Scott County Quitclaim Deed Reserving Life Estate Form (Mississippi)

All Scott County specific forms and documents listed below are included in your immediate download package:

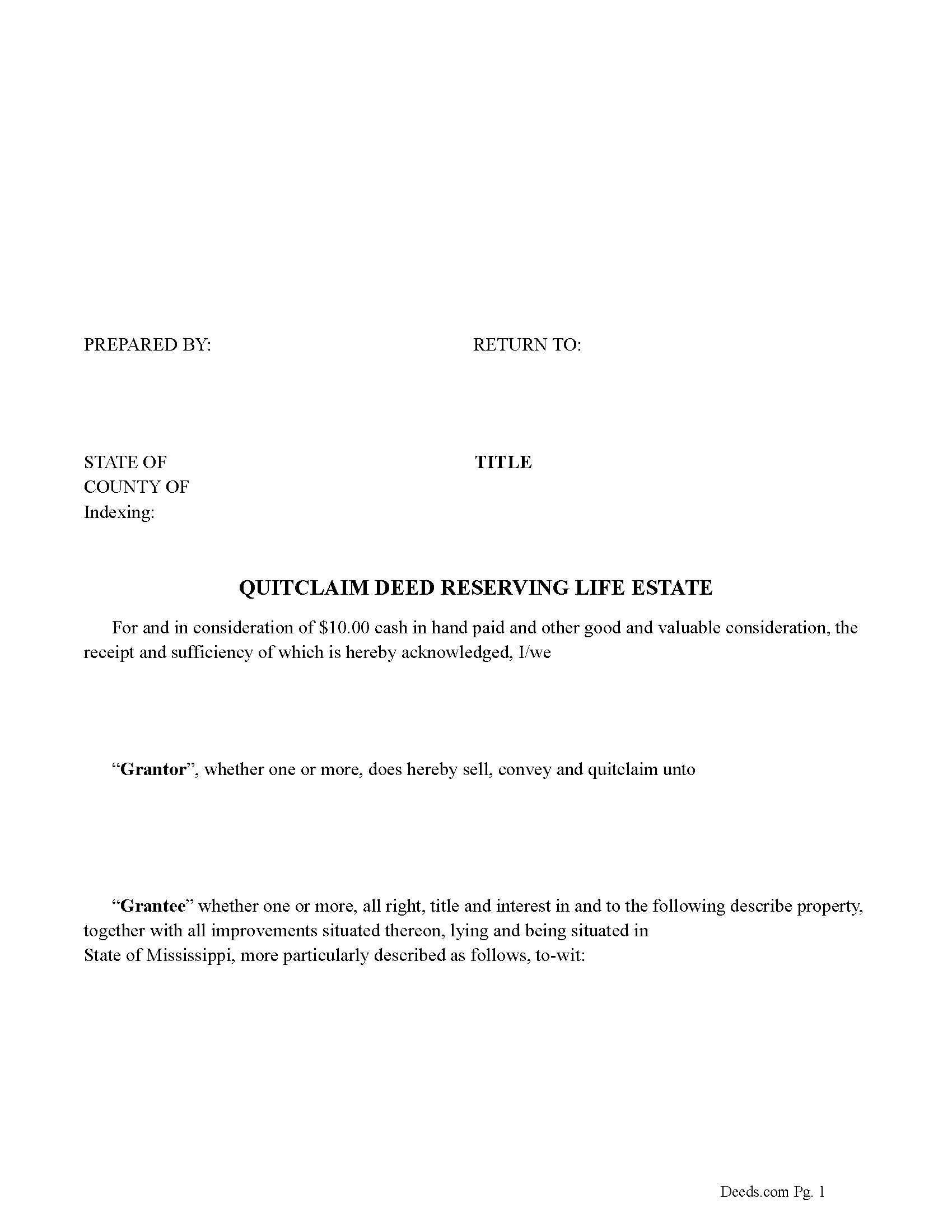

Quitclaim Deed Reserving Life Estate Form

Fill in the blank Quitclaim Deed Reserving Life Estate form formatted to comply with all Mississippi recording and content requirements.

