Arenac County Mortgage Secured by Promissory Note Form (Michigan)

All Arenac County specific forms and documents listed below are included in your immediate download package:

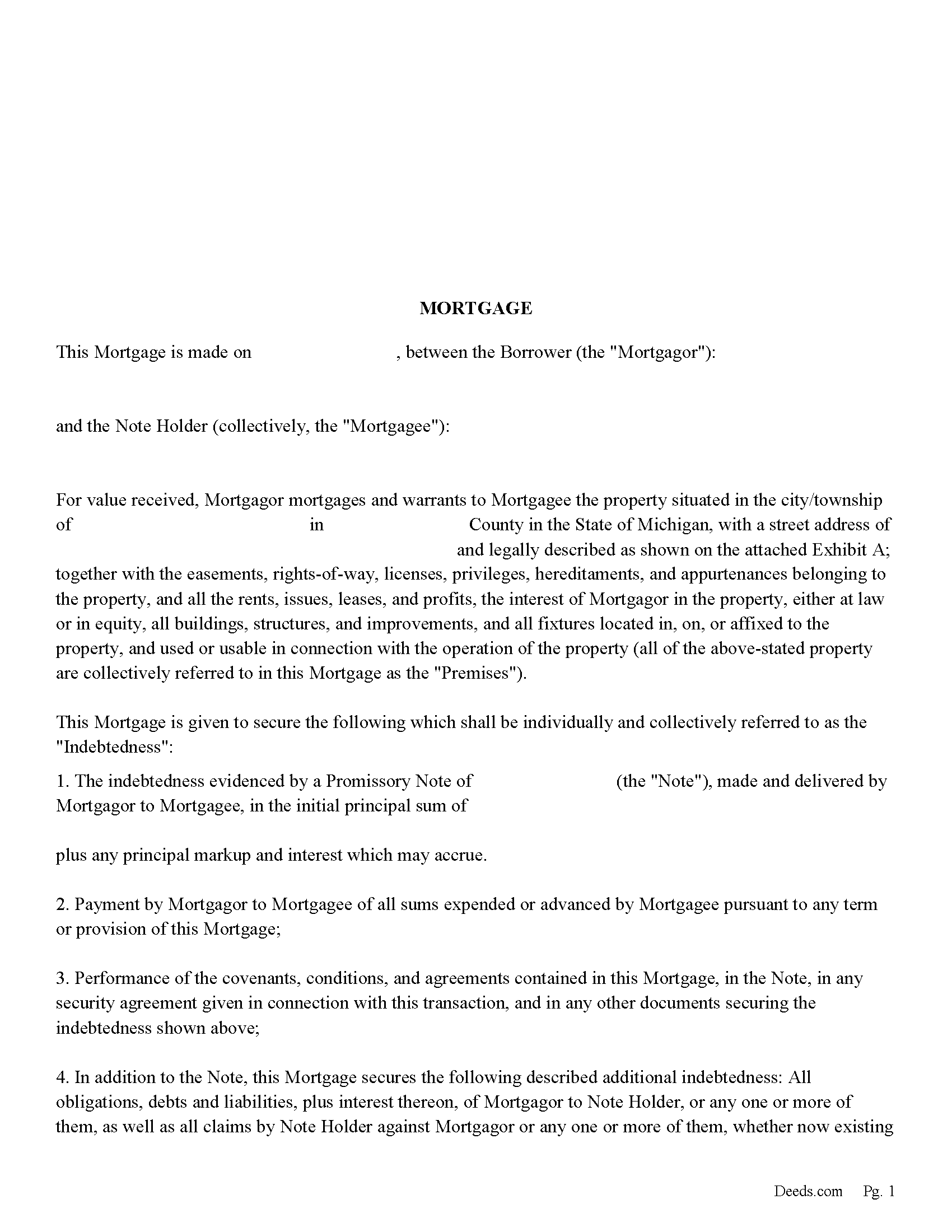

Mortgage Form

Fill in the blank form formatted to comply with all recording and content requirements.

