Newton County Certificate of Trust Form (Mississippi)

All Newton County specific forms and documents listed below are included in your immediate download package:

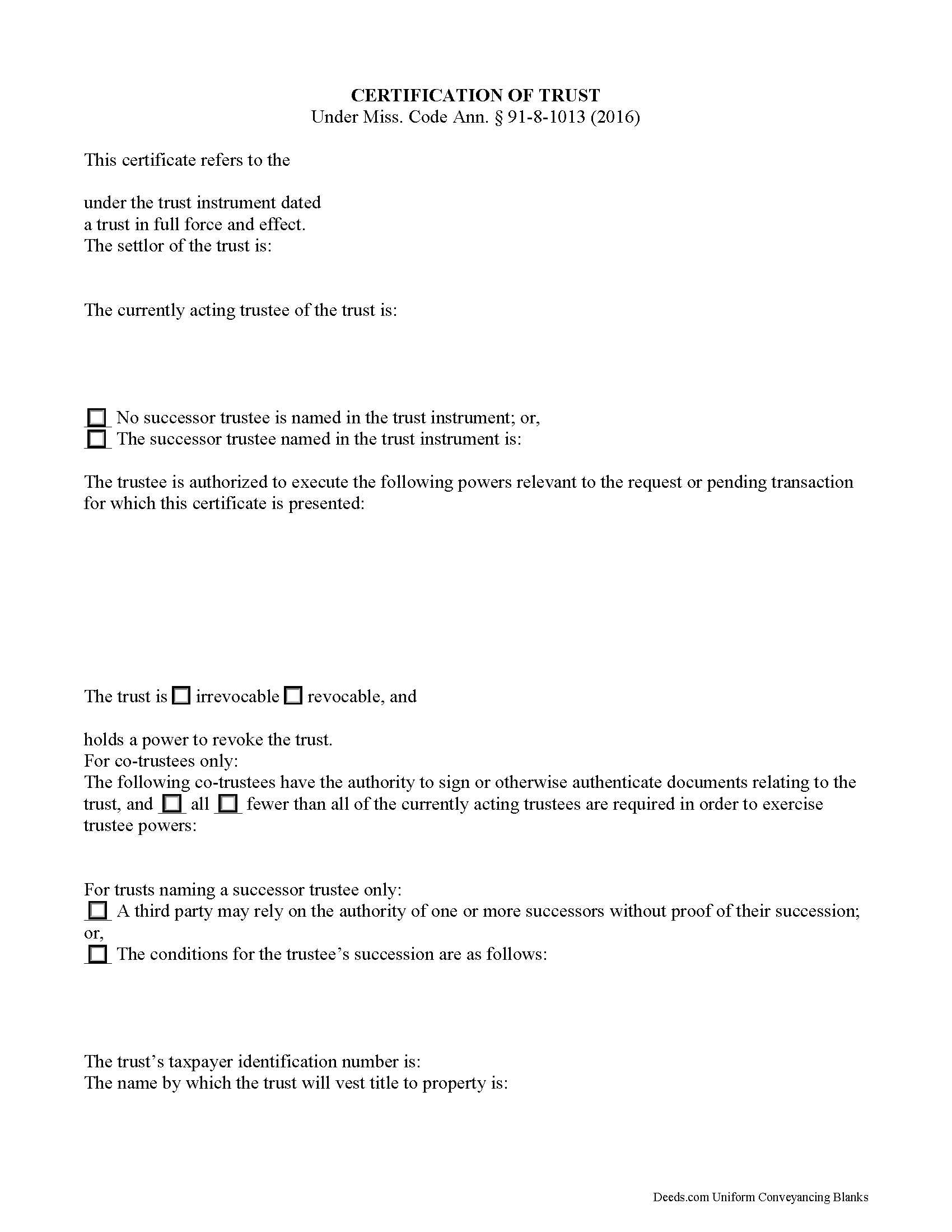

Certificate of Trust Form

Fill in the blank form formatted to comply with all recording and content requirements.

