Aitkin County Transfer on Death Revocation Form (Minnesota)

All Aitkin County specific forms and documents listed below are included in your immediate download package:

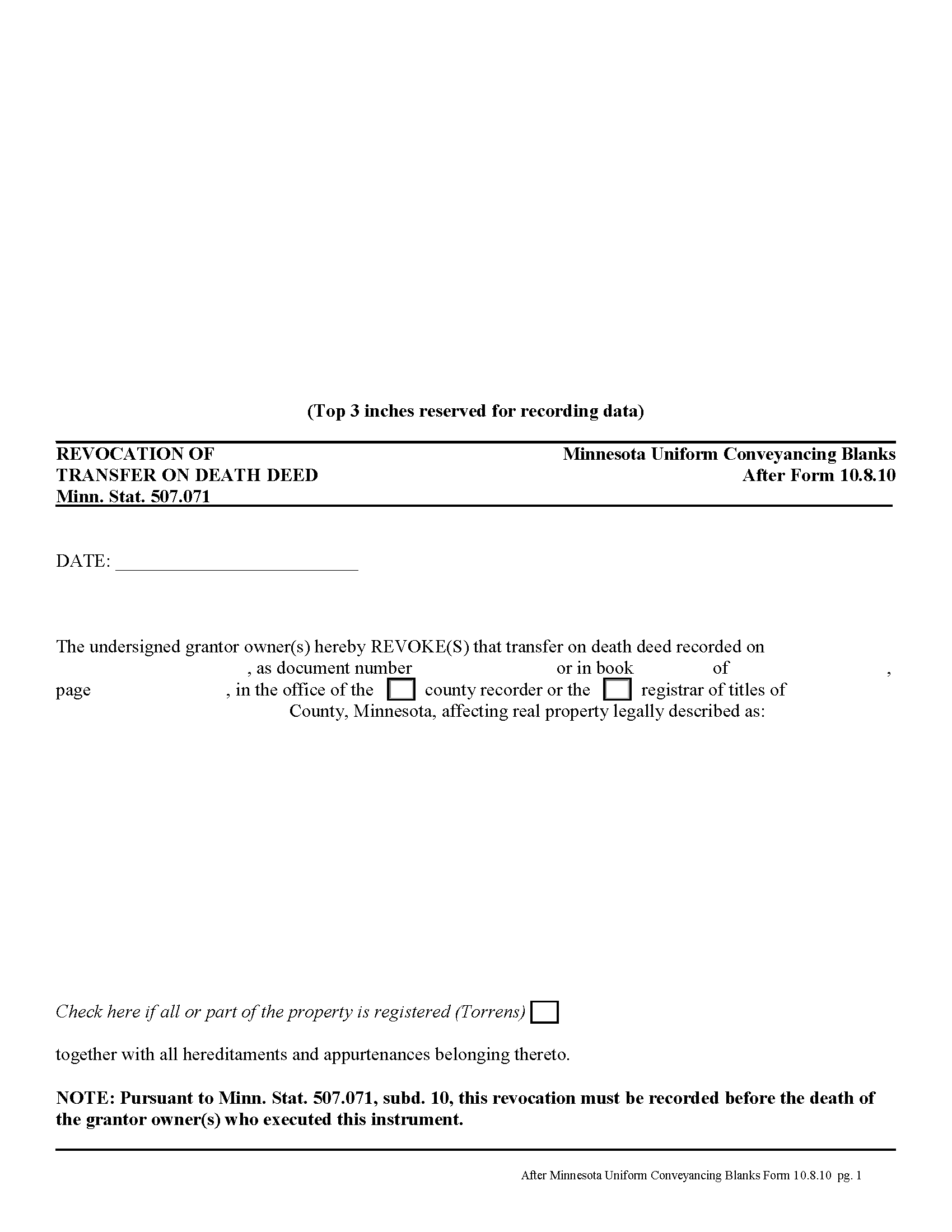

Transfer on Death Revocation Form

Fill in the blank form formatted to comply with all recording and content requirements.

