Olmsted County Transfer on Death Deed Form (Minnesota)

All Olmsted County specific forms and documents listed below are included in your immediate download package:

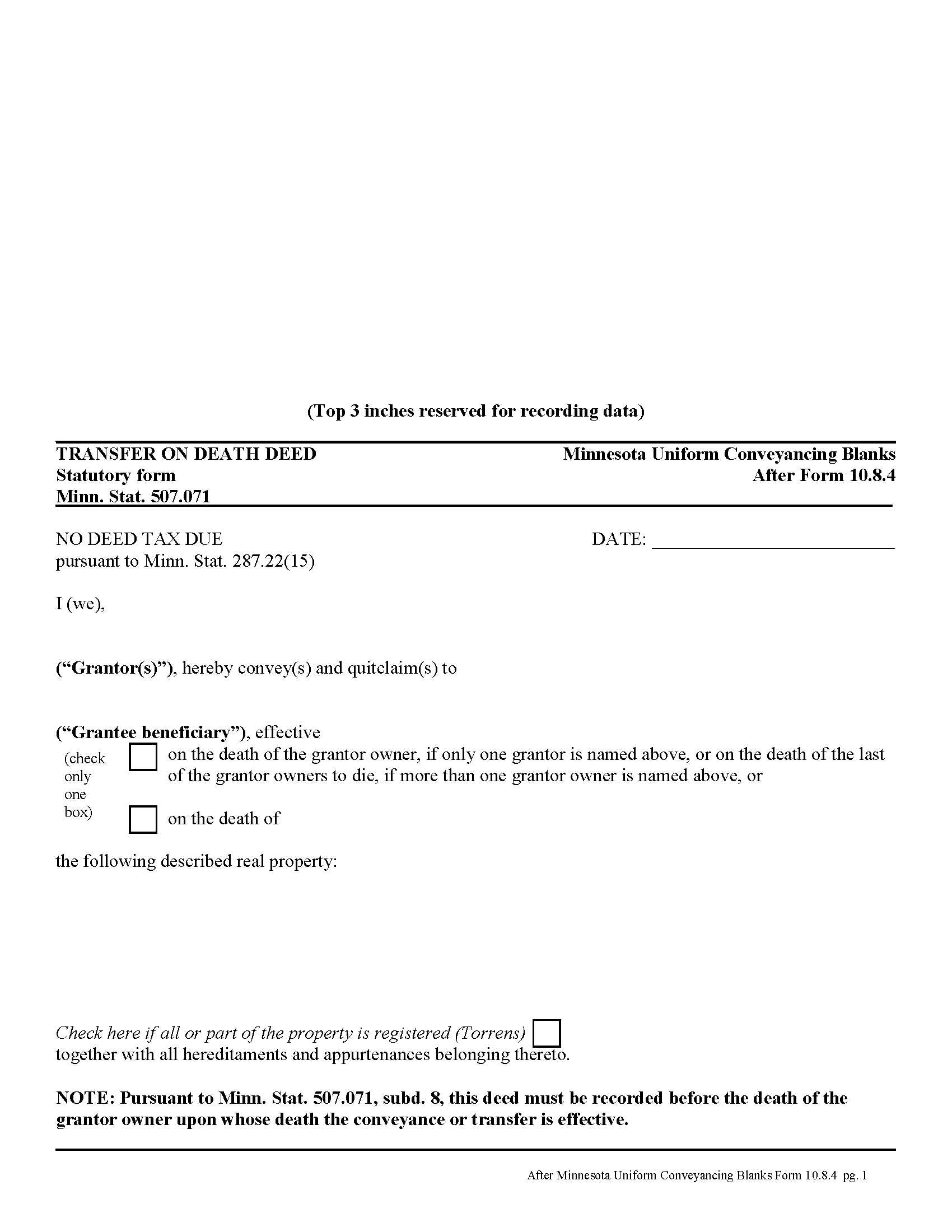

Transfer on Death Deed Form

Fill in the blank form formatted to comply with all recording and content requirements.

