Stearns County Disclaimer of Interest Form (Minnesota)

All Stearns County specific forms and documents listed below are included in your immediate download package:

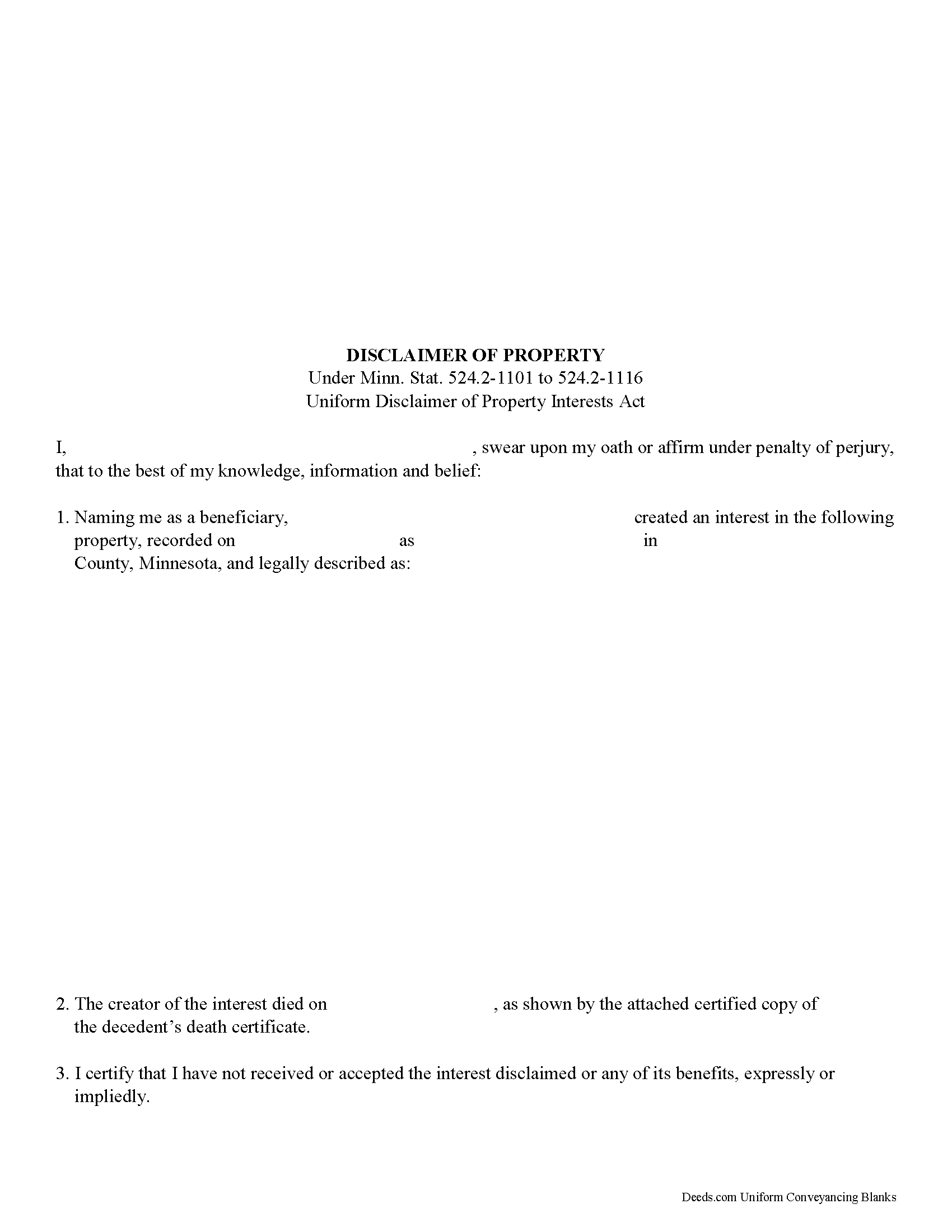

Disclaimer of Interest Form

Fill in the blank form formatted to comply with all recording and content requirements.

