Saint Clair County Durable Power of Attorney Form (Michigan)

All Saint Clair County specific forms and documents listed below are included in your immediate download package:

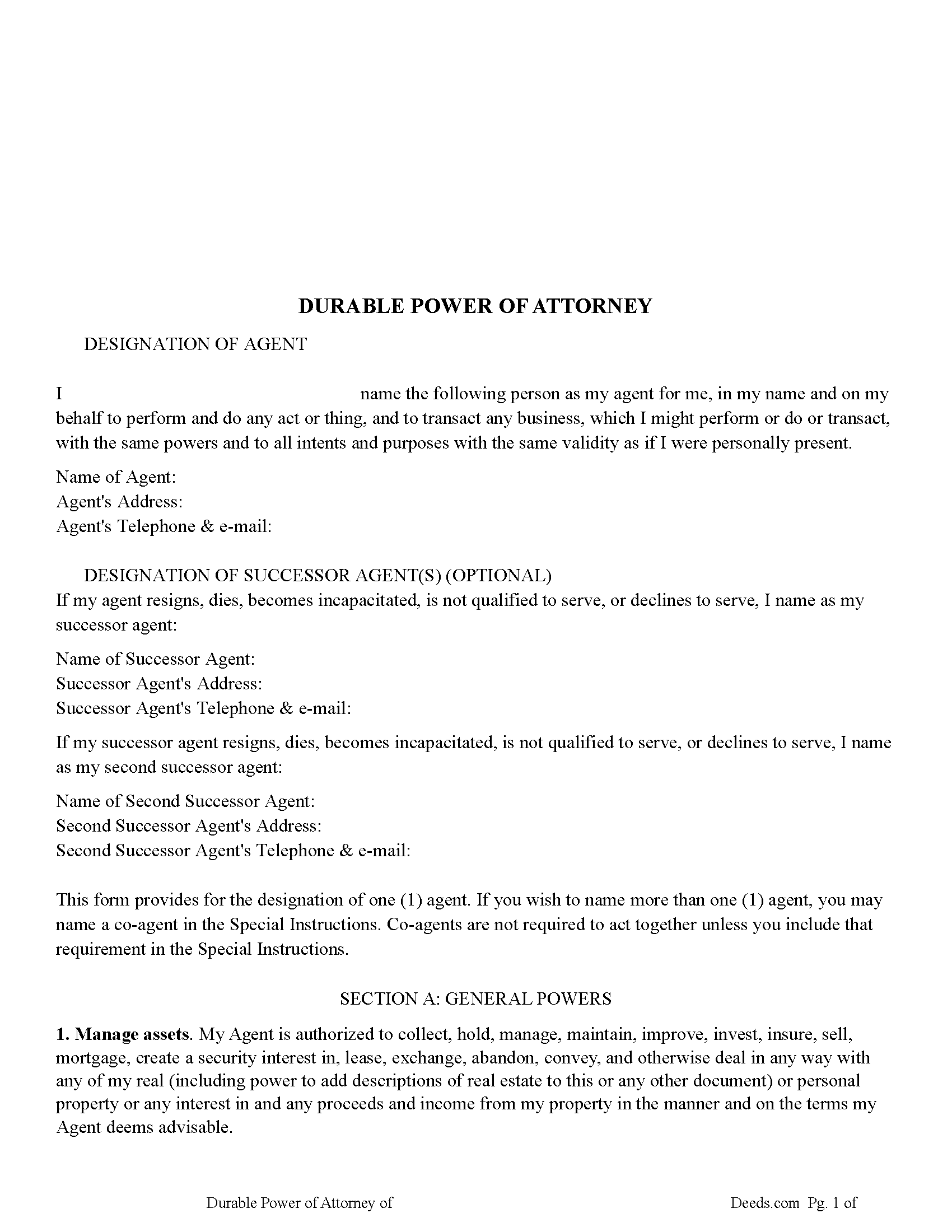

Durable Power of Attorney Form

Fill in the blank form formatted to comply with all recording and content requirements.

