Plymouth County Quitclaim Deed with Covenants Form (Massachusetts)

All Plymouth County specific forms and documents listed below are included in your immediate download package:

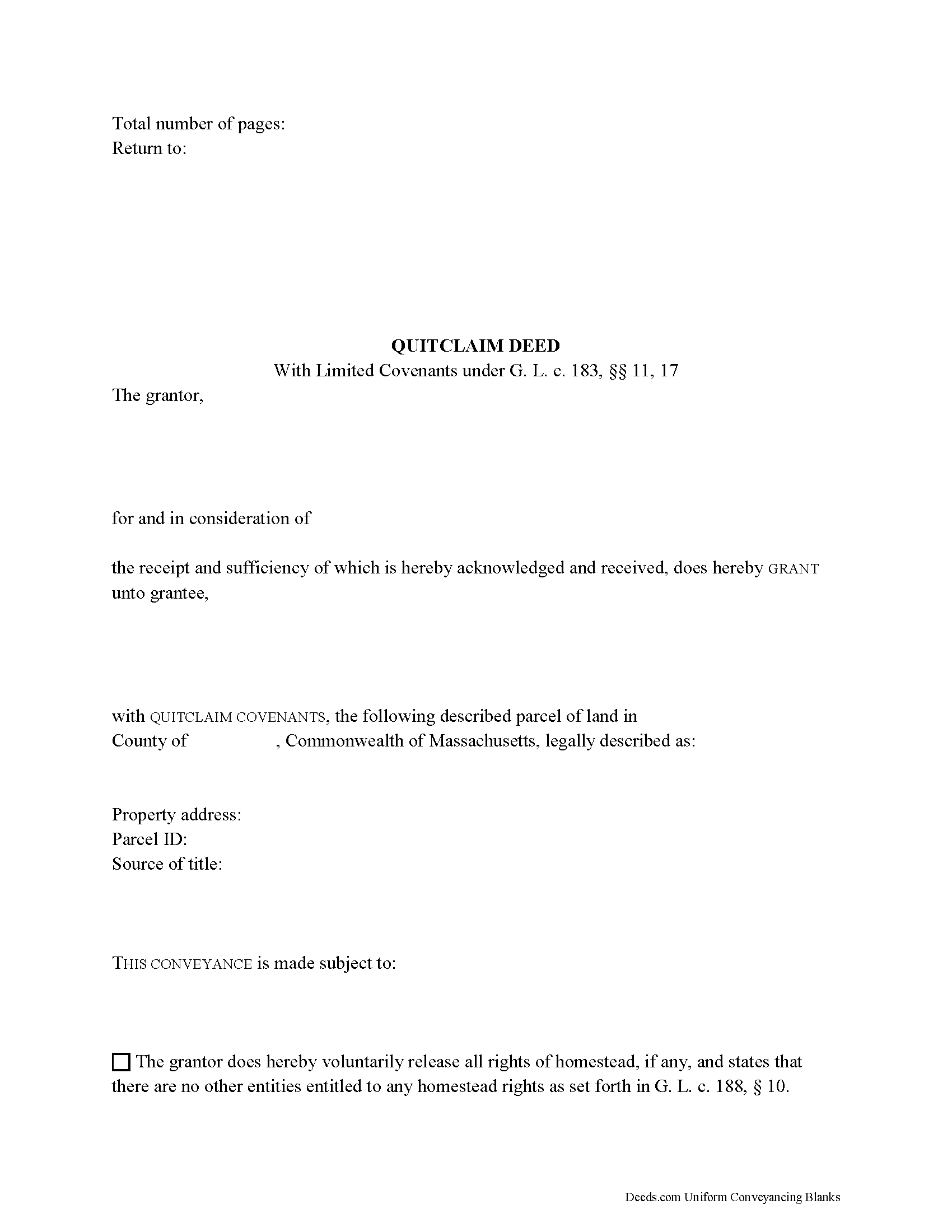

Quitclaim Deed with Covenants Form

Fill in the blank Quitclaim Deed with Covenants form formatted to comply with all Massachusetts recording and content requirements.