Included Arenac County compliant document last validated/updated 10/4/2024

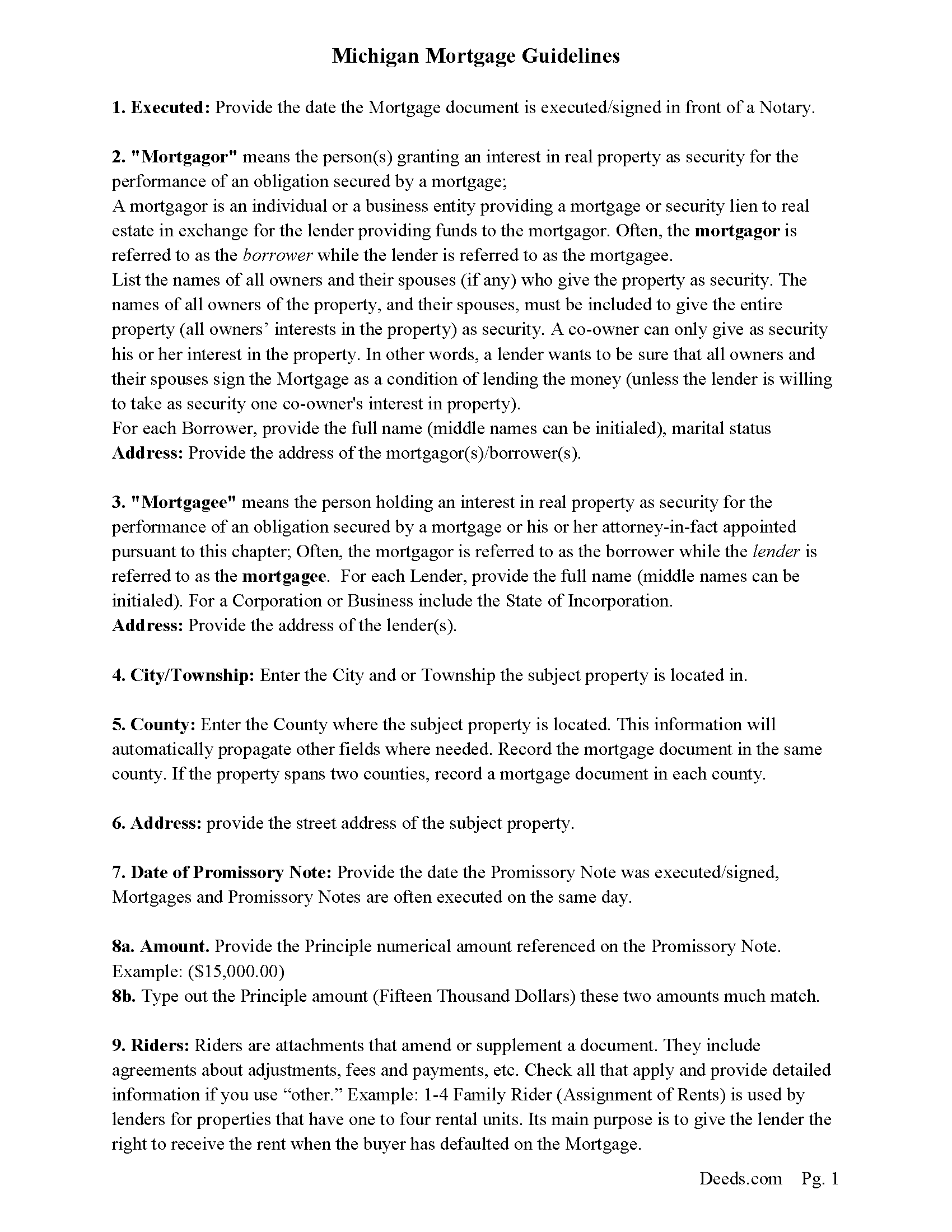

Mortgage Guidelines

Line by line guide explaining every blank on the form.

