Olmsted County Trustee Deed Individual Form (Minnesota)

All Olmsted County specific forms and documents listed below are included in your immediate download package:

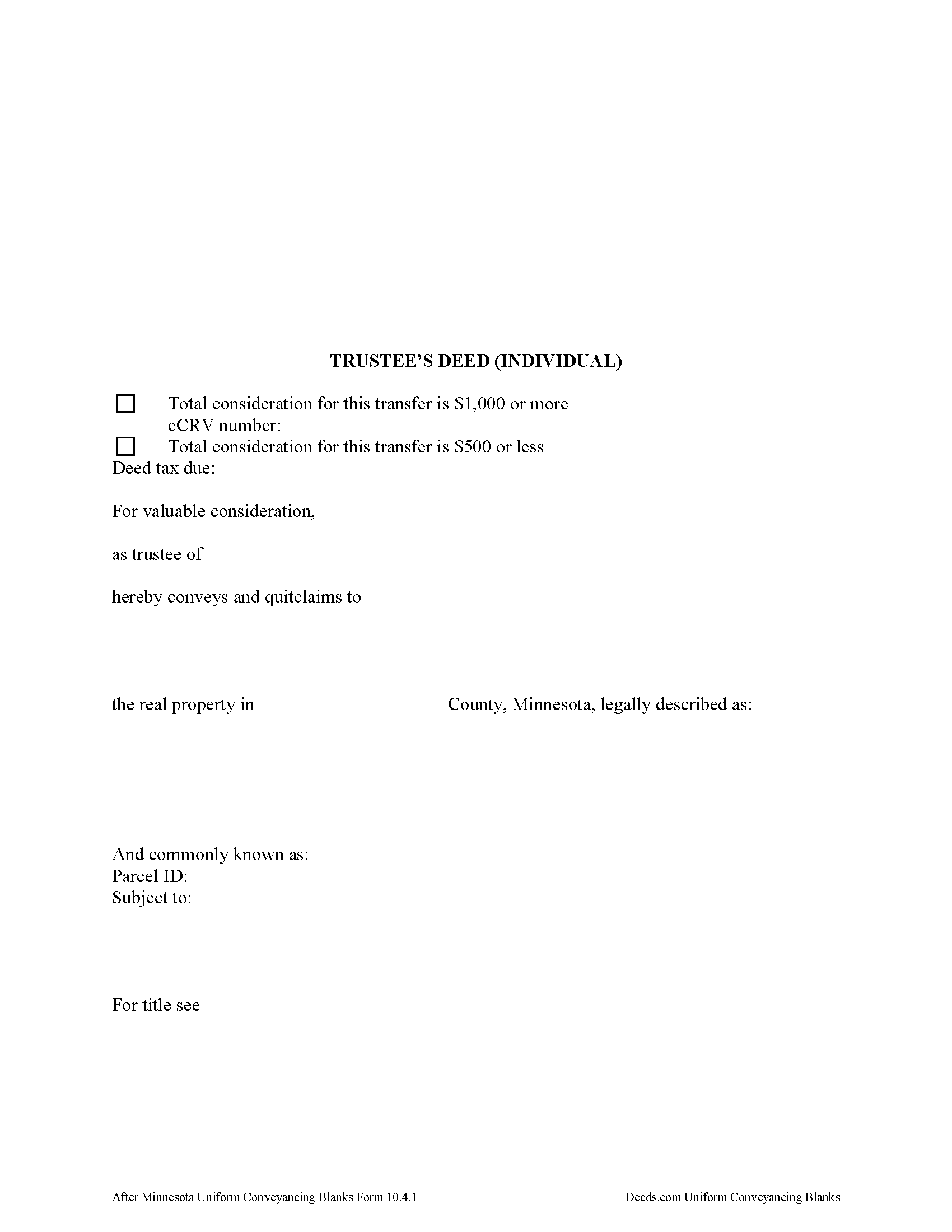

Trustee Deed Form

Fill in the blank form formatted to comply with all recording and content requirements.