Included Saint Clair County compliant document last validated/updated 9/5/2024

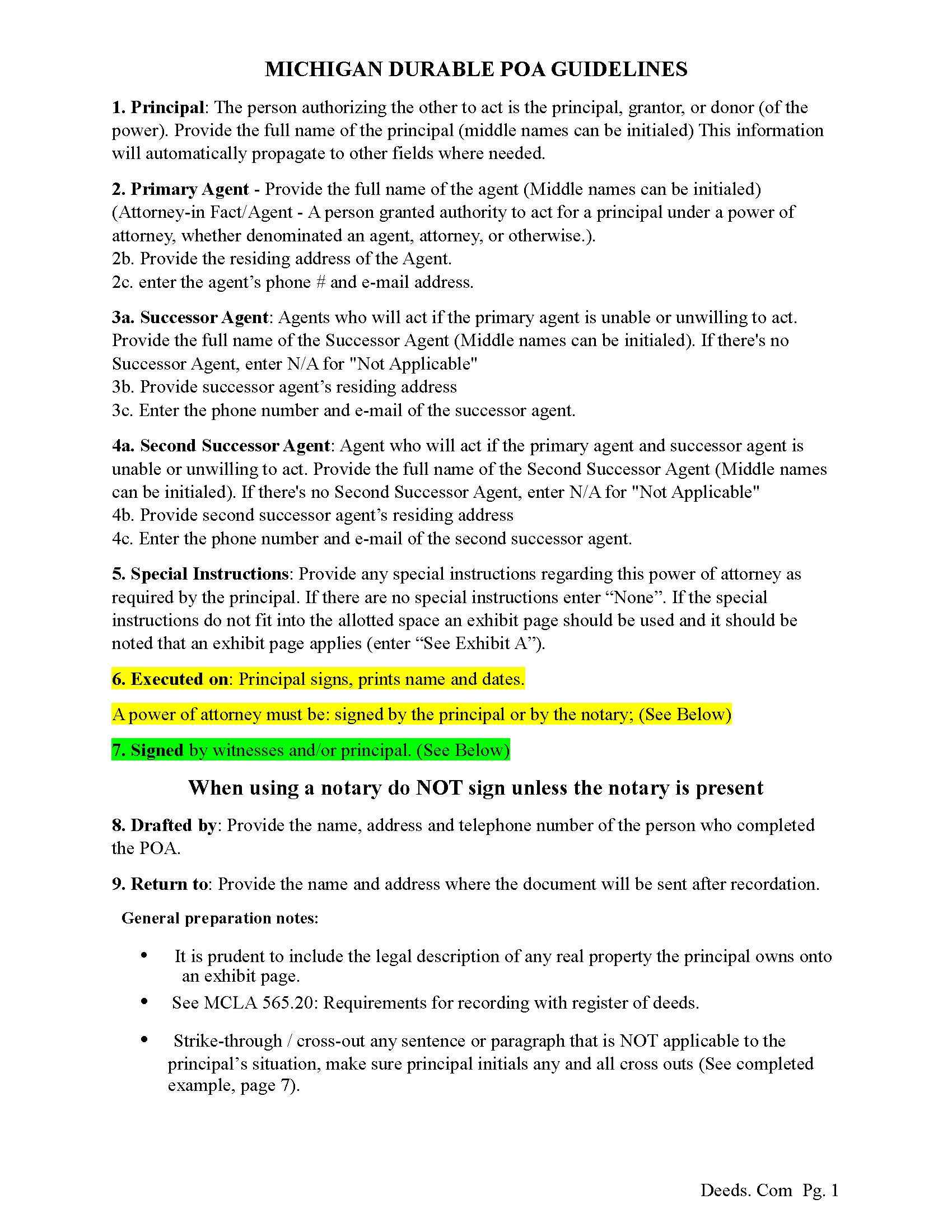

Guidelines Durable Power of Attorney

Line by line guide explaining every blank on the form.

