Howard County Personal Representative Deed Form (Maryland)

All Howard County specific forms and documents listed below are included in your immediate download package:

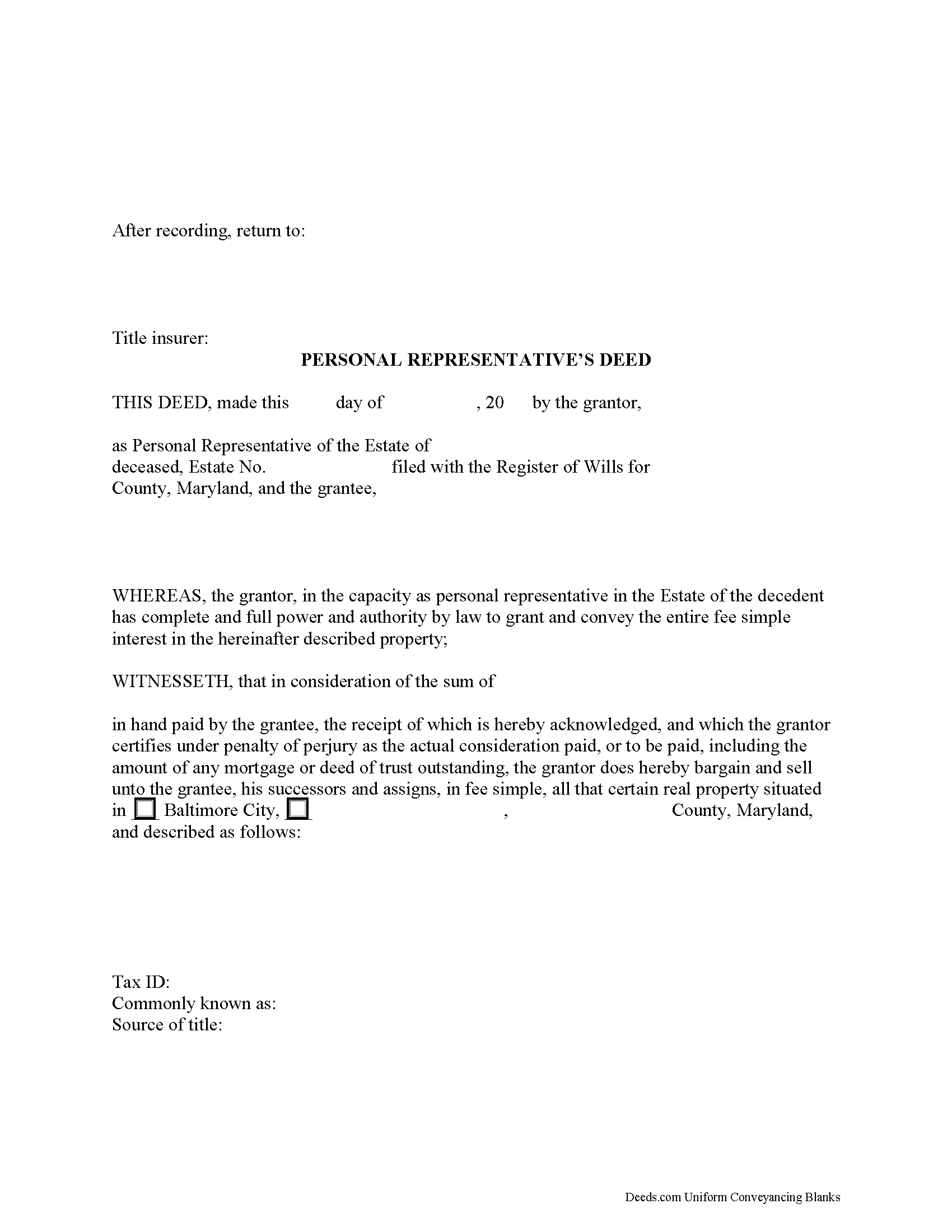

Personal Representative Deed Form

Fill in the blank form formatted to comply with all recording and content requirements.