Included Olmsted County compliant document last validated/updated 12/17/2024

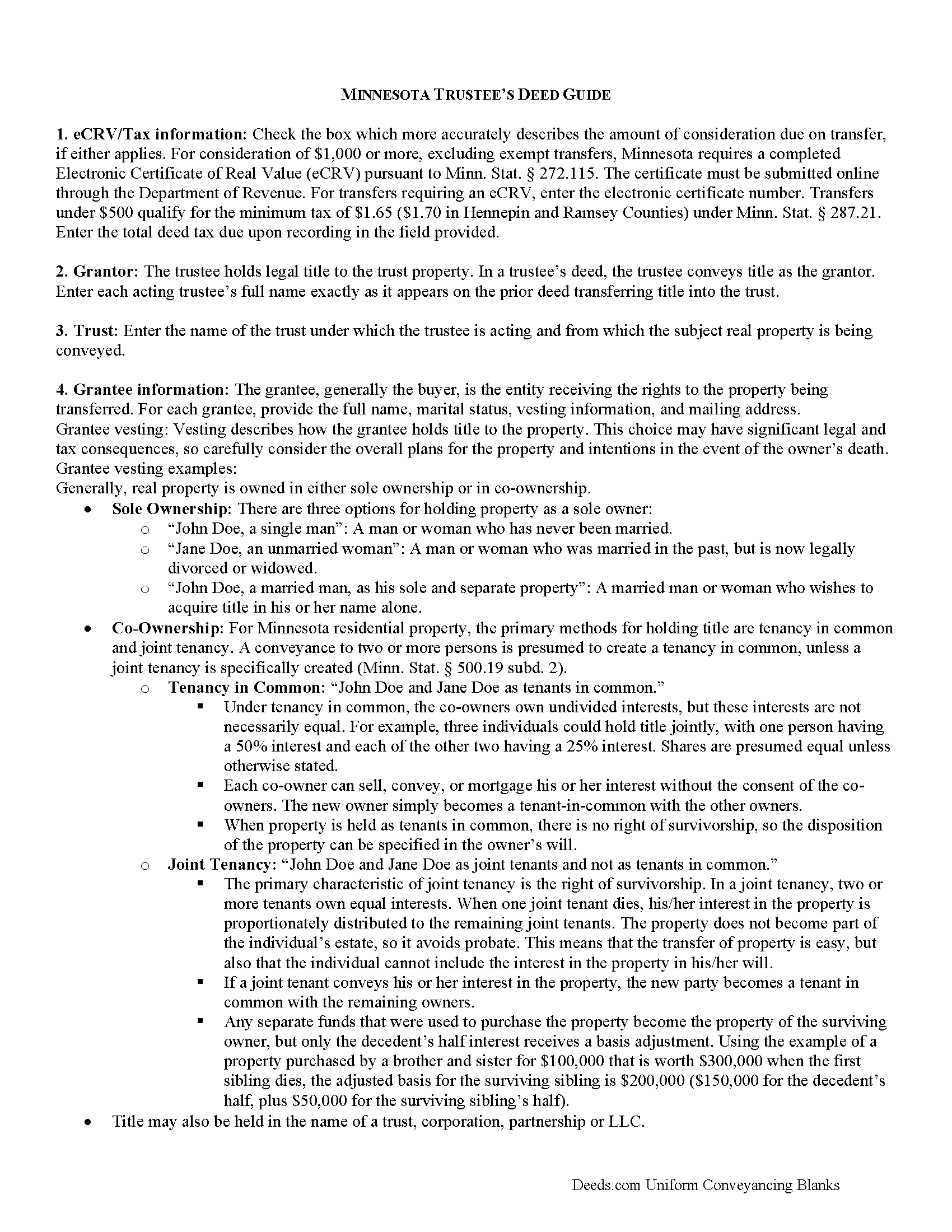

Trustee Deed Guide

Line by line guide explaining every blank on the form.

