Genesee County Partial Unconditional Waiver of Lien Form (Michigan)

All Genesee County specific forms and documents listed below are included in your immediate download package:

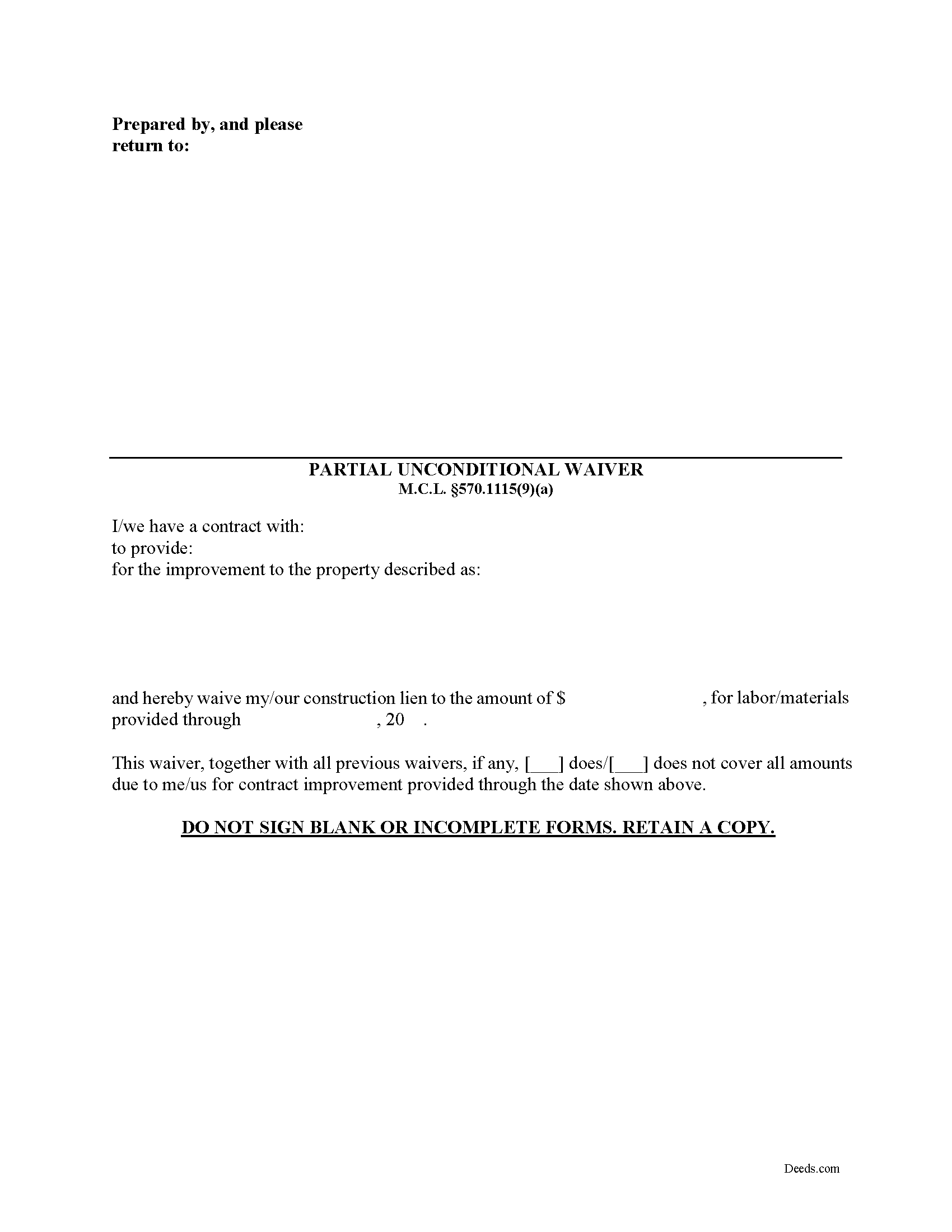

Partial Unconditional Waiver of Lien Form

Fill in the blank form formatted to comply with all recording and content requirements.