Included Olmsted County compliant document last validated/updated 12/19/2024

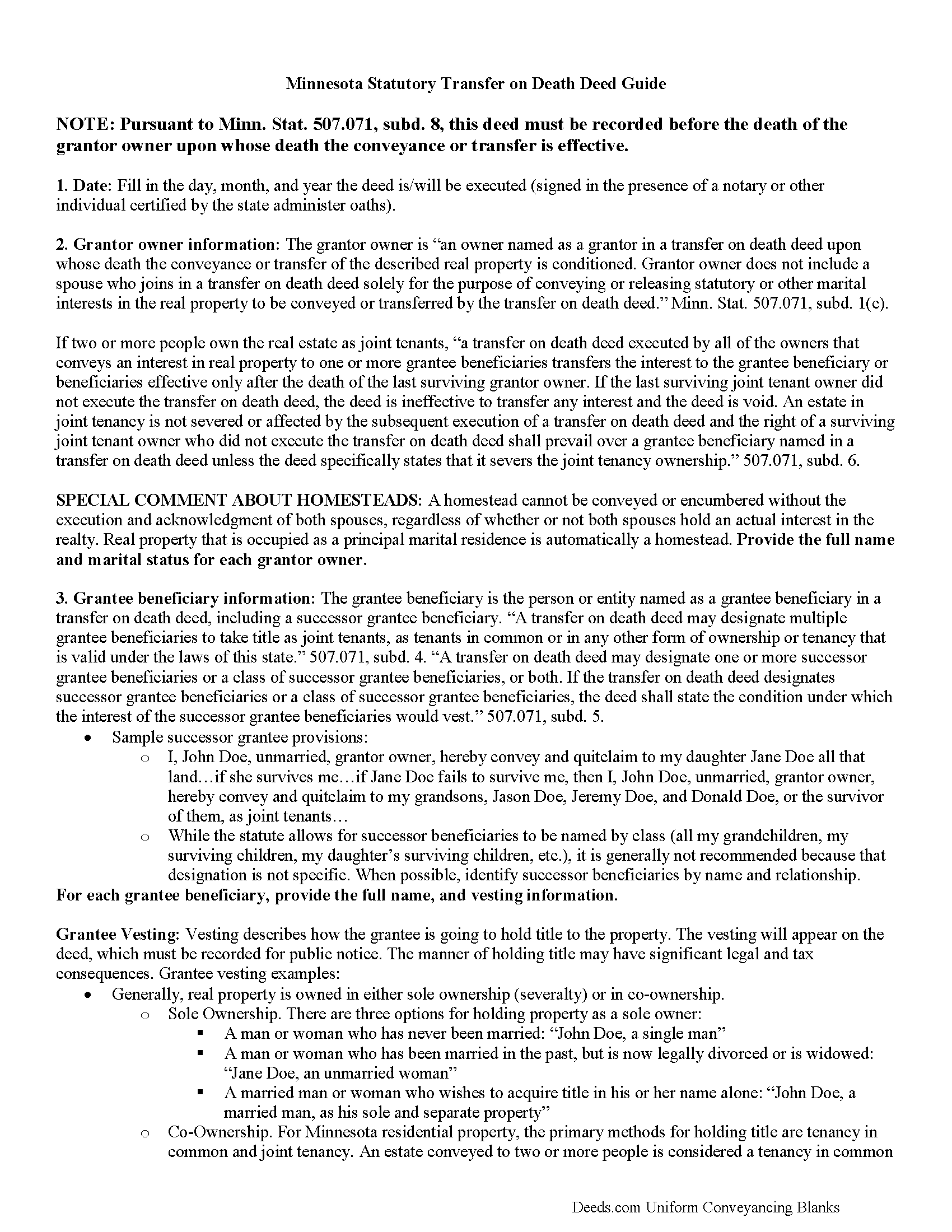

Transfer on Death Deed Guide

Line by line guide explaining every blank on the form.

