Hampshire County Mortgage Deed and Promissory Note Form (Massachusetts)

All Hampshire County specific forms and documents listed below are included in your immediate download package:

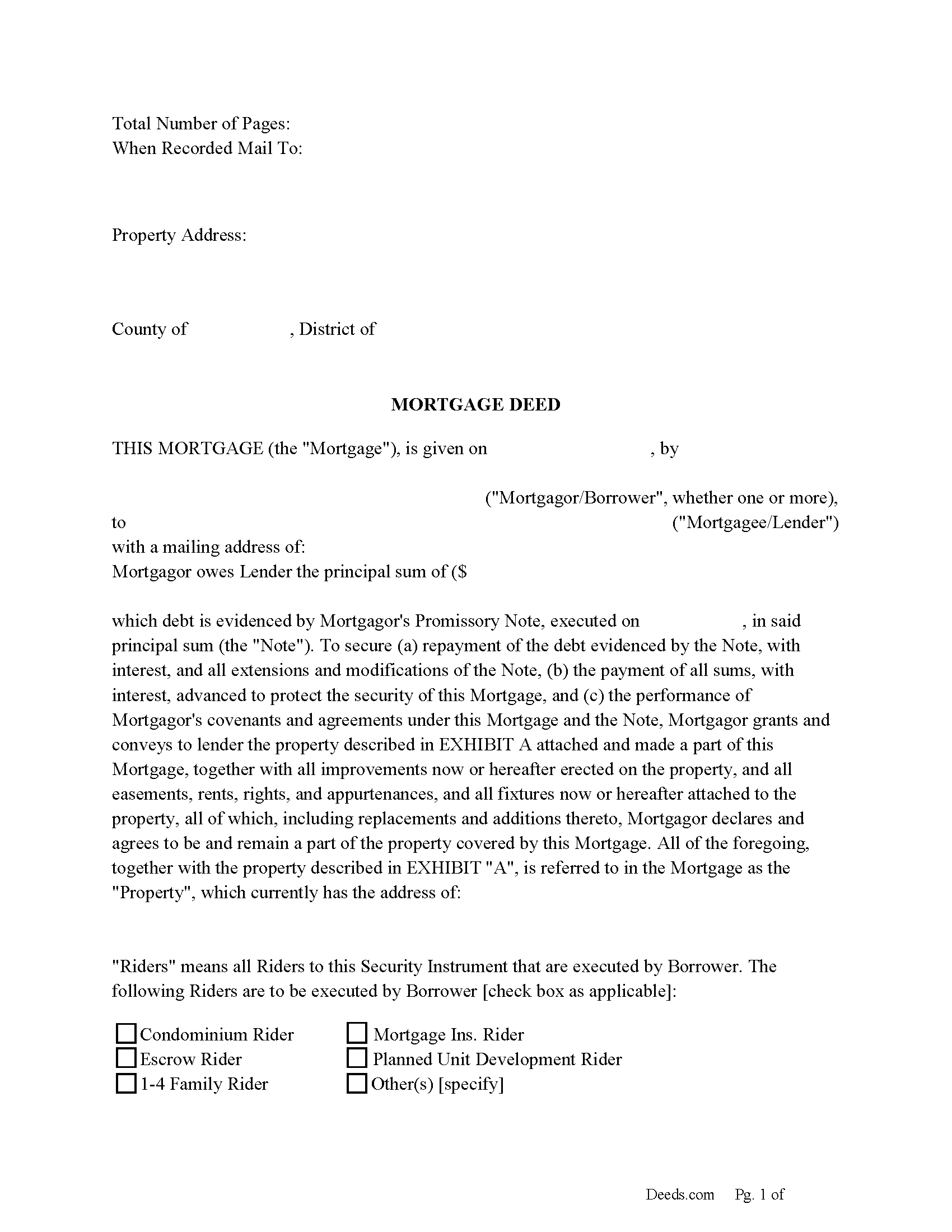

Mortgage Form

Fill in the blank form formatted to comply with all recording and content requirements.

