Saint James Parish Disclaimer of Interest Form (Louisiana)

All Saint James Parish specific forms and documents listed below are included in your immediate download package:

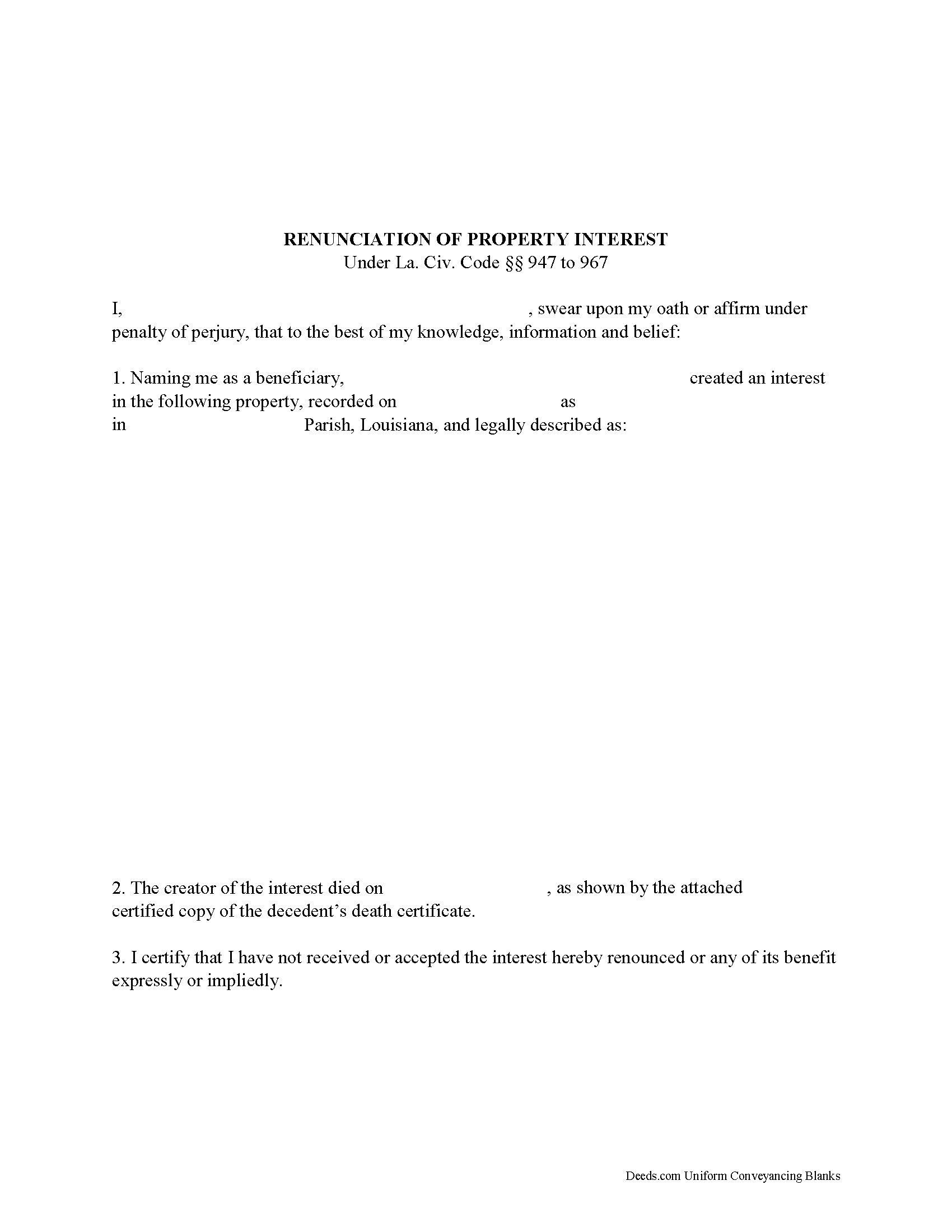

Disclaimer of Interest Form

Fill in the blank form formatted to comply with all recording and content requirements.

