Allen Parish Affidavit of Death and Heirship Form (Louisiana)

All Allen Parish specific forms and documents listed below are included in your immediate download package:

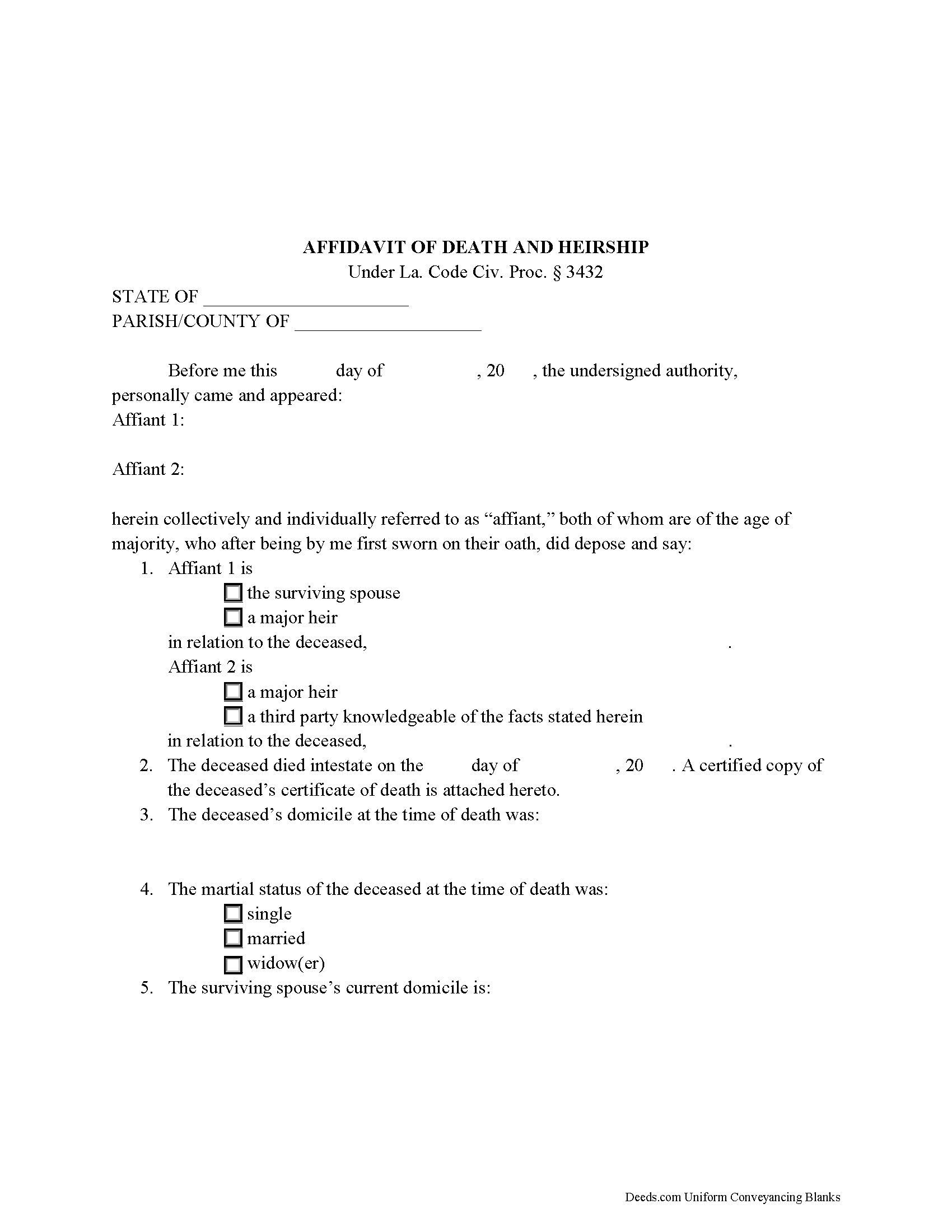

Affidavit of Death and Heirship Form

Fill in the blank form formatted to comply with all recording and content requirements.