Included Genesee County compliant document last validated/updated 11/22/2024

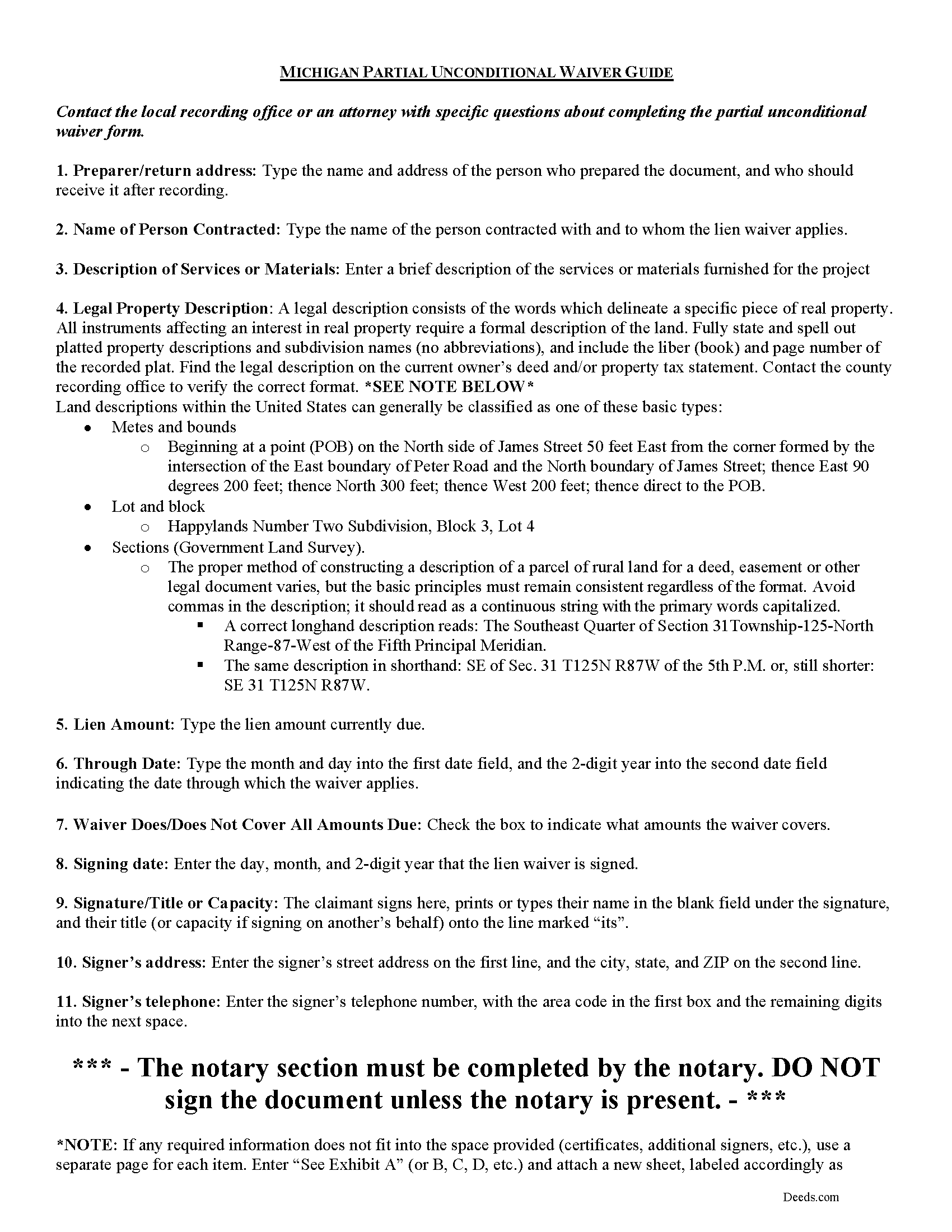

Partial Unconditional Waiver of Lien Guide

Line by line guide explaining every blank on the form.