Included Plymouth County compliant document last validated/updated 10/14/2024

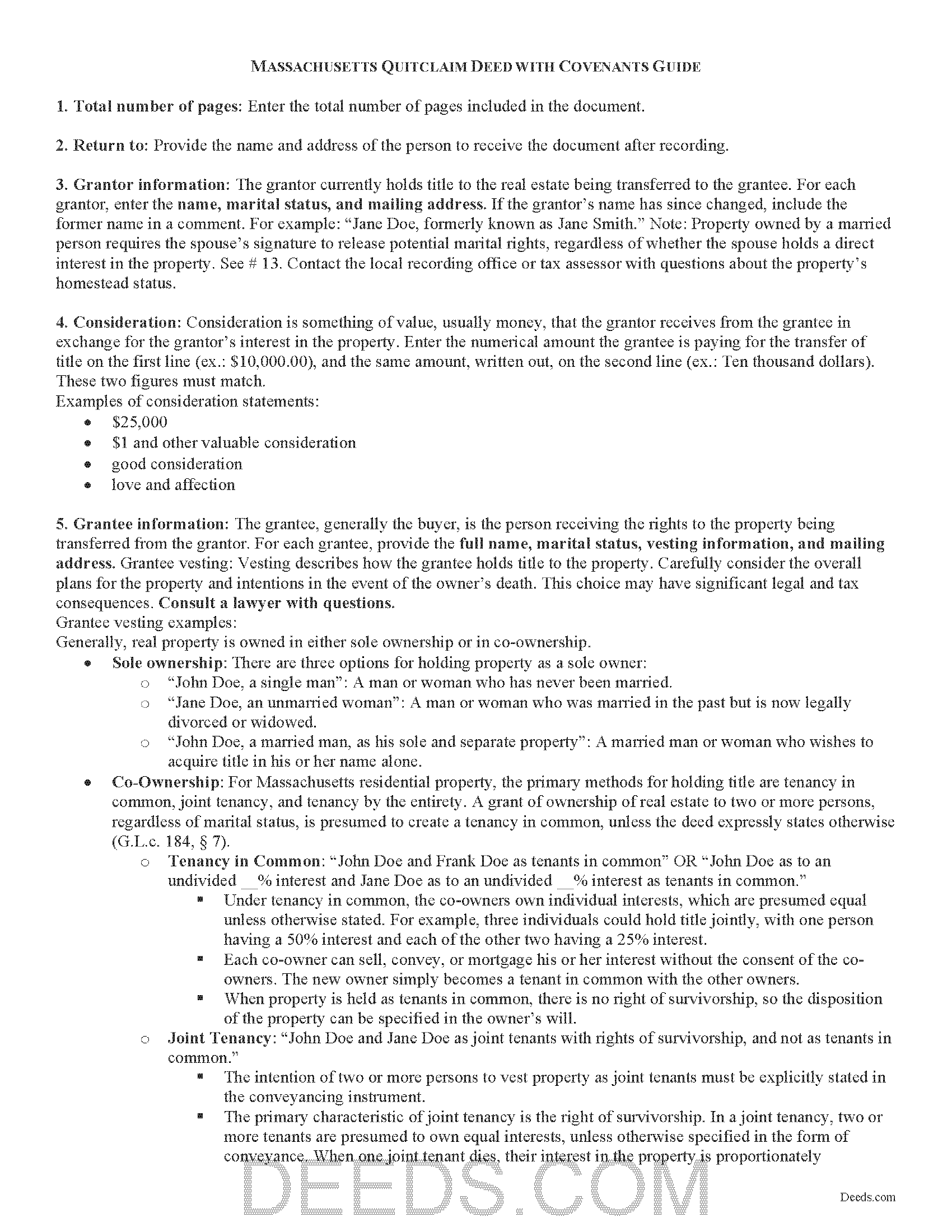

Quitclaim Deed with Covenants Guide

Line by line guide explaining every blank on the Quitclaim Deed with Covenants form.