Included Allen Parish compliant document last validated/updated 10/24/2024

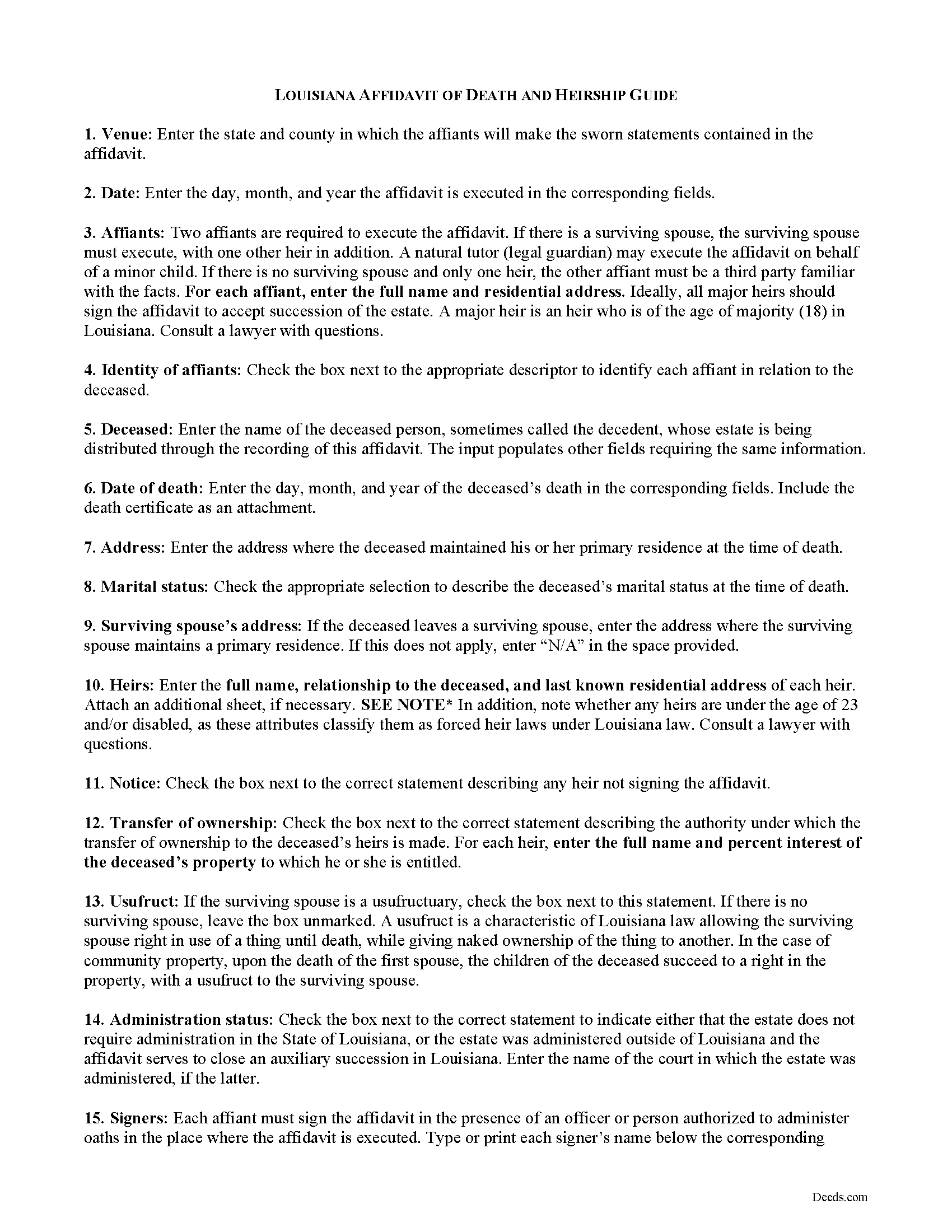

Affidavit of Death and Heirship Guide

Line by line guide explaining every blank on the form.

