Grant County Transfer on Death Deed Form (Minnesota)

All Grant County specific forms and documents listed below are included in your immediate download package:

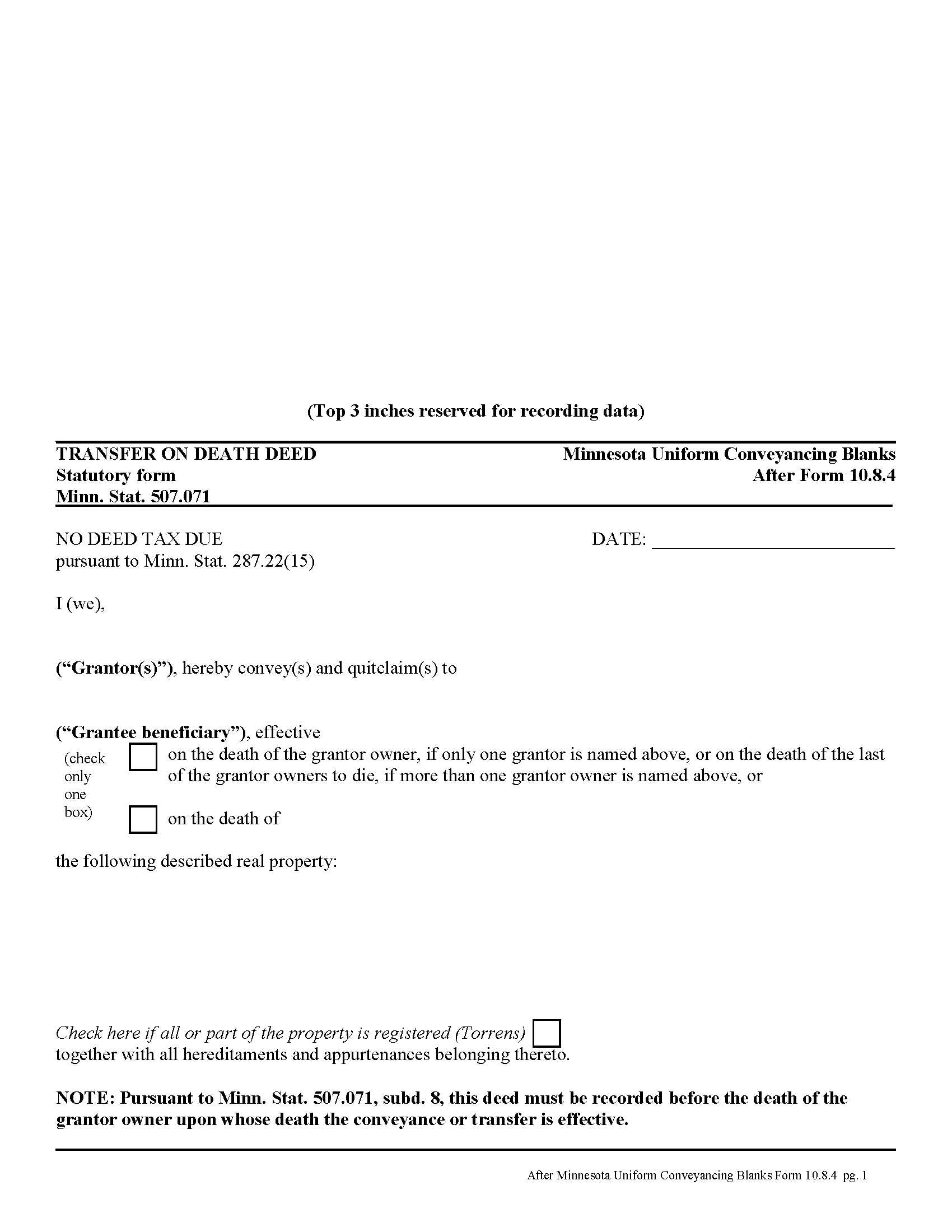

Transfer on Death Deed Form

Fill in the blank form formatted to comply with all recording and content requirements.