Included Saint Clair County compliant document last validated/updated 7/4/2024

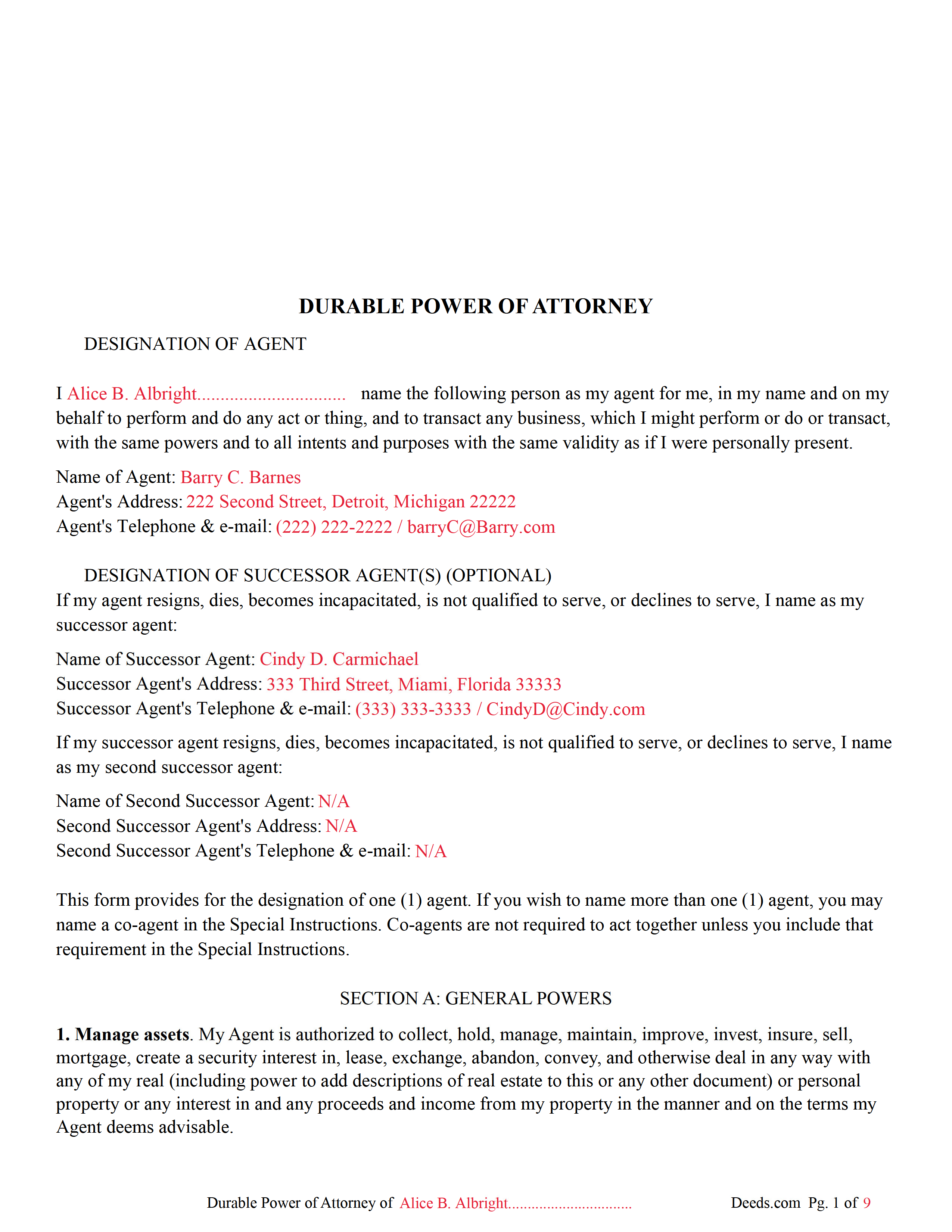

Completed Example of the Durable Power of Attorney Document

Example of a properly completed form for reference.