Included Olmsted County compliant document last validated/updated 12/3/2024

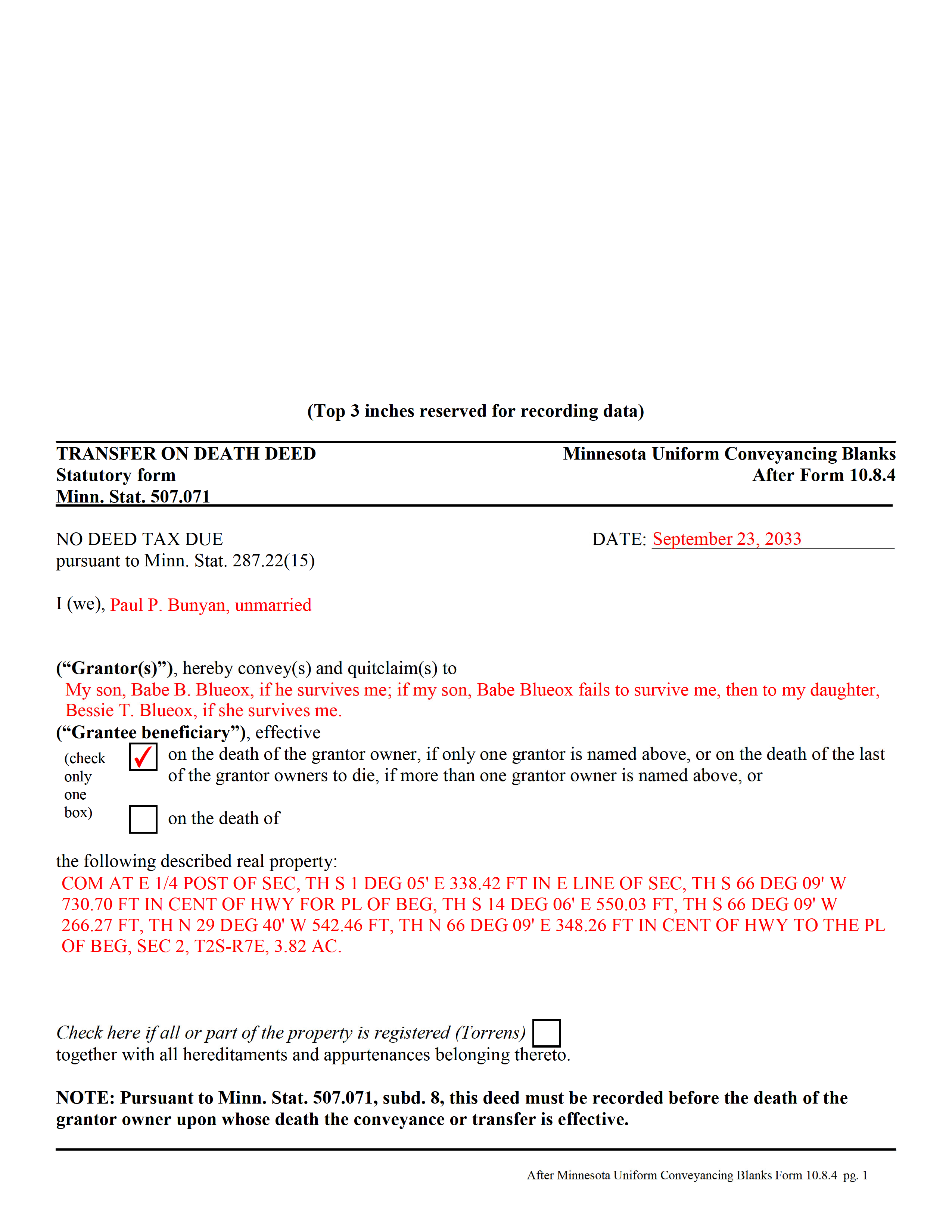

Completed Example of the Transfer on Death Deed Document

Example of a properly completed form for reference.

Included Olmsted County compliant document last validated/updated 9/26/2024

The following Minnesota and Olmsted County supplemental forms are included as a courtesy with your order:

When using these Transfer on Death Deed forms, the subject real estate must be physically located in Olmsted County. The executed documents should then be recorded in the following office:

Property Records & Licensing

Government Center - 151 4th St SE, Rochester, Minnesota 55904

Hours: 8:00am to 5:00pm M-F

Phone: (507) 328-7670 and 328-7635

Local jurisdictions located in Olmsted County include:

- Byron

- Dover

- Eyota

- Oronoco

- Rochester

- Stewartville

How long does it take to get my forms?

Forms are available immediately after submitting payment.

How do I get my forms, are they emailed?