Included Hampshire County compliant document last validated/updated 10/4/2024

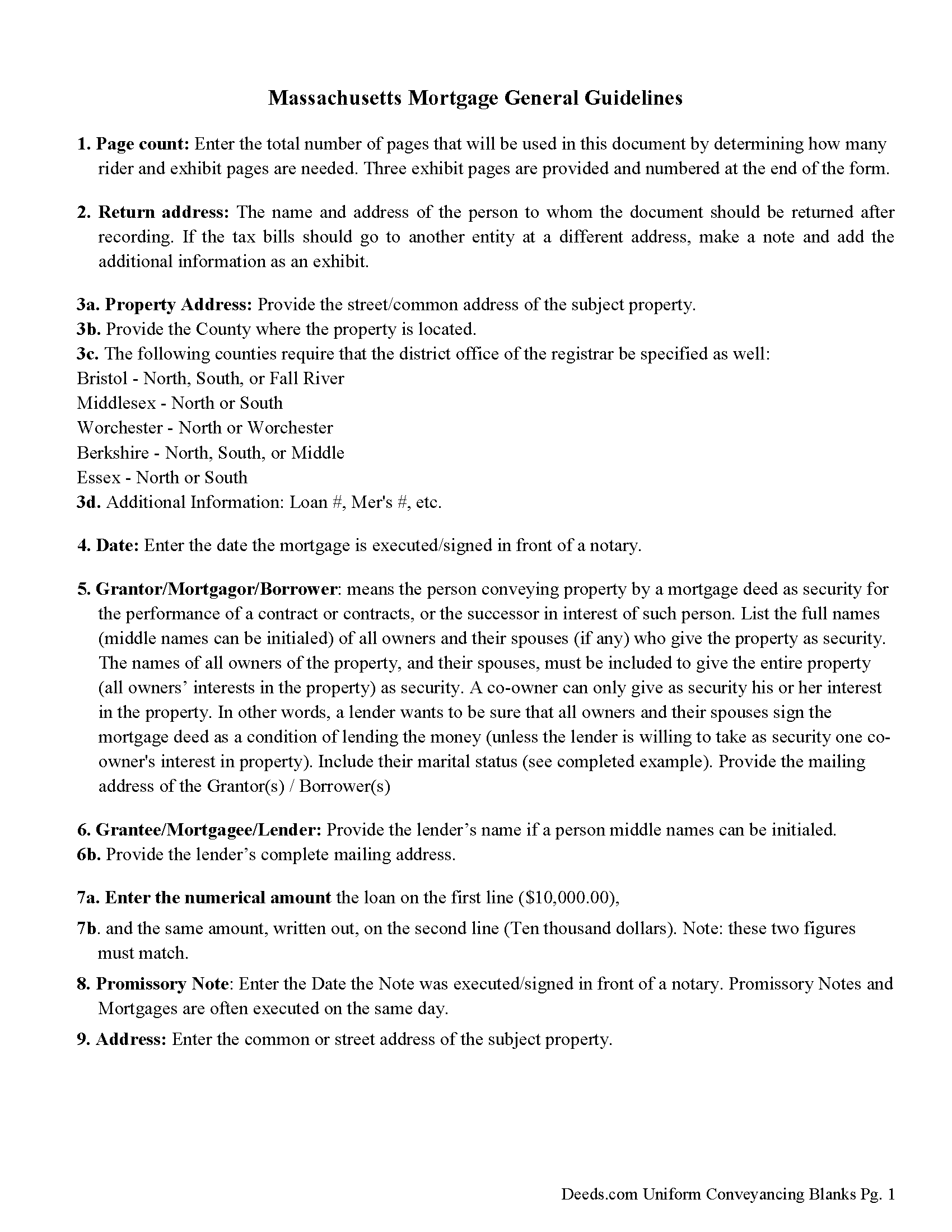

Mortgage Deed Guide

Line by line guide explaining every blank on the form.