Included Grant County compliant document last validated/updated 12/19/2024

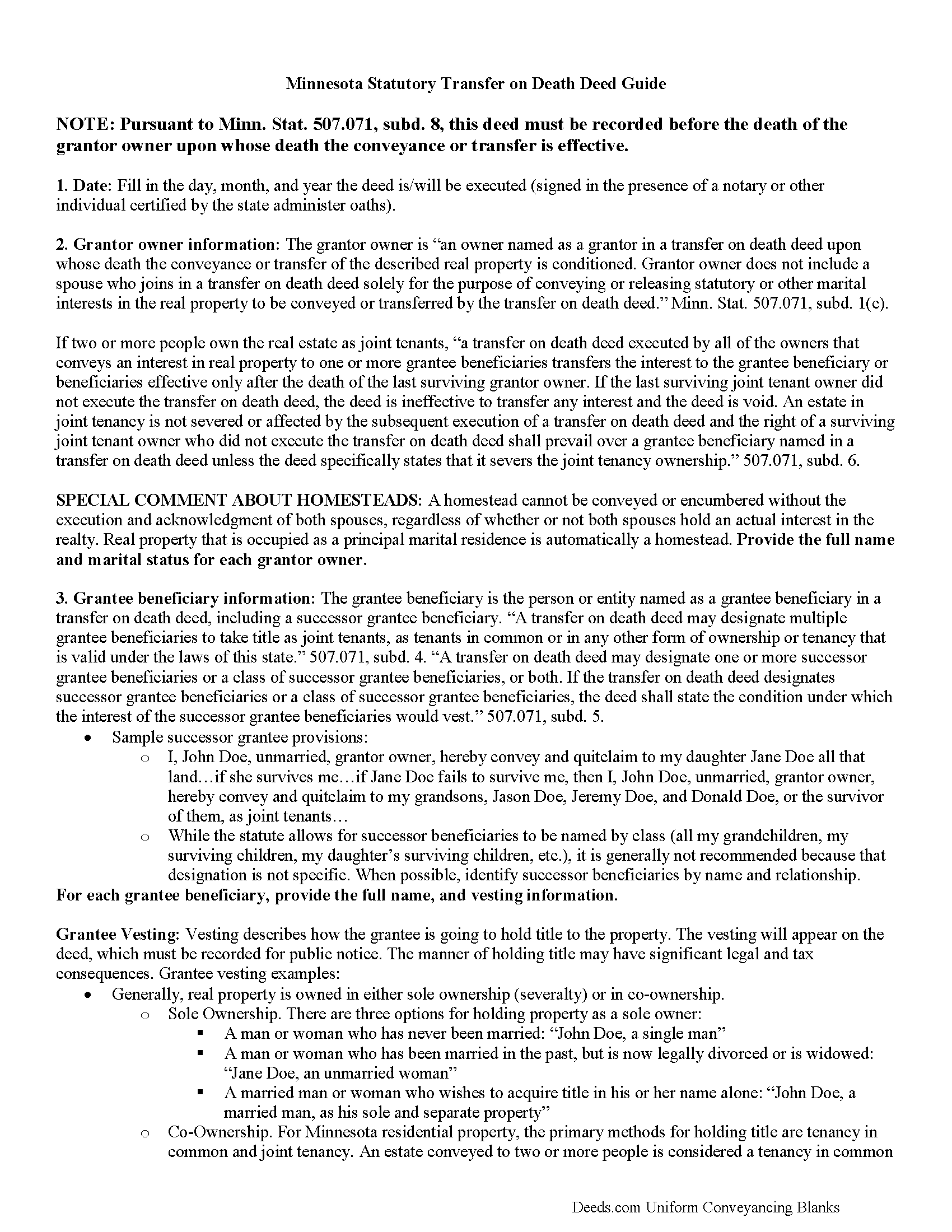

Transfer on Death Deed Guide

Line by line guide explaining every blank on the form.