Included Scott County compliant document last validated/updated 12/16/2024

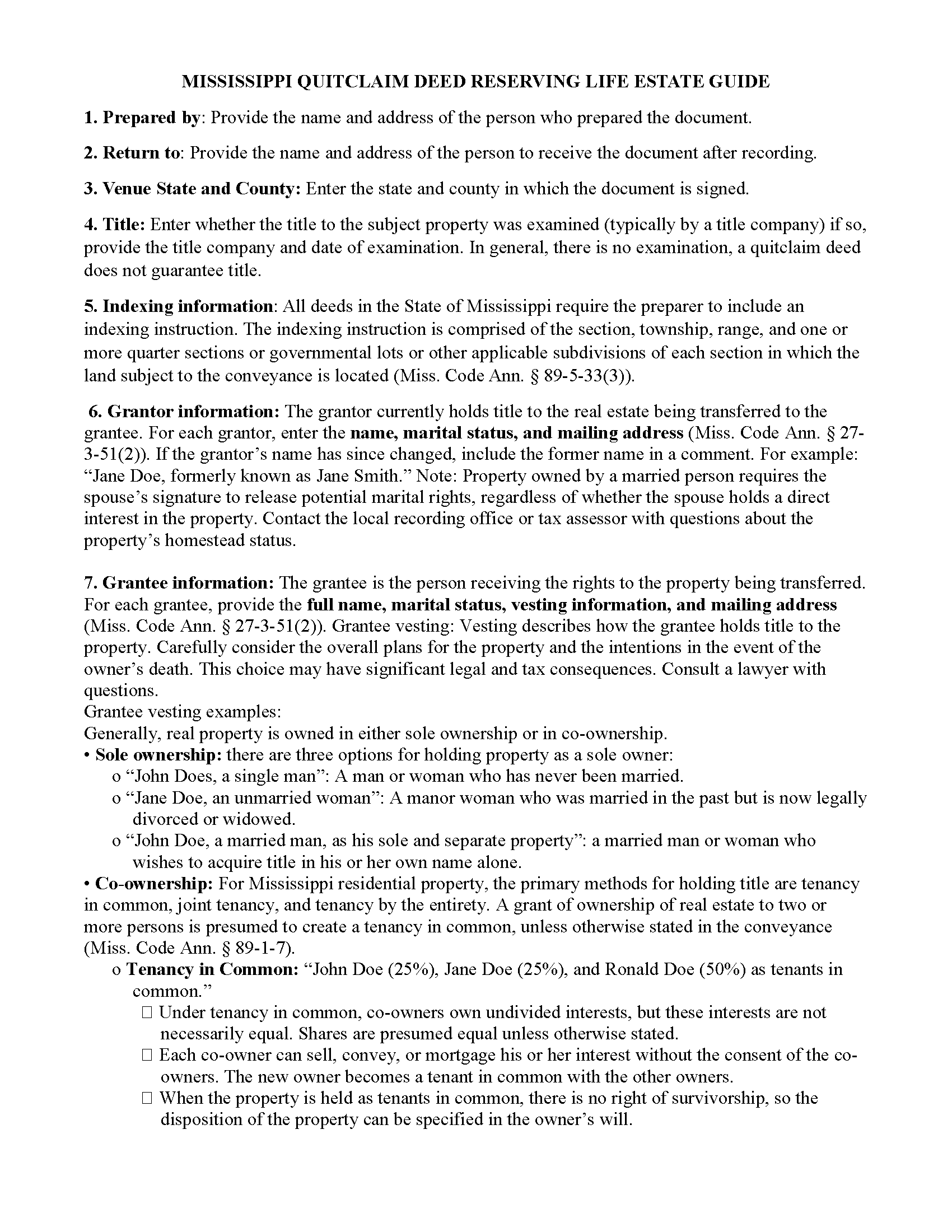

Quitclaim Deed Reserving Life Estate Guide

Line by line guide explaining every blank on the Quitclaim Deed Reserving Life Estate form.

