Hardin County Notice to Owner Form (Kentucky)

All Hardin County specific forms and documents listed below are included in your immediate download package:

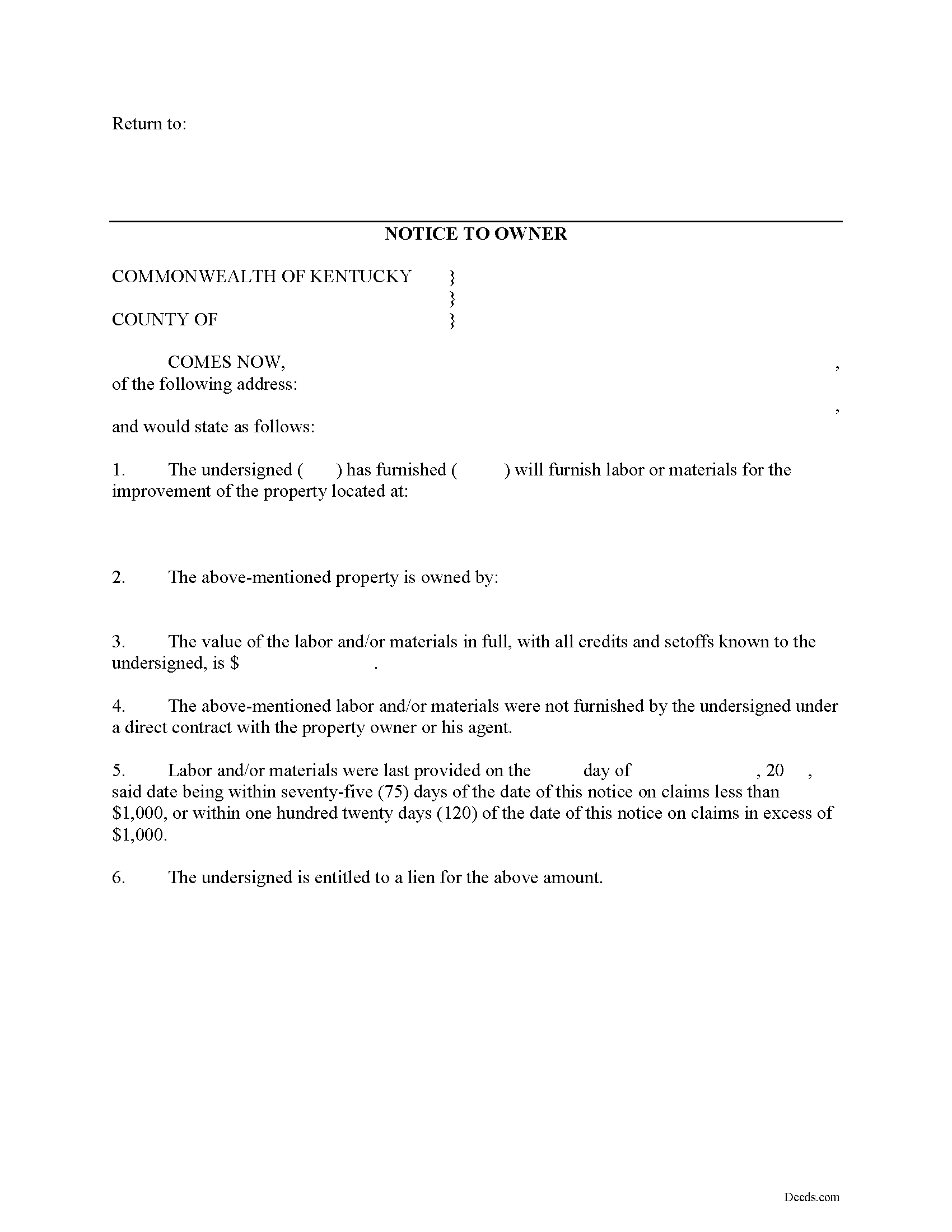

Notice to Owner Form

Fill in the blank Notice to Owner form formatted to comply with all Kentucky recording and content requirements.