Included Howard County compliant document last validated/updated 9/12/2024

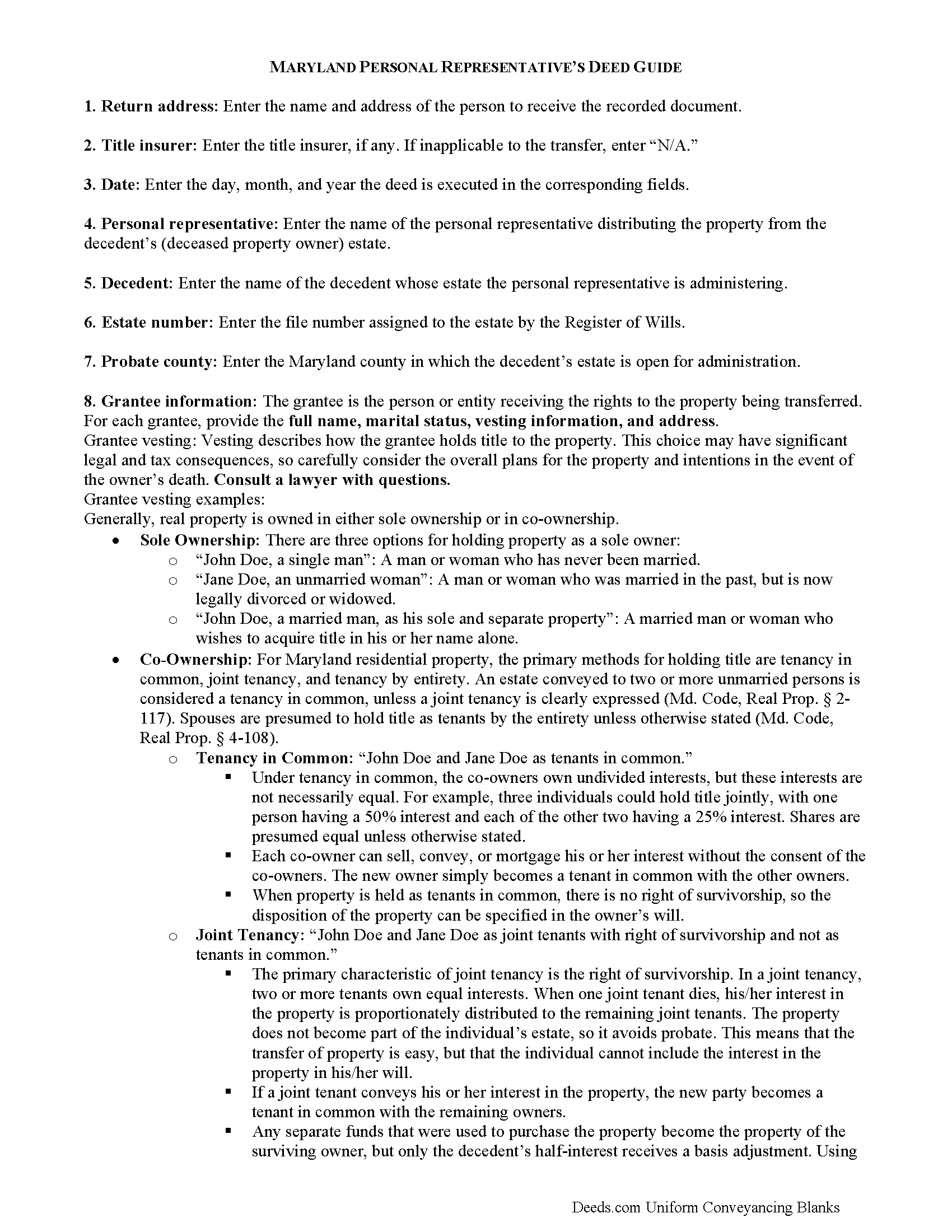

Personal Representative Deed Guide

Line by line guide explaining every blank on the form.