Included Stearns County compliant document last validated/updated 11/29/2024

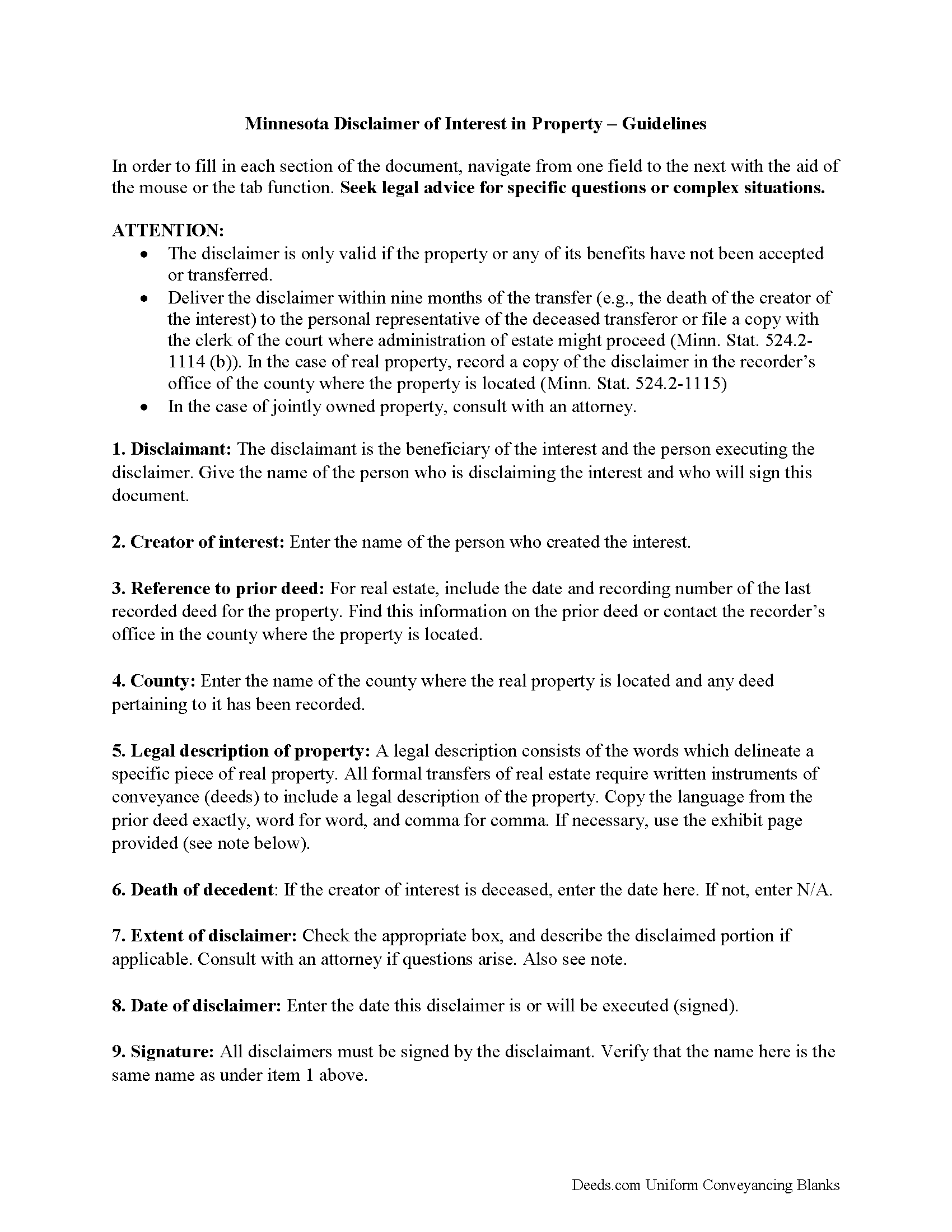

Disclaimer of Interest Guide

Line by line guide explaining every blank on the form.