Included Hampshire County compliant document last validated/updated 10/28/2024

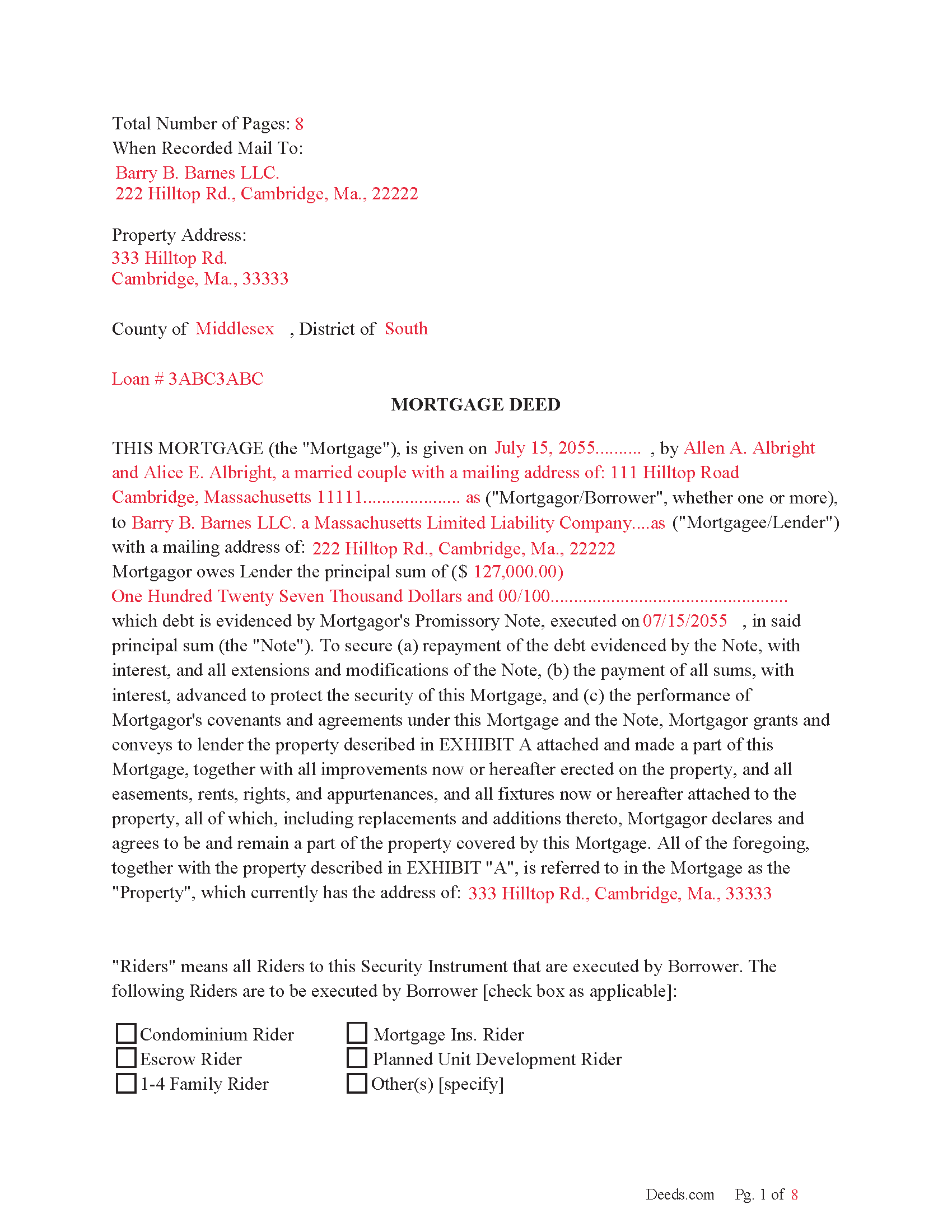

Completed Example of the Mortgage Deed Document

Example of a properly completed form for reference.