Included Scott County compliant document last validated/updated 10/2/2024

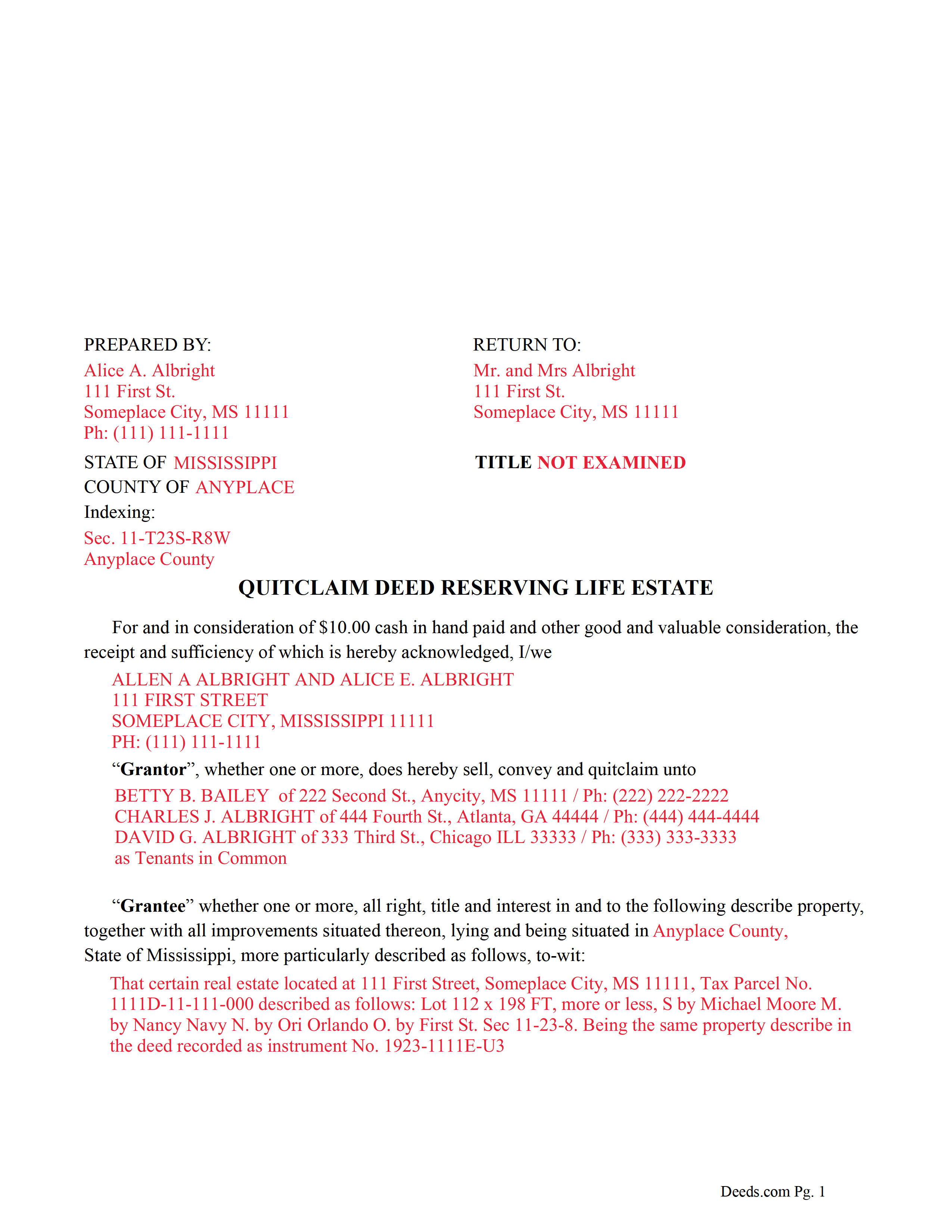

Completed Example of the Quitclaim Deed Reserving Life Estate Document

Example of a properly completed Mississippi Quitclaim Deed Reserving Life Estate document for reference.