Included Howard County compliant document last validated/updated 7/23/2024

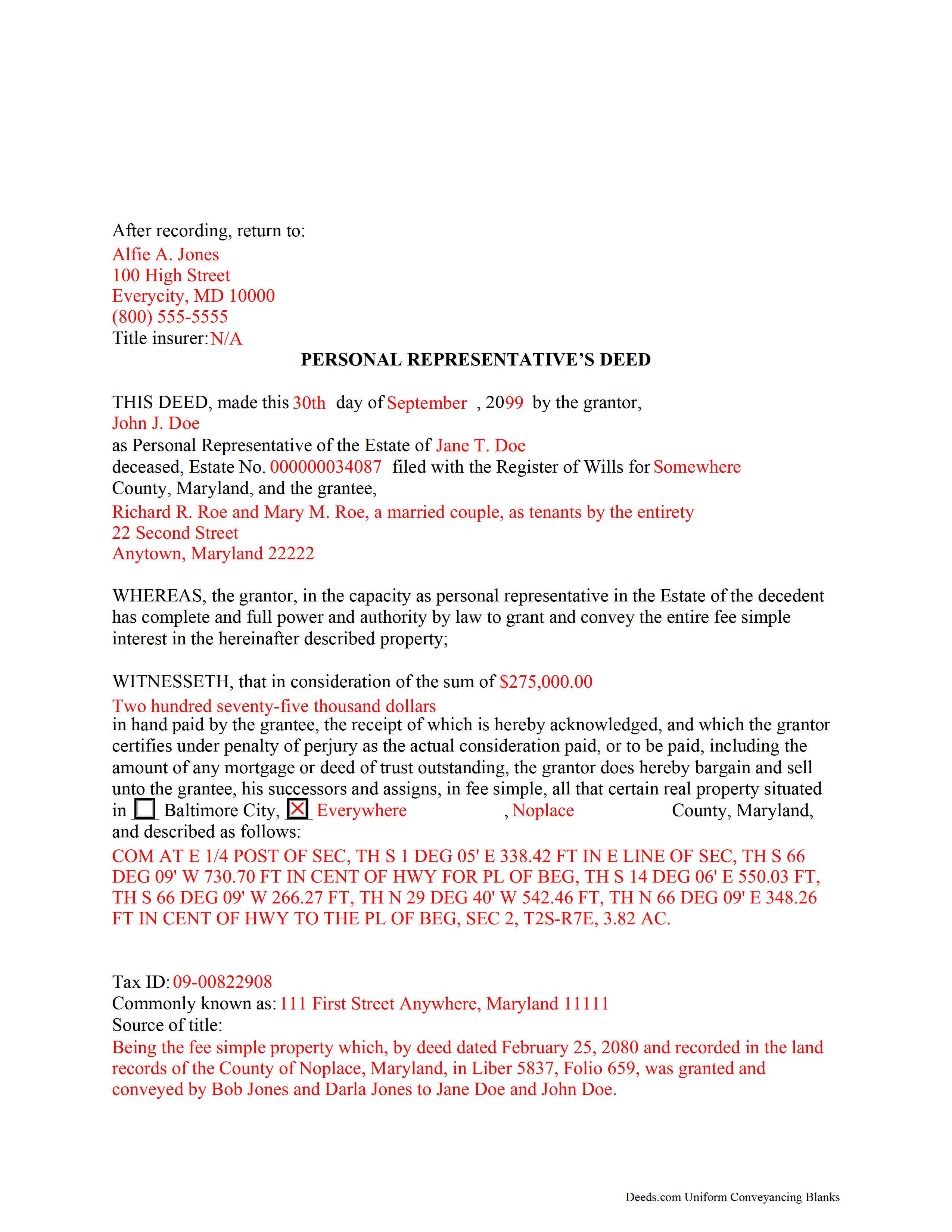

Completed Example of the Personal Representative Deed Document

Example of a properly completed form for reference.

Included Howard County compliant document last validated/updated 11/22/2024

The following Maryland and Howard County supplemental forms are included as a courtesy with your order:

When using these Personal Representative Deed forms, the subject real estate must be physically located in Howard County. The executed documents should then be recorded in the following office:

Circuit Court: Land Records Department

6095 Marshalee Drive, Suite 120, Elkridge, Maryland 21075

Hours: 8:30 to 3:30 M-F

Phone: 410-313-5850

Local jurisdictions located in Howard County include:

- Annapolis Junction

- Clarksville

- Columbia

- Cooksville

- Dayton

- Dhs

- Elkridge

- Ellicott City

- Fulton

- Glenelg

- Glenwood

- Highland

- Jessup

- Laurel

- Lisbon

- Savage

- Simpsonville

- West Friendship

- Woodbine

- Woodstock

How long does it take to get my forms?

