Berkshire County Estate Tax Affidavit Form (Massachusetts)

All Berkshire County specific forms and documents listed below are included in your immediate download package:

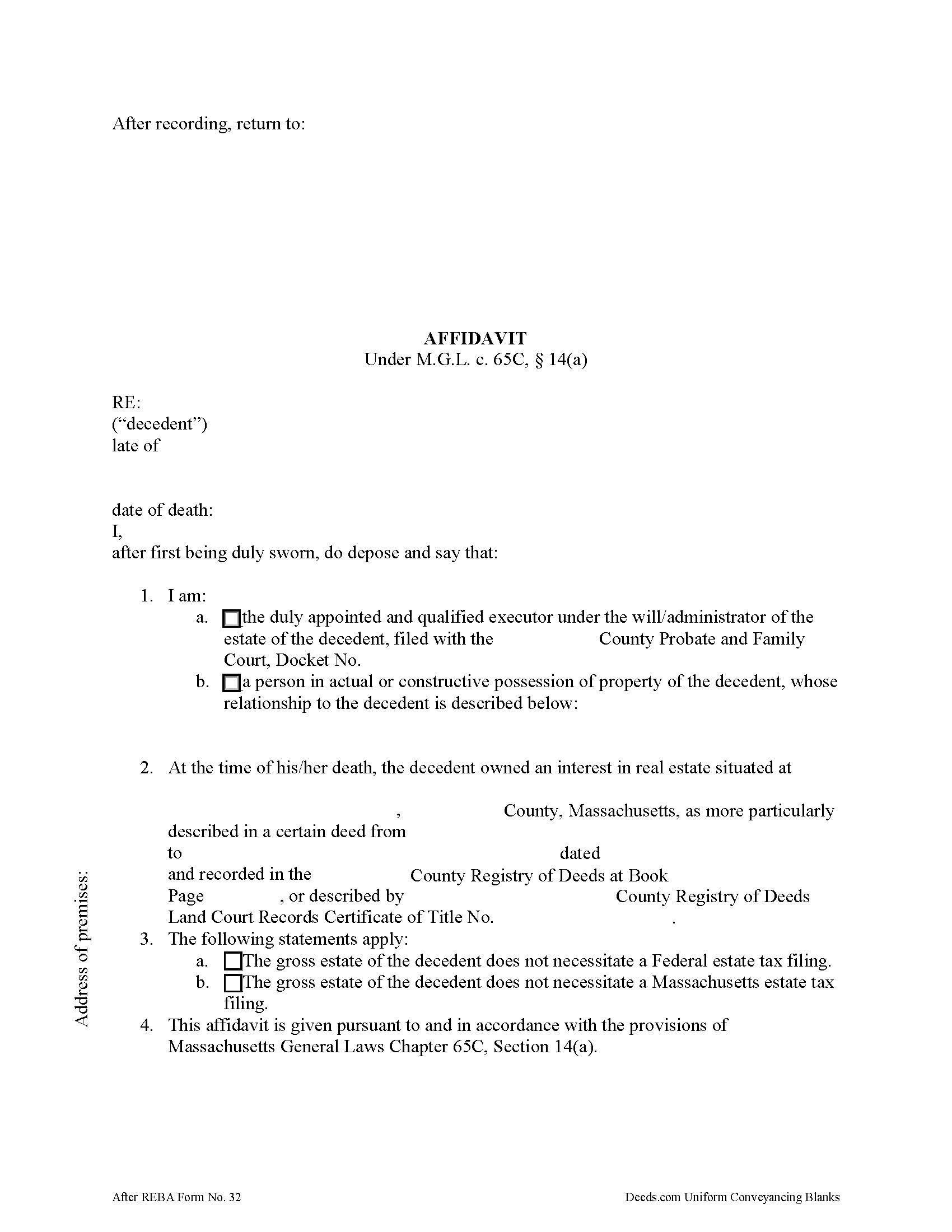

Estate Tax Affidavit Form

Fill in the blank form formatted to comply with all recording and content requirements.