Included Olmsted County compliant document last validated/updated 10/10/2024

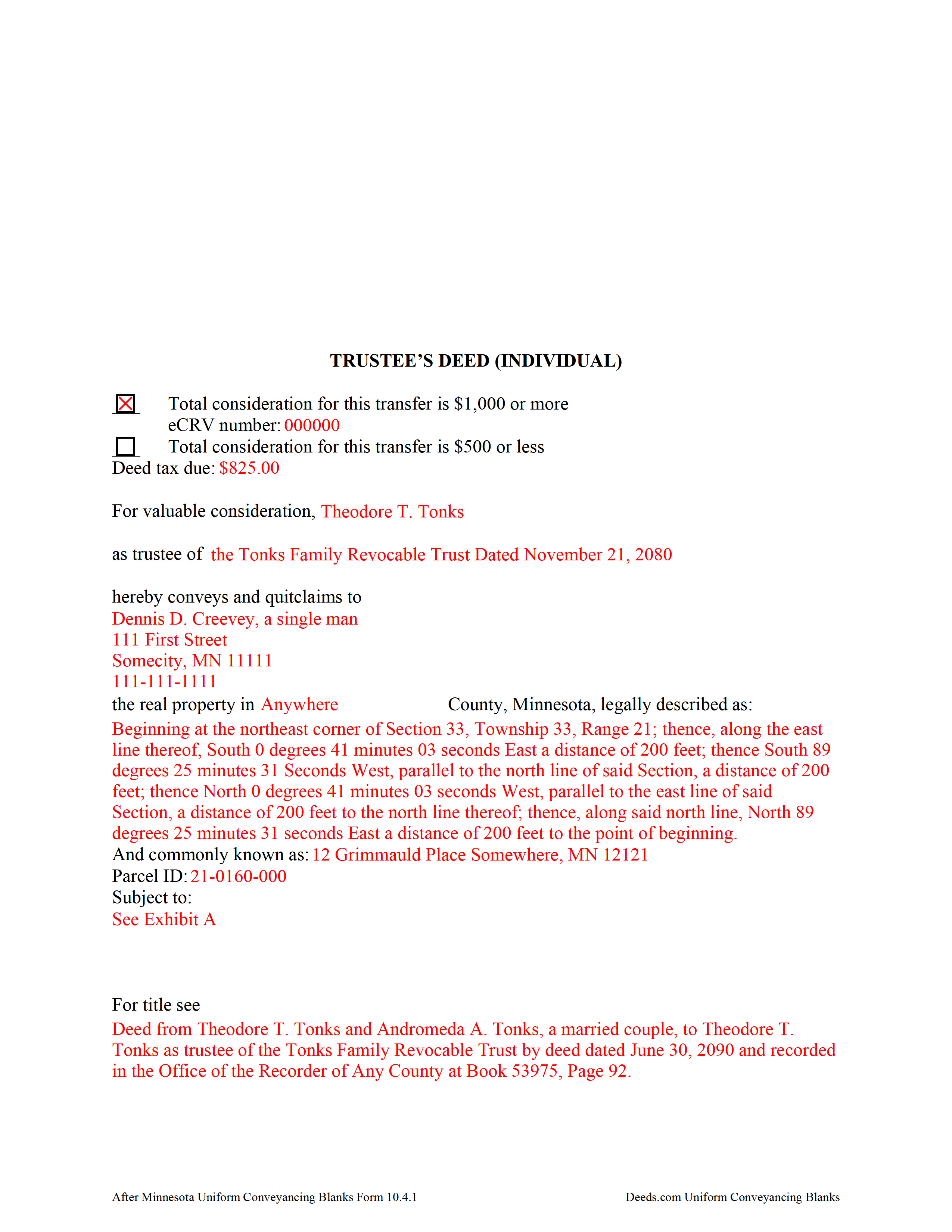

Completed Example of the Trustee Deed Document

Example of a properly completed form for reference.