Included Saint James Parish compliant document last validated/updated 7/4/2024

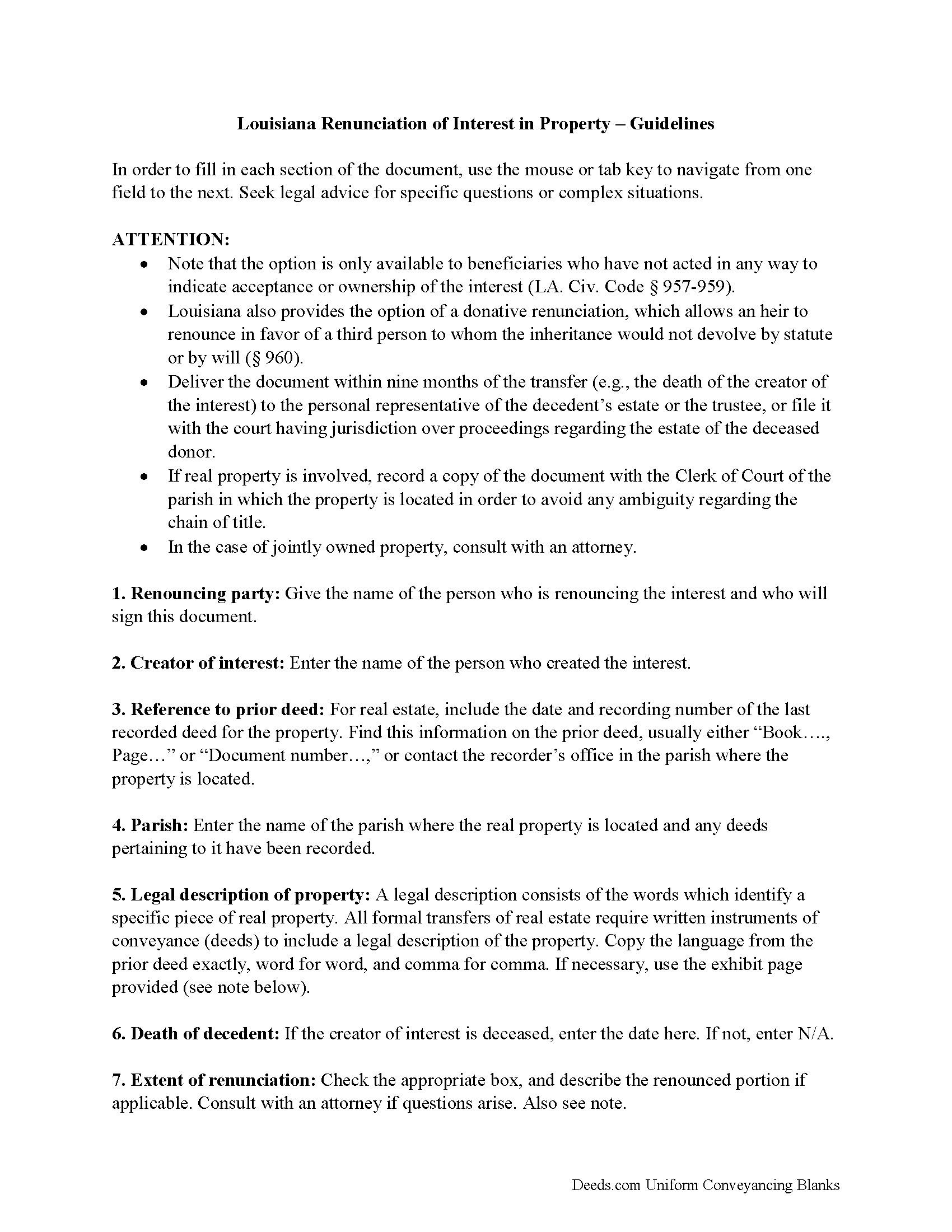

Disclaimer of Interest Guide

Line by line guide explaining every blank on the form.