Included Plymouth County compliant document last validated/updated 4/30/2024

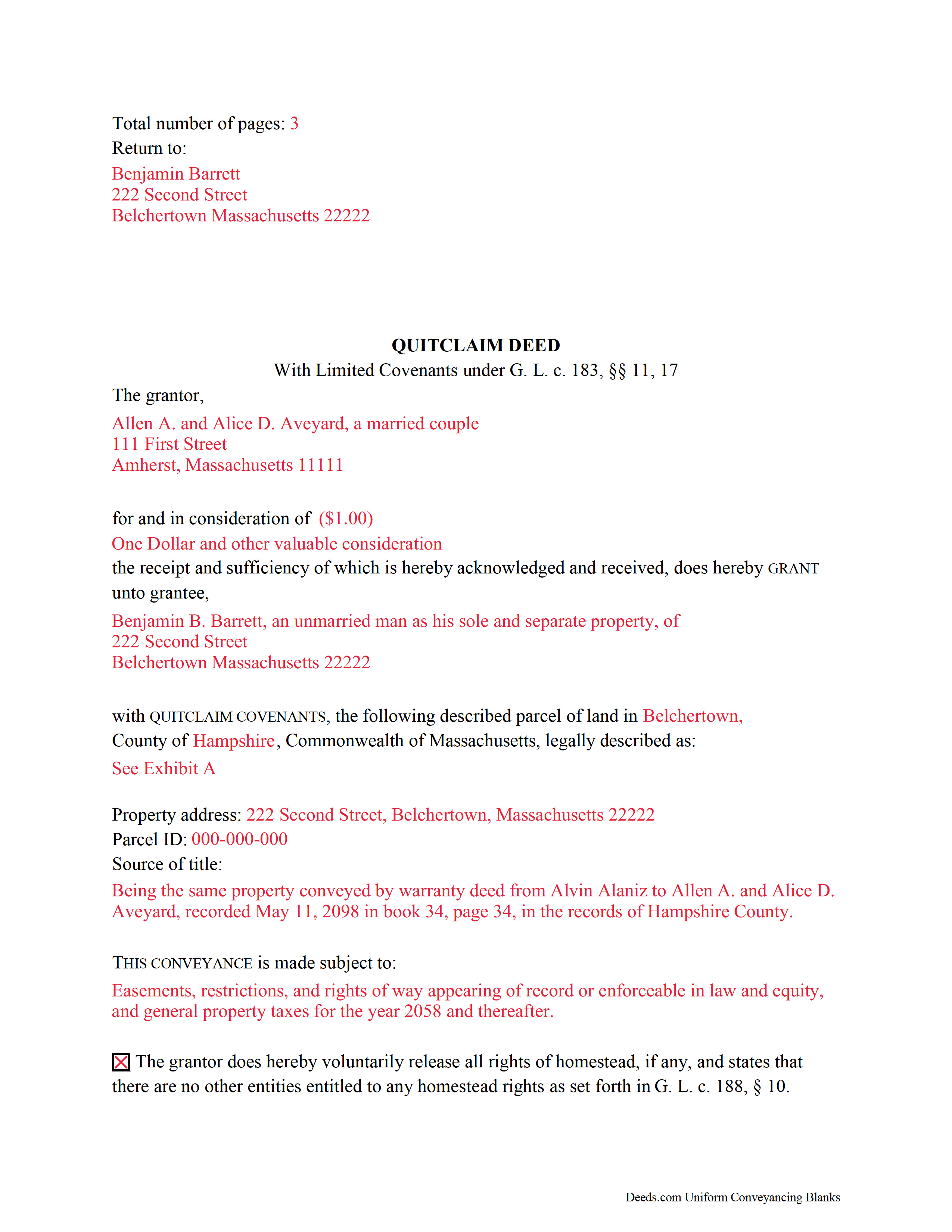

Completed Example of the Quitclaim Deed with Covenants Document

Example of a properly completed Massachusetts Quitclaim Deed with Covenants document for reference.