Included Newton County compliant document last validated/updated 11/8/2024

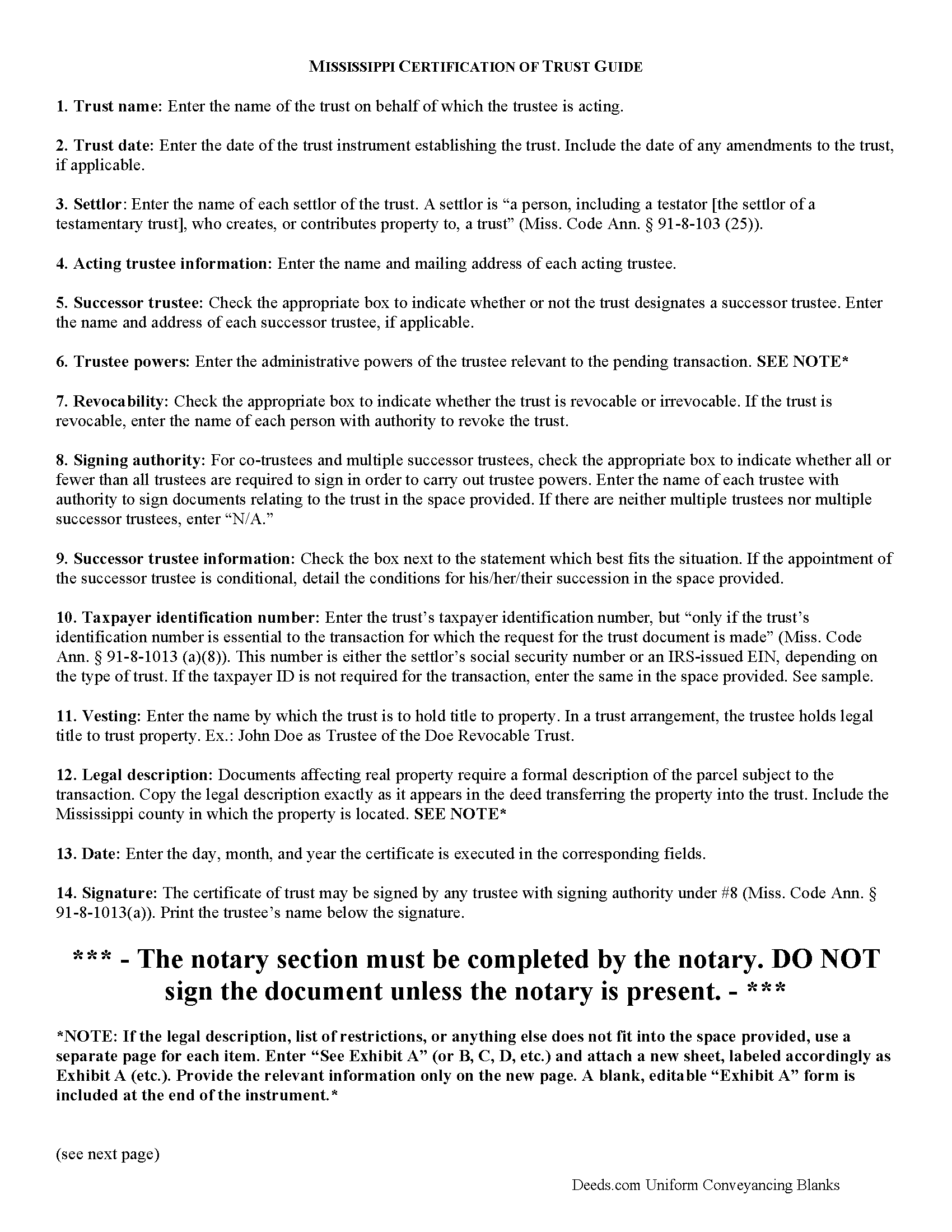

Certificate of Trust Guide

Line by line guide explaining every blank on the form.