Included Aitkin County compliant document last validated/updated 11/1/2024

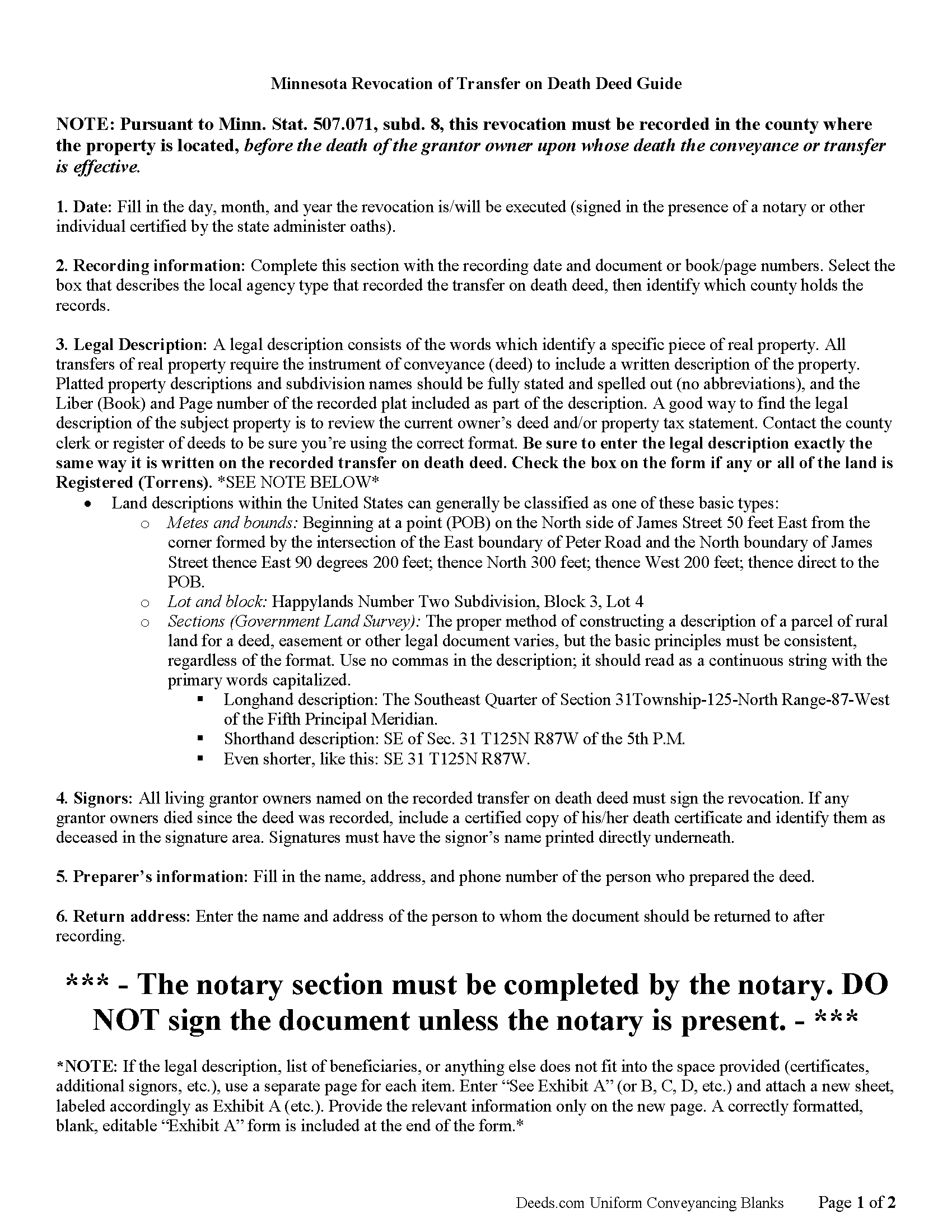

Transfer on Death Revocation Guide

Line by line guide explaining every blank on the form.