Included Plymouth County compliant document last validated/updated 4/11/2024

The following Massachusetts and Plymouth County supplemental forms are included as a courtesy with your order:

When using these Quitclaim Deed with Covenants forms, the subject real estate must be physically located in Plymouth County. The executed documents should then be recorded in one of the following offices:

Plymouth - Main Office with Land Court

50 Obery St, Plymouth, Massachusetts 02360

Hours: 8:15 to 4:30 M-F / Recording until 4:00

Phone: (508) 830-9200

Brockton Satellite Office

155 West Elm St, Brockton, Massachusetts 02301

Hours: 8:30 to 12:00 & 12:45 to 4:15 M-F / Recording until 4:00

Phone: (508) 830-9200

Rockland Satellite Office

900 Hingham St, Rockland, Massachusetts 02370

Hours: 8:30 to 12:00 & 12:45 to 4:15 M-F / Recording until 4:00

Phone: (508) 830-9200

Local jurisdictions located in Plymouth County include:

- Abington

- Accord

- Brant Rock

- Bridgewater

- Brockton

- Bryantville

- Carver

- Duxbury

- East Bridgewater

- East Wareham

- Elmwood

- Green Harbor

- Greenbush

- Halifax

- Hanover

- Hanson

- Hingham

- Hull

- Humarock

- Kingston

- Lakeville

- Manomet

- Marion

- Marshfield

- Marshfield Hills

- Mattapoisett

- Middleboro

- Minot

- Monponsett

- North Carver

- North Marshfield

- North Pembroke

- North Scituate

- Norwell

- Ocean Bluff

- Onset

- Pembroke

- Plymouth

- Plympton

- Rochester

- Rockland

- Scituate

- South Carver

- Wareham

- West Bridgewater

- West Wareham

- White Horse Beach

- Whitman

How long does it take to get my forms?

Forms are available immediately after submitting payment.

How do I get my forms, are they emailed?

Immediately after you submit payment, the Plymouth County forms you order will be available for download directly from your account. You can then download the forms to your computer. If you do not already have an account, one will be created for you as part of the order process, and your login details will be provided to you. If you encounter any issues accessing your forms, please reach out to our support team for assistance. Forms are NOT emailed to you.

What does "validated/updated" mean?

This indicates the most recent date when at least one of the following occurred:

- Updated: The document was updated or changed to remain compliant.

- Validated: The document was examined by an attorney or staff, or it was successfully recorded in Plymouth County using our eRecording service.

Are these forms guaranteed to be recordable in Plymouth County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Plymouth County including margin requirements, content requirements, font and font size requirements.

Can the Quitclaim Deed with Covenants forms be re-used?

Yes. You can re-use the forms for your personal use. For example, if you have more than one property in Plymouth County that you need to transfer you would only need to order our forms once for all of your properties in Plymouth County.

What are supplemental forms?

Often when a deed is recorded, additional documents are required by Massachusetts or Plymouth County. These could be tax related, informational, or even as simple as a coversheet. Supplemental forms are provided for free with your order where available.

What type of files are the forms?

All of our Plymouth County Quitclaim Deed with Covenants forms are PDFs. You will need to have or get Adobe Reader to use our forms. Adobe Reader is free software that most computers already have installed.

Do I need any special software to use these forms?

You will need to have Adobe Reader installed on your computer to use our forms. Adobe Reader is free software that most computers already have installed.

Do I have to enter all of my property information online?

No. The blank forms are downloaded to your computer and you fill them out there, at your convenience.

Can I save the completed form, email it to someone?

Yes, you can save your deed form at any point with your information in it. The forms can also be emailed, blank or complete, as attachments.

Are there any recurring fees involved?

No. Nothing to cancel, no memberships, no recurring fees.

Real estate conveyances in Massachusetts are governed under Massachusetts General Laws Chapters 183 and 184.

Quitclaim deeds with limited covenants are used to transfer the rights, title, and interest in real estate, if any, from the grantor (seller) to the grantee (buyer). When using this kind of deed, the grantor "covenants that the property is free from all encumbrances," and that he will "warrant and defend the same to the grantee forever against the lawful claims and demands of all persons claiming by, through or under the grantor, but against none other" (G.L.c. 183 sec. 17). Because of these covenants, this form is valid as-is for use as a special warranty deed in Massachusetts.

In addition to meeting all state and local standards for recorded documents, a lawful deed identifies the name, address, and marital status of each grantor and grantee (G.L.c. 183 sec. 6). State law requires that all land records contain information on how the grantee will hold title (G.L.c. 184 sec. 7). For Massachusetts residential property, the primary methods for holding title are tenancy in common, joint tenancy, and tenancy by the entirety. A grant of ownership of real estate to two or more persons, regardless of marital status, is presumed to create a tenancy in common, unless the deed expressly states otherwise (G.L.c. 184 sec. 7).

