Download Maryland Personal Representative Deed Legal Forms

Maryland Personal Representative Deed Overview

When someone dies, his or her property will more than likely be subject to probate. Probate is the court-supervised process of transferring a decedent's property to those entitled to receive it. In Maryland, the Orphans' Court handles probate in each judicial jurisdiction.

Excluding property held with a survivorship interest, beneficiary designation, or in a trust, all the decedent's property is subject to administration through probate. In Maryland, the process of estate administration is governed by the Maryland Estates and Trusts Code.

Probate is initiated in the Office of the Register of Wills. Following petition for probate, the court appoints a personal representative (PR) of the estate. In some states, the PR may be called an "executor" (when named by the decedent's will) or an "administrator" (when selected by the court). Maryland, however, uses the general term "personal representative" (PR) in both instances.

The court issues letters of administration to commence the PR's duties. This includes marshalling the decedent's assets, taking inventory of the estate, paying the relevant taxes, valid debts, and administrative costs, and distributing the estate to heirs.

When the decedent dies leaving a will, he is said to have died testate. A testator (person who executes a will) directs the distribution of his or her property by executing a will. The person named as personal representative in the will has a duty to bring the will to the Register of Wills to open probate.

When the decedent dies without a will, he is said to have died intestate. Maryland's laws of intestate succession provide instruction for who has priority to serve as personal representative of a decedent's intestate estate and who will inherit the decedent's property after applicable taxes, debts, and administrative fees have been paid.

As part of administration, the PR may be required to devise real estate pursuant to the terms of the decedent's will or to make a distribution of real property to an heir. The decedent may even have left instructions in the will to sell his or her real property, or the PR may need to sell real property to pay the estate's debts. In Maryland, personal representatives may execute all statutory powers without first gaining court approval, including selling property (Md. Code, Estates and Trusts 7-401).

