Hennepin County Correction Deed Form (Minnesota)

All Hennepin County specific forms and documents listed below are included in your immediate download package:

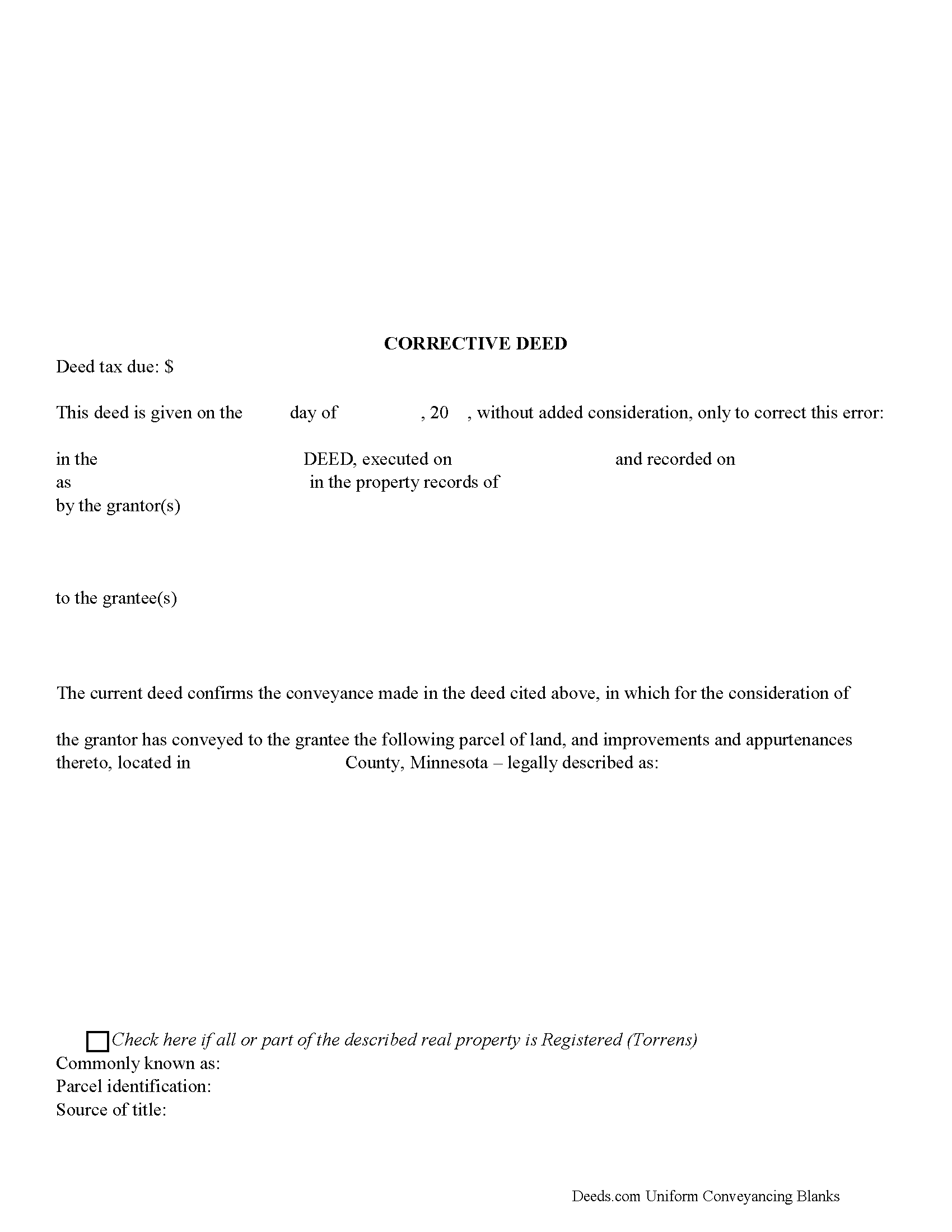

Corrective Deed Form

Fill in the blank form formatted to comply with all recording and content requirements.