Included Hampshire County compliant document last validated/updated 11/27/2024

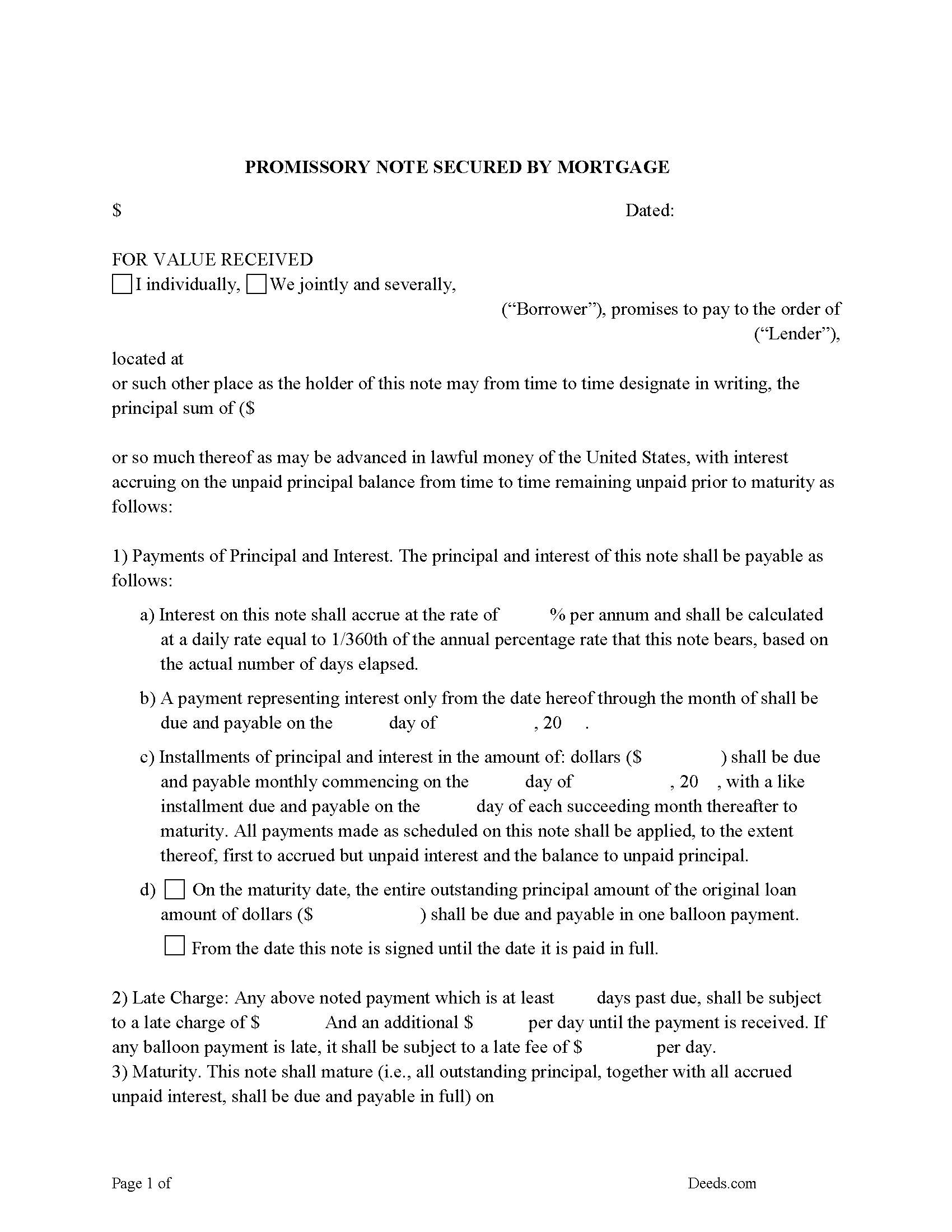

Promissory Note Form

Note that is secured by the Mortgage.