Included Newton County compliant document last validated/updated 8/27/2024

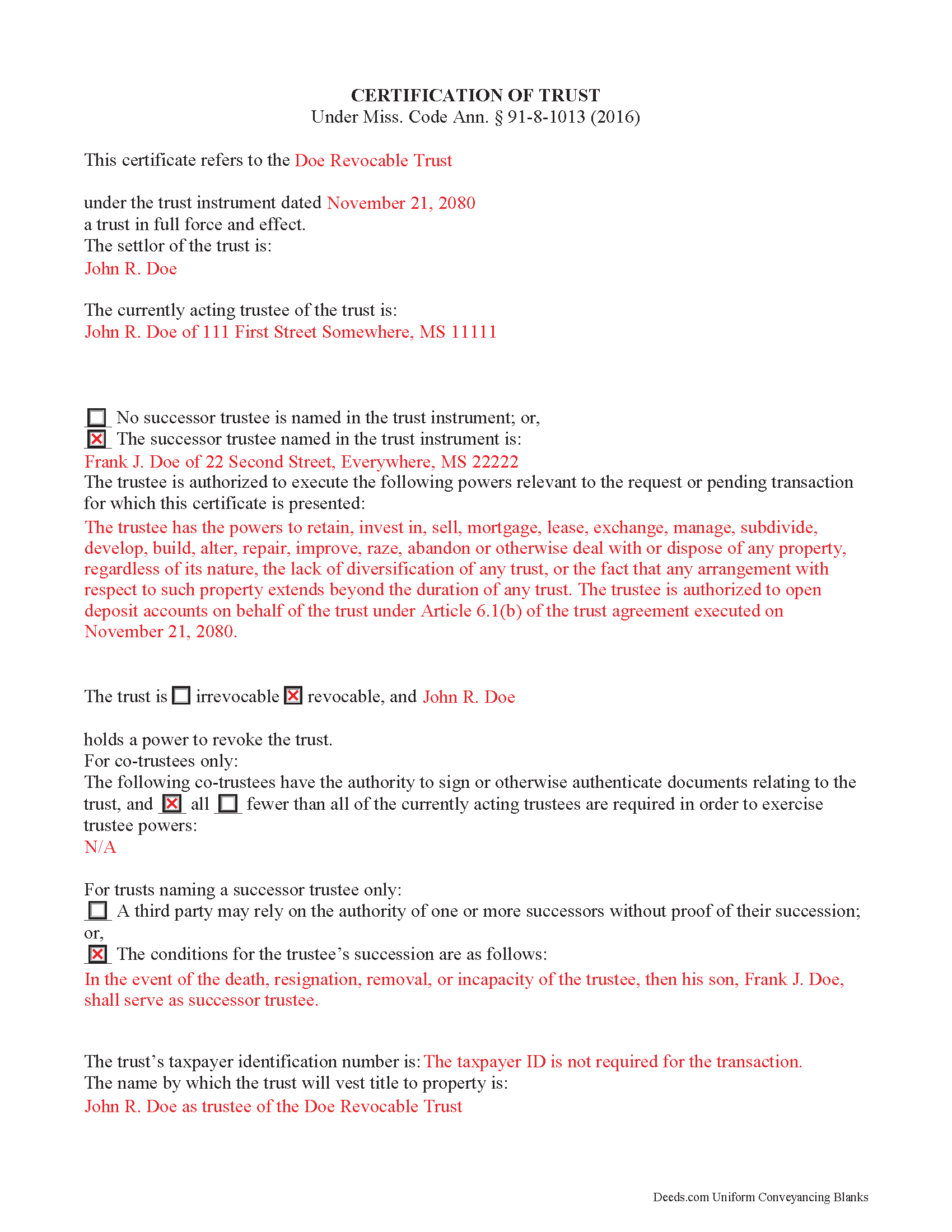

Completed Example of the Certificate of Trust Document

Example of a properly completed form for reference.

Included Newton County compliant document last validated/updated 12/11/2024

The following Mississippi and Newton County supplemental forms are included as a courtesy with your order:

When using these Certificate of Trust forms, the subject real estate must be physically located in Newton County. The executed documents should then be recorded in the following office:

Newton County Chancery Clerk

92 West Broad St / PO Box 68, Decatur, Mississippi 39327

Hours: 8:00 to 5:00 M-F

Phone: (601) 635-2367

Local jurisdictions located in Newton County include:

- Chunky

- Conehatta

- Decatur

- Hickory

- Lawrence

- Little Rock

- Newton

How long does it take to get my forms?

Forms are available immediately after submitting payment.

How do I get my forms, are they emailed?

Immediately after you submit payment, the Newton County forms you order will be available for download directly from your account. You can then download the forms to your computer. If you do not already have an account, one will be created for you as part of the order process, and your login details will be provided to you. If you encounter any issues accessing your forms, please reach out to our support team for assistance. Forms are NOT emailed to you.

What does "validated/updated" mean?

This indicates the most recent date when at least one of the following occurred:

- Updated: The document was updated or changed to remain compliant.