Immediately after you submit payment, the Olmsted County forms you order will be available for download directly from your account. You can then download the forms to your computer. If you do not already have an account, one will be created for you as part of the order process, and your login details will be provided to you. If you encounter any issues accessing your forms, please reach out to our support team for assistance. Forms are NOT emailed to you.

What does "validated/updated" mean?

This indicates the most recent date when at least one of the following occurred:

- Updated: The document was updated or changed to remain compliant.

- Validated: The document was examined by an attorney or staff, or it was successfully recorded in Olmsted County using our eRecording service.

Are these forms guaranteed to be recordable in Olmsted County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Olmsted County including margin requirements, content requirements, font and font size requirements.

Can the Transfer on Death Deed forms be re-used?

Yes. You can re-use the forms for your personal use. For example, if you have more than one property in Olmsted County that you need to transfer you would only need to order our forms once for all of your properties in Olmsted County.

What are supplemental forms?

Often when a deed is recorded, additional documents are required by Minnesota or Olmsted County. These could be tax related, informational, or even as simple as a coversheet. Supplemental forms are provided for free with your order where available.

What type of files are the forms?

All of our Olmsted County Transfer on Death Deed forms are PDFs. You will need to have or get Adobe Reader to use our forms. Adobe Reader is free software that most computers already have installed.

Do I need any special software to use these forms?

You will need to have Adobe Reader installed on your computer to use our forms. Adobe Reader is free software that most computers already have installed.

Do I have to enter all of my property information online?

No. The blank forms are downloaded to your computer and you fill them out there, at your convenience.

Can I save the completed form, email it to someone?

Yes, you can save your deed form at any point with your information in it. The forms can also be emailed, blank or complete, as attachments.

Are there any recurring fees involved?

No. Nothing to cancel, no memberships, no recurring fees.

Minnesota's transfer on death deeds are governed by Minn. Stat. 507.071.

Transfer on death deeds are useful estate planning tools for owners of Minnesota real estate. In most cases, when a land owner dies, his/her real property enters the probate system along with the rest of the estate. Some people avoid probate by owning property as joint tenants. The nature of joint tenancy includes the right of survivorship, which, by function of law, automatically distributes a deceased joint tenant's title rights to the surviving tenants. Joint tenants, however, share a current interest in the real property, and all owners must execute any changes or reconveyances. By executing and recording a transfer on death deed instead, owners still avoid the need for probate distribution of that portion of their assets. Transfer on death deeds do NOT pass a current or future interest in the property, so the owner's interests are fully protected while he/she remains alive.

Unlike most other real estate deeds, transfer on death deeds do not convey any rights or interests to the beneficiaries until the grantor owner's death. But, under Minn. Stat. 524.2-702, named beneficiaries must outlive the grantor owners by at least 120 hours to become eligible for the property. The owner retains absolute title to and control over the real property until death. He/she may rent, use, sell or reconvey the land at will, and with no obligation to the beneficiary (Minn. Stat. 507.071, subd. 10). As a result, the beneficiary has no guarantee of any present or future interest in the property. In addition, a "transfer on death deed that is executed, acknowledged, and recorded in accordance with this section is not revoked by the provisions of a will" (subd. 19).

Transfer on death deeds allow flexibility -- in addition to individuals, the grantor owner may "transfer an interest in real property to the trustee of an inter vivos trust even if the trust is revocable, to the trustee of a testamentary trust or to any other entity legally qualified to hold title to real property under the laws of this state" (subd. 9).

Under Minn. Stat. 507.071, transfer on death deeds must:

- convey or assign an interest in real property (subd. 2)

- name one or more grantee beneficiaries (subds. 2 and 4)

- explicitly state that it takes effect at the death of the named grantor owner(s)

- comply with other Minnesota deed requirements including joinder of spouse in conveying homestead (507.02, subd. 2)

- standard recording requirements regarding legibility, recordability, notarization, and original signature (507.24)

- Notice recording statutes (507.34, 508.48, 508A.48)

Ultimately, transfer on death deeds offer a useful alternative for Minnesota land owners who wish to pass property to specific beneficiaries without probate intervention.

NOTE: All actions related to executing, revoking, or otherwise changing a Minnesota transfer on death deed must be submitted for recording in the county where at least part of the land is located, while the grantor owner is alive. (507.071, subd. 8).