Included Grant County compliant document last validated/updated 12/3/2024

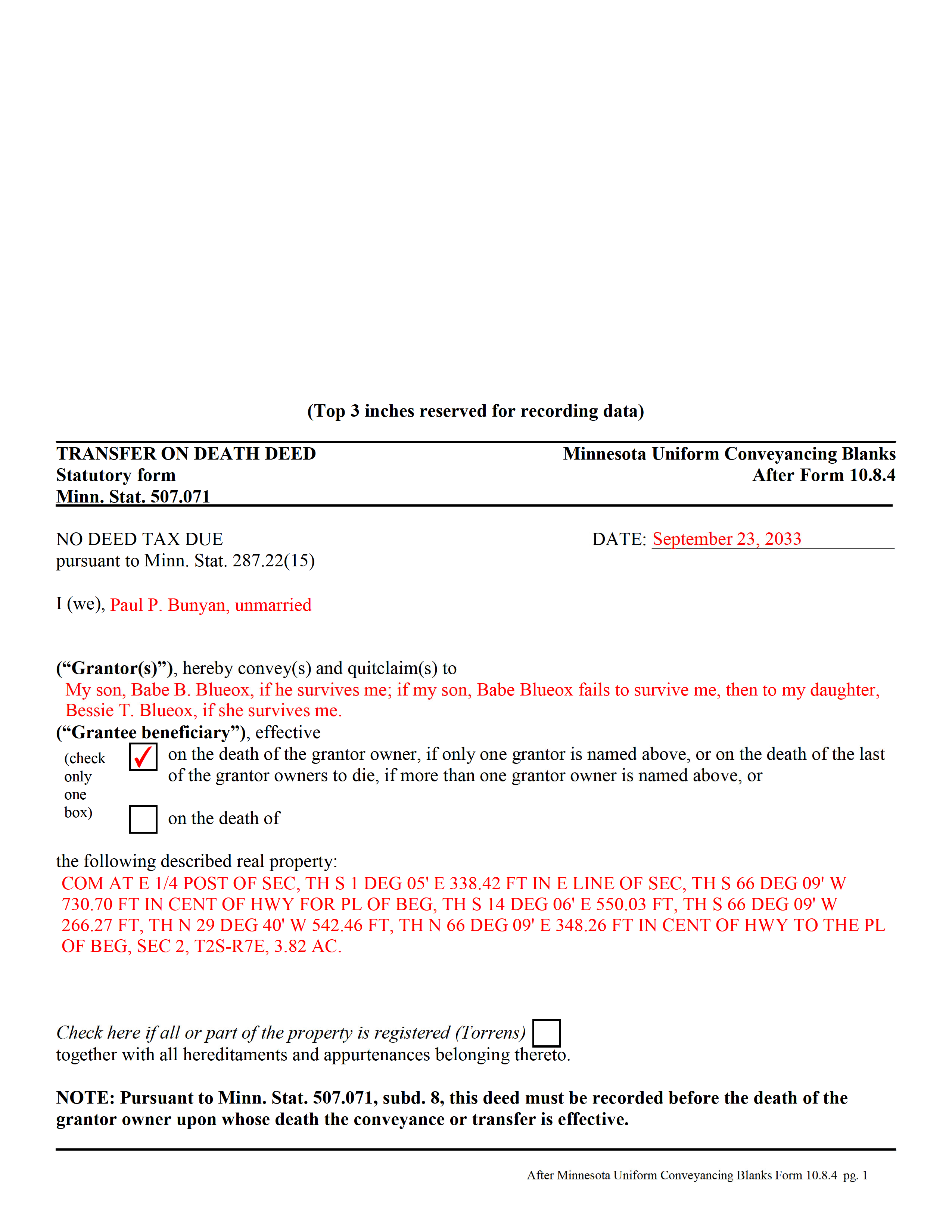

Completed Example of the Transfer on Death Deed Document

Example of a properly completed form for reference.