- Validated: The document was examined by an attorney or staff, or it was successfully recorded in Newton County using our eRecording service.

Are these forms guaranteed to be recordable in Newton County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Newton County including margin requirements, content requirements, font and font size requirements.

Can the Certificate of Trust forms be re-used?

Yes. You can re-use the forms for your personal use. For example, if you have more than one property in Newton County that you need to transfer you would only need to order our forms once for all of your properties in Newton County.

What are supplemental forms?

Often when a deed is recorded, additional documents are required by Mississippi or Newton County. These could be tax related, informational, or even as simple as a coversheet. Supplemental forms are provided for free with your order where available.

What type of files are the forms?

All of our Newton County Certificate of Trust forms are PDFs. You will need to have or get Adobe Reader to use our forms. Adobe Reader is free software that most computers already have installed.

Do I need any special software to use these forms?

You will need to have Adobe Reader installed on your computer to use our forms. Adobe Reader is free software that most computers already have installed.

Do I have to enter all of my property information online?

No. The blank forms are downloaded to your computer and you fill them out there, at your convenience.

Can I save the completed form, email it to someone?

Yes, you can save your deed form at any point with your information in it. The forms can also be emailed, blank or complete, as attachments.

Are there any recurring fees involved?

No. Nothing to cancel, no memberships, no recurring fees.

Using a Certification of Trust in Mississippi

The certificate of trust is codified under the Mississippi Trust Code at Miss. Code Ann. 91-8-1013. This certified document is an abstract of the trust instrument, a generally unrecorded document executed by a settlor and containing the trust's full provisions.

A trustee presents the certification of trust when entering into transactions with persons other than trust beneficiaries. It offers proof that the trust exists and the trustee has the authority to enter into the transaction on behalf of the trust. The section of the Mississippi Code covering the certification of trust offers protection to parties dealing with trustees, even if they fail to request a trust certificate (Miss. Code Ann. 91-8-1013(e)).

In a trust arrangement, a trustee administers a trust estate transferred to the trust by a settlor, for the benefit of a third person or party, called the beneficiary. When the trustee conducts business with someone outside of the trust relationship, the certification of trust allows the trustee to maintain the trust's privacy; the identity of trust beneficiaries, the disclosure of which is not essential to the transaction, remains undisclosed.

The form requires a statement of affirmation that the trust exists and the date of its formation. The document includes the trust's identification number only "if it is essential to the transaction for which the request for the trust document is made" (Miss. Code Ann. 91-8-1013(a)(8)). It discloses the trust's settlor, acting trustee, and anyone with a power to revoke the trust, if applicable. The document provides the name of any successor trustee with either a description of the conditions for his succession, or a statement that the recipient may rely on the authority of successor trustee without proof of succession.

Certificates for trusts with multiple trustees include a section that names all trustees who have signing power under the trust, and identifies whether or not all of them are needed in order to conduct trustee powers.

Because the certificate is presented pursuant to a specific transaction, the form requires a description of the trustee's managerial powers relevant to the request. When the certificate affects real property, the document provides the legal description of the parcel or parcels subject to the transaction. It also describes the name by which the trust will hold title to (vest) property.

Any acting trustee with signing authority as cited in the body of the instrument can sign the certificate in the presence of a notary public. The trustee certifies "that ... the trust has not been revoked, modified, or amended in any manner that would cause the representations contained in the certification of trust to be incorrect" (Miss. Code Ann. 91-8-1013(a)(10)). All statements in the certification of trust are deemed correct, and a recipient is not liable for acting on the information contained within (Miss. Code Ann. 91-8-1013(d)).

Recipients presented with a certificate may ask the trustee for additional information to clarify any ambiguities in the certificate (Miss. Code Ann. 91-8-1013(f)). Trustees, of their own accord, may provide copies of portions of the trust instrument and/or trust amendments, but are not required to do so (Miss. Code Ann. 91-8-1013(c)).

Trust law can be complicated, so contact an attorney with questions about using a certificate of trust or trusts in Mississippi.

(Mississippi COT Package includes form, guidelines, and completed example)

Our Promise

The documents you receive here will meet, or exceed, the Newton County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Newton County Certificate of Trust form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4447 Reviews )

Edward E.

December 22nd, 2024

Easy to use.