Included Hennepin County compliant document last validated/updated 9/17/2024

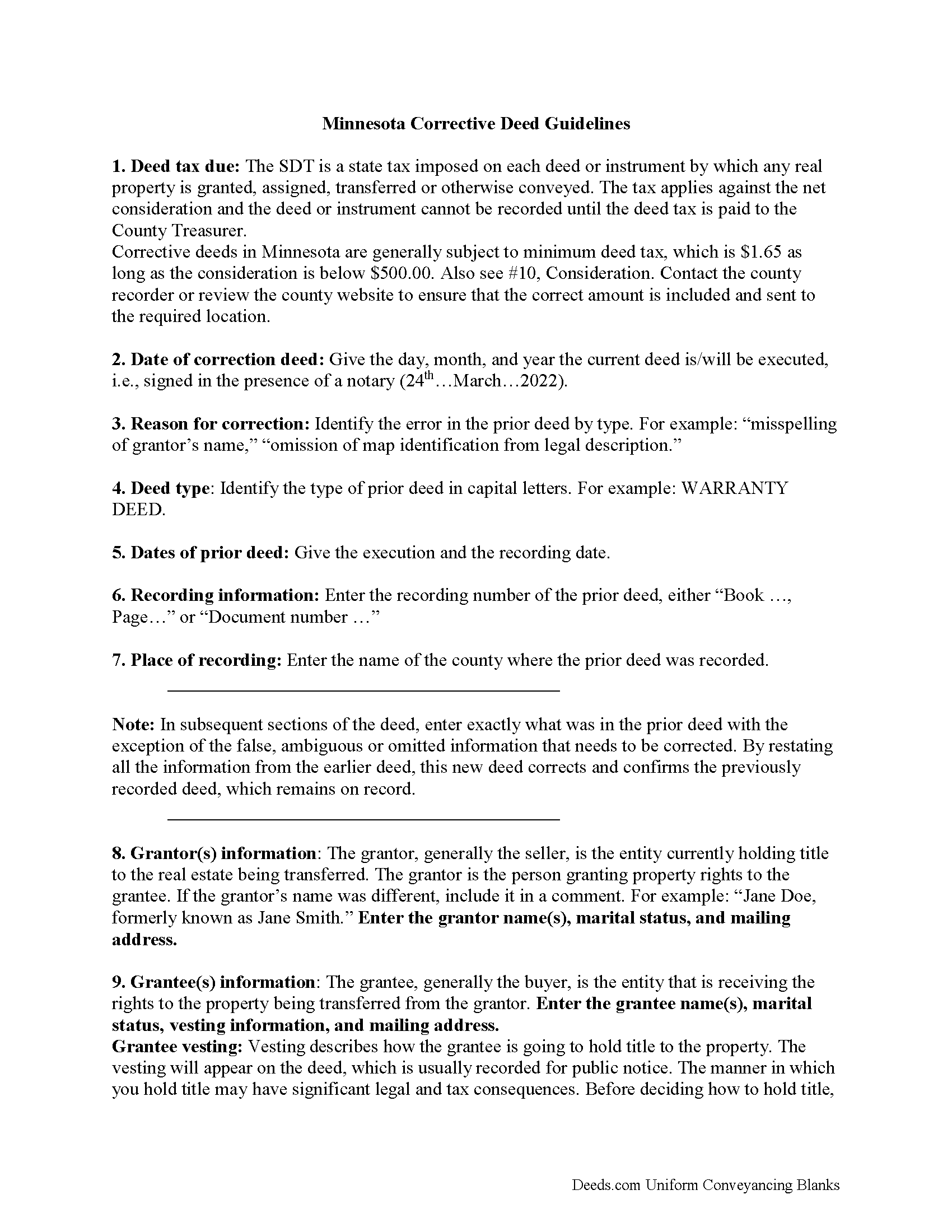

Correction Deed Guide

Line by line guide explaining every blank on the form.