Included Hampshire County compliant document last validated/updated 11/20/2024

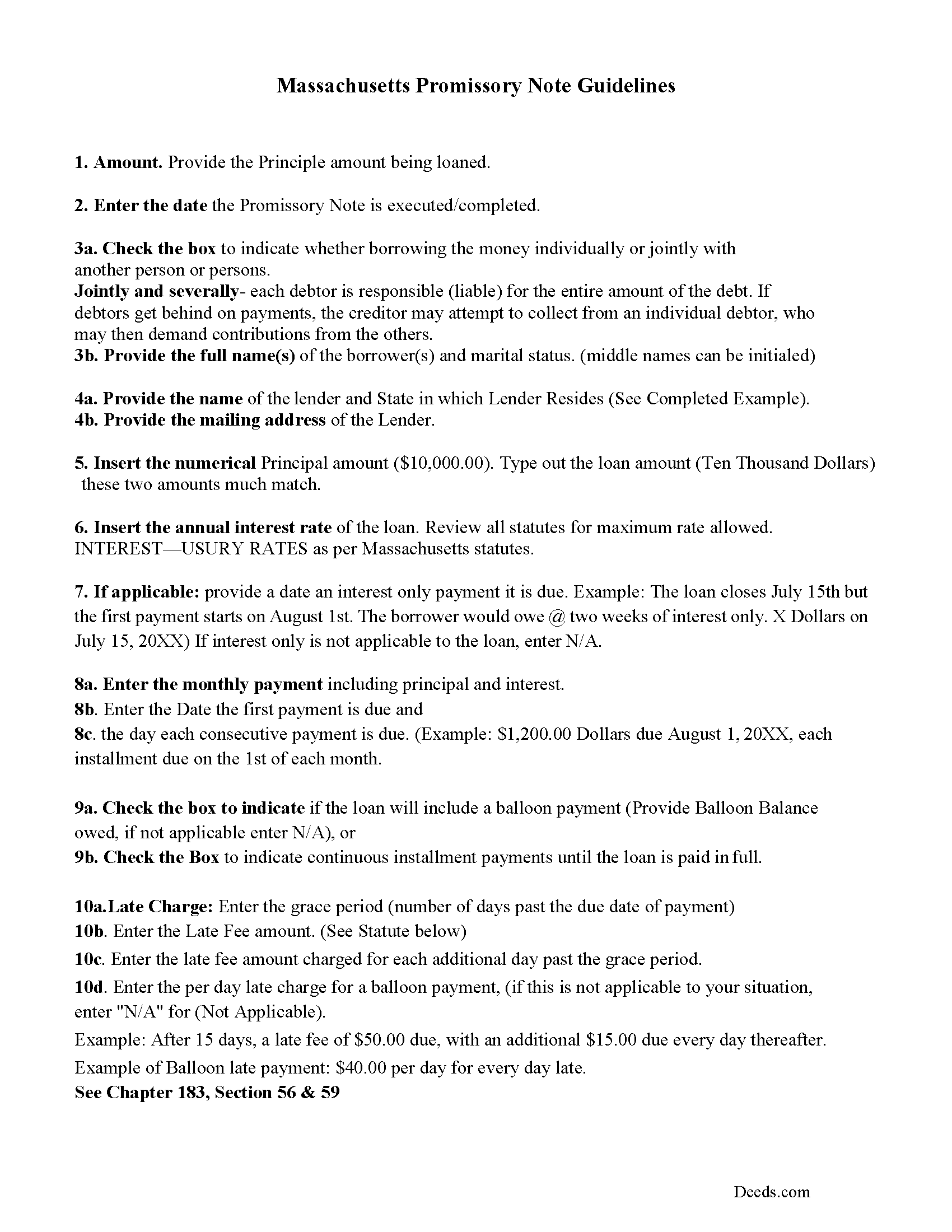

Promissory Note Guidelines

Line by line guide explaining every blank on the form.

Included Hampshire County compliant document last validated/updated 10/23/2024

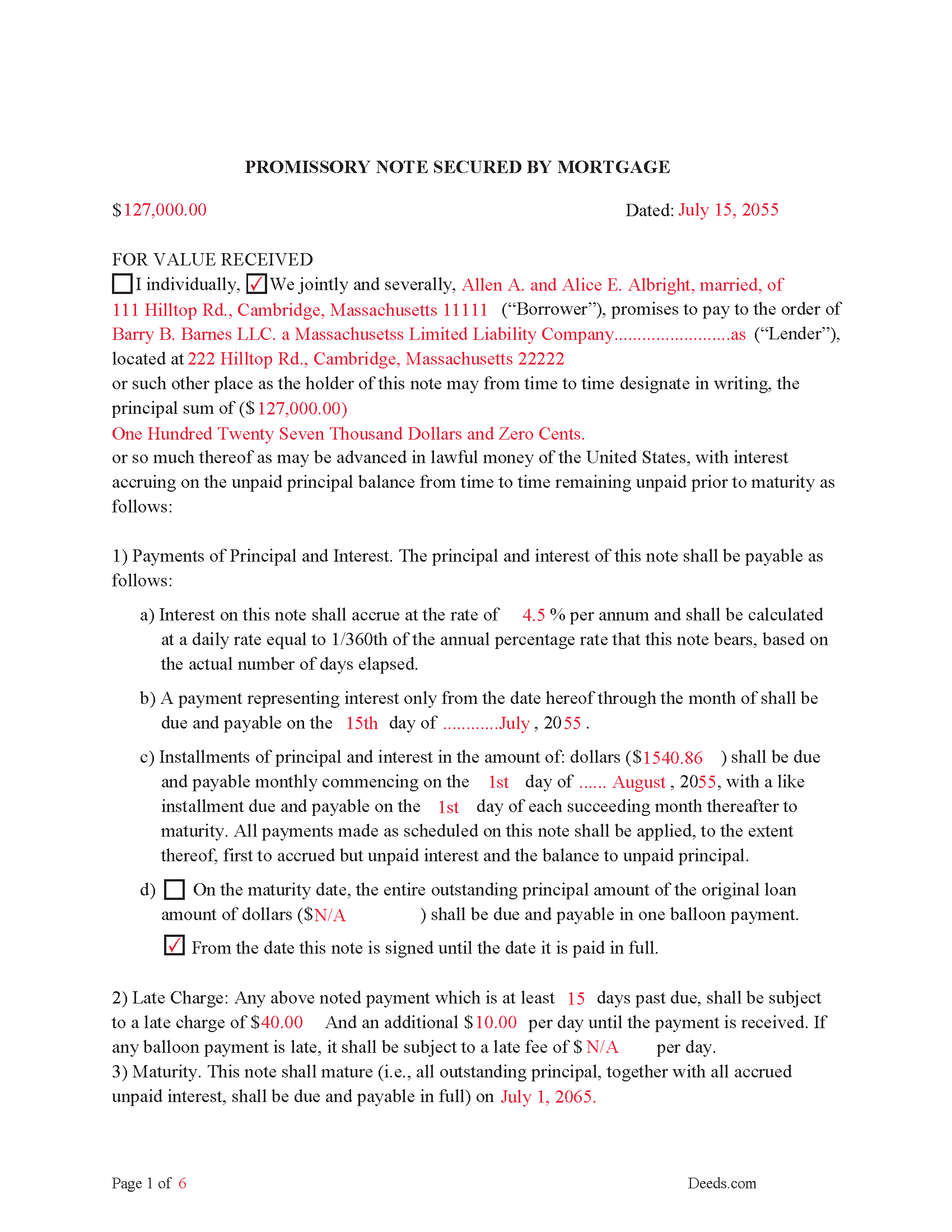

Completed Example of the Promissory Note Document

Example of a properly completed form for reference.