Forms are available immediately after submitting payment.

How do I get my forms, are they emailed?

Immediately after you submit payment, the Howard County forms you order will be available for download directly from your account. You can then download the forms to your computer. If you do not already have an account, one will be created for you as part of the order process, and your login details will be provided to you. If you encounter any issues accessing your forms, please reach out to our support team for assistance. Forms are NOT emailed to you.

What does "validated/updated" mean?

This indicates the most recent date when at least one of the following occurred:

- Updated: The document was updated or changed to remain compliant.

- Validated: The document was examined by an attorney or staff, or it was successfully recorded in Howard County using our eRecording service.

Are these forms guaranteed to be recordable in Howard County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Howard County including margin requirements, content requirements, font and font size requirements.

Can the Personal Representative Deed forms be re-used?

Yes. You can re-use the forms for your personal use. For example, if you have more than one property in Howard County that you need to transfer you would only need to order our forms once for all of your properties in Howard County.

What are supplemental forms?

Often when a deed is recorded, additional documents are required by Maryland or Howard County. These could be tax related, informational, or even as simple as a coversheet. Supplemental forms are provided for free with your order where available.

What type of files are the forms?

All of our Howard County Personal Representative Deed forms are PDFs. You will need to have or get Adobe Reader to use our forms. Adobe Reader is free software that most computers already have installed.

Do I need any special software to use these forms?

You will need to have Adobe Reader installed on your computer to use our forms. Adobe Reader is free software that most computers already have installed.

Do I have to enter all of my property information online?

No. The blank forms are downloaded to your computer and you fill them out there, at your convenience.

Can I save the completed form, email it to someone?

Yes, you can save your deed form at any point with your information in it. The forms can also be emailed, blank or complete, as attachments.

Are there any recurring fees involved?

No. Nothing to cancel, no memberships, no recurring fees.

When someone dies, his or her property will more than likely be subject to probate. Probate is the court-supervised process of transferring a decedent's property to those entitled to receive it. In Maryland, the Orphans' Court handles probate in each judicial jurisdiction.

Excluding property held with a survivorship interest, beneficiary designation, or in a trust, all the decedent's property is subject to administration through probate. In Maryland, the process of estate administration is governed by the Maryland Estates and Trusts Code.

Probate is initiated in the Office of the Register of Wills. Following petition for probate, the court appoints a personal representative (PR) of the estate. In some states, the PR may be called an "executor" (when named by the decedent's will) or an "administrator" (when selected by the court). Maryland, however, uses the general term "personal representative" (PR) in both instances.

The court issues letters of administration to commence the PR's duties. This includes marshalling the decedent's assets, taking inventory of the estate, paying the relevant taxes, valid debts, and administrative costs, and distributing the estate to heirs.

When the decedent dies leaving a will, he is said to have died testate. A testator (person who executes a will) directs the distribution of his or her property by executing a will. The person named as personal representative in the will has a duty to bring the will to the Register of Wills to open probate.

When the decedent dies without a will, he is said to have died intestate. Maryland's laws of intestate succession provide instruction for who has priority to serve as personal representative of a decedent's intestate estate and who will inherit the decedent's property after applicable taxes, debts, and administrative fees have been paid.

As part of administration, the PR may be required to devise real estate pursuant to the terms of the decedent's will or to make a distribution of real property to an heir. The decedent may even have left instructions in the will to sell his or her real property, or the PR may need to sell real property to pay the estate's debts. In Maryland, personal representatives may execute all statutory powers without first gaining court approval, including selling property (Md. Code, Estates and Trusts 7-401).