Included Hardin County compliant document last validated/updated 8/23/2024

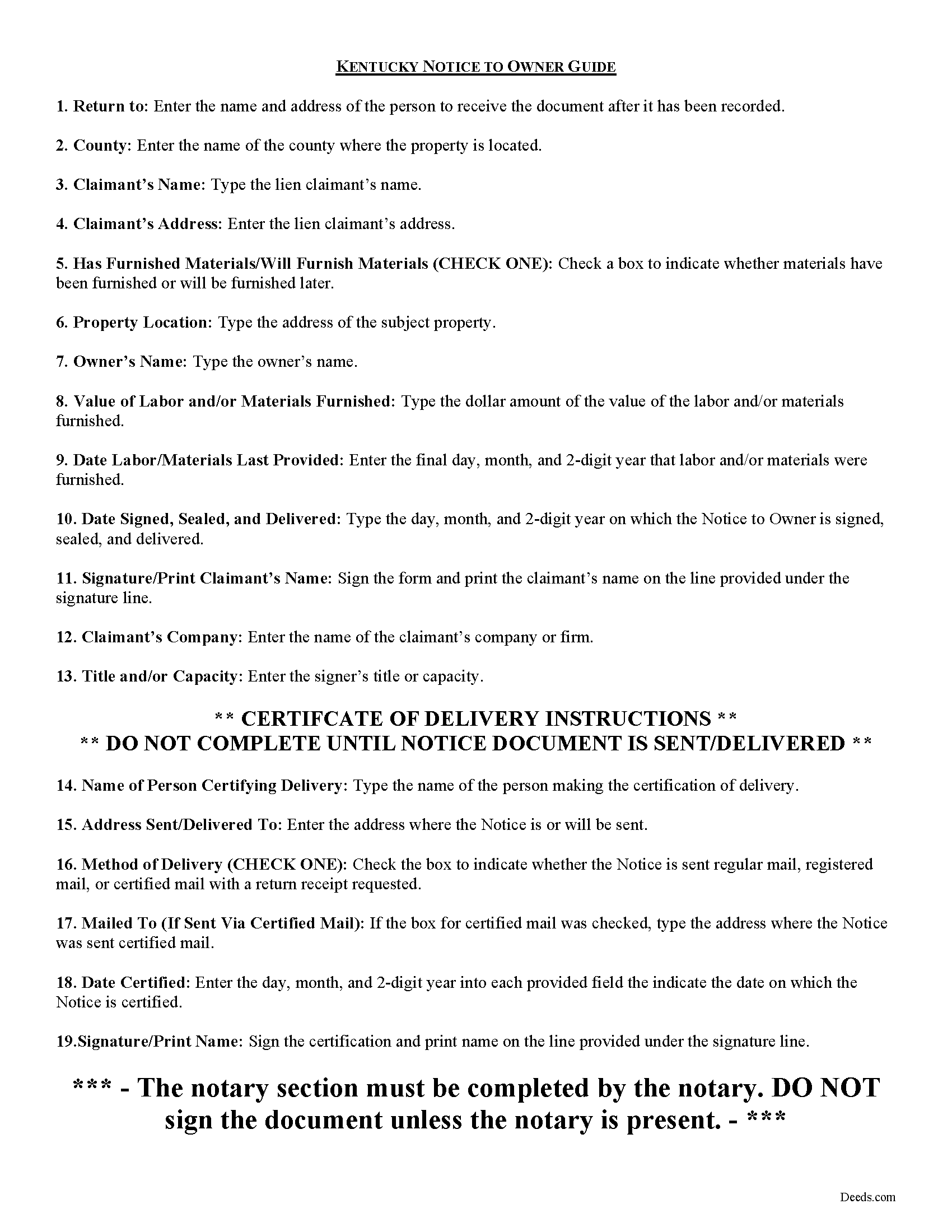

Notice to Owner Guide

Line by line guide explaining every blank on the form.