Important terms:

Grantor owner: "means an owner named as a grantor in a transfer on death deed upon whose death the conveyance or transfer of the described real property is conditioned" (subd. 1c).

Owner: "means a person having an ownership or other interest in all or part of the real property to be conveyed or transferred by a transfer on death deed" (subd. 1d).

Beneficiary or grantee beneficiary: "means a person or entity named as a grantee beneficiary in a transfer on death deed, including a successor grantee beneficiary" (subd. 1a).

(Minnesota TOD Deed Package includes form, guidelines, and completed example)

Our Promise

The documents you receive here will meet, or exceed, the Olmsted County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Olmsted County Transfer on Death Deed form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4448 Reviews )

Dorothy N.

December 22nd, 2024

The mortgage and note were thorough and very satisfactory for my purposes. The accompanying forms were excellent. I am very pleased with my purchase.

We welcome your positive feedback and are thrilled to have met your expectations. Thank you for choosing our services.

Edward E.

December 22nd, 2024

Easy to use.

Your feedback is valuable to us and helps us improve. Thank you for sharing your thoughts!

MARISSA G.

December 22nd, 2024

I recomemed this webside

Thank you for your feedback. We really appreciate it. Have a great day!

Aaron H.

April 3rd, 2023

Excellent service! Easy to use interface and quick response post-recording.

Thank you for your feedback. We really appreciate it. Have a great day!

Mary L M.

November 1st, 2022

Your website was very helpful & easy to use

Thank you for your feedback. We really appreciate it. Have a great day!

Joyce D.

October 29th, 2021

Great service. Fast and efficient.

Thank you!

Daniel R.

August 26th, 2020

It all looked pretty easy to navigate. Forms are just now downloaded so I'll see how opening, filling-out goes. I'm encouraged. Thanks

Thank you for your feedback. We really appreciate it. Have a great day!

Leslie S.

February 12th, 2020

The site was quick and easy to find information I needed. It also provided extra paperwork that would assist me.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

VALETA J.

April 15th, 2022

Easy to navigate

Thank you!

Nola B.

May 18th, 2021

I like the form except the title should be ENHANCED LIFE ESTATE DEED and not Quit Claim Deed

Thank you for your feedback. We really appreciate it. Have a great day!

Kenneth-Wayne L.

August 20th, 2020

1) I was very pleased when the staff mentioned your service since the three referenced on the Recorder's website all wanted HUGE Account set-up and maintenance fees AND BIG fees per recording, and yours has no set-up fee AND nominal per-recording fee; 2) My (few) recordings will be NON-LAND Related, summary or entire record(s) of Administrative (Procedures Act) records, Other than the Border width and Cover Sheet, do you anticipate any other special requirements for such recording(s)? NOTE: I just sent one by Snail Mail, and they just informed me that due to the GERMIPHOBIA 'Pandemic' the ONLY open and record Snail Mail ONCE A MONTH On the first of each chmonth!

Thank you!

Sherry P.

November 24th, 2020

It would be helpful to have a frequently asked questions section. That would make it easier to know I have the correct form.

Sherry

Thank you for your feedback. We really appreciate it. Have a great day!

Joyce B.

July 25th, 2019

Very easy to purchase and download.

Thank you!

Keli A.

June 3rd, 2021

Excellent site, super fast responses to messages, and great patience with a newbie user. Couldn't be more pleased. Thank you!

Thank you for your feedback. We really appreciate it. Have a great day!

Deborah B.

September 30th, 2021

I was skeptical after experiencing other websites. However not only did we get the form we needed for a fraction of the cost vs going to an attorney, the additional resources (guides and samples) made the completion of the Enhanced Life Quitclaim deed quite simple, quick, and painless. We were having difficulty getting my mom to agree to meeting with an attorney or even considering a Lady Bird deed. Deeds.com gave us the ability to move forward with necessary actions with family members walking my mom through the steps, explaining the process and giving her plenty of time to find the needed information. She became part of the process which made it easy for her at a time when decision making was hard. We did everything in the comfort of her own home. I can't think of a better experience or service and I would consider Deeds.com for future needs.

Thank you for the kinds words Deborah. We appreciate you taking the time to share your experience.