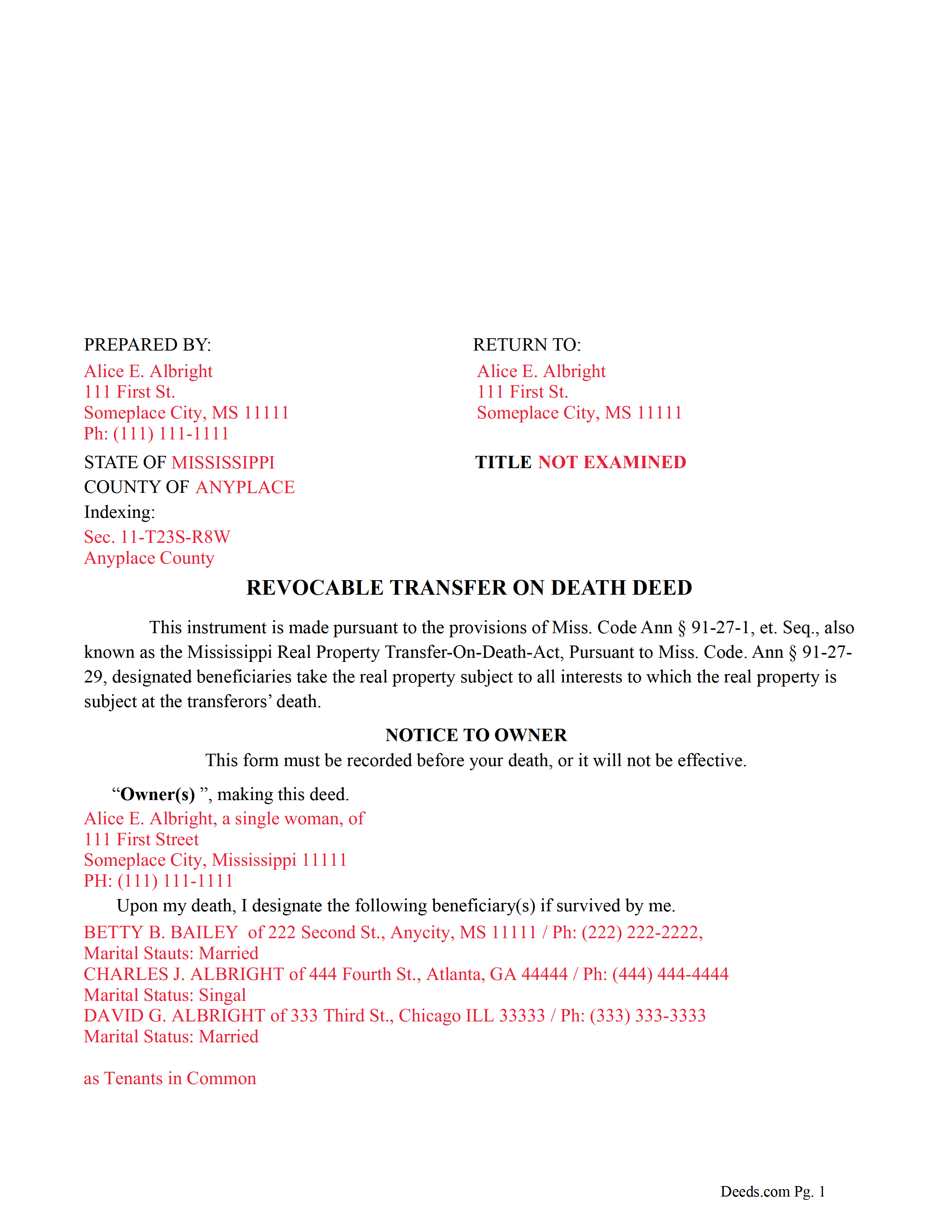

Completed Example of the Revocable Transfer on Death Deed Document

Example of a properly completed form for reference.

Included George County compliant document last validated/updated 10/11/2024

The following Mississippi and George County supplemental forms are included as a courtesy with your order:

When using these Revocable Transfer on Death Deed forms, the subject real estate must be physically located in George County. The executed documents should then be recorded in the following office:

George County Chancery Clerk

355 Cox St, Suite A, Lucedale, Mississippi 39452

Hours: 8:00am to 5:00pm M-F

Phone: (601) 947-4801

Local jurisdictions located in George County include:

- Lucedale

How long does it take to get my forms?