Included Hampshire County compliant document last validated/updated 12/9/2024

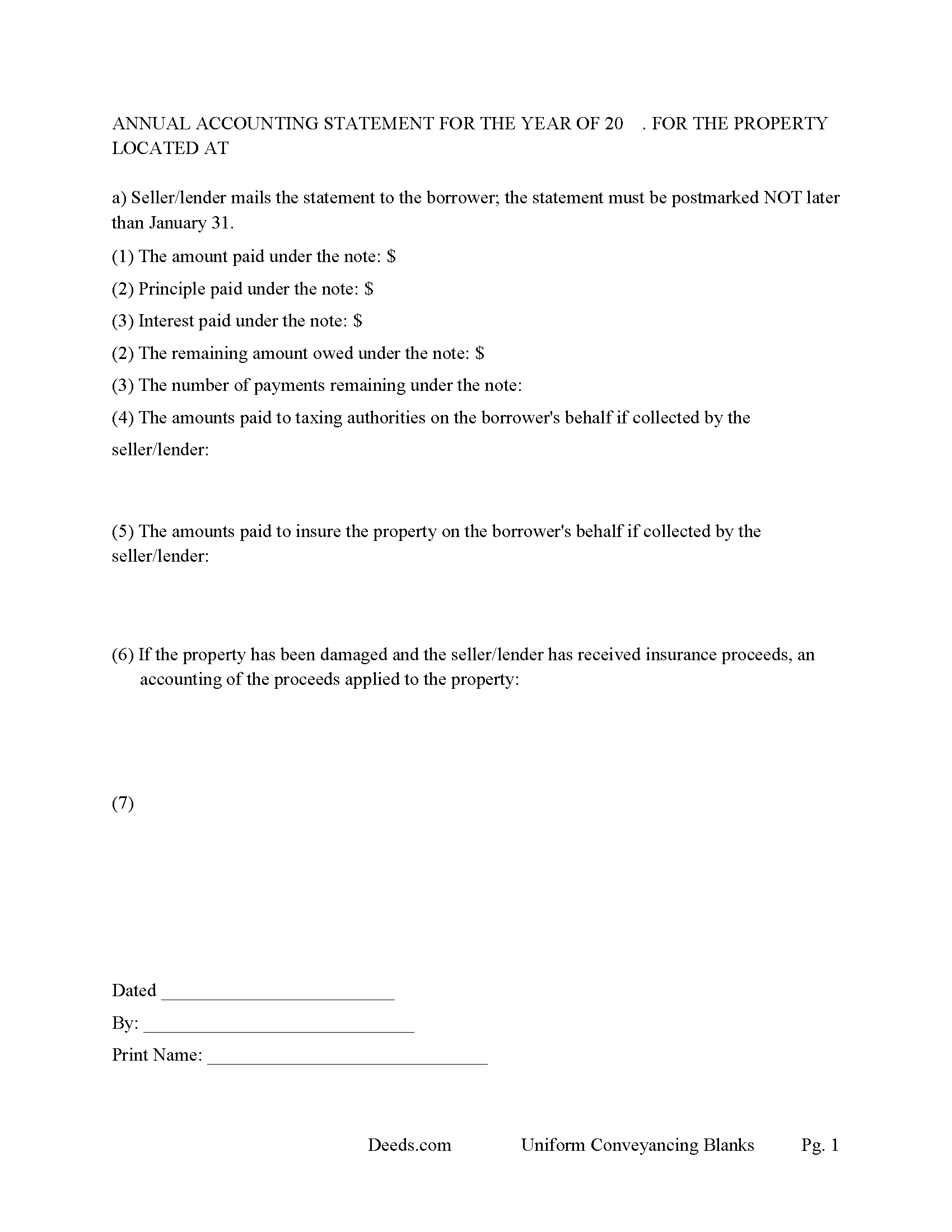

Annual Accounting Statement Form

Mail to borrower for fiscal year reporting.

Included Hampshire County compliant document last validated/updated 11/25/2024

The following Massachusetts and Hampshire County supplemental forms are included as a courtesy with your order:

When using these Mortgage Deed and Promissory Note forms, the subject real estate must be physically located in Hampshire County. The executed documents should then be recorded in the following office:

Hampshire Registry of Deeds

33 King St, Northampton, Massachusetts 01060

Hours: Mon-Fri 8:30 to 4:30 / Recording until 4:00

Phone: (413) 584-3637

Local jurisdictions located in Hampshire County include:

- Amherst

- Belchertown

- Chesterfield

- Cummington

- Easthampton

- Florence

- Goshen

- Granby

- Hadley

- Hatfield

- Haydenville

- Huntington

- Leeds

- Middlefield

- North Amherst

- North Hatfield

- Northampton

- Plainfield

- South Hadley

- Southampton

- Ware

- West Chesterfield

- West Hatfield

- Williamsburg

- Worthington

How long does it take to get my forms?