Included Saint Clair County compliant document last validated/updated 10/9/2024

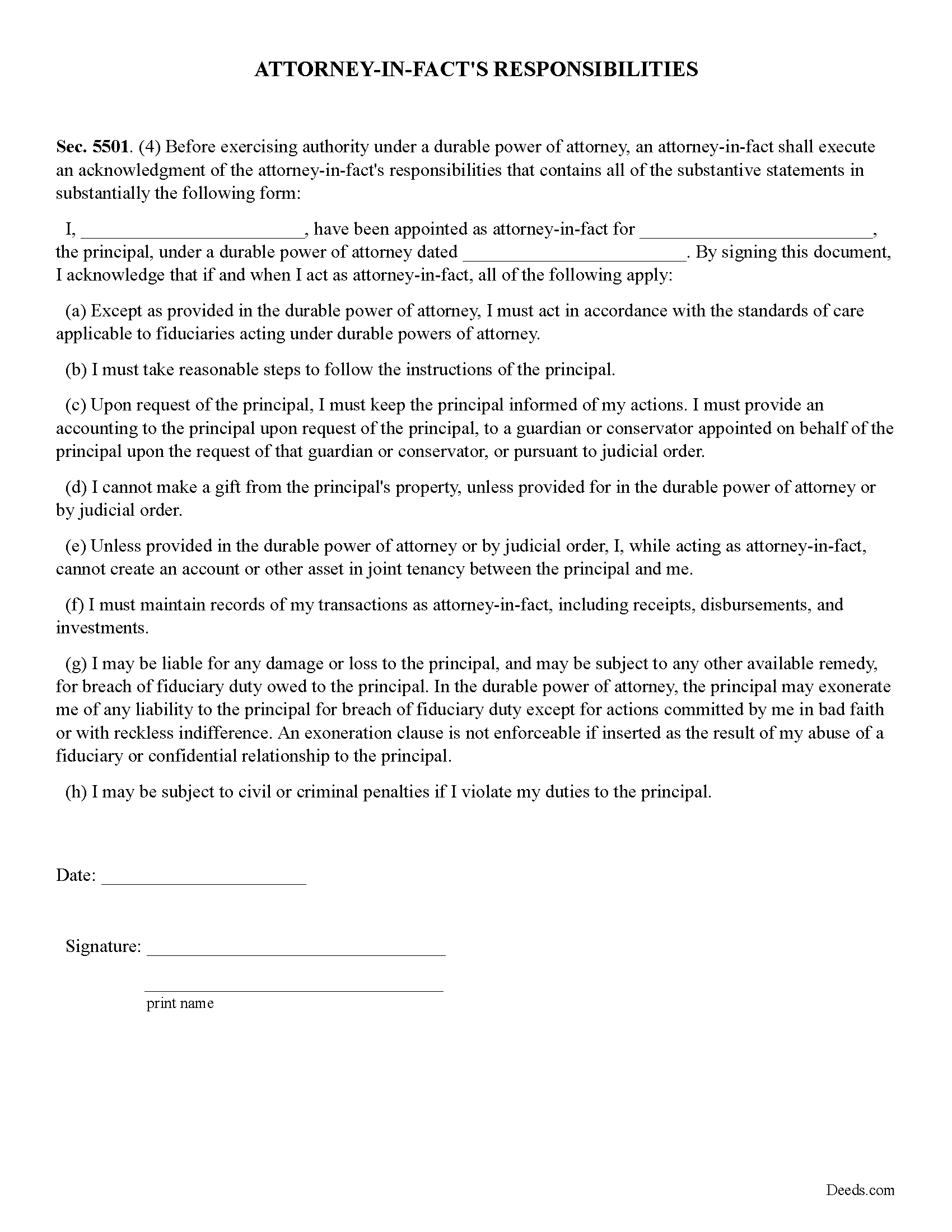

Attorney in Facts Responsibilities Form

Statutory Form, often required by third parties.

Included Saint Clair County compliant document last validated/updated 10/10/2024

The following Michigan and Saint Clair County supplemental forms are included as a courtesy with your order:

When using these Durable Power of Attorney forms, the subject real estate must be physically located in Saint Clair County. The executed documents should then be recorded in the following office:

St. Clair County Register of Deeds

200 Grand River Ave, Suite 103, Port Huron, Michigan 48060

Hours: 8:00 to 12:00 & 1:00 to 4:30 Mon-Thu; 10:30 to 12:00 & 1:00 to 4:30 on Fri

Phone: (810) 989-6930

Local jurisdictions located in Saint Clair County include:

- Algonac

- Allenton

- Anchorville

- Avoca

- Capac

- Casco

- Columbus

- East China

- Emmett

- Fair Haven

- Fort Gratiot

- Goodells

- Harsens Island

- Jeddo

- Marine City

- Marysville

- Memphis

- North Street

- Port Huron

- Saint Clair

- Smiths Creek

- Yale

How long does it take to get my forms?

Forms are available immediately after submitting payment.

How do I get my forms, are they emailed?

Immediately after you submit payment, the Saint Clair County forms you order will be available for download directly from your account. You can then download the forms to your computer. If you do not already have an account, one will be created for you as part of the order process, and your login details will be provided to you. If you encounter any issues accessing your forms, please reach out to our support team for assistance. Forms are NOT emailed to you.

What does "validated/updated" mean?

This indicates the most recent date when at least one of the following occurred:

- Updated: The document was updated or changed to remain compliant.

- Validated: The document was examined by an attorney or staff, or it was successfully recorded in Saint Clair County using our eRecording service.