Included Hennepin County compliant document last validated/updated 12/4/2024

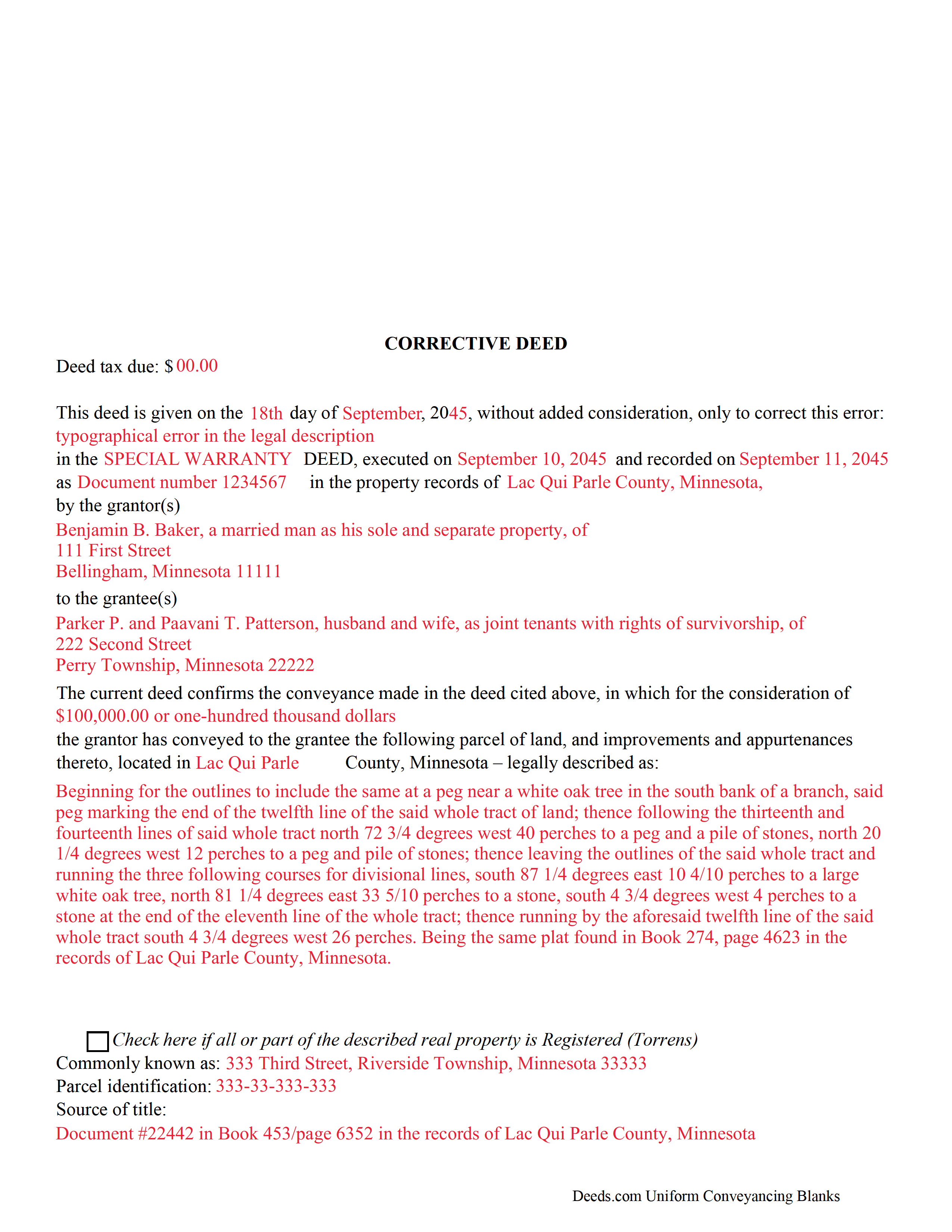

Completed Example of the Corrective Deed Document

Example of a properly completed form for reference.

Included Hennepin County compliant document last validated/updated 11/5/2024

The following Minnesota and Hennepin County supplemental forms are included as a courtesy with your order:

When using these Correction Deed forms, the subject real estate must be physically located in Hennepin County. The executed documents should then be recorded in the following office:

Hennepin Recorder/Registrar

A-500 Government Center - 300 South 6th St, Minneapolis, Minnesota 55487-0055

Hours: 8:00 AM to 4:30 PM

Phone: (612) 348-5139

Local jurisdictions located in Hennepin County include:

- Champlin

- Crystal Bay

- Dayton

- Eden Prairie

- Excelsior

- Hamel

- Hopkins

- Howard Lake

- Long Lake

- Loretto

- Maple Plain

- Minneapolis

- Minnetonka

- Minnetonka Beach

- Mound

- Navarre

- Osseo

- Rockford

- Rogers

- Saint Bonifacius

- Saint Louis Park

- Saint Paul

- Spring Park

- Wayzata

- Young America

How long does it take to get my forms?

Forms are available immediately after submitting payment.

How do I get my forms, are they emailed?

Immediately after you submit payment, the Hennepin County forms you order will be available for download directly from your account. You can then download the forms to your computer. If you do not already have an account, one will be created for you as part of the order process, and your login details will be provided to you. If you encounter any issues accessing your forms, please reach out to our support team for assistance. Forms are NOT emailed to you.

What does "validated/updated" mean?

This indicates the most recent date when at least one of the following occurred:

- Updated: The document was updated or changed to remain compliant.

- Validated: The document was examined by an attorney or staff, or it was successfully recorded in Hennepin County using our eRecording service.

Are these forms guaranteed to be recordable in Hennepin County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Hennepin County including margin requirements, content requirements, font and font size requirements.

Can the Correction Deed forms be re-used?

Yes. You can re-use the forms for your personal use. For example, if you have more than one property in Hennepin County that you need to transfer you would only need to order our forms once for all of your properties in Hennepin County.

What are supplemental forms?

Often when a deed is recorded, additional documents are required by Minnesota or Hennepin County. These could be tax related, informational, or even as simple as a coversheet. Supplemental forms are provided for free with your order where available.

What type of files are the forms?

All of our Hennepin County Correction Deed forms are PDFs. You will need to have or get Adobe Reader to use our forms. Adobe Reader is free software that most computers already have installed.