Forms are available immediately after submitting payment.

How do I get my forms, are they emailed?

Immediately after you submit payment, the Hampshire County forms you order will be available for download directly from your account. You can then download the forms to your computer. If you do not already have an account, one will be created for you as part of the order process, and your login details will be provided to you. If you encounter any issues accessing your forms, please reach out to our support team for assistance. Forms are NOT emailed to you.

What does "validated/updated" mean?

This indicates the most recent date when at least one of the following occurred:

- Updated: The document was updated or changed to remain compliant.

- Validated: The document was examined by an attorney or staff, or it was successfully recorded in Hampshire County using our eRecording service.

Are these forms guaranteed to be recordable in Hampshire County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Hampshire County including margin requirements, content requirements, font and font size requirements.

Can the Mortgage Deed and Promissory Note forms be re-used?

Yes. You can re-use the forms for your personal use. For example, if you have more than one property in Hampshire County that you need to transfer you would only need to order our forms once for all of your properties in Hampshire County.

What are supplemental forms?

Often when a deed is recorded, additional documents are required by Massachusetts or Hampshire County. These could be tax related, informational, or even as simple as a coversheet. Supplemental forms are provided for free with your order where available.

What type of files are the forms?

All of our Hampshire County Mortgage Deed and Promissory Note forms are PDFs. You will need to have or get Adobe Reader to use our forms. Adobe Reader is free software that most computers already have installed.

Do I need any special software to use these forms?

You will need to have Adobe Reader installed on your computer to use our forms. Adobe Reader is free software that most computers already have installed.

Do I have to enter all of my property information online?

No. The blank forms are downloaded to your computer and you fill them out there, at your convenience.

Can I save the completed form, email it to someone?

Yes, you can save your deed form at any point with your information in it. The forms can also be emailed, blank or complete, as attachments.

Are there any recurring fees involved?

No. Nothing to cancel, no memberships, no recurring fees.

Use this form for financing real property- residential, rental units, condominiums, vacant land, small commercial and planned unit developments. A mortgage deed has full force and effect when it includes:

''Mortgage covenants''

(In a conveyance of real estate the words ''mortgage covenants'' shall have the full force, meaning and effect of the following words, and shall be applied and construed accordingly: ''The mortgagor, for himself, his heirs, executors, administrators and successors, covenants with the mortgagee and his heirs, successors and assigns, that he is lawfully seized in fee simple of the granted premises; that they are free from all encumbrances; that the mortgagor has good right to sell and convey the same; and that he will, and his heirs, executors, administrators and successors shall, warrant and defend the same to the mortgagee and his heirs, successors and assigns forever against the lawful claims and demands of all persons; and that the mortgagor and his heirs, successors or assigns, in case a sale shall be made under the power of sale, will, upon request, execute, acknowledge and deliver to the purchaser or purchasers a deed or deeds of release confirming such sale; and that the mortgagee and his heirs, executors, administrators, successors and assigns are appointed and constituted the attorney or attorneys irrevocable of the said mortgagor to execute and deliver to the said purchaser a full transfer of all policies of insurance on the buildings upon the land covered by the mortgage at the time of such sale''.) (General Laws Part II Title I Chapter 183, Section 19)

(CONDITION.)

(Provided, nevertheless, except as otherwise specifically stated in the mortgage, that if the mortgagor, or his heirs, executors, administrators, successors or assigns shall pay unto the mortgagee or his executors, administrators or assigns the principal and interest secured by the mortgage, and shall perform any obligation secured at the time provided in the note, mortgage or other instrument or any extension thereof, and shall perform the condition of any prior mortgage, and until such payment and performance shall pay when due and payable all taxes, charges and assessments to whomsoever and whenever laid or assessed, whether on the mortgaged premises or on any interest therein or on the debt or obligation secured thereby; shall keep the buildings on said premises insured against fire in a sum not less than the amount secured by the mortgage or as otherwise provided therein for insurance for the benefit of the mortgagee and his executors, administrators and assigns, in such form and at such insurance offices as they shall approve, and, at least two days before the expiration of any policy on said premises, shall deliver to him or them a new and sufficient policy to take the place of the one so expiring, and shall not commit or suffer any strip or waste of the mortgaged premises or any breach of any covenant contained in the mortgage or in any prior mortgage, then the mortgage deed, as also the mortgage note or notes, shall be void.) (General Laws Part II Title I Chapter 183, Section 20)

(POWER.)