Included Scott County compliant document last validated/updated 12/23/2024

The following Mississippi and Scott County supplemental forms are included as a courtesy with your order:

When using these Quitclaim Deed Reserving Life Estate forms, the subject real estate must be physically located in Scott County. The executed documents should then be recorded in the following office:

Scott County Chancery Clerk

100 E Main St / PO Box 630, Forest, Mississippi 39074

Hours: 8:30 to 4:30 M-F

Phone: (601) 469-1922

Local jurisdictions located in Scott County include:

- Forest

- Harperville

- Hillsboro

- Lake

- Ludlow

- Morton

- Pulaski

- Sebastopol

How long does it take to get my forms?

Forms are available immediately after submitting payment.

How do I get my forms, are they emailed?

Immediately after you submit payment, the Scott County forms you order will be available for download directly from your account. You can then download the forms to your computer. If you do not already have an account, one will be created for you as part of the order process, and your login details will be provided to you. If you encounter any issues accessing your forms, please reach out to our support team for assistance. Forms are NOT emailed to you.

What does "validated/updated" mean?

This indicates the most recent date when at least one of the following occurred:

- Updated: The document was updated or changed to remain compliant.

- Validated: The document was examined by an attorney or staff, or it was successfully recorded in Scott County using our eRecording service.

Are these forms guaranteed to be recordable in Scott County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Scott County including margin requirements, content requirements, font and font size requirements.

Can the Quitclaim Deed Reserving Life Estate forms be re-used?

Yes. You can re-use the forms for your personal use. For example, if you have more than one property in Scott County that you need to transfer you would only need to order our forms once for all of your properties in Scott County.

What are supplemental forms?

Often when a deed is recorded, additional documents are required by Mississippi or Scott County. These could be tax related, informational, or even as simple as a coversheet. Supplemental forms are provided for free with your order where available.

What type of files are the forms?

All of our Scott County Quitclaim Deed Reserving Life Estate forms are PDFs. You will need to have or get Adobe Reader to use our forms. Adobe Reader is free software that most computers already have installed.

Do I need any special software to use these forms?

You will need to have Adobe Reader installed on your computer to use our forms. Adobe Reader is free software that most computers already have installed.

Do I have to enter all of my property information online?

No. The blank forms are downloaded to your computer and you fill them out there, at your convenience.

Can I save the completed form, email it to someone?

Yes, you can save your deed form at any point with your information in it. The forms can also be emailed, blank or complete, as attachments.

Are there any recurring fees involved?

No. Nothing to cancel, no memberships, no recurring fees.

A Mississippi quitclaim deed reserving a life estate is a legal document used to transfer property ownership while allowing the grantor (the person selling or giving the property) to retain possession and use of the property for the duration of their life. This type of deed offers both an immediate transfer of the property's title and a mechanism for ensuring that the grantor can live on or use the property until their passing.

89-1-37. Effect of a conveyance without warranty. A conveyance without any warranty shall operate to transfer the title and possession of the grantor as a quitclaim and release.

Reservation of Life Estate: This section specifically states that the grantor is reserving a life estate in the property. By doing so, the grantor retains the right to possess, use, and obtain any profits from the property for the duration of their life. Upon the grantor's death, the life estate automatically terminates, and the grantee possesses the property in full, without any further legal action.

Estate Planning: One of the primary uses of a quitclaim deed reserving a life estate is in estate planning. It allows individuals to ensure that their heirs or chosen beneficiaries receive the property upon their death while retaining the ability to live on or use the property during their lifetime.

Avoiding Probate: By using a quitclaim deed with a life estate reservation, the property will automatically pass to the grantee upon the death of the grantor, often avoiding the need for probate.