Included Aitkin County compliant document last validated/updated 8/8/2024

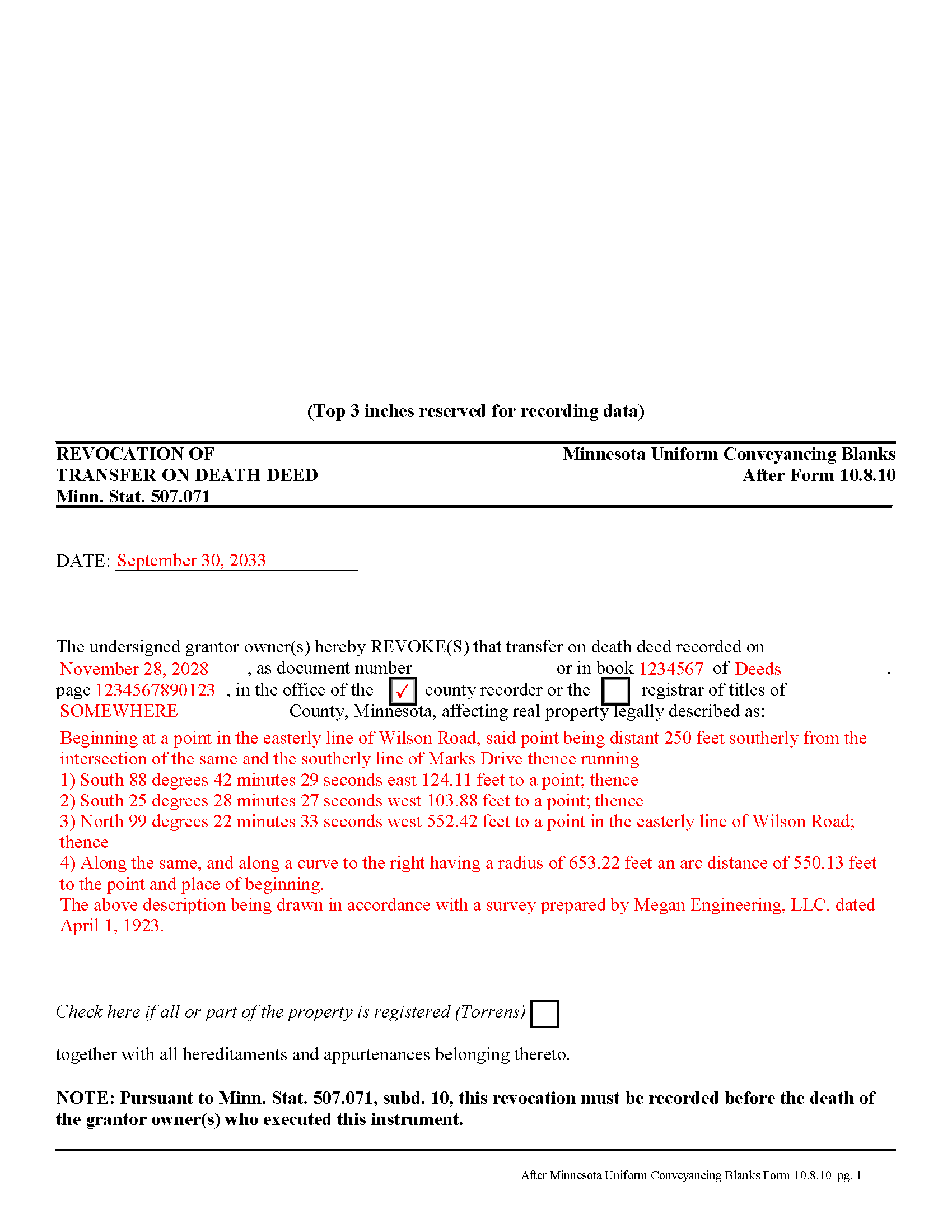

Completed Example of the Transfer on Death Revocation Document

Example of a properly completed form for reference.