Included Allen Parish compliant document last validated/updated 11/27/2024

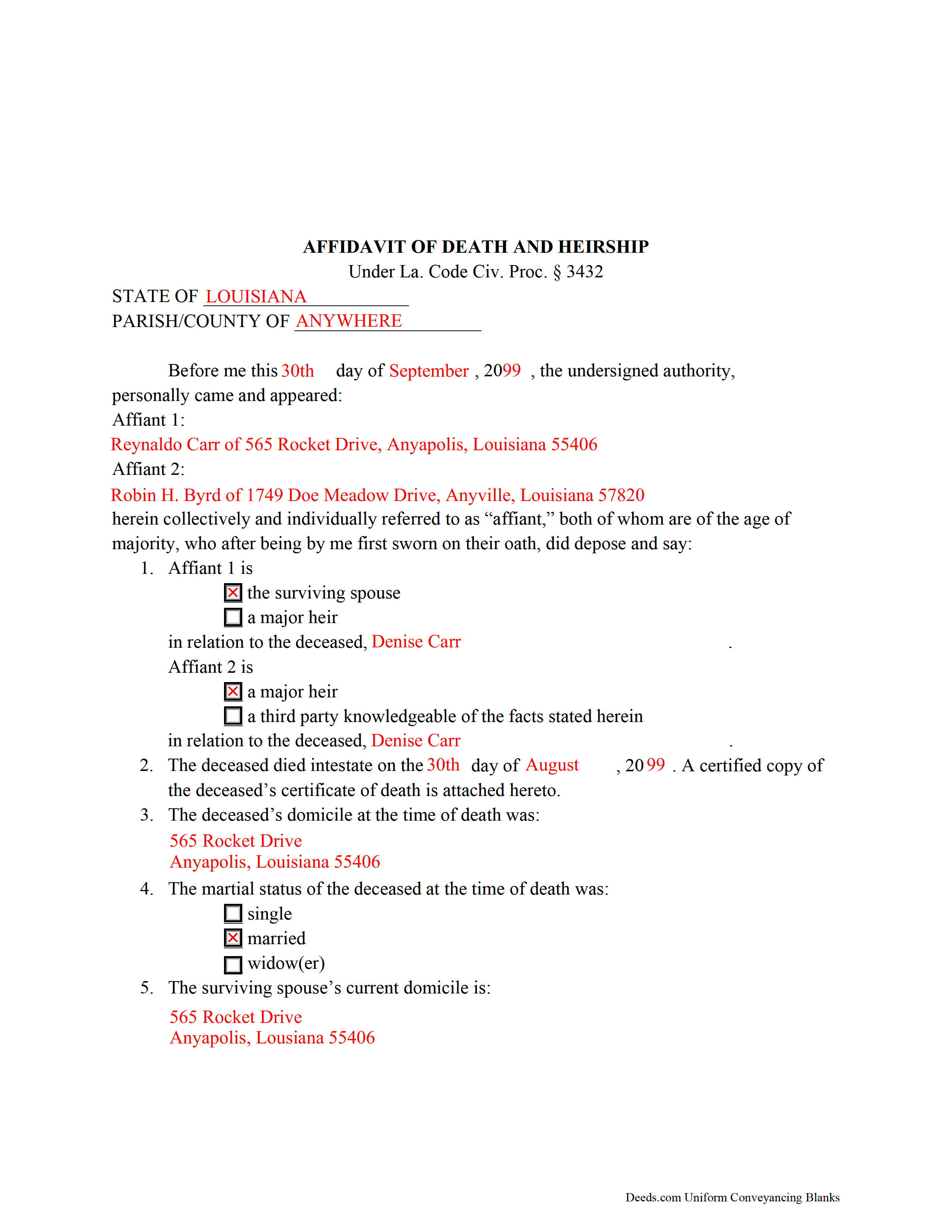

Completed Example of the Affidavit of Death and Heirship Document

Example of a properly completed form for reference.

Included Allen Parish compliant document last validated/updated 6/28/2024

The following Louisiana and Allen Parish supplemental forms are included as a courtesy with your order:

When using these Affidavit of Death and Heirship forms, the subject real estate must be physically located in Allen Parish. The executed documents should then be recorded in the following office:

Allen Parish Clerk of Court

400 West Sixth Ave / PO Box 248, Oberlin, Louisiana 70655

Hours: Call For Appointment

Phone: (337) 639-4351

Local jurisdictions located in Allen Parish include:

- Elizabeth

- Grant

- Kinder

- Leblanc

- Mittie

- Oakdale

- Oberlin

- Reeves

How long does it take to get my forms?

Forms are available immediately after submitting payment.

How do I get my forms, are they emailed?