Included Saint James Parish compliant document last validated/updated 10/3/2024

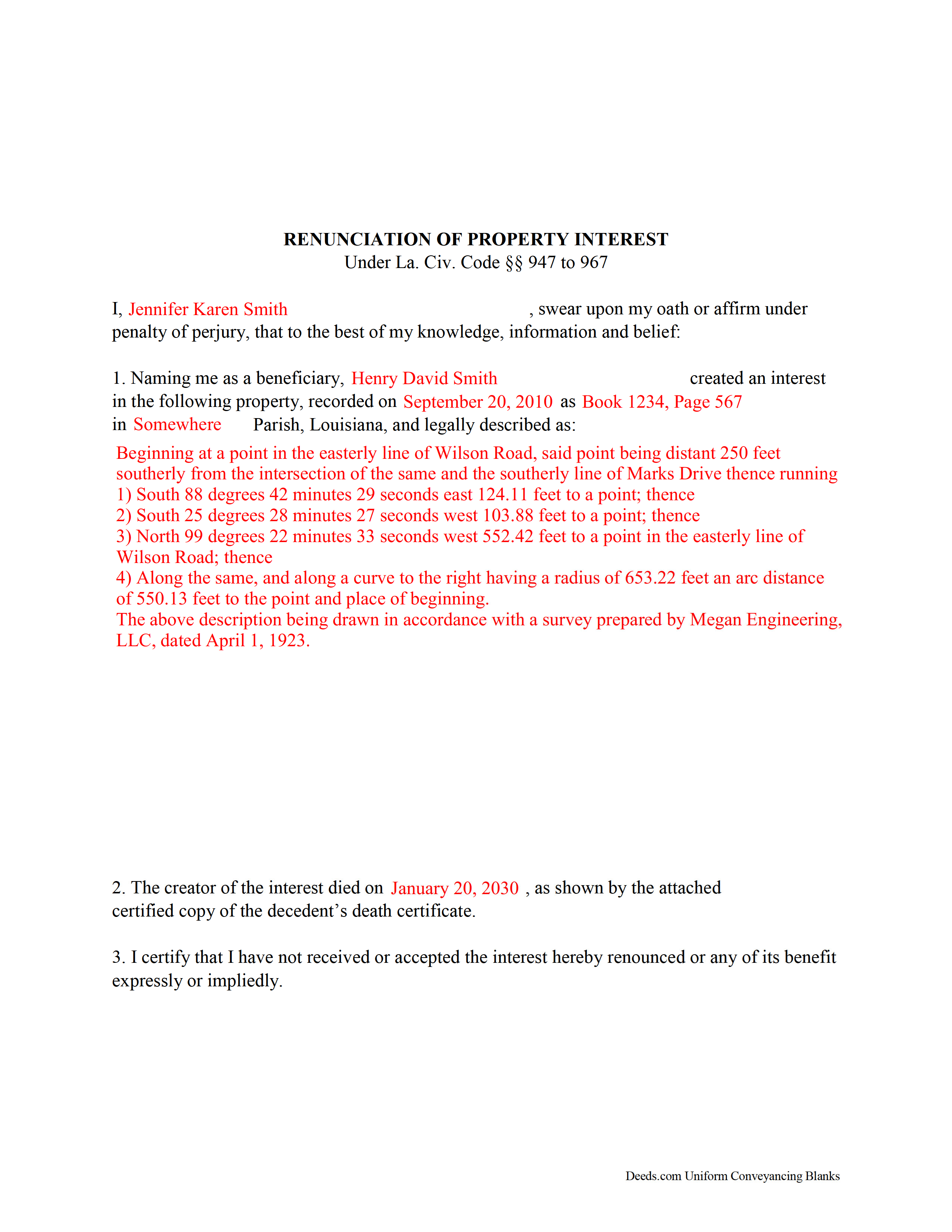

Completed Example of the Disclaimer of Interest Document

Example of a properly completed form for reference.