(But upon any default in the performance or observance of the foregoing or other condition, the mortgagee or his executors, administrators, successors or assigns may sell the mortgaged premises or such portion thereof as may remain subject to the mortgage in case of any partial release thereof, either as a whole or in parcels, together with all improvements that may be thereon, by public auction on or near the premises then subject to the mortgage, or, if more than one parcel is then subject thereto, on or near one of said parcels, or at such place as may be designated for that purpose in the mortgage, first complying with the terms of the mortgage and with the statutes relating to the foreclosure of mortgages by the exercise of a power of sale, and may convey the same by proper deed or deeds to the purchaser or purchasers absolutely and in fee simple; and such sale shall forever bar the mortgagor and all persons claiming under him from all right and interest in the mortgaged premises, whether at law or in equity.) (General Laws Part II Title I Chapter 183, Section 21)

A mortgage deed with statutory power of sale and a promissory note with stringent default terms can be beneficial to the lender.

(Massachusetts Mortgage Package includes forms, guidelines, and completed examples) For use in Massachusetts only.

Our Promise

The documents you receive here will meet, or exceed, the Hampshire County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Hampshire County Mortgage Deed and Promissory Note form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4448 Reviews )

Dorothy N.

December 22nd, 2024

The mortgage and note were thorough and very satisfactory for my purposes. The accompanying forms were excellent. I am very pleased with my purchase.

We welcome your positive feedback and are thrilled to have met your expectations. Thank you for choosing our services.

Edward E.

December 22nd, 2024

Easy to use.

Your feedback is valuable to us and helps us improve. Thank you for sharing your thoughts!

MARISSA G.

December 22nd, 2024

I recomemed this webside

Thank you for your feedback. We really appreciate it. Have a great day!

Corinna N.

October 20th, 2024

The website made it easy to find and print out the documents I needed. The whole process was straightforward and user-friendly. Highly recommend!

We are grateful for your feedback and looking forward to serving you again. Thank you!

Gerald S.

November 7th, 2020

Very pleased with the services provided by deeds.com. Quick response time after information was provided.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Darrel V.

September 27th, 2020

Pretty easy to use and timely, too!

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

JOHN F.

May 24th, 2023

Quick and easy! I had previously prepared a Lady Bird deed, submitted it through Deeds.com and it was accepted/recorded by my county in just a few hours. The Deed.com $21 fee was well worth it as I saved fuel, tolls and parking costs not to mention at least 2-3 hours of my time that it would've taken to get downtown and back home!

Thanks for the feedback John. We appreciate you taking the time to share your experience. Have an amazing day!

Jonnie G.

November 15th, 2019

I very much dreaded this whole endeavor but very pleasantly surprised. So far, so good. I feel much more confidant that the crucial form, when presented, will play well with the county.......

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Ken J.

May 14th, 2022

I liked the software, it's very easy to use. Once it's saved as a .pdf document on your computer, the source document is lost when you log out. I wish it could be saved and then edited on their site later instead of having to create a new document from scratch each time.

Thank you for your feedback. We really appreciate it. Have a great day!

David J.

March 27th, 2020

Very easy to use and saved a lot of time

Thank you!

Lanette H.

September 9th, 2020

I liked getting the forms but I was charged twice for some reason. I'm not sure what happened with that. Can you reimburse me? Thank you. Lanette

Thank you for your feedback Lanette. In review, it looks like your first payment was declined, second one was approved and processed. What you are seeing is one payment and a hold placed by your financial institution for the declined attempt. We are not sure why they do this but the hold usually falls off after a few day depending on their policy. If you have further questions about this you can contact your financial institution and they will explain. Have a great day.

Erik J.

January 8th, 2021

First time using Deeds.com and feel that your platform is clear and easy to use. I was also pleased with the messaging center and follow-up and also surprised at how quickly our particular deed was recorded and available to view. Having said that, when I first investigated Deeds.com the fee was $15 and as of 1/1/21 it has increased to $19 which I feel is pretty steep for the handling of 1 simple document especially when the turnaround was basically the same day. Your fee was nearly the equivalent of the cost of the Clerk's recording fee. Perhaps you should offer a fee schedule for those of us who are not volume recorders. Just a thought.

Thank you!

michael k.

February 24th, 2023

fast and easy to fill out forms.

Thank you!

Joseph D.

November 14th, 2024

Easy to use and a quick turnaround rnDeed was recorded and retuned within 24 hours

We are grateful for your engagement and feedback, which help us to serve you better. Thank you for being an integral part of our community.

Robert W.

February 22nd, 2020

With the guide everything went great

Thank you!