Included Genesee County compliant document last validated/updated 10/8/2024

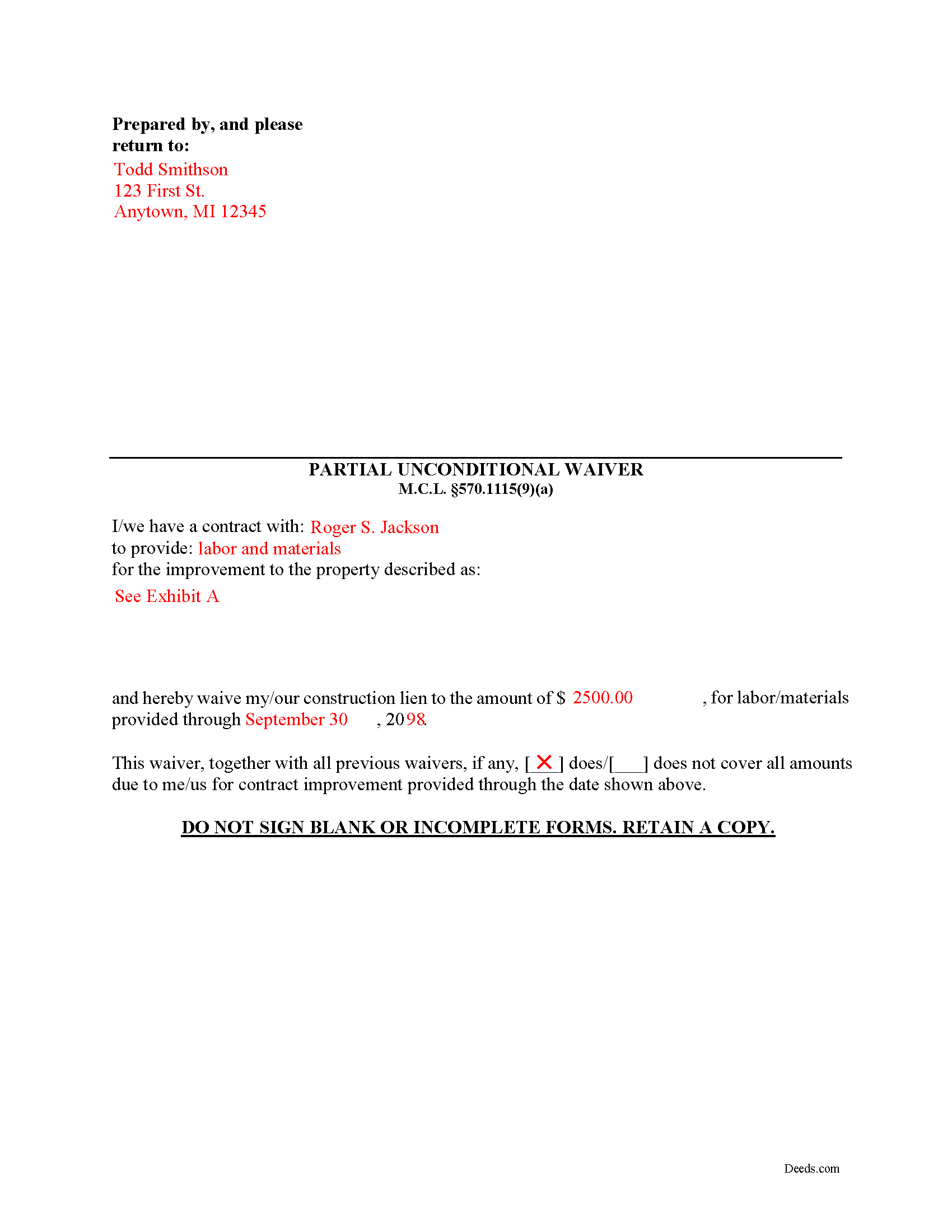

Completed Example of the Partial Unconditional Waiver of Lien Document

Example of a properly completed form for reference.

Included Genesee County compliant document last validated/updated 12/9/2024

The following Michigan and Genesee County supplemental forms are included as a courtesy with your order:

When using these Partial Unconditional Waiver of Lien forms, the subject real estate must be physically located in Genesee County. The executed documents should then be recorded in the following office:

Genesee County Register of Deeds

1101 Beach St, Flint, Michigan 48502

Hours: Mon, Tue, Fri 8:00 - 4:30; Wed, Thu 8:00 - 12:00

Phone: (810) 257-3060

Local jurisdictions located in Genesee County include:

- Atlas

- Burton

- Clio

- Davison

- Fenton

- Flint

- Flushing

- Gaines

- Genesee

- Goodrich

- Grand Blanc

- Lennon

- Linden

- Montrose

- Mount Morris

- Otisville

- Swartz Creek

How long does it take to get my forms?

Forms are available immediately after submitting payment.

How do I get my forms, are they emailed?

Immediately after you submit payment, the Genesee County forms you order will be available for download directly from your account. You can then download the forms to your computer. If you do not already have an account, one will be created for you as part of the order process, and your login details will be provided to you. If you encounter any issues accessing your forms, please reach out to our support team for assistance. Forms are NOT emailed to you.

What does "validated/updated" mean?

This indicates the most recent date when at least one of the following occurred:

- Updated: The document was updated or changed to remain compliant.

- Validated: The document was examined by an attorney or staff, or it was successfully recorded in Genesee County using our eRecording service.

Are these forms guaranteed to be recordable in Genesee County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Genesee County including margin requirements, content requirements, font and font size requirements.

Can the Partial Unconditional Waiver of Lien forms be re-used?

Yes. You can re-use the forms for your personal use. For example, if you have more than one property in Genesee County that you need to transfer you would only need to order our forms once for all of your properties in Genesee County.

What are supplemental forms?

Often when a deed is recorded, additional documents are required by Michigan or Genesee County. These could be tax related, informational, or even as simple as a coversheet. Supplemental forms are provided for free with your order where available.