Included Stearns County compliant document last validated/updated 12/13/2024

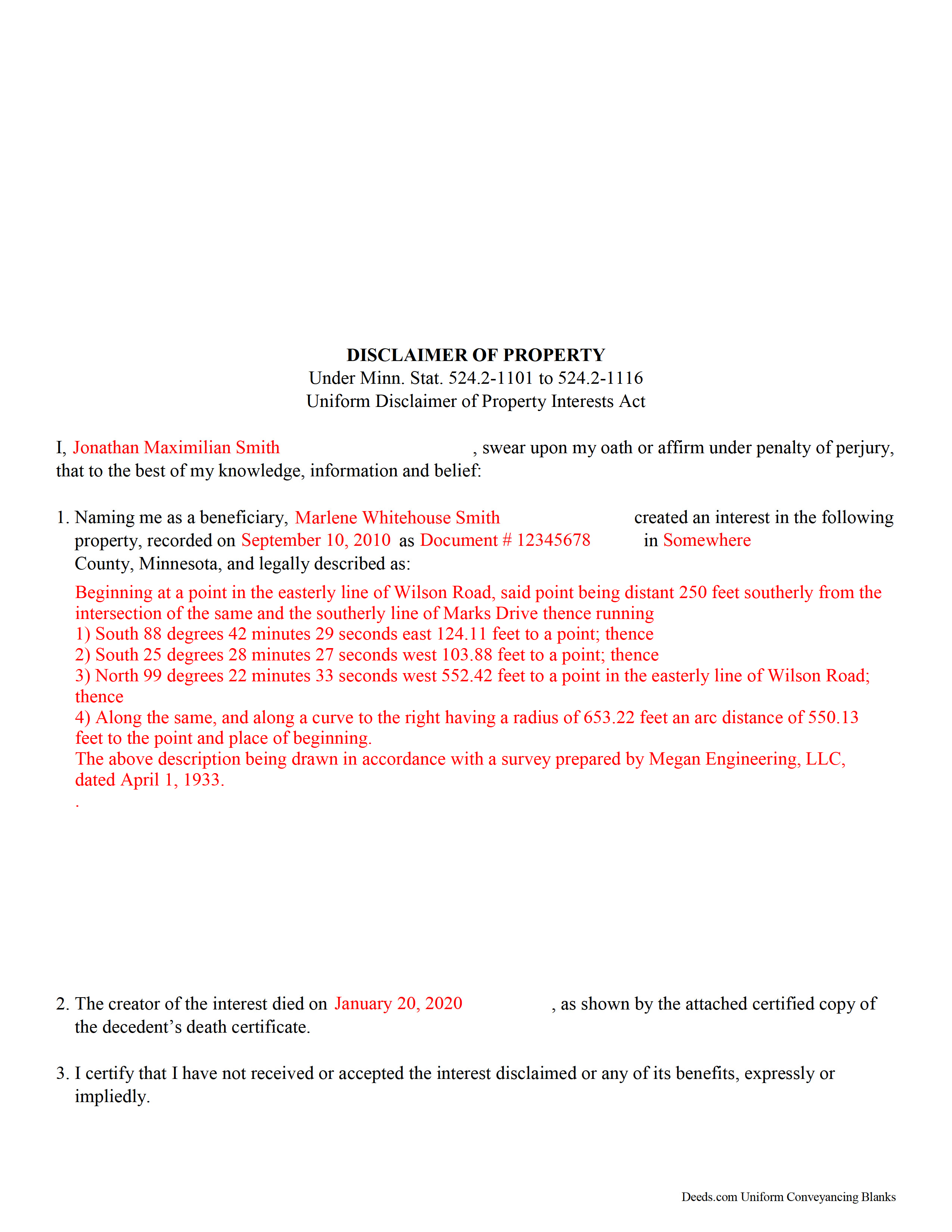

Completed Example of the Disclaimer of Interest Document

Example of a properly completed form for reference.

Included Stearns County compliant document last validated/updated 9/17/2024

The following Minnesota and Stearns County supplemental forms are included as a courtesy with your order:

When using these Disclaimer of Interest forms, the subject real estate must be physically located in Stearns County. The executed documents should then be recorded in the following office:

Service Center, Room 2203

3301 County Road 138, Waite Park, Minnesota 56387

Hours: 8:00am to 4:30pm M-F

Phone: (320) 656-3855

Local jurisdictions located in Stearns County include:

- Albany

- Avon

- Belgrade

- Brooten

- Cold Spring

- Collegeville

- Elrosa

- Freeport

- Greenwald

- Holdingford

- Kimball

- Melrose

- New Munich

- Paynesville

- Richmond

- Rockville

- Roscoe

- Saint Cloud

- Saint Joseph

- Saint Martin

- Saint Stephen

- Sartell

- Sauk Centre

- Waite Park

How long does it take to get my forms?

Forms are available immediately after submitting payment.

How do I get my forms, are they emailed?

Immediately after you submit payment, the Stearns County forms you order will be available for download directly from your account. You can then download the forms to your computer. If you do not already have an account, one will be created for you as part of the order process, and your login details will be provided to you. If you encounter any issues accessing your forms, please reach out to our support team for assistance. Forms are NOT emailed to you.

What does "validated/updated" mean?

This indicates the most recent date when at least one of the following occurred:

- Updated: The document was updated or changed to remain compliant.

- Validated: The document was examined by an attorney or staff, or it was successfully recorded in Stearns County using our eRecording service.

Are these forms guaranteed to be recordable in Stearns County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Stearns County including margin requirements, content requirements, font and font size requirements.

Can the Disclaimer of Interest forms be re-used?

Yes. You can re-use the forms for your personal use. For example, if you have more than one property in Stearns County that you need to transfer you would only need to order our forms once for all of your properties in Stearns County.

What are supplemental forms?

Often when a deed is recorded, additional documents are required by Minnesota or Stearns County. These could be tax related, informational, or even as simple as a coversheet. Supplemental forms are provided for free with your order where available.

What type of files are the forms?

All of our Stearns County Disclaimer of Interest forms are PDFs. You will need to have or get Adobe Reader to use our forms. Adobe Reader is free software that most computers already have installed.

Do I need any special software to use these forms?