89-1-39. Effect of quitclaim and release. A conveyance of quitclaim and release shall be sufficient to pass all the estate or interest the grantor has in the land conveyed, and shall estop the grantor and his heirs from asserting a subsequently acquired adverse title to the lands conveyed.

Protection for the Grantor: Since the grantor retains a life estate, they can continue to live on the property and cannot be forced off by the grantee or any subsequent owner. The grantee cannot sell, mortgage, or otherwise encumber the property in a way that would affect the grantor's life estate.

Tax Implications: There may be tax implications related to transferring property with a reserved life estate, both in terms of gift taxes and potential capital gains taxes. It's essential for individuals considering this option to consult with tax professionals and estate planners.

In summary, a Mississippi quitclaim deed reserving a life estate offers a flexible tool for estate planning, allowing property owners to pass on their property to chosen beneficiaries while retaining rights to the property during their lifetime.

(Mississippi QCD Reserving LE Package includes form, guidelines, and completed example) For use in Mississippi only.

Our Promise

The documents you receive here will meet, or exceed, the Scott County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Scott County Quitclaim Deed Reserving Life Estate form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4449 Reviews )

Daniel B.

December 24th, 2024

easy to use and upload.

We are delighted to have been of service. Thank you for the positive review!

Dorothy N.

December 22nd, 2024

The mortgage and note were thorough and very satisfactory for my purposes. The accompanying forms were excellent. I am very pleased with my purchase.

We welcome your positive feedback and are thrilled to have met your expectations. Thank you for choosing our services.

Edward E.

December 22nd, 2024

Easy to use.

Your feedback is valuable to us and helps us improve. Thank you for sharing your thoughts!

chris m.

March 10th, 2022

Was warned by attorney that forms from internet have lots of mistakes. But after looking all over, took a chance on here. So far, I am satisfied, and actually happy that I got something that (I believe) meets my state and local requirements. Haven't filed the deed yet, or had to put it into effect, but being able to pick the local area, and have the relevant state law listed on the deed, gives me confidence. Also, got the whole package of possibly relevant forms, and a very good guide how to prep the deed with a sample completed deed - greatly appreciated!

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Alan E.

August 11th, 2021

I couldn't be happier with this service. They're helpful, quick and thorough. They make filing government documents very easy.

Thank you for your feedback. We really appreciate it. Have a great day!

Timothy G.

August 1st, 2020

Easy peezy.

Thank you!

Shirley B.

July 9th, 2019

Very convenient, glad I discovered this website.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Dakota H.

December 19th, 2021

Brilliant idea. Beats working with an attorney who charges $250+ per hour. Thanks.

Thank you!

Nina F.

September 23rd, 2020

My experience could not have been better. Easy to communicate with, even though I'm largely ignorant of technical problem-solving. I may be addle-minded with 83 years on earth, but I think they actually cared about solving my problem and were sorry it was beyond their territory. Truly extra nice.

Thank you for your feedback. We really appreciate it. Have a great day!

Larry A.

December 17th, 2021

Provided exactly the form I was looking for at a reasonable price. Easy to do as well.

Thank you!

Laureen M.

November 5th, 2020

This service was extremely helpful. I truly appreciated the way I was communicated with every step of the way in getting my Deed recorded.

Thank you!

Jimmy W.

November 1st, 2024

Very thorough with plenty of instructions. Nice to be able to fill in the forms on my computer at my own pace and edit if needed. Jim

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Jan O.

April 22nd, 2021

This was so easy and just what I needed.

Thank you for your feedback. We really appreciate it. Have a great day!

Nora B.

April 15th, 2019

VERY NICE SERVICE

Thank you for your feedback. We really appreciate it. Have a great day!

Michael M.

June 16th, 2021

THE PROCESS WENT VERY SMOOTH AND EASY

Thank you for your feedback. We really appreciate it. Have a great day!