As with any conveyance of real estate, a quitclaim deed with limited covenants requires a complete legal description of the parcel. The deed must state the amount of the full consideration, or the total price for the conveyance (G.L.c. 183 sec. 6). Based on the consideration paid, an excise tax (also known as a transfer tax or stamp tax) is collected from the seller (G.L.c. 64D sec. 1,2).

Record the completed deed at the local County Registry of Deeds office. Some counties (Berkshire, Bristol, Essex, Middlesex, Worcester) are split into two or more recording districts. Make sure to record the deed in the correct recording district. If the deed pertains to registered land, submit the deed to the Registry District of the Land Court. Include all relevant affidavits, forms, and fees along with the deed for recording. For guidance related to supplemental documentation, speak with the local Registry of Deeds office.

This article is provided for informational purposes only and is not a substitute for legal advice. Contact a lawyer with questions about quitclaim deeds with limited covenants or transfers of real property in Massachusetts.

(Massachusetts QCD with Covenants Package includes form, guidelines, and completed example)

Our Promise

The documents you receive here will meet, or exceed, the Plymouth County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Plymouth County Quitclaim Deed with Covenants form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4434 Reviews )

James S.

November 21st, 2024

Forms used, created quitclaim deed that the county accepted without a second look (turns out they see deeds.com forms regularly via erecording and in person). Will be back for any real estate related forms I need and they carry. Will always be my first stop. Also, will use erecording next time, mad I didn't see it this time.

Thanks for the kind words James, glad we could help. Look forward to seeing you again.

Thomas G.

November 21st, 2024

Wasn’t what I expected

Sorry to hear that your expectations were missed. Your order has been canceled. We do hope that you find something more suitable to your expectations elsewhere. Do keep in mind that purchasing legal forms should not be an exploratory endeavor.

Jimmy P.

November 20th, 2024

They sent me everything I would need to do this. Easy purchase -Easy download. Great!! I'll be back here for all my document needs.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Michael L.

March 3rd, 2019

Perfect timely service! Will use again!

Thank you!

Constance R.

July 13th, 2020

It was very easy to e-file. I liked it.

Thank you for your feedback. We really appreciate it. Have a great day!

Catherine S.

December 19th, 2019

Description of document could have been better

Thank you!

Robert S.

March 20th, 2019

Very timely service and retrieved information I was looking for

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Carol D.

January 17th, 2019

No review provided.

Thank you!

LeRoy E.

June 20th, 2022

So thankful I found this. I was feeling stressed out and reluctant about doing this on my own.

Thank you!

Samuel M.

October 8th, 2020

it was convenient to have a starting place, however, though the property is in Colorado, the probate is in Iowa, so I had to create my own document because you locked my capacity to edit the form I paid for. If I pay for it, I should be able to edit everything including non fill in text. I could not open it in word, as I normally could.

Thank you for your feedback. We really appreciate it. Have a great day!

William G M.

October 10th, 2019

This site is very easy to use.

Thank you!

Jeffrey T.

December 1st, 2022

First Time User here. Simple and easy. Delivered Deed in excellent time. Sure beats going to the recorder's office.

Thank you for your feedback. We really appreciate it. Have a great day!

Jason B.

May 9th, 2019

Providing .doc versions would be much easier than trying to jam information into a non-editable PDF.

Thank you for your feedback. We really appreciate it. Have a great day!

Norbert C.

June 23rd, 2020

Great resource and everything went smoothly except email was performed through autofill prompted by the system but the autofill added a letter that gave wrong email. I can still sign in with wrong email since the system recognizes it as mine even though it is wrong. May be my fault and not the system since I did not catch the discrepancy in time. I would suggest a field that allows a correction to any misinformation prior to signing out from the initial sign on. Still think it is a great resource if all documents are processed and accepted by the pwers to be. Thanks.

Thank you!

David W.

March 10th, 2021

Thanks to all of you.

You provide a great service!

Dave in Ca.

Thank you for your feedback. We really appreciate it. Have a great day!