Included Aitkin County compliant document last validated/updated 11/12/2024

The following Minnesota and Aitkin County supplemental forms are included as a courtesy with your order:

When using these Transfer on Death Revocation forms, the subject real estate must be physically located in Aitkin County. The executed documents should then be recorded in the following office:

Aitkin County Recorder

Courthouse - 209 Second St NW, Rm 205, Aitkin, Minnesota 56431

Hours: 8:00 to 4:30 M-F

Phone: 218-927-7336

Local jurisdictions located in Aitkin County include:

- Aitkin

- Hill City

- Mc Grath

- Mcgregor

- Palisade

- Tamarack

How long does it take to get my forms?

Forms are available immediately after submitting payment.

How do I get my forms, are they emailed?

Immediately after you submit payment, the Aitkin County forms you order will be available for download directly from your account. You can then download the forms to your computer. If you do not already have an account, one will be created for you as part of the order process, and your login details will be provided to you. If you encounter any issues accessing your forms, please reach out to our support team for assistance. Forms are NOT emailed to you.

What does "validated/updated" mean?

This indicates the most recent date when at least one of the following occurred:

- Updated: The document was updated or changed to remain compliant.

- Validated: The document was examined by an attorney or staff, or it was successfully recorded in Aitkin County using our eRecording service.

Are these forms guaranteed to be recordable in Aitkin County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Aitkin County including margin requirements, content requirements, font and font size requirements.

Can the Transfer on Death Revocation forms be re-used?

Yes. You can re-use the forms for your personal use. For example, if you have more than one property in Aitkin County that you need to transfer you would only need to order our forms once for all of your properties in Aitkin County.

What are supplemental forms?

Often when a deed is recorded, additional documents are required by Minnesota or Aitkin County. These could be tax related, informational, or even as simple as a coversheet. Supplemental forms are provided for free with your order where available.

What type of files are the forms?

All of our Aitkin County Transfer on Death Revocation forms are PDFs. You will need to have or get Adobe Reader to use our forms. Adobe Reader is free software that most computers already have installed.

Do I need any special software to use these forms?

You will need to have Adobe Reader installed on your computer to use our forms. Adobe Reader is free software that most computers already have installed.

Do I have to enter all of my property information online?

No. The blank forms are downloaded to your computer and you fill them out there, at your convenience.

Can I save the completed form, email it to someone?

Yes, you can save your deed form at any point with your information in it. The forms can also be emailed, blank or complete, as attachments.

Are there any recurring fees involved?

No. Nothing to cancel, no memberships, no recurring fees.

Minnesota's transfer on death deeds are governed by Minn. Stat. 507.071.

Transfer on death deeds offer an excellent alternative for people who wish to designate a beneficiary for their real estate, while remaining outside the complexity of the probate process. Life is unpredictable, however, and the grantor owner of the property might wish to change or revoke the previously recorded transfer on death deed. The same statute covering the deed also includes a section about revoking it (subd. 10).

There are several ways to revoke a transfer on death deed in Minnesota:

1. Complete and record a statutory revocation form (subd. 25). This is the source for the general revocation form. The statute states that a transfer on death deed "may be revoked at any time by the grantor owner or, if there is more than one grantor owner, by any of the grantor owners. To be effective, the revocation must be recorded in the county in which at least a part of the real property is located before the death of the grantor owner or owners who execute the revocation." The revocation is not effective . . . until the revocation is recorded in the county in which the real property is located.

2. Minnesota transfer on death deeds allow grantor owners full use of and control over the property to be conveyed. If the grantor owner who executed and recorded a transfer on death deed decides to convey the same property to a third party using anything "other than a transfer on death deed, all or a part of such grantor owner's interest in the property described in the transfer on death deed, no transfer of the conveyed interest shall occur on such grantor owner's death and the transfer on death deed shall be ineffective as to the conveyed or transferred interests, but the transfer on death deed remains effective with respect to the conveyance or transfer on death of any other interests described in the transfer on death deed owned by the grantor owner at the time of the grantor owner's death."