Immediately after you submit payment, the Allen Parish forms you order will be available for download directly from your account. You can then download the forms to your computer. If you do not already have an account, one will be created for you as part of the order process, and your login details will be provided to you. If you encounter any issues accessing your forms, please reach out to our support team for assistance. Forms are NOT emailed to you.

What does "validated/updated" mean?

This indicates the most recent date when at least one of the following occurred:

- Updated: The document was updated or changed to remain compliant.

- Validated: The document was examined by an attorney or staff, or it was successfully recorded in Allen Parish using our eRecording service.

Are these forms guaranteed to be recordable in Allen Parish?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Allen Parish including margin requirements, content requirements, font and font size requirements.

Can the Affidavit of Death and Heirship forms be re-used?

Yes. You can re-use the forms for your personal use. For example, if you have more than one property in Allen Parish that you need to transfer you would only need to order our forms once for all of your properties in Allen Parish.

What are supplemental forms?

Often when a deed is recorded, additional documents are required by Louisiana or Allen Parish. These could be tax related, informational, or even as simple as a coversheet. Supplemental forms are provided for free with your order where available.

What type of files are the forms?

All of our Allen Parish Affidavit of Death and Heirship forms are PDFs. You will need to have or get Adobe Reader to use our forms. Adobe Reader is free software that most computers already have installed.

Do I need any special software to use these forms?

You will need to have Adobe Reader installed on your computer to use our forms. Adobe Reader is free software that most computers already have installed.

Do I have to enter all of my property information online?

No. The blank forms are downloaded to your computer and you fill them out there, at your convenience.

Can I save the completed form, email it to someone?

Yes, you can save your deed form at any point with your information in it. The forms can also be emailed, blank or complete, as attachments.

Are there any recurring fees involved?

No. Nothing to cancel, no memberships, no recurring fees.

When a decedent dies, her property, rights, and obligations at the time of death, and those acquired after death, comprise her estate (La. Civil Code Art. 872). The legal process of transferring a decedent's estate to successors is referred to as succession in Louisiana.

By operation of law, a decedent's heirs automatically succeed to an interest in the decedent's property at the decedent's death (Civil Code Art. 935). Though a judicial process may not be required, heirs must take steps to "conform the record title to the rights of ownership provided by" Louisiana Code. Failure to do so "inhibits the ability of family members lacking record title to exercise their rights of ownership of property including the rights to sell, to encumber, and to seek federal aid" in the future. Filing the correct document in the parish land records updates the chain of title and provides a clear record of succession. Consult an experienced succession lawyer to advise which process is appropriate for the situation.

There are several alternate options in Louisiana for transferring property from a decedent to his heirs, such as small succession, a judicial process, or filing an affidavit under La. Code of Civil Procedure Art. 3432, a non-judicial process. These options are available when the estate meets certain requirements.

When the size of the estate is less than $125,000.00, or the succession in Louisiana is ancillary to probate or succession opened elsewhere, the estate may qualify as a small succession under La. Code of Civil Procedure Art. 3421. A judicial succession is always required when a decedent dies testate (with a will), regardless of the estate size.

Small succession is not required, however, when the conditions above apply AND the decedent died intestate with his sole heirs being descendants (children), ascendants (parents), siblings or descendants of siblings, and/or a surviving spouse (CCP 3431). Exceptions also apply for wills probated outside Louisiana.

When a small succession is not required because the decedent died intestate and her sole heirs are those stated above, file an affidavit of death and heirship under La. Code of Civil Procedure Art. 3432.

A minimum of two people must execute the affidavit, including the surviving spouse, if applicable, and one or more heir of the age of majority (18) in the State of Louisiana. An affiant may also be a third party with knowledge of the facts contained within. Art. 3432 of the Code of Civil Procedure indicates an option for one or more original affidavits in some situations. The wrong paperwork can lead to unnecessary expenses, so consult an attorney to confirm the best procedure for the specific case.

Note the name, address, and relation of each affiant to the decedent in the affidavit. The affiants must be duly sworn before any officer or person authorized to administer oaths in the place where the affidavit is executed.

Statutory requirements for the content of the affidavit include the decedent's date of death and his address of primary residence at the time of death; a statement that the decedent died intestate; the martial status at the time of death and the surviving spouse's last-known residence, if applicable.