Included Grant County compliant document last validated/updated 9/26/2024

The following Minnesota and Grant County supplemental forms are included as a courtesy with your order:

When using these Transfer on Death Deed forms, the subject real estate must be physically located in Grant County. The executed documents should then be recorded in the following office:

Grant County Recorder

10 Second St NE, Elbow Lake, Minnesota 56531-1007

Hours: 8:00 to 4:00 Monday through Friday

Phone: (218) 685-8255

Local jurisdictions located in Grant County include:

- Ashby

- Barrett

- Elbow Lake

- Herman

- Hoffman

- Norcross

- Wendell

How long does it take to get my forms?

Forms are available immediately after submitting payment.

How do I get my forms, are they emailed?

Immediately after you submit payment, the Grant County forms you order will be available for download directly from your account. You can then download the forms to your computer. If you do not already have an account, one will be created for you as part of the order process, and your login details will be provided to you. If you encounter any issues accessing your forms, please reach out to our support team for assistance. Forms are NOT emailed to you.

What does "validated/updated" mean?

This indicates the most recent date when at least one of the following occurred:

- Updated: The document was updated or changed to remain compliant.

- Validated: The document was examined by an attorney or staff, or it was successfully recorded in Grant County using our eRecording service.

Are these forms guaranteed to be recordable in Grant County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Grant County including margin requirements, content requirements, font and font size requirements.

Can the Transfer on Death Deed forms be re-used?

Yes. You can re-use the forms for your personal use. For example, if you have more than one property in Grant County that you need to transfer you would only need to order our forms once for all of your properties in Grant County.

What are supplemental forms?

Often when a deed is recorded, additional documents are required by Minnesota or Grant County. These could be tax related, informational, or even as simple as a coversheet. Supplemental forms are provided for free with your order where available.

What type of files are the forms?

All of our Grant County Transfer on Death Deed forms are PDFs. You will need to have or get Adobe Reader to use our forms. Adobe Reader is free software that most computers already have installed.

Do I need any special software to use these forms?

You will need to have Adobe Reader installed on your computer to use our forms. Adobe Reader is free software that most computers already have installed.

Do I have to enter all of my property information online?

No. The blank forms are downloaded to your computer and you fill them out there, at your convenience.

Can I save the completed form, email it to someone?

Yes, you can save your deed form at any point with your information in it. The forms can also be emailed, blank or complete, as attachments.

Are there any recurring fees involved?

No. Nothing to cancel, no memberships, no recurring fees.

Minnesota's transfer on death deeds are governed by Minn. Stat. 507.071.

Transfer on death deeds are useful estate planning tools for owners of Minnesota real estate. In most cases, when a land owner dies, his/her real property enters the probate system along with the rest of the estate. Some people avoid probate by owning property as joint tenants. The nature of joint tenancy includes the right of survivorship, which, by function of law, automatically distributes a deceased joint tenant's title rights to the surviving tenants. Joint tenants, however, share a current interest in the real property, and all owners must execute any changes or reconveyances. By executing and recording a transfer on death deed instead, owners still avoid the need for probate distribution of that portion of their assets. Transfer on death deeds do NOT pass a current or future interest in the property, so the owner's interests are fully protected while he/she remains alive.

Unlike most other real estate deeds, transfer on death deeds do not convey any rights or interests to the beneficiaries until the grantor owner's death. But, under Minn. Stat. 524.2-702, named beneficiaries must outlive the grantor owners by at least 120 hours to become eligible for the property. The owner retains absolute title to and control over the real property until death. He/she may rent, use, sell or reconvey the land at will, and with no obligation to the beneficiary (Minn. Stat. 507.071, subd. 10). As a result, the beneficiary has no guarantee of any present or future interest in the property. In addition, a "transfer on death deed that is executed, acknowledged, and recorded in accordance with this section is not revoked by the provisions of a will" (subd. 19).

Transfer on death deeds allow flexibility -- in addition to individuals, the grantor owner may "transfer an interest in real property to the trustee of an inter vivos trust even if the trust is revocable, to the trustee of a testamentary trust or to any other entity legally qualified to hold title to real property under the laws of this state" (subd. 9).