Included Arenac County compliant document last validated/updated 11/20/2024

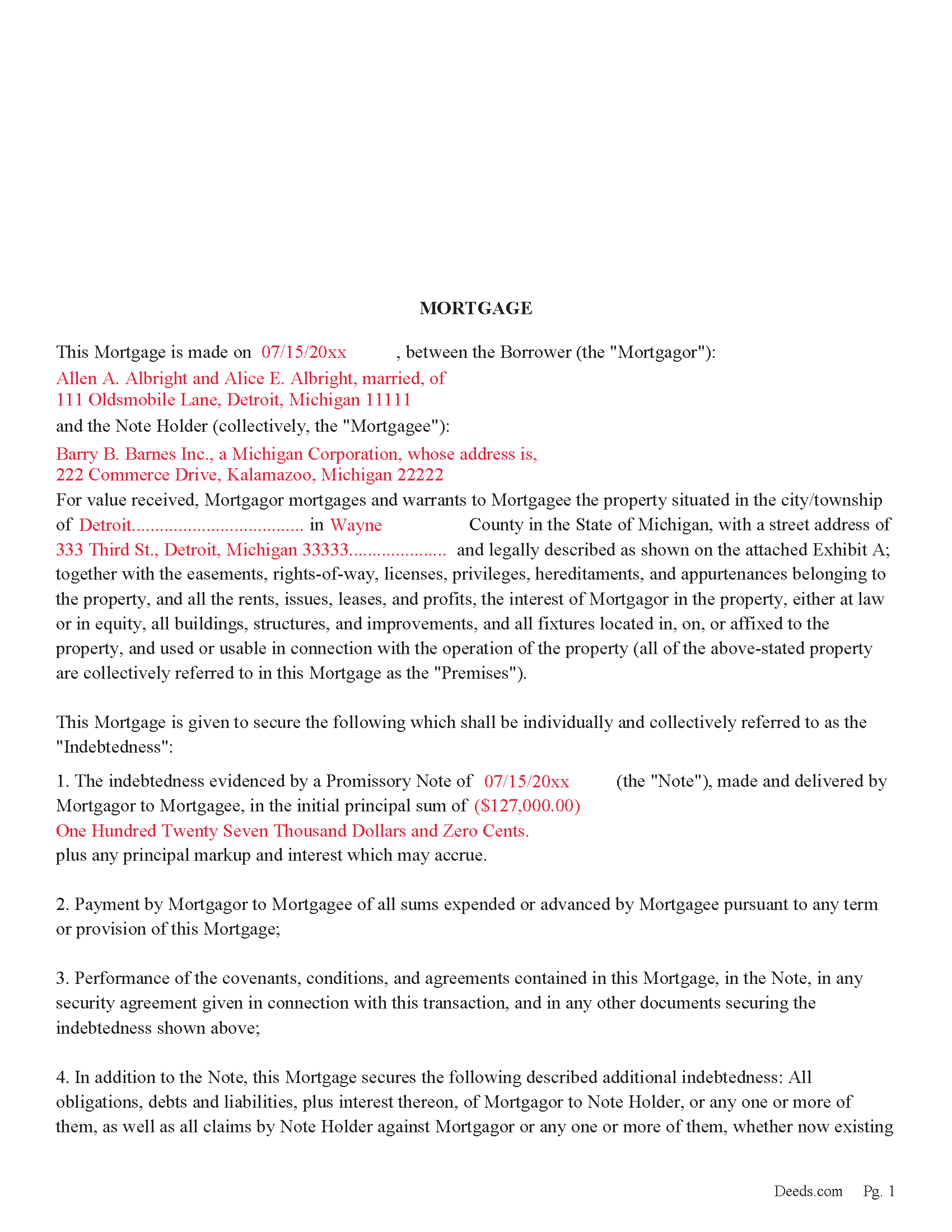

Completed Example of the Mortgage Document

Example of a properly completed form for reference.