Included Berkshire County compliant document last validated/updated 11/25/2024

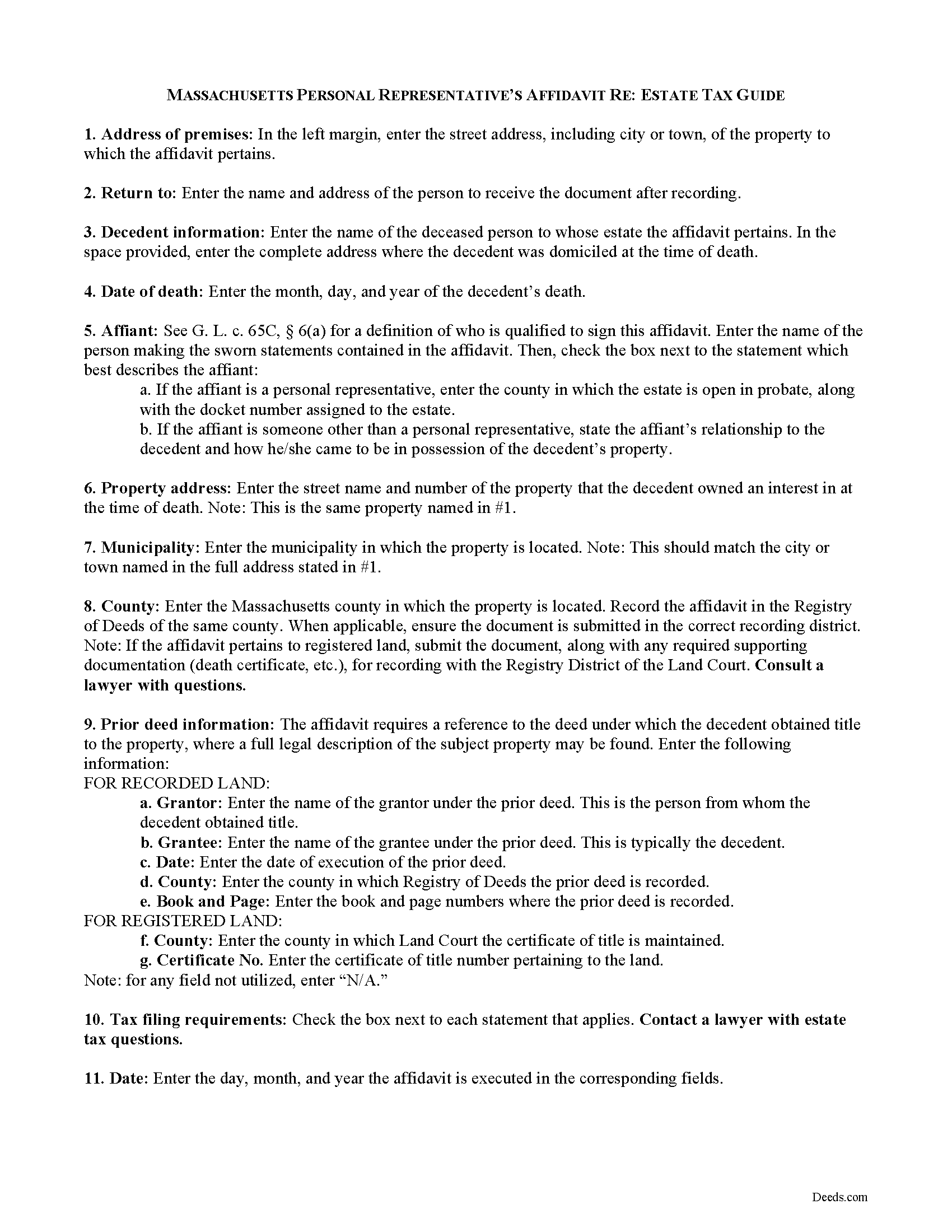

Estate Tax Affidavit Guide

Line by line guide explaining every blank on the form.