To transfer title to real property from a decedent's estate, the PR executes a personal representative's deed. Maryland's statutory personal representative's deed under Real Property Code 4-202 conveys the whole interest and estate to the grantee "unless a limitation or reservation shows, by implication or otherwise, a different intent" (Real Property Code 2-101).

Typically, personal representative's deeds, like other fiduciary deeds, contain special warranty covenants of title. Under Md. Code, Real Property 2-106, a grantor of a special warranty deed covenants that "he will warrant forever and defend the property to the grantee against any lawful claim and demand of the grantor and every person claiming or to claim by, through, or under him."

A personal representative's deed contains information relevant to the probate case, such as the name of the personal representative, the decedent's name, the file number assigned to the estate by the Register of Wills, and the county in which probate is opened. It should meet all other standards of form and content for documents pertaining to an interest in real property in the State of Maryland. A PR deed must be signed by the PR in the presence of a Notary Public before recording in the Land Records Division of the Circuit Court in the jurisdiction where the subject real estate is located.

The information presented in this article is general in nature and does not replace the advice of a lawyer. Before recording a deed, consult a lawyer to ensure all state, county, municipal, and situation-specific requirements are being met.

Contact a lawyer with questions about estate administration and preparing a personal representative's deed in Maryland.

(Maryland PRD Package includes form, guidelines, and completed example)

Our Promise

The documents you receive here will meet, or exceed, the Howard County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Howard County Personal Representative Deed form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4449 Reviews )

Daniel B.

December 24th, 2024

easy to use and upload.

We are delighted to have been of service. Thank you for the positive review!

Dorothy N.

December 22nd, 2024

The mortgage and note were thorough and very satisfactory for my purposes. The accompanying forms were excellent. I am very pleased with my purchase.

We welcome your positive feedback and are thrilled to have met your expectations. Thank you for choosing our services.

Edward E.

December 22nd, 2024

Easy to use.

Your feedback is valuable to us and helps us improve. Thank you for sharing your thoughts!

Linda D C.

August 26th, 2021

This was so easy to use. I appreciated the finished sample to guide me and the proper attachments necessary to process my Quit Claim Deed. I am gifting it to my nephew as I am too old to run farm and I live in a different state now. I tried other websites but their info was not up to date or accurate. Thank you so much. 71 Y/O Nana.

Thank you for your feedback. We really appreciate it. Have a great day!

Patricia M.

August 19th, 2019

Very easy site to navigate and very helpful information

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Laura J.

April 6th, 2021

Very satisfied. Highly recommend!

Thank you!

Michael F.

May 12th, 2021

I'm not too bright and I made a mess of things when I tried to create my own deed. It was lucky that I found the forms here after so many of my personal failures. It's good that the pros know what they are doing.

Such kind words Michael, thank you.

Robert B.

April 2nd, 2019

Excellent, easy to operate, saved $$$ by doing this TOD deed myself. WILL BUY AGAIN!!

Thank you Robert. Have a fantastic day!

Eric G.

October 22nd, 2021

Need to offer option to download ALL forms as a single (bookmarked) PDF, rather than as separates... Quite inefficient as is.

Thank you for your feedback. We really appreciate it. Have a great day!

Alan S.

May 26th, 2020

Quick, easy, and accurate.

And if there's ever a problem, the resolution is also quick, easy, and accurate.

The service is hard to beat.

Thank you for your feedback. We really appreciate it. Have a great day!

THOMAS P.

September 11th, 2020

This site is excellent and makes everything so much easier.

5 star platform.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Vernon A L.

March 23rd, 2022

They are forms....no magic there. I still have to round up the details.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Victoria L.

February 25th, 2019

This is a fantastic website and financial savings to many. Being able to download and complete the document I needed vs having my attorney complete saved me $800. I would highly recommend this website.

Thank you for the kind words Victoria. Have a great day!

Joshua M.

March 15th, 2023

Fast service, very responsive. Thank you!

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

janelle s.

September 15th, 2020

Uncertain about use as I am new to online forms. Through use I am sure it will feel more comfortable. I like the storage of filled in info forms because I might be using I will be using them or the info in the future.

Thank you for your feedback. We really appreciate it. Have a great day!