Your feedback is valuable to us and helps us improve. Thank you for sharing your thoughts!

MARISSA G.

December 22nd, 2024

I recomemed this webside

Thank you for your feedback. We really appreciate it. Have a great day!

Dennis F.

December 20th, 2024

The release of mortgage form was OK, and accepted at the recorder's office, but there were some problems. Many of the fields to type in were too small to accept the data, and I could not find a way to change the field size or use a smaller font. Otherwise I was satisfied.

Your feedback is a crucial part of our dedication to ongoing improvement. Thank you for your insightful comments.

Kevin M.

December 3rd, 2021

My first time using Deeds.com and I am impressed how much you offer and how easy it is to use this site. Had the real-estate forms I needed plus a bonus of how to fill them out. Best value on the internet for real-estate forms and information.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

MARILYN T.

January 8th, 2021

Deed.com was so easy to use to file my Quit Claim deed. They instructed me on how to send them my documents and it was a breeze. The cost was minimal and saved me tons of time.

Thank you!

Robert T.

January 2nd, 2019

Perfect. Downloaded the forms with no issues, filled them out, had them notarized and recorded all in just a few hours (most of that time was spent at the recorder's office). Highly recommend.

Thank you for your feedback. We really appreciate it. Have a great day!

Thomas D.

April 30th, 2020

The documents themselves are fine and the information provided with them is helpful. I find the actual processing of the documents, however, to be difficult particularly once the document has been saved. First, I note that the box for the date only allows entry of the last 2 digits of the year. Unfortunately, my download only allows me to enter one of the 2 digits required. When I delete it repeatedly, it eventually allows both digits to be entered but puts them in extremely small text and in superscrypt. I have not found a solution to this problem and am not sure the deed can even be recorded with this problem.

Another problem is that if you try to revise the document after you have saved it the curser goes to the end of the line after each key entry. This means that there basically is no way to efficiently save the document for reworking later since you will have to delete everything you have entered in the text box unless you only need to make a single keystroke change or are willing to replace the curser after each entry. Try that with a long property description!

Please note that I am using a Mac to prepare my documents and perhaps this is part of an "incompatibility problem". However, I didn't see a disclaimer regarding Mac use and so would expect the documents to perform correctly. Overall, I give the program a "2 star" rating because I am experiencing significant difficulties in entering dates in the documents even before saving them and because saving your work for later revision appears to be basically unworkable.

Thank you for your feedback Thomas, we appreciate you being specific about the issues you encountered. Adobe and Mac have a fairly long history of issues working together.

Betty M.

December 24th, 2020

Glad to find the Easement Forms for Halifax County, NC online. Thanks

Thank you for your feedback. We really appreciate it. Have a great day!

Molly S.

November 13th, 2020

I used deeds.com to record a deed because the recording office closed due to Covid 19.

It was easy to sign up and upload the documents I needed recorded and within 24 hours possibly even less, the deeds were recorded. I am very happy with the service and the $15 fee was affordable and worth every penny to get it done so quickly.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Jane N.

March 7th, 2019

This worked. Saved me a trip to get a copy of a deed. Cost less than the parking fee. Very convenient.

Thank you for your feedback. We really appreciate it. Have a great day!

William S C.

June 11th, 2021

The Lady Bird Deed appears to be fine with me as are the instructions. However, there apparently are no specific laws in Texas addressing them other than they are OK. The problem is that lenders are surely going to use them as triggers for their due on sale clauses, especially as the current small mortgage rates begin to increase. The solution to that seems to be to sign and have them notarized, but not to record them unless the holder needs to enforce the provisions. It seems to me that you should consider your solution to that problem in your instructions.

Thank you for your feedback. We really appreciate it. Have a great day!

Doris M M.

March 30th, 2022

EXCELLENT SERVICE. WILL MAINTAIN CONTACT FOR FUTURE REFERENCE.

THANK YOU!

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Marilyn O.

March 9th, 2021

Good resource. Got what I needed easily

Thank you for your feedback. We really appreciate it. Have a great day!

Valerie R.

October 7th, 2020

My expereince with Deeds.com was easy and efficent. Great way to efile documents during these trying times.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Kimberly M.

February 14th, 2019

Great service. Very helpful and quick. Love Deeds.com and will be using their services again.

Thank you for your feedback Kimberly, we really appreciate it!