You will need to have Adobe Reader installed on your computer to use our forms. Adobe Reader is free software that most computers already have installed.

Do I have to enter all of my property information online?

No. The blank forms are downloaded to your computer and you fill them out there, at your convenience.

Can I save the completed form, email it to someone?

Yes, you can save your deed form at any point with your information in it. The forms can also be emailed, blank or complete, as attachments.

Are there any recurring fees involved?

No. Nothing to cancel, no memberships, no recurring fees.

Under the Minnesota statutes, the beneficiary of an interest in property may renounce the gift, either in part or in full (Minn. Stat. 524.2-1101 to 524.2-1116 Uniform Disclaimer of Property Interests Act). Note that the option to disclaim is only available to beneficiaries who have not acted in any way to indicate acceptance or ownership of the interest.

The disclaimer must be in writing and include a description of the interest, a declaration of intent to disclaim all or a defined portion of the interest, and be signed by the disclaimant (Minn. Stat. 524.2-1107 (c)).

Deliver the disclaimer within nine months of the transfer (e.g., the death of the creator of the interest) to the personal representative of the decedent's estate, or file it with the clerk of the court in any county where administration of estate might proceed (524.2-1114 (b)). In the case of real property, record a copy of the disclaimer in the office of the county recorder or the registrar of titles in the county or counties where the real estate is located (524.2-1115).

A disclaimer is irrevocable and binding for the disclaiming party and his or her creditors, so be sure to consult an attorney when in doubt about the drawbacks and benefits of disclaiming inherited property. If the disclaimed interest arises out of jointly-owned property, seek legal advice as well.

(Minnesota DOI Package includes form, guidelines, and completed example)

Our Promise

The documents you receive here will meet, or exceed, the Stearns County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Stearns County Disclaimer of Interest form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4448 Reviews )

Dorothy N.

December 22nd, 2024

The mortgage and note were thorough and very satisfactory for my purposes. The accompanying forms were excellent. I am very pleased with my purchase.

We welcome your positive feedback and are thrilled to have met your expectations. Thank you for choosing our services.

Edward E.

December 22nd, 2024

Easy to use.

Your feedback is valuable to us and helps us improve. Thank you for sharing your thoughts!

MARISSA G.

December 22nd, 2024

I recomemed this webside

Thank you for your feedback. We really appreciate it. Have a great day!

Alan E.

August 11th, 2021

I couldn't be happier with this service. They're helpful, quick and thorough. They make filing government documents very easy.

Thank you for your feedback. We really appreciate it. Have a great day!

Kevin R.

January 4th, 2024

Deeds.com made a very difficult time in our lives much easier to deal with. So happy that we found this app when we did!

Your feedback is greatly appreciated. Thank you for taking the time to share your experience!

Meridith B.

January 27th, 2021

Well, When I got the question right I got the answers right from Claim Deed. In the end it all worked out very, very good. I'm pleased with the deed and the price was very fair. Thank you for answering all my crazy questions. Now all we have to do is go to UPS and sign it. Thank, again.

Thank you!

Cathleen H.

January 25th, 2019

The pdf form is good; however, the input boxes merge into the line above so the text is hard to read when complete. I added a return before entering my data and this solved the problem.

Thank you for your feedback Cathleen. We will have staff take a look at the document for issues with the text fields. Have a great day!

Jack B.

January 26th, 2020

All worked out well.

Thank you!

Ricky N.

June 22nd, 2023

Great service and instructions are excellent.

Thank you for your feedback. We really appreciate it. Have a great day!

Gary F.

October 6th, 2021

5 star review. Was able to order and download what I wanted in just a few minutes without any glitches.

Thank you for your feedback. We really appreciate it. Have a great day!

Steve G.

August 21st, 2021

The forms were very easy to use. However, the Mercer County cover page is an older version. You can find the recent version on the county website.

Thank you for your feedback. We really appreciate it. Have a great day!

Douglas D.

March 18th, 2021

WOW! What a great service! Incredibly fast (just under 3 hours from creating the package to getting a receipt from the county recorder!) Will definitely use this service again!

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Thomas N.

May 9th, 2019

TODD Form would not print surveyor degrees character (superscript "o") in Exhibit A. It also would not print the "Return Address" or "Prepared By" entries with my middle name as your example showed.

Thank you for your feedback. We really appreciate it. Have a great day!

Leslie S.

July 29th, 2020

After over a month of turmoil and feeling like "you can't get there from here",you solved my problem in a little over an hour. Thank you!!

Thank you for your feedback. We really appreciate it. Have a great day!

David C.

April 21st, 2021

This has been a lifesaver for me. Exactly what I needed. Forma are easy to fill in. Thank you for offering this instead of going thru a lawyer. faster and no wait time.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!