Included Arenac County compliant document last validated/updated 11/22/2024

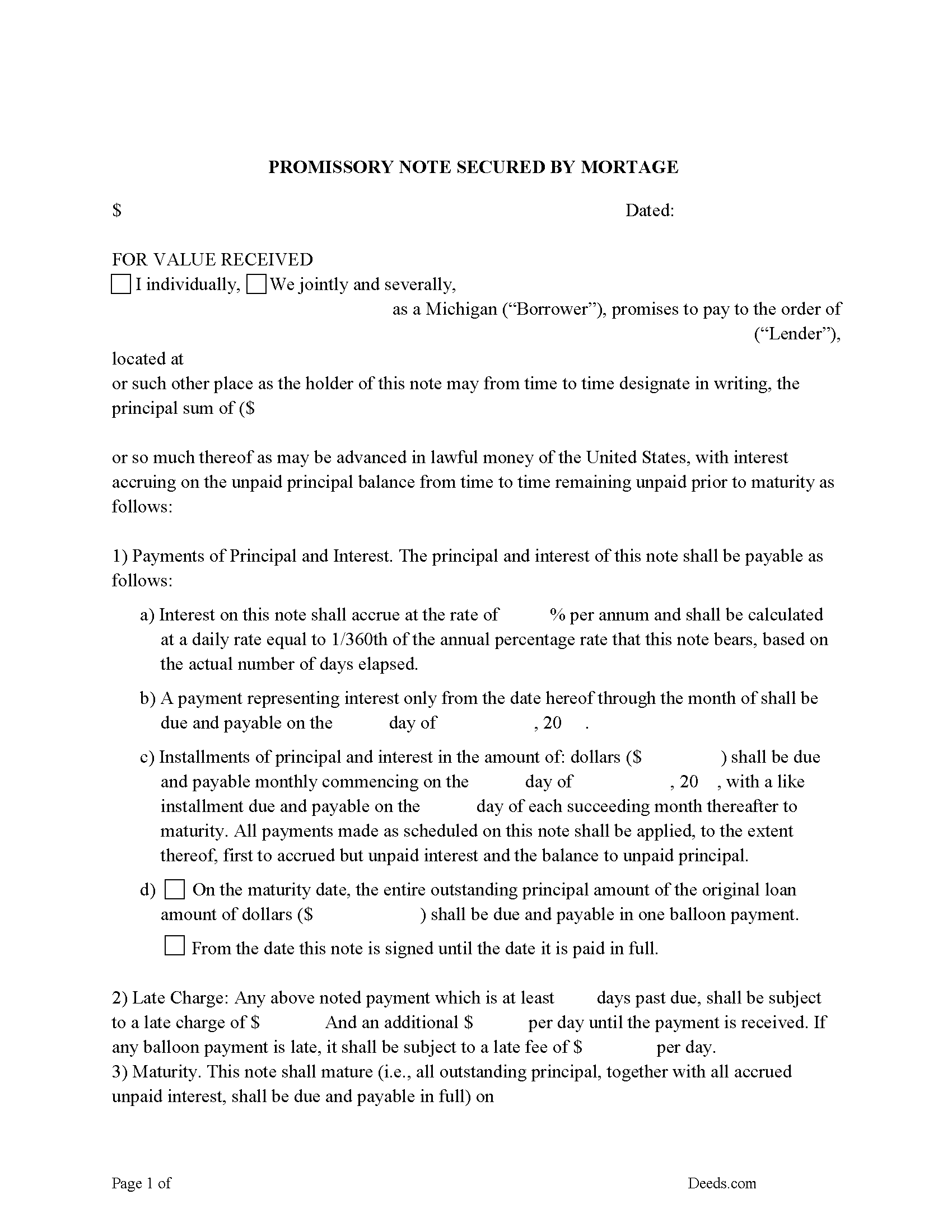

Promissory Note Form

Fill in the blank Form.