Do I need any special software to use these forms?

You will need to have Adobe Reader installed on your computer to use our forms. Adobe Reader is free software that most computers already have installed.

Do I have to enter all of my property information online?

No. The blank forms are downloaded to your computer and you fill them out there, at your convenience.

Can I save the completed form, email it to someone?

Yes, you can save your deed form at any point with your information in it. The forms can also be emailed, blank or complete, as attachments.

Are there any recurring fees involved?

No. Nothing to cancel, no memberships, no recurring fees.

Use the corrective deed to amend a previously recorded deed of conveyance with an error that could affect the title.

In Minnesota, there are two options for correcting a deed, re-recording the corrected original deed and recording a newly drafted corrective deed. When re-recording the original deed, make corrections directly on the document, but keep in mind that legal documents cannot be altered with strikeout, whiteout, line through or correction tape. Check with the county's recording office before choosing this option to verify local requirements regarding title pages, required attachments and how to handle the correcting itself.

A re-recorded document must be re-signed by the original parties and re-acknowledged and contain a correction statement that gives the reason for the re-recording and refers to the prior recording. Keep in mind that adding extra pages for the various required statements and the signatures will increase the overall page count of the re-recording, which may affect recording fees.

The easiest and cleanest option is to record a new corrective deed, which mostly restates the prior deed, but also contains the reason for the correction, reference to the prior deed by date, recording number and title, as well as the actual corrected information. By restating all the information from the earlier deed, the new deed corrects and confirms the previously recorded deed, which remains on record.

Take advantage of the statutorily defined right to have a corrective instrument inspected by the county attorney, who, "on finding that such deed is given for the purpose of correcting a defect in the title, or on account of a technical error in a prior conveyance," will certify those findings so that the deed can be recorded even if "there are unpaid taxes or assessments upon such land." (Minn. Stat. 272.15) As far as deed tax is concerned, corrective deeds in Minnesota are generally subject to minimum deed tax. Contact the county recorder or review the county website to ensure that the correct amount is included and sent to the required location.

(Minnesota CD Package includes form, guidelines, and completed example)

Our Promise

The documents you receive here will meet, or exceed, the Hennepin County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Hennepin County Correction Deed form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4448 Reviews )

Dorothy N.

December 22nd, 2024

The mortgage and note were thorough and very satisfactory for my purposes. The accompanying forms were excellent. I am very pleased with my purchase.

We welcome your positive feedback and are thrilled to have met your expectations. Thank you for choosing our services.

Edward E.

December 22nd, 2024

Easy to use.

Your feedback is valuable to us and helps us improve. Thank you for sharing your thoughts!

MARISSA G.

December 22nd, 2024

I recomemed this webside

Thank you for your feedback. We really appreciate it. Have a great day!

NormaJean Q.

July 4th, 2021

Thank you, thie was very helpful. I did find the forms I needed.Very easy to use.,

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Margaret J.

July 27th, 2022

Forms were clear and understandable

Thank you!

Pauletta C.

February 12th, 2022

worked like a charm

Thank you!

Barbara S.

February 28th, 2019

I had an issue due to the fact that I had many beneficiaries. I was and still am not sure how to handle this. We do have Adobe Pro and can modify the form, if needed. But I would like to talk to your organization for more information.

While we are unable to assist you specifically with completing the document we can note that this is addressed in the guide. Information that does not fit in the available space should be included in an exhibit page.

Alexander H.

August 17th, 2019

As an experienced attorney new to estate planning, I attest that this website and its documents were very helpful. Their documents including everything one needed to know and was very comprehensive.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Jonathan W.

March 7th, 2023

Deeds gave me the forms and the guidance that I needed. If I had paid a pro for this service it would have cost at least $300.

Thank you for your feedback. We really appreciate it. Have a great day!

Liza B.

June 22nd, 2021

Fantastic forms and service, could not be happier, wish you girls did more than deed forms.

Thank you!

Dale Mary G.

July 14th, 2020

This was an easy site to use - saving so much time and allowing me to complete what I needed to do. All the added information, guidelines and even a sample completed form. Great!

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Ruth R.

January 31st, 2020

Very pleased with the service, solved an immediate problem for me and at good price.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

john o.

August 8th, 2020

very simple to use

Thank you!

Vicky M.

September 1st, 2022

I would give Deeds.com 10 stars if I could!! The staff were super friendly and easy to work with. They kept me constantly updated during the process of uploading and forwarding my deeds for recording. And, the price was extremely reasonable. I look forward to utilizing Deeds.com every time I need to record a deed no matter what U.S. State. I wholeheartedly recommend them!

Thank you for your feedback. We really appreciate it. Have a great day!

William G M.

October 10th, 2019

This site is very easy to use.

Thank you!