3. "If a grantor owner executes and records more than one transfer on death deed conveying the same interest in real property or a greater interest in the real property, the transfer on death deed that has the latest acknowledgment date and that is recorded before the death of the grantor owner upon whose death the conveyance or transfer is conditioned is the effective transfer on death deed and all other transfer on death deeds, if any, executed by the grantor owner or the grantor owners are ineffective to transfer any interest and are void." (subd. 13)

NOTE: a correctly executed, acknowledged, and recorded transfer on death deed cannot be revoked by a will. (subd. 19)

To summarize, once a transfer on death deed is recorded, there are three primary ways to revoke it: a revocation form, conveying the property to a third party by another kind of deed (warranty, quitclaim, etc.), or by executing and recording a new transfer on death deed with a different beneficiary. They may also be invalidated as part of a final divorce decree, but that is part of a different process. To maintain the most clarity in the chain of title (ownership history), however, it makes sense to record a revocation before changing anything else about the status of real estate covered by a transfer on death deed.

Remember that the revocation must be recorded, DURING THE GRANTOR OWNER'S LIFE, in the county where the property is located.

(Minnesota TOD Revocation Package includes form, guidelines, and completed example)

Our Promise

The documents you receive here will meet, or exceed, the Aitkin County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Aitkin County Transfer on Death Revocation form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4448 Reviews )

Dorothy N.

December 22nd, 2024

The mortgage and note were thorough and very satisfactory for my purposes. The accompanying forms were excellent. I am very pleased with my purchase.

We welcome your positive feedback and are thrilled to have met your expectations. Thank you for choosing our services.

Edward E.

December 22nd, 2024

Easy to use.

Your feedback is valuable to us and helps us improve. Thank you for sharing your thoughts!

MARISSA G.

December 22nd, 2024

I recomemed this webside

Thank you for your feedback. We really appreciate it. Have a great day!

Stephen F.

September 3rd, 2020

Easy to use. Outstanding interface.

Thank you!

Aubrey M.

May 31st, 2020

I am an attorney who was trying to draft some deeds in arizona. The deed templates coupled with the document instructions saved me hours work. At 1st I was skeptical, so spent hours figuring out how to draft the documents, but could have saved so much time If I had just spend the $20 sooner. Would use again is needed a deed format as a basis for my drafting.

Thank you for your feedback. We really appreciate it. Have a great day!

Jacqueline S.

May 4th, 2021

Outstanding service. The quit claim Deed form was great. Very easy to use and explained very clearly. Definitely recommend.

Thank you for your feedback. We really appreciate it. Have a great day!

Frank K.

July 27th, 2023

One thing I suggest is use the nomenclature Borrower / Lender / instead of Mortgatator / Mortgatee… Had to google which is which ? !

Thank you for your feedback. We really appreciate it. Have a great day!

Bob B.

September 14th, 2021

Good so far. Will be great if you get the deed recorded.

Thank you!

Kenneth S.

December 30th, 2018

Navigating the site was fine, but the service was not able to find my deed. Still have not received my refund.

Thanks for your feedback Kenneth. Sorry we were not able to pull the deed for your property. We voided your payment on December 28, 2018. Sometimes, depending on your financial institution, it can take a few days for the pending charge (hold) to expire.

LIsa B.

January 27th, 2023

Deeds.com made this process of electronic document recording so easy! The communication was quick, friendly, helpful and efficient. I am out of state and have administrative items to handle for my father who has Alzheimer's. Deeds.com is a great service. I highly recommend them, and will use them again when the time comes.

Thank you!

Leo b.

March 26th, 2019

Awesome site great paperwork EZ Forms great.

Thank you Leo.

Jessica B.

September 23rd, 2021

Amazing service. Immediate responses at all hours of the day and prevent late in the evening! Patient and friendly. I will say that Adobe scan did not work well for me. Notes app for IOS has a scan feature and that seemed to work best.

Thank you for your feedback. We really appreciate it. Have a great day!

James S.

July 16th, 2019

The forms download was quick and easy. The example deed was excellent. However, the payment method should include PayPal, not just credit cards.

Thank you for your feedback James, we appreciate it.

marshall w.

September 24th, 2019

was not ready to pay for much needed forms but very important

Thank you for your feedback. We really appreciate it. Have a great day!

Fred B.

February 8th, 2019

Great service and all seems to be what I was looking for

Thank you Fred, have a great day!