Included Arenac County compliant document last validated/updated 11/26/2024

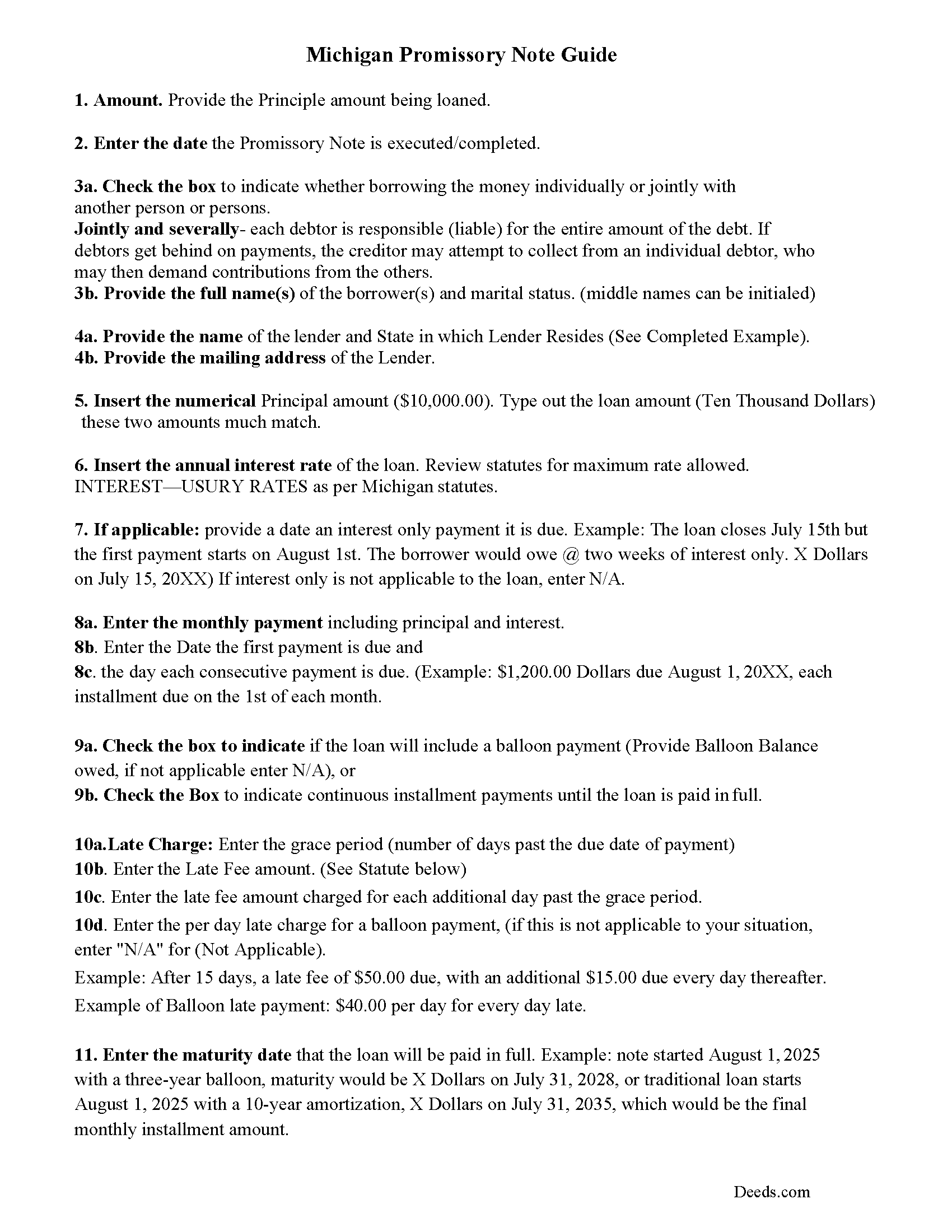

Promissory Note Guidelines

Line by line guide explaining every blank on the form.