What type of files are the forms?

All of our Genesee County Partial Unconditional Waiver of Lien forms are PDFs. You will need to have or get Adobe Reader to use our forms. Adobe Reader is free software that most computers already have installed.

Do I need any special software to use these forms?

You will need to have Adobe Reader installed on your computer to use our forms. Adobe Reader is free software that most computers already have installed.

Do I have to enter all of my property information online?

No. The blank forms are downloaded to your computer and you fill them out there, at your convenience.

Can I save the completed form, email it to someone?

Yes, you can save your deed form at any point with your information in it. The forms can also be emailed, blank or complete, as attachments.

Are there any recurring fees involved?

No. Nothing to cancel, no memberships, no recurring fees.

During the construction process, a property owner (or his or her lessee) may ask the contractor for a lien waiver in exchange for a full or partial payment.

Michigan defines four permissible types of lien waivers. These include: (1) Partial Unconditional Waiver, (2) Partial Conditional Waiver, (3), Full Unconditional Waiver, and (4) Full Conditional Waiver. M.C.L. 570.1115(9).

Use a partial unconditional waiver of lien when the claimant receives an agreed-upon payment for his or her contract from the owner, lessee, or designee. M.C.L. 570.1115(3). This partial payment may be a scheduled disbursement, be tied to a progress point in the improvement process, or another circumstance as set out in the original contract.

A waiver under this section takes effect when a person makes payment relying on the waiver, unless at the time the payment was made, the person making the payment had written notice that the payment or consideration for the waiver has failed (i.e., the check bounced at the bank). M.C.L. 570.1115(6).

Lien waiver forms must be in writing and must comply with Michigan law to be valid. Include the names of the contractor and the property owner, and identify the property and dates covered by the recorded lien.

Lien waivers can be confusing, and issuing the wrong type of waiver (or issuing one too early) can lead to dire consequences for construction liens. Contact an attorney with questions about waivers or any other issues related to liens in Michigan.

Our Promise

The documents you receive here will meet, or exceed, the Genesee County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Genesee County Partial Unconditional Waiver of Lien form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4446 Reviews )

MARISSA G.

December 22nd, 2024

I recomemed this webside

Thank you for your feedback. We really appreciate it. Have a great day!

Dennis F.

December 20th, 2024

The release of mortgage form was OK, and accepted at the recorder's office, but there were some problems. Many of the fields to type in were too small to accept the data, and I could not find a way to change the field size or use a smaller font. Otherwise I was satisfied.

Your feedback is a crucial part of our dedication to ongoing improvement. Thank you for your insightful comments.

Frazer W.

December 19th, 2024

Deeds.com does a great job getting our legal documents filed with the D.C. Recorder of Deeds.rnrnFrazer Walton, Jr.rnLaw Office of Frazer Walton, Jr.

Your appreciative words mean the world to us. Thank you.

John H.

September 16th, 2022

Response was timely, even though unsuccessful in locating a requested deed. Deeds very courteously and professionally cancelled my order and cancelled its charge to my credit card.

Thank you for your feedback. We really appreciate it. Have a great day!

Anita B.

April 15th, 2020

Service was fast and complete. Would use again.

Thank you!

tim r.

August 15th, 2019

easy sight and extra forms that I can use any time

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Gina B.

March 30th, 2023

This website is reliable and informative. So glad I can across this website. They provide a wide range of documents that are always provided on the recording county website. Thanks!

Thank you!

Joe W.

January 22nd, 2020

Effortless transaction and very thorough paperwork and explanations.

Thank you!

Mark M.

October 1st, 2020

So nice to find the forms I was looking for. Great site!! Thanks

Thank you for your feedback. We really appreciate it. Have a great day!

Susan J.

June 6th, 2023

I was pleased that I could send the documents this way rather than having to mail it or take time out of my day to go down to the records office.

Thank you for taking the time to leave your feedback Susan, we really appreciate you. Have an amazing day.

Michelle N.

April 1st, 2019

Great experience

Thank you Michelle.

Daniel V.

April 11th, 2023

Awesome service Recorded a deed within 24hrs and saved my self a 14hr+ journey

Thank you for your feedback. We really appreciate it. Have a great day!

Keith M.

September 18th, 2020

Great bargain! Thanks. Easy to download forms.

-Keith M

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Patricia C.

May 13th, 2019

I found there were a large number of documents available to download. The file naming on the PDFs could be more descriptive, and it would be nice to be able to download a complete set with one click.

Thank you for your feedback. We really appreciate it. Have a great day!

Marilyn C.

April 6th, 2020

My document got recorded right away. Thank you! Will use again in the future when needed.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!