Included Olmsted County compliant document last validated/updated 11/1/2024

The following Minnesota and Olmsted County supplemental forms are included as a courtesy with your order:

When using these Trustee Deed Individual forms, the subject real estate must be physically located in Olmsted County. The executed documents should then be recorded in the following office:

Property Records & Licensing

Government Center - 151 4th St SE, Rochester, Minnesota 55904

Hours: 8:00am to 5:00pm M-F

Phone: (507) 328-7670 and 328-7635

Local jurisdictions located in Olmsted County include:

- Byron

- Dover

- Eyota

- Oronoco

- Rochester

- Stewartville

How long does it take to get my forms?

Forms are available immediately after submitting payment.

How do I get my forms, are they emailed?

Immediately after you submit payment, the Olmsted County forms you order will be available for download directly from your account. You can then download the forms to your computer. If you do not already have an account, one will be created for you as part of the order process, and your login details will be provided to you. If you encounter any issues accessing your forms, please reach out to our support team for assistance. Forms are NOT emailed to you.

What does "validated/updated" mean?

This indicates the most recent date when at least one of the following occurred:

- Updated: The document was updated or changed to remain compliant.

- Validated: The document was examined by an attorney or staff, or it was successfully recorded in Olmsted County using our eRecording service.

Are these forms guaranteed to be recordable in Olmsted County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Olmsted County including margin requirements, content requirements, font and font size requirements.

Can the Trustee Deed Individual forms be re-used?

Yes. You can re-use the forms for your personal use. For example, if you have more than one property in Olmsted County that you need to transfer you would only need to order our forms once for all of your properties in Olmsted County.

What are supplemental forms?

Often when a deed is recorded, additional documents are required by Minnesota or Olmsted County. These could be tax related, informational, or even as simple as a coversheet. Supplemental forms are provided for free with your order where available.

What type of files are the forms?

All of our Olmsted County Trustee Deed Individual forms are PDFs. You will need to have or get Adobe Reader to use our forms. Adobe Reader is free software that most computers already have installed.

Do I need any special software to use these forms?

You will need to have Adobe Reader installed on your computer to use our forms. Adobe Reader is free software that most computers already have installed.

Do I have to enter all of my property information online?

No. The blank forms are downloaded to your computer and you fill them out there, at your convenience.

Can I save the completed form, email it to someone?

Yes, you can save your deed form at any point with your information in it. The forms can also be emailed, blank or complete, as attachments.

Are there any recurring fees involved?

No. Nothing to cancel, no memberships, no recurring fees.

What's in a Minnesota Trustee's Deed?

Minnesota allows for two main types of trustees deeds: one between individuals, and one for use by business entities. The primary differences between the two forms are that the deed intended for businesses contains details about the corporate entity and the laws under which it was formed, and a corporate notary acknowledgement, while the form for individuals does not require that information. This article focuses on the trustee's deed for individuals.

A trustee's deed conveys title to real property held in a non-testamentary trust. The deed is named for the executing trustee, unlike other deed forms, which are named for the warranties of title they contain. Trustees are authorized to sell property under Minn. Stat. 501C.0816.

In a trust arrangement, the trustee holds legal title to property conveyed to the trust by the settlor, for the benefit of the trust's beneficiaries. A beneficiary is someone with a present or future interest in the trust (Minn. Stat. 501C. 0103). The settlor establishes the provisions of the trust, including the designation of a trustee and a trust beneficiary, in the trust instrument, which typically is not recorded.

In Minnesota, the trustee's deed is a modified quitclaim deed, containing the granting language "convey and quitclaim." A quitclaim deed merely grants "all right, title, and interest of the grantor in the premises described" to the grantee, and contains no warranty of title (Minn. Stat. 707.07).

The deed names the trustee and the trust on behalf of which the trustee is authorized to act. As with all other forms of conveyance, the deed requires the name, vesting information, and address of the grantee. In addition, the deed recites the full legal description of the premises conveyed, and indicates whether the deed is to be recorded in the abstract or Torrens system (the Office of the Recorder for the county in which the property is situated handles recording for both systems).

In a nutshell, the Torrens system is a system of recording whereby the state guarantees the title through a more rigorous certification process; conveyances submitted in the abstract system meeting basic recording requirements will be recorded, but the title is not guaranteed.

Finally, all conveyances in Minnesota need to contain the drafter's information, and an address to which property tax statements can be sent.

