Download Minnesota Certificate of Trust Legal Forms

Minnesota Certificate of Trust Overview

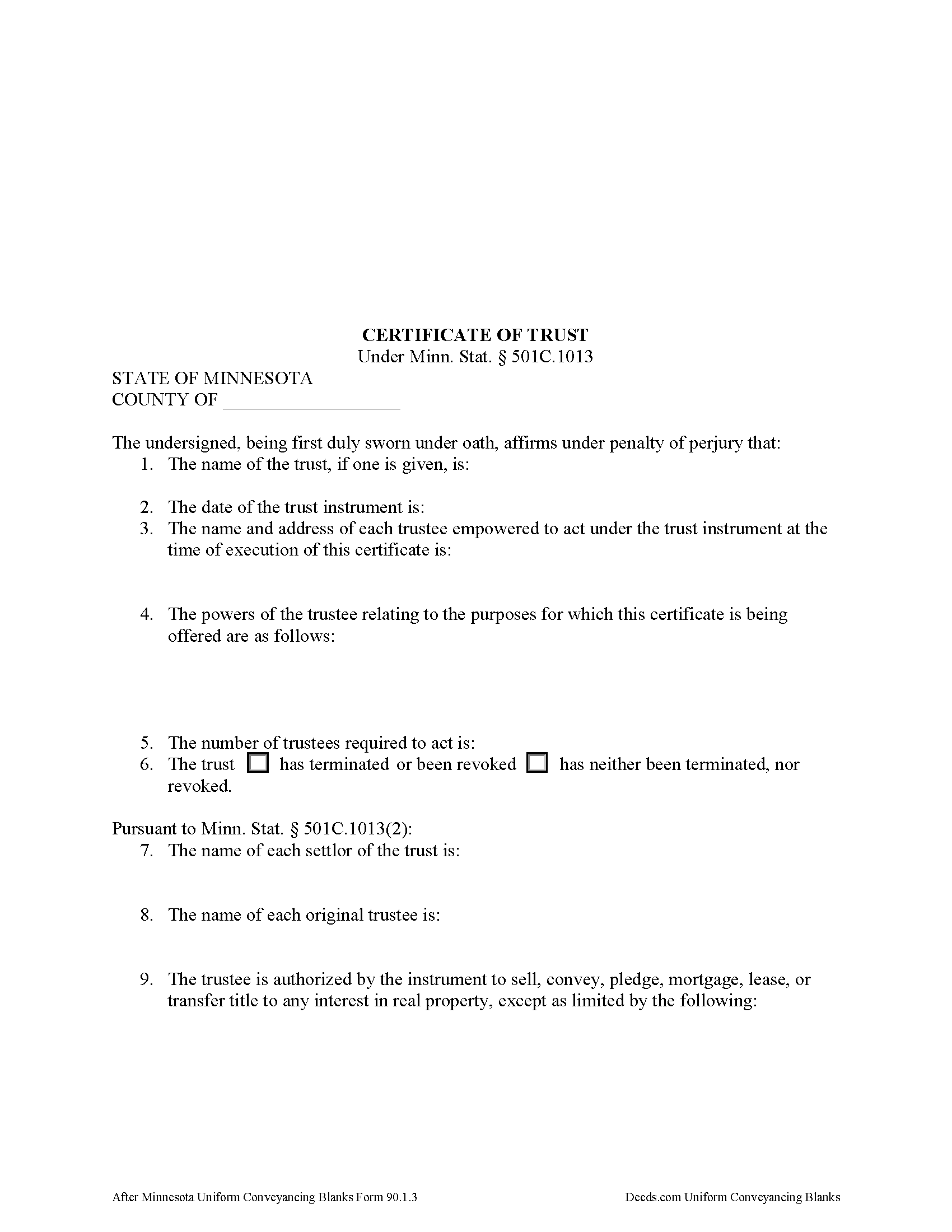

The certificate of trust is codified under the Minnesota Trust Code at Minn. Stat. 501C.1013.

This document is an abstract of the trust instrument setting forth "fewer than all of the provisions . . . and any amendments to the instrument," and contains only essential information relevant to the transaction for which it is being presented (Minn. Stat. 501C.1013, Subd. 1). It "serves to document the existence of the trust, the identity of the trustees, the powers of the trustees and any limitations on those powers, and other matters the certificate of trust sets out, as though the full trust instrument had been recorded or presented" (Subd. 4).

Presented to a recipient in situations regarding personal property, or filed with the county recorder in situations regarding real property, a certificate of trust is "prima facie proof as to matters contained in it" (Subd. 4).

A certificate is valid when executed by settlor or trustee "any time after the execution or creation of a trust" (Subd. 1). The basic content requirements include the name of the trust; the date of the trust instrument; the name and address of each acting trustee; the number of trustees required to act; and the powers of the trustee relevant to the transaction at hand. The certificate also declares whether the trust has terminated or the trust instrument has been revoked (Subd. 1 (1-6)).

For use in real property transactions, the certificate requires the name of each settlor and original trustee, along with a specific statement relating to the authority of the trustee and any restrictions on the trustee's power "to sell, convey, pledge, mortgage, lease, or transfer title to any interest in real property" (Subd. 2). Transactions affecting real property may also require an affidavit of trustee under Minn. Stat. 501C.1014.

The representations contained within the certificate are made by the executing trustee or settlor under oath before a public notary and as such the executing party ensure there are no provisions in the trust instrument or subsequent amendments to limit the power of the trustee in the transaction or "to exercise any other power identified in the certificate" (Subd. 1).

Contact an attorney with any questions regarding trusts or certificates of trust, as each situation is unique.

(Minnesota COT Package includes form, guidelines, and completed example)