Are these forms guaranteed to be recordable in Saint Clair County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Saint Clair County including margin requirements, content requirements, font and font size requirements.

Can the Durable Power of Attorney forms be re-used?

Yes. You can re-use the forms for your personal use. For example, if you have more than one property in Saint Clair County that you need to transfer you would only need to order our forms once for all of your properties in Saint Clair County.

What are supplemental forms?

Often when a deed is recorded, additional documents are required by Michigan or Saint Clair County. These could be tax related, informational, or even as simple as a coversheet. Supplemental forms are provided for free with your order where available.

What type of files are the forms?

All of our Saint Clair County Durable Power of Attorney forms are PDFs. You will need to have or get Adobe Reader to use our forms. Adobe Reader is free software that most computers already have installed.

Do I need any special software to use these forms?

You will need to have Adobe Reader installed on your computer to use our forms. Adobe Reader is free software that most computers already have installed.

Do I have to enter all of my property information online?

No. The blank forms are downloaded to your computer and you fill them out there, at your convenience.

Can I save the completed form, email it to someone?

Yes, you can save your deed form at any point with your information in it. The forms can also be emailed, blank or complete, as attachments.

Are there any recurring fees involved?

No. Nothing to cancel, no memberships, no recurring fees.

The Principal designates an attorney in fact and contains the words ("This power of attorney is not affected by the principal's subsequent disability or incapacity, or by the lapse of time", or "This power of attorney is effective upon the disability or incapacity of the principal" or similar words showing the principal's intent that the authority conferred is exercisable notwithstanding the principal's subsequent disability or incapacity and, unless the power states a termination time, notwithstanding the lapse of time since the execution of the instrument) (sec.5501.(a))

Sec 5501. (3) An attorney-in-fact designated and acting under a durable power of attorney has the authority, rights, responsibilities, and limitations as provided by law with respect to a durable power of attorney, including, but not limited to, all of the following:

(a) Except as provided in the durable power of attorney, the attorney-in-fact shall act in accordance with the standards of care applicable to fiduciaries exercising powers under a durable power of attorney.

(b) The attorney-in-fact shall take reasonable steps to follow the instructions of the principal.

(c) Upon request of the principal, the attorney-in-fact shall keep the principal informed of the attorney-in-fact's actions. The attorney-in-fact shall provide an accounting to the principal upon request of the principal, to a conservator or guardian appointed on behalf of the principal upon request of the guardian or conservator, or pursuant to judicial order.

(d) The attorney-in-fact shall not make a gift of all or any part of the principal's assets, unless provided for in the durable power of attorney or by judicial order.

(e) Unless provided in the durable power of attorney or by judicial order, the attorney-in-fact, while acting as attorney-in-fact, shall not create an account or other asset in joint tenancy between the principal and the attorney-in-fact.

(f) The attorney-in-fact shall maintain records of the attorney-in-fact's actions on behalf of the principal, including transactions, receipts, disbursements, and investments.

(g) The attorney-in-fact may be liable for any damage or loss to the principal, and may be subject to any other available remedy, for breach of fiduciary duty owed to the principal. In the durable power of attorney, the principal may exonerate the attorney-in-fact of any liability to the principal for breach of fiduciary duty except for actions committed by the attorney-in-fact in bad faith or with reckless indifference. An exoneration clause is not enforceable if inserted as the result of an abuse by the attorney-in-fact of a fiduciary or confidential relationship to the principal.

(h) The attorney-in-fact may receive reasonable compensation for the attorney-in-fact's services if provided for in the durable power of attorney

MICHIGAN DURABLE POA

SECTION A: GENERAL POWERS

1. Manage assets.

2. Debts and expenses.

3. Bank Accounts.

4. Deposits and withdrawals.

5. Checks.

6. Borrowing.

7. Collection powers.

8. Safe deposit box.

9. Securities and investments.

10. Litigation

11. Insurance, annuities, and benefit plans.

12. College savings accounts

13. Taxes

14. Services.

15. Support.

16. Government benefits.

17. Medicaid Qualification

18. Access to Digital Assets (Including Content).

SECTION B: EXTRAORDINARY POWERS AND LIMITATIONS

1. Gifts

2. Gifts from trust

3. Creating Joint Tenancy.

4. Create trusts

5. Amend, revoke, restate, reform, and terminate trusts

6. Transfer assets to trusts

7. Withdraw income and principal from trusts

8. Disclaimer.

9. Intent of Principal with regard to paying for my care and needs

10. Limitation on Agent liability for investments

11. Limitation on Agent liability for preservation of the estate plan

12. Amend/Revoke Funeral Representative Designation

SECTION C: POWERS RELATED TO MY PERSONAL CARE

l. Establish residency.