Forms are available immediately after submitting payment.

How do I get my forms, are they emailed?

Immediately after you submit payment, the George County forms you order will be available for download directly from your account. You can then download the forms to your computer. If you do not already have an account, one will be created for you as part of the order process, and your login details will be provided to you. If you encounter any issues accessing your forms, please reach out to our support team for assistance. Forms are NOT emailed to you.

What does "validated/updated" mean?

This indicates the most recent date when at least one of the following occurred:

- Updated: The document was updated or changed to remain compliant.

- Validated: The document was examined by an attorney or staff, or it was successfully recorded in George County using our eRecording service.

Are these forms guaranteed to be recordable in George County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by George County including margin requirements, content requirements, font and font size requirements.

Can the Revocable Transfer on Death Deed forms be re-used?

Yes. You can re-use the forms for your personal use. For example, if you have more than one property in George County that you need to transfer you would only need to order our forms once for all of your properties in George County.

What are supplemental forms?

Often when a deed is recorded, additional documents are required by Mississippi or George County. These could be tax related, informational, or even as simple as a coversheet. Supplemental forms are provided for free with your order where available.

What type of files are the forms?

All of our George County Revocable Transfer on Death Deed forms are PDFs. You will need to have or get Adobe Reader to use our forms. Adobe Reader is free software that most computers already have installed.

Do I need any special software to use these forms?

You will need to have Adobe Reader installed on your computer to use our forms. Adobe Reader is free software that most computers already have installed.

Do I have to enter all of my property information online?

No. The blank forms are downloaded to your computer and you fill them out there, at your convenience.

Can I save the completed form, email it to someone?

Yes, you can save your deed form at any point with your information in it. The forms can also be emailed, blank or complete, as attachments.

Are there any recurring fees involved?

No. Nothing to cancel, no memberships, no recurring fees.

On July 1, 2020, the "Mississippi Real Property Transfer on Death Act" became effective, allowing the owner/transferor the right to transfer his/her/their property rights upon the death of the transferor(s). {"Transferor" means an individual who makes a transfer-on-death deed.} The instrument used is a "Transfer on Death Deed" (TODD). The transferor(s) names a designated beneficiary(s)/transferee(s) who will receive the property upon the transferor's death. ["Beneficiary" means a person who receives real property under a transfer-on-death deed.] To be effective the TODD must be recorded before the transferor's death ({in the official records of the chancery clerk of the county where the real property is located)}. A TODD is unique in that it does NOT have to be delivered or accepted by the beneficiary(s). {Section 91-27-3 (g)} [Section 91-27-3(b)] ({Section 91-27-17(3)})

A TODD allows the transferor to keep possession of the subject property throughout his/her/their lifetime and is frequently used to bypass the probate process, thus saving time and money. A TODD may be revoked, by the transferor if the revocation is recorded before the death of the transferor.

Section 91-27-27 - Effect of transfer-on-death deed at transferor's death

On the death of the transferor, the following rules apply to an interest in real property that is the subject of a transfer-on-death deed and owned by the transferor at death except as otherwise provided: in the transfer-on-death deed; in this chapter; in Title 91, Chapter 29, Mississippi Code of 1972, relating to revocation by divorce; in Section 91-1-25 relating to the prohibition on inheriting from a person whom one has killed; in Title 91, Chapter 3, Mississippi Code of 1972, the Mississippi Uniform Simultaneous Death Act; and in Section 91-5-25 relating to the spousal right to renounce a will:

(1) If a transferor is a joint owner with right of survivorship who is survived by one or more other joint owners, the real property that is the subject of the transfer-on-death deed belongs to the surviving joint owner or owners. If a transferor is a joint owner with right of survivorship who is the last-surviving joint owner, the transfer-on-death deed is effective.

(2) The last-surviving joint owner may revoke the transfer-on-death deed subject to Section 91-27-19.

(3) A transfer-on-death deed transfers real property without covenant or warranty of title even if the deed contains a contrary provision.