Included Arenac County compliant document last validated/updated 10/17/2024

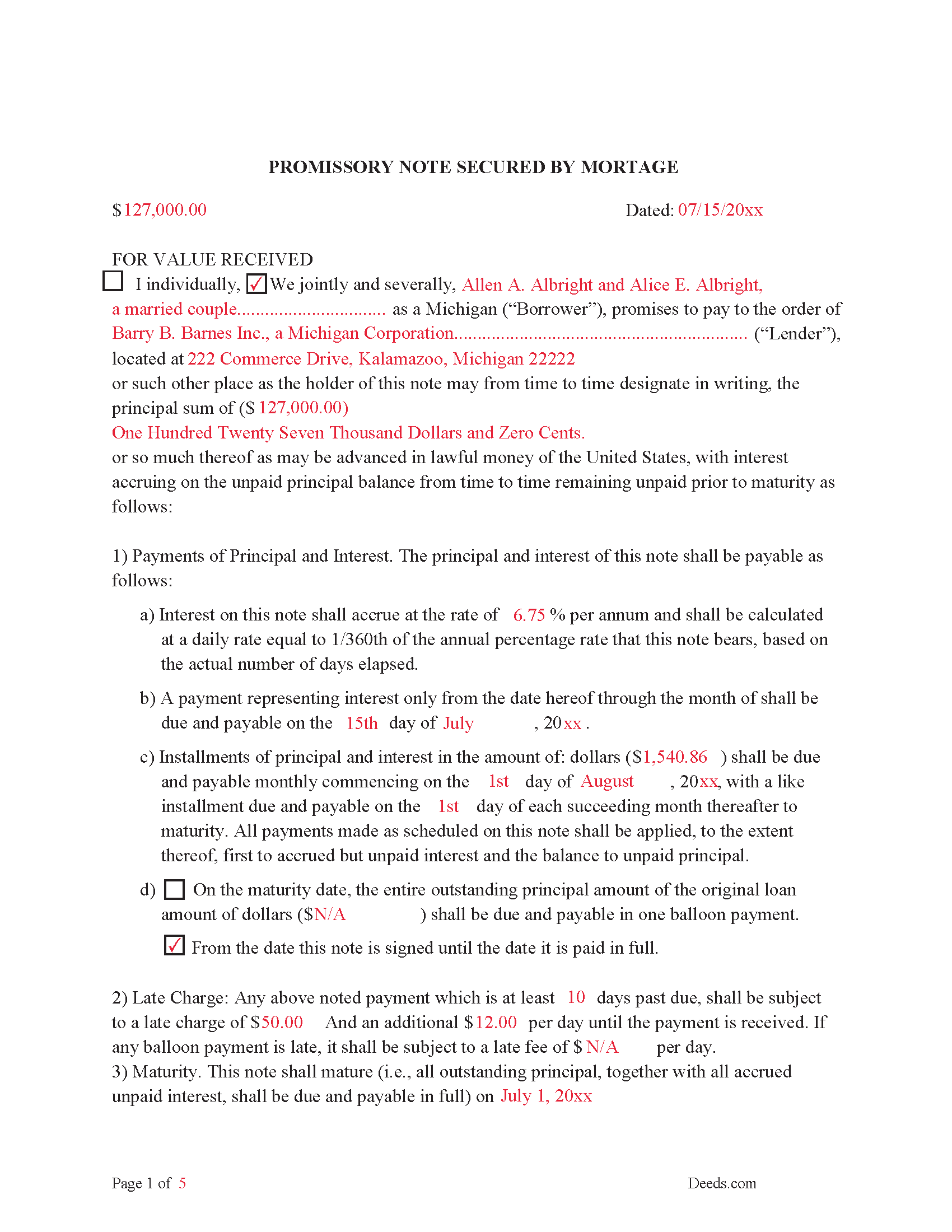

Completed Example of the Promissory Note Document

This Promissory Note is filled in and highlighted, showing how the guideline information, can be interpreted into the document.