Included Saint James Parish compliant document last validated/updated 12/19/2024

The following Louisiana and Saint James Parish supplemental forms are included as a courtesy with your order:

When using these Disclaimer of Interest forms, the subject real estate must be physically located in Saint James Parish. The executed documents should then be recorded in the following office:

St. James Parish Clerk of Court

5800 Louisiana Highway 44 / PO Box 63, Convent, Louisiana 70723

Hours: 8:30 to 4:30 M-F

Phone: (225) 562-2270

Local jurisdictions located in Saint James Parish include:

- Convent

- Gramercy

- Hester

- Lutcher

- Paulina

- Saint James

- Uncle Sam

- Vacherie

How long does it take to get my forms?

Forms are available immediately after submitting payment.

How do I get my forms, are they emailed?

Immediately after you submit payment, the Saint James Parish forms you order will be available for download directly from your account. You can then download the forms to your computer. If you do not already have an account, one will be created for you as part of the order process, and your login details will be provided to you. If you encounter any issues accessing your forms, please reach out to our support team for assistance. Forms are NOT emailed to you.

What does "validated/updated" mean?

This indicates the most recent date when at least one of the following occurred:

- Updated: The document was updated or changed to remain compliant.

- Validated: The document was examined by an attorney or staff, or it was successfully recorded in Saint James Parish using our eRecording service.

Are these forms guaranteed to be recordable in Saint James Parish?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Saint James Parish including margin requirements, content requirements, font and font size requirements.

Can the Disclaimer of Interest forms be re-used?

Yes. You can re-use the forms for your personal use. For example, if you have more than one property in Saint James Parish that you need to transfer you would only need to order our forms once for all of your properties in Saint James Parish.

What are supplemental forms?

Often when a deed is recorded, additional documents are required by Louisiana or Saint James Parish. These could be tax related, informational, or even as simple as a coversheet. Supplemental forms are provided for free with your order where available.

What type of files are the forms?

All of our Saint James Parish Disclaimer of Interest forms are PDFs. You will need to have or get Adobe Reader to use our forms. Adobe Reader is free software that most computers already have installed.

Do I need any special software to use these forms?

You will need to have Adobe Reader installed on your computer to use our forms. Adobe Reader is free software that most computers already have installed.

Do I have to enter all of my property information online?

No. The blank forms are downloaded to your computer and you fill them out there, at your convenience.

Can I save the completed form, email it to someone?

Yes, you can save your deed form at any point with your information in it. The forms can also be emailed, blank or complete, as attachments.

Are there any recurring fees involved?

No. Nothing to cancel, no memberships, no recurring fees.

Louisiana Renunciation of Property Interest

Under the Louisiana Civil Code, the beneficiary of an interest in property may renounce the gift, either in part or in full (La. Civ. Code 947 to 967). Note that the option is only available to beneficiaries who have not acted in any way to indicate acceptance or ownership of the interest ( 957-959). Louisiana also provides the option of a donative renunciation, which allows an heir to renounce in favor of a third person to whom the inheritance would not devolve by statute or by will ( 960). For the specifics of this option, consult with an attorney.

Acceptance is presumed unless there is an official renunciation ( 962). The document must be in writing and include a description of the interest, a declaration of intent to renounce all or a defined portion of the interest, and be signed by the renouncing party ( 963).

Deliver the document within nine months of the transfer (e.g., the death of the creator of the interest) to the personal representative of the decedent's estate or the trustee, or file it with the court that has jurisdiction over proceedings regarding the estate of the deceased donor. If real property is involved, avoid any ambiguity regarding the chain of title by recording a copy of the document with the Clerk of Court of the parish in which the property is located.

A renunciation is irrevocable and binding for the renouncing party and his or her creditors ( 954, 964), so be sure to consult an attorney when in doubt about the drawbacks and benefits. If the interest arises out of jointly-owned property, seek legal advice as well.

(Louisiana DOI Package includes form, guidelines, and completed example)

Our Promise

The documents you receive here will meet, or exceed, the Saint James Parish recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Saint James Parish Disclaimer of Interest form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4448 Reviews )

Dorothy N.

December 22nd, 2024

The mortgage and note were thorough and very satisfactory for my purposes. The accompanying forms were excellent. I am very pleased with my purchase.

We welcome your positive feedback and are thrilled to have met your expectations. Thank you for choosing our services.