(4) The interest in the property is transferred to a designated beneficiary in accordance with the deed, but the interest of a designated beneficiary is contingent on the designated beneficiary surviving the transferor. The interest of a designated beneficiary that fails to survive the transferor lapses.

(5) Concurrent interests are transferred to the beneficiaries in equal and undivided shares with no right of survivorship, but if the transferor has identified two (2) or more designated beneficiaries to receive concurrent interests in the property, the share of one which lapses or fails for any reason is transferred to the other, or to the others in proportion to the interest of each in the remaining part of the property held concurrently.

(Mississippi RTODD Package includes form, guidelines, and completed example) For use in Mississippi only.

Our Promise

The documents you receive here will meet, or exceed, the George County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your George County Revocable Transfer on Death Deed form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4434 Reviews )

James S.

November 21st, 2024

Forms used, created quitclaim deed that the county accepted without a second look (turns out they see deeds.com forms regularly via erecording and in person). Will be back for any real estate related forms I need and they carry. Will always be my first stop. Also, will use erecording next time, mad I didn't see it this time.

Thanks for the kind words James, glad we could help. Look forward to seeing you again.

Thomas G.

November 21st, 2024

Wasn’t what I expected

Sorry to hear that your expectations were missed. Your order has been canceled. We do hope that you find something more suitable to your expectations elsewhere. Do keep in mind that purchasing legal forms should not be an exploratory endeavor.

Jimmy P.

November 20th, 2024

They sent me everything I would need to do this. Easy purchase -Easy download. Great!! I'll be back here for all my document needs.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Shonda S.

April 5th, 2023

This is my first time using the site for business and I must say this site made it so easy for me. I was so lost, thank you so much.

Thank you!

lamar J.

January 18th, 2021

Easy to understand and work with

Very pleased with the information I

Received

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Lorrie P.

January 8th, 2021

What a wonderful and easy task using deeds.com. I searched on line for the proper procedure to file a quit claim deed. It looked to confusing to do mysellf until I found deeds.com. With their instructions, I was able to fill out all the proper forms and file with the court in two days. Saved me at least a thousand dollars if I had an attorney do the same. Thank you. I will definitely use them again.

Thank you for your feedback. We really appreciate it. Have a great day!

Brett B.

July 12th, 2022

easy to use

Thank you!

Ralph O.

September 16th, 2024

The experience has been excellent. The site gave me exactly what I was looking for. The documentation we easy to understand.

We are grateful for your feedback and looking forward to serving you again. Thank you!

Patricia D.

January 22nd, 2019

It worked great- I had a little trouble at first with the site, figuring out where to do what, but the form was much better than the one we purchased at Staples, loved being able to fill out with the computer. We did need the other form as per the screen prior to ordering but couldn't figure out which one. The ladies at the recorders were great too.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

John H.

September 16th, 2022

Response was timely, even though unsuccessful in locating a requested deed. Deeds very courteously and professionally cancelled my order and cancelled its charge to my credit card.

Thank you for your feedback. We really appreciate it. Have a great day!

Mary H.

July 27th, 2022

Great source for forms acceptable to the county.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

barbara s.

June 3rd, 2020

I was in a rush to record a quit claim deed, however due to covid 19 Miami dade county recorders office are not open to public. According to staff I would have to mail in the quit claim deed and wait approximately two weeks for the deed to get recorded. Thanks to Deeds.com I got my document recorded in less than one day. You guys are awesome, I will use this company anytime I need something like this again. Very reliable.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Rebecca M.

December 28th, 2023

Great service! fast turnaround! I’ve used Deeds.com multiple times, and the software interface is easy to use. I was able to get Deeds for Nevada re-recorded (errors on my lawyers part), quickly with Deeds.com support. Thanks Deeds.com!!

It was a pleasure serving you. Thank you for the positive feedback!

james h.

June 15th, 2020

Service was quick and easy to use. I got not only the necessary forms, but instructions and sample forms filled out. Highly recommended.

Thank you!

Roxanne C.

October 18th, 2021

I love that this service is available. Uploading my document took no time at all. I love that we have an option of upload our documentsinsread of going in to file.

Thank you for your feedback. We really appreciate it. Have a great day!