In addition, the affidavit lists the name, last known address, and relationship to the decedent of each heir. Each heir's respective interest in the decedent's property, and whether a legal usufruct of the surviving spouses attaches to the property, should be noted. If any heir does not join as an affiant, the affidavit should state that either the heir could not be located or was given notice of the intent to execute the affidavit and did not object.

The affidavit describes the property left by the decedent and indicate whether the property is community property or separate property. The description of any immovable property "must be sufficient to identify the property for purposes of transfer" (CCP 3432(A)(5)). The affidavit should also show the value of each item of property and the aggregate value of all property at the time of death.

Finally, the affiant's signature affirms that the signers accept the succession of the decedent and that the information contained in the affidavit is true, correct, and complete to the best of the signer's knowledge. The statements are made under penalty of perjury.

Aside from these content requirements, the affidavit must be in recordable form. File the affidavit along with a copy of the decedent's death certificate in the conveyancing records of the parish where the immovable property described within the document is situated. When the affidavit pertains to immovable property, file after 90 days have passed since the decedent's death.

Consult an experienced succession lawyer in the State of Louisiana with questions about immovable property, affidavits of death and heirship, any other issues related to probate or decedent's property in Louisiana, as the law is complex, and each situation is unique.

(Louisiana AOD Package includes form, guidelines, and completed example)

Our Promise

The documents you receive here will meet, or exceed, the Allen Parish recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Allen Parish Affidavit of Death and Heirship form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4448 Reviews )

Dorothy N.

December 22nd, 2024

The mortgage and note were thorough and very satisfactory for my purposes. The accompanying forms were excellent. I am very pleased with my purchase.

We welcome your positive feedback and are thrilled to have met your expectations. Thank you for choosing our services.

Edward E.

December 22nd, 2024

Easy to use.

Your feedback is valuable to us and helps us improve. Thank you for sharing your thoughts!

MARISSA G.

December 22nd, 2024

I recomemed this webside

Thank you for your feedback. We really appreciate it. Have a great day!

Joseph N.

September 17th, 2020

The site is easy to navigate and exceptional services. Unfortunately, they could find no information on a tract of land that I own, and they canceled the search and refunded my payment.

Sorry we were unable to help you find what you were looking for Joseph.

DEBORAH H.

December 9th, 2023

I found everything I needed

Your feedback is valuable to us and helps us improve. Thank you for sharing your thoughts!

Robert S B.

May 22nd, 2019

I would not have ordered this form had I realised how limited the fields are for details. There is no room for elaboration of terms. The language only allows one grantor and one grantee, and the gender and quantity default construction is a poor choice. Be basic, but leave room for more.

Thank you for your feedback. We really appreciate it. Have a great day!

Diane C.

December 5th, 2019

Hey, great job! Love these forms. They make the process really easy.

Great to hear Diane, have a fantastic day!

Norma O.

March 10th, 2020

good

Thank you!

Samuel J M.

December 14th, 2018

I needed to prepare a Correction Warranty Deed and have not done so in years. I ordered your form and modified it to fit my situation. Saved me a lot of time.

Thanks.

Thank you for your feedback. We really appreciate it. Have a great day!

William L.

May 10th, 2023

This is an initial review of Deeds.Com and the ordering process for their Quit Claim package for Virginia. The ordering process was very easy and the price seems reasonable for what you get. I have reviewed and downloaded all my forms, but have not used them yet. Thus far I am pleased with the product and the process. E-Recording service is also offered, but I have not used that yet either. At this writing, I can whole-heartedly recommend Deeds.Com.

Thank you for your feedback. We really appreciate it. Have a great day!

Dee R.

November 14th, 2019

Quick, Simple order process with many options of forms to download!

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Ralph B.

November 25th, 2023

My needs were met quickly and efficiently with very little wait. Deeds.com made it easy to understand and use their program and I couldn't be more happy with the results!

It was a pleasure serving you. Thank you for the positive feedback!

Tisha J.

November 10th, 2021

A quick and efficient way to record! Awesome customer service and SUPER FAST turnaround time.!

Thank you!

James R.

August 10th, 2022

This site is a blessing in disguise-/>

Thank you!

Lorraine J.

April 6th, 2023

Thank-you.

Thank you!