Included Hardin County compliant document last validated/updated 8/29/2024

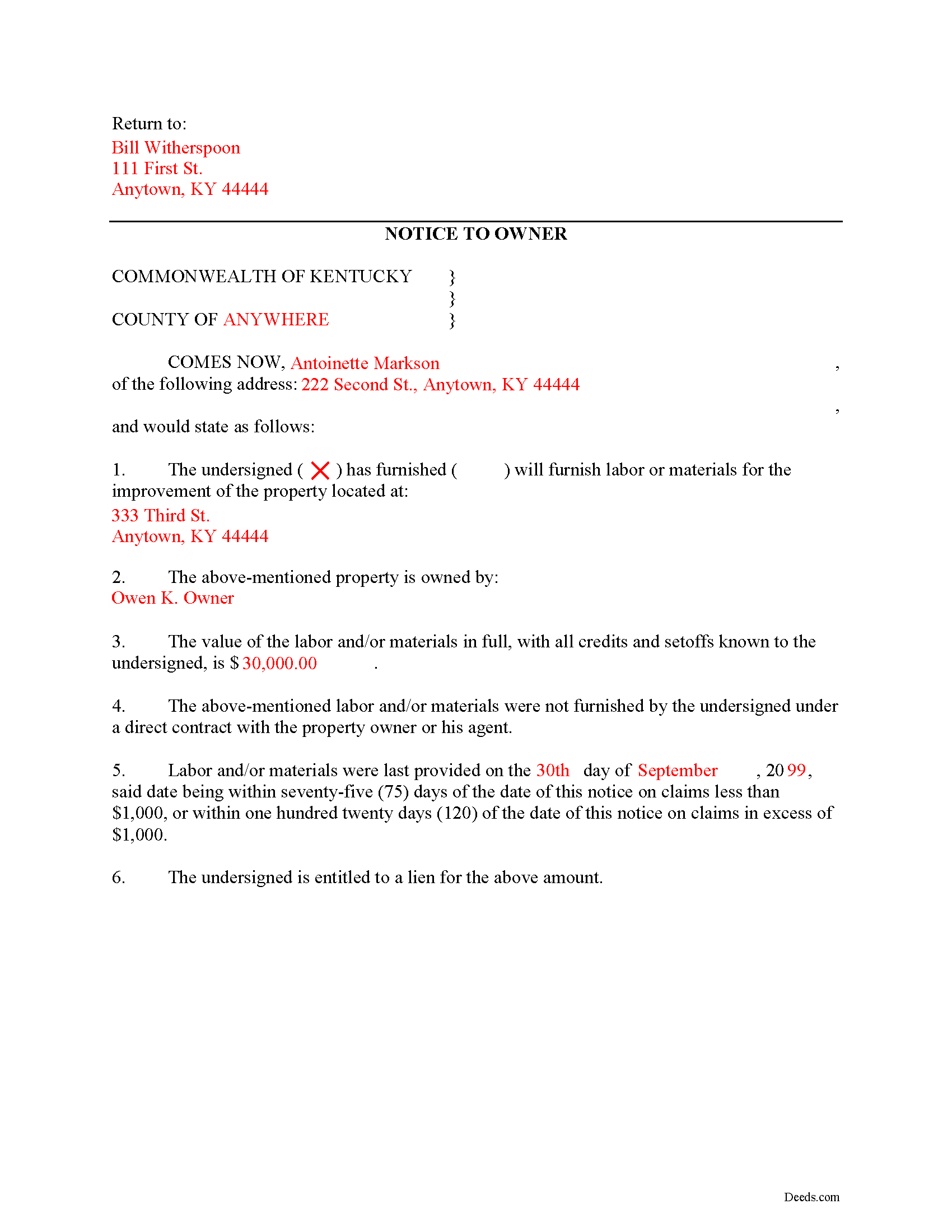

Completed Example of the Notice to Owner Document

Example of a properly completed form for reference.

Included Hardin County compliant document last validated/updated 12/18/2024

The following Kentucky and Hardin County supplemental forms are included as a courtesy with your order:

When using these Notice to Owner forms, the subject real estate must be physically located in Hardin County. The executed documents should then be recorded in the following office:

Hardin County Clerk

Government Bldg - 150 N Provident Way, Suite 103, Elizabethtown, Kentucky 42701

Hours: 8:00 to 4:30 M-F

Phone: (270) 765-2171

Local jurisdictions located in Hardin County include:

- Cecilia

- Eastview

- Elizabethtown

- Fort Knox

- Glendale

- Radcliff

- Rineyville

- Sonora

- Upton

- Vine Grove

- West Point

- White Mills

How long does it take to get my forms?

Forms are available immediately after submitting payment.

How do I get my forms, are they emailed?

Immediately after you submit payment, the Hardin County forms you order will be available for download directly from your account. You can then download the forms to your computer. If you do not already have an account, one will be created for you as part of the order process, and your login details will be provided to you. If you encounter any issues accessing your forms, please reach out to our support team for assistance. Forms are NOT emailed to you.

What does "validated/updated" mean?

This indicates the most recent date when at least one of the following occurred:

- Updated: The document was updated or changed to remain compliant.

- Validated: The document was examined by an attorney or staff, or it was successfully recorded in Hardin County using our eRecording service.

Are these forms guaranteed to be recordable in Hardin County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Hardin County including margin requirements, content requirements, font and font size requirements.

Can the Notice to Owner forms be re-used?

Yes. You can re-use the forms for your personal use. For example, if you have more than one property in Hardin County that you need to transfer you would only need to order our forms once for all of your properties in Hardin County.

What are supplemental forms?

Often when a deed is recorded, additional documents are required by Kentucky or Hardin County. These could be tax related, informational, or even as simple as a coversheet. Supplemental forms are provided for free with your order where available.

What type of files are the forms?

All of our Hardin County Notice to Owner forms are PDFs. You will need to have or get Adobe Reader to use our forms. Adobe Reader is free software that most computers already have installed.

Do I need any special software to use these forms?

You will need to have Adobe Reader installed on your computer to use our forms. Adobe Reader is free software that most computers already have installed.

Do I have to enter all of my property information online?