Included Arenac County compliant document last validated/updated 12/11/2024

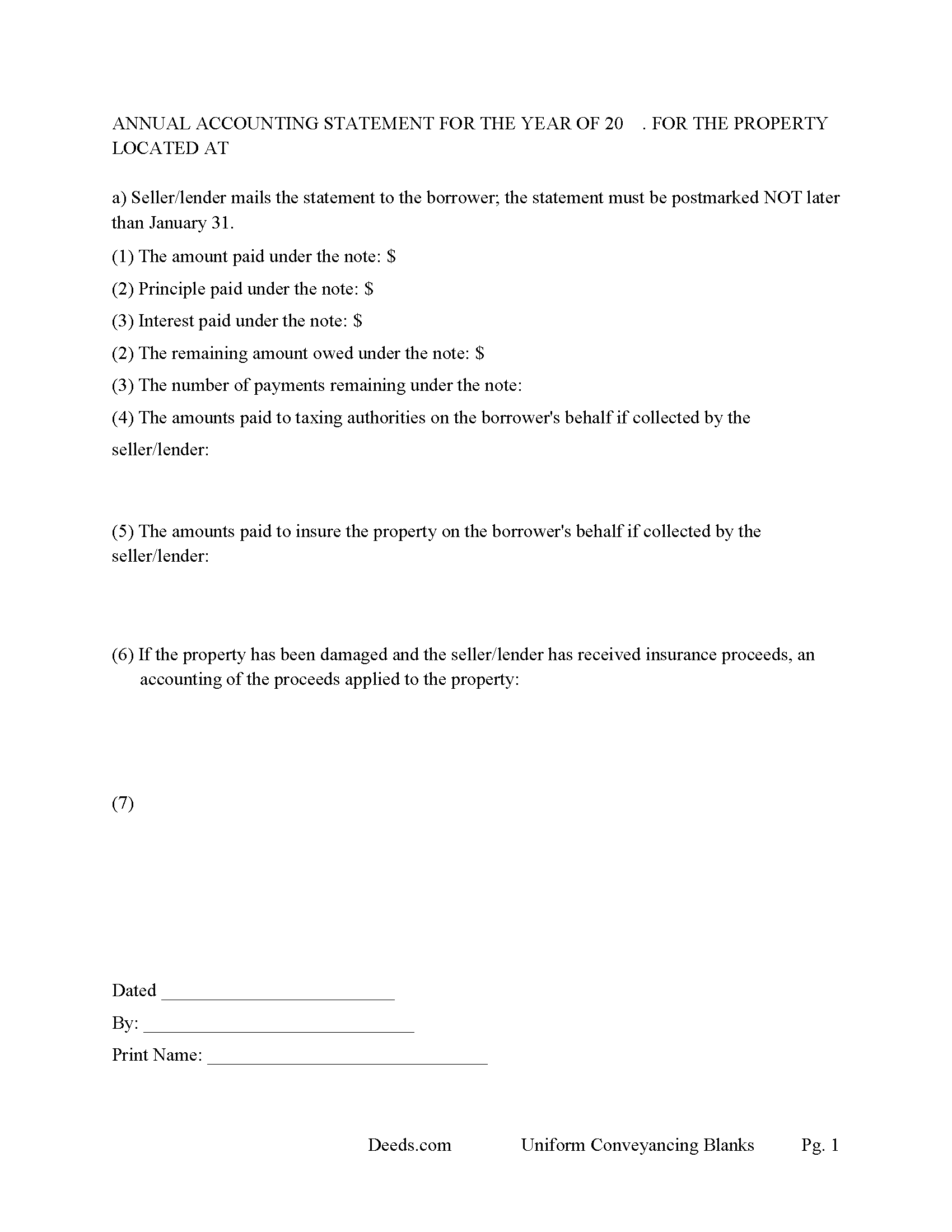

Annual Accounting Statement Form

Mail to borrower for fiscal year reporting.

Included Arenac County compliant document last validated/updated 8/27/2024

The following Michigan and Arenac County supplemental forms are included as a courtesy with your order:

When using these Mortgage Secured by Promissory Note forms, the subject real estate must be physically located in Arenac County. The executed documents should then be recorded in the following office:

Arenac County Register of Deeds

120 North Grove St / PO Box 296, Standish, Michigan 48658

Hours: 9:00 to 4:30 M-F

Phone: (989) 846-9201

Local jurisdictions located in Arenac County include:

- Alger

- Au Gres

- Omer

- Standish

- Sterling

- Turner

- Twining

How long does it take to get my forms?

Forms are available immediately after submitting payment.

How do I get my forms, are they emailed?

Immediately after you submit payment, the Arenac County forms you order will be available for download directly from your account. You can then download the forms to your computer. If you do not already have an account, one will be created for you as part of the order process, and your login details will be provided to you. If you encounter any issues accessing your forms, please reach out to our support team for assistance. Forms are NOT emailed to you.

What does "validated/updated" mean?

This indicates the most recent date when at least one of the following occurred:

- Updated: The document was updated or changed to remain compliant.

- Validated: The document was examined by an attorney or staff, or it was successfully recorded in Arenac County using our eRecording service.

Are these forms guaranteed to be recordable in Arenac County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Arenac County including margin requirements, content requirements, font and font size requirements.

Can the Mortgage Secured by Promissory Note forms be re-used?

Yes. You can re-use the forms for your personal use. For example, if you have more than one property in Arenac County that you need to transfer you would only need to order our forms once for all of your properties in Arenac County.

What are supplemental forms?

Often when a deed is recorded, additional documents are required by Michigan or Arenac County. These could be tax related, informational, or even as simple as a coversheet. Supplemental forms are provided for free with your order where available.

What type of files are the forms?

All of our Arenac County Mortgage Secured by Promissory Note forms are PDFs. You will need to have or get Adobe Reader to use our forms. Adobe Reader is free software that most computers already have installed.

Do I need any special software to use these forms?

You will need to have Adobe Reader installed on your computer to use our forms. Adobe Reader is free software that most computers already have installed.

Do I have to enter all of my property information online?

No. The blank forms are downloaded to your computer and you fill them out there, at your convenience.

Can I save the completed form, email it to someone?

Yes, you can save your deed form at any point with your information in it. The forms can also be emailed, blank or complete, as attachments.

Are there any recurring fees involved?

No. Nothing to cancel, no memberships, no recurring fees.

This mortgage includes a power of sale clause and waiver of rights, saving time and expense in the case of a foreclosure.

Waiver of Rights. This Mortgage contains a power of sale that permits the Mortgagee/Lender to cause the Premises to be sold in the event of a default. Mortgagee/Lender may elect to cause the Premises to be sold by advertisement rather than pursuant to court action, and Mortgagor/Borrower voluntarily and knowingly waives any right Mortgagor/Borrower may have by virtue of any applicable constitutional provision or statute to any notice or court hearing before the exercise required by the Michigan statute governing foreclosures by advertisement.

In the event of default in any of the terms or covenants of this Mortgage, Mortgagee/Lender shall be entitled to all of the rights and benefits of MCL 554.231-.233, MSA 26.1137(1)-(3), and 1966 PA 151.