Edward E.

December 22nd, 2024

Easy to use.

Your feedback is valuable to us and helps us improve. Thank you for sharing your thoughts!

MARISSA G.

December 22nd, 2024

I recomemed this webside

Thank you for your feedback. We really appreciate it. Have a great day!

Melanie N.

October 12th, 2019

I'm happy with the forms, thank you.

Thank you!

Walter T.

December 12th, 2020

Awesome thanks

Thank you for your feedback. We really appreciate it. Have a great day!

Norma G.

July 30th, 2020

Very fast response!

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

A. S.

February 27th, 2019

First, I am glad that you gave a blank copy, an example copy, and a 'guide'. It made it much easier to do. Overall I was very happy with your products and organization... however, things got pretty confusing and I have a pretty 'serious' law background in Real Estate and Civil law. With that said, I spent about 10+ hours getting my work done, using the Deed of Trust and Promissory note from you and there were a few problems: First, it would be FANTASTIC if you actually aligned your guide to actually match the Deed or Promissory Note. What I mean is that if the Deed says 'section (E)' then your guide shouldn't be 'randomly' numbered as 1,2,3, for advice/instructions, but should EXACTLY match 'section (E)'. Some places you have to 'hunt' for what you are looking for, and if you did it based on my suggestion, you wouldn't need to 'hunt' and it would avoid confusion. 2nd: This one really 'hurt'... you had something called the 'Deed of Trust Master Form' yet you had basically no information on what it was or how to use it. The only information you had was a small section at the top of the 'Short Form Deed of Trust Guide'. Holy Cow, was that 'section' super confusing. I still don't know if I did it correctly, but your guide says only put a return address on it and leave the rest of the 16 or so page Deed of Trust beneath it blank... and then include your 'Deed of Trust' (I had to assume the short form deed that I had just created) as part of it. I had to assume that I had to print off the entire 17 page or so title page and blank deed. I also had to assume that the promissory note was supposed to be EXHIBIT A or B on the Short Form Deed. It would be great if someone would take a serious look at that short section in your 'Short Form Deed of Trust Guide' and realize that those of us using your products are seriously turning this into a county clerk to file and that most of us, probably already have a property that has an existing Deed... or at least can find one in the county records if necessary... and make sure that you make a distinction between the Deed for the property that already exists, versus the Deed of Trust and Promissory note that we are trying to file. Thanks.

Thank you for your feedback. We'll have staff review the document for clarity. Have a great day!

janice b.

April 29th, 2021

This is a very helpful site when you don't know exactly what to do. Very clear in explaining the wording on deeds. Thank you it made a big difference knowing the right way to do things.

Thank you for your feedback. We really appreciate it. Have a great day!

Ryan K.

August 23rd, 2023

Excellent service! Quick and much easier than having to do everything through the mail. The agent was quick to answer questions and everything was processed and submitted from Deeds.com within a couple of hours. Will definitely use again if the need arises.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Arthur H.

March 17th, 2022

Deeds.com was informative, quick, and complete. Found everything I needed complete with instructions and examples. Easy to use and understand. And VERY reasonably priced.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Lisa C.

October 7th, 2020

Please change on the example for the warranty deed the portion that says Source of Title:

They don't use book and pages anymore They only use recording numbers. Please show an example with that for Maricopa County AZ

Plus your Notary certificates should have a blank part for if it is signed in another state.

Thank you for your feedback. We really appreciate it. Have a great day!

Ruth L.

August 18th, 2021

Easy to use form. I filled it out and took it to the county office. Entire process took less than 20 min.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Dennis B.

June 19th, 2019

It was easy to download the necessary "Death of Joint Tenant" forms. These easy to use interactive forms are made to comply with the laws specific to your state.

Thank you!

Daniel S.

February 11th, 2019

It was easy to find the forms I was looking for and the guided steps and examples of how to use the form were beneficial.

Thank you for your feedback. We really appreciate it. Have a great day!

Walter P.

August 19th, 2021

Quick and easy!

We appreciate your business and value your feedback. Thank you. Have a wonderful day!