Download Maine Certificate of Trust Legal Forms

Maine Certificate of Trust Overview

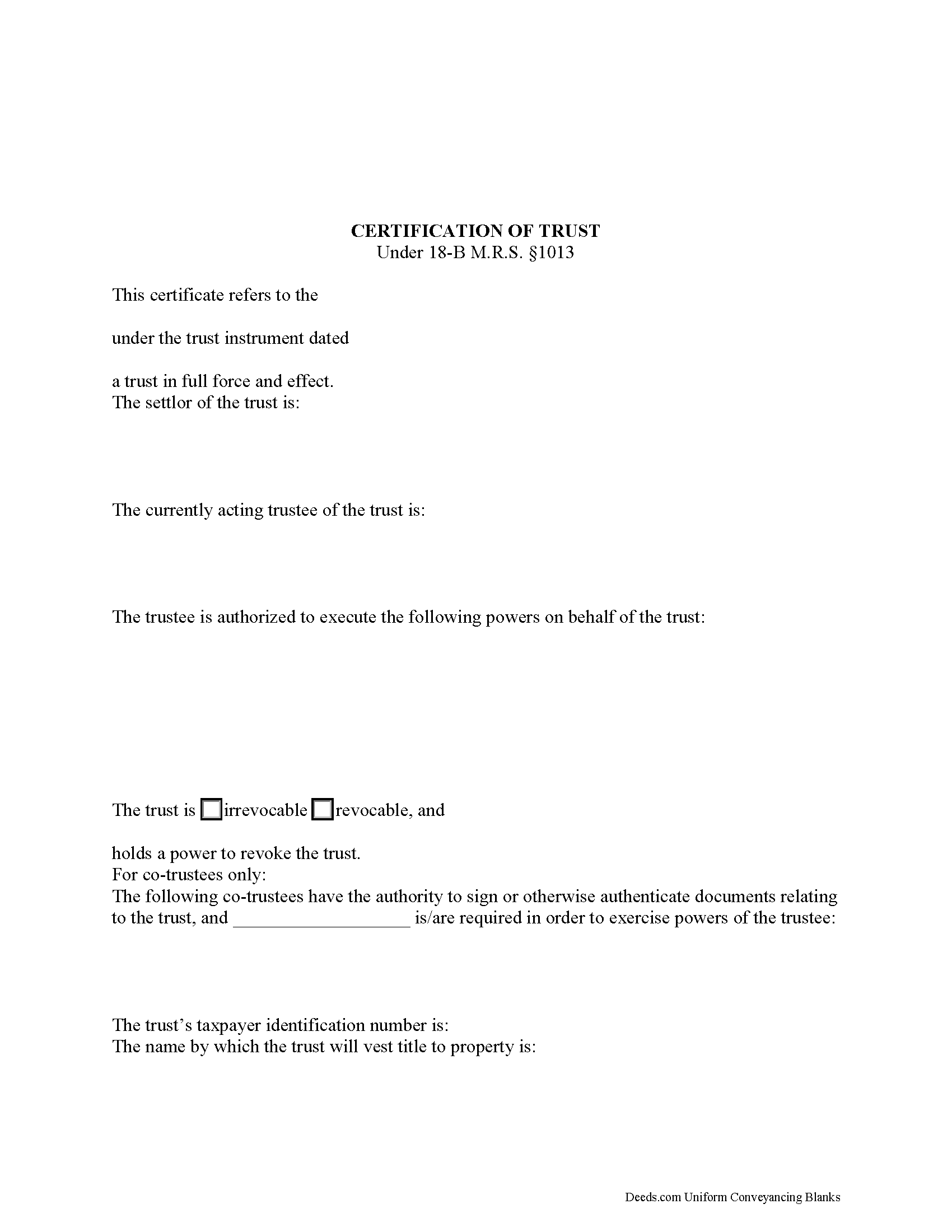

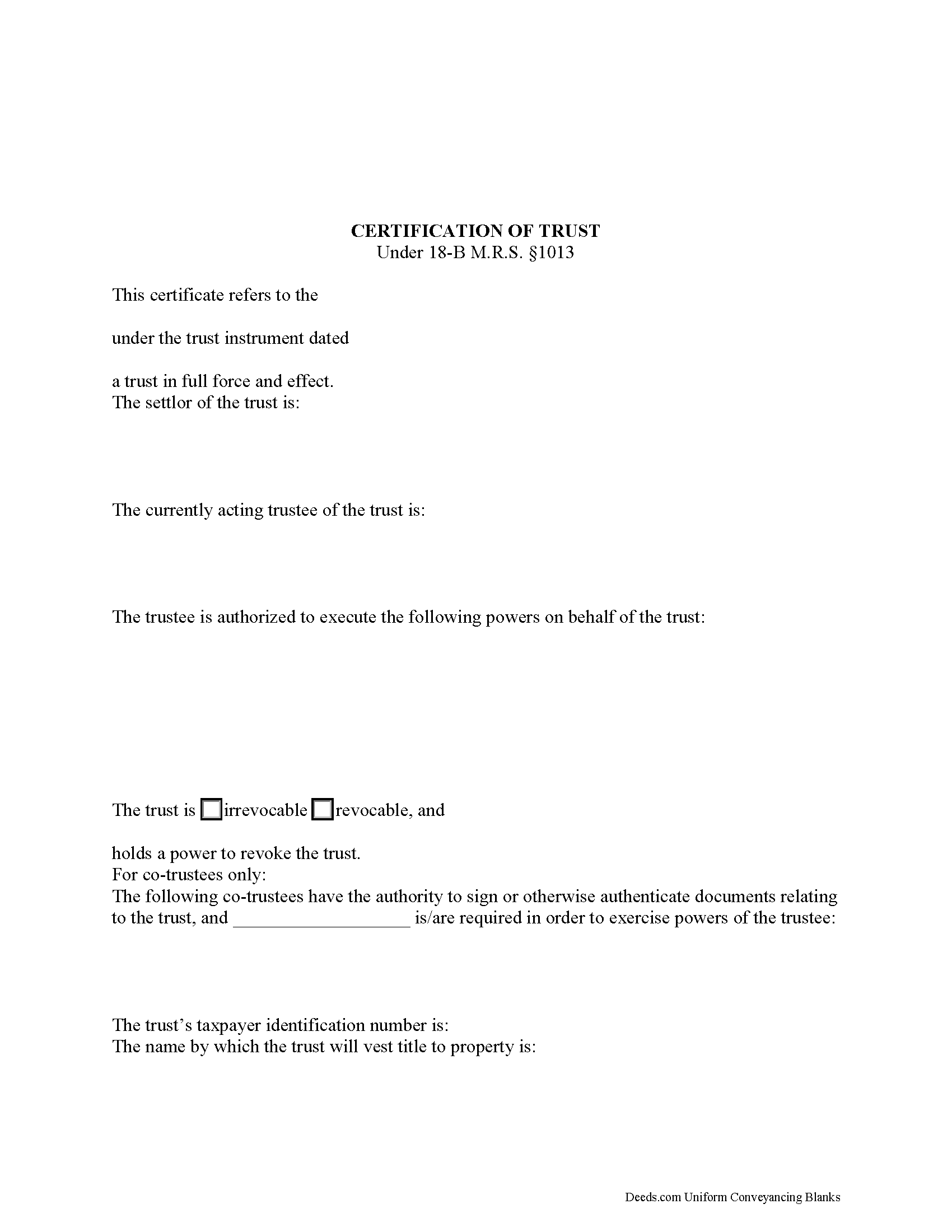

The Maine certification of trust falls under the Maine Uniform Trust Code and is codified at 18-B M.R.S. 1013.

Under the statute, "Instead of furnishing a copy of the trust instrument to a person other than a beneficiary, the trustee may furnish to the person a certification of trust" (18-B M.R.S. 1013(1)). A trustee doing business on behalf of a trust generally provides a certificate as proof of his/her/their authority to act.

As an abstract of the trust instrument, the certificate contains only essential information relevant to the transaction at hand, allowing the trust instrument to remain private. For trustees not wishing to disclose the identity of persons having a beneficial interest in the trust, the certificate is a useful alternative to providing the trust instrument.

The certificate requires specific information about the trust, including the name and date of the trust instrument, the trust's taxpayer identification number, and whether the trust is revocable or irrevocable. It includes the trust's settlor, who is "a person, including a testator, who creates or contributes property to a trust" in addition to each acting trustee's name and address (18-B M.R.S. 103(14)).

A lawful certificate also requires a description of the trustee's powers as they relate to the transaction at hand. Since certificates are usually presented in real estate transactions involving trust property, they also require a legal description of the real property in the trust. The certificate includes the name by which the trust will hold property.

If there is more than one trustee, the certificate presents the names of each trustee who is authorized to authenticate documents, and whether all or fewer than all are required to exercise trustee powers.

Finally, the certificate requires a statement "that the trust has not been revoked, modified or amended in any manner that would cause the representations contained in the certification of trust to be incorrect" (18-B M.R.S. 1013(3)). Representations are deemed correct, and a recipient of a certification of trust is not liable for acting on the information contained within (18-B M.R.S. 1013(6)).

Recipients may ask the trustee for excerpts from the trust instrument that designate the trustee and authorize the trustee to act in the transaction at hand, but requesting the entire trust document opens them to liabilities as set out in 18-B M.R.S. 1013(8).

Certificates can be signed by any trustee (18-B M.R.S. 1013(2)). If recording, submit the certificate in the county in which the real property subject to the transaction is situated.

Trust law can be complicated, so contact an attorney with questions about using a certificate of trust or other related issues.

(Maine COT Package includes form, guidelines, and completed example)