Minnesota statutes require an Electronic Certificate of Real Value (eCRV) to accompany deeds with a consideration of $1,000 or more (Min. Stat. 272.115). The certificate is submitted online through the Department of Revenue. For transfers requiring an eCRV, the electronic certificate number must be reflected on the first page of the documents. Considerations of $500 or less qualify for the minimum deed tax. Because the eCRV contains more specific information for a majority of documents, the consideration statement reflected on the face of the deed is typically generic.

Pursuant to Minn. Stat. 103I.235, sellers of real property must submit a well disclosure certificate, along with the $50 well disclosure certificate fee, before agreeing to a transfer. Subd. 1(c) of that statute explains that the certificate is unnecessary "if the seller does not know of any wells on the property" and includes a statement to that effect on the deed. A deed may also state that the status of wells on the property has not changed since the previously filed certificate. Finally, recite the electronic well disclosure certificate number if relevant to the property.

All acting trustees must sign the deed in the presence of a notary public or other authorized officer before submitting the deed for recording at the county level. A certificate of trust and/or affidavit of trustee may be required alongside the trustee's deed.

Each situation is unique, so contact an attorney with any questions about trustee's deeds, trusts, and directions relating specifically to your situation.

(Minnesota Trustee Deed Individual Package includes form, guidelines, and completed example)

Our Promise

The documents you receive here will meet, or exceed, the Olmsted County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Olmsted County Trustee Deed Individual form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4448 Reviews )

Dorothy N.

December 22nd, 2024

The mortgage and note were thorough and very satisfactory for my purposes. The accompanying forms were excellent. I am very pleased with my purchase.

We welcome your positive feedback and are thrilled to have met your expectations. Thank you for choosing our services.

Edward E.

December 22nd, 2024

Easy to use.

Your feedback is valuable to us and helps us improve. Thank you for sharing your thoughts!

MARISSA G.

December 22nd, 2024

I recomemed this webside

Thank you for your feedback. We really appreciate it. Have a great day!

Scott P.

March 15th, 2021

The site was easy to use and find what I needed. The purchase and download were very easy.

Thank you!

sheila m.

August 26th, 2019

Very happy with the forms. Ease of use and price were points for high marks.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Rachelle S.

March 21st, 2021

Wow that was easy

Thank you!

michele d.

July 31st, 2022

It was easy to download, received it quickly, the sample really helped. I would like if some of the text was editable. for instance - the addresses were defaulted with the state of filing while we lived in another one.

Thank you for your feedback. We really appreciate it. Have a great day!

Terri A.

April 3rd, 2019

So far so good --- I'm helping a friend with her property! Thanks!

Thank you Terri.

Barbara E.

March 19th, 2024

Love the accessibility to all counties. Save money and time using Deeds for all our recording needs!

Your satisfaction with our services is of utmost importance to us. Thank you for letting us know how we did!

Barbara D.

November 11th, 2021

Very helpful, clear and precise. The example further clarifies exactly what is needed to be included in information.

Thank you!

Philip S.

May 2nd, 2019

You're service saved the day! I had gone to several lawyers and title companies who all said, at a Minimum, preparing a deed costs $1000...

Through your service and some work reading about the requirements as well as calling my county clerks office, I was able to complete the deed and it read accepted and recorded today!

Thanks so much.

Thank you for your feedback. We really appreciate it. Have a great day!

gary c.

January 26th, 2022

process was easy and simple to do

Thank you for your feedback. We really appreciate it. Have a great day!

Jeanette S.

September 3rd, 2020

Your site was easy to figure out after a few mistakes on my part. Messages were returned quickly. Very convenient for our recording of documents. I will recommend using this method for recording in future. Thank you for working fast in our recording.

Thank you for your feedback. We really appreciate it. Have a great day!

Daniel R.

December 6th, 2021

Could have had Clerk's certification of mailing form after it is recorded. Not fatal, but I did have to resort to reading the statute as well.

Thank you!

Gloria R.

June 2nd, 2022

Great system

Thank you!