No. The blank forms are downloaded to your computer and you fill them out there, at your convenience.

Can I save the completed form, email it to someone?

Yes, you can save your deed form at any point with your information in it. The forms can also be emailed, blank or complete, as attachments.

Are there any recurring fees involved?

No. Nothing to cancel, no memberships, no recurring fees.

Notice to Owner -- Preliminary Notice in Kentucky

Most states require lien claimants to serve a preliminary (pre-lien) notice on a property owner or other party to ensure all interested parties have notification of who is involved in a construction job and who may have a claim to a mechanic's lien. In Kentucky, the Notice to Owner document fulfills this purpose.

No person who has not contracted directly with the owner or his agent is eligible to acquire a lien unless he notifies the owner (or his authorized agent) of the property to be held liable, in writing, within seventy-five (75) days on claims amounting to less than $1,000 and one hundred twenty (120) days on claims in excess of $1,000 after the last item of material or labor is furnished, of his intention to hold the property liable and the amount for which he will claim a lien. K.R.S. 376.010(3).

It shall be sufficient to prove that the notice was mailed to the last known address of the owner of the property upon which the lien is claimed, or to his duly authorized agent within the county in which the property to be held liable is located. Id.

The Notice to Owner document contains the following information: 1) Name and address of the potential lien claimant; 2) Address of the subject property; 3) Name of the owner; 4) Value of materials or labor furnished; and 5) Date of last furnishing. The document also contains a Certificate of Delivery detailing the person serving the notice, the method of service, and date of service. The Certificate must be signed to affirm service was made in the described manner.

This article is provided for information purposes only and should not be relied on as a substitute for the advice from a legal professional. If you have questions about preliminary notice, or any other issues related to liens in Kentucky, please speak with a licensed attorney.

Our Promise

The documents you receive here will meet, or exceed, the Hardin County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Hardin County Notice to Owner form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4447 Reviews )

Edward E.

December 22nd, 2024

Easy to use.

Your feedback is valuable to us and helps us improve. Thank you for sharing your thoughts!

MARISSA G.

December 22nd, 2024

I recomemed this webside

Thank you for your feedback. We really appreciate it. Have a great day!

Dennis F.

December 20th, 2024

The release of mortgage form was OK, and accepted at the recorder's office, but there were some problems. Many of the fields to type in were too small to accept the data, and I could not find a way to change the field size or use a smaller font. Otherwise I was satisfied.

Your feedback is a crucial part of our dedication to ongoing improvement. Thank you for your insightful comments.

Connie C.

February 18th, 2021

I thought the process was fairly easy. The price was reasonable. I had a slight problem, some of the words were missing from one page of the documents when I printed it. However, after I saved it to my computer, I was able to print the page in full.

Thank you for your feedback. We really appreciate it. Have a great day!

joab k.

May 20th, 2021

Usable mediocre average stuff.

functional but not extraordinary

but the price and service is quite good

Thank you for your feedback. We really appreciate it. Have a great day!

Remi W.

April 13th, 2020

Submitting documents electronically through Deeds.com saved me time and provided the best possible service for me in the comfort of my own home. There's no faster, better way to record documents than e-recording with Deeds.com.

Thank you for your feedback. We really appreciate it. Have a great day!

Jacqui G.

April 8th, 2020

Excellent system and serviced!

Thank you!

PEGGY D.

April 1st, 2022

Very easy to find what I needed. Really liked the instructions included with the forms and also the suggestion of other forms that I might need.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Lori W.

December 2nd, 2020

Great resource! Nice to have these forms and information available. No problems at the recorder, in fact it was the recorder that referred me to deeds.com they like their forms so much.

Thank you for your feedback. We really appreciate it. Have a great day!

Belinda B.

June 22nd, 2022

Very difficult navigating this site.

Sorry to hear of your struggle. Thank you for your feedback.

John C N.

June 17th, 2023

Just the website I needed.

Very detailed and efficient.

Thank you for taking the time to provide your feedback John, we really appreciate it. Have an amazing day!

Terrill B.

May 10th, 2019

I found it very difficult to find this website, had my accountant search for me. Instructions are invaluable through guide and example. Thank you for them.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Maxine P.

August 24th, 2020

This is so amazing and I truly thank you for what I needed for my documents. This is a great company and will take care of what you needs.

Thank you for your feedback. We really appreciate it. Have a great day!

Yvonne W.

December 30th, 2018

I'm not certain yet that this is all I need to do what I need to do. Marion Co. Clerk's office has not been helpful. I found this site from that site & hopefully it will help.

Thanks for the feedback Yvonne. We hope you found what you needed. Have a wonderful day!

Susan M.

July 13th, 2022

Purchased and received immediately w/instructions for completion.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!