2. Care contracts

3. Medical and personal records

4. Privacy rights

SECTION D: OTHER PROVISIONS

l. Incidental authority

2. Nomination of Agent as conservator

3. Compensation of Agent

4. Use of copies

5. Durability.

6. Third-party reliance

7. Special Instructions

(Michigan DPOA Package includes form, guidelines, and completed example) For use in Michigan only.

Our Promise

The documents you receive here will meet, or exceed, the Saint Clair County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Saint Clair County Durable Power of Attorney form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4437 Reviews )

Jubal T.

November 27th, 2024

This is the most comprehensive, helpful real estate tool I have seen. I was at first worried because the 330# didn’t have live operators but I received messages in my account as quickly as a conversation had by text and was able to download a deed and record it the same day in a county 1,300 miles away. Highly recommended!

We are sincerely grateful for your feedback and are committed to providing the highest quality service. Thank you for your trust in us.

Michael S.

November 27th, 2024

Recording a Warranty Deed with Mohave County AZ was easy and efficient by using Deeds.com. I will be using their service for all of my e-filing going forward. Thank you Deeds.com!!!!

We are delighted to have been of service. Thank you for the positive review!

Zennell W.

November 24th, 2024

Quick fast and easy transaction.

We are grateful for your feedback and looking forward to serving you again. Thank you!

Eric S.

August 11th, 2020

Very easy and efficient to use.

Thank you!

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

MARY LACEY M.

April 11th, 2024

I am extremely impressed with the quality of this service. They are a pleasure to work with and I know I can rely on them.

Thank you for your feedback. We really appreciate it. Have a great day!

Roberta M.

February 21st, 2022

I found a lot of useful information regarding the Lady Bird Deed and feel it will serve my needs as opposed to a Revocable

Living

Trust. The information was easy to understand and very helpful. The forms seem easy to complete and I plan to get them notarized and filed at the courthouse very soon.

Thank you for your feedback. We really appreciate it. Have a great day!

Barry N.

February 14th, 2019

The form was straight forward and very easy to complete. It took me less than 15 minutes to complete. Make sure you have the "current deed' available' when completing the form.

Thank you for your feedback Barry. Have a fantastic day!

Christina H.

April 15th, 2021

The process was straightforward, quick and reasonably priced.

The agents provided updates every step of the way.

Thank you!

Martin L.

February 26th, 2024

Deeds.com is a lifesaver! They are fast and not too expensive. I highly recommend them!

Recognizing the value of your feedback helps us to enhance our services continually. Thank you for sharing your experience with us.

Karen H.

April 6th, 2024

Saves a trip to the Recorders Office!

It was a pleasure serving you. Thank you for the positive feedback!

Mary P.

February 11th, 2019

Excellent easy to follow instructions.

Great to hear Mary, Have a wonderful day!

Ron E.

September 25th, 2019

Flawless. I ordered the forms needed, along with completed samples. I filled them out, and I was on my way to the recorders office. I would use deeds.com without hesitation.

Thank you for your feedback. We really appreciate it. Have a great day!

Marites T.

April 6th, 2023

Extremely helpful team of professionals who are patient when you need to get things filed correctly.

Very small price for the comfort of knowing your DOCUMENTS are FILED with you local Recorder's Office.

Some of the filings, if they are correctly formatted are already uploaded and official within a few hours.

Here's the ALTERNATIVE you may encounter.

For Example:

King County Recorder's Office moved which means most filings are backed up 7-10 days if you DROP your filing in a BOX with your CHECK or MAIL IT. Neither is a great option, since they have no WALK IN HOURS.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Joanne D.

May 14th, 2020

Loved your easy to follow instructions along with the paperwork forms that I was looking for. Would highly suggest this service to everyone. You should share this platform with other counties!! Extremely helpful

Thank you!

Constance F.

August 27th, 2021

Quick and easy download with instructions and a sample document to ensure conformity to the different jurisdictions.

Thank you!