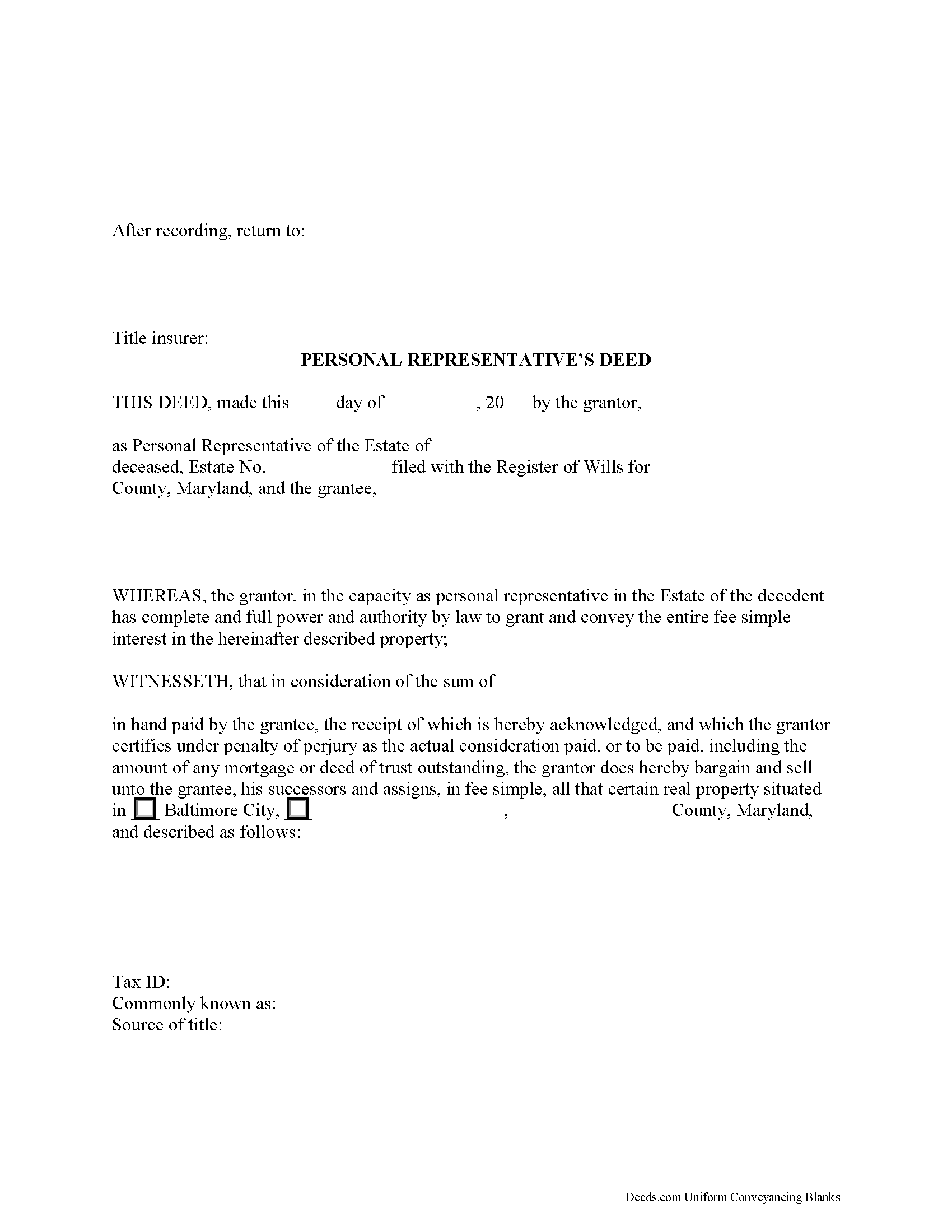

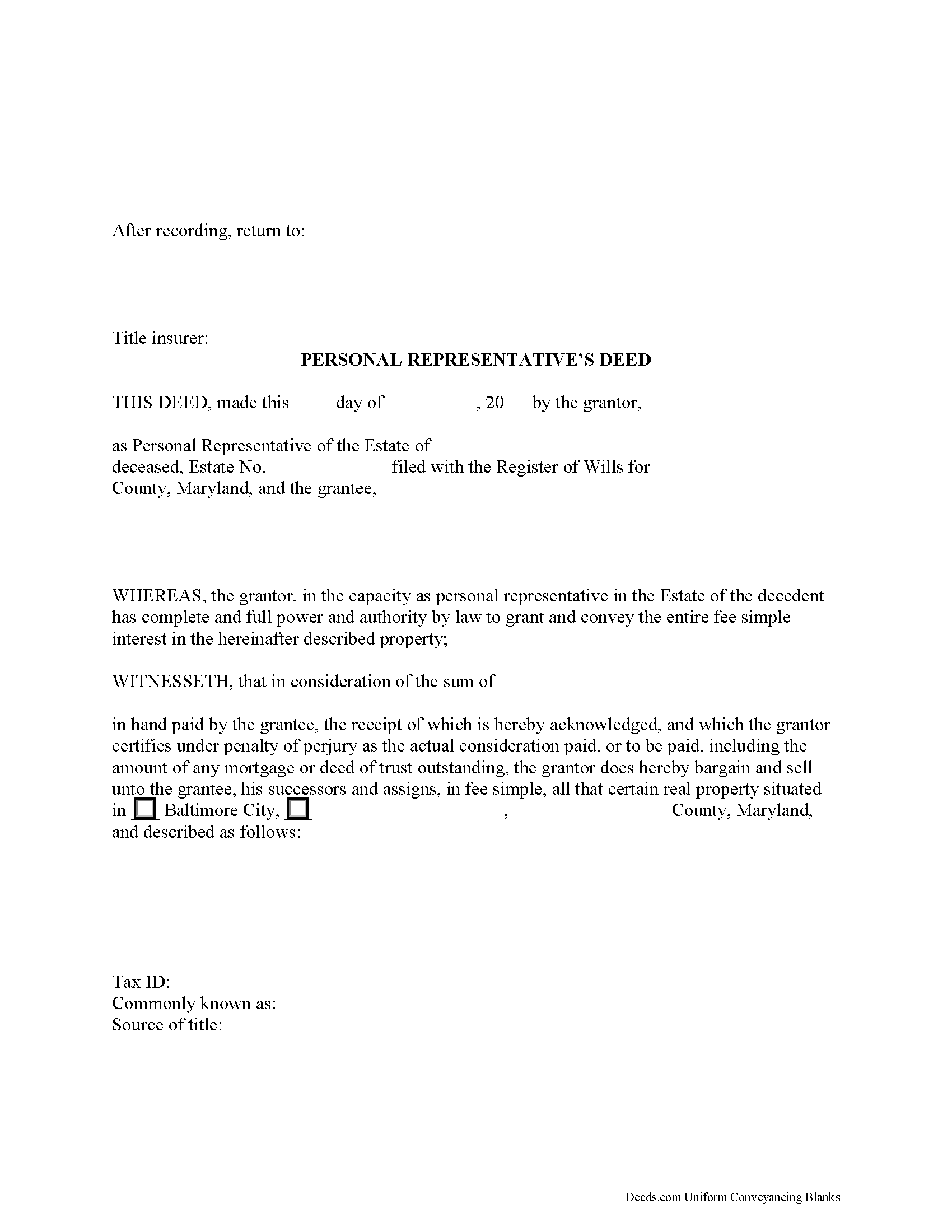

To transfer title to real property from a decedent's estate, the PR executes a personal representative's deed. Maryland's statutory personal representative's deed under Real Property Code 4-202 conveys the whole interest and estate to the grantee "unless a limitation or reservation shows, by implication or otherwise, a different intent" (Real Property Code 2-101).

Typically, personal representative's deeds, like other fiduciary deeds, contain special warranty covenants of title. Under Md. Code, Real Property 2-106, a grantor of a special warranty deed covenants that "he will warrant forever and defend the property to the grantee against any lawful claim and demand of the grantor and every person claiming or to claim by, through, or under him."

A personal representative's deed contains information relevant to the probate case, such as the name of the personal representative, the decedent's name, the file number assigned to the estate by the Register of Wills, and the county in which probate is opened. It should meet all other standards of form and content for documents pertaining to an interest in real property in the State of Maryland. A PR deed must be signed by the PR in the presence of a Notary Public before recording in the Land Records Division of the Circuit Court in the jurisdiction where the subject real estate is located.

The information presented in this article is general in nature and does not replace the advice of a lawyer. Before recording a deed, consult a lawyer to ensure all state, county, municipal, and situation-specific requirements are being met.

Contact a lawyer with questions about estate administration and preparing a personal representative's deed in Maryland.

(Maryland PRD Package includes form, guidelines, and completed example)