Under Minn. Stat. 507.071, transfer on death deeds must:

- convey or assign an interest in real property (subd. 2)

- name one or more grantee beneficiaries (subds. 2 and 4)

- explicitly state that it takes effect at the death of the named grantor owner(s)

- comply with other Minnesota deed requirements including joinder of spouse in conveying homestead (507.02, subd. 2)

- standard recording requirements regarding legibility, recordability, notarization, and original signature (507.24)

- Notice recording statutes (507.34, 508.48, 508A.48)

Ultimately, transfer on death deeds offer a useful alternative for Minnesota land owners who wish to pass property to specific beneficiaries without probate intervention.

NOTE: All actions related to executing, revoking, or otherwise changing a Minnesota transfer on death deed must be submitted for recording in the county where at least part of the land is located, while the grantor owner is alive. (507.071, subd. 8).

Important terms:

Grantor owner: "means an owner named as a grantor in a transfer on death deed upon whose death the conveyance or transfer of the described real property is conditioned" (subd. 1c).

Owner: "means a person having an ownership or other interest in all or part of the real property to be conveyed or transferred by a transfer on death deed" (subd. 1d).

Beneficiary or grantee beneficiary: "means a person or entity named as a grantee beneficiary in a transfer on death deed, including a successor grantee beneficiary" (subd. 1a).

(Minnesota TOD Deed Package includes form, guidelines, and completed example)

Our Promise

The documents you receive here will meet, or exceed, the Grant County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Grant County Transfer on Death Deed form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4448 Reviews )

Dorothy N.

December 22nd, 2024

The mortgage and note were thorough and very satisfactory for my purposes. The accompanying forms were excellent. I am very pleased with my purchase.

We welcome your positive feedback and are thrilled to have met your expectations. Thank you for choosing our services.

Edward E.

December 22nd, 2024

Easy to use.

Your feedback is valuable to us and helps us improve. Thank you for sharing your thoughts!

MARISSA G.

December 22nd, 2024

I recomemed this webside

Thank you for your feedback. We really appreciate it. Have a great day!

Donna B.

January 10th, 2019

Really liked the quick access to documents. Great service, thanks.

Thank you Donna, we appreciate you taken the time to leave your feedback. Have a great day!

Edward Z.

March 11th, 2021

Very easy to do. Will use them in the future.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Jennie P.

June 25th, 2019

Thank you for the information you sent.

Thank you!

Amie S.

January 8th, 2019

The forms that I downloaded from Deeds were perfect for what I needed. I even checked with a lawyer to see if the papers would work and she said yes.

Thanks Amie, have a great day!

Iva R.

August 20th, 2020

Great service. Fast, got everything done (form, recording) done in a couple of hours, lightning speed in the real estate world. Thanks!

Thank you for your feedback. We really appreciate it. Have a great day!

DENNIS K.

July 22nd, 2020

I am a civil engineer, not an attorney. I deal with easements on a regular basis but not so much on the "recording" side of things. I normally prepare the graphic exhibits that accompany the dedication language but I am not the one who provides that language. Your forms solved that issue for me. Thanks.

Thank you!

Maribel P.

July 14th, 2023

Thank you so much for providing simple but very significant documents one can basically do PRO SE, without any additional huge counsel expenses and yet be legitimate enough to officially file them as state law allows and extends to basic documents processing and filings. Thank you so much for the professional documents provided as they do the proper job. MP

Thank you for the kind words Maribel. Glad we were able to help!

Raymundo M.

November 1st, 2023

Very fast and smooth process, thank you for your quick answers and follow up.

Thank you for your feedback. We really appreciate it. Have a great day!

Veronica T.

September 14th, 2021

Great Service! Thank you

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

sonja E.

May 31st, 2019

It's very easy to find your way around on deeds.com, Excellent layout on this website and user friendly!

Thank you!

HELENA M.

March 19th, 2021

Quick, super easy and very reasonable charge!!

Thank you for your feedback. We really appreciate it. Have a great day!

Marilyn L.

September 3rd, 2020

Good!!

Thank you!