Included Berkshire County compliant document last validated/updated 11/26/2024

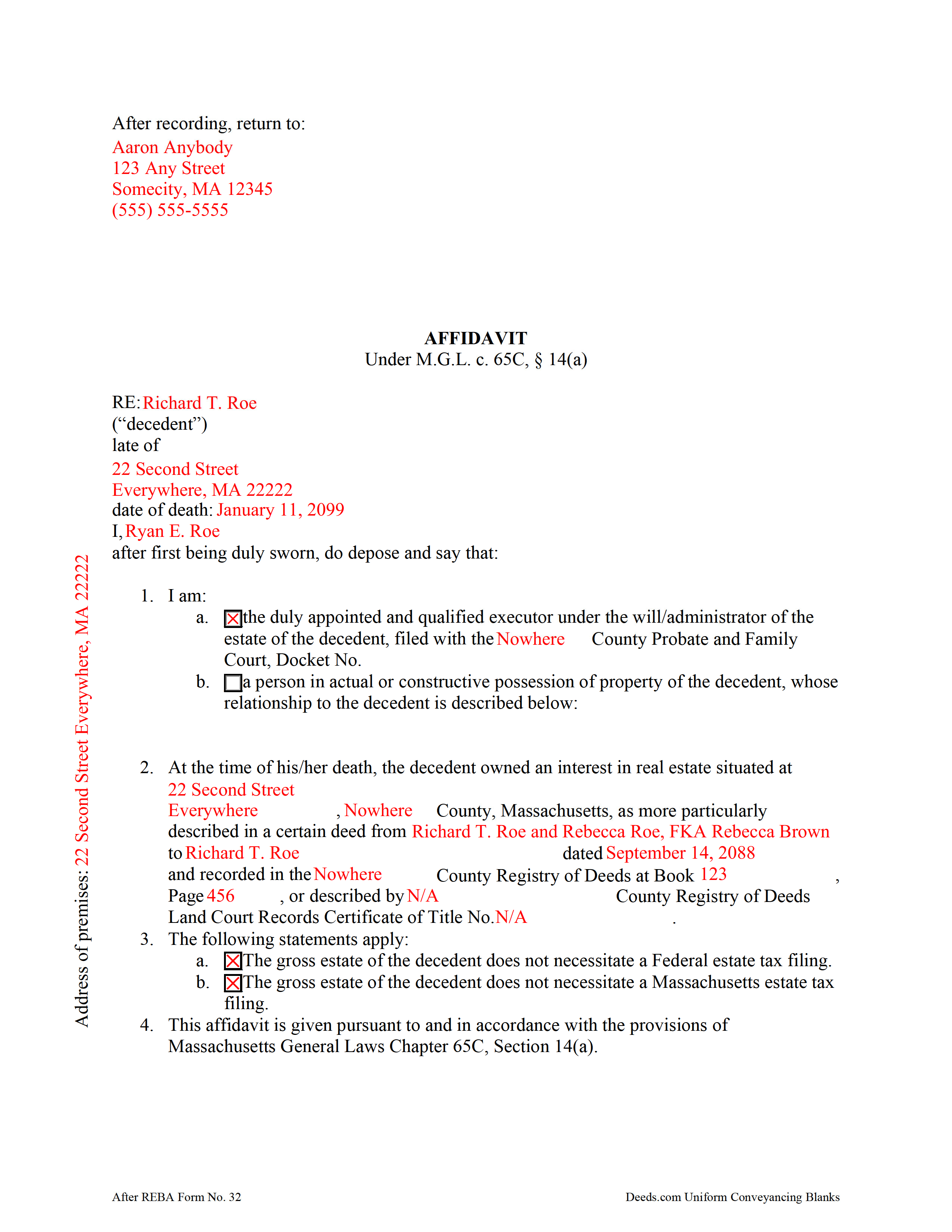

Completed Example of the Estate Tax Affidavit Document

Example of a properly completed form for reference.

Included Berkshire County compliant document last validated/updated 12/11/2024

The following Massachusetts and Berkshire County supplemental forms are included as a courtesy with your order:

When using these Estate Tax Affidavit forms, the subject real estate must be physically located in Berkshire County. The executed documents should then be recorded in one of the following offices:

Berkshire Middle District Registry of Deeds

44 Bank Row, Pittsfield, Massachusetts 01201

Hours: 8:30 to 4:30 M-F / Recording until 4:00

Phone: (413) 443-7438

Northern Berkshire District Registry of Deeds

65 Park Street, Adams, Massachusetts 01220

Hours: 8:30 to 4:30 M-F / Recording until 4:00

Phone: (413) 743-0035

Southern Berkshire District Registry of Deeds

334 Main St, Suite 2, Great Barrington, Massachusetts 01230

Hours: 8:30 to 4:30 M-F / Recording until 4:00

Phone: (413) 528-0146

Local jurisdictions located in Berkshire County include:

- Adams

- Ashley Falls

- Becket

- Berkshire

- Cheshire

- Dalton

- Drury

- East Otis

- Glendale

- Great Barrington

- Hinsdale

- Housatonic

- Lanesboro

- Lee

- Lenox

- Lenox Dale

- Mill River

- Monterey

- North Adams

- North Egremont

- Otis

- Pittsfield

- Richmond

- Sandisfield

- Savoy

- Sheffield

- South Egremont

- South Lee

- Southfield

- Stockbridge

- Tyringham

- West Stockbridge

- Williamstown

- Windsor

How long does it take to get my forms?

Forms are available immediately after submitting payment.

How do I get my forms, are they emailed?

Immediately after you submit payment, the Berkshire County forms you order will be available for download directly from your account. You can then download the forms to your computer. If you do not already have an account, one will be created for you as part of the order process, and your login details will be provided to you. If you encounter any issues accessing your forms, please reach out to our support team for assistance. Forms are NOT emailed to you.

What does "validated/updated" mean?

This indicates the most recent date when at least one of the following occurred:

- Updated: The document was updated or changed to remain compliant.

- Validated: The document was examined by an attorney or staff, or it was successfully recorded in Berkshire County using our eRecording service.

Are these forms guaranteed to be recordable in Berkshire County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Berkshire County including margin requirements, content requirements, font and font size requirements.

Can the Estate Tax Affidavit forms be re-used?

Yes. You can re-use the forms for your personal use. For example, if you have more than one property in Berkshire County that you need to transfer you would only need to order our forms once for all of your properties in Berkshire County.