Use this mortgage to finance residential property, small commercial, condominiums, rental property, and planned unit developments even with an existing first mortgage on the subject property. A mortgage and promissory note that include stringent default terms can be beneficial to the Mortgagee/Lender.

Included is an annual accounting statement form

565.161 Annual statements to mortgagor; when required, contents.

Sec. 1.

Where, by the terms of a mortgage on real property, the mortgagor is required to make periodic payments which include sums to be allocated to an escrow account for the purpose of paying taxes, insurance or improvements to the property, or any combination of such purposes, the mortgagee or agent receiving the periodic payments shall furnish the mortgagor with a statement within 60 days of the close of the calendar year, showing the beginning balance of the escrow fund, total receipts received by the fund during the calendar year, an itemized statement of all expenditures from the fund during the calendar year and the balance in the fund at the end of the calendar year.

(Michigan Mortgage Package includes forms, guidelines, and completed examples) For use in Michigan only.

Our Promise

The documents you receive here will meet, or exceed, the Arenac County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Arenac County Mortgage Secured by Promissory Note form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4449 Reviews )

Daniel B.

December 24th, 2024

easy to use and upload.

We are delighted to have been of service. Thank you for the positive review!

Dorothy N.

December 22nd, 2024

The mortgage and note were thorough and very satisfactory for my purposes. The accompanying forms were excellent. I am very pleased with my purchase.

We welcome your positive feedback and are thrilled to have met your expectations. Thank you for choosing our services.

Edward E.

December 22nd, 2024

Easy to use.

Your feedback is valuable to us and helps us improve. Thank you for sharing your thoughts!

Kelli M.

April 27th, 2020

It is easy to use but difficult to know when the document has been reviewed for recording and when the invoice is ready. It would be helpful for the website to send an email automatically once the document(s) are ready to be recorded to let you know what the time line is.....Thank you for your help.

Thank you for your feedback. We really appreciate it. Have a great day!

JoAnn S.

July 31st, 2021

Easy to process orders.

Thank you!

Gary M.

February 13th, 2024

This was such an easy experience

We are grateful for your feedback and looking forward to serving you again. Thank you!

Amanda S.

April 3rd, 2019

Thank you! My husband and I went in the get notary stamps for a Special Warranty Deed and a Post Nuptial Agreement. The representative was very knowledgeable and thorough with the notary process. She made sure we read and understood all documents that we were signing and they required us to recite in sworn statements that everything there was true and understood! I will be using the notary service again at Bank of America! The representative was very respectful and had a nice smile the entire time to make our visit great!

Thank you!

Todd W.

September 3rd, 2020

Communication is hard. The reps need to be empowered and encouraged to call the customers when necessary. They encourage 300 dpi resolution and under 2 MB PDF file, which is not even possible with our scanner. They made a vague comment about a legal description looking abbreviated but did not explain. They refused to call me. They said the county said "Image is light please darken", but the image looked fine to me. Maybe not their fault, but they refused to help work with the county on that for me. I followed their suggestion though and re-scanned at 300 dpi, but they misunderstood me and did not re-submit it right away. Over 48 hours later, it's still not recorded yet. I hope it will be today.

Thank you for your feedback Todd.

Jonnie G.

November 15th, 2019

I very much dreaded this whole endeavor but very pleasantly surprised. So far, so good. I feel much more confidant that the crucial form, when presented, will play well with the county.......

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Andrew M.

March 20th, 2021

Very easy to find the Quitclaim Deed form I needed. It was correct format and was accepted by my bank.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Caroline W.

June 30th, 2019

They didn't have what I needed, but they were very quick in responding to let me know and where I needed to go to receive the desired information.

Thank you for your feedback Caroline.

Debbie M.

July 3rd, 2020

The forms and instructions were easy to follow and get complete. It was very nice to be able to just find them, pay for them, and download them so that they were printed just within a matter of 30 minutes. Thank you

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

ray r.

July 17th, 2020

excellent service

Thank you!

Terry M.

December 2nd, 2021

Application is not well laid out. I guess it does the job but leaves a lot to be desired. Hard to follow

Thank you for your feedback. We really appreciate it. Have a great day!

Justine John S.

February 17th, 2022

Splendid! I will definitely and absolutely recommend you guys and this company to my co-investors !

Thank you!