What are supplemental forms?

Often when a deed is recorded, additional documents are required by Massachusetts or Berkshire County. These could be tax related, informational, or even as simple as a coversheet. Supplemental forms are provided for free with your order where available.

What type of files are the forms?

All of our Berkshire County Estate Tax Affidavit forms are PDFs. You will need to have or get Adobe Reader to use our forms. Adobe Reader is free software that most computers already have installed.

Do I need any special software to use these forms?

You will need to have Adobe Reader installed on your computer to use our forms. Adobe Reader is free software that most computers already have installed.

Do I have to enter all of my property information online?

No. The blank forms are downloaded to your computer and you fill them out there, at your convenience.

Can I save the completed form, email it to someone?

Yes, you can save your deed form at any point with your information in it. The forms can also be emailed, blank or complete, as attachments.

Are there any recurring fees involved?

No. Nothing to cancel, no memberships, no recurring fees.

In Massachusetts, upon death, a lien attaches to a decedent's real property for ten years, or until the estate tax is paid, or an affidavit showing that the decedent's gross estate does not require an estate tax filing is recorded by a personal representative (or other qualified person under G. L. c. 65C, 6(a)) in the Registry of Deeds.

Use the affidavit of estate tax under M.G.L. c. 65C, 14(a) to release the lien on the decedent's property. The affidavit should include the name, address, and date of death of the decedent. The affiant shall indicate whether he/she is the personal representative of the decedent's probated estate, or, if the property is not subject to probate, then the affiant's relationship to the decedent.

The document's recitals also include the address of the premises affected and the prior instrument containing a legal description of the property. All statements contained within the affidavit are made by the affiant on penalty of perjury and sworn to before a notary public.

Contact a lawyer with questions about the Massachusetts estate tax and affidavits relating to decedents' estates in the Commonwealth of Massachusetts.

(Massachusetts ETA Package includes form, guidelines, and completed example)

Our Promise

The documents you receive here will meet, or exceed, the Berkshire County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Berkshire County Estate Tax Affidavit form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4448 Reviews )

Dorothy N.

December 22nd, 2024

The mortgage and note were thorough and very satisfactory for my purposes. The accompanying forms were excellent. I am very pleased with my purchase.

We welcome your positive feedback and are thrilled to have met your expectations. Thank you for choosing our services.

Edward E.

December 22nd, 2024

Easy to use.

Your feedback is valuable to us and helps us improve. Thank you for sharing your thoughts!

MARISSA G.

December 22nd, 2024

I recomemed this webside

Thank you for your feedback. We really appreciate it. Have a great day!

Rebecca H.

August 6th, 2019

quick and easy. Perfect

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Shelba M.

July 26th, 2023

The web site is alright, not the easiest to navigate and the wording on the papers could be simpler to understand.

Thank you for your feedback! We appreciate your input regarding the website's navigation and the wording on our documents. We'll definitely take your suggestions into account to improve the user experience and make the content more accessible and easier to understand. Your insights are valuable to us as we strive to enhance our services. If you have any further suggestions or concerns, please feel free to share them with us. Thank you again for your feedback!

Sterling H.

September 17th, 2024

I liked being able to drill down to state and county. Just simply the search for all property records

We welcome your positive feedback and are thrilled to have met your expectations. Thank you for choosing our services.

Fred B.

May 19th, 2020

Great site and very easy to use. I will be using this for all of my search and form requirements.

Thank you for your feedback. We really appreciate it. Have a great day!

Deborah D.

June 1st, 2023

What I thought was gonna be a long drawn out tedious process was literally 10min tops... The help was quick and a load off. Thanks y'all.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

cosmin B.

March 19th, 2021

It's all good!!!!

Thank you!

George R.

July 28th, 2020

One of the most satisfactory and easy to use websites I have come across. Being able to record documents in the court records without having to pay an atty $500 per hour and accomplish the recording in about 24 hours instead of days and even weeks i

s invaluable. Worked perfectly.

Thank you!

Vallerie M.

March 12th, 2024

Amazing! Great prompt service and follow up. I couldn’t be happier

We are grateful for your engagement and feedback, which help us to serve you better. Thank you for being an integral part of our community.

barbara m.

March 16th, 2021

deeds.com is the most efficient, easy to use site for legal forms I've found! Thank You

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Agnes I H.

January 28th, 2019

Good knowing the price right up front...and not a FREE one you pay at the end....

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Barbara S.

March 11th, 2021

I found your site easy to use, though I would prefer an option to download to MWords but Adobe works well. The cost is very, very reasonable and provides documents I didn't know were needed. I would recommend this to anyone trying to deal with legal documents.

Thank you!

Yvonne A.

April 25th, 2021

love your Deeds.com website...

Thank you!